|

市場調查報告書

商品編碼

1750524

高溫工業鍋爐市場機會、成長動力、產業趨勢分析及2025-2034年預測High Temperature Industrial Boiler Market Opportunity, Growth Drivers, Industry Trend Analysis, and Forecast 2025 - 2034 |

||||||

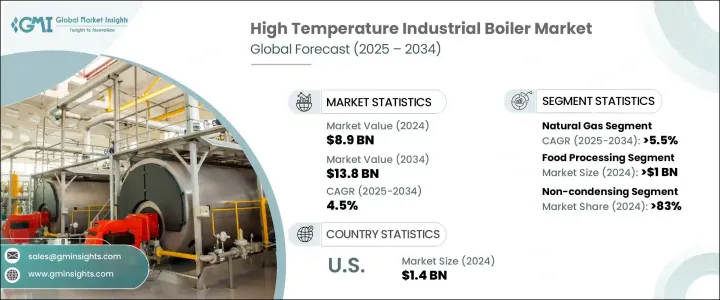

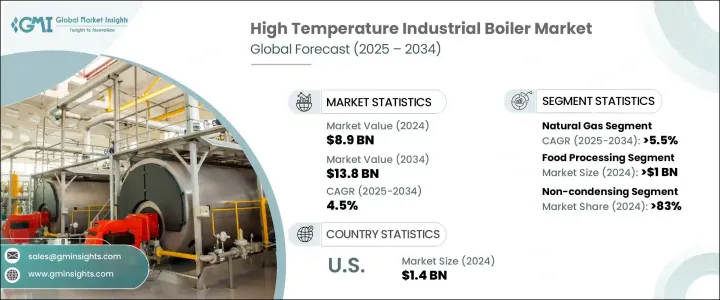

2024年,全球高溫工業鍋爐市場規模達89億美元,預計到2034年將以4.5%的複合年成長率成長,達到138億美元,這得益於發展中國家工業生產的激增和城市化進程的快速推進。隨著各國實施更嚴格的能源效率法規,對先進鍋爐技術的需求預計將大幅成長。人口成長影響著消費模式,尤其是商業和工業領域的暖氣解決方案。隨著基礎建設的蓬勃發展和再生能源的日益普及,各行各業面臨越來越大的壓力,需要更環保、低排放的技術。這些趨勢預計將推動對永續高溫鍋爐系統的需求。

全球範圍內對現代製造程序的投資不斷成長以及環保政策的訂定也正在塑造該行業。隨著排放控制成為優先事項,人們越來越傾向於選擇符合氣候目標的節能解決方案。各行各業擴大採用整合系統,以降低營運成本和能耗,高溫工業鍋爐市場也因此受益匪淺。能源安全和天然氣基礎設施的不斷完善,持續支持燃氣高溫鍋爐的普及。由於各行各業,尤其是在高熱環境下,對可靠的高溫蒸汽解決方案的需求日益成長,因此燃氣鍋爐的業務前景仍然強勁。貿易政策和零件定價是影響全球競爭力的其他因素。

| 市場範圍 | |

|---|---|

| 起始年份 | 2024 |

| 預測年份 | 2025-2034 |

| 起始值 | 89億美元 |

| 預測值 | 138億美元 |

| 複合年成長率 | 4.5% |

隨著各行各業持續轉向更清潔的能源,預計到2034年,天然氣高溫鍋爐的複合年成長率將達到5.5%。人們對空氣品質的日益關注、天然氣供應的不斷增加以及配套基礎設施的不斷擴張,使得這些系統更加可行且更具成本效益。許多政府和私人實體正在積極投資燃氣暖氣技術,以減少對溫室氣體排放量更高的煤炭和石油的依賴。天然氣鍋爐能夠提供穩定的高溫輸出,同時保持較低的排放水平,使其成為製造、加工和化學等能源密集型行業的首選。

非冷凝式高溫鍋爐市場在2024年佔了83%的市佔率。這類鍋爐因其設計簡潔、經久耐用且能夠在嚴苛環境下運作而備受青睞。需要持續供暖的行業高度依賴非冷凝式系統,因為它們保溫性能高、響應速度快。儘管環保法規日益嚴格,但在基礎設施或成本因素阻礙轉向冷凝式或混合式鍋爐的情況下,這類鍋爐仍廣受歡迎。然而,為了滿足不斷變化的能源效率標準,製造商正在透過更完善的控制系統和先進的燃燒技術來改進非冷凝式鍋爐。

