|

市場調查報告書

商品編碼

1750528

桌上型牙科高壓滅菌器市場機會、成長動力、產業趨勢分析及 2025 - 2034 年預測Bench-top Dental Autoclaves Market Opportunity, Growth Drivers, Industry Trend Analysis, and Forecast 2025 - 2034 |

||||||

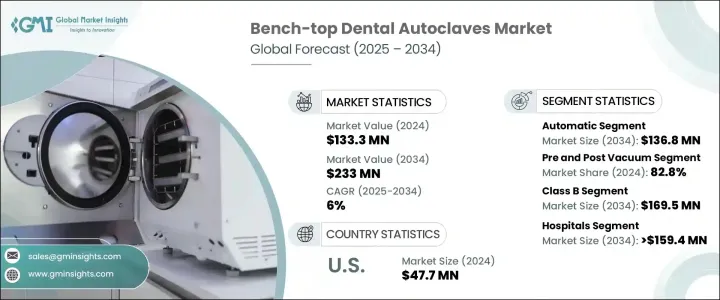

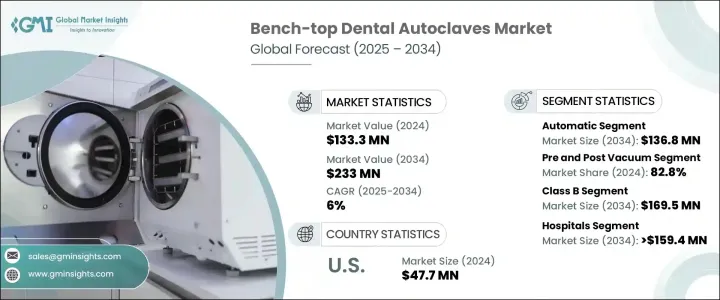

2024年,全球桌上型牙科高壓滅菌器市場規模達1.333億美元,預計2034年將以6%的複合年成長率成長至2.33億美元。桌上型牙科高壓滅菌器是牙科手術過程中設備滅菌的關鍵設備,由於老齡人口成長和感染控制意識增強等因素,對這類設備的需求正在不斷成長。隨著全球人口老化,牙齦疾病導致的牙齒脫落、蛀牙和其他口腔健康問題變得越來越普遍。這些疾病在老年人中更為常見,這促使人們對牙科治療以及隨之而來的滅菌解決方案的需求增加。確保設備免受有害細菌和病毒侵害的需求進一步推動了桌上型牙科高壓滅菌器的普及。

除了人口老化之外,全球對牙科診所衛生和感染控制重要性的認知也日益增強。這導致牙科診所的滅菌法規更加嚴格,標準也更高,這大大促進了桌上型牙科高壓滅菌器市場的發展。隨著牙科專業人士努力滿足這些嚴格的標準,對先進滅菌設備的需求也穩定成長。

| 市場範圍 | |

|---|---|

| 起始年份 | 2024 |

| 預測年份 | 2025-2034 |

| 起始值 | 1.333億美元 |

| 預測值 | 2.33億美元 |

| 複合年成長率 | 6% |

隨著牙科診所越來越需要更有效率、更精準的設備,對自動化滅菌流程的需求不斷成長,推動了市場的發展。預計到2034年,自動高壓滅菌器市場的複合年成長率將達到6.1%。這些設備可幫助牙科專業人員在最少的人為干預下保持高標準的滅菌,從而減少錯誤並確保結果的一致性和可靠性。觸控螢幕介面和自我診斷等技術進步使這些高壓滅菌器更加方便用戶使用且高效。此外,它們也符合日益嚴格的感染控制規程的要求。

桌上型牙科高壓滅菌器市場主要分為兩大技術類別:預真空、後真空和重力。預真空和後真空部分佔據最大佔有率,2024 年佔 82.8%,預計這一趨勢將持續下去。這些高壓滅菌器採用先進技術,在滅菌前後去除滅菌室內的空氣和水分,確保卓越的蒸氣滲透性和更快的乾燥時間。因此,它們在需要快速滅菌週期和嚴格遵守滅菌標準的牙科診所中越來越受歡迎。

