|

市場調查報告書

商品編碼

1750473

寵物血壓監測設備市場機會、成長動力、產業趨勢分析及 2025 - 2034 年預測Pet Blood Pressure Monitoring Devices Market Opportunity, Growth Drivers, Industry Trend Analysis, and Forecast 2025 - 2034 |

||||||

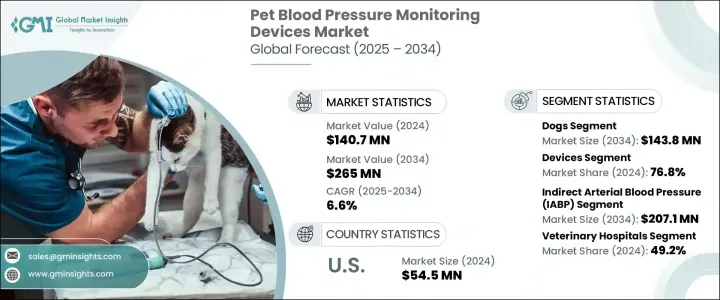

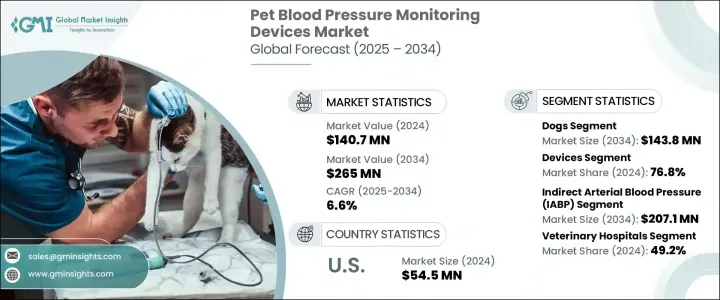

2024年,全球寵物血壓監測設備市場規模達1.407億美元,預計2034年將以6.6%的複合年成長率成長,達到2.65億美元。推動該市場成長的因素包括寵物擁有量的增加、寵物高血壓發病率的上升以及動物預防保健的興起。此外,寵物腎臟病、糖尿病、肥胖症和心臟病等慢性疾病的發生率不斷上升,也催生了持續監測的需求。這些設備在寵物高血壓、心血管疾病和腎衰竭等疾病的早期發現和持續管理中發揮關鍵作用。多參數監測儀尤其有價值,因為它們可以同時測量各種生命徵象,提供全面的診斷,幫助獸醫更全面地了解動物的健康狀況。

另一方面,血壓監測設備專注於追蹤血壓水平,這對於診斷高血壓和預防器官損傷等更嚴重的併發症至關重要。這些工具如今在獸醫診所中很常見,及時且準確的診斷可以顯著改善寵物的治療效果。隨著寵物擴大出現與人類相似的慢性健康狀況,對這些精密監測設備的需求持續成長,以改善疾病的預防性護理和長期管理。

| 市場範圍 | |

|---|---|

| 起始年份 | 2024 |

| 預測年份 | 2025-2034 |

| 起始值 | 1.407億美元 |

| 預測值 | 2.65億美元 |

| 複合年成長率 | 6.6% |

市場按動物類型細分,其中犬類佔據主導地位,佔據市場收入的最大佔有率。 2024年,犬類市場收入為7,730萬美元,預計到2034年將達到1.438億美元,複合年成長率為6.5%。犬類系統性高血壓的高發生率推動了對早期診斷和持續監測的需求。改善伴侶動物慢性疾病管理的技術進步也推動了這一趨勢。寵物主人對高血壓症狀和風險的認知不斷提高,進一步鼓勵了他們採取積極主動的預防性護理。

就產品類型而言,市場分為設備和耗材兩類。設備細分市場在2024年佔據76.8%的市場佔有率,預計到2034年將達到2.092億美元,複合年成長率為6.9%。此細分市場包括多參數和血壓監測設備。人們對綜合診斷工具的日益青睞,使得獸醫專業人士和寵物主人青睞多參數監測儀,因為它們非侵入性、準確,並能快速讀取血壓。隨著高血壓和慢性病在老年寵物中越來越常見,對這些先進設備的需求也持續成長,使其成為管理寵物心血管和腎臟疾病不可或缺的一部分。

