|

市場調查報告書

商品編碼

1750490

金屬瓶蓋市場機會、成長動力、產業趨勢分析及 2025 - 2034 年預測Metal Closures Market Opportunity, Growth Drivers, Industry Trend Analysis, and Forecast 2025 - 2034 |

||||||

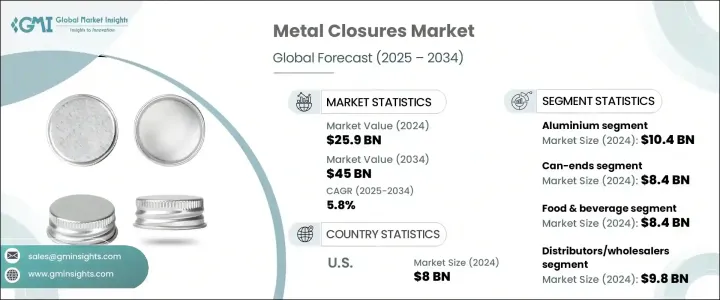

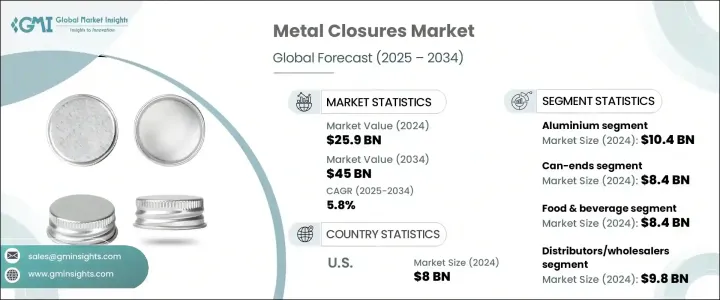

2024年,全球金屬瓶蓋市場規模達259億美元,預計到2034年將以5.8%的複合年成長率成長,達到450億美元。這一成長主要源自於已開發經濟體和新興經濟體對包裝食品和飲料的需求成長,以及酒精飲料消費量的上升。隨著消費者生活方式的快節奏和城市化程度的提高,對便利、耐用、防篡改包裝解決方案的需求大幅成長,從而推動了金屬瓶蓋的普及。金屬瓶蓋因其能夠保持產品完整性、延長保存期限並支持永續包裝而備受青睞。近年來,市場參與者紛紛響應不斷變化的法規和消費者期望,紛紛加入環保特性並優先考慮可回收材料。

川普政府對進口鋁和鋼徵收關稅,對金屬產業造成了重大衝擊。這些措施導致原物料成本飆升,漲幅高達25%,對依賴進口的製造商造成了廣泛影響。國內企業利潤率收緊,不得不將更高的成本轉嫁給客戶。雖然一些本土金屬生產商受益於暫時的價格優勢,但整個產業面臨市場波動加劇和營運成本上升的雙重壓力。這些挑戰也促使企業重新評估採購策略,許多企業轉向自動化,並探索替代材料以穩定生產成本。

| 市場範圍 | |

|---|---|

| 起始年份 | 2024 |

| 預測年份 | 2025-2034 |

| 起始值 | 259億美元 |

| 預測值 | 450億美元 |

| 複合年成長率 | 5.8% |

依材質分類,市場可分為鋁、鋼、錫和其他材質。鋁在2024年佔據主導地位,市場規模超過104億美元。鋁製瓶蓋因其輕質特性(可降低物流成本)和耐用性(可提供可靠的密封解決方案)而廣受青睞。這種材料尤其因其耐腐蝕性和與酸性產品的兼容性而備受青睞。鋁與循環經濟計劃的契合以及企業對永續發展日益成長的承諾,正在推動其在各行各業的應用。

就產品類型而言,市場包括皇冠蓋、罐蓋、螺旋蓋、旋蓋和其他類型的封蓋。罐蓋類別成為領先細分市場,2024 年市場規模超過 84 億美元。它們在食品和飲料包裝中的應用日益廣泛,顯著加速了需求成長。這些封蓋具有卓越的密封性能,是保鮮和防止污染的理想選擇。便捷包裝解決方案的普及也促進了該細分市場的快速成長,尤其是在注重耐用性和方便用戶使用性的領域。

根據最終用途,金屬瓶蓋市場可分為個人護理和化妝品、食品和飲料、消費品、藥品和其他。食品和飲料產業在2024年引領市場,估值達84億美元。消費習慣的改變、對即食食品的偏好增加以及密封容器在加工食品中的廣泛使用,都對推動需求成長發揮了至關重要的作用。金屬瓶蓋具有阻隔性能,可保護內容物免受水分和氧氣的侵害,有助於延長保存期限並保持品質,特別適用於碳酸飲料和發酵飲料。

