|

市場調查報告書

商品編碼

1750512

不銹鋼棒材和棒材形狀市場機會、成長動力、產業趨勢分析及 2025 - 2034 年預測Stainless Steel Bars and Bar-Size Shapes Market Opportunity, Growth Drivers, Industry Trend Analysis, and Forecast 2025 - 2034 |

||||||

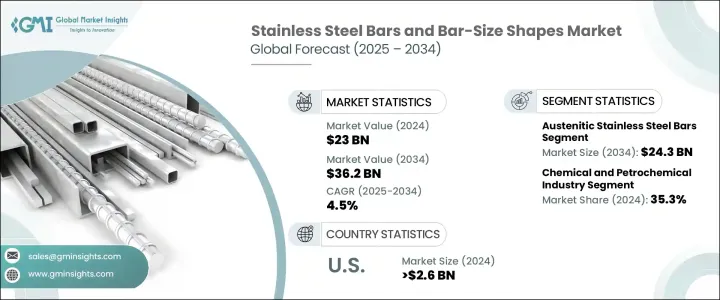

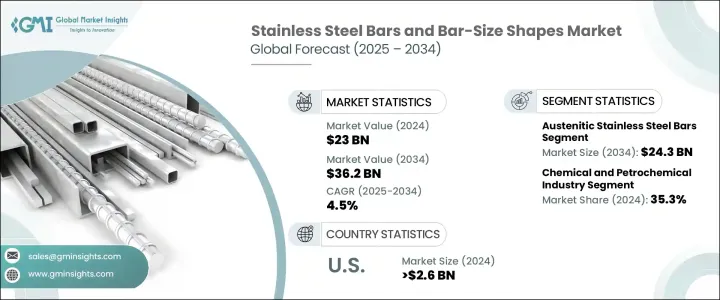

2024年,全球不銹鋼棒材和棒材型材市場價值為230億美元,預計到2034年將以4.5%的複合年成長率成長,達到362億美元,這主要得益於建築、汽車、能源和製造等行業對不銹鋼需求的快速成長。不銹鋼獨特的性能——強度高、耐腐蝕、可回收——使其成為現代工業應用的必備材料。其在極端環境下的堅固耐用性以及永續性使其成為全球工業成長的關鍵參與者。

不銹鋼棒材因其優異的抗應力和腐蝕性能,在各個領域都發揮著至關重要的作用。在建築領域,它們為持久耐用的建築物和基礎設施提供所需的結構完整性。汽車業依賴不銹鋼棒材來製造易受磨損和腐蝕的關鍵部件。同樣,能源行業,尤其是石油和天然氣行業,也使用不銹鋼,因為它在高壓和極端條件下具有出色的耐用性。不銹鋼在醫療和食品加工行業也至關重要,因為這些行業對衛生標準要求很高。隨著不銹鋼新應用的不斷湧現,棒材和棒材形狀的市場持續擴張,從而刺激了對可靠耐用材料的需求。

| 市場範圍 | |

|---|---|

| 起始年份 | 2024 |

| 預測年份 | 2025-2034 |

| 起始值 | 230億美元 |

| 預測值 | 362億美元 |

| 複合年成長率 | 4.5% |

奧氏體不銹鋼棒材市場在2024年達到158億美元,預計2034年將成長至243億美元。奧氏體不銹鋼,尤其是304和316等牌號,因其出色的抗氧化、抗腐蝕和耐高溫性能而備受推崇,使其成為建築、化學加工和醫療等領域不可或缺的材料。這些棒材也以其高延展性、非磁性和易於加工而聞名,這使得它們能夠在不影響強度的情況下被加工成複雜的結構。

化工和石化產業在不銹鋼棒材和型材市場中扮演著至關重要的角色,2024年其市場佔有率為35.3%。不銹鋼棒材和型材在製造反應器、閥門、泵浦、熱交換器和管道系統方面不可或缺,這些設備都必須承受腐蝕性化學品、高溫和極端壓力等嚴苛條件。這些行業要求材料即使在持續暴露於腐蝕性物質和揮發性化合物的情況下也能保持其結構完整性,因此不銹鋼是確保關鍵操作可靠性和安全性的理想選擇。

2024年,美國不銹鋼棒材和型材市場規模達到26億美元,預計到2034年將繼續以4.5%的複合年成長率穩步成長,這主要得益於製造業和建築業的活躍發展以及正在進行的基礎設施建設項目。不銹鋼部件廣泛應用於機械、運輸和建築材料等各個領域,這推動了對耐用、多功能且能夠承受惡劣環境的材料的需求。隨著美國工業活動保持強勁,預計未來幾年不銹鋼棒材和型材市場將穩定擴張。

全球不銹鋼棒材及棒材形狀市場的主要參與者包括奧托昆普、新日鐵、阿塞里諾克斯、浦項製鐵和金達爾不銹鋼。這些公司正在採取多種策略,例如豐富產品線、提升生產能力以及注重永續發展,以鞏固其市場地位。透過投資創新生產技術並拓展新興市場,這些參與者正致力於滿足市場對高品質不銹鋼產品日益成長的需求。

目錄

第1章:方法論與範圍

第2章:執行摘要

第3章:行業洞察

- 概括

- 市場亮點和主要發現

- 市場規模和成長預測

- 主要市場促進因素與限制因素

- 競爭格局概覽

- 策略建議概覽

- 川普政府關稅

- 對貿易的影響

- 貿易量中斷

- 報復措施

- 對產業的影響

- 供給側影響(原料)

