|

市場調查報告書

商品編碼

1750499

臨床實驗室測試市場機會、成長動力、產業趨勢分析及 2025 - 2034 年預測Clinical Laboratory Tests Market Opportunity, Growth Drivers, Industry Trend Analysis, and Forecast 2025 - 2034 |

||||||

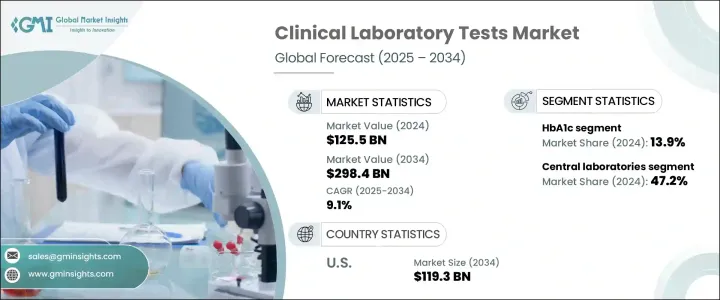

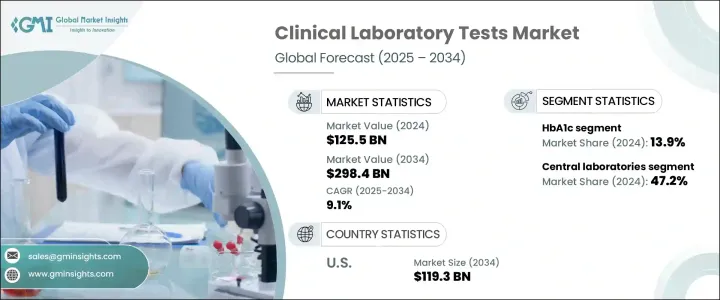

2024年,全球臨床實驗室檢測市場規模達1,255億美元,預計到2034年將以9.1%的複合年成長率成長,達到2,984億美元。這主要得益於慢性病病例的增加、全球人口老化以及對診斷檢測在早期發現和治療監測方面的日益依賴。實驗室檢測有助於醫療決策,大多數診斷工作流程依賴試劑、分析儀和檢體採集系統等工具。老齡化人口,尤其是已開發地區的老齡化人口,由於其易患心臟病、癌症和糖尿病等慢性疾病,對檢測需求貢獻巨大。

人工智慧和自動化的應用提高了檢測的周轉時間和準確性。現代實驗室如今將機器學習和機器人技術融入工作流程,以減少人為錯誤,提高營運效率,並管理不斷成長的樣本量。個人化醫療的發展推動了對精準診斷和多分析物檢測的需求。臨床檢測已成為全球預防性醫療保健策略的常規組成部分,即使在新興經濟體中,定期健康篩檢也變得越來越普遍。

| 市場範圍 | |

|---|---|

| 起始年份 | 2024 |

| 預測年份 | 2025-2034 |

| 起始值 | 1255億美元 |

| 預測值 | 2984億美元 |

| 複合年成長率 | 9.1% |

2024年,糖化血紅蛋白(HbA1c)檢測佔據最大市場佔有率,貢獻了總收入的13.9%。這些檢測對於監測長期血糖控制至關重要,尤其對於糖尿病患者而言。攜帶式分析儀和自動化系統等技術進步使HbA1c檢測更加便捷有效率。公眾對早期診斷和疾病管理意識的不斷提升也推動了這些檢測的頻率。隨著全球糖尿病病例的增加,對定期監測的需求持續激增,推動了該領域的持續成長。

2024年,中心實驗室市場佔據最大佔有率,達到472億美元,這得益於其高通量診斷能力、完善的基礎設施以及與醫院和研究機構的緊密整合。這些實驗室配備齊全,能夠處理包括基因和分子診斷在內的複雜檢測,並能在廣泛的地理網路中保持結果的一致性。其經濟高效的解決方案和可靠性使其成為滿足大規模檢測需求的首選。

