|

市場調查報告書

商品編碼

1750485

高溫超導體 (HTS) 市場機會、成長動力、產業趨勢分析及 2025 - 2034 年預測High-Temperature Superconductors (HTS) Market Opportunity, Growth Drivers, Industry Trend Analysis, and Forecast 2025 - 2034 |

||||||

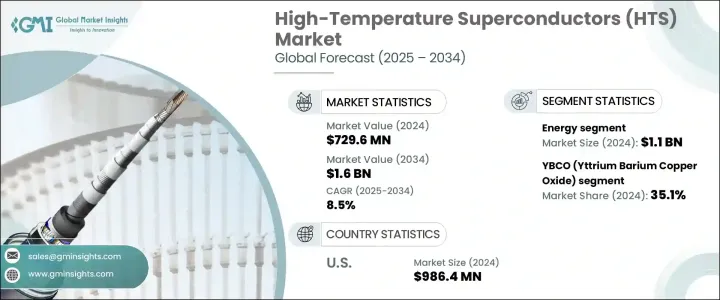

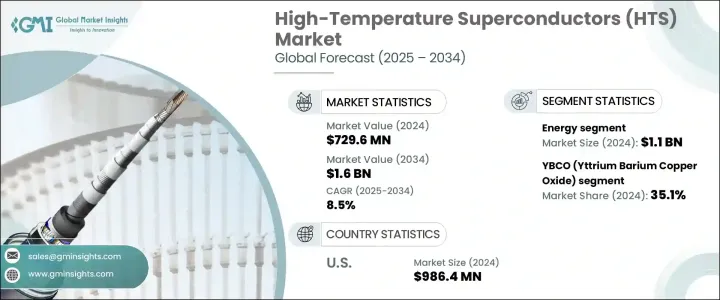

2024年全球高溫超導體市場規模為7.296億美元,預估年複合成長率為8.5%,2034年將達16億美元。高溫超導體(通常簡稱為HTS)是一種先進材料,能夠在遠高於傳統超導體的溫度下實現無阻力導電。與在接近絕對零度的溫度下工作的傳統超導體不同,HTS材料的工作溫度在77開爾文或以上,這使得它們能夠與液態氮冷卻系統相容,既經濟高效又易於管理。這一關鍵特性使HTS成為高能量效應用的理想選擇,包括下一代電力系統、交通運輸和先進的醫學影像技術。

各行各業對增強電氣性能的需求日益成長,這在推動高溫超導材料的應用方面發揮關鍵作用。這些超導體正被整合到現代化能源基礎設施中,特別是用於升級輸電網和最大限度地減少能源損耗。世界各國政府和公用事業公司都高度重視老化系統的改造,而基於高溫超導的解決方案因其高效性以及能夠以更低的運行損耗處理更高功率負載的能力而被視為必不可少。全球對永續能源的追求以及對能夠適應不斷成長的電力消耗和分散式能源的彈性電力基礎設施的需求進一步推動了這些舉措。超導設備在限制故障電流、提高電能品質和最佳化電網性能方面的應用也進一步推動了這一發展勢頭。

| 市場範圍 | |

|---|---|

| 起始年份 | 2024 |

| 預測年份 | 2025-2034 |

| 起始值 | 7.296億美元 |

| 預測值 | 16億美元 |

| 複合年成長率 | 8.5% |

在眾多高溫超導材料中,釔鋇銅氧化物 (YBCO) 繼續佔據市場主導地位。 2024 年,該領域佔據全球市場佔有率的 35.1%,估值達到 11 億美元。 YBCO 因其在近 90 開爾文溫度下的穩定性能而備受青睞,這簡化了冷卻物流,同時提供了卓越的電流密度和耐受強磁場的能力。這些特性使其非常適合用於高功率和以磁鐵為中心的應用。與傳統超導體相比,YBCO 具有更佳的熱管理和運作效率,這使其在商業和實驗部署中得到了廣泛的應用。