2024年,美國寵物血壓監測設備市場規模達5,450萬美元,這得益於寵物擁有率的不斷上升以及人們對動物保健的日益關注。獸醫支出的成長推動了先進醫療技術的採用,進一步促進了市場的發展。此外,對使用者友善、高效的設備的需求,旨在提高慢性病的治療效果,也加速了這個細分市場的成長。

全球寵物血壓監測設備市場的領先公司包括 KeeboVet 獸醫超音波設備、AD Instruments、GF Health Products、Midmark 和 SunTech Medical。這些公司正在實施產品創新、策略合作和提升客戶服務等策略,以擴大市場佔有率。其重點在於開發更精準、更便利、更有效率的監測設備,以滿足日益成長的寵物慢性病有效管理需求。透過改進技術並與獸醫診所和醫院建立合作夥伴關係,這些公司正在鞏固其在日益成長的寵物醫療保健市場中的地位。

目錄

第1章:方法論與範圍

第2章:執行摘要

第3章:行業洞察

- 產業生態系統分析

- 產業衝擊力

- 成長動力

- 寵物擁有率不斷提高

- 寵物高血壓盛行率上升

- 轉向預防性獸醫護理

- 非侵入性監測的技術進步

- 產業陷阱與挑戰

- 缺乏報銷政策

- 成長動力

- 成長潛力分析

- 監管格局

- 川普政府關稅

- 對貿易的影響

- 貿易量中斷

- 報復措施

- 對產業的影響

- 供應方影響(原料)

- 主要材料價格波動

- 供應鏈重組

- 生產成本影響

- 需求面影響(售價)

- 價格傳導至終端市場

- 市佔率動態

- 消費者反應模式

- 供應方影響(原料)

- 受影響的主要公司

- 策略產業反應

- 供應鏈重組

- 定價和產品策略

- 政策參與

- 展望與未來考慮

- 對貿易的影響

- 未來趨勢

- 波特的分析

- PESTEL分析

第4章:競爭格局

- 介紹

- 公司矩陣分析

- 主要市場參與者的競爭分析

- 競爭定位矩陣

- 策略儀表板

第5章:市場估計與預測:依動物類型 2021 – 2034

- 主要趨勢

- 狗

- 貓

- 其他動物類型

第6章:市場估計與預測:按產品,2021 年至 2034 年

- 主要趨勢

- 裝置

- 類型

- 多參數監視器

- 血壓監測儀

- 情態

- 桌上型

- 便攜的

- 類型

- 耗材

第7章:市場估計與預測:按監測技術,2021 年至 2034 年

- 主要趨勢

- 直接動脈血壓(DABP)

- 間接動脈血壓(IABP)

第8章:市場估計與預測:依最終用途,2021 年至 2034 年

- 主要趨勢

- 獸醫院

- 獸醫診所

- 其他最終用途

第9章:市場估計與預測:按地區,2021 年至 2034 年

- 主要趨勢

- 北美洲

- 美國

- 加拿大

- 歐洲

- 德國

- 英國

- 法國

- 西班牙

- 義大利

- 荷蘭

- 亞太地區

- 中國

- 印度

- 日本

- 澳洲

- 韓國

- 拉丁美洲

- 巴西

- 墨西哥

- 阿根廷

- 中東和非洲

- 南非

- 沙烏地阿拉伯

- 阿拉伯聯合大公國

第10章:公司簡介

- AD Instruments

- BerryMedical

- Burtons Medical Equipment

- GF Health Products

- KeeboVet Veterinary Ultrasound Equipment

- Kent Scientific Corporation

- Med-Linket

- Midmark

- Shenzhen Mindray Animal Medical Technology

- New Gen Medical Systems

- Panlab

- Ramsey Medical

- Stoelting

- SunTech Medical

- Tootoo Meditech

- Vetland Medical

The Global Pet Blood Pressure Monitoring Devices Market was valued at USD 140.7 million in 2024 and is estimated to grow at a CAGR of 6.6% to reach USD 265 million by 2034 driven by several factors, including the rise in pet ownership, the increasing occurrence of pet hypertension, and a shift toward preventive care for animals. Additionally, the growing prevalence of chronic health conditions such as kidney disease, diabetes, obesity, and heart issues in pets is creating a demand for continuous monitoring. These devices play a pivotal role in the early detection and ongoing management of conditions like hypertension, cardiovascular diseases, and kidney failure in pets. Multi-parameter monitors are especially valuable as they provide comprehensive diagnostics by measuring various vital signs simultaneously, helping veterinarians get a more holistic view of an animal's health.

