|

市場調查報告書

商品編碼

1750465

癲癇監測設備市場機會、成長動力、產業趨勢分析及 2025 - 2034 年預測Epilepsy Monitoring Device Market Opportunity, Growth Drivers, Industry Trend Analysis, and Forecast 2025 - 2034 |

||||||

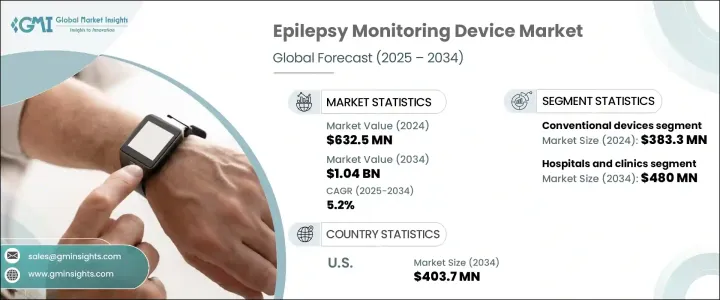

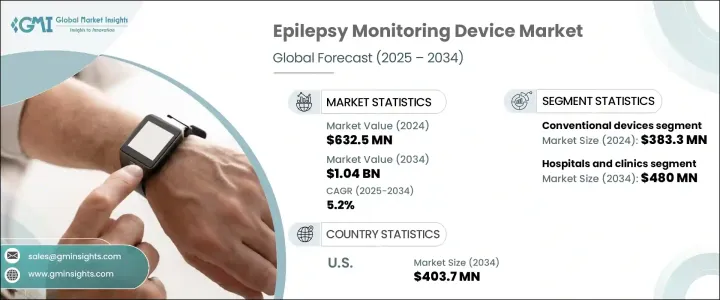

2024年,全球癲癇監測設備市場規模達6.325億美元,預計到2034年將以5.2%的複合年成長率成長,達到10.4億美元。全球癲癇負擔日益加重,精準診斷工具的需求日益成長,是推動該市場發展的關鍵因素。醫療保健機構正在採用先進技術監測癲癇患者的大腦活動,從而更好地進行診斷和治療。這些工具有助於檢測大腦中不規則的電訊號,為了解癲癇發作模式提供寶貴的見解,並支持個人化治療方案。此外,穿戴式裝置、即時資料追蹤和人工智慧系統等新一代技術的整合,增強了診斷能力,並拓展了其在家庭護理、門診和醫院環境中的應用。

持續的創新正在塑造癲癇監測的格局。如今,設備的準確性、便攜性和便利性均有所提升,使其更易於獲取,也更方便患者使用。隨著對非侵入式即時監測的需求不斷成長,這些進步正推動其在各種臨床環境中得到更廣泛的應用。人們對早期診斷的認知不斷提高,以及對長期癲癇發作管理的需求也加速了市場的擴張。

| 市場範圍 | |

|---|---|

| 起始年份 | 2024 |

| 預測年份 | 2025-2034 |

| 起始值 | 6.325億美元 |

| 預測值 | 10.4億美元 |

| 複合年成長率 | 5.2% |

2024年,傳統癲癇監測設備市場規模達3.833億美元。其強大的臨床表現、增強的診斷功能以及對多樣化醫療需求的適應性,繼續鞏固了其市場主導地位。這些設備已發展到具備基於人工智慧的癲癇發作檢測、雲端連接和持續腦電波追蹤等功能,使其成為藥物研究和臨床診斷中不可或缺的一部分。腦電圖系統憑藉其非侵入性和即時腦活動映射功能,仍然是癲癇監測的核心,並推動了該市場的持續成長。

預計到2034年,醫院和診所細分市場將創造4.8億美元的收入,這得益於其在管理癲癇等複雜神經系統疾病方面發揮的關鍵作用。這些醫療機構為患者提供一體化的照護環境,使其成為先進癲癇監測技術的理想之選。這些機構配備了神經影像系統、集中式資料管理平台和高風險護理單元等專業工具,能夠對癲癇進行全天候監測和精準診斷。