- 主要材料價格波動

- 供應鏈重組

- 生產成本影響

- 需求面影響(售價)

- 價格傳導至終端市場

- 市佔率動態

- 消費者反應模式

- 供給側影響(原料)

- 受影響的主要公司

- 策略產業回應

- 供應鏈重構

- 定價和產品策略

- 政策參與

- 展望與未來考慮

- 對貿易的影響

- 貿易統計(HS編碼)

- 主要出口國(2021-2024年)

- 主要進口國(2021-2024年)

註:以上貿易統計僅提供重點國家

- 市場概況與動態

- 市場定義與演變

- 價值鏈分析

- 市場規模與成長預測(2021-2034)

- 歷史市場價值(2021-2024)

- 當前市場估值(2024年)

- 市場預測(2025-2034)

- 市場動態

- 主要成長動力

- 市場限制與挑戰

- 市場機會

- 市場力量的影響分析

- 大環境分析

- 波特五力分析

- COVID-19影響評估與恢復分析

- 全球鋼鐵業概況及其對不銹鋼棒市場的影響

- 規範架構和標準

- 全球不銹鋼產業法規

- 不銹鋼棒材國際標準

- ASTM標準

- ASME標準

- EN標準

- JIS標準

- ISO標準

- 區域監理框架

- 北美法規

- 歐洲法規

- 亞太法規

- 貿易政策和關稅

- 進出口法規

- 反傾銷措施

- 反補助稅

- 保障措施

- 品質認證要求

- 材質認證

- 流程認證

- 品質管理體系

- 環境法規

- 排放標準

- 廢棄物管理條例

- 能源效率要求

- 職業安全法規

- 監管影響分析

- 對生產成本的影響

- 對市場進入障礙的影響

- 對定價策略的影響

- 行業趨勢和最終用戶偏好

- 向高性能不銹鋼等級轉變

- 耐腐蝕等級

- 高強度等級

- 耐熱等級

- 汽車產業趨勢

- 車輛輕量化舉措

- 電動汽車影響

- 排放法規的影響

- 安全和性能要求

- 石油和天然氣產業趨勢

- 深水探勘要求

- 腐蝕環境解決方案

- 高壓/高溫應用

- 化工產業趨勢

- 耐腐蝕要求

- 流程效率改進

- 安全性和可靠性要求

- 食品飲料產業趨勢

- 衛生和衛生要求

- 流程自動化的影響

- 監理合規需求

- 醫療產業趨勢

- 生物相容性要求

- 精密製造需求

- 滅菌相容性

- 建築業趨勢

- 建築應用的成長

- 永續建築實踐

- 耐腐蝕基礎設施

- 區域最終用途偏好差異

- OEM規格趨勢

- 材料選擇標準

- 性能要求

- 成本考慮

- 向高性能不銹鋼等級轉變

- 供應鍊和原料分析

- 原物料採購分析

- 鐵礦石和廢料

- 鎳

- 鉻

- 鉬

- 其他合金元素

- 不銹鋼生產流程分析

- 煉鋼技術

- 合金工藝

- 軋製和精加工工藝

- 熱處理流程

- 品質控制措施

- 配銷通路分析

- 直接銷售給原始設備製造商

- 鋼鐵服務中心

- 分銷商和批發商

- 電子商務平台

- 供應鏈挑戰

- 原物料價格波動

- 能源成本波動

- 物流和運輸挑戰

- 供應鏈中斷

- 供應鏈最佳化策略

- 永續供應鏈實踐

- 供應鏈中的技術整合

- 原物料採購分析

- 定價分析和成本結構

- 依產品類型進行價格點分析

- 奧氏體不銹鋼棒定價

- 鐵素體不銹鋼棒定價

- 馬氏體不銹鋼棒定價

- 雙相不銹鋼棒定價

- PH 不銹鋼棒定價

- 價格趨勢分析(2020-2025)

- 價格預測(2025-2030)