2024年,美國桌上型牙科高壓滅菌器市場規模達4,770萬美元,預計到2034年將以5.3%的複合年成長率成長,這得益於病患安全日益受到重視以及對高效滅菌流程的需求。美國牙醫診所持續面臨維持高衛生標準的壓力,促使他們投資更先進、更有效率的滅菌設備。以創新方法著稱的美國醫療保健產業鼓勵開發具有更快滅菌週期、更直覺使用者介面且符合最嚴格健康和安全法規的尖端高壓滅菌器。

市場的主要參與者包括 Biolab Scientific、Bionics Scientific、Dentsply Sirona、Flight Dental Systems 和 FONA 等公司。這些公司專注於持續產品創新、改善使用者介面、提高滅菌效率並遵守監管標準,以鞏固其市場地位。為了鞏固市場地位,各公司投資研發下一代高壓滅菌器,這些高壓滅菌器具有更快的滅菌週期、方便用戶使用的觸控螢幕控制和增強的安全機制等先進功能。他們專注於透過進入新興市場、提供經濟高效的解決方案以及與牙科設備經銷商建立策略合作夥伴關係來擴大其全球影響力,以滿足牙科診所日益成長的滅菌需求。

目錄

第1章:方法論與範圍

第2章:執行摘要

第3章:行業洞察

- 產業生態系統分析

- 產業衝擊力

- 成長動力

- 自動桌上型牙科高壓滅菌器的需求不斷增加

- 日益重視感染控制

- 高壓釜的技術進步

- 牙齒疾病盛行率上升

- 產業陷阱與挑戰

- 採用翻新的牙科高壓滅菌器

- 發展中經濟體的認知有限

- 成長動力

- 成長潛力分析

- 技術格局

- 監管格局

- 川普政府關稅

- 對貿易的影響

- 貿易量中斷

- 各國應對措施

- 對產業的影響

- 供應方影響(製造成本)

- 主要材料價格波動

- 供應鏈重組

- 生產成本影響

- 需求面影響(消費者成本)

- 價格傳導至終端市場

- 市佔率動態

- 消費者反應模式

- 供應方影響(製造成本)

- 受影響的主要公司

- 策略產業反應

- 供應鏈重組

- 定價和產品策略

- 政策參與

- 展望與未來考慮

- 對貿易的影響

- 波特的分析

- PESTEL分析

第4章:競爭格局

- 介紹

- 公司市佔率分析

- 主要市場參與者的競爭分析

- 競爭定位矩陣

- 策略儀表板

第5章:市場估計與預測:按產品,2021 - 2034 年

- 主要趨勢

- 自動的

- 半自動

- 手動的

第6章:市場估計與預測:按技術,2021 - 2034 年

- 主要趨勢

- 前後真空

- 重力

第7章:市場估計與預測:按類別,2021 - 2034 年

- 主要趨勢

- B類

- N類

- S級

第8章:市場估計與預測:依最終用途,2021 - 2034 年

- 主要趨勢

- 醫院和牙科診所

- 牙科實驗室

- 學術和研究機構

第9章:市場估計與預測:按地區,2021 - 2034 年

- 主要趨勢

- 北美洲

- 美國

- 加拿大

- 歐洲

- 德國

- 英國

- 法國

- 西班牙

- 義大利

- 荷蘭

- 亞太地區

- 中國

- 日本

- 印度

- 澳洲

- 韓國

- 拉丁美洲

- 巴西

- 墨西哥

- 阿根廷

- 中東和非洲

- 南非

- 沙烏地阿拉伯

- 阿拉伯聯合大公國

第10章:公司簡介

- Biolab Scientific

- Bionics Scientific

- Dentsply Sirona

- Flight Dental Systems

- FONA

- Labocon

- Life Steriware

- Matachana

- Midmark Corporation

- NSK

- RAYPA

- Steelco

- Thermo Fisher Scientific

- Tuttnauer

- W&H

The Global Bench-top Dental Autoclaves Market was valued at USD 133.3 million in 2024 and is estimated to grow at a CAGR of 6% to reach USD 233 million by 2034. Bench-top dental autoclaves are essential for sterilizing equipment used during dental procedures, and the demand for these devices is rising due to factors like the increasing elderly population and heightened awareness of infection control. As the global population ages, dental issues such as tooth loss from gum disease, tooth decay, and other oral health problems become increasingly prevalent. These conditions are more common among older adults, prompting a greater demand for dental treatments and, consequently, sterilization solutions. The need to ensure equipment remains free from harmful bacteria and viruses further drives the adoption of bench-top dental autoclaves.

