|

市場調查報告書

商品編碼

1750515

經導管栓塞及封堵裝置市場機會、成長動力、產業趨勢分析及 2025 - 2034 年預測Transcatheter Embolization And Occlusion Devices Market Opportunity, Growth Drivers, Industry Trend Analysis, and Forecast 2025 - 2034 |

||||||

2024年,全球經導管栓塞與封堵裝置市場規模達53億美元,預計到2034年將以8.3%的複合年成長率成長,達到115億美元。推動這一成長的因素包括癌症等慢性疾病的發生率不斷上升、妊娠併發症、血管畸形以及血友病等出血性疾病,這些疾病都需要專科醫療照護。此外,全球人口老化導致人們對生活品質更高的手術需求不斷成長,這些手術旨在降低手術創傷並縮短住院時間,這使得經導管栓塞與封堵裝置(TEO)對醫生和患者都頗具吸引力。

肝癌和肝細胞癌病例的增加,尤其是在亞太地區,導致栓塞療法(例如經動脈化療栓塞術 (TACE))的應用日益廣泛。導管技術、醫學影像和生物相容性材料的進步提高了這些手術的安全性和準確性,從而促進了其更廣泛的應用。此外,人們對微創治療方案的認知不斷提高,使得子宮肌瘤栓塞術 (UFE) 成為尋求傳統外科手術替代方案的女性群體的熱門選擇。與子宮切除術不同,UFE 可以保留子宮,縮短恢復時間,並最大程度地減少住院時間,使其成為更具吸引力且更方便患者的治療方案。病患偏好的這種轉變促使更多婦科醫師和介入放射科醫師推薦栓塞技術,進而推動了經導管栓塞裝置的普及。

| 市場範圍 | |

|---|---|

| 起始年份 | 2024 |

| 預測年份 | 2025-2034 |

| 起始值 | 53億美元 |

| 預測值 | 115億美元 |

| 複合年成長率 | 8.3% |

市場按設備類型細分為非線圈和線圈兩類。非線圈市場預計將以 8.6% 的複合年成長率成長,到 2034 年達到 67 億美元,這得益於微球和液體栓塞劑等新型栓塞劑的普及,以及相比傳統線圈設備在閉塞過程中控制性能更佳的栓塞。非線圈解決方案尤其適用於治療肝癌、動靜脈畸形、胃腸道出血和子宮肌瘤的標靶栓塞手術。它們能夠導航複雜的血管解剖結構並獲得一致的結果,因此越來越受到介入放射科醫師的青睞。

在應用方面,腫瘤領域預計將推動業務成長,複合年成長率達8.8%,到2034年將達到44億美元。這得歸功於全球癌症負擔的持續加重,尤其是肝癌、腎癌和肺癌,這些癌症通常需要更局部化、侵入性更低的治療方案。經動脈化療栓塞術(TACE)和放射栓塞術作為重要的介入性腫瘤治療手段的應用顯著成長。肝細胞癌病例的不斷增加,主要集中在亞太和拉丁美洲地區,也見證了栓塞療法的應用日益增加。

美國經導管栓塞和封堵裝置市場在2024年達到18億美元,預計2025年至2034年期間的複合年成長率將達到7.4%。栓塞治療裝置的需求在很大程度上受到癌症、胃腸道出血、動脈瘤和子宮肌瘤等廣泛健康問題的影響,而微創栓塞療法是治療這些疾病的最佳方法。美國占主導地位的醫療保健支出及其完善的醫療基礎設施促進了新型經導管栓塞術(TEO)的推廣。此外,領先市場製造商的不斷湧現以及美國食品藥物管理局(FDA)對新型高效栓塞劑和輸送系統的批准激增,也推動了市場的成長。

全球經導管栓塞和封堵裝置行業的知名企業包括雅培、Acandis、Balt、波士頓科學、COOK MEDICAL、Edwards Lifesciences、強生、LEPU MEDICAL、美敦力、Merit Medical、MicroVention、Penumbra、Shape Memory Medical、SIRTEX、Stryker 和 TERUMO。為了鞏固市場地位,經導管栓塞和封堵裝置市場的公司正專注於幾項關鍵策略。這些策略包括投資研發,以創造滿足醫療服務提供者和患者不斷變化的需求的創新產品。公司正在與醫院和醫療機構建立策略夥伴關係和合作關係,以提高產品採用率並擴大市場範圍。此外,該公司還致力於擴展其產品組合,以滿足更廣泛的醫療條件和應用需求。

