|

市場調查報告書

商品編碼

1750481

動物腸道健康市場機會、成長動力、產業趨勢分析及2025-2034年預測Animal Intestinal Health Market Opportunity, Growth Drivers, Industry Trend Analysis, and Forecast 2025 - 2034 |

||||||

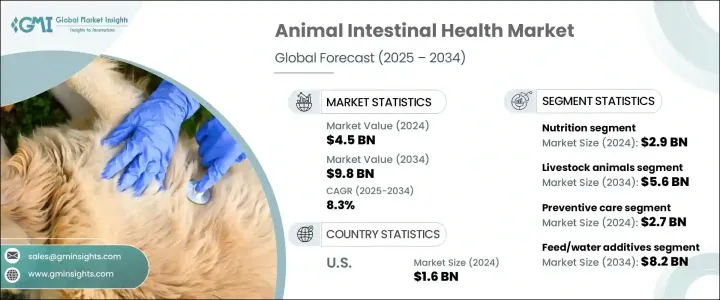

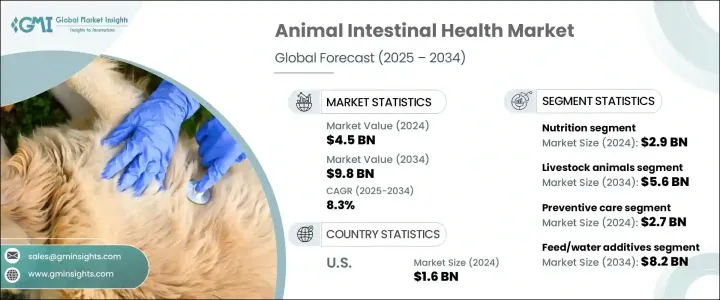

2024年,全球動物腸道健康市場價值45億美元,預計到2034年將以8.3%的複合年成長率成長,達到98億美元,原因是動物胃腸道疾病(包括慢性消化系統疾病和發炎相關問題)的激增。隨著人們對動物健康的日益關注,對預防性照護的需求也在加速成長,尤其是在畜牧業管理方面。維持最佳的腸道健康不僅對預防疾病至關重要,而且對提高飼料效率和動物整體生產力也至關重要。隨著全球肉類、乳製品和蛋類消費量持續成長,尤其是在快速發展的經濟體中,對健康牲畜的需求變得更加緊迫和具有商業重要性。

隨著全球農業實踐逐漸擺脫抗生素依賴,益生菌和益生元等天然替代品正獲得巨大發展。這些營養補充品為維持動物的消化平衡和免疫功能提供了永續的解決方案。市場也反映出人們對整體非治療性畜牧業方法日益成長的興趣。消化健康如今被視為牲畜和伴侶動物經濟效益和生物學性能的核心,它正在推動營養和醫學領域的創新和產品開發。

| 市場範圍 | |

|---|---|

| 起始年份 | 2024 |

| 預測年份 | 2025-2034 |

| 起始值 | 45億美元 |

| 預測值 | 98億美元 |

| 複合年成長率 | 8.3% |

按產品類別分類,2024年營養解決方案佔最大佔有率,創造了29億美元的收入。這一成長源於農民、寵物主人和獸醫對均衡飲食和腸道支持營養素價值的認知不斷提高。預防性方法正變得越來越流行,因為它們減少了對藥物治療的依賴。企業加強了對利害關係人的教育力度,使其了解膳食補充劑的長期益處,鼓勵商業農場和家庭更多地採用腸道健康增強劑。

依動物種類分類,畜牧業是主要細分市場,預計到2034年將創造56億美元的產值。畜牧業包括牛、家禽和豬,它們是全球蛋白質供應不可或缺的一部分。健康的牲畜腸道功能可確保更高的生產力、增強的免疫反應和降低的死亡率,因此腸道健康管理是高效養殖的關鍵環節。隨著消費者對肉類和乳製品的需求持續成長,維護牲畜腸道健康對於維持糧食安全和經濟穩定至關重要。