預計2034年,第一代高溫超導線市場規模將達7.618億美元,複合年成長率高達11.6%。第一代導線基於BSCCO化合物,得益於諸如「粉末管內法」等成熟的生產技術,已實現商業化應用。該工藝將超導粉末放入銀基管中,並將其製成導線,從而生產出高效且易於規模生產的導體。這些導線在與液態氮相容的溫度下也能高效運行,從而降低了冷卻總成本,使其成為能源系統和科學研究中中試規模和小批量應用的理想選擇。

能源仍是高溫超導材料最大的應用領域,2024 年估值為 11 億美元,預計 2025 年至 2034 年的複合年成長率將達到 12%,佔整個市場的 35.4%。全球電力基礎設施的轉型在很大程度上依賴能夠無損耗傳輸電力的材料。與傳統的銅或鋁電纜相比,採用高溫超導技術的電力線路和組件能夠長距離傳輸更大的電流,尤其是在城市人口密集、新設施物理空間有限的地區。它們的部署可以減少能量損耗並提高系統可靠性,使其成為現代配電網路不可或缺的一部分。

在美國,該市場在2024年的估值達到9.864億美元,預計到2034年將以12.4%的複合年成長率成長。增加聯邦機構、私人實體和研究機構之間的資金投入和合作,對於美國實現電網現代化以及探索國防和清潔能源新技術至關重要。投資正被引導至專注於超導功率裝置的項目,這些裝置能夠提供更高的性能,同時解決系統漏洞。這些投資是旨在加強國家基礎設施和推動能源獨立的更廣泛策略的一部分。

高溫超導市場競爭格局適中,既有成熟企業,也有利基市場創新者。涉足該領域的公司通常擁有垂直整合的營運模式、先進的研發能力以及合作夥伴關係,以保持競爭力。大型企業擁有豐富的製造經驗和基礎設施,而小型企業則透過專業技術和材料開發做出貢獻。持續創新以及產學研政府之間的策略聯盟,對於滿足醫療保健、能源和運輸等領域不斷變化的需求至關重要。預計這種持續的合作將塑造高溫超導技術發展的下一個階段。

目錄

第1章:方法論與範圍

第2章:執行摘要

第3章:行業洞察

- 產業生態系統分析

- 影響價值鏈的因素

- 利潤率分析

- 中斷

- 未來展望

- 製造商

- 經銷商

- 川普政府關稅

- 對貿易的影響

- 貿易量中斷

- 報復措施

- 對產業的影響

- 供應方影響(原料)

- 主要材料價格波動

- 供應鏈結構

- 生產成本影響

- 供應方影響(原料)

- 需求面影響(售價)

- 價格傳導至終端市場

- 市佔率動態

- 消費者反應模式

- 受影響的主要公司

- 策略產業反應

- 供應鏈重組

- 定價和產品策略

- 政策參與

- 展望與未來考慮

- 對貿易的影響

- 貿易統計資料(HS 編碼) 註:以上貿易統計僅提供重點國家。

- 2021-2024年主要出口國

- 2021-2024年主要進口國

- 供應商格局

- 利潤率分析

- 重要新聞和舉措

- 監管格局

- 衝擊力

- 成長動力

- 對節能解決方案的需求不斷增加

- 低溫技術的進步

- 醫療保健領域的應用日益增多

- 聚變能研究投資不斷增加

- 產業陷阱與挑戰

- 製造成本高

- 大規模生產的技術挑戰

- 冷卻系統的複雜性

- 成長動力

- 市場機會

- 成長潛力分析

- 波特的分析

- PESTEL分析

第4章:競爭格局

- 介紹

- 市佔率分析

- 全球製造商市場佔有率

- 各製造商的區域市場佔有率

- 競爭基準測試

- 產品組合比較

- 技術能力比較

- 研發投入對比

- 製造能力比較

- 策略舉措和發展

- 併購

- 夥伴關係與合作

- 產品發布和創新

- 擴張計劃

- 競爭定位矩陣

- 戰略儀表板

第5章:市場估計與預測:依材料類型,2021-2034

- 主要趨勢

- YBCO(釔鋇銅氧化物)

- BSCCO(鉍鍶鈣銅氧化物)

- REBCO(稀土鋇銅氧化物)

- MgB2(二硼化鎂)