就分銷通路而言,市場細分為直銷、分銷商/批發商、零售商和電商。 2024年,分銷商和批發商佔據了最高的市場佔有率,達到98億美元。這一細分市場的成長歸功於各行各業製造商的批量採購,從而確保了可靠的供應鏈連續性。這些分銷商通常面向中型企業,提供靈活的訂單規模和客製化選項,使其能夠滿足利基市場和特殊包裝的需求。

2024年,美國佔據該地區最大的市場佔有率,價值達80億美元。該國強大的藥品生產基礎設施,加上嚴格的安全和包裝標準,推動了先進封蓋系統的採用。具有防篡改和兒童安全功能的金屬封蓋對於合規性和消費者安全日益重要。高階包裝商品的日益普及以及酒精飲料消費的增加也推動了對封蓋的需求,所有這些都需要安全高效的密封技術。

金屬瓶蓋產業競爭激烈,全球和地區製造商均有參與。 2024年,前三名的公司——Silgan Holdings Inc.、Crown Holdings Inc. 和 Guala Closures Group——合計佔據超過12.8%的市場。領先企業持續投入研發,推出專注於輕量化材料、增強可回收性和創新密封機制的新一代產品。隨著企業尋求提升消費者參與度、可追溯性和產品安全性,配備2D碼和NFC晶片的智慧瓶蓋等功能正日益受到青睞。此外,健康意識和可追溯包裝的重要性日益提升,促使製造商開發採用BPA-NI襯裡和高阻隔技術等特性的瓶蓋。線上零售、直銷品牌和各行各業的手工生產日益普及,也加劇了對兼具功能性和美觀性的可客製化、短期生產瓶蓋的需求。

目錄

第1章:方法論與範圍

第2章:執行摘要

第3章:行業洞察

- 產業生態系統分析

- 川普政府關稅

- 對貿易的影響

- 貿易量中斷

- 報復措施

- 對產業的影響

- 供應方影響(原料)

- 主要材料價格波動

- 供應鏈重組

- 生產成本影響

- 需求面影響(售價)

- 價格傳導至終端市場

- 市佔率動態

- 消費者反應模式

- 供應方影響(原料)

- 受影響的主要公司

- 策略產業反應

- 供應鏈重組

- 定價和產品策略

- 政策參與

- 展望與未來考慮

- 對貿易的影響

- 產業衝擊力

- 成長動力

- 包裝食品和飲料的需求不斷成長

- 蓬勃發展的製藥業

- 酒精飲料消費量增加

- 保存期限長且密封性佳

- 永續性和可回收性的吸引力

- 產業陷阱與挑戰

- 原物料價格波動

- 輕質軟包裝替代

- 成長動力

- 成長潛力分析

- 監管格局

- 技術格局

- 未來市場趨勢

- 差距分析

- 波特的分析

- PESTEL分析

第4章:競爭格局

- 介紹

- 公司市佔率分析

- 主要市場參與者的競爭分析

- 競爭定位矩陣

- 策略儀表板

第5章:市場估計與預測:按材料,2021 - 2034 年

- 主要趨勢

- 鋁

- 鋼

- 錫

- 其他

第6章:市場估計與預測:按類型,2021 - 2034 年(百萬美元和十億單位)

- 主要趨勢

- 王冠

- 罐蓋

- 擰緊

- 捻

- 其他

第7章:市場估計與預測:依最終用途,2021 - 2034 年

- 主要趨勢

- 食品和飲料

- 製藥

- 消費品

- 個人護理和化妝品

- 其他

第8章:市場估計與預測:按配銷通路,2021 - 2034 年

- 主要趨勢

- 直銷

- 分銷商/批發商

- 零售商

- 電子商務

第9章:市場估計與預測:按地區,2021 - 2034 年

- 主要趨勢

- 北美洲

- 美國

- 加拿大

- 歐洲

- 德國

- 英國

- 法國

- 西班牙

- 義大利

- 荷蘭

- 亞太地區

- 中國

- 印度

- 日本

- 澳洲

- 韓國

- 拉丁美洲

- 巴西

- 墨西哥

- 阿根廷

- 中東和非洲

- 沙烏地阿拉伯

- 南非

- 阿拉伯聯合大公國

第10章:公司簡介

- Amcor

- AptarGroup

- Berry Global

- CL Smith

- Closure Systems International

- Crown Holdings

- Finn-Korkki

- Guala Closures

- MJS Packaging

- Metal Closures

- Nippon Closures

- O. Berk

- Pelliconi

- Silgan Holdings

- Sonoco Products

- Tecnocap

The Global Metal Closures Market was valued at USD 25.9 billion in 2024 and is estimated to grow at a CAGR of 5.8% to reach USD 45 billion by 2034. This growth is primarily driven by the increasing demand for packaged food and beverages, along with rising consumption of alcoholic drinks across both developed and emerging economies. As consumer lifestyles become more fast-paced and urbanized, the need for convenient, durable, and tamper-proof packaging solutions has grown substantially, fueling the adoption of metal closures. These closures are favored due to their ability to preserve product integrity, offer extended shelf life, and support sustainable packaging efforts. In recent years, market players have responded to evolving regulations and consumer expectations by incorporating environmentally friendly features and prioritizing recyclable materials.