Blood pressure monitoring devices, on the other hand, focus specifically on tracking blood pressure levels, which is crucial for diagnosing hypertension and preventing more severe complications such as organ damage. These tools are now common in veterinary practices, where timely and accurate diagnosis can significantly improve the treatment outcomes for pets. As pets increasingly experience chronic health conditions similar to humans, the demand for these sophisticated monitoring devices continues to rise, improving both preventative care and long-term management of illnesses.

| Market Scope | |

|---|---|

| Start Year | 2024 |

| Forecast Year | 2025-2034 |

| Start Value | $140.7 Million |

| Forecast Value | $265 Million |

| CAGR | 6.6% |

The market is segmented based on animal type, with dogs being the dominant segment, accounting for the largest share of market revenue. In 2024, the dog segment generated USD 77.3 million, and by 2034, it is expected to reach USD 143.8 million at a CAGR of 6.5%. The high prevalence of systemic hypertension in dogs drives the demand for early diagnosis and consistent monitoring. This trend is also supported by technological advancements that improve the management of chronic diseases among companion animals. Increased awareness of hypertension symptoms and risks among pet owners is further encouraging proactive, preventive care.

In terms of product type, the market is divided into devices and consumables. The devices segment accounted for 76.8% share in 2024 and is projected to reach USD 209.2 million by 2034, growing at a CAGR of 6.9%. This segment includes multi-parameter and blood pressure monitoring devices. The growing preference for comprehensive diagnostic tools has led veterinary professionals and pet owners to favor multi-parameter monitors, which are non-invasive, accurate, and provide quick blood pressure readings. As hypertension and chronic conditions become more common in aging pets, the demand for these advanced devices continues to rise, making them integral to managing cardiovascular and renal diseases in pets.

United States Pet Blood Pressure Monitoring Devices Market was valued at USD 54.5 million in 2024, attributed to the increasing pet ownership rates and a growing focus on animal healthcare. The rise in veterinary expenditures has fueled the adoption of advanced medical technologies, further boosting the market. Additionally, the demand for user-friendly, efficient devices to enhance treatment outcomes for chronic diseases is accelerating the growth of this market segment.

Leading companies in the Global Pet Blood Pressure Monitoring Devices Market include KeeboVet Veterinary Ultrasound Equipment, AD Instruments, GF Health Products, Midmark, and SunTech Medical. These companies are implementing strategies such as product innovation, strategic collaborations, and enhancing customer service to expand their market presence. The focus is on developing more accurate, user-friendly, and efficient monitoring devices, which cater to the increasing demand for effective chronic disease management in pets. By improving technology and fostering partnerships with veterinary clinics and hospitals, these companies are strengthening their positions in the growing market for pet healthcare.

Table of Contents

Chapter 1 Methodology and Scope

- 1.1 Market scope and definition

- 1.2 Research design

- 1.2.1 Research approach

- 1.2.2 Data collection methods

- 1.3 Base estimates and calculations

- 1.3.1 Base year calculation

- 1.3.2 Key trends for market estimation

- 1.4 Forecast model

- 1.5 Primary research and validation

- 1.5.1 Primary sources

- 1.5.2 Data mining sources

Chapter 2 Executive Summary

- 2.1 Industry 360° synopsis

Chapter 3 Industry Insights

- 3.1 Industry ecosystem analysis

- 3.2 Industry impact forces

- 3.2.1 Growth drivers

- 3.2.1.1 Increasing pet ownership rate

- 3.2.1.2 Rising prevalence of hypertension in pets

- 3.2.1.3 Shift towards preventive veterinary care

- 3.2.1.4 Technological advancements in non-invasive monitoring

- 3.2.2 Industry pitfalls and challenges

- 3.2.2.1 Lack of reimbursement policies

- 3.2.1 Growth drivers

- 3.3 Growth potential analysis

- 3.4 Regulatory landscape

- 3.5 Trump administration tariffs

- 3.5.1 Impact on trade

- 3.5.1.1 Trade volume disruptions

- 3.5.1.2 Retaliatory measures

- 3.5.2 Impact on the Industry

- 3.5.2.1 Supply-side impact (raw materials)