- 影響定價的因素

- 原料成本

- 能源成本

- 勞動成本

- 生產成本

- 運輸費用

- 市場競爭

- 貿易政策和關稅

- 區域價格差異

- 關鍵參與者的定價策略

- 成本結構分析

- 原料成本

- 能源成本

- 勞動成本

- 製造成本

- 分銷成本

- 行銷和銷售成本

- 按產品細分的獲利能力分析

- 加值服務對定價的影響

- 依產品類型進行價格點分析

- 技術進步與創新

- 近期技術發展

- 先進煉鋼技術

- 電弧爐創新

- AOD工藝的進步

- 連續鑄造改進

- 合金設計創新

- 精益雙相不銹鋼

- 高氮不鏽鋼

- 高級馬氏體鋼種

- 特種奧氏體鋼種

- 加工技術的進步

- 熱軋創新

- 冷加工技術的進步

- 熱處理創新

- 表面處理技術

- 品質控制和測試創新

- 非破壞性檢驗的進步

- 自動檢測系統

- 材料表徵技術

- 不銹鋼生產中的數位化整合

- 工業4.0實施

- 人工智慧應用

- 預測性維護系統

- 數位孿生技術

- 永續生產技術

- 能源效率創新

- 減排技術

- 減少廢棄物和回收利用

- 專利分析與研發趨勢

- 未來技術路線圖

- 永續性和環境影響

- 不銹鋼生產的環境足跡

- 碳足跡分析

- 能源消耗評估

- 用水和管理

- 廢棄物產生和管理

- 不銹鋼產業的永續發展舉措

- 碳減排策略

- 能源效率措施

- 循環經濟方法

- 回收和材料回收

- 廢料利用率

- 安寧療護

- 閉迴路製造

- 綠色鋼鐵生產技術

- 氫基煉鋼

- 碳捕獲和儲存

- 生質能減排

- 永續性的監管壓力

- 碳定價機制

- 排放交易體系

- 環境合規要求

- 產業永續發展承諾

- 生命週期評估(LCA)分析

- 永續實踐的成本效益分析

- 不銹鋼生產的環境足跡

- 市場挑戰與機遇

- 主要市場挑戰

- 原物料價格波動

- 能源成本波動

- 鋼鐵業產能過剩

- 貿易壁壘與保護主義

- 環境合規成本

- 替代材料的競爭

- 市場機會

- 高性能合金開發

- 新興市場擴張

- 基礎建設發展項目

- 再生能源成長

- 醫療和製藥應用

- 積層製造應用

- 宏觀經濟因素的影響

- 全球經濟成長

- 工業生產趨勢

- 施工活動

- 石油和天然氣產業動態

- 技術機會評估

- 戰略機會圖

- 主要市場挑戰

- 未來市場展望與預測

- 按產品類型分類的市場預測(2025-2030 年)

- 奧氏體不銹鋼棒材預測

- 鐵素體不銹鋼棒材預測

- 馬氏體不銹鋼棒材預測

- 雙相不銹鋼棒材預測

- PH不銹鋼棒材預測

- 按形狀分類的市場預測(2025-2030)

- 圓棒預測

- 方形和矩形條預測

- 六角棒預測

- 其他形狀預測

- 按應用分類的市場預測(2025-2030)

- 各地區市場預測(2025-2030)

- 新興市場趨勢

- 未來成長動力

- 市場演變情景

- 樂觀情境

- 現實場景

- 悲觀情景

- 投資機會評估

- 未來競爭格局預測

- 按產品類型分類的市場預測(2025-2030 年)

- 策略建議

- 市場進入策略

- 產品開發建議

- 區域擴張機會

- 競爭定位策略

- 永續發展實施路線圖

- 數位轉型策略

- 監理合規策略

- 行銷和分銷建議

- 風險緩解策略

- 投資優先框架

- 不銹鋼與其他材質的比較分析

- 不銹鋼與碳鋼

- 不銹鋼與鋁

- 不銹鋼與鎳合金

- 性能基準化分析

- 成本效益分析

- 應用適用性比較

- 專利分析與創新格局

- 近期專利申請分析

- 技術創新與研發重點領域

- 區域和公司層面的專利趨勢

第4章:競爭格局

- 市場結構與集中度分析

- 市場集中度概覽

- 市場分散與市場主導地位分析

- 進入障礙和市場准入評估

- 關鍵參與者的市佔率分析

- 頂級製造商的百分比佔有率

- 跨區域市場主導地位

- 市佔率變化的歷史趨勢

- 競爭定位矩陣

- 根據產品範圍和地理位置對主要參與者進行定位

- 戰略能力與技術優勢對比

- 基於績效和創新的象限映射

- 主要參與者的詳細公司簡介

- 奧托昆普

- 阿塞里諾克斯

- 金達爾不銹鋼

- 新日鐵公司

- 浦項製鐵

- 山特維克材料技術

- 卡彭特技術公司

- 瓦爾布魯納不鏽鋼公司

- 奧鋼聯股份公司

- 青山控股集團

- 競爭策略分析

- 產能擴張計劃

- 合併與收購

- 夥伴關係與合作

- 產品開發與創新

- 投資和融資情景

- 近期投資趨勢

- 私募股權和創投的參與

- 公共部門資金和激勵措施

第5章:市場規模及預測:依等級,2021-2034

- 主要趨勢

- 奧氏體不銹鋼棒(300系列)

- 304/304l不銹鋼

- 316/316l不銹鋼

- 321不銹鋼

- 347不銹鋼

- 其他奧氏體鋼種

- 鐵素體不鏽鋼棒材(400系列)

- 430不銹鋼

- 409不鏽鋼

- 446不銹鋼

- 其他鐵素體鋼種

- 馬氏體不銹鋼棒(400系列)

