|

市場調查報告書

商品編碼

1750439

拉臂拖車市場機會、成長動力、產業趨勢分析及 2025 - 2034 年預測Hooklift Trailer Market Opportunity, Growth Drivers, Industry Trend Analysis, and Forecast 2025 - 2034 |

||||||

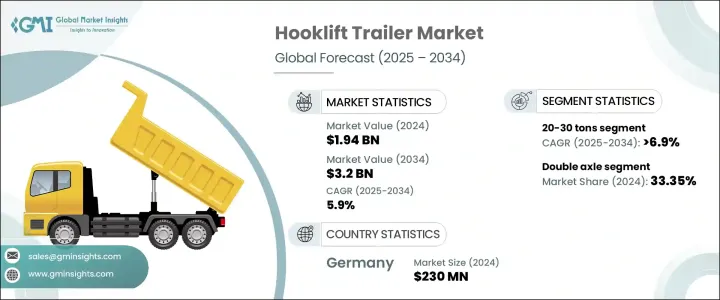

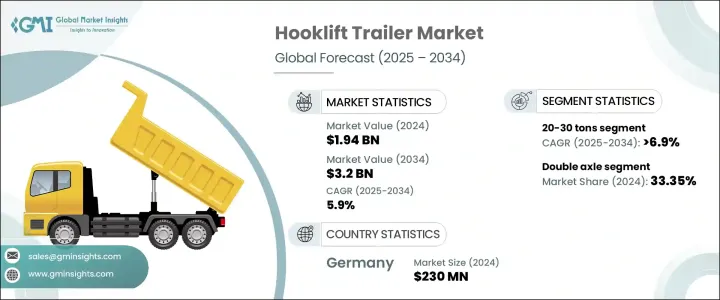

2024年,全球拉鉤拖車市場規模達19.4億美元,預計到2034年將以5.9%的複合年成長率成長,達到32億美元,這得益於全球建築、拆除和基礎建設的蓬勃發展。這些拖車因其靈活性、耐用性和高效性,日益被視為廢棄物處理、農業、採礦和物流領域的重要資產。隨著各行各業轉向模組化運輸系統以最佳化時間和資源,拉鉤拖車具備多功能運輸能力,允許使用單一車輛平台運輸各種類型的貨櫃。

這種適應性在工地條件和貨物類型差異很大的地區尤其具有吸引力,例如人口稠密的城區、偏遠的挖掘區域和廣闊的農田。此外,隨著營運更加重視減少停機時間和營運成本,先進的液壓系統和基於物聯網的追蹤等智慧技術正成為關鍵特性。這些整合提供即時診斷和維護警報,提高車隊的可靠性和生產力,同時降低整體擁有成本。透過啟用遠端監控和預測性維護,操作員可以在問題升級之前發現問題,從而減少非計劃性停機時間和維修成本。此外,透過這些系統收集的性能資料有助於做出明智的決策,最佳化燃油使用和駕駛員行為。隨著時間的推移,這種可見度水準將有助於改善資產管理、延長設備使用壽命以及提高調度效率和營運效率。

| 市場範圍 | |

|---|---|

| 起始年份 | 2024 |

| 預測年份 | 2025-2034 |

| 起始值 | 19.4億美元 |

| 預測值 | 32億美元 |

| 複合年成長率 | 5.9% |

雙軸拖車市場在2024年佔據了33.35%的市場佔有率,預計到2034年將以6.7%的複合年成長率成長。雙軸拖車以其在承載力和機動性方面的平衡而聞名,在農業、建築和廢物處理等領域備受青睞。其設計確保了即使在嚴苛條件下也能穩定操控並延長使用壽命。加固的車架和多貨櫃相容性使這些拖車在日常工業應用中更加高效,而新型節油系統則進一步激發了人們對永續解決方案日益成長的興趣。

