|

市場調查報告書

商品編碼

1750476

影像導引治療系統市場機會、成長動力、產業趨勢分析及 2025 - 2034 年預測Image-guided Therapy Systems Market Opportunity, Growth Drivers, Industry Trend Analysis, and Forecast 2025 - 2034 |

||||||

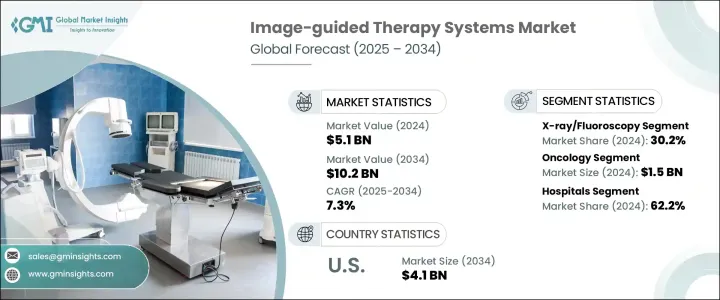

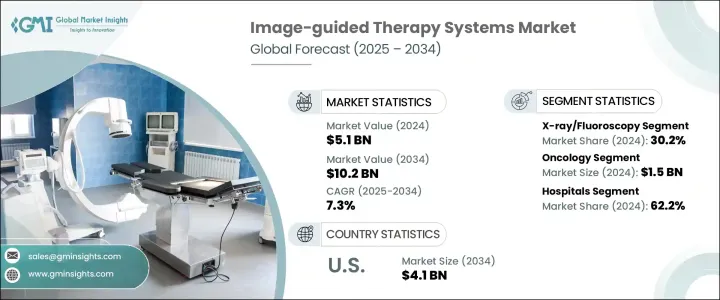

2024年,全球影像導引治療系統市場規模達51億美元,預計2034年將以7.3%的複合年成長率成長,達到102億美元,這主要得益於神經系統疾病、心血管疾病和癌症等慢性疾病的發生率不斷上升。對精準醫療的日益依賴,加上對微創手術的大力推動,顯著提升了對即時影像導引系統的需求。人工智慧成像、機器人輔助導航和3D視覺化等醫學進步正在透過提高精準度、縮短手術時間並改善臨床療效,徹底改變外科手術。

由於微創治療具有減輕疼痛、加速恢復時間和縮短住院時間等優勢,患者和醫療服務提供者都越來越青睞這種治療方法。人工智慧和機器學習透過簡化診斷、改進影像解讀和自動化程式導航,最佳化了影像引導治療的效用。隨著全球醫療保健系統逐漸轉向以患者為中心和基於價值的醫療服務,影像引導解決方案正成為手術規劃和執行的重要組成部分。混合手術室的採用正在加速先進影像工具的整合,使其能夠直接融入手術室,實現術中無縫銜接,從而增強決策能力並降低併發症風險。

| 市場範圍 | |

|---|---|

| 起始年份 | 2024 |

| 預測年份 | 2025-2034 |

| 起始值 | 51億美元 |

| 預測值 | 102億美元 |

| 複合年成長率 | 7.3% |

在產品類別中,X光和透視引導系統在2024年的市佔率為30.2%,反映心臟病學、骨科和介入放射學等領域的強勁需求。能夠以最小的創傷進行即時影像引導干預是其在醫院和門診廣泛應用的關鍵因素。這些系統改進的成像功能使醫生能夠以更高的精度和更低的風險執行複雜的手術,這有助於該細分市場的持續成長。

2024年,腫瘤學領域產值達15億美元。隨著全球癌症病例持續上升,臨床醫生正轉向影像導引系統,尋求更具針對性的治療,包括放射治療、活體組織切片和消融。 MRI、PET、CT和超音波等影像工具的即時整合極大地增強了術中引導,從而能夠更精準地定位腫瘤、縮小切口,並實現個性化治療,避免損傷周圍組織。這加速了這些系統在近距離放射治療、立體定位放射治療(SBRT)和射頻消融等手術中的應用。