- 410不鏽鋼

- 416不銹鋼

- 420不鏽鋼

- 440不銹鋼

- 其他馬氏體牌號

- 雙相不銹鋼棒材

- 2205雙工

- 2507超級雙工

- 其他雙相不銹鋼

- 沉澱硬化不銹鋼棒

- 17-4 PH不銹鋼

- 15-5 PH不銹鋼

- 其他 PH 等級

第6章:市場規模與預測:依形狀與尺寸,2021-2034 年

- 主要趨勢

- 圓棒

- 方棒

- 六角棒

- 扁鋼

- 角度

- 頻道

- 其他條形尺寸形狀

第7章:市場規模及預測:依加工方法,2021-2034

- 主要趨勢

- 熱軋不銹鋼棒材

- 冷加工不銹鋼棒

- 冷拉鋼筋

- 冷軋鋼筋

- 車削和拋光棒材

- 研磨和拋光棒

第 8 章:市場規模與預測:按應用,2021-2034 年

- 主要趨勢

- 汽車和運輸

- 排氣系統

- 結構部件

- 緊固件和連接器

- 燃油系統部件

- 航太和國防

- 飛機部件

- 緊固件和連接器

- 起落架部件

- 國防裝備

- 建築和基礎設施

- 結構部件

- 加固應用

- 建築應用

- 緊固件和錨固件

- 石油和天然氣產業

- 鑽井設備

- 探索組件

- 精煉設備

- 海上應用

- 化學和石化工業

- 製程設備零件

- 閥門和配件

- 熱交換組件

- 食品和飲料業

- 加工設備

- 儲槽和容器

- 輸送系統

- 醫療和製藥

- 手術器械

- 植入式裝置

- 設備組件

- 發電

- 傳統發電廠

- 核電廠

- 再生能源設備

- 海洋和造船業

- 結構部件

- 推進系統

- 甲板設備

- 機械設備製造業

- 產業機械

- 紡織機械

- 造紙和紙漿設備

- 其他應用

- 消費品

- 電子產品

- 運動器材

第9章:市場規模及預測:按地區,2021-2034

- 主要趨勢

- 北美洲

- 美國

- 加拿大

- 歐洲

- 英國

- 德國

- 法國

- 義大利

- 西班牙

- 荷蘭

- 亞太地區

- 中國

- 印度

- 日本

- 韓國

- 澳洲

- 拉丁美洲

- 巴西

- 墨西哥

- 阿根廷

- MEA

- 南非

- 沙烏地阿拉伯

- 阿拉伯聯合大公國

第10章:公司簡介

- Outokumpu

- Acerinox

- Jindal Stainless

- Nippon Steel

- POSCO

- Sandvik Materials Technology

- Carpenter Technology

- Valbruna Stainless

- Voestalpine

- Tsingshan Holding Group

The Global Stainless Steel Bars and Bar-Size Shapes Market was valued at USD 23 billion in 2024 and is estimated to grow at a CAGR of 4.5% to reach USD 36.2 billion by 2034, driven by the rapid growth in demand for stainless steel across industries like construction, automotive, energy, and manufacturing. Stainless steel's unique properties-strength, corrosion resistance, and recyclability-make it an essential material for modern industrial applications. The material's robustness in extreme environments, along with its sustainability, positions it as a key player in global industrial growth.

Stainless steel bars are crucial in various sectors due to their ability to withstand stress and corrosion. In construction, they provide the structural integrity needed for long-lasting buildings and infrastructure. The automotive industry relies on stainless-steel bars for critical components exposed to wear and corrosion. Similarly, the energy sector, particularly oil and gas, uses stainless steel for its durability under high pressures and extreme conditions. Stainless steel is also vital in the medical and food processing industries, where high hygiene standards are required. As new applications for stainless steel emerge, the market for bars and bar-size shapes continues to expand, bolstering the demand for reliable, durable materials.

| Market Scope | |

|---|---|

| Start Year | 2024 |

| Forecast Year | 2025-2034 |

| Start Value | $23 Billion |

| Forecast Value | $36.2 Billion |

| CAGR | 4.5% |

The austenitic stainless steel bars segment accounted for USD 15.8 billion in 2024 and is expected to grow to USD 24.3 billion by 2034. Austenitic stainless steel, especially grades like 304 and 316, is prized for its excellent resistance to oxidation, corrosion, and high temperatures, making it indispensable in applications such as construction, chemical processing, and the medical field. These bars are also known for their high ductility, non-magnetic properties, and ease of fabrication, which allows them to be shaped into complex structures without compromising their strength.

The chemical and petrochemical industries play a crucial role in the stainless steel bars and bar-size shapes market, holding a 35.3% share in 2024. Stainless steel bars and shapes are indispensable in manufacturing reactors, valves, pumps, heat exchangers, and piping systems, all of which must endure the demanding conditions of aggressive chemicals, high temperatures, and extreme pressures. These sectors require materials that maintain their structural integrity even under constant exposure to corrosive substances and volatile compounds, making stainless steel an ideal choice for ensuring reliability and safety in critical operations.

U.S. Stainless Steel Bars and Bar-Size Shapes Market reached USD 2.6 billion in 2024 and is projected to continue growing at a steady pace of 4.5% CAGR through 2034, driven by the active manufacturing and construction industries, as well as ongoing infrastructure development projects. Stainless steel components are widely used in various sectors, including machinery, transportation, and building materials, fueling the demand for durable and versatile materials that can withstand harsh environments. As industrial activity in the U.S. remains robust, the market for stainless steel bars and shapes is expected to expand steadily over the coming years.

Key players in the Global Stainless Steel Bars and Bar-Size Shapes Market include Outokumpu, Nippon Steel Corporation, Acerinox, POSCO, and Jindal Stainless. These companies are adopting strategies such as diversifying product offerings, enhancing production capabilities, and focusing on sustainability to strengthen their market position. By investing in innovative production techniques and expanding into emerging markets, these players are looking to meet the increasing demand for high-quality stainless-steel products.

Table of Contents

Chapter 1 Methodology & Scope

- 1.1 Market scope & definition

- 1.2 Base estimates & calculations

- 1.3 Forecast calculation

- 1.4 Data sources

- 1.4.1 Primary

- 1.4.2 Secondary

- 1.4.2.1 Paid sources

- 1.4.2.2 Public sources

Chapter 2 Executive Summary

- 2.1 Industry synopsis, 2021-2034

Chapter 3 Industry Insights

- 3.1 Summary

- 3.1.1 Market Highlights and Key Findings

- 3.1.2 Market Size and Growth Projections

- 3.1.3 Key Market Drivers and Restraints

- 3.1.4 Competitive Landscape Overview

- 3.1.5 Strategic Recommendations Snapshot

- 3.2 Trump Administration Tariffs

- 3.2.1 Impact on Trade

- 3.2.1.1 Trade Volume Disruptions

- 3.2.1.2 Retaliatory Measures

- 3.2.2 Impact on the Industry

- 3.2.2.1 Supply-Side Impact (Raw Materials)