2024年,載重量20-30噸的拉臂拖車佔了34.23%的市佔率。這個重量等級在有效載荷和多功能性之間實現了關鍵平衡,使其成為運輸城市垃圾、拆除材料和礦產資源的理想選擇。此細分市場的成長反映了其在減少行程和降低燃油消耗方面的價值,尤其是在地形和物流需求變化較大的作業中。

2024年,德國拉臂拖車市場產值達2.3億美元,佔28.6%的市佔率。該國對智慧垃圾處理系統、永續發展和高效物流的重視,持續支撐拖車市場的需求。 Meiller、Krampe等本土製造商大力推動創新,強調自動化、長期耐用性和符合歐盟運輸標準。

為了擴大市場佔有率,Palfinger、Stellar Industries、SwapLoader、Hiab、Stronga、Hyva Group、VDL Containersystemen 和 Marrel SAS 等主要參與者正在投資產品創新、整合液壓系統和遠端資訊處理。許多公司正在建立區域合作夥伴關係,加強售後支持,並提供根據不同最終用戶需求量身定做的模組化設備選項。這些策略正在幫助企業滿足日益成長的需求,同時在全球吊鉤拖車領域樹立性能標竿。

目錄

第1章:方法論與範圍

第2章:執行摘要

第3章:行業洞察

- 產業生態系統分析

- 供應商格局

- 零件供應商

- 製造商

- 車隊營運商

- 經銷商

- 最終用途

- 川普政府關稅的影響

- 貿易影響

- 貿易量中斷

- 報復措施

- 對產業的影響

- 供給側影響(原料)

- 主要材料價格波動

- 供應鏈重組

- 生產成本影響

- 需求面影響(客戶成本)

- 價格傳導至終端市場

- 市佔率動態

- 消費者反應模式

- 供給側影響(原料)

