|

市場調查報告書

商品編碼

1750503

船舶市場機會、成長動力、產業趨勢分析及 2025 - 2034 年預測Marine Vessels Market Opportunity, Growth Drivers, Industry Trend Analysis, and Forecast 2025 - 2034 |

||||||

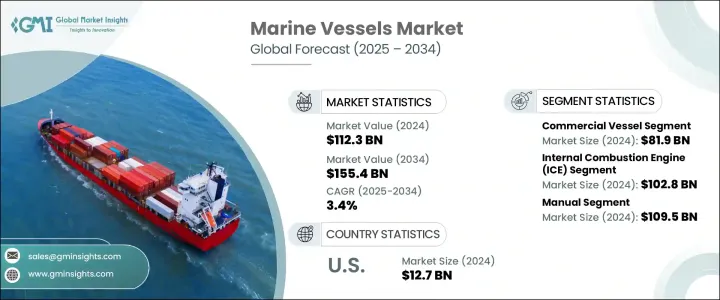

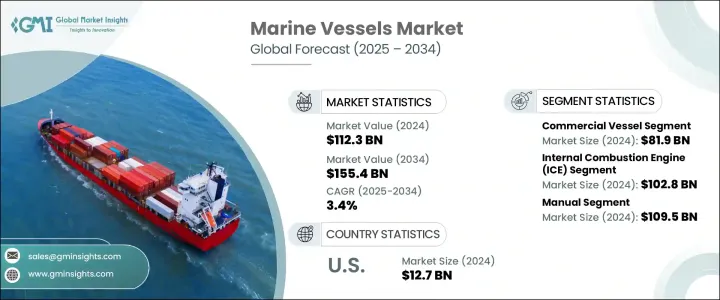

2024年,全球船舶市場規模達1123億美元,預計到2034年將以3.4%的複合年成長率成長,達到1554億美元,這得益於全球海上貿易規模的擴大以及各國政府對海軍艦隊現代化建設的不斷投入。隨著貿易路線的拓展和地緣政治緊張局勢的持續,各國正在加強海軍能力建設並推進艦隊現代化,從而對商用和軍用船舶的需求持續穩定。海上貿易對物流效率的需求,加上不斷變化的海上安全要求,將繼續影響全球對先進船舶的需求。

近年來,美國對鋼鐵和鋁等主要進口材料徵收關稅,對整個船舶產業產生了巨大的連鎖反應。這些政策提高了國內造船廠的製造成本,使得美國製造的船舶在價格和交貨週期方面不如國際同行具有競爭力。原料成本的上漲導致船舶建造進度放緩,商業和國防合約的預算緊張。此外,其他國家實施的報復性貿易措施限制了美國製造船舶的出口潛力,加劇了國內船廠的營運和財務挑戰。這些政策帶來的不確定性擾亂了供應鏈,延誤了項目,並促使一些造船廠重新評估採購和生產策略,以維持生存。

| 市場範圍 | |

|---|---|

| 起始年份 | 2024 |

| 預測年份 | 2025-2034 |

| 起始值 | 1123億美元 |

| 預測值 | 1554億美元 |

| 複合年成長率 | 3.4% |

2024年,商用船舶市場價值達819億美元。全球航運活動的不斷成長和港口基礎設施的升級,推動了對更多油輪、貨櫃船和散裝船的需求。此外,郵輪旅行的復甦和高容量渡輪系統的引入也推動了該市場的成長。一些國家加大了對港口和海上物流網路的投資,這進一步擴大了沿海和內陸水道對專用船舶和支線船舶的需求。

就推進系統而言,2024年內燃機 (ICE) 市場價值為 1,028 億美元。這類引擎在業界享有盛譽,具有成本效益、動力可靠性和更長的續航里程,對於長途貨物運輸和遠洋作業尤其重要。對於許多航運公司和海上作業而言,內燃機驅動的船舶仍然是最實用的解決方案,尤其是在加油基礎設施有限的情況下。這種推進系統也因其能夠支援重型船舶執行海上鑽井和物流任務而被廣泛採用。

受多個強勁需求促進因素的推動,美國船舶市場規模在2024年達到127億美元。專業服務和船員轉運船的需求不斷成長,尤其是在大型海上能源專案中,這推動了新船採購。這些船舶在離岸風電場和能源平台的建設和維護中發揮關鍵作用。此外,旨在振興內陸水路運輸(尤其是跨河流運輸)的投資,也推動了老舊船隊的現代化升級,從而提高了整個區域物流的效率和永續性。