- 3.2.2.1.1 Price Volatility in Key Materials

- 3.2.2.1.2 Supply Chain Restructuring

- 3.2.2.1.3 Production Cost Implications

- 3.2.2.2 Demand-Side Impact (Selling Price)

- 3.2.2.2.1 Price Transmission to End Markets

- 3.2.2.2.2 Market Share Dynamics

- 3.2.2.2.3 Consumer Response Patterns

- 3.2.2.1 Supply-Side Impact (Raw Materials)

- 3.2.3 Key Companies Impacted

- 3.2.4 Strategic Industry Responses

- 3.2.4.1 Supply Chain Reconfiguration

- 3.2.4.2 Pricing and Product Strategies

- 3.2.4.3 Policy Engagement

- 3.2.5 Outlook and Future Considerations

- 3.2.1 Impact on Trade

- 3.3 Trade statistics (HS Code)

- 3.3.1 Major Exporting Countries, 2021-2024 (USD Mn)

- 3.3.2 Major Importing Countries, 2021-2024 (USD Mn)

Note: The above trade statistics will be provided for key countries only

- 3.4 Market Overview and Dynamics

- 3.4.1 Market Definition and Evolution

- 3.4.2 Value Chain Analysis

- 3.4.3 Market Size and Growth Forecast 2021–2034

- 3.4.3.1 Historical Market Value 2021–2024

- 3.4.3.2 Current Market Valuation 2024

- 3.4.3.3 Market Projections 2025–2034

- 3.4.4 Market Dynamics

- 3.4.4.1 Primary Growth Drivers

- 3.4.4.2 Market Restraints and Challenges

- 3.4.4.3 Market Opportunities

- 3.4.4.4 Impact Analysis of Market Forces

- 3.4.5 PESTLE Analysis

- 3.4.6 Porter's Five Forces Analysis

- 3.4.7 COVID-19 Impact Assessment and Recovery Analysis

- 3.4.8 Global Steel Industry Overview and Impact on Stainless Steel Bars Market

- 3.5 Regulatory Framework and Standards

- 3.5.1 Global Stainless Steel Industry Regulations

- 3.5.2 International Standards for Stainless Steel Bars

- 3.5.2.1 ASTM Standards

- 3.5.2.2 ASME Standards

- 3.5.2.3 EN Standards

- 3.5.2.4 JIS Standards

- 3.5.2.5 ISO Standards

- 3.5.3 Regional Regulatory Frameworks

- 3.5.3.1 North American Regulations

- 3.5.3.2 European Regulations

- 3.5.3.3 Asia-Pacific Regulations

- 3.5.4 Trade Policies and Tariffs

- 3.5.4.1 Import/Export Regulations

- 3.5.4.2 Anti-Dumping Measures

- 3.5.4.3 Countervailing Duties

- 3.5.4.4 Safeguard Measures

- 3.5.5 Quality Certification Requirements

- 3.5.5.1 Material Certification

- 3.5.5.2 Process Certification

- 3.5.5.3 Quality Management Systems

- 3.5.6 Environmental Regulations

- 3.5.6.1 Emissions Standards

- 3.5.6.2 Waste Management Regulations

- 3.5.6.3 Energy Efficiency Requirements

- 3.5.7 Occupational Safety Regulations

- 3.5.8 Regulatory Impact Analysis

- 3.5.8.1 Impact on Production Costs

- 3.5.8.2 Impact on Market Entry Barriers

- 3.5.8.3 Impact on Pricing Strategies

- 3.6 Industry Trends and End-User Preferences

- 3.6.1 Shift Towards High-Performance Stainless-Steel Grades

- 3.6.1.1 Corrosion-Resistant Grades

- 3.6.1.2 High-Strength Grades

- 3.6.1.3 Heat-Resistant Grades

- 3.6.2 Automotive Industry Trends

- 3.6.2.1 Vehicle Lightweighting Initiatives

- 3.6.2.2 Electric Vehicle Impact

- 3.6.2.3 Emissions Regulations Impact

- 3.6.2.4 Safety and Performance Requirements

- 3.6.3 Oil and Gas Industry Trends

- 3.6.3.1 Deepwater Exploration Requirements

- 3.6.3.2 Corrosive Environment Solutions

- 3.6.3.3 High-Pressure/High-Temperature Applications

- 3.6.4 Chemical Industry Trends

- 3.6.4.1 Corrosion Resistance Requirements

- 3.6.4.2 Process Efficiency Improvements

- 3.6.4.3 Safety and Reliability Demands

- 3.6.5 Food and Beverage Industry Trends

- 3.6.5.1 Hygiene and Sanitation Requirements

- 3.6.5.2 Process Automation Impact

- 3.6.5.3 Regulatory Compliance Needs

- 3.6.6 Medical Industry Trends

- 3.6.6.1 Biocompatibility Requirements

- 3.6.6.2 Precision Manufacturing Demands

- 3.6.6.3 Sterilization Compatibility

- 3.6.7 Construction Industry Trends

- 3.6.7.1 Architectural Applications Growth

- 3.6.7.2 Sustainable Building Practices

- 3.6.7.3 Corrosion-Resistant Infrastructure

- 3.6.8 Regional End Use Preference Variations

- 3.6.9 OEM Specification Trends

- 3.6.9.1 Material Selection Criteria

- 3.6.9.2 Performance Requirements

- 3.6.9.3 Cost Considerations

- 3.6.1 Shift Towards High-Performance Stainless-Steel Grades

- 3.7 Supply Chain and Raw Material Analysis

- 3.7.1 Raw Material Sourcing Analysis