- 受影響的主要公司

- 策略產業反應

- 供應鏈重組

- 定價和產品策略

- 政策參與

- 展望與未來考慮

- 貿易影響

- 利潤率分析

- 技術與創新格局

- 專利分析

- 價格趨勢

- 地區

- 軸

- 成本細分分析

- 重要新聞和舉措

- 監管格局

- 對部隊的影響

- 成長動力

- 建築和拆除活動增加

- 都市化和基礎設施發展

- 對高效率物流的需求

- 政府對公共基礎建設的投資

- 產業陷阱與挑戰

- 初期投資成本高

- 維護和操作複雜性

- 成長動力

- 成長潛力分析

- 波特的分析

- PESTEL分析

第4章:競爭格局

- 介紹

- 公司市佔率分析

- 競爭定位矩陣

- 戰略展望矩陣

第5章:市場估計與預測:按車橋,2021 - 2034 年

- 主要趨勢

- 單軸

- 雙軸

- 三軸

- 多軸

第6章:市場估計與預測:按載客量,2021 - 2034

- 主要趨勢

- 10噸以下

- 10–20噸

- 20–30噸

- 30噸以上

第7章:市場估計與預測:按應用,2021 - 2034 年

- 主要趨勢

- 建築與拆除

- 城市廢棄物管理

- 回收作業

- 農業

- 採礦和採石

- 物流與運輸

第8章:市場估計與預測:按地區,2021 - 2034 年

- 主要趨勢

- 北美洲

- 美國

- 加拿大

- 歐洲

- 英國

- 德國

- 法國

- 義大利

- 西班牙

- 俄羅斯

- 北歐人

- 亞太地區

- 中國

- 印度

- 日本

- 韓國

- 澳新銀行

- 東南亞

- 拉丁美洲

- 巴西

- 墨西哥

- 阿根廷

- MEA

- 阿拉伯聯合大公國

- 沙烏地阿拉伯

- 南非

第9章:公司簡介

- Fahrzeugbau KEMPF

- Fliegl Agrartechnik

- Fors MW

- Fortuna Fahrzeugbau GmbH

- Hiab Corporation

- Hyva Group

- Joskin

- Krampe Fahrzeugbau

- Marrel SAS

- Meiller Group

- Metaltech

- MS DORSE

- Palfinger AG

- Palmse Metall

- Peeters Group

- Peter Kroger GmbH

- Stellar Industries

- Stronga

- SwapLoader USA

- VDL Containersystemen BV

The Global Hooklift Trailer Market was valued at USD 1.94 billion in 2024 and is estimated to grow at a CAGR of 5.9% to reach USD 3.2 billion by 2034, driven by the surge in construction, demolition, and infrastructure development worldwide. These trailers are increasingly viewed as essential assets in waste handling, agriculture, mining, and logistics due to their flexibility, durability, and efficiency. As industries shift toward modular transport systems to optimize time and resources, hooklift trailers offer multi-functional hauling capabilities, allowing the use of various container types with a single vehicle platform.

This adaptability is particularly appealing in areas where jobsite conditions and cargo types vary widely, including dense urban locations, remote excavation areas, and expansive farmland. Additionally, as operations focus more on reducing downtime and operational costs, advanced hydraulic systems and smart technologies like IoT-based tracking are becoming key features. These integrations provide real-time diagnostics and maintenance alerts, improving fleet reliability and productivity while lowering total cost of ownership. By enabling remote monitoring and predictive maintenance, operators can identify issues before they escalate, reducing unplanned downtime and repair costs. Additionally, performance data collected through these systems allows for informed decision-making, optimizing fuel usage and driver behavior. Over time, this level of visibility supports better asset management, longer equipment lifespans, and more efficient scheduling and operational efficiency.

| Market Scope | |

|---|---|

| Start Year | 2024 |

| Forecast Year | 2025-2034 |

| Start Value | $1.94 Billion |

| Forecast Value | $3.2 Billion |

| CAGR | 5.9% |

The double axle trailers segment held a prominent 33.35% share in 2024 and is projected to grow at a CAGR of 6.7% through 2034. Known for balancing load-bearing strength with maneuverability, they're highly favored across sectors like agriculture, construction, and waste processing. Their design ensures stable handling and extended lifespan, even under demanding conditions. Reinforced frames and multi-container compatibility have made these trailers more effective for daily industrial use, while new fuel-efficient systems further support growing interest in sustainable solutions.

Hooklift trailers with a 20-30 ton capacity secured a 34.23% market share in 2024. This weight class strikes a critical balance between payload and versatility, making it ideal for transporting municipal waste, demolition materials, and mined resources. The segment's growth reflects its value in minimizing trips and reducing fuel consumption across operations with variable terrain and logistical needs.

Germany Hooklift Trailer Market generated USD 230 million and held 28.6% market share in 2024. The country's focus on smart waste systems, sustainable development, and efficient logistics continues to support trailer demand. Local manufacturers like Meiller, Krampe, and others have pushed innovations that emphasize automation, long-term durability, and compliance with EU transport standards.

To expand market presence, key players like Palfinger, Stellar Industries, SwapLoader, Hiab, Stronga, Hyva Group, VDL Containersystemen, and Marrel SAS are investing in product innovation, integrated hydraulics, and telematics. Many are forming regional partnerships, enhancing after-sales support, and offering modular equipment options tailored to diverse end-user needs. These strategies are helping companies meet growing demand while setting performance benchmarks in the global hooklift trailer space.

Table of Contents

Chapter 1 Methodology & Scope

- 1.1 Research design

- 1.1.1 Research approach

- 1.1.2 Data collection methods

- 1.2 Base estimates and calculations

- 1.2.1 Base year calculation

- 1.2.2 Key trends for market estimates

- 1.3 Forecast model

- 1.4 Primary research & validation

- 1.4.1 Primary sources

- 1.4.2 Data mining sources

- 1.5 Market definitions

Chapter 2 Executive Summary

- 2.1 Industry 3600 synopsis, 2021 - 2034

Chapter 3 Industry Insights

- 3.1 Industry ecosystem analysis

- 3.2 Supplier landscape

- 3.2.1 Component suppliers

- 3.2.2 Manufacturers

- 3.2.3 Fleet operators

- 3.2.4 Distributors

- 3.2.5 End use

- 3.3 Impact of Trump administration tariffs

- 3.3.1 Trade impact

- 3.3.1.1 Trade volume disruptions

- 3.3.1.2 Retaliatory measures

- 3.3.2 Impact on industry

- 3.3.2.1 Supply-side impact (raw materials)

