|

市場調查報告書

商品編碼

1750489

碳纖維注入聚合物市場機會、成長動力、產業趨勢分析及 2025 - 2034 年預測Carbon Fiber-Infused Polymers Market Opportunity, Growth Drivers, Industry Trend Analysis, and Forecast 2025 - 2034 |

||||||

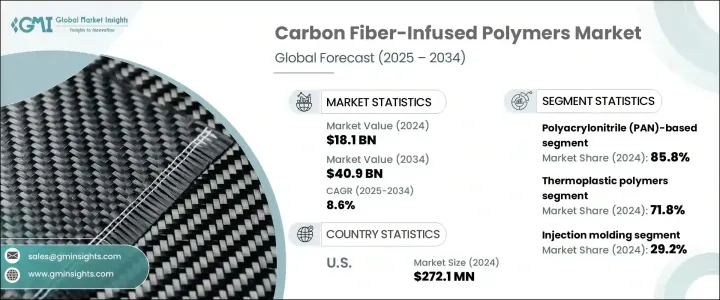

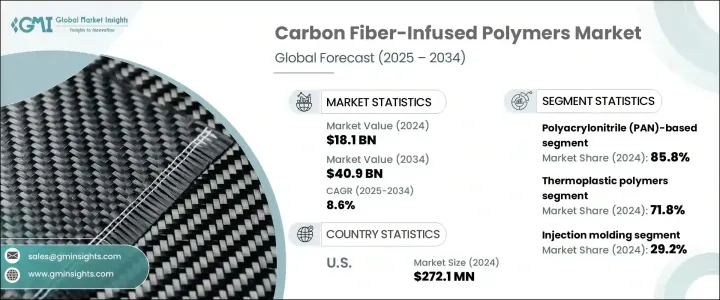

2024年,全球碳纖維注入聚合物市場價值為181億美元,預計2034年將以8.6%的複合年成長率成長,達到409億美元,這得益於汽車、航太、國防和再生能源等各行各業日益成長的需求。碳纖維注入聚合物的獨特性能——例如高強度重量比、耐腐蝕性和熱穩定性——使其成為需要輕質耐用材料的應用的理想選擇。在汽車產業,這些材料有助於提高燃油效率並減少排放,符合嚴格的環境法規。

同樣,在航太和國防領域,採用這些複合材料可以提高性能並降低營運成本。再生能源產業,尤其是風電領域,正持續受益於將碳纖維複合材料整合到渦輪葉片生產中。這些材料可以製造更輕、更耐用的葉片,在捕獲風能的同時提高運作效率。其較高的強度重量比支持更長葉片的設計,從而在不損害結構完整性的情況下實現更大的能量輸出——這對於陸上和海上大型風力發電設施至關重要。

| 市場範圍 | |

|---|---|

| 起始年份 | 2024 |

| 預測年份 | 2025-2034 |

| 起始值 | 181億美元 |

| 預測值 | 409億美元 |

| 複合年成長率 | 8.6% |

在碳纖維注入聚合物市場中,按聚合物類型細分,突出了熱塑性和熱固性兩種聚合物。熱塑性聚合物在2024年佔據了71.8%的市場佔有率,因其可回收性、快速加工時間以及耐受反覆加熱和重塑的能力而受到青睞。這些特性使其在汽車和航太製造業的大批量應用領域頗具吸引力,在這些領域,永續性和成本效益正變得越來越重要。

注塑成型憑藉其能夠大規模生產精密耐用的零件,在2024年佔據了29.2%的市場。汽車產業尤其受益於這項工藝,因為它能夠生產輕質且堅固的結構部件,有助於提高車輛性能和燃油效率。注塑成型對複雜幾何形狀的適應性以及與熱塑性複合材料的兼容性進一步增強了其市場相關性。

受美國對創新和先進製造業策略投資的推動,美國碳纖維注入聚合物市場在2024年將佔85%的市場。公共和私營部門的資金支持建立了專門的研究中心和試驗平台,致力於最佳化複合材料的生產。這些努力旨在降低碳纖維的成本,並提高其在商業用途的性能,尤其是在國防、交通和清潔能源等關鍵領域。