- 3.7.1.1 Iron Ore and Scrap

- 3.7.1.2 Nickel

- 3.7.1.3 Chromium

- 3.7.1.4 Molybdenum

- 3.7.1.5 Other Alloying Elements

- 3.7.2 Stainless Steel Production Process Analysis

- 3.7.2.1 Steelmaking Technologies

- 3.7.2.2 Alloying Processes

- 3.7.2.3 Rolling and Finishing Processes

- 3.7.2.4 Heat Treatment Processes

- 3.7.2.5 Quality Control Measures

- 3.7.3 Distribution Channel Analysis

- 3.7.3.1 Direct Sales to OEMs

- 3.7.3.2 Steel Service Centers

- 3.7.3.3 Distributors and Wholesalers

- 3.7.3.4 E-commerce Platforms

- 3.7.4 Supply Chain Challenges

- 3.7.4.1 Raw Material Price Volatility

- 3.7.4.2 Energy Cost Fluctuations

- 3.7.4.3 Logistics and Transportation Challenges

- 3.7.4.4 Supply Chain Disruptions

- 3.7.5 Supply Chain Optimization Strategies

- 3.7.6 Sustainable Supply Chain Practices

- 3.7.7 Technology Integration in the Supply Chain

- 3.7.1 Raw Material Sourcing Analysis

- 3.8 Pricing Analysis and Cost Structure

- 3.8.1 Price Point Analysis by Product Type

- 3.8.1.1 Austenitic Stainless Steel Bars Pricing

- 3.8.1.2 Ferritic Stainless Steel Bars Pricing

- 3.8.1.3 Martensitic Stainless Steel Bars Pricing

- 3.8.1.4 Duplex Stainless Steel Bars Pricing

- 3.8.1.5 PH Stainless Steel Bars Pricing

- 3.8.2 Price Trend Analysis 2020-2025

- 3.8.3 Price Forecast 2025-2030

- 3.8.4 Factors Affecting Pricing

- 3.8.4.1 Raw Material Costs

- 3.8.4.2 Energy Costs

- 3.8.4.3 Labor Costs

- 3.8.4.4 Production Costs

- 3.8.4.5 Transportation Costs

- 3.8.4.6 Market Competition

- 3.8.4.7 Trade Policies and Tariffs

- 3.8.5 Regional Price Variations

- 3.8.6 Pricing Strategies for Key Players

- 3.8.7 Cost Structure Analysis

- 3.8.7.1 Raw Material Costs

- 3.8.7.2 Energy Costs

- 3.8.7.3 Labor Costs

- 3.8.7.4 Manufacturing Costs

- 3.8.7.5 Distribution Costs

- 3.8.7.6 Marketing and Sales Costs

- 3.8.8 Profitability Analysis by Product Segment

- 3.8.9 Value-Added Services Impact on Pricing

- 3.8.1 Price Point Analysis by Product Type

- 3.9 Technological Advancements and Innovations

- 3.9.1 Recent technological developments

- 3.9.2 Advanced steelmaking technologies

- 3.9.2.1 Electric arc furnace innovations

- 3.9.2.2 AOD process advancements

- 3.9.2.3 Continuous casting improvements

- 3.9.3 Alloy design innovations

- 3.9.3.1 Lean duplex stainless steel

- 3.9.3.2 High-nitrogen stainless steels

- 3.9.3.3 Advanced martensitic grades

- 3.9.3.4 Specialty austenitic grades

- 3.9.4 Processing technology advancements

- 3.9.4.1 Hot-rolling innovations

- 3.9.4.2 Cold-finishing advancements

- 3.9.4.3 Heat treatment innovations

- 3.9.4.4 Surface treatment technologies

- 3.9.5 Quality control and testing innovations

- 3.9.5.1 Non-destructive testing advancements

- 3.9.5.2 Automated inspection systems

- 3.9.5.3 Material characterization technologies

- 3.9.6 Digital integration in stainless steel production

- 3.9.6.1 Industry 4.0 implementation

- 3.9.6.2 Artificial intelligence applications

- 3.9.6.3 Predictive maintenance systems

- 3.9.6.4 Digital twin technology

- 3.9.7 Sustainable production technologies

- 3.9.7.1 Energy efficiency innovations

- 3.9.7.2 Emissions reduction technologies

- 3.9.7.3 Waste reduction and recycling

- 3.9.8 Patent analysis and R&D trends

- 3.9.9 Future technology roadmap

- 3.10 Sustainability and Environmental Impact

- 3.10.1 Environmental footprint of stainless-steel production

- 3.10.1.1 Carbon footprint analysis

- 3.10.1.2 Energy consumption assessment

- 3.10.1.3 Water usage and management

- 3.10.1.4 Waste generation and management

- 3.10.2 Sustainability initiatives in stainless steel industry

- 3.10.2.1 Carbon reduction strategies

- 3.10.2.2 Energy efficiency measures

- 3.10.2.3 Circular economy approaches

- 3.10.3 Recycling and material recovery

- 3.10.3.1 Scrap utilization rates

- 3.10.3.2 End-of-life considerations

- 3.10.3.3 Closed-loop manufacturing

- 3.10.4 Green steel production technologies

- 3.10.4.1 Hydrogen-based steelmaking

- 3.10.4.2 Carbon capture and storage

- 3.10.4.3 Biomass-based reduction

- 3.10.5 Regulatory pressures for sustainability

- 3.10.5.1 Carbon pricing mechanisms

