|

市場調查報告書

商品編碼

1750523

獸醫超音波市場機會、成長動力、產業趨勢分析及 2025 - 2034 年預測Veterinary Ultrasound Market Opportunity, Growth Drivers, Industry Trend Analysis, and Forecast 2025 - 2034 |

||||||

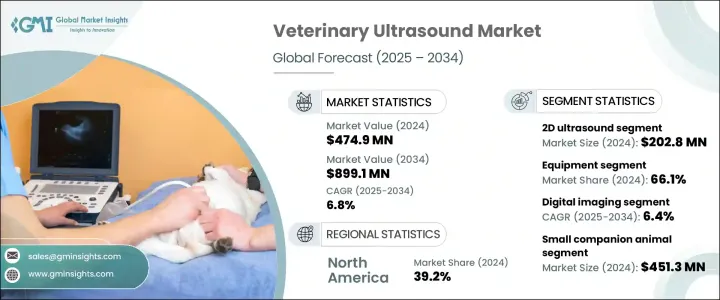

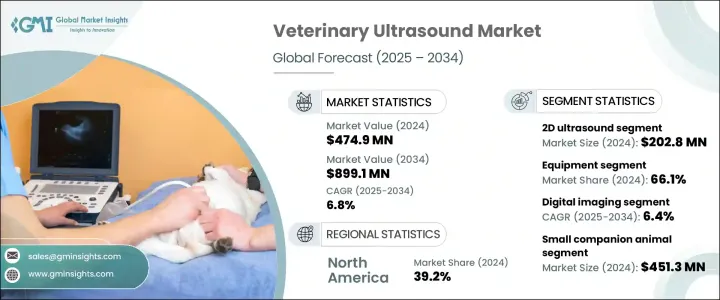

2024年,全球獸醫超音波市場規模達4.749億美元,預計到2034年將以6.8%的複合年成長率成長,達到8.991億美元,這主要得益於幾個關鍵因素。動物疾病和病症發病率的不斷上升,促使人們需要先進的診斷工具來改善動物保健。此外,寵物主人對早期診斷和治療重要性的認知不斷提高,進一步刺激了對這些技術的需求。寵物收養率的上升,加上畜牧養殖業的擴張,也增加了定期健康監測的需求,以確保最佳的生產力和福利。攜帶式超音波設備和與遠距醫療平台的整合等技術創新,正在顯著促進市場成長。此外,對動物福利的日益關注以及動物保健支出的增加,預計將繼續推動市場向前發展。

獸醫超音波技術在動物保健領域具有顯著優勢,無需侵入性操作,即可讓獸醫詳細準確地了解動物的內部健康狀況。該設備發射高頻聲波,聲波在動物內部結構反射後,產生即時的視覺影像,這些影像易於解讀,可用於評估各種疾病。這些影像有助於診斷各種疾病,例如心臟病、腎臟疾病、生殖問題和胃腸道疾病,使獸醫能夠及時做出精準的治療決策。

| 市場範圍 | |

|---|---|

| 起始年份 | 2024 |

| 預測年份 | 2025-2034 |

| 起始值 | 4.749億美元 |

| 預測值 | 8.991億美元 |

| 複合年成長率 | 6.8% |

2024年,2D超音波市場價值2.028億美元。2D超音波設備因其能夠產生即時影像,輔助診斷動物各種疾病而廣受歡迎。2D超音波價格實惠、操作簡單、效果顯著,尤其在懷孕檢測和腹部影像等應用領域備受獸醫青睞。攜帶式2D超音波設備的進步為現場和臨床應用提供了更大的靈活性,預計該領域將繼續蓬勃發展。

2024年,設備細分市場佔據了66.1%的市場佔有率,這得益於動物保健領域對先進診斷成像解決方案日益成長的需求。獸醫診所和動物醫院擴大採用超音波技術,尤其是在早期疾病檢測和改善動物福利方面。製造商正在透過3D/4D成像和多普勒技術等功能增強其產品,進一步提升了超音波設備在市場上的吸引力。