2024年,美國臨床實驗室檢測市場規模達508億美元,預計2034年將達到1,193億美元,主要得益於多種結構性因素和技術因素。高昂的人均醫療保健支出使得尖端診斷技術能夠廣泛地應用於醫院、診所和研究實驗室。慢性病、傳染病和與年齡相關的健康狀況的發病率不斷上升,進一步加劇了對及時準確的實驗室檢測的需求。對分子診斷、個人化醫療和早期疾病檢測工具的日益依賴正在重塑全國的臨床工作流程。

該領域的主要參與者包括西門子醫療、生物梅里埃、安捷倫科技、Illumina、賽默飛世爾科技、雅培實驗室、Hologic、Bio-Rad Laboratories、凱傑、丹納赫和珀金埃爾默。為了增強市場影響力,各公司正專注於與醫療服務提供者建立合作關係,擴展實驗室自動化,並投資以人工智慧為基礎的平台。他們也致力於實現檢測菜單的多樣化,收購規模較小的診斷公司,並擴大全球分銷網路。在不斷變化的診斷領域,合規性、產品創新和經濟高效的解決方案對於保持競爭力仍然至關重要。

目錄

第1章:方法論與範圍

第2章:執行摘要

第3章:行業洞察

- 產業生態系統分析

- 產業衝擊力

- 成長動力

- 慢性病和傳染病症率不斷上升

- 診斷技術的進步

- 老年人口不斷增加

- 產業陷阱與挑戰

- 缺乏熟練的實驗室人員

- 嚴格的監管情景

- 成長動力

- 成長潛力分析

- 監管格局

- 川普政府關稅

- 對貿易的影響

- 貿易量中斷

- 各國應對措施

- 對產業的影響

- 供應方影響(製造成本)

- 主要材料價格波動

- 供應鏈重組

- 生產成本影響

- 需求面影響(消費者成本)

- 價格傳導至終端市場

- 市佔率動態

- 消費者反應模式

- 供應方影響(製造成本)

- 受影響的主要公司

- 策略產業反應

- 供應鏈重組

- 定價和產品策略

- 政策參與

- 展望與未來考慮

- 對貿易的影響

- 技術格局

- 未來市場趨勢

- 差距分析

- 波特的分析

- PESTEL分析

第4章:競爭格局

- 介紹

- 公司市佔率分析

- 公司矩陣分析

- 主要市場參與者的競爭分析

- 競爭定位矩陣

- 策略儀表板

第5章:市場估計與預測:按測試類型,2021 年至 2034 年

- 主要趨勢

- 全血球計數

- 糖化血紅素

- 代謝組

- 肝臟檢查

- 腎臟檢查

- 脂質組

- 心血管小組

- 其他測試類型

第6章:市場估計與預測:依最終用途,2021 年至 2034 年

- 主要趨勢

- 中央實驗室

- 基層診所

- 醫院

- 其他最終用途

第7章:市場估計與預測:按地區,2021 年至 2034 年

- 主要趨勢

- 北美洲

- 美國

- 加拿大

- 歐洲

- 德國

- 英國

- 法國

- 西班牙

- 義大利

- 荷蘭

- 亞太地區

- 中國

- 印度

- 日本

- 澳洲

- 韓國

- 拉丁美洲

- 巴西

- 墨西哥

- 阿根廷

- 中東和非洲

- 沙烏地阿拉伯

- 南非

- 阿拉伯聯合大公國

第8章:公司簡介

- Abbott Laboratories

- Agilent Technologies

- Beckman Coulter

- Becton, Dickinson and Company

- bioMerieux

- Bio-Rad Laboratories

- F. Hoffmann-La Roche

- Grifols

- Hologic

- Illumina

- PerkinElmer

- QIAGEN

- QuidelOrtho

- Siemens Healthineers

- Thermo Fisher Scientific

The Global Clinical Laboratory Tests Market was valued at USD 125.5 billion in 2024 and is estimated to grow at a CAGR of 9.1% to reach USD 298.4 billion by 2034, fueled by rising chronic disease cases, the aging global population, and the increasing reliance on diagnostic testing for early detection and treatment monitoring. Laboratory testing helps in medical decision-making, with most diagnostic workflows depending on tools like reagents, analyzers, and specimen collection systems. Aging populations, especially in developed regions, contribute significantly to testing demand due to their susceptibility to chronic illnesses such as heart disease, cancer, and diabetes.