預計到2034年,美國癲癇監測設備市場規模將達到4.037億美元,這得益於不斷成長的癲癇病例以及全球最先進的醫療保健體系。隨著人們對神經系統健康的認知不斷提高,加上優惠的報銷政策和遠距醫療的普及,診斷技術的可近性正在不斷擴大。美國各地的主要參與者和研究機構正在積極投資下一代解決方案,包括基於人工智慧的分析、攜帶式腦電圖系統和即時雲端連接平台。

該領域的領先公司包括 Cadwell Industries、NeuroWave Systems、美敦力、日本光電株式會社、Seer Medical、Zeto、Medpage、Natus Medical Incorporated、波士頓科學公司、The Magstim、Masimo Corporation、Compumedics、荷蘭皇家飛利浦、Stratus 和 Empatica。為了鞏固市場地位,主要公司專注於策略性舉措,例如透過人工智慧整合和穿戴式解決方案擴展產品組合、與醫療保健提供者建立合作夥伴關係以及投資下一代監測技術的研發。他們還在擴大製造能力並改善設備連接性,以支援遠端患者管理。

目錄

第1章:方法論與範圍

第2章:執行摘要

第3章:行業洞察

- 產業生態系統分析

- 產業衝擊力

- 成長動力

- 癲癇盛行率不斷上升

- 穿戴式裝置的使用日益增多

- 癲癇監測技術的技術進步

- 人們對神經退化性疾病的認知不斷提高

- 產業陷阱與挑戰

- 複雜的癲癇監測程序和設備成本高昂

- 不利的報銷政策

- 成長動力

- 成長潛力分析

- 監管格局

- 川普政府關稅

- 對貿易的影響

- 貿易量中斷

- 各國應對措施

- 對產業的影響

- 供應方影響(製造成本)

- 主要材料價格波動

- 供應鏈重組

- 生產成本影響

- 需求面影響(消費者成本)

- 價格傳導至終端市場

- 市佔率動態

- 消費者反應模式

- 供應方影響(製造成本)

- 受影響的主要公司

- 策略產業反應

- 供應鏈重組

- 定價和產品策略

- 政策參與

- 展望與未來考慮

- 對貿易的影響

- 技術格局

- 未來市場趨勢

- 差距分析

- 波特的分析

- PESTEL分析

第4章:競爭格局

- 介紹

- 公司市佔率分析

- 公司矩陣分析

- 主要市場參與者的競爭分析

- 競爭定位矩陣

- 策略儀表板

第5章:市場估計與預測:按產品,2021 - 2034 年

- 主要趨勢

- 穿戴式裝置

- 傳統設備

- 深部腦部刺激裝置

- 監控設備

- 腦電圖設備

- 標準腦電圖

- 視訊腦電圖

- 其他腦電圖設備

- 肌電圖設備

- MEG 設備

- 其他監控設備

- 腦電圖設備

第6章:市場估計與預測:依最終用途,2021 - 2034 年

- 主要趨勢

- 醫院和診所

- 門診手術中心

- 神經病學中心

- 診斷中心

- 居家照護環境

第7章:市場估計與預測:按地區,2021 - 2034 年

- 主要趨勢

- 北美洲

- 美國

- 加拿大

- 歐洲

- 德國

- 英國

- 法國

- 西班牙

- 義大利

- 荷蘭

- 亞太地區

- 中國

- 日本

- 印度

- 澳洲

- 拉丁美洲

- 巴西

- 墨西哥

- 阿根廷

- 中東和非洲

- 南非

- 沙烏地阿拉伯

- 阿拉伯聯合大公國

第8章:公司簡介

- Boston Scientific Corporation

- Cadwell Industries

- Compumedics

- Empatica

- Koninklijke Philips

- Masimo Corporation

- Medpage

- Medtronic

- Natus Medical Incorporated

- NeuroWave Systems

- NIHON KOHDEN CORPORATION

- Seer Medical

- Stratus

- The Magstim

- Zeto

The Global Epilepsy Monitoring Device Market was valued at USD 632.5 million in 2024 and is estimated to grow at a CAGR of 5.2% to reach USD 1.04 billion by 2034, driven by the growing global burden of epilepsy and the increasing demand for accurate diagnostic tools are key drivers of this market. Healthcare providers are adopting advanced technologies to monitor brain activity in patients experiencing seizures, enabling better diagnosis and treatment strategies. These tools help detect irregular electrical signals in the brain, offering valuable insights into seizure patterns and supporting personalized treatment plans. Additionally, the integration of next-generation technologies such as wearable devices, real-time data tracking, and AI-powered systems enhances diagnostic capabilities while expanding their use across homecare, ambulatory, and hospital settings.

