|

市場調查報告書

商品編碼

1750486

醫用導管市場機會、成長動力、產業趨勢分析及 2025 - 2034 年預測Medical Tubing Market Opportunity, Growth Drivers, Industry Trend Analysis, and Forecast 2025 - 2034 |

||||||

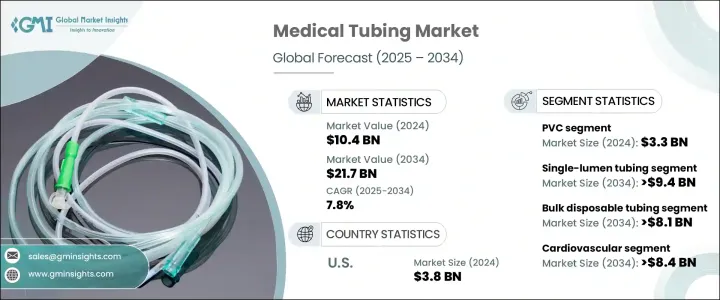

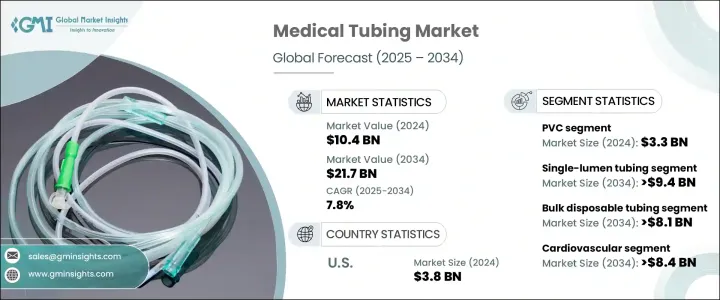

2024年,全球醫用導管市場規模達104億美元,預計到2034年將以7.8%的複合年成長率成長,達到217億美元,這主要得益於醫療支出的增加、醫療器械製造技術的進步以及全球慢性病的激增。高性能、生物相容性導管材料的日益普及,提高了患者的治療效果和安全性,使其在外科和診斷程序中廣泛應用。隨著人們對微創治療的偏好日益成長,導管插入術和輸液治療等應用對導管的需求也隨之成長。全球人口老化也影響了這一趨勢,因為老年患者通常需要涉及液體輸送和生命徵象監測的長期照護解決方案。

一個關鍵的市場促進因素是人們對一次性醫療器材的日益青睞。一次性導管如今因其減少交叉污染和醫院內感染而備受青睞。家庭醫療保健服務的激增加速了這一需求,尤其是對於需要定期透析、靜脈注射治療或呼吸輔助的患者。彈性體導管和感測器整合結構的進步,拓展了醫用導管在現代生物醫學和外科技術中的應用。這些趨勢,加上聚合物配方和導管設計的持續創新,正在不斷重塑醫用導管產業的格局。

| 市場範圍 | |

|---|---|

| 起始年份 | 2024 |

| 預測年份 | 2025-2034 |

| 起始值 | 104億美元 |

| 預測值 | 217億美元 |

| 複合年成長率 | 7.8% |

2024年,PVC市場規模達33億美元,反映其作為產業首選材料的地位。 PVC的柔韌性、化學穩定性和滅菌相容性使其成為藥物輸送、透析和導管產品製造商的首選材料。不含DEHP的PVC品種的出現提升了市場興趣,這些品種符合監管標準,同時保持了良好的性能。 PVC能夠支援複雜的管道配置,包括多腔和薄壁類型,這使其在現代醫療保健應用中具有不可估量的價值。

預計醫用導管市場中的散裝一次性導管細分市場將保持領先地位,複合年成長率為 8.2%,到 2034 年將達到 81 億美元。此細分市場的優勢在於其廣泛應用於各種關鍵醫療程序,包括呼吸治療、靜脈輸液和各種液體管理系統。這些導管解決方案在醫院和家庭護理環境中不可或缺,在這些環境中,無菌性、安全性和一次性使用功能至關重要。其成本效益和較低的交叉污染風險使其成為高頻使用的理想選擇,尤其是在易受感染的環境中。

美國醫用導管市場規模在2024年達到38億美元,預計2034年將以7.3%的複合年成長率成長。美國在醫療創新領域的領先地位,支撐著先進導管技術的蓬勃發展,尤其是在診斷影像、導管插入術、微創手術和長期慢性病照護領域。戈爾、科德寶和德尼培等主要產業參與者的加入,進一步推動了這一成長。這些公司專注於研發投入,推動了多腔、微孔和感測器整合導管系統的進步。醫院和門診中心採用此類系統來支援先進的手術、精準的液體管理和個人化的病患治療。