- 鐵基超導

- 鎳酸鹽

- 其他

第6章:市場估計與預測:依產品形式,2021-2034

- 主要趨勢

- 第一代(1G)高溫超導導線

- 第二代(2G)HTS磁帶

- 高溫超導塊體材料

- HTS薄膜

- 其他

第7章:市場估計與預測:按應用,2021-2034

- 主要趨勢

- 能源

- 電源線

- 變形金剛

- 電動機和發電機

- 故障電流限制器

- 儲能系統

- 衛生保健

- MRI系統

- 核磁共振設備

- 其他

- 運輸

- 磁浮列車

- 電動飛機

- 船舶推進

- 電子與通訊

- 微波濾波器

- 射頻和微波設備

- 量子運算組件

- 研究與科學儀器

- 高場磁鐵

- 粒子加速器

- 聚變反應器

- 工業應用

- 感應加熱器

- 磁選

- 其他

- 其他

第8章:市場估計與預測:按地區,2021-2034

- 主要趨勢

- 北美洲

- 美國

- 加拿大

- 歐洲

- 英國

- 德國

- 法國

- 義大利

- 西班牙

- 亞太地區

- 中國

- 印度

- 日本

- 韓國

- 澳洲

- 拉丁美洲

- 巴西

- 墨西哥

- 阿根廷

- MEA

- 南非

- 沙烏地阿拉伯

- 阿拉伯聯合大公國

第9章:公司簡介

- American Superconductor

- Bruker

- Fujikura

- High Temperature Superconductors

- IBM

- Japan Superconductor Technology

- Nexans

- SuperOx

- SuperPower

- Theva

The Global High-Temperature Superconductors Market was valued at USD 729.6 million in 2024 and is estimated to grow at a CAGR of 8.5% to reach USD 1.6 billion by 2034. High-temperature superconductors, often referred to as HTS, are advanced materials capable of conducting electricity without resistance at temperatures significantly higher than traditional superconductors. Unlike conventional counterparts that operate near absolute zero, HTS materials function at or above 77 Kelvin, making them compatible with liquid nitrogen cooling systems, which are both cost-effective and easier to manage. This key attribute positions HTS as a favorable option in applications requiring high energy efficiency, including next-generation power systems, transportation, and advanced medical imaging technologies.

Growing demand for enhanced electrical performance across sectors is playing a pivotal role in driving the adoption of HTS materials. These superconductors are being integrated into modern energy infrastructures, particularly for upgrading transmission grids and minimizing energy losses. Governments and utilities worldwide are placing emphasis on revamping aging systems, and HTS-based solutions are being considered essential due to their efficiency and ability to handle higher power loads with lower operational losses. These initiatives are further encouraged by the global push for sustainable energy and the need for resilient power infrastructures that can accommodate rising electricity consumption and distributed energy resources. The use of superconducting devices in limiting fault currents, enhancing power quality, and optimizing grid performance is adding to the momentum.

| Market Scope | |

|---|---|

| Start Year | 2024 |

| Forecast Year | 2025-2034 |

| Start Value | $729.6 Million |

| Forecast Value | $1.6 Billion |

| CAGR | 8.5% |

Among various HTS types, Yttrium Barium Copper Oxide (YBCO) continues to dominate the market. This segment accounted for 35.1% of the global share in 2024 and reached a valuation of USD 1.1 billion. YBCO remains preferred due to its stable performance at nearly 90 Kelvin, which simplifies cooling logistics while providing superior current density and the ability to withstand strong magnetic fields. These features make it suitable for use in high-power and magnet-centric applications. Compared to older superconductors, YBCO delivers better thermal management and operational efficiency, which has led to its wide-scale use in commercial and experimental deployments.

The first-generation HTS wires segment is projected to hit USD 761.8 million by 2034, growing at an impressive CAGR of 11.6%. First-generation wires, based on BSCCO compounds, have achieved commercial availability thanks to mature production techniques like the Powder-In-Tube method. This process involves placing superconducting powder into silver-based tubes and forming them into wires, resulting in conductors that are both effective and easier to produce at scale. These wires function efficiently at temperatures compatible with liquid nitrogen, reducing the overall cost of cooling and making them an attractive option for pilot-scale and low-volume applications in energy systems and scientific research.