2024年,美國高溫工業鍋爐市場規模達14億美元,反映出強勁的國內需求。這一成長主要源自於老舊工業設施中老化低效鍋爐系統的更換。隨著能源消耗和排放新規日益嚴格,各行各業都在積極推動營運現代化。聯邦和州級的激勵措施正在鼓勵這種轉變,支持企業採用更清潔、更有效率的設備。對永續性的日益關注,加上對能源基礎設施的經濟投資,正在推動對符合未來能源政策、技術先進的鍋爐的需求。

為市場格局做出貢獻的領先公司包括西門子、Thermax、三菱重工、赫斯特鍋爐和焊接公司、巴布科克和威爾科克斯企業、Sofinter、福布斯馬歇爾、通用電氣 Vernova、勝利能源營運公司、克利弗-布魯克斯、菲斯曼、克萊頓工業公司、科克倫、斗山重工業與建築公司、FONDITALsnagar工業公司、約翰·科克里爾、三浦美國、富爾頓公司、羅伯特·博世、Fonderie Sime 和 Rentech Boilers。為了鞏固其在市場中的地位,主要參與者正專注於創新、永續性和策略聯盟。本公司投資研發,以開發符合嚴格排放標準的緊湊、節能鍋爐。與政府和其他工業公司的合作有助於擴大業務範圍並簡化供應鏈。許多公司增強了數位控制系統,以最佳化鍋爐性能並最大限度地減少停機時間,同時擴大售後服務以建立長期的客戶關係。

目錄

第1章:方法論與範圍

第2章:執行摘要

第3章:行業洞察

- 產業生態系統分析

- 產業衝擊力

- 成長動力

- 自動桌上型牙科高壓滅菌器的需求不斷增加

- 日益重視感染控制

- 高壓釜的技術進步

- 牙齒疾病盛行率上升

- 產業陷阱與挑戰

- 採用翻新的牙科高壓滅菌器

- 發展中經濟體的認知有限

- 成長動力

- 成長潛力分析

- 技術格局

- 監管格局

- 川普政府關稅

- 對貿易的影響

- 貿易量中斷

- 各國應對措施

- 對產業的影響

- 供應方影響(製造成本)

- 主要材料價格波動

- 供應鏈重組

- 生產成本影響

- 需求面影響(消費者成本)

- 價格傳導至終端市場

- 市佔率動態

- 消費者反應模式

- 供應方影響(製造成本)

- 受影響的主要公司

- 策略產業反應

- 供應鏈重組

- 定價和產品策略

- 政策參與

- 展望與未來考慮

- 對貿易的影響

- 波特的分析

- PESTEL分析

第4章:競爭格局

- 介紹

- 公司市佔率分析

- 主要市場參與者的競爭分析

- 競爭定位矩陣

- 策略儀表板

第5章:市場估計與預測:按產品,2021 - 2034 年

- 主要趨勢

- 自動的

- 半自動

- 手動的

第6章:市場估計與預測:按技術,2021 - 2034 年

- 主要趨勢

- 前後真空

- 重力

第7章:市場估計與預測:按類別,2021 - 2034 年

- 主要趨勢

- B類

- N類

- S級

第8章:市場估計與預測:依最終用途,2021 - 2034 年

- 主要趨勢

- 醫院和牙科診所

- 牙科實驗室

- 學術和研究機構

第9章:市場估計與預測:按地區,2021 - 2034 年

- 主要趨勢

- 北美洲

- 美國

- 加拿大

- 歐洲

- 德國

- 英國

- 法國

- 西班牙

- 義大利

- 荷蘭

- 亞太地區

- 中國

- 日本

- 印度

- 澳洲

- 韓國

- 拉丁美洲

- 巴西

- 墨西哥

- 阿根廷

- 中東和非洲

- 南非

- 沙烏地阿拉伯

- 阿拉伯聯合大公國

第10章:公司簡介

- Biolab Scientific

- Bionics Scientific

- Dentsply Sirona

- Flight Dental Systems

- FONA

- Labocon

- Life Steriware

- Matachana

- Midmark Corporation

- NSK

- RAYPA

- Steelco

- Thermo Fisher Scientific

- Tuttnauer

- W&H

The Global High Temperature Industrial Boiler Market was valued at USD 8.9 billion in 2024 and is estimated to grow at a CAGR of 4.5% to reach USD 13.8 billion by 2034, driven by the surge in industrial production with rapid urban expansion across developing nations. As countries implement stricter regulations to boost energy efficiency, demand for advanced boiler technologies is expected to grow significantly. Rising population levels influence consumption patterns, particularly for heating solutions in commercial and industrial spaces. With infrastructure development gaining momentum and renewable energy integration becoming more widespread, industries are under increased pressure to adopt greener, low-emission technologies. These trends are expected to fuel demand for sustainable high-temperature boiler systems.