全球碳纖維注入聚合物市場的主要公司包括東麗株式會社、帝人株式會社、赫氏株式會社、西格里碳素公司和索爾維公司。這些公司處於創新前沿,專注於開發先進材料和製造程序,以滿足各行各業日益成長的需求。為了鞏固市場地位,碳纖維注入聚合物產業的公司正在採取多項策略舉措,包括投資研發以創新和改進材料性能、建立合資企業和合作夥伴關係以擴大市場覆蓋範圍,以及提升製造能力以滿足日益成長的需求。

目錄

第1章:方法論與範圍

第2章:執行摘要

第3章:行業洞察

- 產業生態系統分析

- 原物料供應商

- 製造商

- 經銷商

- 最終用途

- 利潤率分析

- 新冠疫情導致的價值鏈中斷

- 川普政府關稅的影響—結構化概述

- 對貿易的影響

- 貿易量中斷

- 報復措施

- 對產業的影響

- 供應方影響(原料)

- 主要材料價格波動

- 供應鏈重組

- 生產成本影響

- 需求面影響(售價)

- 價格傳導至終端市場

- 市佔率動態

- 消費者反應模式

- 受影響的主要公司

- 策略產業反應

- 供應鏈重組

- 定價和產品策略

- 政策參與

- 展望與未來考慮

- 對貿易的影響

- 貿易統計(HS編碼)

- 主要出口國

- 主要進口國

註:以上貿易統計僅針對重點國家。

- 利潤率分析

- 重要新聞和舉措

- 技術格局

- 傳統製造技術

- 先進製造技術

- 新興技術

- 專利分析

- 監管格局

- 市場動態

- 市場促進因素

- 汽車和航太工業對輕質材料的需求不斷增加

- 越來越關注燃油效率和減排

- 在運動和休閒應用的採用率不斷上升

- 擴大再生能源領域

- 製造程序的技術進步

- 產業陷阱與挑戰

- 生產成本高

- 複雜的製造程序

- 回收和報廢挑戰

- 供應鏈漏洞

- 市場促進因素

- 成長潛力分析

- 波特的分析

- PESTEL分析

第4章:競爭格局

- 市佔率分析

- 競爭儀錶板

- 策略舉措

- 併購

- 合資企業

- 產品發布

- 擴張計劃

- 研發投資

- 競爭基準測試

- 供應商採用矩陣

- 競爭定位矩陣

第5章:市場估計與預測:按聚合物類型,2021 - 2034 年

- 主要趨勢

- 熱塑性聚合物

- 聚醯胺(PA)

- 聚丙烯(PP)

- 聚醚醚酮(PEEK)

- 聚苯硫醚(PPS)

- 聚醚醯亞胺(PEI)

- 其他

- 熱固性聚合物

- 環氧樹脂

- 聚酯纖維

- 乙烯基酯

- 聚氨酯

- 其他

第6章:市場估計與預測:依碳纖維類型,2021 - 2034 年

- 主要趨勢

- 聚丙烯腈(PAN)基

- 標準模量

- 中間模量

- 高模量

- 基於音調

- 人造絲基

- 再生碳纖維

第7章:市場估計與預測:按製造程序,2021 - 2034 年

- 主要趨勢

- 射出成型

- 壓縮成型

- 樹脂傳遞模塑

- 拉擠成型

- 纖維纏繞

- 積層製造

- 其他

第8章:市場估計與預測:依最終用途,2021 - 2034 年

- 主要趨勢

- 航太與國防

- 飛機部件

- 空間應用

- 國防裝備

- 汽車

- 結構部件

- 內裝部件

- 動力總成部件

- 電動汽車應用

- 風能

- 刀片

- 機艙

- 其他組件

- 運動與休閒

- 自行車

- 網球拍

- 高爾夫球桿

- 其他

- 建造

- 加固材料

- 結構部件

- 其他

- 海洋

- 船體結構

- 甲板組件

- 其他

- 醫療的

- 義肢

- 影像設備

- 其他

- 工業設備

- 其他

第9章:市場估計與預測:按地區,2021 - 2034 年

- 主要趨勢

- 北美洲

- 美國

- 加拿大

- 歐洲

- 德國

- 英國

- 法國

- 西班牙

- 義大利

- 歐洲其他地區

- 亞太地區

- 中國

- 印度

- 日本

- 澳洲

- 韓國

- 亞太其他地區

- 拉丁美洲

- 巴西

- 墨西哥

- 拉丁美洲其他地區

- 中東和非洲

- 沙烏地阿拉伯

- 南非

- 阿拉伯聯合大公國

- 中東和非洲其他地區

第10章:公司簡介

- Carbon Fiber Composite Design

- Composite Horizons LLC

- Cytec Industries Inc.

