|

市場調查報告書

商品編碼

1750493

PVT 收集器市場機會、成長動力、產業趨勢分析及 2025 - 2034 年預測PVT Collectors Market Opportunity, Growth Drivers, Industry Trend Analysis, and Forecast 2025 - 2034 |

||||||

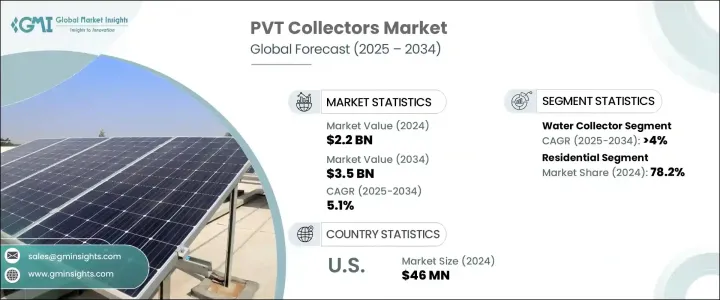

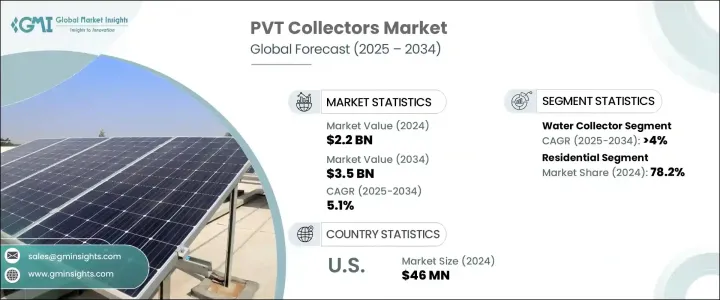

2024年,全球光電集熱器市場規模達22億美元,預計2034年將以5.1%的複合年成長率成長,達到35億美元。偏遠地區和離網地區對混合太陽能系統的需求日益成長,這加速了光電集熱器在全球的普及。這些系統將光伏和熱能技術整合到一塊面板中,同時提供電力和熱能。透過高效利用太陽能,光伏集熱器有助於減少對傳統燃料來源的依賴,提供經濟高效且永續的能源解決方案。服務欠缺地區日益增多的電氣化計畫預計將進一步推動這一需求,尤其是在能源基礎設施有限的地區。

除了農村電氣化之外,人們對混合再生能源系統在建築能源管理中日益成長的興趣也推動了光伏集熱器的廣泛應用。這些系統可以節省空間,實現雙能源輸出,同時最大限度地降低土地使用和安裝成本。隨著城市地區交通日益堵塞,人們越來越關注能夠以最小面積實現最大發電量的技術。光電集熱器恰好滿足了這項需求,為人口密集地區提供了切實可行的解決方案。隨著更嚴格的法規鼓勵節能低排放的建築實踐,政府也在推動向光伏系統等綜合再生能源技術轉變方面發揮關鍵作用。

| 市場範圍 | |

|---|---|

| 起始年份 | 2024 |

| 預測年份 | 2025-2034 |

| 起始值 | 22億美元 |

| 預測值 | 35億美元 |

| 複合年成長率 | 5.1% |

PVT集熱器與熱泵等其他綠色技術的日益融合,進一步刺激了市場成長。這種組合能夠提高生活熱水系統和空間加熱解決方案的能源效率。 PVT集熱器與熱泵之間的協同作用顯著節約能源,使其成為尋求性能最佳化和成本降低的住宅和商業能源消費者的可行選擇。隨著越來越多的公司和機構開發此類整合解決方案,市場滲透率預計將加速成長。

影響市場動態的另一個重要趨勢是住宅和商業建築對高效低溫供熱的需求日益成長。光電系統 (PVT) 可以滿足這一需求,同時也能提供發電的額外優勢,所有這些都只需一個屋頂單元即可完成。隨著分散式能源系統在全球的普及,像光伏集熱器這樣的雙發電裝置因其高投資回報率而越來越受到青睞。這些系統可以提高建築的整體能源性能,尤其是在屋頂空間有限的城市住宅區。這種高效率正推動建築一體化太陽能解決方案日益普及,尤其是在業主和開發商尋求在不影響能源產出的情況下實現永續發展目標的情況下。