- 3.10.5.2 Emissions trading systems

- 3.10.5.3 Environmental compliance requirements

- 3.10.6 Industry sustainability commitments

- 3.10.7 Lifecycle assessment (LCA) analysis

- 3.10.8 Cost-benefit analysis of sustainable practices

- 3.10.1 Environmental footprint of stainless-steel production

- 3.11 Market Challenges and Opportunities

- 3.11.1 Key market challenges

- 3.11.1.1 Raw material price volatility

- 3.11.1.2 Energy cost fluctuations

- 3.11.1.3 Overcapacity in the steel industry

- 3.11.1.4 Trade barriers and protectionism

- 3.11.1.5 Environmental compliance costs

- 3.11.1.6 Competition of alternative materials

- 3.11.2 Market opportunities

- 3.11.2.1 High-performance alloy development

- 3.11.2.2 Emerging markets expansion

- 3.11.2.3 Infrastructure development projects

- 3.11.2.4 Renewable energy growth

- 3.11.2.5 Medical and pharmaceutical applications

- 3.11.2.6 Additive manufacturing applications

- 3.11.3 Impact of macro-economic factors

- 3.11.3.1 Global economic growth

- 3.11.3.2 Industrial production trends

- 3.11.3.3 Construction activity

- 3.11.3.4 Oil and gas industry dynamics

- 3.11.4 Technological opportunity assessment

- 3.11.5 Strategic opportunity mapping

- 3.11.1 Key market challenges

- 3.12 Future Market Outlook and Forecast

- 3.12.1 Market forecast by product type 2025-2030

- 3.12.1.1 Austenitic stainless-steel bars forecast

- 3.12.1.2 Ferritic stainless-steel bars forecast

- 3.12.1.3 Martensitic stainless-steel bars forecast

- 3.12.1.4 Duplex stainless-steel bars forecast

- 3.12.1.5 PH stainless steel bars forecast

- 3.12.2 Market forecast by shape 2025-2030

- 3.12.2.1 Round bars forecast

- 3.12.2.2 Square and rectangular bars forecast

- 3.12.2.3 Hexagonal bars forecast

- 3.12.2.4 Other shapes forecast

- 3.12.3 Market forecast by application 2025-2030

- 3.12.4 Market forecast by region 2025-2030

- 3.12.5 Emerging market trends

- 3.12.6 Future growth drivers

- 3.12.7 Market evolution scenarios

- 3.12.7.1 Optimistic scenario

- 3.12.7.2 Realistic scenario

- 3.12.7.3 Pessimistic scenario

- 3.12.8 Investment opportunities assessment

- 3.12.9 Future competitive landscape projection

- 3.12.1 Market forecast by product type 2025-2030

- 3.13 Strategic Recommendations

- 3.13.1 Market entry strategies

- 3.13.2 Product development recommendations

- 3.13.3 Regional expansion opportunities

- 3.13.4 Competitive positioning strategies

- 3.13.5 Sustainability implementation roadmap

- 3.13.6 Digital transformation strategies

- 3.13.7 Regulatory compliance strategies

- 3.13.8 Marketing and distribution recommendations

- 3.13.9 Risk mitigation strategies

- 3.13.10 Investment prioritization framework

- 3.14 Comparative Analysis of Stainless Steel vs. Other Materials

- 3.14.1 Stainless Steel vs. Carbon Steel

- 3.14.2 Stainless Steel vs. Aluminum

- 3.14.3 Stainless Steel vs. Nickel Alloys

- 3.14.4 Performance Benchmarking

- 3.14.5 Cost-Benefit Analysis

- 3.14.6 Application Suitability Comparison

- 3.15 Patent Analysis and Innovation Landscape

- 3.15.1 Analysis of recent patent filings

- 3.15.2 Technological innovations and R&D focus areas

- 3.15.3 Regional and company-level patent trends

Chapter 4 Competitive Landscape, 2024

- 4.1 Market Structure and Concentration Analysis

- 4.1.1 Overview of market concentration levels

- 4.1.2 Analysis of market fragmentation vs. dominance

- 4.1.3 Assessment of entry barriers and market access

- 4.2 Market Share Analysis of Key Players

- 4.2.1 Percentage share of top manufacturers

- 4.2.2 Market dominance across regions

- 4.2.3 Historical trends in market share shifts

- 4.3 Competitive Positioning Matrix

- 4.3.1 Positioning of major players by product range and geographic presence

- 4.3.2 Comparison of strategic capabilities and technological edge

- 4.3.3 Quadrant mapping based on performance and innovation

- 4.4 Detailed Company Profiles of Major Players

- 4.4.1 Outokumpu

- 4.4.2 Acerinox

- 4.4.3 Jindal Stainless

- 4.4.4 Nippon Steel Corporation

- 4.4.5 POSCO

- 4.4.6 Sandvik Materials Technology

- 4.4.7 Carpenter Technology Corporation

- 4.4.8 Valbruna Stainless Inc.