- DowAksa

- Formosa Plastics Corporation

- Hexcel Corporation

- Hyosung Advanced Materials

- Kureha Corporation

- Mitsubishi Chemical Holdings Corporation

- Nippon Carbon Co., Ltd.

- Plasan Carbon Composites

- SABIC

- SGL Carbon

- Sigmatex

- Solvay SA

- Teijin Limited

- Toho Tenax Co., Ltd.

- Toray Industries, Inc.

- Zhongfu Shenying Carbon Fiber Co., Ltd.

- Zoltek Companies, Inc.

The Global Carbon Fiber-Infused Polymers Market was valued at USD 18.1 billion in 2024 and is estimated to grow at a CAGR of 8.6% to reach USD 40.9 billion by 2034, driven by the increasing demand across various industries, including automotive, aerospace, defense, and renewable energy sectors. The unique properties of carbon fiber-infused polymers-such as high strength-to-weight ratios, corrosion resistance, and thermal stability-make them ideal for applications requiring lightweight and durable materials. In the automotive industry, these materials contribute to fuel efficiency and reduced emissions, aligning with stringent environmental regulations.

Similarly, in aerospace and defense, adopting these composites enhances performance and reduces operational costs. The renewable energy industry, especially the wind power segment, continues to gain from integrating carbon fiber composites into turbine blade production. These materials allow lighter, more durable blades that capture wind energy while enhancing operational efficiency. Their high strength-to-weight ratio supports the design of longer blades, which leads to greater energy output without compromising structural integrity-an essential factor for large-scale wind installations both onshore and offshore.

| Market Scope | |

|---|---|

| Start Year | 2024 |

| Forecast Year | 2025-2034 |

| Start Value | $18.1 Billion |

| Forecast Value | $40.9 Billion |

| CAGR | 8.6% |

Within the carbon fiber-infused polymers market, segmentation by polymer type highlights thermoplastic and thermoset variants. The thermoplastic polymers segment held 71.8% share in 2024, favored for their recyclability, fast processing times, and ability to withstand repeated heating and reshaping. These features make them attractive for high-volume applications in automotive and aerospace manufacturing, where sustainability and cost-efficiency are becoming increasingly important.

The injection molding segment held a 29.2% share in 2024 due to its ability to deliver precise, durable parts at scale. The automotive sector, in particular, benefits from this process, as it enables the production of lightweight yet robust structural parts that contribute to improved vehicle performance and fuel efficiency. Injection molding's adaptability to complex geometries and compatibility with thermoplastic composites further amplify its market relevance.

United States Carbon Fiber-Infused Polymers Market held 85% share in 2024, driven by the nation's strategic investment in innovation and advanced manufacturing. Public and private sector funding has facilitated the establishment of dedicated research centers and test beds focused on optimizing composite material production. These efforts aim to lower the cost of carbon fiber and improve its performance for commercial use, particularly in key sectors like defense, mobility, and clean energy.

Key companies operating in the Global Carbon Fiber-Infused Polymers Market include Toray Industries Inc., Teijin Limited, Hexcel Corporation, SGL Carbon, and Solvay S.A. These companies are at the forefront of innovation, focusing on developing advanced materials and manufacturing processes to meet the growing demands of various industries. To strengthen their market position, companies in the carbon fiber-infused polymers industry are adopting several strategic initiatives. These include investing in research and development to innovate and improve material properties, establishing joint ventures and partnerships to expand market reach, and enhancing manufacturing capabilities to meet increasing demand.