The imposition of tariffs on imported aluminum and steel under the Trump administration significantly impacted the industry. These measures led to raw material cost surges-up to 25%-causing widespread disruptions for manufacturers reliant on imports. Domestic players faced tightened margins and had to pass on higher costs to customers. While some local metal producers benefited from the temporary pricing advantage, the broader industry dealt with heightened volatility and rising operational expenses. These challenges also encouraged firms to re-evaluate sourcing strategies, with many shifting towards automation and exploring alternative materials to stabilize production costs.

| Market Scope | |

|---|---|

| Start Year | 2024 |

| Forecast Year | 2025-2034 |

| Start Value | $25.9 Billion |

| Forecast Value | $45 Billion |

| CAGR | 5.8% |

By material, the market is segmented into aluminum, steel, tin, and others. The aluminum segment dominated in 2024, generating over USD 10.4 billion. Aluminum closures are widely chosen for their lightweight nature, which reduces logistics expenses, and their durability, which provides reliable sealing solutions. This material is especially favored for its resistance to corrosion and compatibility with acidic products. Its alignment with circular economy initiatives and rising corporate commitments toward sustainability are boosting its adoption across various industries.

In terms of product type, the market includes crown, can-ends, screw, twist, and other closures. The can-ends category emerged as the leading segment, surpassing USD 8.4 billion in 2024. Their increasing use in the packaging of food and beverages has significantly accelerated demand. These closures provide excellent sealing performance, making them ideal for maintaining freshness and preventing contamination. The popularity of convenient packaging solutions has also contributed to the rapid growth of this segment, especially in sectors where longevity and user-friendliness are essential.

Based on end-use, the metal closures market is divided into personal care and cosmetics, food and beverage, consumer goods, pharmaceuticals, and others. The food and beverage sector led the market in 2024 with a valuation of USD 8.4 billion. Changing consumption habits, increased preference for ready-to-eat meals, and the widespread use of airtight containers in processed food have all played a vital role in driving demand. Metal closures offer barrier properties that protect contents from moisture and oxygen, helping extend shelf life and maintain quality, especially for carbonated and fermented beverages.

Regarding distribution channels, the market is segmented into direct sales, distributors/wholesalers, retailers, and e-commerce. Distributors and wholesalers accounted for the highest market share in 2024, reaching USD 9.8 billion. The growth of this segment is attributed to bulk purchasing by manufacturers across various industries, ensuring reliable supply chain continuity. These distributors often cater to mid-sized firms with flexible order sizes and custom options, enabling them to meet the needs of niche markets and specialty packaging requirements.

The United States held the largest regional share in 2024, valued at USD 8 billion. The country's robust pharmaceutical production infrastructure, combined with stringent safety and packaging standards, has driven the adoption of advanced closure systems. Metal closures designed with tamper-evident and child-resistant features have become increasingly important for compliance and consumer safety. Demand is also being fueled by the rising popularity of premium packaged goods, along with increased consumption of alcohol-based beverages, all of which require secure and efficient sealing technologies.

Competition in the metal closures industry is intense, with the presence of both global and regional manufacturers. The top three companies- Silgan Holdings Inc., Crown Holdings Inc., and Guala Closures Group-together held a market share of over 12.8% in 2024. Leading firms continue to invest in research and development to introduce next-generation products focusing on lightweight materials, enhanced recyclability, and innovative sealing mechanisms. Features such as smart closures equipped with QR codes and NFC chips are gaining momentum as companies look to boost consumer engagement, traceability, and product safety. Additionally, the rising importance of health-conscious and traceable packaging is prompting manufacturers to develop closures with features like BPA-NI linings and high-barrier technologies. The growing popularity of online retail, direct-to-consumer brands, and craft production across industries is also amplifying the need for customizable, short-run closures that combine functionality with aesthetic appeal.