- 3.5.2.1.1 Price volatility in key materials

- 3.5.2.1.2 Supply chain restructuring

- 3.5.2.1.3 Production cost implications

- 3.5.2.2 Demand-side impact (selling price)

- 3.5.2.2.1 Price transmission to end markets

- 3.5.2.2.2 Market share dynamics

- 3.5.2.2.3 Consumer response patterns

- 3.5.2.1 Supply-side impact (raw materials)

- 3.5.3 Key companies impacted

- 3.5.4 Strategic industry responses

- 3.5.4.1 Supply chain reconfiguration

- 3.5.4.2 Pricing and product strategies

- 3.5.4.3 Policy engagement

- 3.5.5 Outlook and future considerations

- 3.5.1 Impact on trade

- 3.6 Future trends

- 3.7 Porter's analysis

- 3.8 PESTEL analysis

Chapter 4 Competitive Landscape, 2024

- 4.1 Introduction

- 4.2 Company matrix analysis

- 4.3 Competitive analysis of major market players

- 4.4 Competitive positioning matrix

- 4.5 Strategy dashboard

Chapter 5 Market Estimates and Forecast, By Animal Type 2021 – 2034 ($ Mn)

- 5.1 Key trends

- 5.2 Dogs

- 5.3 Cats

- 5.4 Other animal types

Chapter 6 Market Estimates and Forecast, By Product, 2021 – 2034 ($ Mn)

- 6.1 Key trends

- 6.2 Devices

- 6.2.1 Type

- 6.2.1.1 Multi parameter monitors

- 6.2.1.2 Blood pressure monitors

- 6.2.2 Modality

- 6.2.2.1 Benchtop

- 6.2.2.2 Portable

- 6.2.1 Type

- 6.3 Consumables

Chapter 7 Market Estimates and Forecast, By Monitoring Technique, 2021 – 2034 ($ Mn)

- 7.1 Key trends

- 7.2 Direct arterial blood pressure (DABP)

- 7.3 Indirect arterial blood pressure (IABP)

Chapter 8 Market Estimates and Forecast, By End Use, 2021 – 2034 ($ Mn)

- 8.1 Key trends

- 8.2 Veterinary hospital

- 8.3 Veterinary clinics

- 8.4 Other end use

Chapter 9 Market Estimates and Forecast, By Region, 2021 – 2034 ($ Mn)

- 9.1 Key trends

- 9.2 North America

- 9.2.1 U.S.

- 9.2.2 Canada

- 9.3 Europe

- 9.3.1 Germany

- 9.3.2 UK

- 9.3.3 France

- 9.3.4 Spain

- 9.3.5 Italy

- 9.3.6 Netherlands

- 9.4 Asia Pacific

- 9.4.1 China

- 9.4.2 India

- 9.4.3 Japan

- 9.4.4 Australia

- 9.4.5 South Korea

- 9.5 Latin America

- 9.5.1 Brazil

- 9.5.2 Mexico

- 9.5.3 Argentina

- 9.6 Middle East and Africa

- 9.6.1 South Africa

- 9.6.2 Saudi Arabia

- 9.6.3 UAE

Chapter 10 Company Profiles

- 10.1 AD Instruments

- 10.2 BerryMedical

- 10.3 Burtons Medical Equipment

- 10.4 GF Health Products

- 10.5 KeeboVet Veterinary Ultrasound Equipment

- 10.6 Kent Scientific Corporation

- 10.7 Med-Linket

- 10.8 Midmark

- 10.9 Shenzhen Mindray Animal Medical Technology

- 10.10 New Gen Medical Systems

- 10.11 Panlab

- 10.12 Ramsey Medical

- 10.13 Stoelting

- 10.14 SunTech Medical

- 10.15 Tootoo Meditech

- 10.16 Vetland Medical