全球船舶產業的主要參與者包括通用動力 NASSCO、Vard、HII、住友重工船舶與工程公司、達門造船集團、邁爾造船廠、三菱重工、巴布科克國際集團、奧斯塔爾、SHI-MCI、芬坎蒂尼、邁耶圖爾庫、Navantia、Lurssen、日本海洋建築公司、現代重工、聯合造船廠、建築加工、建築工工、建築工廠重建築工廠。

為了保持市場競爭力並拓展全球業務,領先的船舶製造商專注於下一代船舶設計、混合動力推進系統整合以及先進的自動化技術。企業透過投資綠色造船、液化天然氣推進系統和人工智慧驅動的維護解決方案,使其策略與脫碳目標保持一致。與港務局、海軍和物流供應商建立策略合作夥伴關係,增強了營運覆蓋範圍,同時積極的研發和數位轉型持續使市場領導者從競爭對手中脫穎而出。

目錄

第1章:方法論與範圍

第2章:執行摘要

第3章:行業洞察

- 產業生態系統分析

- 川普政府關稅

- 對貿易的影響

- 貿易量中斷

- 報復措施

- 對產業的影響

- 供給側影響

- 關鍵零件價格波動

- 供應鏈重組

- 生產成本影響

- 需求面影響(售價)

- 價格傳導至終端市場

- 市佔率動態

- 消費者反應模式

- 供給側影響

- 受影響的主要公司

- 策略產業反應

- 供應鏈重組

- 定價和產品策略

- 政策參與

- 展望與未來考慮

- 對貿易的影響

- 產業衝擊力

- 成長動力

- 全球貿易快速擴張

- 海軍擴張與現代化

- 客運和旅遊活動激增

- 本土製造和政府舉措

- 更大、更有效率船舶的需求不斷增加

- 產業陷阱與挑戰

- 地緣政治緊張與安全風險

- 經濟不確定性和通貨膨脹

- 成長動力

- 成長潛力分析

- 監管格局

- 技術格局

- 未來市場趨勢

- 差距分析

- 波特的分析

- PESTEL分析

第4章:競爭格局

- 介紹

- 公司市佔率分析

- 主要市場參與者的競爭分析

- 競爭定位矩陣

- 策略儀表板

第5章:市場估計與預測:按船舶類型,2021 - 2034 年

- 主要趨勢

- 商用船舶

- 貨櫃船

- 油輪

- 散貨船

- 遊輪

- 其他

- 海軍和防禦艦艇

- 驅逐艦

- 潛水艇

- 航空母艦

- 巡邏艦

- 其他

第6章:市場估計與預測:按推進類型,2021 - 2034 年

- 主要趨勢

- 內燃機(ICE)

- 電的

- 混合動力(電動+內燃機)

第7章:市場估計與預測:按控制機制,2021 - 2034 年

- 主要趨勢

- 手動的

- 自主

- 半自主

- 完全自主

第8章:市場估計與預測:按地區,2021 - 2034 年

- 主要趨勢

- 北美洲

- 美國

- 加拿大

- 歐洲

- 德國

- 英國

- 法國

- 西班牙

- 義大利

- 荷蘭

- 亞太地區

- 中國

- 印度

- 日本

- 澳洲

- 韓國

- 拉丁美洲

- 巴西

- 墨西哥

- 阿根廷

- 中東和非洲

- 沙烏地阿拉伯

- 南非

- 阿拉伯聯合大公國

第9章:公司簡介

- Austal

- Babcock International Group

- China Shipbuilding Industry Corporation

- Cochin Shipyard

- Damen Shipyards Group

- Fincantieri

- Garden Reach Shipbuilders and Engineers

- General Dynamics NASSCO

- HII

- Hyundai Heavy Industries

- Japan Marine United Corporation

- Lurssen

- Meyer Turku

- Meyer Werft

- Mitsubishi Heavy Industries

- Navantia

- SHI-MCI

- Sumitomo Heavy Industries Marine and Engineering

- Tsuneishi Shipbuilding

- Vard

The Global Marine Vessels Market was valued at USD 112.3 billion in 2024 and is estimated to grow at a CAGR of 3.4% to reach USD 155.4 billion by 2034, driven by the rising scale of global maritime trade and increasing government investments in naval fleet modernization. As trade routes expand and geopolitical tensions persist, countries are strengthening naval capabilities and modernizing their fleets, creating a stable demand for both commercial and military vessels. The need for logistical efficiency in seaborne trade, coupled with evolving maritime security requirements, continues to shape the global demand for advanced marine vessels.