為了在全球醫用導管市場保持強勢地位,特瑞堡、宙斯、聖戈班、普特南塑膠和史派克等主要參與者正積極提升自身實力。這些公司在材料科學領域投入大量資金,旨在打造耐久性、生物相容性以及在各種條件下性能更佳的導管。與醫療器材原始設備製造商的策略合作,以及不斷擴張的生產基地和無塵室設施,使其能夠有效率地滿足全球需求。一些公司專注於永續發展,開發可回收或不含鄰苯二甲酸二(DEHP)的產品,以適應監管變化和醫院採購偏好。此外,強大的研發管道和專有擠出技術的智慧財產權保護,也使其在競爭激烈的市場中脫穎而出。

目錄

第1章:方法論與範圍

第2章:執行摘要

第3章:行業洞察

- 產業生態系統分析

- 產業衝擊力

- 成長動力

- 心血管疾病和呼吸系統疾病等慢性疾病的盛行率不斷上升

- 對微創外科手術的需求不斷成長

- 一次性醫療器材的採用激增,以預防感染

- 醫用導管在藥物傳輸系統的應用日益增多

- 產業陷阱與挑戰

- 先進材料帶來的高製造成本

- 與材料相容性和耐久性相關的問題

- 成長動力

- 成長潛力分析

- 監管格局

- 川普政府關稅

- 對貿易的影響

- 貿易量中斷

- 報復措施

- 對產業的影響

- 供應方影響(原料)

- 主要材料價格波動

- 供應鏈重組

- 生產成本影響

- 需求面影響(售價)

- 價格傳導至終端市場

- 市佔率動態

- 消費者反應模式

- 供應方影響(原料)

- 受影響的主要公司

- 策略產業反應

- 供應鏈重組

- 定價和產品策略

- 政策參與

- 展望與未來考慮

- 對貿易的影響

- 技術格局

- 定價分析

- 差距分析

- 波特的分析

- PESTEL分析

第4章:競爭格局

- 介紹

- 公司矩陣分析

- 公司市佔率分析

- 主要市場參與者的競爭分析

- 競爭定位矩陣

- 策略儀表板

第5章:市場估計與預測:按材料,2021 - 2034 年

- 主要趨勢

- 聚氯乙烯(PVC)

- 矽酮

- 聚烯烴

- 聚碳酸酯

- 其他材料

第6章:市場估計與預測:依結構,2021 - 2034 年

- 主要趨勢

- 單腔管

- 多腔管

- 共擠管

- 其他結構

第7章:市場估計與預測:按應用,2021 - 2034 年

- 主要趨勢

- 散裝一次性管

- 導管和套管

- 藥物輸送系統

- 其他應用

第8章:市場估計與預測:按指標 2021 - 2034

- 主要趨勢

- 心血管

- 呼吸系統

- 胃腸道

- 其他適應症

第9章:市場估計與預測:依最終用途 2021 - 2034

- 主要趨勢

- 醫院和診所

- 門診手術中心

- 診斷實驗室

- 其他最終用途

第10章:市場估計與預測:按地區,2021 - 2034 年

- 主要趨勢

- 北美洲

- 美國

- 加拿大

- 歐洲

- 德國

- 英國

- 法國

- 西班牙

- 義大利

- 荷蘭

- 亞太地區

- 中國

- 日本

- 印度

- 澳洲

- 韓國

- 拉丁美洲

- 巴西

- 墨西哥

- 阿根廷

- 中東和非洲

- 南非

- 沙烏地阿拉伯

- 阿拉伯聯合大公國

第 11 章:公司簡介

- AdvantaPURE

- AngioDynamics

- AP Technologies

- mdc

- FREUDENBERG

- Nordson

- Parker

- POLYZEN

- Putnam Plastics

- raumedic

- SAINT-GOBAIN

- SPECTRUM

- TRELLEBORG

- GORE

- ZEUS

The Global Medical Tubing Market was valued at USD 10.4 billion in 2024 and is estimated to grow at a CAGR of 7.8% to reach USD 21.7 billion by 2034, propelled by increasing healthcare expenditures, technological advancements in medical device manufacturing, and the global surge in chronic illnesses. Rising adoption of high-performance, biocompatible tubing materials enhances patient outcomes and safety, supporting widespread use in surgical and diagnostic procedures. As the preference for less invasive treatments grows, so does the demand for tubing in applications like catheterization and infusion therapy. The aging global population influences this trend, since older patients often require long-term care solutions involving tubes for fluid transfer and vital monitoring.