2024年,美國動物腸道健康市場規模達16億美元,這得益於消費者對寵物健康意識的不斷提升、伴侶動物領養率的激增以及對預防性獸醫護理的日益重視。全美寵物擁有量的穩定成長是推動市場擴張的關鍵因素。越來越多的家庭將寵物視為家庭成員,並在寵物的健康和營養方面投入資金。由於腸道健康對動物的整體福祉和壽命至關重要,寵物主人在選擇腸道支持型飲食、補充劑和功能性產品方面也變得更加積極主動。

市場的主要參與者包括AdvaCarePharma、贏創、Lallemand、碩騰、凱裡集團、Phibro Animal Health、建明、嘉吉、ADM、荷蘭皇家帝斯曼集團、PetAg、安迪蘇、Karyotica Biologicals、PRN Pharmacal和BioChem。這些公司正在投資針對性研發,以開發先進的益生元、合生元和腸道增強酶。許多公司正在透過合作夥伴關係和策略性收購擴大其全球影響力,同時也開展宣傳活動,推廣動物早期採用預防性腸道健康解決方案。

目錄

第1章:方法論與範圍

第2章:執行摘要

第3章:行業洞察

- 產業生態系統分析

- 產業衝擊力

- 成長動力

- 提高對動物腸道微生物組的認知

- 動物保健產品需求不斷成長

- 動物腸道疾病發生率上升

- 產業陷阱與挑戰

- 監管挑戰和可靠性問題

- 寵物主人和飼養者缺乏意識

- 成長動力

- 成長潛力分析

- 監管格局

- 川普政府關稅

- 對貿易的影響

- 貿易量中斷

- 報復措施

- 對產業的影響

- 供應方影響(原料)

- 主要材料價格波動

- 供應鏈重組

- 生產成本影響

- 需求面影響(售價)

- 價格傳導至終端市場

- 市佔率動態

- 消費者反應模式

- 供應方影響(原料)

- 受影響的主要公司

- 策略產業反應

- 供應鏈重組

- 定價和產品策略

- 政策參與

- 展望與未來考慮

- 對貿易的影響

- 波特的分析

- PESTEL分析

第4章:競爭格局

- 介紹

- 公司矩陣分析

- 主要市場參與者的競爭分析

- 競爭定位矩陣

- 策略儀表板

第5章:市場估計與預測:依產品類型,2021 年至 2034 年

- 主要趨勢

- 營養成分

- 益生菌

- 益生元

- 合生元

- 酵素

- 免疫調節劑

- 其他營養

- 製藥

- 抗生素

- 其他藥品

第6章:市場估計與預測:依動物類型,2021 年至 2034 年

- 主要趨勢

- 伴侶動物

- 狗

- 貓

- 馬匹

- 其他伴侶動物

- 牲畜

- 牛

- 豬

- 家禽

- 其他牲畜

第7章:市場估計與預測:按功能,2021 年至 2034 年

- 主要趨勢

- 預防保健

- 疾病治療

第8章:市場估計與預測:依管理模式,2021 年至 2034 年

- 主要趨勢

- 飼料/水添加劑

- 其他給藥方式

第9章:市場估計與預測:按配銷通路,2021 年至 2034 年

- 主要趨勢

- 獸醫院

- 電子商務

- 零售藥局

- 其他分銷管道

第10章:市場估計與預測:按地區,2021 年至 2034 年

- 主要趨勢

- 北美洲

- 美國

- 加拿大

- 歐洲

- 德國

- 英國

- 法國

- 西班牙

- 義大利

- 荷蘭

- 亞太地區

- 中國

- 日本

- 印度

- 澳洲

- 韓國

- 拉丁美洲

- 巴西

- 墨西哥

- 阿根廷

- 中東和非洲

- 南非

- 沙烏地阿拉伯

- 阿拉伯聯合大公國

第 11 章:公司簡介

- Adisseo

- ADM

- AdvaCarePharma

- BioChem

- Cargill

- Evonik

- Karyotica Biologicals

- Kemin

- Kerry Group

- Koninklijke DSM

- Lallemand

- PetAg

- Phibro Animal Health

- PRN Pharmacal

- Zoetis

The Global Animal Intestinal Health Market was valued at USD 4.5 billion in 2024 and is estimated to grow at a CAGR of 8.3% to reach USD 9.8 billion by 2034 due to a surge in gastrointestinal conditions among animals, including chronic digestive disorders and inflammation-related issues. With growing concerns around animal wellness, the demand for preventive care is accelerating, especially in livestock management. Maintaining optimal gut health has become a crucial factor not just for disease prevention but also for improving feed efficiency and overall animal productivity. As meat, dairy, and egg consumption continues to rise globally, particularly in fast-developing economies, demand for healthy livestock has become more urgent and commercially important.