Adoption of AI and automation has improved test turnaround time and accuracy. Modern laboratories now integrate machine learning and robotics into workflows to reduce manual errors, boost operational efficiency, and manage rising sample volumes. The move toward personalized medicine pushes demand for precise diagnostics and multi-analyte tests. Clinical testing has become a regular part of preventive healthcare strategies worldwide, and regular health screenings are becoming increasingly common, even in emerging economies.

| Market Scope | |

|---|---|

| Start Year | 2024 |

| Forecast Year | 2025-2034 |

| Start Value | $125.5 Billion |

| Forecast Value | $298.4 Billion |

| CAGR | 9.1% |

In 2024, HbA1c tests accounted for the largest market share, contributing 13.9% of total revenue. These tests are essential for monitoring long-term blood glucose control, particularly in patients with diabetes. Technological improvements such as portable analyzers and automated systems have made HbA1c testing more accessible and efficient. Growing public awareness around early diagnosis and disease management has also pushed the frequency of these tests. With diabetes cases rising globally, demand for regular monitoring continues to surge, driving sustained growth for this segment.

The central laboratories segment held the largest share in 2024, accounting for USD 47.2 billion, supported by high-throughput diagnostic capabilities, well-established infrastructure, and strong integration with hospitals and research institutions. These labs are equipped to handle complex tests, including genetic and molecular diagnostics, and maintain consistency in results across wide geographical networks. Their cost-effective solutions and reliability make them the preferred option for large-scale testing needs.

U.S. Clinical Laboratory Tests Market was valued at USD 50.8 billion in 2024 and is projected to reach USD 119.3 billion by 2034, driven by multiple structural and technological factors. High per capita healthcare spending enables widespread integration of cutting-edge diagnostic technologies across hospitals, clinics, and research labs. The rising incidence of chronic illnesses, infectious diseases, and age-related health conditions further amplifies the need for timely and accurate laboratory testing. Increasing reliance on molecular diagnostics, personalized medicine, and early disease detection tools is reshaping clinical workflows nationwide.

Key players in this space include Siemens Healthineers, bioMerieux, Agilent Technologies, Illumina, Thermo Fisher Scientific, Abbott Laboratories, Hologic, Bio-Rad Laboratories, QIAGEN, Danaher, and PerkinElmer. To strengthen market presence, companies are focusing on partnerships with healthcare providers, expanding laboratory automation, and investing in AI-based platforms. They also aim to diversify test menus, acquire smaller diagnostic firms, and increase their global distribution networks. Regulatory compliance, product innovation, and cost-effective solutions remain critical to staying competitive in the evolving diagnostic landscape.