儘管前景樂觀,但一些監管和政策相關的挑戰正在影響該行業。太陽能電池和熱電聯產機組等光電模組的高額進口關稅推高了系統價格,並減緩了其普及速度,尤其是在嚴重依賴進口技術的市場。這一成本壁壘限制了先進且高效系統的普及,並延長了大型專案的部署時間,這可能會減緩某些地區的成長。

就產品細分而言,PVT集熱器市場分為水集熱器、空氣集熱器和聚光系統。其中,水集熱器市場預計到2034年將以超過4%的複合年成長率擴張。這些系統因其能夠在各種氣候條件下提供可靠的熱輸出而日益普及,支持其在已開發市場和發展中市場的廣泛應用。它們與節能計劃的兼容性使其成為致力於長期脫碳的機構和企業的首選。

按應用領域分類,光電市場分為住宅和商業領域。 2024年,住宅領域佔據全球市場78.2%的主導地位。這一強勁成長源於日益加重的公共事業費用負擔以及屋主對能源自給自足的日益偏好。緊湊的設計和雙能源輸出使光伏系統成為住宅建築的理想選擇,尤其是在空間有限的城市地區。政府支持的太陽能技術應用激勵措施和返利計劃進一步鼓勵了家庭層面的安裝,從而增強了該領域的成長。

在美國,PVT 集熱器市場呈現穩定成長,到 2024 年將達到 4,600 萬美元,高於 2023 年的 4,300 萬美元和 2022 年的 4,100 萬美元。北美目前佔全球市場的 2.3%,預計到 2034 年這一數字將穩定上升。美國幾個州的高電價促使消費者探索 PVT 系統等替代能源,以降低公用事業成本並減少對電網的依賴。

該產業的領導企業合計佔全球約39.5%的市場。這些公司透過垂直整合保持競爭優勢,涵蓋從研發、製造到安裝和服務的各個環節。他們與建築和暖通空調公司的合作進一步鞏固了其市場地位,確保了無縫的系統相容性和最佳化的性能。在研發方面的大量投入促成了新一代PVT面板的推出,這些面板具有卓越的能量輸出,並配備了先進的監控技術。這些發展不僅提高了系統效率,也符合全球對永續淨零能耗建築日益成長的承諾。

目錄

第1章:方法論與範圍

第2章:執行摘要

第3章:行業洞察

- 產業生態系統

- 川普政府關稅分析

- 對貿易的影響

- 貿易量中斷

- 報復措施

- 對產業的影響

- 供應方影響(原料)

- 主要材料價格波動

- 供應鏈重組

- 生產成本影響

- 需求面影響(售價)

- 價格傳導至終端市場

- 市佔率動態

- 消費者反應模式

- 供應方影響(原料)