One key market driver is the increasing preference for disposable medical devices. Single-use tubing is now favored for reducing cross-contamination and hospital-acquired infections. The surge in home healthcare services accelerates this demand, especially for patients needing regular dialysis, IV therapies, or respiratory assistance. Advancements in elastomer-based tubing and sensor-integrated structures have expanded medical tubing applications in modern biomedicine and surgical technologies. These trends, along with ongoing innovation in polymer formulations and tubing design, continue to reshape the landscape of the medical tubing industry.

| Market Scope | |

|---|---|

| Start Year | 2024 |

| Forecast Year | 2025-2034 |

| Start Value | $10.4 Billion |

| Forecast Value | $21.7 Billion |

| CAGR | 7.8% |

PVC segment accounted for USD 3.3 billion in 2024, reflecting its role as a highly preferred material in the industry. Its flexibility, chemical stability, and compatibility with sterilization make it a go-to choice for manufacturers across drug delivery, dialysis, and catheter products. Market interest has been boosted by the emergence of DEHP-free PVC variants, which comply with regulatory standards while maintaining performance. PVC's ability to support intricate tubing configurations, including multi-lumen and thin-wall types, makes it invaluable for modern healthcare applications.

The bulk disposable tubing segment in the medical tubing market is forecast to maintain its lead with a CAGR of 8.2%, generating USD 8.1 billion by 2034. This segment's strength lies in its extensive use across a wide range of critical healthcare procedures, including respiratory therapy, IV fluid delivery, and various fluid management systems. These tubing solutions are indispensable in hospital and home care environments, where sterility, safety, and single-use functionality are paramount. Their cost-effectiveness and reduced risk of cross-contamination make them ideal for high-frequency usage, particularly in infection-sensitive settings.

United States Medical Tubing Market reached USD 3.8 billion in 2024 and is projected to grow at a CAGR of 7.3% through 2034. The country's leadership in healthcare innovation supports robust adoption of sophisticated tubing technologies, especially in diagnostic imaging, catheterization, minimally invasive procedures, and long-term chronic care. The presence of key industry players such as Gore, Freudenberg, and Tekni-Plex bolsters this growth. These companies focus on R&D investments, leading to advancements in multi-lumen, microbore, and sensor-integrated tubing systems. Hospitals and outpatient centers adopt such systems to support advanced surgeries, precise fluid management, and tailored patient therapies.

To maintain a strong position in the Global Medical Tubing Market, key players like Trelleborg, Zeus, Saint-Gobain, Putnam Plastics, and Spectrum are actively enhancing their capabilities. These companies invest significantly in material science to create tubing with improved durability, biocompatibility, and performance under various conditions. Strategic collaborations with medical device OEMs, along with expanding production sites and cleanroom facilities, allow them to meet global demand efficiently. Several firms focus on sustainability by developing recyclable or DEHP-free options to align with regulatory shifts and hospital procurement preferences. Additionally, robust R&D pipelines and IP protections for proprietary extrusion technologies are helping them differentiate in a competitive market.

Table of Contents

Chapter 1 Methodology and Scope

- 1.1 Market scope and definitions

- 1.2 Research design

- 1.2.1 Research approach

- 1.2.2 Data collection methods

- 1.3 Base estimates and calculations

- 1.3.1 Base year calculation

- 1.3.2 Key trends for market estimation

- 1.4 Forecast model

- 1.5 Primary research and validation

- 1.5.1 Primary sources

- 1.5.2 Data mining sources

Chapter 2 Executive Summary

- 2.1 Industry 3600 synopsis

Chapter 3 Industry Insights

- 3.1 Industry ecosystem analysis

- 3.2 Industry impact forces

- 3.2.1 Growth drivers

- 3.2.1.1 Increasing prevalence of chronic diseases, such as cardiovascular and respiratory conditions