Table of Contents

Chapter 1 Methodology and Scope

- 1.1 Market scope and definitions

- 1.2 Research design

- 1.2.1 Research approach

- 1.2.2 Data collection methods

- 1.3 Base estimates and calculations

- 1.3.1 Base year calculation

- 1.3.2 Key trends for market estimation

- 1.4 Forecast model

- 1.5 Primary research and validation

- 1.5.1 Primary sources

- 1.5.2 Data mining sources

Chapter 2 Executive Summary

- 2.1 Industry 3600 synopsis

Chapter 3 Industry Insights

- 3.1 Industry ecosystem analysis

- 3.2 Trump administration tariffs

- 3.2.1 Impact on trade

- 3.2.1.1 Trade volume disruptions

- 3.2.1.2 Retaliatory measures

- 3.2.2 Impact on the industry

- 3.2.2.1 Supply-side impact (raw materials)

- 3.2.2.1.1 Price volatility in key materials

- 3.2.2.1.2 Supply chain restructuring

- 3.2.2.1.3 Production cost implications

- 3.2.2.2 Demand-side impact (selling price)

- 3.2.2.2.1 Price transmission to end markets

- 3.2.2.2.2 Market share dynamics

- 3.2.2.2.3 Consumer response patterns

- 3.2.2.1 Supply-side impact (raw materials)

- 3.2.3 Key companies impacted

- 3.2.4 Strategic industry responses

- 3.2.4.1 Supply chain reconfiguration

- 3.2.4.2 Pricing and product strategies

- 3.2.4.3 Policy engagement

- 3.2.5 Outlook and future considerations

- 3.2.1 Impact on trade

- 3.3 Industry impact forces

- 3.3.1 Growth drivers

- 3.3.1.1 Rising demand for packaged food & beverages

- 3.3.1.2 Booming pharmaceutical industry

- 3.3.1.3 Increasing alcoholic beverage consumption

- 3.3.1.4 Long shelf life and hermetic sealing

- 3.3.1.5 Sustainability & recyclability appeal

- 3.3.2 Industry pitfalls and challenges

- 3.3.2.1 Volatility in raw material prices

- 3.3.2.2 Substitution by lightweight flexible packaging

- 3.3.1 Growth drivers

- 3.4 Growth potential analysis

- 3.5 Regulatory landscape

- 3.6 Technology landscape

- 3.7 Future market trends

- 3.8 Gap analysis

- 3.9 Porter's analysis

- 3.10 PESTEL analysis

Chapter 4 Competitive Landscape, 2024

- 4.1 Introduction

- 4.2 Company market share analysis

- 4.3 Competitive analysis of major market players

- 4.4 Competitive positioning matrix

- 4.5 Strategy dashboard

Chapter 5 Market Estimates and Forecast, By Material, 2021 - 2034 (USD Million and Billion Units)

- 5.1 Key trends

- 5.2 Aluminum

- 5.3 Steel

- 5.4 Tin

- 5.5 Others

Chapter 6 Market Estimates and Forecast, By Type, 2021 - 2034 (USD Million and Billion Units)

- 6.1 Key trends

- 6.2 Crown

- 6.3 Can-ends

- 6.4 Screw

- 6.5 Twist

- 6.6 Others

Chapter 7 Market Estimates and Forecast, By End Use, 2021 - 2034 (USD Million and Billion Units)

- 7.1 Key trends

- 7.2 Food & beverages

- 7.3 Pharmaceuticals

- 7.4 Consumer goods

- 7.5 Personal care & cosmetics

- 7.6 Others

Chapter 8 Market Estimates and Forecast, By Distribution Channel, 2021 - 2034 (USD Million and Billion Units)

- 8.1 Key trends

- 8.2 Direct sales

- 8.3 Distributors / wholesalers

- 8.4 Retailer

- 8.5 E-commerce

Chapter 9 Market Estimates and Forecast, By Region, 2021 - 2034 (USD Million and Billion Units)

- 9.1 Key trends

- 9.2 North America

- 9.2.1 U.S.

- 9.2.2 Canada

- 9.3 Europe

- 9.3.1 Germany

- 9.3.2 UK

- 9.3.3 France

- 9.3.4 Spain

- 9.3.5 Italy

- 9.3.6 Netherlands

- 9.4 Asia Pacific

- 9.4.1 China

- 9.4.2 India

- 9.4.3 Japan

- 9.4.4 Australia

- 9.4.5 South Korea

- 9.5 Latin America

- 9.5.1 Brazil

- 9.5.2 Mexico

- 9.5.3 Argentina

- 9.6 Middle East and Africa

- 9.6.1 Saudi Arabia

- 9.6.2 South Africa

- 9.6.3 UAE

Chapter 10 Company Profiles

- 10.1 Amcor

- 10.2 AptarGroup

- 10.3 Berry Global

- 10.4 CL Smith

- 10.5 Closure Systems International

- 10.6 Crown Holdings

- 10.7 Finn-Korkki

- 10.8 Guala Closures

- 10.9 MJS Packaging

- 10.10 Metal Closures

- 10.11 Nippon Closures

- 10.12 O. Berk

- 10.13 Pelliconi

- 10.14 Silgan Holdings

- 10.15 Sonoco Products

- 10.16 Tecnocap