|

市場調查報告書

商品編碼

1750455

結締組織疾病治療市場機會、成長動力、產業趨勢分析及 2025 - 2034 年預測Connective Tissue Disease Treatment Market Opportunity, Growth Drivers, Industry Trend Analysis, and Forecast 2025 - 2034 |

||||||

2024年,全球結締組織疾病治療市場規模達258億美元,預計到2034年將以5.9%的複合年成長率成長,達到453億美元,這主要得益於類風濕性關節炎、硬皮病和系統性紅斑狼瘡等自體免疫疾病的日益普及。全球老年人口尤其容易患上這些疾病,因為免疫系統會隨著年齡成長而減弱,從而增加了結締組織疾病的風險。此外,人們的認知度提高和診斷能力的提升使得人們能夠更早發現和治療結締組織疾病,這進一步推動了市場的成長。

結締組織疾病的治療涉及多種藥物的綜合組合,旨在控制症狀、減輕發炎並延緩病情進展。這些治療方案包括用於快速緩解症狀的皮質類固醇、用於調節人體免疫反應的免疫抑制劑、用於標靶干預的生物製劑、用於長期控制疾病的改善病情的抗風濕藥物 (DMARD),以及用於改善患者舒適度的止痛療法。由於這些疾病通常是慢性的,並且會影響多個器官和系統,因此通常會採用聯合療法來確保更有效、更持久的療效。

| 市場範圍 | |

|---|---|

| 起始年份 | 2024 |

| 預測年份 | 2025-2034 |

| 起始值 | 258億美元 |

| 預測值 | 453億美元 |

| 複合年成長率 | 5.9% |

結締組織疾病治療市場中的自體免疫疾病細分市場在2024年創收204億美元。類風濕性關節炎等慢性疾病推動了這項需求,因為它們通常需要終身治療和密切監測。全球自體免疫性結締組織疾病的盛行率不斷上升,以及尋求早期介入的患者群體不斷擴大,持續支持著該細分市場的擴張。標靶療法的不斷發展以及新型生物製劑的問世,促進了更個人化和有效的治療,從而減少了疾病發作和長期併發症。

在各類藥物中,免疫抑制劑領域在2024年創造了91億美元的市場規模,因為這類藥物在抑制人體免疫系統攻擊健康結締組織(自體免疫疾病的標誌)方面發揮關鍵作用。對於病情進展迅速或多器官受影響的患者,免疫抑制劑的重要性尤其突出。免疫抑制劑有助於限制長期損害和住院治療,凸顯了其在治療方案中的持續重要性。製劑和給藥策略的改進也提高了免疫抑制劑的安全性,促進了其更廣泛的應用。

2024年,北美結締組織疾病治療市場規模達99億美元,這得益於先進的醫療體系、較高的診斷率以及專注於自體免疫疾病和發炎性疾病的強大研發管線。政府支持的計畫和公私合作持續資助早期篩檢、藥物研發和病患支持計畫的創新。這種投資水準不僅改善了臨床療效,也提高了整個北美大陸患者獲得高效治療方案的可近性。

全球結締組織疾病治療市場的主要參與者包括艾伯維、安進、勃林格殷格翰、禮來公司、葛蘭素史克、Ingenus Pharmaceutical、楊森製藥、默克、諾華、輝瑞、賽諾菲和梯瓦製藥。這些公司積極參與開發和商業化旨在治療影響結締組織的自身免疫性和遺傳性疾病的療法。為了鞏固市場地位,結締組織疾病治療領域的公司正在採取多項策略措施。這些措施包括投資研發以創新和推出新療法,建立策略合作夥伴關係和合作關係以擴大產品組合和市場範圍,以及專注於個人化醫療方法以滿足患者的特定需求。

目錄

第1章:方法論與範圍

第2章:執行摘要

第3章:行業洞察

- 產業生態系統分析

- 產業衝擊力

- 成長動力

- 結締組織疾病盛行率上升

- 生物製劑和標靶治療的進展

- 不斷增加的研發投資

- 藥物傳輸技術創新

- 產業陷阱與挑戰

- 治療費用高昂

- 副作用和長期安全問題

- 成長動力

- 成長潛力分析

- 監管格局

- 管道分析

- 川普政府關稅

- 對貿易的影響

- 貿易量中斷

- 報復措施

- 對產業的影響

- 供應方影響(原料)