2024年,美國獸醫超音波市場規模達1.693億美元。美國完善的醫療基礎設施、非侵入性診斷工具的廣泛應用以及日益提升的寵物健康意識,使其成為全球市場的重要參與者。獸醫診所和醫院數量的不斷增加,以及人們對寵物疾病和早期檢測重要性的日益重視,推動了超音波設備需求的持續成長。

全球獸醫超音波市場的領導者包括通用電氣醫療集團 (GE Healthcare)、科瑞斯 (Clarius)、百勝 (Esaote)、富士索諾聲 (Fujifilm Sonosite) 和安萬特動物保健 (Avante Animal Health)。這些公司致力於改進產品供應並擴大市場佔有率。其關鍵策略包括開發創新超音波技術、與獸醫診所和醫院建立合作夥伴關係,以及投資行動超音波解決方案以滿足現場應用需求。各公司也強調整合無線連接和與遠距醫療平台相容等先進功能,以滿足日益成長的遠端診斷和即時諮詢需求。此外,這些企業正在擴展其分銷網路,以滲透新興市場,並利用不同地區獸醫超音波日益普及的優勢。

目錄

第1章:方法論與範圍

第2章:執行摘要

第3章:行業洞察

- 產業生態系統分析

- 產業衝擊力

- 成長動力

- 寵物擁有量和支出增加

- 成像技術的進步

- 獸醫診所和醫院的數量不斷增加

- 對非侵入性和即時診斷工具的需求不斷成長

- 產業陷阱與挑戰

- 與儀器和程序相關的高成本

- 成長動力

- 成長潛力分析

- 監管格局

- 技術格局

- 未來市場趨勢

- 波特的分析

- PESTEL分析

第4章:競爭格局

- 介紹

- 公司矩陣分析

- 主要市場參與者的競爭分析

- 競爭定位矩陣

- 策略儀表板

第5章:市場估計與預測:按類型,2021 年至 2034 年

- 主要趨勢

- 2D超音波

- 多普勒超音波

- 3D/4D超音波

第6章:市場估計與預測:按產品,2021 年至 2034 年

- 裝置

- 推車式超音波掃描儀

- 攜帶式超音波掃描儀

- 配件/耗材

- 軟體

第7章:市場估計與預測:按技術,2021 年至 2034 年

- 主要趨勢

- 數位影像

- 對比成像

第8章:市場估計與預測:依動物類型,2021 年至 2034 年

- 主要趨勢

- 小型伴侶動物

- 狗

- 貓

- 其他小型伴侶動物

- 大型動物

- 馬

- 牛

- 其他大型動物

- 其他動物

第9章:市場估計與預測:按應用,2021 年至 2034 年

- 主要趨勢

- 婦產科

- 心臟病學

- 骨科

- 腹部影像學檢查

- 其他應用

第 10 章:市場估計與預測:依最終用途,2021 年至 2034 年

- 主要趨勢

- 獸醫醫院和診所

- 診斷影像中心

- 其他最終用途

第 11 章:市場估計與預測:按地區,2021 年至 2034 年

- 主要趨勢

- 北美洲

- 美國

- 加拿大

- 歐洲

- 德國

- 英國

- 法國

- 義大利

- 西班牙

- 荷蘭

- 亞太地區

- 中國

- 日本

- 印度

- 澳洲

- 韓國

- 拉丁美洲

- 巴西

- 墨西哥

- 阿根廷

- 中東和非洲

- 南非

- 沙烏地阿拉伯

- 阿拉伯聯合大公國

第12章:公司簡介

- Avante Animal Health

- BMV Medtech Group

- Clarius

- Esaote

- EDAN Instruments

- Fujifilm Sonosite

- GE Healthcare

- Heska Corporation

- IMV Imaging

- Lepu Medical Technology

- Samsung Healthcare

- Shenzhen Mindray Animal Medical Technology

- SonoStar Medical

- Siemens Healthineers

- Vinno Technology

The Global Veterinary Ultrasound Market was valued at USD 474.9 million in 2024 and is estimated to grow at a CAGR of 6.8% to reach USD 899.1 million by 2034, driven by several key factors. Increasing rates of animal diseases and disorders are prompting the need for advanced diagnostic tools to improve animal healthcare. Additionally, growing awareness among pet owners about the importance of early diagnosis and treatment has further spurred the demand for these technologies. The rising rates of pet adoption, coupled with the expansion of livestock farming, have also increased the need for regular health monitoring to ensure optimal productivity and welfare. Technological innovations, such as portable ultrasound devices and integration with telemedicine platforms, are significantly contributing to market growth. Furthermore, an increased focus on animal welfare, along with rising spending on animal healthcare, is expected to continue driving the market forward.

