|

市場調查報告書

商品編碼

1750470

飛機電線電纜市場機會、成長動力、產業趨勢分析及2025-2034年預測Aircraft Wire and Cable Market Opportunity, Growth Drivers, Industry Trend Analysis, and Forecast 2025 - 2034 |

||||||

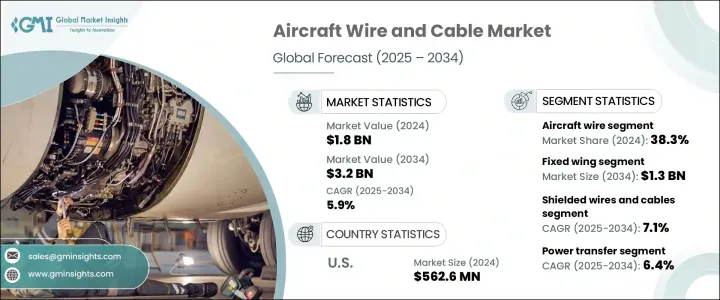

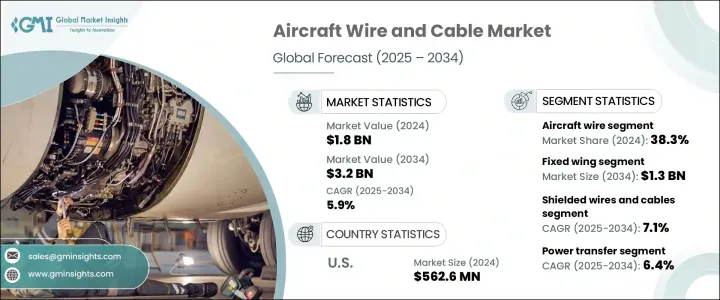

2024年,全球飛機電線電纜市場規模達18億美元,預計到2034年將以5.9%的複合年成長率成長,達到32億美元,這得益於飛機產量的激增,以及電動化和城市空中交通平台的快速發展。隨著飛機系統複雜化和推進電氣化的發展,對創新佈線解決方案的需求持續激增。多位利害關係人也指出,隨著下一代飛機對高性能電纜的依賴程度不斷提高,輕量化、熱穩定性和高壓佈線系統在商用和軍用應用中的作用將變得更加關鍵。

公司官員回憶起早期的貿易限制,特別是對進口鋁和鋼的關稅,如何擾亂了航太價值鏈。這些政策變化推高了原料價格,使原始設備製造商 (OEM) 和主要一級供應商的預算編制變得複雜。此外,國際報復性關稅擾亂了採購業務,導致重要電纜材料的價格和採購不穩定。擁有全球整合供應鏈的公司面臨最嚴重的挫折,因為採購延遲和成本上升使製造時間表緊張。正如工程師所指出的,如今的電動飛機和 eVTOL 平台需要為航空電子設備、電池推進和熱控制等系統提供複雜的佈線。這些應用需要能夠承受極端條件同時保持最小重量的電纜。分析師強調,先進的飛機設計趨勢促使航太公司加大投資,開發符合下一代航空目標的堅固緊湊的電纜系統。

| 市場範圍 | |

|---|---|

| 起始年份 | 2024 |

| 預測年份 | 2025-2034 |

| 起始值 | 18億美元 |

| 預測值 | 32億美元 |

| 複合年成長率 | 5.9% |

2024年,電線電纜產品領域的飛機電線佔據了38.3%的市場佔有率,這歸因於其在飛機各個系統中傳輸電力、控制訊號和資料的關鍵作用。產業供應商強調,對耐熱、輕質電線解決方案的需求正在成長,尤其是在飛機專案向下一代電氣架構轉型並提高自動化程度的背景下。電磁干擾和防火方面的監管壓力也影響設計參數,使得先進的電線配置對於適航認證和機隊改造至關重要。

預計到2034年,固定翼飛機市場規模將達到13億美元,這得益於生產線的擴張和老舊機隊的持續升級。航空工程師指出,固定翼飛機通常比旋翼飛機或無人機需要更複雜的佈線系統,因為它們搭載了更集中的航空電子設備、飛行控制和客艙系統。這些飛機通常需要密集的模組化線束,以支援遠程飛行和先進的安全功能。

2024年,美國飛機電線電纜市場規模達5.626億美元,這得益於商用航太和國防領域雄厚的資金支持。業內人士指出,美國的專案優先考慮惡劣條件下的可靠性和生存能力,這推動了專用電線材料和屏蔽技術的研發。美國仍然是為多電飛機平台設計的高壓和光纖佈線系統的試驗場,這預示著其長期成長潛力。