Continuous innovation is shaping the landscape of epilepsy monitoring. Devices today offer improved accuracy, portability, and convenience, making them more accessible and patient-friendly. As the demand for non-invasive and real-time monitoring rises, these advancements encourage wider adoption in various clinical environments. The growing awareness about early diagnosis and the need for long-term seizure management accelerate market expansion.

| Market Scope | |

|---|---|

| Start Year | 2024 |

| Forecast Year | 2025-2034 |

| Start Value | $632.5 Million |

| Forecast Value | $1.04 Billion |

| CAGR | 5.2% |

The conventional epilepsy monitoring devices segment generated USD 383.3 million in 2024. Their strong clinical performance, enhanced diagnostic features, and adaptability to diverse medical needs continue to drive their dominance. These devices have evolved to include capabilities like AI-based seizure detection, cloud connectivity, and continuous brainwave tracking, making them indispensable in pharmaceutical research and clinical diagnosis. EEG systems remain the core of epilepsy monitoring due to their non-invasive nature and real-time brain activity mapping, contributing to the sustained growth of this segment.

The hospitals and clinics segment is projected to generate USD 480 million by 2034, driven by their critical role in managing complex neurological conditions like epilepsy. These healthcare settings offer an integrated environment for patient care, making them ideal for advanced epilepsy monitoring technologies. Equipped with specialized tools such as neuroimaging systems, centralized data management platforms, and high-acuity care units, these facilities enable round-the-clock monitoring and precise diagnosis of seizure disorders.

United States Epilepsy Monitoring Device Market is anticipated to reach USD 403.7 million by 2034, supported by a rising number of epilepsy cases and one of the world's most advanced healthcare systems. The increasing awareness of neurological health, paired with favorable reimbursement policies and the adoption of telemedicine, is expanding access to diagnostic technologies. Major players and research institutions across the country are actively investing in next-generation solutions, including AI-based analytics, portable EEG systems, and real-time cloud-connected platforms.

Leading companies in this space include Cadwell Industries, NeuroWave Systems, Medtronic, NIHON KOHDEN CORPORATION, Seer Medical, Zeto, Medpage, Natus Medical Incorporated, Boston Scientific Corporation, The Magstim, Masimo Corporation, Compumedics, Koninklijke Philips, Stratus, and Empatica. To strengthen their market position, key companies focus on strategic initiatives such as expanding product portfolios through AI integration and wearable solutions, forming partnerships with healthcare providers, and investing in R&D for next-gen monitoring technologies. They are also scaling manufacturing capabilities and improving device connectivity to support remote patient management.

Table of Contents

Chapter 1 Methodology and Scope

- 1.1 Market scope and definitions

- 1.2 Research design

- 1.2.1 Research approach

- 1.2.2 Data collection methods

- 1.3 Base estimates and calculations

- 1.3.1 Base year calculation

- 1.3.2 Key trends for market estimation

- 1.4 Forecast model

- 1.5 Primary research and validation

- 1.5.1 Primary sources

- 1.5.2 Data mining sources

Chapter 2 Executive Summary

- 2.1 Industry 3600 synopsis

Chapter 3 Industry Insights

- 3.1 Industry ecosystem analysis

- 3.2 Industry impact forces

- 3.2.1 Growth drivers

- 3.2.1.1 Increasing prevalence of epilepsy

- 3.2.1.2 Rising use of wearable devices

- 3.2.1.3 Technological advancements in epilepsy monitoring technologies

- 3.2.1.4 Growing awareness of neurodegenerative disorders

- 3.2.2 Industry pitfalls and challenges

- 3.2.2.1 High cost of complex epilepsy monitoring procedures and devices

- 3.2.2.2 Unfavorable reimbursement policies

- 3.2.1 Growth drivers

- 3.3 Growth potential analysis

- 3.4 Regulatory landscape

- 3.5 Trump administration tariffs

- 3.5.1 Impact on trade

- 3.5.1.1 Trade volume disruptions

- 3.5.1.2 Country-wise response

- 3.5.2 Impact on the industry

- 3.5.2.1 Supply-side impact (Cost of manufacturing)