- 受影響的主要公司

- 策略產業反應

- 供應鏈重組

- 定價和產品策略

- 政策參與

- 展望與未來考慮

- 對貿易的影響

- 監管格局

- 產業衝擊力

- 成長動力

- 產業陷阱與挑戰

- 成長潛力分析

- 波特的分析

- PESTEL分析

第4章:競爭格局

- 介紹

- 公司市佔率

- 戰略儀表板

- 策略舉措

- 競爭基準測試

- 創新與永續發展格局

第5章:市場規模及預測:依類型,2021 - 2034

- 主要趨勢

- 集水器

- 覆蓋

- 裸露

- 真空管

- 空氣收集器

- 集中器

第6章:市場規模及預測:依應用,2021 - 2034

- 主要趨勢

- 住宅

- 商業的

第7章:市場規模及預測:依地區,2021 - 2034

- 主要趨勢

- 北美洲

- 美國

- 加拿大

- 歐洲

- 德國

- 義大利

- 希臘

- 波蘭

- 法國

- 亞太地區

- 中國

- 印度

- 日本

- 韓國

- 中東和北非

- 以色列

- 約旦

- 黎巴嫩

- 摩洛哥

- 世界其他地區

第8章:公司簡介

- Abora Solar

- Balkansolar

- Dualsun

- Naked Energy

- NIBE Energy

- PowerPanel

- SolarPower

- Solimpeks

- SunEarth

- Sunmaxx

The Global Photovoltaic Thermal Collectors Market was valued at USD 2.2 billion in 2024 and is estimated to grow at a CAGR of 5.1% to reach USD 3.5 billion by 2034. Increasing demand for hybrid solar energy systems in remote and off-grid locations is accelerating the adoption of PVT collectors worldwide. These systems combine photovoltaic and thermal technologies into a single panel, offering both electricity and heat. By efficiently utilizing solar energy, PVT collectors help reduce reliance on conventional fuel sources, offering cost-effective and sustainable energy solutions. Growing electrification initiatives in underserved areas are expected to further drive this demand, particularly in regions with limited energy infrastructure.

In addition to rural electrification, growing interest in hybrid renewable systems in building energy management is encouraging the broader use of PVT collectors. These systems allow for space-efficient installations that deliver dual energy outputs while minimizing land use and installation costs. As urban areas become more congested, there is an increasing focus on technologies that enable maximum energy generation from minimal surface area. PVT collectors fit this requirement well, offering a practical solution for densely populated areas. With stricter regulations encouraging energy-efficient and low-emission building practices, governments are also playing a key role in driving the shift toward integrated renewable technologies like PVT systems.

| Market Scope | |

|---|---|

| Start Year | 2024 |

| Forecast Year | 2025-2034 |

| Start Value | $2.2 Billion |

| Forecast Value | $3.5 Billion |

| CAGR | 5.1% |

Market growth is being further stimulated by the increasing integration of PVT collectors with other green technologies, such as heat pumps. The combination enables greater energy efficiency in both domestic hot water systems and space heating solutions. The synergy between PVT panels and heat pumps contributes to notable energy savings, making it a viable option for both residential and commercial energy consumers seeking performance optimization and cost reduction. As more companies and institutions develop these integrated solutions, market penetration is expected to accelerate.

Another important trend shaping market dynamics is the rising need for efficient low-temperature heat in residential and commercial buildings. PVT systems can meet this demand while offering the added benefit of electricity generation, all from a single rooftop unit. As decentralized energy systems gain traction globally, dual-generation units like PVT collectors are increasingly preferred for their high return on investment. These systems enhance overall building energy performance, especially in urban residential spaces where rooftop space is limited. This efficiency is contributing to the growing popularity of building-integrated solar solutions, especially as property owners and developers seek ways to meet sustainability targets without compromising on energy output.

Despite the positive outlook, some regulatory and policy-related challenges are impacting the industry. High import duties on PVT components such as solar cells and thermal units have increased system prices and slowed adoption, especially in markets heavily dependent on imported technology. This cost barrier limits access to advanced, high-efficiency systems and extends the deployment timeline for larger projects, potentially slowing growth in some regions.

In terms of product segmentation, the PVT collectors market is categorized into water collectors, air collectors, and concentrator systems. Among these, the water collectors segment is projected to expand at a CAGR exceeding 4% through 2034. These systems are gaining popularity for their ability to deliver reliable thermal output in a wide range of climatic conditions, supporting broader adoption in both developed and developing markets. Their compatibility with energy-saving initiatives makes them a preferred option for institutions and enterprises targeting long-term decarbonization.

By application, the market is split between residential and commercial sectors. The residential segment accounted for a dominant 78.2% share of global revenue in 2024. This strong presence is due to the increasing burden of utility bills and a rising preference among homeowners for energy self-sufficiency. The compact design and dual-energy output make PVT systems ideal for residential buildings, especially in urban areas where space is limited. Government-backed incentives and rebate programs for solar technology adoption further encourage household-level installations, reinforcing the growth of this segment.

In the United States, the PVT collectors market has shown steady growth, reaching USD 46 million in 2024, up from USD 43 million in 2023 and USD 41 million in 2022. North America currently holds a 2.3% share of the global market, a figure expected to rise steadily through 2034. High electricity prices in several US states are driving consumers to explore alternative energy sources like PVT systems to cut down on utility costs and reduce grid dependency.