The imposition of tariffs on key imported materials such as steel and aluminum in recent years created significant ripple effects across the marine vessels industry. These policies raised manufacturing costs for domestic shipbuilders, making U.S.-built vessels less competitive in pricing and lead times than their international counterparts. The increase in raw material expenses led to slower progress on vessel construction and strained budgets for commercial and defense contracts. Furthermore, retaliatory trade measures imposed by other nations restricted the export potential of American-built vessels, compounding the operational and financial challenges for domestic yards. The uncertainty introduced by such policies disrupted supply chains, delayed projects, and prompted some shipbuilders to reevaluate sourcing and production strategies to remain viable.

| Market Scope | |

|---|---|

| Start Year | 2024 |

| Forecast Year | 2025-2034 |

| Start Value | $112.3 Billion |

| Forecast Value | $155.4 Billion |

| CAGR | 3.4% |

The commercial vessels segment was valued at USD 81.9 billion in 2024. Expanding global shipping activities and infrastructure upgrades across ports fuel the need for more tankers, container ships, and bulk carriers. Additionally, the resurgence of cruise travel and the introduction of high-capacity ferry systems are helping drive segment growth. Several nations have stepped up investments in port and maritime logistics networks, which further amplifies the demand for specialized and feeder vessels across coastal and inland waterways.

On the basis of propulsion, the internal combustion engines (ICE) segment was valued at USD 102.8 billion in 2024. These engines are well-established in the industry, offering cost efficiency, power reliability, and extended range, especially crucial for long-haul cargo transport and deep-sea operations. For many shipping companies and offshore operations, ICE-powered ships remain the most practical solution, particularly where fueling infrastructure is limited. This propulsion type is also widely adopted for its ability to support heavy-duty vessels in offshore drilling and logistics missions.

United States Marine Vessels Market reached USD 12.7 billion in 2024, supported by several robust demand drivers. The expanding need for specialized service and crew transfer vessels, particularly for large-scale offshore energy projects, is fueling new vessel procurement. These vessels play a critical role in enabling the construction and maintenance of offshore wind farms and energy platforms. Additionally, investments aimed at revitalizing inland waterway transportation, especially across river systems, encourage the modernization of older fleets, improving efficiency and sustainability across regional logistics.

Key players in the Global Marine Vessels Industry include General Dynamics NASSCO, Vard, HII, Sumitomo Heavy Industries Marine and Engineering, Damen Shipyards Group, Meyer Werft, Mitsubishi Heavy Industries, Babcock International Group, Austal, SHI-MCI, Fincantieri, Meyer Turku, Navantia, Lurssen, Japan Marine United Corporation, Hyundai Heavy Industries, Tsuneishi Shipbuilding, Cochin Shipyard, Garden Reach Shipbuilders and Engineers, and China Shipbuilding Industry Corporation.

To maintain market relevance and expand globally, leading marine vessel manufacturers focus on next-generation ship designs, integration of hybrid propulsion systems, and advanced automation technologies. Companies align their strategies with decarbonization goals by investing in green shipbuilding, LNG propulsion, and AI-driven maintenance solutions. Strategic partnerships with port authorities, naval forces, and logistics providers enhance operational reach, while aggressive R&D and digital transformation continue to differentiate market leaders from competitors.

Table of Contents

Chapter 1 Methodology and Scope

- 1.1 Market scope and definitions

- 1.2 Research design

- 1.2.1 Research approach

- 1.2.2 Data collection methods

- 1.3 Base estimates and calculations

- 1.3.1 Base year calculation

- 1.3.2 Key trends for market estimation

- 1.4 Forecast model

- 1.5 Primary research and validation

- 1.5.1 Primary sources

- 1.5.2 Data mining sources

Chapter 2 Executive Summary

- 2.1 Industry 3600 synopsis

Chapter 3 Industry Insights

- 3.1 Industry ecosystem analysis

- 3.2 Trump administration tariffs

- 3.2.1 Impact on trade

- 3.2.1.1 Trade volume disruptions

- 3.2.1.2 Retaliatory measures

- 3.2.2 Impact on the industry

- 3.2.2.1 Supply-side impact

- 3.2.2.1.1 Price volatility in key components

- 3.2.2.1.2 Supply chain restructuring

- 3.2.2.1.3 Production cost implications

- 3.2.2.2 Demand-side impact (selling price)