目錄

第1章:方法論與範圍

第2章:執行摘要

第3章:行業洞察

- 產業生態系統分析

- 產業衝擊力

- 成長動力

- 轉向微創手術

- 提高介入放射學能力

- 慢性病盛行率上升

- 栓塞材料的技術進步

- 創傷發生率增加

- 產業陷阱與挑戰

- 設備和手術成本高昂

- 非標靶栓塞的風險

- 成長動力

- 成長潛力分析

- 監管格局

- 川普政府關稅

- 對貿易的影響

- 貿易量中斷

- 各國應對措施

- 對產業的影響

- 供應方影響(製造成本)

- 主要材料價格波動

- 供應鏈重組

- 生產成本影響

- 需求面影響(消費者成本)

- 價格傳導至終端市場

- 市佔率動態

- 消費者反應模式

- 供應方影響(製造成本)

- 受影響的主要公司

- 策略產業反應

- 供應鏈重組

- 定價和產品策略

- 政策參與

- 展望與未來考慮

- 對貿易的影響

- 技術格局

- 差距分析

- 波特的分析

- PESTEL分析

- 價值鏈分析

第4章:競爭格局

- 介紹

- 公司矩陣分析

- 公司市佔率分析

- 主要市場參與者的競爭分析

- 競爭定位矩陣

- 策略儀表板

第5章:市場估計與預測:按設備類型,2021 - 2034 年

- 主要趨勢

- 無線圈

- 流量轉向裝置

- 栓塞顆粒

- 液態栓塞劑

- 其他非線圈設備類型

- 線圈

- 可推式線圈

- 可拆卸彈簧

第6章:市場估計與預測:按應用,2021 - 2034 年

- 主要趨勢

- 腫瘤學

- 周邊血管疾病

- 神經病學

- 泌尿科

- 其他應用

第7章:市場估計與預測:依最終用途,2021 - 2034 年

- 主要趨勢

- 醫院

- 門診手術中心

- 其他最終用途

第8章:市場估計與預測:按地區,2021 - 2034 年

- 主要趨勢

- 北美洲

- 美國

- 加拿大

- 歐洲

- 德國

- 英國

- 法國

- 西班牙

- 義大利

- 荷蘭

- 亞太地區

- 中國

- 日本

- 印度

- 澳洲

- 韓國

- 拉丁美洲

- 巴西

- 墨西哥

- 阿根廷

- 中東和非洲

- 南非

- 沙烏地阿拉伯

- 阿拉伯聯合大公國

第9章:公司簡介

- Abbott

- acandis

- balt

- Boston Scientific

- COOK MEDICAL

- Edwards Lifesciences

- Johnson & Johnson

- LEPU MEDICAL

- Medtronic

- Merit Medical

- MicroVention

- Penumbra

- shape memory medical

- SIRTEX

- stryker

- TERUMO

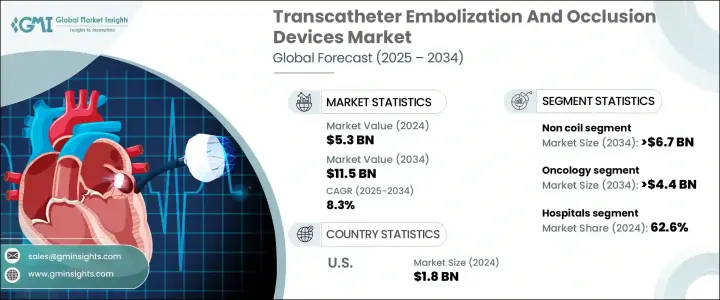

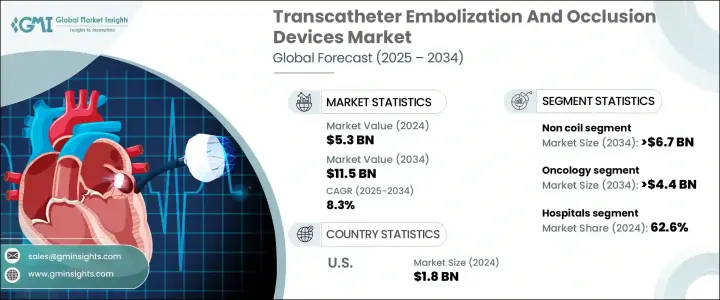

The Global Transcatheter Embolization And Occlusion Devices Market was valued at USD 5.3 billion in 2024 and is estimated to grow at a CAGR of 8.3% to reach USD 11.5 billion by 2034, driven by several factors, including the increasing prevalence of chronic diseases such as cancer, complicated pregnancies, vascular malformations, and hemorrhagic disorders like hemophilia, all of which require specialized medical attention. Additionally, the aging global population is leading to a higher demand for quality-of-life procedures that reduce the invasiveness of surgery and shorten hospital stays, making TEO devices favorable to both physicians and patients.