As global agricultural practices shift away from antibiotic-heavy treatments, natural alternatives such as probiotics and prebiotics are gaining substantial momentum. These nutritional supplements offer sustainable solutions for maintaining digestive balance and immune performance in animals. The market also reflects a growing interest in holistic, non-therapeutic approaches to animal husbandry. Digestive health, now viewed as central to the economic and biological performance of livestock and companion animals alike, is driving innovation and product development across nutritional and pharmaceutical segments.

| Market Scope | |

|---|---|

| Start Year | 2024 |

| Forecast Year | 2025-2034 |

| Start Value | $4.5 Billion |

| Forecast Value | $9.8 Billion |

| CAGR | 8.3% |

Based on product category, nutrition-based solutions held the largest share in 2024, generating USD 2.9 billion in revenue. This growth stems from increasing awareness among farmers, pet owners, and veterinarians about the value of balanced diets and gut-supporting nutrients. Preventive approaches are becoming more popular as they reduce the dependency on drug-based treatments. Companies have ramped up efforts to educate stakeholders on the long-term benefits of dietary supplementation, encouraging greater adoption of gut health enhancers in both commercial farms and homes.

Livestock animals represent the leading segment by animal type are projected to generate USD 5.6 billion by 2034. This segment includes cattle, poultry, and swine integral to the global protein supply. Healthy intestinal function in livestock ensures higher productivity, improved immune response, and reduced mortality, making gut health management a key part of efficient farming. As consumer demand for meat and dairy continues to climb, maintaining intestinal well-being in livestock becomes essential to sustaining food security and economic stability.

United States Animal Intestinal Health Market generated USD 1.6 billion in 2024, driven by increasing consumer awareness about pet health, a surge in companion animal adoption, and the growing emphasis on preventive veterinary care. The steady rise in pet ownership across the country is a key factor contributing to the expansion of the market. More households treat pets as family members, spending on their wellness and nutrition. With intestinal health playing a vital role in the overall well-being and longevity of animals, pet owners are becoming more proactive in choosing gut-supportive diets, supplements, and functional products.

Key players in the market include AdvaCarePharma, Evonik, Lallemand, Zoetis, Kerry Group, Phibro Animal Health, Kemin, Cargill, ADM, Koninklijke DSM, PetAg, Adisseo, Karyotica Biologicals, PRN Pharmacal, and BioChem. These companies are investing in targeted R&D for developing advanced prebiotics, synbiotics, and gut-boosting enzymes. Many are expanding their global presence through partnerships and strategic acquisitions, while also launching awareness campaigns to promote early adoption of preventive gut health solutions in animals.

Table of Contents

Chapter 1 Methodology and Scope

- 1.1 Market scope and definitions

- 1.2 Research design

- 1.2.1 Research approach

- 1.2.2 Data collection methods

- 1.3 Base estimates and calculations

- 1.3.1 Base year calculation

- 1.3.2 Key trends for market estimation

- 1.4 Forecast model

- 1.5 Primary research and validation

- 1.5.1 Primary sources

- 1.5.2 Data mining sources

Chapter 2 Executive Summary

- 2.1 Industry 3600 synopsis

Chapter 3 Industry Insights

- 3.1 Industry ecosystem analysis

- 3.2 Industry impact forces

- 3.2.1 Growth drivers

- 3.2.1.1 Increasing awareness of animal gut microbiome

- 3.2.1.2 Growing demand for animal healthcare products

- 3.2.1.3 Rising prevalence of animal intestinal diseases

- 3.2.2 Industry pitfalls and challenges

- 3.2.2.1 Regulatory challenges and reliability concerns

- 3.2.2.2 Lack of awareness among pet owners and farmers

- 3.2.1 Growth drivers

- 3.3 Growth potential analysis

- 3.4 Regulatory landscape

- 3.5 Trump administration tariffs

- 3.5.1 Impact on trade

- 3.5.1.1 Trade volume disruptions

- 3.5.1.2 Retaliatory measures

- 3.5.2 Impact on the Industry

- 3.5.2.1 Supply-side impact (raw materials)