全球飛機電線電纜市場的公司正在採取多種策略來擴大其市場佔有率。阿美特克 (Ametek)、伊頓 (Eaton)、航太( Aerospace Wire & Cable)、卑爾根電纜技術 (Bergen Cable Technology)、安費諾 (Amphenol) 和柯林斯航空航太 (Collins Aerospace )航太航太 (Collins Aerospace)等主要參與者已優先考慮研發投資,以開發更輕、更耐熱的電纜電纜解決方案。許多公司正在擴展其全球製造能力,以提高供應鏈敏捷性並滿足不斷成長的需求。與飛機原始設備製造商 (OEM) 和系統整合商的合作也在增多,從而能夠客製化佈線架構,以適應不斷發展的飛機設計。此外,各公司正專注於策略性收購和認證,以增強其產品組合和競爭地位。這些措施旨在確保在高度技術化和監管驅動的市場中保持韌性和持續成長。

目錄

第1章:方法論與範圍

第2章:執行摘要

第3章:行業洞察

- 產業生態系統分析

- 川普政府關稅分析

- 對貿易的影響

- 貿易量中斷

- 報復措施

- 對產業的影響

- 供應方影響(原料)

- 主要材料價格波動

- 供應鏈重組

- 生產成本影響

- 需求面影響(售價)

- 價格傳導至終端市場

- 市佔率動態

- 消費者反應模式

- 供應方影響(原料)

- 受影響的主要公司

- 策略產業反應

- 供應鏈重組

- 定價和產品策略

- 政策參與

- 展望與未來考慮

- 對貿易的影響

- 產業衝擊力

- 成長動力

- 飛機產量和交付量不斷上升

- 新興經濟體商業航空的擴張

- 軍用飛機採購和升級激增

- 維護、修理和大修(MRO)行業的成長

- 城市空中交通和電動飛機計畫的投資不斷增加

- 產業陷阱與挑戰

- 先進航空級材料成本高昂

- 改造老舊飛機的挑戰

- 成長動力

- 成長潛力分析

- 監管格局

- 技術格局

- 未來市場趨勢

- 差距分析

- 波特的分析

- Pestel 分析

第4章:競爭格局

- 介紹

- 公司市佔率分析

- 主要市場參與者的競爭分析

- 競爭定位矩陣

- 策略儀表板

第5章:市場估計與預測:依類型,2021-2034

- 主要趨勢

- 飛機線

- 飛機電纜

- 同軸電纜

- 數據線

- 電源線

- 光纖電纜

- 射頻電纜

- 其他

- 飛機線束

第6章:市場估計與預測:依飛機類型,2021-2034

- 主要趨勢

- 固定翼

- 旋翼機

- 無人機

第7章:市場估計與預測:依屏蔽類型,2021-2034

- 主要趨勢

- 屏蔽電線和電纜

- 非屏蔽電線和電纜

第 8 章:市場估計與預測:按應用,2021 年至 2034 年

- 主要趨勢

- 飛行控制系統

- 照明系統

- 資料傳輸

- 電力傳輸

- 航空電子設備

- 起落架和煞車系統

- 其他

第9章:市場估計與預測:按地區,2021-2034

- 主要趨勢

- 北美洲

- 美國

- 加拿大

- 歐洲

- 德國

- 英國

- 法國

- 西班牙

- 義大利

- 荷蘭

- 亞太地區

- 中國

- 印度

- 日本

- 澳洲

- 韓國

- 拉丁美洲

- 巴西

- 墨西哥

- 阿根廷

- 中東和非洲

- 沙烏地阿拉伯

- 南非

- 阿拉伯聯合大公國

第10章:公司簡介

- Aerospace Wire & Cable

- Ametek

- Amphenol

- Bergen Cable Technology

- Collins Aerospace

- Eaton

- HUBER+SUHNER

- Lexco Cable

- Miracle Electronics Devices

- Molex

- Nexans

- PIC Wire & Cable

- Prysmian Group

- Radiall

- Sanghvi Aerospace

- TE Connectivity

- Tyler Madison

- WL Gore and Associates

The Global Aircraft Wire and Cable Market was valued at USD 1.8 billion in 2024 and is estimated to grow at a CAGR of 5.9% to reach USD 3.2 billion by 2034, driven by the surge in aircraft production volumes, paired with rapid advancements in electric and urban air mobility platforms. As aircraft evolve with complex systems and propulsion electrification, the demand for innovative wiring solutions continues to surge. Several stakeholders also pointed out that as next-generation aircraft become more reliant on high-performance cables, the role of lightweight, thermally stable, and high-voltage wiring systems becomes even more crucial in both commercial and military applications.