- 主要材料價格波動

- 供應鏈重組

- 生產成本影響

- 需求面影響(售價)

- 價格傳導至終端市場

- 市佔率動態

- 消費者反應模式

- 供應方影響(原料)

- 受影響的主要公司

- 策略產業反應

- 供應鏈重組

- 定價和產品策略

- 政策參與

- 展望與未來考慮

- 對貿易的影響

- 波特的分析

- PESTEL分析

第4章:競爭格局

- 介紹

- 公司矩陣分析

- 公司市佔率分析

- 主要市場參與者的競爭分析

- 競爭定位矩陣

- 策略儀表板

第5章:市場估計與預測:依疾病類型,2021 年至 2034 年

- 主要趨勢

- 自體免疫疾病

- 類風濕關節炎

- 硬皮症

- 混合結締組織疾病

- 遺傳性疾病

第6章:市場估計與預測:依藥物類型,2021 年至 2034 年

- 主要趨勢

- 免疫抑制劑

- 皮質類固醇

- 非類固醇抗發炎藥

- 抗瘧藥物

- 其他藥物類型

第7章:市場估計與預測:依管理路線,2021 年至 2034 年

- 主要趨勢

- 口服

- 注射劑

第8章:市場估計與預測:按配銷通路,2021 年至 2034 年

- 主要趨勢

- 醫院藥房

- 零售藥局

- 網路藥局

第9章:市場估計與預測:按地區,2021 年至 2034 年

- 主要趨勢

- 北美洲

- 美國

- 加拿大

- 歐洲

- 德國

- 英國

- 法國

- 西班牙

- 義大利

- 荷蘭

- 亞太地區

- 中國

- 日本

- 印度

- 澳洲

- 韓國

- 拉丁美洲

- 巴西

- 墨西哥

- 阿根廷

- 中東和非洲

- 南非

- 沙烏地阿拉伯

- 阿拉伯聯合大公國

第10章:公司簡介

- AbbVie

- Amgen

- Azurity Pharmaceuticals

- Boehringer Ingelheim

- Eli Lilly and Company

- GlaxoSmithKline

- Ingenus Pharmaceutical

- Janssen Pharmaceutical

- Merck

- Novartis

- Pfizer

- Sanofi

- Teva Pharmaceutical

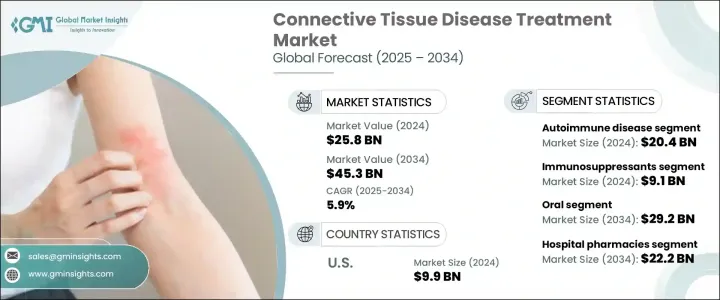

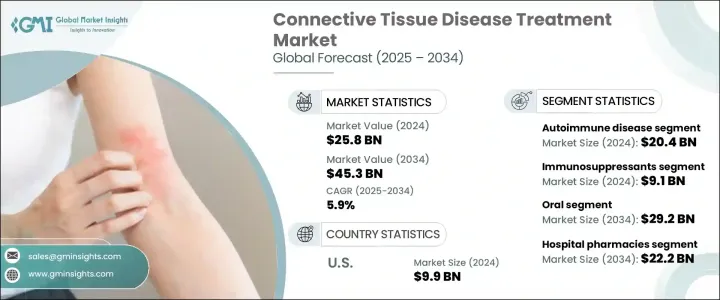

The Global Connective Tissue Disease Treatment Market was valued at USD 25.8 billion in 2024 and is estimated to grow at a CAGR of 5.9% to reach USD 45.3 billion by 2034, driven by the increasing prevalence of autoimmune disorders such as rheumatoid arthritis, scleroderma, and systemic lupus erythematosus. The aging global population is particularly susceptible to these conditions, as the immune system weakens with age, heightening the risk of developing connective tissue diseases. Additionally, heightened awareness and improved diagnostic capabilities have led to earlier detection and treatment, further propelling market growth.