- 3.5.2.1.1 Price volatility in key materials

- 3.5.2.1.2 Supply chain restructuring

- 3.5.2.1.3 Production cost implications

- 3.5.2.2 Demand-side impact (selling price)

- 3.5.2.2.1 Price transmission to end markets

- 3.5.2.2.2 Market share dynamics

- 3.5.2.2.3 Consumer response patterns

- 3.5.2.1 Supply-side impact (raw materials)

- 3.5.3 Key companies impacted

- 3.5.4 Strategic industry responses

- 3.5.4.1 Supply chain reconfiguration

- 3.5.4.2 Pricing and product strategies

- 3.5.4.3 Policy engagement

- 3.5.5 Outlook and future considerations

- 3.5.1 Impact on trade

- 3.6 Porter's analysis

- 3.7 PESTEL analysis

Chapter 4 Competitive Landscape, 2024

- 4.1 Introduction

- 4.2 Company matrix analysis

- 4.3 Competitive analysis of major market players

- 4.4 Competitive positioning matrix

- 4.5 Strategy dashboard

Chapter 5 Market Estimates and Forecast, By Product Type, 2021 – 2034 ($ Mn)

- 5.1 Key trends

- 5.2 Nutritions

- 5.2.1 Probiotics

- 5.2.2 Prebiotics

- 5.2.3 Synbiotics

- 5.2.4 Enzymes

- 5.2.5 Immunomodulators

- 5.2.6 Other nutrition

- 5.3 Pharmaceuticals

- 5.3.1 Antibiotics

- 5.3.2 Other pharmaceuticals

Chapter 6 Market Estimates and Forecast, By Animal Type, 2021 – 2034 ($ Mn)

- 6.1 Key trends

- 6.2 Companion animals

- 6.2.1 Dogs

- 6.2.2 Cats

- 6.2.3 Horses

- 6.2.4 Other companion animals

- 6.3 Livestock animals

- 6.3.1 Cattle

- 6.3.2 Swine

- 6.3.3 Poultry

- 6.3.4 Other livestock animals

Chapter 7 Market Estimates and Forecast, By Function, 2021 – 2034 ($ Mn)

- 7.1 Key trends

- 7.2 Preventive care

- 7.3 Disease treatment

Chapter 8 Market Estimates and Forecast, By Mode of Administration, 2021 – 2034 ($ Mn)

- 8.1 Key trends

- 8.2 Feed/water additives

- 8.3 Other modes of administration

Chapter 9 Market Estimates and Forecast, By Distribution Channel, 2021 – 2034 ($ Mn)

- 9.1 Key trends

- 9.2 Veterinary hospitals

- 9.3 E-commerce

- 9.4 Retail pharmacies

- 9.5 Other distribution channels

Chapter 10 Market Estimates and Forecast, By Region, 2021 – 2034 ($ Mn)

- 10.1 Key trends

- 10.2 North America

- 10.2.1 U.S.

- 10.2.2 Canada

- 10.3 Europe

- 10.3.1 Germany

- 10.3.2 UK

- 10.3.3 France

- 10.3.4 Spain

- 10.3.5 Italy

- 10.3.6 Netherlands

- 10.4 Asia Pacific

- 10.4.1 China

- 10.4.2 Japan

- 10.4.3 India

- 10.4.4 Australia

- 10.4.5 South Korea

- 10.5 Latin America

- 10.5.1 Brazil

- 10.5.2 Mexico

- 10.5.3 Argentina

- 10.6 Middle East and Africa

- 10.6.1 South Africa

- 10.6.2 Saudi Arabia

- 10.6.3 UAE

Chapter 11 Company Profiles

- 11.1 Adisseo

- 11.2 ADM

- 11.3 AdvaCarePharma

- 11.4 BioChem

- 11.5 Cargill

- 11.6 Evonik

- 11.7 Karyotica Biologicals

- 11.8 Kemin

- 11.9 Kerry Group

- 11.10 Koninklijke DSM

- 11.11 Lallemand

- 11.12 PetAg

- 11.13 Phibro Animal Health

- 11.14 PRN Pharmacal

- 11.15 Zoetis