Company officials recalled how earlier trade restrictions, particularly the tariffs on imported aluminum and steel, disrupted the aerospace value chain. These policy changes elevated raw material prices, complicating budgeting for OEMs and major tier-1 suppliers. Additionally, international retaliatory tariffs disrupted sourcing operations, leading to instability in pricing and procurement of vital cabling materials. Firms with globally integrated supply chains faced the most severe setbacks, as sourcing delays and elevated costs strained manufacturing timelines. As noted by engineers, electrical aircraft and eVTOL platforms today demand sophisticated wiring for systems like avionics, battery propulsion, and thermal control. These applications require cables that can withstand extreme conditions while keeping weight minimal. Analysts emphasized that advanced aircraft design trends have driven aerospace firms to invest more in developing robust and compact cable systems that align with next-gen aviation goals.

| Market Scope | |

|---|---|

| Start Year | 2024 |

| Forecast Year | 2025-2034 |

| Start Value | $1.8 Billion |

| Forecast Value | $3.2 Billion |

| CAGR | 5.9% |

The aircraft wire segment in the wire and cable product segment held a 38.3% share in 2024, attributed to its essential role in transmitting power, control signals, and data throughout various aircraft systems. Industry suppliers emphasized that demand is growing for heat-resistant, lightweight wiring solutions, particularly as aircraft programs transition toward next-generation electric architectures and increased automation. Regulatory pressures around electromagnetic interference and fire resistance also shape design parameters, making advanced wire configurations vital for airworthiness certifications and fleet retrofits.

The fixed-wing aircraft segment is anticipated to reach USD 1.3 billion by 2034, driven by expanding production lines and continued upgrades to aging fleets. Aviation engineers pointed out that fixed-wing designs generally require more intricate cabling systems than rotary-wing or unmanned aerial vehicles, as they host a greater concentration of avionics, flight control, and cabin systems. These aircraft typically demand dense, modular wiring harnesses that support long-range operations and advanced safety features.

United States Aircraft Wire and Cable Market generated USD 562.6 million in 2024, underpinned by strong funding for the commercial aerospace and defense sectors. Industry insiders noted that U.S.-based programs prioritize reliability and survivability under harsh conditions, prompting the development of specialized wire materials and shielding technologies. The country remains a testing ground for high-voltage and fiber-optic cabling systems designed for more electric aircraft platforms, signaling long-term growth potential.

Companies operating in the Global Aircraft Wire and Cable Market are adopting multiple strategies to bolster their market footprint. Key players such as Ametek, Eaton, Aerospace Wire & Cable, Bergen Cable Technology, Amphenol, and Collins Aerospace have prioritized R&D investments to develop lighter, more thermally stable cable solutions. Many firms are expanding their global manufacturing capabilities to improve supply chain agility and meet growing demand. Collaborations with aircraft OEMs and system integrators are also rising, enabling tailored wiring architectures that align with evolving aircraft designs. In addition, companies are focusing on strategic acquisitions and certifications that enhance their product portfolios and competitive standing. These moves aim to ensure resilience and sustained growth in a highly technical and regulation-driven market.

Table of Contents

Chapter 1 Methodology and scope

- 1.1 Market scope and definitions

- 1.2 Research design

- 1.2.1 Research approach

- 1.2.2 Data collection methods

- 1.3 Base estimates and calculations

- 1.3.1 Base year calculation

- 1.3.2 Key trends for market estimation

- 1.4 Forecast model

- 1.5 Primary research and validation

- 1.5.1 Primary sources

- 1.5.2 Data mining sources

Chapter 2 Executive summary

- 2.1 Industry 3600 synopsis

Chapter 3 Industry insights

- 3.1 Industry ecosystem analysis

- 3.2 Trump administration tariffs analysis

- 3.2.1 Impact on trade

- 3.2.1.1 Trade volume disruptions

- 3.2.1.2 Retaliatory measures

- 3.2.2 Impact on the industry

- 3.2.2.1 Supply-side impact (raw materials)

- 3.2.2.1.1 Price volatility in key materials

- 3.2.2.1.2 Supply chain restructuring

- 3.2.2.1.3 Production cost implications

- 3.2.2.2 Demand-side impact (selling price)