Table of Contents

Chapter 1 Methodology and Scope

- 1.1 Market scope and definitions

- 1.2 Research design

- 1.2.1 Research approach

- 1.2.2 Data collection methods

- 1.3 Base estimates and calculations

- 1.3.1 Base year calculation

- 1.3.2 Key trends for market estimation

- 1.4 Forecast model

- 1.5 Primary research and validation

- 1.5.1 Primary sources

- 1.5.2 Data mining sources

Chapter 2 Executive Summary

- 2.1 Industry 3600 synopsis

Chapter 3 Industry Insights

- 3.1 Industry ecosystem analysis

- 3.2 Industry impact forces

- 3.2.1 Growth drivers

- 3.2.1.1 Increasing prevalence of chronic and infectious diseases

- 3.2.1.2 Advancements in diagnostic technologies

- 3.2.1.3 Growing geriatric population

- 3.2.2 Industry pitfalls and challenges

- 3.2.2.1 Shortage of skilled laboratory personnel

- 3.2.2.2 Stringent regulatory scenario

- 3.2.1 Growth drivers

- 3.3 Growth potential analysis

- 3.4 Regulatory landscape

- 3.5 Trump administration tariffs

- 3.5.1 Impact on trade

- 3.5.1.1 Trade volume disruptions

- 3.5.1.2 Country-wise response

- 3.5.2 Impact on the Industry

- 3.5.2.1 Supply-side impact (cost of manufacturing)

- 3.5.2.1.1 Price volatility in key materials

- 3.5.2.1.2 Supply chain restructuring

- 3.5.2.1.3 Production cost implications

- 3.5.2.2 Demand-side impact (cost to consumers)

- 3.5.2.2.1 Price transmission to end markets

- 3.5.2.2.2 Market share dynamics

- 3.5.2.2.3 Consumer response patterns

- 3.5.2.1 Supply-side impact (cost of manufacturing)

- 3.5.3 Key companies impacted

- 3.5.4 Strategic industry responses

- 3.5.4.1 Supply chain reconfiguration

- 3.5.4.2 Pricing and product strategies

- 3.5.4.3 Policy engagement

- 3.5.5 Outlook and future considerations

- 3.5.1 Impact on trade

- 3.6 Technological landscape

- 3.7 Future market trends

- 3.8 Gap analysis

- 3.9 Porter's analysis

- 3.10 PESTEL analysis

Chapter 4 Competitive Landscape, 2024

- 4.1 Introduction

- 4.2 Company market share analysis

- 4.3 Company matrix analysis

- 4.4 Competitive analysis of major market players

- 4.5 Competitive positioning matrix

- 4.6 Strategy dashboard

Chapter 5 Market Estimates and Forecast, By Test Type, 2021 – 2034 ($ Mn)

- 5.1 Key trends

- 5.2 Complete blood count

- 5.3 HbA1c

- 5.4 Metabolic panel

- 5.5 Liver panel

- 5.6 Renal panel

- 5.7 Lipid panel

- 5.8 Cardiovascular panel

- 5.9 Other test types

Chapter 6 Market Estimates and Forecast, By End Use, 2021 – 2034 ($ Mn)

- 6.1 Key trends

- 6.2 Central laboratories

- 6.3 Primary clinics

- 6.4 Hospitals

- 6.5 Other end use

Chapter 7 Market Estimates and Forecast, By Region, 2021 – 2034 ($ Mn)

- 7.1 Key trends

- 7.2 North America

- 7.2.1 U.S.

- 7.2.2 Canada

- 7.3 Europe

- 7.3.1 Germany

- 7.3.2 UK

- 7.3.3 France

- 7.3.4 Spain

- 7.3.5 Italy

- 7.3.6 Netherlands

- 7.4 Asia Pacific

- 7.4.1 China

- 7.4.2 India

- 7.4.3 Japan

- 7.4.4 Australia

- 7.4.5 South Korea

- 7.5 Latin America

- 7.5.1 Brazil

- 7.5.2 Mexico

- 7.5.3 Argentina

- 7.6 Middle East and Africa

- 7.6.1 Saudi Arabia

- 7.6.2 South Africa

- 7.6.3 UAE

Chapter 8 Company Profiles

- 8.1 Abbott Laboratories

- 8.2 Agilent Technologies

- 8.3 Beckman Coulter

- 8.4 Becton, Dickinson and Company

- 8.5 bioMerieux

- 8.6 Bio-Rad Laboratories

- 8.7 F. Hoffmann-La Roche

- 8.8 Grifols

- 8.9 Hologic

- 8.10 Illumina

- 8.11 PerkinElmer

- 8.12 QIAGEN

- 8.13 QuidelOrtho

- 8.14 Siemens Healthineers

- 8.15 Thermo Fisher Scientific