Treatment for connective tissue diseases involves a comprehensive mix of medications designed to control symptoms, reduce inflammation, and slow disease progression. These therapeutic options include corticosteroids for rapid symptom relief, immunosuppressants to regulate the body's immune response, biologics for targeted intervention, disease-modifying antirheumatic drugs (DMARDs) for long-term disease control, and pain-relief therapies to improve patient comfort. Since these disorders are often chronic and impact multiple organs and systems, combination therapies are frequently prescribed to ensure more effective and sustained results.

| Market Scope | |

|---|---|

| Start Year | 2024 |

| Forecast Year | 2025-2034 |

| Start Value | $25.8 Billion |

| Forecast Value | $45.3 Billion |

| CAGR | 5.9% |

The autoimmune disease segment in the connective tissue disease treatment market generated USD 20.4 billion in 2024. Chronic conditions like rheumatoid arthritis drive this demand, as they often require lifelong treatment and close monitoring. The increasing global prevalence of autoimmune-related connective tissue disorders, along with a growing patient base seeking early intervention, continues to support the expansion of this segment. Continuous development in targeted therapies and the availability of new biologics have contributed to more personalized and effective treatments, reducing flare-ups and long-term complications.

Among the different drug classes, the immunosuppressants segment generated USD 9.1 billion in 2024 as these drugs play a critical role by inhibiting the body's immune system from attacking healthy connective tissue, a hallmark of autoimmune diseases. Their importance is particularly evident in patients with aggressive disease progression or multi-organ involvement. The use of immunosuppressants helps limit long-term damage and hospitalizations, underscoring their ongoing relevance in treatment protocols. Advancements in formulation and dosing strategies have also improved their safety profiles, encouraging wider adoption.

North America Connective Tissue Disease Treatment Market accounted for USD 9.9 billion in 2024, driven by the advanced healthcare systems, a high diagnosis rate, and strong R&D pipelines focused on autoimmune and inflammatory diseases. Government-backed programs and public-private collaborations continue to fund innovations in early screening, drug development, and patient support initiatives. This level of investment has not only improved clinical outcomes but has also increased the accessibility of high-efficacy treatment options to patients across the continent.

Key players in the Global Connective Tissue Disease Treatment Market include AbbVie, Amgen, Boehringer Ingelheim, Eli Lilly and Company, GlaxoSmithKline, Ingenus Pharmaceutical, Janssen Pharmaceutical, Merck, Novartis, Pfizer, Sanofi, and Teva Pharmaceutical. These companies are actively involved in developing and commercializing therapies aimed at managing autoimmune and genetic disorders affecting connective tissues. To strengthen their market position, companies in the connective tissue disease treatment sector are adopting several strategic initiatives. These include investing in research and development to innovate and introduce new therapies, forming strategic partnerships and collaborations to expand their product portfolios and market reach, and focusing on personalized medicine approaches to cater to the specific needs of patients.

Table of Contents

Chapter 1 Methodology and Scope

- 1.1 Market scope and definitions

- 1.2 Research design

- 1.2.1 Research approach

- 1.2.2 Data collection methods

- 1.3 Base estimates and calculations

- 1.3.1 Base year calculation

- 1.3.2 Key trends for market estimation

- 1.4 Forecast model

- 1.5 Primary research and validation

- 1.5.1 Primary sources

- 1.5.2 Data mining sources

Chapter 2 Executive Summary

- 2.1 Industry 3600 synopsis

Chapter 3 Industry Insights

- 3.1 Industry ecosystem analysis

- 3.2 Industry impact forces

- 3.2.1 Growth drivers

- 3.2.1.1 Rising prevalence of connective tissue diseases

- 3.2.1.2 Advancements in biologics and targeted therapies

- 3.2.1.3 Growing research and development investments

- 3.2.1.4 Technological innovations in drug delivery

- 3.2.2 Industry pitfalls and challenges

- 3.2.2.1 High cost of treatment

- 3.2.2.2 Side effects and long-term safety concerns

- 3.2.1 Growth drivers

- 3.3 Growth potential analysis

- 3.4 Regulatory landscape

- 3.5 Pipeline analysis

- 3.6 Trump administration tariffs

- 3.6.1 Impact on trade

- 3.6.1.1 Trade volume disruptions

- 3.6.1.2 Retaliatory measures

- 3.6.2 Impact on the Industry

- 3.6.2.1 Supply-side impact (raw materials)