The industry is also being shaped by growing investments in modern manufacturing processes and eco-conscious policies at the global level. With emissions control becoming a priority, there's a growing preference for energy-efficient solutions that align with climate goals. The high temperature industrial boiler market is further benefiting from the increased use of integrated systems across sectors seeking to reduce operational costs and energy consumption. Energy security and the expanding availability of natural gas infrastructure continue to support the adoption of gas-powered high-temperature boilers. With industries demanding reliable high-temperature steam solutions, especially in heat-intensive environments, the business outlook remains strong. Trade policies and component pricing are additional factors shaping global competitiveness.

| Market Scope | |

|---|---|

| Start Year | 2024 |

| Forecast Year | 2025-2034 |

| Start Value | $8.9 Billion |

| Forecast Value | $13.8 Billion |

| CAGR | 4.5% |

Natural gas-fired high temperature boilers are projected to grow at a CAGR of 5.5% through 2034, as industries continue shifting toward cleaner energy sources. Increasing concerns around air quality, rising natural gas availability, and expanding supportive infrastructure make these systems more viable and cost-effective. Many governments and private entities are actively investing in gas-powered heating technologies to reduce dependence on coal and oil, which emit higher levels of greenhouse gases. The ability of natural gas boilers to deliver consistent high-temperature output while maintaining lower emission levels positions them as a preferred option across energy-intensive sectors such as manufacturing, processing, and chemicals.

Non-condensing high temperature boilers segment held an 83% share in 2024. These boilers are favored for their simple design, durability, and ability to perform in demanding environments. Industries with continuous heating needs rely heavily on non-condensing systems due to their high heat retention and quick response time. Despite growing environmental regulations, these boilers remain popular where infrastructure or cost considerations prevent a shift to condensing or hybrid models. However, to meet changing efficiency standards, manufacturers are enhancing non-condensing models with better control systems and advanced combustion technologies.

United States High Temperature Industrial Boiler Market reached USD 1.4 billion in 2024, reflecting strong domestic demand. A major portion of this growth is attributed to replacing aging and inefficient boiler systems in older industrial facilities. As new regulations on energy consumption and emissions become more stringent, industries modernize their operations. Federal and state-level incentives are encouraging this shift by offering support for the adoption of cleaner, high-efficiency equipment. The increased focus on sustainability, coupled with economic investments in energy infrastructure, is driving the need for technologically advanced boilers that align with future-ready energy policies.

Leading companies contributing to the market landscape include Siemens, Thermax, Mitsubishi Heavy Industries, Hurst Boiler and Welding, Babcock and Wilcox Enterprises, Sofinter, Forbes Marshall, GE Vernova, Victory Energy Operations, Cleaver-Brooks, Viessmann, Clayton Industries, Cochran, Doosan Heavy Industries & Construction, FONDITAL, Bharat Heavy Electricals, FERROLI, Hoval, John Wood Group, Groupe Atlantic, IHI Corporation, Walchandnagar Industries, John Cockerill, Miura America, The Fulton Companies, Robert Bosch, Fonderie Sime, and Rentech Boilers. To reinforce their position in the market, major players are focusing on innovation, sustainability, and strategic alliances. Companies invest in R&D to develop compact, energy-efficient boilers that meet stringent emissions standards. Partnerships with governments and other industrial firms help expand operational reach and streamline supply chains. Many enhance digital control systems to optimize boiler performance and minimize downtime, while expanding aftermarket services to build long-term client relationships.