The rise in cases of liver cancer and hepatocellular carcinoma, particularly in the Asia Pacific region, has led to an increased use of embolization therapies like transarterial chemoembolization (TACE). Advancements in catheter technology, medical imaging, and biocompatible materials have improved the safety and accuracy of these procedures, encouraging more widespread adoption. Additionally, the rising awareness about minimally invasive treatment options has made uterine fibroid embolization (UFE) a popular choice among women seeking alternatives to traditional surgical procedures. Unlike hysterectomy, UFE preserves the uterus, reduces recovery time, and minimizes hospital stays, making it a more attractive and patient-friendly solution. This shift in patient preference is encouraging more gynecologists and interventional radiologists to recommend embolization techniques, which is, in turn, boosting the adoption of transcatheter embolization devices.

| Market Scope | |

|---|---|

| Start Year | 2024 |

| Forecast Year | 2025-2034 |

| Start Value | $5.3 Billion |

| Forecast Value | $11.5 Billion |

| CAGR | 8.3% |

The market is segmented by device type into non-coil and coil categories. The non-coil segment is expected to grow at a CAGR of 8.6%, reaching USD 6.7 billion by 2034, attributed to the adoption of new embolic agents like microspheres and liquid embolics, along with plugs that offer superior control during occlusion compared to traditional coil-based devices. Non-coil solutions are particularly preferred in targeted embolization procedures used in treating liver cancer, arteriovenous malformations, gastrointestinal bleeding, and uterine fibroids. Their ability to navigate complex vascular anatomies with consistent results has made them increasingly favored by interventional radiologists.

In terms of application, the oncology segment is expected to drive business growth, expanding at a CAGR of 8.8%, reaching USD 4.4 billion by 2034, fueled by the increasing global burden of cancer, especially liver, kidney, and lung cancers, which often require more localized and less invasive treatment options. There has been significant growth in the adoption of transarterial chemoembolization (TACE) and radioembolization as vital interventional oncology procedures. The growing caseload of hepatocellular carcinoma, predominantly in the Asia Pacific and Latin America regions, is witnessing greater use of embolization therapies.

U.S. Transcatheter Embolization And Occlusion Devices Market accounted for USD 1.8 billion in 2024 and is anticipated to grow at a CAGR of 7.4% between 2025 to 2034. Demand for embolization therapeutic devices is greatly influenced by widespread health issues such as cancer, gastrointestinal bleeding, aneurysms, and uterine fibroids, which are optimally treated using minimally invasive embolization therapies. The country's dominant healthcare spending, along with its sophisticated healthcare infrastructure, facilitates the adoption of new TEO procedures. Furthermore, the increasing availability of leading market manufacturers and a surge in FDA approvals for new and efficient embolic agents and delivery systems fuel market growth.

Prominent players operating in the Global Transcatheter Embolization And Occlusion Devices Industry include Abbott, Acandis, Balt, Boston Scientific, COOK MEDICAL, Edwards Lifesciences, Johnson & Johnson, LEPU MEDICAL, Medtronic, Merit Medical, MicroVention, Penumbra, Shape Memory Medical, SIRTEX, Stryker, and TERUMO. To strengthen their market position, companies in the transcatheter embolization and occlusion devices market are focusing on several key strategies. These include investing in research and development to create innovative products that meet the evolving needs of healthcare providers and patients. Strategic partnerships and collaborations with hospitals and healthcare institutions are being pursued to enhance product adoption and expand market reach. Additionally, companies are focusing on expanding their product portfolios to cater to a wider range of medical conditions and applications.