- 4.4.9 Voestalpine AG

- 4.4.10 Tsingshan Holding Group

- 4.5 Competitive Strategies Analysis

- 4.5.1 Capacity Expansion Initiatives

- 4.5.2 Mergers and Acquisitions

- 4.5.3 Partnerships and Collaborations

- 4.5.4 Product Development and Innovation

- 4.6 Investment and Funding Scenario

- 4.6.1 Recent investment trends

- 4.6.2 Private equity and venture capital involvement

- 4.6.3 Public sector funding and incentives

Chapter 5 Market Size and Forecast, By Grade, 2021-2034 (USD Million) (Tons)

- 5.1 Key trends

- 5.2 Austenitic stainless-steel bars (300 series)

- 5.2.1 304/304l stainless steel

- 5.2.2 316/316l stainless steel

- 5.2.3 321 stainless steel

- 5.2.4 347 stainless steel

- 5.2.5 Other austenitic grades

- 5.3 Ferritic stainless-steel bars (400 series)

- 5.3.1 430 stainless steel

- 5.3.2 409 stainless steel

- 5.3.3 446 stainless steel

- 5.3.4 Other ferritic grades

- 5.4 Martensitic stainless-steel bars (400 series)

- 5.4.1 410 stainless steel

- 5.4.2 416 stainless steel

- 5.4.3 420 stainless steel

- 5.4.4 440 stainless steel

- 5.4.5 Other martensitic grades

- 5.5 Duplex stainless-steel bars

- 5.5.1 2205 duplex

- 5.5.2 2507 super duplex

- 5.5.3 Other duplex grades

- 5.6 Precipitation hardening stainless steel bars

- 5.6.1 17-4 PH stainless steel

- 5.6.2 15-5 PH stainless steel

- 5.6.3 Other PH Grades

Chapter 6 Market Size and Forecast, By Shape & Dimension, 2021-2034 (USD Million) (Tons)

- 6.1 Key trends

- 6.2 Round bars

- 6.3 Square bars

- 6.4 Hexagonal bars

- 6.5 Flat bars

- 6.6 Angles

- 6.7 Channels

- 6.8 Other bar-size shapes

Chapter 7 Market Size and Forecast, By Processing Method, 2021-2034 (USD Million) (Tons)

- 7.1 Key trends

- 7.2 Hot-rolled stainless-steel bars

- 7.3 Cold-finished stainless-steel bars

- 7.3.1 Cold-drawn bars

- 7.3.2 Cold-rolled bars

- 7.3.3 Turned and polished bars

- 7.3.4 Ground and polished bars

Chapter 8 Market Size and Forecast, By Application, 2021-2034 (USD Million) (Tons)

- 8.1 Key trends

- 8.2 Automotive and transportation

- 8.2.1 Exhaust systems

- 8.2.2 Structural components

- 8.2.3 Fasteners and connectors

- 8.2.4 Fuel system components

- 8.3 Aerospace and defense

- 8.3.1 Aircraft components

- 8.3.2 Fasteners and connectors

- 8.3.3 Landing gear components

- 8.3.4 Defense equipment

- 8.4 Construction and infrastructure

- 8.4.1 Structural components

- 8.4.2 Reinforcement applications

- 8.4.3 Architectural applications

- 8.4.4 Fasteners and anchors

- 8.5 Oil and gas industry

- 8.5.1 Drilling equipment

- 8.5.2 Exploration components

- 8.5.3 Refining equipment

- 8.5.4 Offshore applications

- 8.6 Chemical and petrochemical industry

- 8.6.1 Process equipment components

- 8.6.2 Valves and fittings

- 8.6.3 Heat exchange components

- 8.7 Food and beverage industry

- 8.7.1 Processing equipment

- 8.7.2 Storage tanks and vessels

- 8.7.3 Conveying systems

- 8.8 Medical and pharmaceutical

- 8.8.1 Surgical instruments

- 8.8.2 Implantable devices

- 8.8.3 Equipment components

- 8.9 Power generation

- 8.9.1 Conventional power plants

- 8.9.2 Nuclear power plants

- 8.9.3 Renewable energy equipment

- 8.10 Marine and shipbuilding

- 8.10.1 Structural components

- 8.10.2 Propulsion systems

- 8.10.3 Deck equipment

- 8.11 Machinery and equipment manufacturing

- 8.11.1 Industrial machinery

- 8.11.2 Textile machinery

- 8.11.3 Paper and pulp equipment

- 8.12 Other applications

- 8.12.1 Consumer goods

- 8.12.2 Electronics

- 8.12.3 Sporting equipment

Chapter 9 Market Size and Forecast, By Region, 2021-2034 (USD Million) (Tons)

- 9.1 Key trends

- 9.2 North America

- 9.2.1 U.S.

- 9.2.2 Canada

- 9.3 Europe

- 9.3.1 UK

- 9.3.2 Germany

- 9.3.3 France

- 9.3.4 Italy

- 9.3.5 Spain

- 9.3.6 Netherlands

- 9.4 Asia Pacific

- 9.4.1 China

- 9.4.2 India

- 9.4.3 Japan

- 9.4.4 South Korea

- 9.4.5 Australia

- 9.5 Latin America

- 9.5.1 Brazil

- 9.5.2 Mexico

- 9.5.3 Argentina

- 9.6 MEA

- 9.6.1 South Africa

- 9.6.2 Saudi Arabia

- 9.6.3 UAE

Chapter 10 Company Profiles

- 10.1 Outokumpu

- 10.2 Acerinox

- 10.3 Jindal Stainless

- 10.4 Nippon Steel

- 10.5 POSCO

- 10.6 Sandvik Materials Technology

- 10.7 Carpenter Technology

- 10.8 Valbruna Stainless

- 10.9 Voestalpine

- 10.10 Tsingshan Holding Group