- 3.5.2.1.1 Price volatility in key materials

- 3.5.2.1.2 Supply chain restructuring

- 3.5.2.1.3 Production cost implications

- 3.5.2.2 Demand-side impact (Cost to consumers)

- 3.5.2.2.1 Price transmission to end markets

- 3.5.2.2.2 Market share dynamics

- 3.5.2.2.3 Consumer response patterns

- 3.5.2.1 Supply-side impact (Cost of manufacturing)

- 3.5.3 Key companies impacted

- 3.5.4 Strategic industry responses

- 3.5.4.1 Supply chain reconfiguration

- 3.5.4.2 Pricing and product strategies

- 3.5.4.3 Policy engagement

- 3.5.5 Outlook and future considerations

- 3.5.1 Impact on trade

- 3.6 Technological landscape

- 3.7 Future market trends

- 3.8 Gap analysis

- 3.9 Porter's analysis

- 3.10 PESTEL analysis

Chapter 4 Competitive Landscape, 2024

- 4.1 Introduction

- 4.2 Company market share analysis

- 4.3 Company matrix analysis

- 4.4 Competitive analysis of major market players

- 4.5 Competitive positioning matrix

- 4.6 Strategy dashboard

Chapter 5 Market Estimates and Forecast, By Product, 2021 - 2034 ($ Mn)

- 5.1 Key trends

- 5.2 Wearable devices

- 5.3 Conventional devices

- 5.3.1 Deep brain stimulation devices

- 5.3.2 Monitoring devices

- 5.3.2.1 EEG devices

- 5.3.2.1.1 Standard EEG

- 5.3.2.1.2 Video EEG

- 5.3.2.1.3 Other EEG devices

- 5.3.2.2 EMG devices

- 5.3.2.3 MEG devices

- 5.3.2.4 Other monitoring devices

- 5.3.2.1 EEG devices

Chapter 6 Market Estimates and Forecast, By End Use, 2021 - 2034 ($ Mn)

- 6.1 Key trends

- 6.2 Hospitals and clinics

- 6.3 Ambulatory surgical centers

- 6.4 Neurology centers

- 6.5 Diagnostic centers

- 6.6 Home care settings

Chapter 7 Market Estimates and Forecast, By Region, 2021 - 2034 ($ Mn)

- 7.1 Key trends

- 7.2 North America

- 7.2.1 U.S.

- 7.2.2 Canada

- 7.3 Europe

- 7.3.1 Germany

- 7.3.2 UK

- 7.3.3 France

- 7.3.4 Spain

- 7.3.5 Italy

- 7.3.6 Netherlands

- 7.4 Asia Pacific

- 7.4.1 China

- 7.4.2 Japan

- 7.4.3 India

- 7.4.4 Australia

- 7.5 Latin America

- 7.5.1 Brazil

- 7.5.2 Mexico

- 7.5.3 Argentina

- 7.6 Middle East and Africa

- 7.6.1 South Africa

- 7.6.2 Saudi Arabia

- 7.6.3 UAE

Chapter 8 Company Profiles

- 8.1 Boston Scientific Corporation

- 8.2 Cadwell Industries

- 8.3 Compumedics

- 8.4 Empatica

- 8.5 Koninklijke Philips

- 8.6 Masimo Corporation

- 8.7 Medpage

- 8.8 Medtronic

- 8.9 Natus Medical Incorporated

- 8.10 NeuroWave Systems

- 8.11 NIHON KOHDEN CORPORATION

- 8.12 Seer Medical

- 8.13 Stratus

- 8.14 The Magstim

- 8.15 Zeto