- 3.2.1.2 Growing demand for minimally invasive surgical procedures

- 3.2.1.3 Surging adoption of single-use medical devices to prevent infections

- 3.2.1.4 Rising use of medical tubing in drug delivery systems

- 3.2.2 Industry pitfalls and challenges

- 3.2.2.1 High manufacturing costs associated with advanced materials

- 3.2.2.2 Issues related to material compatibility and durability

- 3.2.1 Growth drivers

- 3.3 Growth potential analysis

- 3.4 Regulatory landscape

- 3.5 Trump administration tariffs

- 3.5.1 Impact on trade

- 3.5.1.1 Trade volume disruptions

- 3.5.1.2 Retaliatory measures

- 3.5.2 Impact on the Industry

- 3.5.2.1 Supply-side impact (raw materials)

- 3.5.2.1.1 Price volatility in key materials

- 3.5.2.1.2 Supply chain restructuring

- 3.5.2.1.3 Production cost implications

- 3.5.2.2 Demand-side impact (selling price)

- 3.5.2.2.1 Price transmission to end markets

- 3.5.2.2.2 Market share dynamics

- 3.5.2.2.3 Consumer response patterns

- 3.5.2.1 Supply-side impact (raw materials)

- 3.5.3 Key companies impacted

- 3.5.4 Strategic industry responses

- 3.5.4.1 Supply chain reconfiguration

- 3.5.4.2 Pricing and product strategies

- 3.5.4.3 Policy engagement

- 3.5.5 Outlook and future considerations

- 3.5.1 Impact on trade

- 3.6 Technology landscape

- 3.7 Pricing analysis

- 3.8 Gap analysis

- 3.9 Porter's analysis

- 3.10 PESTEL analysis

Chapter 4 Competitive Landscape, 2024

- 4.1 Introduction

- 4.2 Company matrix analysis

- 4.3 Company market share analysis

- 4.4 Competitive analysis of major market players

- 4.5 Competitive positioning matrix

- 4.6 Strategy dashboard

Chapter 5 Market Estimates and Forecast, By Material, 2021 - 2034 ($ Mn)

- 5.1 Key trends

- 5.2 Polyvinyl chloride (PVC)

- 5.3 Silicone

- 5.4 Polyolefins

- 5.5 Polycarbonates

- 5.6 Other materials

Chapter 6 Market Estimates and Forecast, By Structure, 2021 - 2034 ($ Mn)

- 6.1 Key trends

- 6.2 Single-lumen tubing

- 6.3 Multi-lumen tubing

- 6.4 Co-extruded tubing

- 6.5 Other structures

Chapter 7 Market Estimates and Forecast, By Application, 2021 - 2034 ($ Mn)

- 7.1 Key trends

- 7.2 Bulk disposable tubing

- 7.3 Catheters and cannulas

- 7.4 Drug delivery systems

- 7.5 Other applications

Chapter 8 Market Estimates and Forecast, By Indication 2021 - 2034 ($ Mn)

- 8.1 Key trends

- 8.2 Cardiovascular

- 8.3 Respiratory

- 8.4 Gastrointestinal

- 8.5 Other indications

Chapter 9 Market Estimates and Forecast, By End Use 2021 - 2034 ($ Mn)

- 9.1 Key trends

- 9.2 Hospitals and clinics

- 9.3 Ambulatory surgical centers

- 9.4 Diagnostic laboratories

- 9.5 Other end use

Chapter 10 Market Estimates and Forecast, By Region, 2021 - 2034 ($ Mn)

- 10.1 Key trends

- 10.2 North America

- 10.2.1 U.S.

- 10.2.2 Canada

- 10.3 Europe

- 10.3.1 Germany

- 10.3.2 UK

- 10.3.3 France

- 10.3.4 Spain

- 10.3.5 Italy

- 10.3.6 Netherlands

- 10.4 Asia Pacific

- 10.4.1 China

- 10.4.2 Japan

- 10.4.3 India

- 10.4.4 Australia

- 10.4.5 South Korea

- 10.5 Latin America

- 10.5.1 Brazil

- 10.5.2 Mexico

- 10.5.3 Argentina

- 10.6 Middle East and Africa

- 10.6.1 South Africa

- 10.6.2 Saudi Arabia

- 10.6.3 UAE

Chapter 11 Company Profiles

- 11.1 AdvantaPURE

- 11.2 AngioDynamics

- 11.3 AP Technologies

- 11.4 mdc

- 11.5 FREUDENBERG

- 11.6 Nordson

- 11.7 Parker

- 11.8 POLYZEN

- 11.9 Putnam Plastics

- 11.10 raumedic

- 11.11 SAINT-GOBAIN

- 11.12 SPECTRUM

- 11.13 TRELLEBORG

- 11.14 GORE

- 11.15 ZEUS