2024年,美國影像導引治療系統市場規模達21億美元,預計2034年將翻倍。美國大力推行以結果為導向的醫療保健,鼓勵採用兼具臨床和成本效益的技術。日益成長的老年人口面臨慢性疾病的困擾,也擴大了潛在的市場。醫院和門診中心整合了影像導引治療系統,以提高手術精準度並最大程度縮短病患復原時間。向基於價值的報銷模式的轉變激勵醫療機構投資於能夠帶來更好療效、更少併發症的設備。

為了增強影響力,史賽克、美敦力、西門子醫療、佳能醫療系統和直覺外科等領先企業正在投資人工智慧軟體、雲端整合影像平台和先進的手術機器人。這些公司正在與醫院建立策略夥伴關係,收購專業新創公司,並擴大研發力度以支持下一代產品線。他們專注於針對特定市場的設備客製化和術後分析工具,以提升手術效果並增強醫療服務提供者的品牌忠誠度。

目錄

第1章:方法論與範圍

第2章:執行摘要

第3章:行業洞察

- 產業生態系統分析

- 產業衝擊力

- 成長動力

- 慢性病盛行率上升

- 成像和導航技術的進步

- 微創手術的需求不斷成長

- 政府支持政策和私人投資

- 產業陷阱與挑戰

- 資本和維護成本高

- 新興市場准入受限

- 成長動力

- 成長潛力分析

- 川普政府關稅

- 對貿易的影響

- 貿易量中斷

- 報復措施

- 對產業的影響

- 供給側影響(原料)

- 主要材料價格波動

- 供應鏈重組

- 生產成本影響

- 需求面影響(售價)

- 價格傳導至終端市場

- 市佔率動態

- 消費者反應模式

- 供給側影響(原料)

- 受影響的主要公司

- 策略產業反應

- 供應鏈重組

- 定價和產品策略

- 政策參與

- 展望與未來考慮川普政府關稅

- 對貿易的影響

- 技術格局

- 未來市場趨勢

- 監管格局

- 差距分析

- 專利分析

- 波特的分析

- PESTEL分析

第4章:競爭格局

- 介紹

- 公司市佔率分析

- 公司矩陣分析

- 主要市場參與者的競爭分析

- 競爭定位矩陣

- 策略儀表板

第5章:市場估計與預測:依產品類型,2021 - 2034 年

- 主要趨勢

- X光/螢光透視

- 超音波

- 電腦斷層掃描

- 磁振造影

- 正子斷層掃描

- 其他產品類型

第6章:市場估計與預測:按應用,2021 - 2034 年

- 主要趨勢

- 心臟手術

- 神經外科

- 骨科手術

- 胃腸病學

- 泌尿科

- 腫瘤學

- 耳鼻喉手術

- 其他應用

第7章:市場估計與預測:依最終用途,2021 - 2034 年

- 主要趨勢

- 醫院

- 門診手術中心

- 專科診所

- 研究和學術機構

第8章:市場估計與預測:按地區,2021 - 2034 年

- 主要趨勢

- 北美洲

- 美國

- 加拿大

- 歐洲

- 德國

- 英國

- 法國

- 義大利

- 西班牙

- 荷蘭

- 亞太地區

- 日本

- 中國

- 印度

- 澳洲

- 韓國

- 拉丁美洲

- 墨西哥

- 巴西

- 阿根廷

- 中東和非洲

- 南非

- 沙烏地阿拉伯

- 阿拉伯聯合大公國

第9章:公司簡介

- Accuray

- Analogic

- Brainlab

- Canon Medical Systems

- Fujifilm Holdings

- GE HealthCare

- Intuitive Surgical

- Karl Storz

- Koninklijke Philips

- Medtronic

- Olympus

- Siemens Healthineers

- Smith & Nephew

- Stryker

- Zimmer Biomet

The Global Image-guided Therapy Systems Market was valued at USD 5.1 billion in 2024 and is estimated to grow at a CAGR of 7.3% to reach USD 10.2 billion by 2034, driven by the rising prevalence of chronic illnesses, including neurological disorders, cardiovascular conditions, and cancer. Increasing reliance on precision medicine, coupled with a strong push for minimally invasive procedures, has significantly boosted demand for systems that allow real-time, image-based guidance. Medical advancements such as AI-enabled imaging, robotic-assisted navigation, and 3D visualization are transforming surgery by enhancing precision, shortening procedure durations, and improving clinical outcomes.