Energy remains the largest application segment for HTS materials, with a valuation of USD 1.1 billion in 2024 and expected to grow at a CAGR of 12% from 2025 to 2034, capturing 35.4% of the total market. The transformation of global power infrastructure relies heavily on materials that can transmit electricity without losses. HTS-enabled power lines and components are capable of transmitting higher currents over long distances compared to conventional copper or aluminum cables, particularly in areas with dense urban populations and limited physical space for new installations. Their deployment reduces energy dissipation and enhances system reliability, making them essential for modern electricity distribution networks.

In the United States, the market reached a valuation of USD 986.4 million in 2024 and is set to expand at a CAGR of 12.4% through 2034. Increased funding and collaboration between federal agencies, private entities, and research institutions are central to the country's efforts to modernize its power grid and explore new technologies for defense and clean energy. Investments are being channeled into projects focusing on superconducting power devices that can deliver greater performance while addressing system vulnerabilities. These investments are part of broader strategies aimed at reinforcing national infrastructure and advancing energy independence.

The market landscape for high-temperature superconductors is moderately competitive, with a mix of established corporations and niche innovators. Companies involved in this field often possess vertically integrated operations, advanced research capabilities, and collaborative partnerships to remain competitive. Larger enterprises bring in extensive manufacturing experience and infrastructure, while smaller players contribute through specialized technologies and materials development. Continued innovation, along with strategic alliances between industry, academia, and government, is vital for keeping pace with evolving demands in sectors such as healthcare, energy, and transportation. This ongoing collaboration is expected to shape the next phase of high-temperature superconductivity advancements.

Table of Contents

Chapter 1 Methodology & Scope

- 1.1 Market scope & definitions

- 1.2 Base estimates & calculations

- 1.3 Forecast calculations

- 1.4 Data sources

- 1.4.1 Primary

- 1.4.2 Secondary

- 1.4.2.1 Paid sources

- 1.4.2.2 Public sources

Chapter 2 Executive Summary

- 2.1 Industry synopsis, 2021-2034

Chapter 3 Industry Insights

- 3.1 Industry ecosystem analysis

- 3.1.1 Factor affecting the value chain

- 3.1.2 Profit margin analysis

- 3.1.3 Disruptions

- 3.1.4 Future outlook

- 3.1.5 Manufacturers

- 3.1.6 Distributors

- 3.2 Trump administration tariffs

- 3.2.1 Impact on trade

- 3.2.1.1 Trade volume disruptions

- 3.2.1.2 Retaliatory measures

- 3.2.2 Impact on the industry

- 3.2.2.1 Supply-side impact (raw materials)

- 3.2.2.1.1 Price volatility in key materials

- 3.2.2.1.2 Supply chain structure

- 3.2.2.1.3 Production cost implications

- 3.2.2.1 Supply-side impact (raw materials)

- 3.2.3 Demand-side impact (selling price)

- 3.2.3.1 Price transmission to end markets

- 3.2.3.2 Market share dynamics

- 3.2.3.3 Consumer response patterns

- 3.2.4 Key companies impacted

- 3.2.5 Strategic industry responses

- 3.2.5.1 Supply chain reconfiguration

- 3.2.5.2 Pricing and product strategies

- 3.2.5.3 Policy engagement

- 3.2.6 Outlook and future considerations

- 3.2.1 Impact on trade

- 3.3 Trade statistics (HS code) Note: the above trade statistics will be provided for key countries only.

- 3.3.1 Major exporting countries, 2021-2024 (kilo tons)

- 3.3.2 Major importing countries, 2021-2024 (kilo tons)