- 3.2.2.2.1 Price transmission to end markets

- 3.2.2.2.2 Market share dynamics

- 3.2.2.2.3 Consumer response patterns

- 3.2.2.1 Supply-side impact

- 3.2.3 Key companies impacted

- 3.2.4 Strategic industry responses

- 3.2.4.1 Supply chain reconfiguration

- 3.2.4.2 Pricing and product strategies

- 3.2.4.3 Policy engagement

- 3.2.5 Outlook and future considerations

- 3.2.1 Impact on trade

- 3.3 Industry impact forces

- 3.3.1 Growth drivers

- 3.3.1.1 Rapid expansion of global trade

- 3.3.1.2 Military navy expansion and modernization

- 3.3.1.3 Surge in passenger and tourism activities

- 3.3.1.4 Indigenous manufacturing and government initiatives

- 3.3.1.5 Increasing demand for larger and more efficient vessels

- 3.3.2 Industry pitfalls and challenges

- 3.3.2.1 Geopolitical tensions and security risks

- 3.3.2.2 Economic uncertainty and inflation

- 3.3.1 Growth drivers

- 3.4 Growth potential analysis

- 3.5 Regulatory landscape

- 3.6 Technology landscape

- 3.7 Future market trends

- 3.8 Gap analysis

- 3.9 Porter's analysis

- 3.10 PESTEL analysis

Chapter 4 Competitive Landscape, 2024

- 4.1 Introduction

- 4.2 Company market share analysis

- 4.3 Competitive analysis of major market players

- 4.4 Competitive positioning matrix

- 4.5 Strategy dashboard

Chapter 5 Market Estimates and Forecast, By Vessel Type, 2021 - 2034 (USD Billion and Units)

- 5.1 Key trends

- 5.2 Commercial vessels

- 5.2.1 Containerships

- 5.2.2 Tankers

- 5.2.3 Bulk carriers

- 5.2.4 Cruise ships

- 5.2.5 Others

- 5.3 Naval & defense vessels

- 5.3.1 Destroyers

- 5.3.2 Submarines

- 5.3.3 Aircraft carriers

- 5.3.4 Patrol ships

- 5.3.5 Others

Chapter 6 Market Estimates and Forecast, By Propulsion Type, 2021 - 2034 (USD Billion and Units)

- 6.1 Key trends

- 6.2 Internal combustion engine (ICE)

- 6.3 Electric

- 6.4 Hybrid (Electric + ICE)

Chapter 7 Market Estimates and Forecast, By Control Mechanism, 2021 - 2034 (USD Billion and Units)

- 7.1 Key trends

- 7.2 Manual

- 7.3 Autonomous

- 7.4 Semi-autonomous

- 7.5 Fully autonomous

Chapter 8 Market Estimates and Forecast, By Region, 2021 - 2034 (USD Billion and Units)

- 8.1 Key trends

- 8.2 North America

- 8.2.1 U.S.

- 8.2.2 Canada

- 8.3 Europe

- 8.3.1 Germany

- 8.3.2 UK

- 8.3.3 France

- 8.3.4 Spain

- 8.3.5 Italy

- 8.3.6 Netherlands

- 8.4 Asia Pacific

- 8.4.1 China

- 8.4.2 India

- 8.4.3 Japan

- 8.4.4 Australia

- 8.4.5 South Korea

- 8.5 Latin America

- 8.5.1 Brazil

- 8.5.2 Mexico

- 8.5.3 Argentina

- 8.6 Middle East and Africa

- 8.6.1 Saudi Arabia

- 8.6.2 South Africa

- 8.6.3 UAE

Chapter 9 Company Profiles

- 9.1 Austal

- 9.2 Babcock International Group

- 9.3 China Shipbuilding Industry Corporation

- 9.4 Cochin Shipyard

- 9.5 Damen Shipyards Group

- 9.6 Fincantieri

- 9.7 Garden Reach Shipbuilders and Engineers

- 9.8 General Dynamics NASSCO

- 9.9 HII

- 9.10 Hyundai Heavy Industries

- 9.11 Japan Marine United Corporation

- 9.12 Lurssen

- 9.13 Meyer Turku

- 9.14 Meyer Werft

- 9.15 Mitsubishi Heavy Industries

- 9.16 Navantia

- 9.17 SHI-MCI

- 9.18 Sumitomo Heavy Industries Marine and Engineering

- 9.19 Tsuneishi Shipbuilding

- 9.20 Vard