Table of Contents

Chapter 1 Methodology & Scope

- 1.1 Research methodology

- 1.1.1 Initial data exploration

- 1.1.2 Primary research methodology

- 1.1.3 Secondary research methodology

- 1.1.4 Market size estimation approach

- 1.1.5 Data triangulation techniques

- 1.1.6 Research assumptions

- 1.2 Market definition and scope

- 1.2.1 Base year and forecast period

- 1.2.2 Market segmentation

- 1.2.3 Regional scope

- 1.2.4 Currency conversion rates

- 1.3 Information procurement

- 1.3.1 Purchased database

- 1.3.2 GMI's internal database

- 1.3.3 Secondary sources

- 1.3.4 Primary research

- 1.4 Information analysis

- 1.4.1 Data analysis models

- 1.4.2 Market breakdown and data triangulation

Chapter 2 Executive Summary

- 2.1 Carbon fiber-infused polymers industry 3600 synopsis, 2021-2034

- 2.1.1 Business trends

- 2.1.2 Regional trends

- 2.1.3 Polymer type trends

- 2.1.4 Carbon fiber type trends

- 2.1.5 Manufacturing process trends

- 2.1.6 End use industry trends

Chapter 3 Industry Insights

- 3.1 Industry ecosystem analysis

- 3.1.1 Raw material suppliers

- 3.1.2 Manufacturers

- 3.1.3 Distributors

- 3.1.4 End use

- 3.1.5 Profit margin analysis

- 3.1.6 Value chain disruptions due to COVID-19

- 3.2 Impact of trump administration tariffs – structured overview

- 3.2.1 Impact on trade

- 3.2.1.1 Trade volume disruptions

- 3.2.1.2 Retaliatory measures

- 3.2.2 Impact on the industry

- 3.2.2.1.1 Supply-side impact (raw materials)

- 3.2.2.1.2 Price volatility in key materials

- 3.2.2.1.3 Supply chain restructuring

- 3.2.2.1.4 Production cost implications

- 3.2.2.2 Demand-side impact (selling price)

- 3.2.2.2.1 Price transmission to end markets

- 3.2.2.2.2 Market share dynamics

- 3.2.2.2.3 Consumer response patterns

- 3.2.3 Key companies impacted

- 3.2.4 Strategic industry responses

- 3.2.4.1 Supply chain reconfiguration

- 3.2.4.2 Pricing and product strategies

- 3.2.4.3 Policy engagement

- 3.2.5 Outlook and future considerations

- 3.2.1 Impact on trade

- 3.3 Trade statistics (HS code)

- 3.3.1 Major exporting countries

- 3.3.2 Major importing countries

Note: the above trade statistics will be provided for key countries only.

- 3.4 Profit margin analysis

- 3.5 Key news & initiatives

- 3.5.1 Technology landscape

- 3.5.2 Traditional manufacturing technologies

- 3.5.3 Advanced manufacturing technologies

- 3.5.4 Emerging technologies

- 3.5.5 Patent analysis

- 3.6 Regulatory landscape

- 3.6.1 North America

- 3.6.2 Europe

- 3.6.3 Asia Pacific

- 3.6.4 Latin America

- 3.6.5 MEA

- 3.7 Market dynamics

- 3.7.1 Market drivers

- 3.7.1.1 Increasing demand for lightweight materials in the automotive and aerospace industries

- 3.7.1.2 Growing focus on fuel efficiency and emission reduction

- 3.7.1.3 Rising adoption in sports and leisure applications

- 3.7.1.4 Expanding the renewable energy sector

- 3.7.1.5 Technological advancements in manufacturing processes

- 3.7.2 Industry pitfalls and challenges

- 3.7.2.1 High production costs

- 3.7.2.2 Complex manufacturing processes

- 3.7.2.3 Recycling and end-of-life challenges

- 3.7.2.4 Supply chain vulnerabilities

- 3.7.1 Market drivers

- 3.8 Growth potential analysis

- 3.9 Porter's analysis

- 3.9.1 Supplier power

- 3.9.2 Buyer power

- 3.9.3 Threat of new entrants

- 3.9.4 Threat of substitutes

- 3.9.5 Industry rivalry

- 3.10 PESTEL analysis

Chapter 4 Competitive Landscape, 2024

- 4.1 Market share analysis, 2024

- 4.2 Competitive dashboard

- 4.3 Strategic initiatives

- 4.3.1 Mergers & acquisitions

- 4.3.2 Joint ventures

- 4.3.3 Product launches

- 4.3.4 Expansion plans

- 4.3.5 R&D investments

- 4.4 Competitive benchmarking

- 4.5 Vendor adoption matrix

- 4.6 Competitive positioning matrix

Chapter 5 Market Estimates and Forecast, By Polymer Type, 2021 - 2034 (USD Billion) (Kilo Tons)

- 5.1 Key trends

- 5.2 Thermoplastic polymers

- 5.2.1 Polyamide (PA)

- 5.2.2 Polypropylene (PP)

- 5.2.3 Polyether ether ketone (PEEK)