Veterinary ultrasound offers significant advantages in animal healthcare, providing veterinarians with a detailed and accurate view of an animal's internal health without the need for invasive procedures. By emitting high-frequency sound waves that bounce off internal structures, the device generates real-time, visual images that can be easily interpreted to assess various conditions. These images help diagnose a variety of ailments, such as heart disease, kidney disorders, reproductive issues, and gastrointestinal problems, enabling veterinarians to make timely and precise treatment decisions.

| Market Scope | |

|---|---|

| Start Year | 2024 |

| Forecast Year | 2025-2034 |

| Start Value | $474.9 Million |

| Forecast Value | $899.1 Million |

| CAGR | 6.8% |

In 2024, the 2D ultrasound was valued at USD 202.8 million. 2D ultrasound devices are popular for their ability to produce real-time images that assist in diagnosing various conditions in animals. The affordability, simplicity, and effectiveness of 2D ultrasound make it a favored choice among veterinarians, especially for applications such as pregnancy detection and abdominal imaging. The segment is expected to continue thriving, fueled by advancements in portable 2D ultrasound devices that offer greater flexibility for both field-based and clinical use.

The equipment segment accounted for 66.1% share in 2024, driven by a growing need for advanced diagnostic imaging solutions in animal healthcare. Veterinary clinics and animal hospitals are increasingly adopting ultrasound technology, particularly for early disease detection and improving animal welfare. Manufacturers are enhancing their offerings with features like 3D/4D imaging and Doppler technology, further boosting the appeal of ultrasound equipment in the market.

U.S. Veterinary Ultrasound Market was valued at USD 169.3 million in 2024. The country's well-established healthcare infrastructure, widespread use of non-invasive diagnostic tools, and rising awareness about pet health have positioned it as a major player in the global market. The high demand for ultrasound devices is driven by an increasing number of veterinary clinics and hospitals, as well as a growing awareness of pet diseases and the importance of early detection.

Leading players in the Global Veterinary Ultrasound Market include GE Healthcare, Clarius, Esaote, Fujifilm Sonosite, and Avante Animal Health. These companies are focusing on improving product offerings and expanding their market presence. Key strategies employed include the development of innovative ultrasound technologies, partnerships with veterinary clinics and hospitals, and investments in mobile ultrasound solutions to cater to field-based applications. Companies are also emphasizing the integration of advanced features such as wireless connectivity and compatibility with telemedicine platforms to meet the growing demand for remote diagnostics and real-time consultation. Additionally, these players are expanding their distribution networks to penetrate emerging markets and capitalize on the increasing adoption of veterinary ultrasound across different regions.