Patients and providers alike are increasingly favoring less invasive approaches due to benefits like reduced pain, quicker recovery times, and shorter hospital stays. Artificial intelligence and machine learning optimize the utility of image-guided therapy by streamlining diagnostics, improving imaging interpretation, and automating procedural navigation. As global healthcare systems move toward patient-centered and value-based care, image-guided solutions are becoming an essential part of surgical planning and execution. The adoption of hybrid operating rooms is accelerating and integrating advanced imaging tools directly into the surgical suite for seamless intraoperative use, which enhances decision-making and lowers the risk of complications.

| Market Scope | |

|---|---|

| Start Year | 2024 |

| Forecast Year | 2025-2034 |

| Start Value | $5.1 Billion |

| Forecast Value | $10.2 Billion |

| CAGR | 7.3% |

Among product categories, X-ray and fluoroscopy-guided systems accounted for a 30.2% share in 2024, reflecting strong demand in fields such as cardiology, orthopedics, and interventional radiology. The ability to perform real-time image-guided interventions with minimal trauma is a key factor behind their widespread adoption across hospitals and ambulatory settings. Improved imaging functionality in these systems enables physicians to carry out complex procedures with higher accuracy and reduced risk, which is contributing to ongoing segment growth.

The oncology segment generated USD 1.5 billion in 2024. As cancer cases continue to rise globally, clinicians are turning to image-guided systems for more targeted therapies, including radiation, biopsies, and ablations. Real-time integration of imaging tools like MRI, PET, CT, and ultrasound has greatly enhanced intra-procedural guidance, allowing for better tumor localization, smaller incisions, and personalized treatments that spare surrounding tissue. This has accelerated the use of these systems in procedures such as brachytherapy, SBRT, and RF ablation.

U.S. Image-guided Therapy Systems Market was valued at USD 2.1 billion in 2024 and is projected to double by 2034. The country's push for outcome-driven healthcare is encouraging the adoption of technologies that deliver both clinical and cost efficiency. A growing elderly population facing chronic illnesses is also expanding the addressable market. Hospitals and outpatient centers integrate image-guided therapy systems to improve procedural precision and minimize patient recovery time. The shift toward value-based reimbursement models incentivizes providers to invest in equipment that supports better outcomes with fewer complications.

To strengthen their presence, leading firms like Stryker, Medtronic, Siemens Healthineers, Canon Medical Systems, and Intuitive Surgical are investing in AI-powered software, cloud-integrated imaging platforms, and advanced surgical robotics. These companies are forming strategic partnerships with hospitals, acquiring specialized startups, and expanding R&D efforts to support next-generation product pipelines. They focus on market-specific device customization and post-operative analytics tools to enhance procedural outcomes and extend brand loyalty among healthcare providers.

Table of Contents

Chapter 1 Methodology and Scope

- 1.1 Market scope and definitions

- 1.2 Research design

- 1.2.1 Research approach

- 1.2.2 Data collection methods

- 1.3 Base estimates and calculations

- 1.3.1 Base year calculation

- 1.3.2 Key trends for market estimation

- 1.4 Forecast model

- 1.5 Primary research and validation

- 1.5.1 Primary sources

- 1.5.2 Data mining sources

Chapter 2 Executive Summary

- 2.1 Industry 3600 synopsis

Chapter 3 Industry Insights

- 3.1 Industry ecosystem analysis

- 3.2 Industry impact forces

- 3.2.1 Growth drivers

- 3.2.1.1 Rising prevalence of chronic diseases

- 3.2.1.2 Advancements in imaging and navigation technologies

- 3.2.1.3 Growing demand for minimally invasive surgeries

- 3.2.1.4 Supportive government policies and private investments

- 3.2.2 Industry pitfalls and challenges

- 3.2.2.1 High capital and maintenance costs

- 3.2.2.2 Limited access in emerging markets

- 3.2.1 Growth drivers

- 3.3 Growth potential analysis

- 3.4 Trump administration tariffs

- 3.4.1 Impact on trade

- 3.4.1.1 Trade volume disruptions

- 3.4.1.2 Retaliatory measures

- 3.4.2 Impact on the Industry

- 3.4.2.1 Supply-side impact (raw materials)