- 3.6.2.1.1 Price volatility in key materials

- 3.6.2.1.2 Supply chain restructuring

- 3.6.2.1.3 Production cost implications

- 3.6.2.2 Demand-side impact (selling price)

- 3.6.2.2.1 Price transmission to end markets

- 3.6.2.2.2 Market share dynamics

- 3.6.2.2.3 Consumer response patterns

- 3.6.2.1 Supply-side impact (raw materials)

- 3.6.3 Key companies impacted

- 3.6.4 Strategic industry responses

- 3.6.4.1 Supply chain reconfiguration

- 3.6.4.2 Pricing and product strategies

- 3.6.4.3 Policy engagement

- 3.6.5 Outlook and future considerations

- 3.6.1 Impact on trade

- 3.7 Porter's analysis

- 3.8 PESTEL analysis

Chapter 4 Competitive Landscape, 2024

- 4.1 Introduction

- 4.2 Company matrix analysis

- 4.3 Company market share analysis

- 4.4 Competitive analysis of major market players

- 4.5 Competitive positioning matrix

- 4.6 Strategy dashboard

Chapter 5 Market Estimates and Forecast, By Disease Type, 2021 – 2034 ($ Mn)

- 5.1 Key trends

- 5.2 Autoimmune diseases

- 5.2.1 Rheumatoid arthritis

- 5.2.2 Scleroderma

- 5.2.3 Mixed connective tissue disease

- 5.3 Genetic disorders

Chapter 6 Market Estimates and Forecast, By Drug Type, 2021 – 2034 ($ Mn)

- 6.1 Key trends

- 6.2 Immnuosuppresants

- 6.3 Corticosteroids

- 6.4 NSAIDs

- 6.5 Antimalarial drugs

- 6.6 Other drug types

Chapter 7 Market Estimates and Forecast, By Route of Administration, 2021 – 2034 ($ Mn)

- 7.1 Key trends

- 7.2 Oral

- 7.3 Injectables

Chapter 8 Market Estimates and Forecast, By Distribution Channel, 2021 – 2034 ($ Mn)

- 8.1 Key trends

- 8.2 Hospital pharmacies

- 8.3 Retail pharmacies

- 8.4 Online pharmacies

Chapter 9 Market Estimates and Forecast, By Region, 2021 – 2034 ($ Mn)

- 9.1 Key trends

- 9.2 North America

- 9.2.1 U.S.

- 9.2.2 Canada

- 9.3 Europe

- 9.3.1 Germany

- 9.3.2 UK

- 9.3.3 France

- 9.3.4 Spain

- 9.3.5 Italy

- 9.3.6 Netherlands

- 9.4 Asia Pacific

- 9.4.1 China

- 9.4.2 Japan

- 9.4.3 India

- 9.4.4 Australia

- 9.4.5 South Korea

- 9.5 Latin America

- 9.5.1 Brazil

- 9.5.2 Mexico

- 9.5.3 Argentina

- 9.6 Middle East and Africa

- 9.6.1 South Africa

- 9.6.2 Saudi Arabia

- 9.6.3 UAE

Chapter 10 Company Profiles

- 10.1 AbbVie

- 10.2 Amgen

- 10.3 Azurity Pharmaceuticals

- 10.4 Boehringer Ingelheim

- 10.5 Eli Lilly and Company

- 10.6 GlaxoSmithKline

- 10.7 Ingenus Pharmaceutical

- 10.8 Janssen Pharmaceutical

- 10.9 Merck

- 10.10 Novartis

- 10.11 Pfizer

- 10.12 Sanofi

- 10.13 Teva Pharmaceutical