Table of Contents

Chapter 1 Methodology and Scope

- 1.1 Market scope and definition

- 1.2 Research design

- 1.2.1 Research approach

- 1.2.2 Data collection methods

- 1.3 Base estimates and calculations

- 1.3.1 Base year calculation

- 1.3.2 Key trends for market estimation

- 1.4 Forecast model

- 1.5 Primary research and validation

- 1.5.1 Primary sources

- 1.5.2 Data mining sources

Chapter 2 Executive Summary

- 2.1 Industry 3600 synopsis

Chapter 3 Industry Insights

- 3.1 Industry ecosystem analysis

- 3.2 Industry impact forces

- 3.2.1 Growth drivers

- 3.2.1.1 Increasing pet ownership and expenditure

- 3.2.1.2 Advancements in imaging technologies

- 3.2.1.3 Growing number of veterinary clinics and hospitals

- 3.2.1.4 Growing demand for non-invasive and real-time diagnostic tools

- 3.2.2 Industry pitfalls and challenges

- 3.2.2.1 High cost associated with the instruments and procedures

- 3.2.1 Growth drivers

- 3.3 Growth potential analysis

- 3.4 Regulatory landscape

- 3.5 Technology landscape

- 3.6 Future market trends

- 3.7 Porter's analysis

- 3.8 PESTEL analysis

Chapter 4 Competitive Landscape, 2024

- 4.1 Introduction

- 4.2 Company matrix analysis

- 4.3 Competitive analysis of major market players

- 4.4 Competitive positioning matrix

- 4.5 Strategy dashboard

Chapter 5 Market Estimates and Forecast, By Type, 2021 – 2034 ($ Mn)

- 5.1 Key trends

- 5.2 2D ultrasound

- 5.3 Doppler ultrasound

- 5.4 3D/4D ultrasound

Chapter 6 Market Estimates and Forecast, By Product, 2021 – 2034 ($ Mn)

- 6.1 Equipment

- 6.1.1 Cart-based ultrasound scanners

- 6.1.2 Portable ultrasound scanners

- 6.2 Accessories/consumables

- 6.3 Software

Chapter 7 Market Estimates and Forecast, By Technology, 2021 – 2034 ($ Mn)

- 7.1 Key trends

- 7.2 Digital imaging

- 7.3 Contrast imaging

Chapter 8 Market Estimates and Forecast, By Animal Type, 2021 – 2034 ($ Mn)

- 8.1 Key trends

- 8.2 Small companion animals

- 8.2.1 Dogs

- 8.2.2 Cats

- 8.2.3 Other small companion animals

- 8.3 Large animals

- 8.3.1 Horse

- 8.3.2 Cattle

- 8.3.3 Other large animals

- 8.4 Other animals

Chapter 9 Market Estimates and Forecast, By Application, 2021 – 2034 ($ Mn)

- 9.1 Key trends

- 9.2 Obstetrics/gynecology

- 9.3 Cardiology

- 9.4 Orthopedics

- 9.5 Abdominal imaging

- 9.6 Other applications

Chapter 10 Market Estimates and Forecast, By End Use, 2021 – 2034 ($ Mn)

- 10.1 Key trends

- 10.2 Veterinary hospitals and clinics

- 10.3 Diagnostic imaging centers

- 10.4 Other end use

Chapter 11 Market Estimates and Forecast, By Region, 2021 – 2034 ($ Mn)

- 11.1 Key trends

- 11.2 North America

- 11.2.1 U.S.

- 11.2.2 Canada

- 11.3 Europe

- 11.3.1 Germany

- 11.3.2 UK

- 11.3.3 France

- 11.3.4 Italy

- 11.3.5 Spain

- 11.3.6 Netherlands

- 11.4 Asia Pacific

- 11.4.1 China

- 11.4.2 Japan

- 11.4.3 India

- 11.4.4 Australia

- 11.4.5 South Korea

- 11.5 Latin America

- 11.5.1 Brazil

- 11.5.2 Mexico

- 11.5.3 Argentina

- 11.6 Middle East and Africa

- 11.6.1 South Africa

- 11.6.2 Saudi Arabia

- 11.6.3 UAE

Chapter 12 Company Profiles

- 12.1 Avante Animal Health

- 12.2 BMV Medtech Group

- 12.3 Clarius

- 12.4 Esaote

- 12.5 EDAN Instruments

- 12.6 Fujifilm Sonosite

- 12.7 GE Healthcare

- 12.8 Heska Corporation

- 12.9 IMV Imaging

- 12.10 Lepu Medical Technology

- 12.11 Samsung Healthcare

- 12.12 Shenzhen Mindray Animal Medical Technology

- 12.13 SonoStar Medical

- 12.14 Siemens Healthineers

- 12.15 Vinno Technology