Leading players in the industry collectively account for around 39.5% of the global market share. These companies maintain competitive advantages through vertical integration, managing everything from R&D and manufacturing to installation and service. Their partnerships with construction and HVAC firms further enhance their market position, ensuring seamless system compatibility and optimized performance. Heavy investment in R&D has led to the rollout of new-generation PVT panels that offer superior energy output and are equipped with advanced monitoring technologies. These developments not only improve system efficiency but also align with growing global commitments to sustainable, net-zero energy buildings.

Table of Contents

Chapter 1 Methodology & Scope

- 1.1 Research design

- 1.2 Base estimates & calculations

- 1.3 Forecast calculation

- 1.4 Primary research & validation

- 1.4.1 Primary sources

- 1.4.2 Data mining sources

- 1.5 Market definitions

Chapter 2 Executive Summary

- 2.1 Industry synopsis, 2021 - 2034

Chapter 3 Industry Insights

- 3.1 Industry ecosystem

- 3.2 Trump administration tariff analysis

- 3.2.1 Impact on trade

- 3.2.1.1 Trade volume disruptions

- 3.2.1.2 Retaliatory measures

- 3.2.2 Impact on the industry

- 3.2.2.1 Supply-side impact (raw materials)

- 3.2.2.1.1 Price volatility in key materials

- 3.2.2.1.2 Supply chain restructuring

- 3.2.2.1.3 Production cost implications

- 3.2.2.2 Demand-side impact (selling price)

- 3.2.2.2.1 Price transmission to end markets

- 3.2.2.2.2 Market share dynamics

- 3.2.2.2.3 Consumer response patterns

- 3.2.2.1 Supply-side impact (raw materials)

- 3.2.3 Key companies impacted

- 3.2.4 Strategic industry responses

- 3.2.4.1 Supply chain reconfiguration

- 3.2.4.2 Pricing and product strategies

- 3.2.4.3 Policy engagement

- 3.2.5 Outlook and future considerations

- 3.2.1 Impact on trade

- 3.3 Regulatory landscape

- 3.4 Industry impact forces

- 3.4.1 Growth drivers

- 3.4.2 Industry pitfalls & challenges

- 3.5 Growth potential analysis

- 3.6 Porter's analysis

- 3.6.1 Bargaining power of suppliers

- 3.6.2 Bargaining power of buyers

- 3.6.3 Threat of new entrants

- 3.6.4 Threat of substitutes

- 3.7 PESTEL analysis

Chapter 4 Competitive landscape, 2024

- 4.1 Introduction

- 4.2 Company market share

- 4.3 Strategic dashboard

- 4.4 Strategic initiative

- 4.5 Competitive benchmarking

- 4.6 Innovation & sustainability landscape

Chapter 5 Market Size and Forecast, By Type, 2021 - 2034 (USD Million, m2 & MW)

- 5.1 Key trends

- 5.2 Water collectors

- 5.2.1 Covered

- 5.2.2 Uncovered

- 5.2.3 Evacuated tube

- 5.3 Air collectors

- 5.4 Concentrators

Chapter 6 Market Size and Forecast, By Application, 2021 - 2034 (USD Million, m2 & MW)

- 6.1 Key trends

- 6.2 Residential

- 6.3 Commercial

Chapter 7 Market Size and Forecast, By Region, 2021 - 2034 (USD Million, m2 & MW)

- 7.1 Key trends

- 7.2 North America

- 7.2.1 U.S.

- 7.2.2 Canada

- 7.3 Europe

- 7.3.1 Germany

- 7.3.2 Italy

- 7.3.3 Greece

- 7.3.4 Poland

- 7.3.5 France

- 7.4 Asia Pacific

- 7.4.1 China

- 7.4.2 India

- 7.4.3 Japan

- 7.4.4 South Korea

- 7.5 Middle East & North Africa

- 7.5.1 Israel

- 7.5.2 Jordan

- 7.5.3 Lebanon

- 7.5.4 Morocco

- 7.6 Rest of World

Chapter 8 Company Profiles

- 8.1 Abora Solar

- 8.2 Balkansolar

- 8.3 Dualsun

- 8.4 Naked Energy

- 8.5 NIBE Energy

- 8.6 PowerPanel

- 8.7 SolarPower

- 8.8 Solimpeks

- 8.9 SunEarth

- 8.10 Sunmaxx