In addition to the aging population, there is a growing global awareness of the importance of hygiene and infection control within dental practices. This has led to stricter regulations and higher standards for sterilization in dental clinics, contributing significantly to the bench-top dental autoclave market. As dental professionals strive to meet these rigorous standards, the demand for advanced sterilization devices is steadily rising.

| Market Scope | |

|---|---|

| Start Year | 2024 |

| Forecast Year | 2025-2034 |

| Start Value | $133.3 Million |

| Forecast Value | $233 Million |

| CAGR | 6% |

The rising demand for automated sterilization processes drives the market, as dental clinics are more efficient and precise equipment. The automatic autoclaves segment is projected to grow at a CAGR of 6.1% by 2034. These devices help dental professionals maintain high standards of sterilization with minimal human intervention, reducing errors and ensuring consistent, reliable results. The technological advancements, including touch-screen interfaces and self-diagnostics, make these autoclaves more user-friendly and efficient. In addition, they align with the growing emphasis on stringent infection control protocols.

The bench-top dental autoclave market has two major technology categories: pre- and post-vacuum and gravity. The pre- and post-vacuum segment holds the largest share, accounting for 82.8% in 2024, and this trend is expected to continue. These autoclaves use advanced technology to remove air and moisture from the chamber before and after sterilization, ensuring superior steam penetration and faster drying times. As a result, they are increasingly favored in dental practices that require rapid sterilization cycles and compliance with high sterilization standards.

United States Bench-top Dental Autoclaves Market was valued at USD 47.7 million in 2024 and is expected to grow at a CAGR of 5.3% through 2034, driven by the increased focus on patient safety and the need for highly effective sterilization processes. U.S. dental clinics are under constant pressure to maintain high hygiene standards, leading them to invest in more advanced and efficient sterilization equipment. The U.S. healthcare sector, known for its innovative approach, encourages the development of cutting-edge autoclaves that feature faster sterilization cycles, more intuitive user interfaces, and compliance with the most stringent health and safety regulations.

Key players in the market include companies like Biolab Scientific, Bionics Scientific, Dentsply Sirona, Flight Dental Systems, and FONA. These companies focus on continuous product innovation, improving user interfaces, enhancing sterilization efficiency, and complying with regulatory standards to strengthen their presence in the market. To strengthen their market position, companies invest in R&D to develop next-generation autoclaves with advanced features like faster sterilization cycles, user-friendly touch-screen controls, and enhanced safety mechanisms. They focus on expanding their global reach by entering emerging markets, offering cost-effective solutions, and forming strategic partnerships with dental equipment distributors to cater to the growing demand for sterilization in dental clinics.