- 3.4.2.1.1 Price volatility in key materials

- 3.4.2.1.2 Supply chain restructuring

- 3.4.2.1.3 Production cost implications

- 3.4.2.2 Demand-side impact (selling price)

- 3.4.2.2.1 Price transmission to end markets

- 3.4.2.2.2 Market share dynamics

- 3.4.2.2.3 Consumer response patterns

- 3.4.2.1 Supply-side impact (raw materials)

- 3.4.3 Key companies impacted

- 3.4.4 Strategic industry responses

- 3.4.4.1 Supply chain reconfiguration

- 3.4.4.2 Pricing and product strategies

- 3.4.4.3 Policy engagement

- 3.4.5 Outlook and future considerationsTrump administration tariffs

- 3.4.1 Impact on trade

- 3.5 Technology landscape

- 3.6 Future market trends

- 3.7 Regulatory landscape

- 3.8 Gap analysis

- 3.9 Patent analysis

- 3.10 Porter's analysis

- 3.11 PESTEL analysis

Chapter 4 Competitive Landscape, 2024

- 4.1 Introduction

- 4.2 Company market share analysis

- 4.3 Company matrix analysis

- 4.4 Competitive analysis of major market players

- 4.5 Competitive positioning matrix

- 4.6 Strategy dashboard

Chapter 5 Market Estimates and Forecast, By Product Type, 2021 - 2034 ($ Mn)

- 5.1 Key trends

- 5.2 X-ray/fluoroscopy

- 5.3 Ultrasound

- 5.4 Computed tomography

- 5.5 Magnetic resonance imaging

- 5.6 Positron emission tomography

- 5.7 Other product types

Chapter 6 Market Estimates and Forecast, By Application, 2021 - 2034 ($ Mn)

- 6.1 Key trends

- 6.2 Cardiac surgery

- 6.3 Neurosurgery

- 6.4 Orthopedic surgery

- 6.5 Gastroenterology

- 6.6 Urology

- 6.7 Oncology

- 6.8 ENT surgery

- 6.9 Other applications

Chapter 7 Market Estimates and Forecast, By End Use, 2021 - 2034 ($ Mn)

- 7.1 Key trends

- 7.2 Hospitals

- 7.3 Ambulatory surgical centers

- 7.4 Specialty clinics

- 7.5 Research and academic institutions

Chapter 8 Market Estimates and Forecast, By Region, 2021 - 2034 ($ Mn)

- 8.1 Key trends

- 8.2 North America

- 8.2.1 U.S.

- 8.2.2 Canada

- 8.3 Europe

- 8.3.1 Germany

- 8.3.2 UK

- 8.3.3 France

- 8.3.4 Italy

- 8.3.5 Spain

- 8.3.6 Netherlands

- 8.4 Asia Pacific

- 8.4.1 Japan

- 8.4.2 China

- 8.4.3 India

- 8.4.4 Australia

- 8.4.5 South Korea

- 8.5 Latin America

- 8.5.1 Mexico

- 8.5.2 Brazil

- 8.5.3 Argentina

- 8.6 Middle East and Africa

- 8.6.1 South Africa

- 8.6.2 Saudi Arabia

- 8.6.3 UAE

Chapter 9 Company Profiles

- 9.1 Accuray

- 9.2 Analogic

- 9.3 Brainlab

- 9.4 Canon Medical Systems

- 9.5 Fujifilm Holdings

- 9.6 GE HealthCare

- 9.7 Intuitive Surgical

- 9.8 Karl Storz

- 9.9 Koninklijke Philips

- 9.10 Medtronic

- 9.11 Olympus

- 9.12 Siemens Healthineers

- 9.13 Smith & Nephew

- 9.14 Stryker

- 9.15 Zimmer Biomet