- 3.2.2.2.1 Price transmission to end markets

- 3.2.2.2.2 Market share dynamics

- 3.2.2.2.3 Consumer response patterns

- 3.2.2.1 Supply-side impact (raw materials)

- 3.2.3 Key companies impacted

- 3.2.4 Strategic industry responses

- 3.2.4.1.1 Supply chain reconfiguration

- 3.2.4.1.2 Pricing and product strategies

- 3.2.4.1.3 Policy engagement

- 3.2.5 Outlook and future considerations

- 3.2.1 Impact on trade

- 3.3 Industry impact forces

- 3.3.1 Growth drivers

- 3.3.1.1 Rising aircraft production and deliveries

- 3.3.1.2 Expansion of commercial aviation in emerging economies

- 3.3.1.3 Surge in military aircraft procurement and upgrades

- 3.3.1.4 Growth of the maintenance, repair, and overhaul (mro) sector

- 3.3.1.5 Rising investments in urban air mobility and electric aircraft programs

- 3.3.2 Industry pitfalls and challenges

- 3.3.2.1 High cost of advanced aerospace-grade materials

- 3.3.2.2 Challenges in retrofitting legacy aircraft

- 3.3.1 Growth drivers

- 3.4 Growth potential analysis

- 3.5 Regulatory landscape

- 3.6 Technology landscape

- 3.7 Future market trends

- 3.8 Gap analysis

- 3.9 Porter's analysis

- 3.10 Pestel analysis

Chapter 4 Competitive Landscape, 2024

- 4.1 Introduction

- 4.2 Company market share analysis

- 4.3 Competitive analysis of major market players

- 4.4 Competitive positioning matrix

- 4.5 Strategy dashboard

Chapter 5 Market Estimates & Forecast, By Type, 2021-2034 (USD Million & Units)

- 5.1 Key trends

- 5.2 Aircraft wire

- 5.3 Aircraft cable

- 5.3.1 Coaxial cables

- 5.3.2 Data cables

- 5.3.3 Power cables

- 5.3.4 Fiber optic cables

- 5.3.5 RF cables

- 5.3.6 Others

- 5.4 Aircraft harness

Chapter 6 Market Estimates & Forecast, By Aircraft Type, 2021-2034 (USD Million & Units)

- 6.1 Key trends

- 6.2 Fixed wing

- 6.3 Rotary wing

- 6.4 Unmanned aerial vehicles

Chapter 7 Market Estimates & Forecast, By Shielding Type, 2021-2034 (USD Million & Units)

- 7.1 Key trends

- 7.2 Shielded wires and cables

- 7.3 Unshielded wires and cables

Chapter 8 Market Estimates & Forecast, By Application, 2021-2034 (USD Million & Units)

- 8.1 Key trends

- 8.2 Flight control systems

- 8.3 Lighting systems

- 8.4 Data transfer

- 8.5 Power transfer

- 8.6 Avionics

- 8.7 Landing gear & braking systems

- 8.8 Others

Chapter 9 Market Estimates and Forecast, By Region, 2021-2034 (USD Billion & Units)

- 9.1 Key trends

- 9.2 North America

- 9.2.1 U.S.

- 9.2.2 Canada

- 9.3 Europe

- 9.3.1 Germany

- 9.3.2 UK

- 9.3.3 France

- 9.3.4 Spain

- 9.3.5 Italy

- 9.3.6 Netherlands

- 9.4 Asia Pacific

- 9.4.1 China

- 9.4.2 India

- 9.4.3 Japan

- 9.4.4 Australia

- 9.4.5 South Korea

- 9.5 Latin America

- 9.5.1 Brazil

- 9.5.2 Mexico

- 9.5.3 Argentina

- 9.6 Middle East and Africa

- 9.6.1 Saudi Arabia

- 9.6.2 South Africa

- 9.6.3 UAE

Chapter 10 Company Profiles

- 10.1 Aerospace Wire & Cable

- 10.2 Ametek

- 10.3 Amphenol

- 10.4 Bergen Cable Technology

- 10.5 Collins Aerospace

- 10.6 Eaton

- 10.7 HUBER+SUHNER

- 10.8 Lexco Cable

- 10.9 Miracle Electronics Devices

- 10.10 Molex

- 10.11 Nexans

- 10.12 PIC Wire & Cable

- 10.13 Prysmian Group

- 10.14 Radiall

- 10.15 Sanghvi Aerospace

- 10.16 TE Connectivity

- 10.17 Tyler Madison

- 10.18 WL Gore and Associates