Table of Contents

Chapter 1 Methodology and Scope

- 1.1 Market scope and definitions

- 1.2 Research design

- 1.2.1 Research approach

- 1.2.2 Data collection methods

- 1.3 Base estimates and calculations

- 1.3.1 Base year calculation

- 1.3.2 Key trends for market estimation

- 1.4 Forecast model

- 1.5 Primary research and validation

- 1.5.1 Primary sources

- 1.5.2 Data mining sources

Chapter 2 Executive Summary

- 2.1 Industry 3600 synopsis

Chapter 3 Industry Insights

- 3.1 Industry ecosystem analysis

- 3.2 Industry impact forces

- 3.2.1 Growth drivers

- 3.2.1.1 Increasing demand for automatic bench-top dental autoclaves

- 3.2.1.2 Growing focus on infection control

- 3.2.1.3 Technological advancement in autoclave

- 3.2.1.4 Rising prevalence of dental disorders

- 3.2.2 Industry pitfalls and challenges

- 3.2.2.1 Adoption of refurbished dental autoclaves

- 3.2.2.2 Limited awareness in developing economies

- 3.2.1 Growth drivers

- 3.3 Growth potential analysis

- 3.4 Technological landscape

- 3.5 Regulatory landscape

- 3.6 Trump administration tariffs

- 3.6.1 Impact on trade

- 3.6.1.1 Trade volume disruptions

- 3.6.1.2 Country-wise response

- 3.6.2 Impact on the industry

- 3.6.2.1 Supply-side impact (Cost of manufacturing)

- 3.6.2.1.1 Price volatility in key materials

- 3.6.2.1.2 Supply chain restructuring

- 3.6.2.1.3 Production cost implications

- 3.6.2.2 Demand-side impact (Cost to consumers)

- 3.6.2.2.1 Price transmission to end markets

- 3.6.2.2.2 Market share dynamics

- 3.6.2.2.3 Consumer response patterns

- 3.6.2.1 Supply-side impact (Cost of manufacturing)

- 3.6.3 Key companies impacted

- 3.6.4 Strategic industry responses

- 3.6.4.1 Supply chain reconfiguration

- 3.6.4.2 Pricing and product strategies

- 3.6.4.3 Policy engagement

- 3.6.5 Outlook and future considerations

- 3.6.1 Impact on trade

- 3.7 Porter's analysis

- 3.8 PESTEL analysis

Chapter 4 Competitive Landscape, 2024

- 4.1 Introduction

- 4.2 Company market share analysis

- 4.3 Competitive analysis of major market players

- 4.4 Competitive positioning matrix

- 4.5 Strategy dashboard

Chapter 5 Market Estimates and Forecast, By Product, 2021 - 2034 ($ Mn)

- 5.1 Key trends

- 5.2 Automatic

- 5.3 Semi-automatic

- 5.4 Manual

Chapter 6 Market Estimates and Forecast, By Technology, 2021 - 2034 ($ Mn)

- 6.1 Key trends

- 6.2 Pre and post vacuum

- 6.3 Gravity

Chapter 7 Market Estimates and Forecast, By Class, 2021 - 2034 ($ Mn)

- 7.1 Key trends

- 7.2 Class B

- 7.3 Class N

- 7.4 Class S

Chapter 8 Market Estimates and Forecast, By End Use, 2021 - 2034 ($ Mn)

- 8.1 Key trends

- 8.2 Hospitals and dental clinics

- 8.3 Dental laboratories

- 8.4 Academic and research institutes

Chapter 9 Market Estimates and Forecast, By Region, 2021 - 2034 ($ Mn)

- 9.1 Key trends

- 9.2 North America

- 9.2.1 U.S.

- 9.2.2 Canada

- 9.3 Europe

- 9.3.1 Germany

- 9.3.2 UK

- 9.3.3 France

- 9.3.4 Spain

- 9.3.5 Italy

- 9.3.6 Netherlands

- 9.4 Asia Pacific

- 9.4.1 China

- 9.4.2 Japan

- 9.4.3 India

- 9.4.4 Australia

- 9.4.5 South Korea

- 9.5 Latin America

- 9.5.1 Brazil

- 9.5.2 Mexico

- 9.5.3 Argentina

- 9.6 Middle East and Africa

- 9.6.1 South Africa

- 9.6.2 Saudi Arabia

- 9.6.3 UAE

Chapter 10 Company Profiles

- 10.1 Biolab Scientific

- 10.2 Bionics Scientific

- 10.3 Dentsply Sirona

- 10.4 Flight Dental Systems

- 10.5 FONA

- 10.6 Labocon

- 10.7 Life Steriware

- 10.8 Matachana

- 10.9 Midmark Corporation

- 10.10 NSK

- 10.11 RAYPA

- 10.12 Steelco

- 10.13 Thermo Fisher Scientific

- 10.14 Tuttnauer

- 10.15 W&H