- 5.2.4 Polyphenylene sulfide (PPS)

- 5.2.5 Polyetherimide (PEI)

- 5.2.6 Others

- 5.3 Thermoset polymers

- 5.3.1 Epoxy

- 5.3.2 Polyester

- 5.3.3 Vinyl ester

- 5.3.4 Polyurethane

- 5.3.5 Others

Chapter 6 Market Estimates and Forecast, By Carbon Fiber Type, 2021 - 2034 (USD Billion) (Kilo Tons)

- 6.1 Key trends

- 6.2 Polyacrylonitrile (PAN)-based

- 6.2.1 Standard modulus

- 6.2.2 Intermediate modulus

- 6.2.3 High modulus

- 6.3 Pitch-based

- 6.4 Rayon-based

- 6.5 Recycled carbon fiber

Chapter 7 Market Estimates and Forecast, By Manufacturing Process, 2021 - 2034 (USD Billion) (Kilo Tons)

- 7.1 Key trends

- 7.2 Injection molding

- 7.3 Compression molding

- 7.4 Resin transfer molding

- 7.5 Pultrusion

- 7.6 Filament winding

- 7.7 Additive manufacturing

- 7.8 Others

Chapter 8 Market Estimates and Forecast, By End Use, 2021 - 2034 (USD Billion) (Kilo Tons)

- 8.1 Key trends

- 8.2 Aerospace & defense

- 8.2.1 Aircraft components

- 8.2.2 Space applications

- 8.2.3 Defense equipment

- 8.3 Automotive

- 8.3.1 Structural components

- 8.3.2 Interior components

- 8.3.3 Powertrain components

- 8.3.4 Electric vehicle applications

- 8.4 Wind energy

- 8.4.1 Blades

- 8.4.2 Nacelles

- 8.4.3 Other components

- 8.5 Sports & leisure

- 8.5.1 Bicycles

- 8.5.2 Tennis rackets

- 8.5.3 Golf clubs

- 8.5.4 Others

- 8.6 Construction

- 8.6.1 Reinforcement materials

- 8.6.2 Structural components

- 8.6.3 Others

- 8.7 Marine

- 8.7.1 Hull structures

- 8.7.2 Deck components

- 8.7.3 Others

- 8.8 Medical

- 8.8.1 Prosthetics

- 8.8.2 Imaging equipment

- 8.8.3 Others

- 8.9 Industrial equipment

- 8.10 Others

Chapter 9 Market Estimates and Forecast, By Region, 2021 - 2034 (USD Billion) (Kilo Tons)

- 9.1 Key trends

- 9.2 North America

- 9.2.1 U.S.

- 9.2.2 Canada

- 9.3 Europe

- 9.3.1 Germany

- 9.3.2 UK

- 9.3.3 France

- 9.3.4 Spain

- 9.3.5 Italy

- 9.3.6 Rest of Europe

- 9.4 Asia Pacific

- 9.4.1 China

- 9.4.2 India

- 9.4.3 Japan

- 9.4.4 Australia

- 9.4.5 South Korea

- 9.4.6 Rest of Asia Pacific

- 9.5 Latin America

- 9.5.1 Brazil

- 9.5.2 Mexico

- 9.5.3 Rest of Latin America

- 9.6 Middle East and Africa

- 9.6.1 Saudi Arabia

- 9.6.2 South Africa

- 9.6.3 UAE

- 9.6.4 Rest of Middle East and Africa

Chapter 10 Company Profiles

- 10.1 Carbon Fiber Composite Design

- 10.2 Composite Horizons LLC

- 10.3 Cytec Industries Inc.

- 10.4 DowAksa

- 10.5 Formosa Plastics Corporation

- 10.6 Hexcel Corporation

- 10.7 Hyosung Advanced Materials

- 10.8 Kureha Corporation

- 10.9 Mitsubishi Chemical Holdings Corporation

- 10.10 Nippon Carbon Co., Ltd.

- 10.11 Plasan Carbon Composites

- 10.12 SABIC

- 10.13 SGL Carbon

- 10.14 Sigmatex

- 10.15 Solvay S.A.

- 10.16 Teijin Limited

- 10.17 Toho Tenax Co., Ltd.

- 10.18 Toray Industries, Inc.

- 10.19 Zhongfu Shenying Carbon Fiber Co., Ltd.

- 10.20 Zoltek Companies, Inc.