Table of Contents

Chapter 1 Methodology and Scope

- 1.1 Market scope and definitions

- 1.2 Research design

- 1.2.1 Research approach

- 1.2.2 Data collection methods

- 1.3 Base estimates and calculations

- 1.3.1 Base year calculation

- 1.3.2 Key trends for market estimation

- 1.4 Forecast model

- 1.5 Primary research and validation

- 1.5.1 Primary sources

- 1.5.2 Data mining sources

Chapter 2 Executive Summary

- 2.1 Industry 3600 synopsis

Chapter 3 Industry Insights

- 3.1 Industry ecosystem analysis

- 3.2 Industry impact forces

- 3.2.1 Growth drivers

- 3.2.1.1 Shift toward minimally invasive procedures

- 3.2.1.2 Increasing interventional radiology capabilities

- 3.2.1.3 Rising prevalence of chronic diseases

- 3.2.1.4 Technological advancements in embolic materials

- 3.2.1.5 Increased incidence of traumatic injuries

- 3.2.2 Industry pitfalls and challenges

- 3.2.2.1 High cost of devices and procedures

- 3.2.2.2 Risk of non-target embolization

- 3.2.1 Growth drivers

- 3.3 Growth potential analysis

- 3.4 Regulatory landscape

- 3.5 Trump administration tariffs

- 3.5.1 Impact on trade

- 3.5.1.1 Trade volume disruptions

- 3.5.1.2 Country-wise Response

- 3.5.2 Impact on the industry

- 3.5.2.1 Supply-side impact (Cost of manufacturing)

- 3.5.2.1.1 Price volatility in key materials

- 3.5.2.1.2 Supply chain restructuring

- 3.5.2.1.3 Production cost implications

- 3.5.2.2 Demand-side impact (Cost to consumers)

- 3.5.2.2.1 Price transmission to end markets

- 3.5.2.2.2 Market share dynamics

- 3.5.2.2.3 Consumer response patterns

- 3.5.2.1 Supply-side impact (Cost of manufacturing)

- 3.5.3 Key companies impacted

- 3.5.4 Strategic industry responses

- 3.5.4.1 Supply chain reconfiguration

- 3.5.4.2 Pricing and product strategies

- 3.5.4.3 Policy engagement

- 3.5.5 Outlook and future considerations

- 3.5.1 Impact on trade

- 3.6 Technology landscape

- 3.7 Gap analysis

- 3.8 Porter's analysis

- 3.9 PESTEL analysis

- 3.10 Value chain analysis

Chapter 4 Competitive Landscape, 2024

- 4.1 Introduction

- 4.2 Company matrix analysis

- 4.3 Company market share analysis

- 4.4 Competitive analysis of major market players

- 4.5 Competitive positioning matrix

- 4.6 Strategy dashboard

Chapter 5 Market Estimates and Forecast, By Device Type, 2021 - 2034 ($ Mn)

- 5.1 Key trends

- 5.2 Non coil

- 5.2.1 Flow diverting devices

- 5.2.2 Embolization particles

- 5.2.3 Liquid embolics

- 5.2.4 Other non-coil device types

- 5.3 Coils

- 5.3.1 Pushable coils

- 5.3.2 Detachable coils

Chapter 6 Market Estimates and Forecast, By Application, 2021 - 2034 ($ Mn)

- 6.1 Key trends

- 6.2 Oncology

- 6.3 Peripheral vascular disease

- 6.4 Neurology

- 6.5 Urology

- 6.6 Other applications

Chapter 7 Market Estimates and Forecast, By End Use, 2021 - 2034 ($ Mn)

- 7.1 Key trends

- 7.2 Hospitals

- 7.3 Ambulatory surgical centers

- 7.4 Other end use

Chapter 8 Market Estimates and Forecast, By Region, 2021 - 2034 ($ Mn)

- 8.1 Key trends

- 8.2 North America

- 8.2.1 U.S.

- 8.2.2 Canada

- 8.3 Europe

- 8.3.1 Germany

- 8.3.2 UK

- 8.3.3 France

- 8.3.4 Spain

- 8.3.5 Italy

- 8.3.6 Netherlands

- 8.4 Asia Pacific

- 8.4.1 China

- 8.4.2 Japan

- 8.4.3 India

- 8.4.4 Australia

- 8.4.5 South Korea

- 8.5 Latin America

- 8.5.1 Brazil

- 8.5.2 Mexico

- 8.5.3 Argentina

- 8.6 Middle East and Africa

- 8.6.1 South Africa

- 8.6.2 Saudi Arabia

- 8.6.3 UAE

Chapter 9 Company Profiles

- 9.1 Abbott

- 9.2 acandis

- 9.3 balt

- 9.4 Boston Scientific

- 9.5 COOK MEDICAL

- 9.6 Edwards Lifesciences

- 9.7 Johnson & Johnson

- 9.8 LEPU MEDICAL

- 9.9 Medtronic

- 9.10 Merit Medical

- 9.11 MicroVention

- 9.12 Penumbra

- 9.13 shape memory medical

- 9.14 SIRTEX

- 9.15 stryker

- 9.16 TERUMO