- 3.4 Supplier landscape

- 3.5 Profit margin analysis

- 3.6 Key news & initiatives

- 3.7 Regulatory landscape

- 3.8 Impact forces

- 3.8.1 Growth drivers

- 3.8.1.1 Increasing demand for energy-efficient solutions

- 3.8.1.2 Advancements in cryogenic technologies

- 3.8.1.3 Growing applications in healthcare sector

- 3.8.1.4 Rising investments in fusion energy research

- 3.8.2 Industry pitfalls & challenges

- 3.8.2.1 High manufacturing costs

- 3.8.2.2 Technical challenges in large-scale production

- 3.8.2.3 Cooling system complexities

- 3.8.1 Growth drivers

- 3.9 Market opportunities

- 3.10 Growth potential analysis

- 3.11 Porter's analysis

- 3.12 PESTEL analysis

Chapter 4 Competitive Landscape, 2024

- 4.1 Introduction

- 4.2 Market share analysis

- 4.2.1 Global market share by manufacturer

- 4.2.2 Regional market share by manufacturer

- 4.3 Competitive benchmarking

- 4.3.1 Product portfolio comparison

- 4.3.2 Technological capabilities comparison

- 4.3.3 R&D investment comparison

- 4.3.4 Manufacturing capacity comparison

- 4.4 Strategic initiatives & developments

- 4.4.1 Mergers & acquisitions

- 4.4.2 Partnerships & collaborations

- 4.4.3 Product launches & innovations

- 4.4.4 Expansion plans

- 4.5 Competitive positioning matrix

- 4.6 Strategic dashboard

Chapter 5 Market Estimates & Forecast, By Material Type, 2021-2034 (USD Billion) (Kilo Tons)

- 5.1 Key trends

- 5.2 YBCO (Yttrium Barium Copper Oxide)

- 5.3 BSCCO (Bismuth Strontium Calcium Copper Oxide)

- 5.4 REBCO (Rare Earth Barium Copper Oxide)

- 5.5 MgB2 (Magnesium Diboride)

- 5.6 Iron-based superconduct

- 5.7 Nickelates

- 5.8 Others

Chapter 6 Market Estimates & Forecast, By Product Form, 2021-2034 (USD Billion) (Kilo Tons)

- 6.1 Key trends

- 6.2 First-generation (1G) HTS wires

- 6.3 Second-generation (2G) HTS tapes

- 6.4 HTS bulk materials

- 6.5 HTS thin films

- 6.6 Others

Chapter 7 Market Estimates & Forecast, By Application, 2021-2034 (USD Billion) (Kilo Tons)

- 7.1 Key trends

- 7.2 Energy

- 7.2.1 Power cables

- 7.2.2 Transformers

- 7.2.3 Motors & generators

- 7.2.4 Fault current limiters

- 7.2.5 Energy storage systems

- 7.3 Healthcare

- 7.3.1 MRI systems

- 7.3.2 NMR equipment

- 7.3.3 Others

- 7.4 Transportation

- 7.4.1 Maglev trains

- 7.4.2 Electric aircraft

- 7.4.3 Ship propulsion

- 7.5 Electronics & communication

- 7.5.1 Microwave filters

- 7.5.2 RF & microwave devices

- 7.5.3 Quantum computing components

- 7.6 Research & scientific instruments

- 7.6.1 High-field magnets

- 7.6.2 Particle accelerators

- 7.6.3 Fusion reactors

- 7.7 Industrial applications

- 7.7.1 Induction heaters

- 7.7.2 Magnetic separation

- 7.7.3 Others

- 7.8 Others

Chapter 8 Market Estimates & Forecast, By Region, 2021-2034 (USD Billion) (Kilo Tons)

- 8.1 Key trends

- 8.2 North America

- 8.2.1 U.S.

- 8.2.2 Canada

- 8.3 Europe

- 8.3.1 UK

- 8.3.2 Germany

- 8.3.3 France

- 8.3.4 Italy

- 8.3.5 Spain

- 8.4 Asia Pacific

- 8.4.1 China

- 8.4.2 India

- 8.4.3 Japan

- 8.4.4 South Korea

- 8.4.5 Australia

- 8.5 Latin America

- 8.5.1 Brazil

- 8.5.2 Mexico

- 8.5.3 Argentina

- 8.6 MEA

- 8.6.1 South Africa

- 8.6.2 Saudi Arabia

- 8.6.3 UAE

Chapter 9 Company Profiles

- 9.1 American Superconductor

- 9.2 Bruker

- 9.3 Fujikura

- 9.4 High Temperature Superconductors

- 9.5 IBM

- 9.6 Japan Superconductor Technology

- 9.7 Nexans

- 9.8 SuperOx

- 9.9 SuperPower

- 9.10 Theva