Table of Contents

Chapter 1 Methodology and Scope

- 1.1 Market scope and definitions

- 1.2 Research design

- 1.2.1 Research approach

- 1.2.2 Data collection methods

- 1.3 Base estimates and calculations

- 1.3.1 Base year calculation

- 1.3.2 Key trends for market estimation

- 1.4 Forecast model

- 1.5 Primary research and validation

- 1.5.1 Primary sources

- 1.5.2 Data mining sources

Chapter 2 Executive Summary

- 2.1 Industry 3600 synopsis

Chapter 3 Industry Insights

- 3.1 Industry ecosystem analysis

- 3.2 Industry impact forces

- 3.2.1 Growth drivers

- 3.2.1.1 Increasing demand for automatic bench-top dental autoclaves

- 3.2.1.2 Growing focus on infection control

- 3.2.1.3 Technological advancement in autoclave

- 3.2.1.4 Rising prevalence of dental disorders

- 3.2.2 Industry pitfalls and challenges

- 3.2.2.1 Adoption of refurbished dental autoclaves

- 3.2.2.2 Limited awareness in developing economies

- 3.2.1 Growth drivers

- 3.3 Growth potential analysis

- 3.4 Technological landscape

- 3.5 Regulatory landscape

- 3.6 Trump administration tariffs

- 3.6.1 Impact on trade

- 3.6.1.1 Trade volume disruptions

- 3.6.1.2 Country-wise response

- 3.6.2 Impact on the industry

- 3.6.2.1 Supply-side impact (Cost of manufacturing)

- 3.6.2.1.1 Price volatility in key materials

- 3.6.2.1.2 Supply chain restructuring

- 3.6.2.1.3 Production cost implications

- 3.6.2.2 Demand-side impact (Cost to consumers)

- 3.6.2.2.1 Price transmission to end markets

- 3.6.2.2.2 Market share dynamics

- 3.6.2.2.3 Consumer response patterns

- 3.6.2.1 Supply-side impact (Cost of manufacturing)

- 3.6.3 Key companies impacted

- 3.6.4 Strategic industry responses

- 3.6.4.1 Supply chain reconfiguration

- 3.6.4.2 Pricing and product strategies

- 3.6.4.3 Policy engagement

- 3.6.5 Outlook and future considerations

- 3.6.1 Impact on trade

- 3.7 Porter's analysis

- 3.8 PESTEL analysis

Chapter 4 Competitive Landscape, 2024

- 4.1 Introduction

- 4.2 Company market share analysis

- 4.3 Competitive analysis of major market players

- 4.4 Competitive positioning matrix

- 4.5 Strategy dashboard

Chapter 5 Market Estimates and Forecast, By Product, 2021 - 2034 ($ Mn)

- 5.1 Key trends

- 5.2 Automatic

- 5.3 Semi-automatic

- 5.4 Manual

Chapter 6 Market Estimates and Forecast, By Technology, 2021 - 2034 ($ Mn)

- 6.1 Key trends

- 6.2 Pre and post vacuum

- 6.3 Gravity

Chapter 7 Market Estimates and Forecast, By Class, 2021 - 2034 ($ Mn)

- 7.1 Key trends

- 7.2 Class B

- 7.3 Class N

- 7.4 Class S

Chapter 8 Market Estimates and Forecast, By End Use, 2021 - 2034 ($ Mn)

- 8.1 Key trends

- 8.2 Hospitals and dental clinics

- 8.3 Dental laboratories

- 8.4 Academic and research institutes

Chapter 9 Market Estimates and Forecast, By Region, 2021 - 2034 ($ Mn)

- 9.1 Key trends

- 9.2 North America

- 9.2.1 U.S.

- 9.2.2 Canada

- 9.3 Europe

- 9.3.1 Germany

- 9.3.2 UK

- 9.3.3 France

- 9.3.4 Spain

- 9.3.5 Italy

- 9.3.6 Netherlands

- 9.4 Asia Pacific

- 9.4.1 China

- 9.4.2 Japan

- 9.4.3 India

- 9.4.4 Australia

- 9.4.5 South Korea

- 9.5 Latin America

- 9.5.1 Brazil

- 9.5.2 Mexico

- 9.5.3 Argentina

- 9.6 Middle East and Africa

- 9.6.1 South Africa

- 9.6.2 Saudi Arabia

- 9.6.3 UAE

Chapter 10 Company Profiles

- 10.1 Biolab Scientific

- 10.2 Bionics Scientific

- 10.3 Dentsply Sirona

- 10.4 Flight Dental Systems

- 10.5 FONA

- 10.6 Labocon

- 10.7 Life Steriware

- 10.8 Matachana

- 10.9 Midmark Corporation

- 10.10 NSK

- 10.11 RAYPA

- 10.12 Steelco

- 10.13 Thermo Fisher Scientific

- 10.14 Tuttnauer

- 10.15 W&H