- 3.3.2.1.1 Price volatility in key materials

- 3.3.2.1.2 Supply chain restructuring

- 3.3.2.1.3 Production cost implications

- 3.3.2.2 Demand-side impact (Cost to customers)

- 3.3.2.2.1 Price transmission to end markets

- 3.3.2.2.2 Market share dynamics

- 3.3.2.2.3 Consumer response patterns

- 3.3.2.1 Supply-side impact (raw materials)

- 3.3.3 Key companies impacted

- 3.3.4 Strategic industry responses

- 3.3.4.1 Supply chain reconfiguration

- 3.3.4.2 Pricing and product strategies

- 3.3.4.3 Policy engagement

- 3.3.5 Outlook & future considerations

- 3.3.1 Trade impact

- 3.4 Profit margin analysis

- 3.5 Technology & innovation landscape

- 3.6 Patent analysis

- 3.7 Price trend

- 3.7.1 Region

- 3.7.2 Axle

- 3.8 Cost breakdown analysis

- 3.9 Key news & initiatives

- 3.10 Regulatory landscape

- 3.11 Impact on forces

- 3.11.1 Growth drivers

- 3.11.1.1 Increase in construction and demolition activities

- 3.11.1.2 Urbanization and infrastructure development

- 3.11.1.3 Demand for efficient logistics

- 3.11.1.4 Government investments in public infrastructure

- 3.11.2 Industry pitfalls & challenges

- 3.11.2.1 High initial investment cost

- 3.11.2.2 Maintenance and operational complexity

- 3.11.1 Growth drivers

- 3.12 Growth potential analysis

- 3.13 Porter's analysis

- 3.14 PESTEL analysis

Chapter 4 Competitive Landscape, 2024

- 4.1 Introduction

- 4.2 Company market share analysis

- 4.3 Competitive positioning matrix

- 4.4 Strategic outlook matrix

Chapter 5 Market Estimates & Forecast, By Axle, 2021 - 2034 ($Mn, Units)

- 5.1 Key trends

- 5.2 Single axle

- 5.3 Double axle

- 5.4 Triple axle

- 5.5 Multi- axle

Chapter 6 Market Estimates & Forecast, By Load Capacity, 2021 - 2034 ($Mn, Units)

- 6.1 Key trends

- 6.2 Below 10 tons

- 6.3 10–20 tons

- 6.4 20–30 tons

- 6.5 Above 30 tons

Chapter 7 Market Estimates & Forecast, By Application, 2021 - 2034 ($Mn, Units)

- 7.1 Key trends

- 7.2 Construction & demolition

- 7.3 Municipal waste management

- 7.4 Recycling operations

- 7.5 Agriculture

- 7.6 Mining & quarrying

- 7.7 Logistics & transportation

Chapter 8 Market Estimates & Forecast, By Region, 2021 - 2034 ($Mn, Units)

- 8.1 Key trends

- 8.2 North America

- 8.2.1 U.S.

- 8.2.2 Canada

- 8.3 Europe

- 8.3.1 UK

- 8.3.2 Germany

- 8.3.3 France

- 8.3.4 Italy

- 8.3.5 Spain

- 8.3.6 Russia

- 8.3.7 Nordics

- 8.4 Asia Pacific

- 8.4.1 China

- 8.4.2 India

- 8.4.3 Japan

- 8.4.4 South Korea

- 8.4.5 ANZ

- 8.4.6 Southeast Asia

- 8.5 Latin America

- 8.5.1 Brazil

- 8.5.2 Mexico

- 8.5.3 Argentina

- 8.6 MEA

- 8.6.1 UAE

- 8.6.2 Saudi Arabia

- 8.6.3 South Africa

Chapter 9 Company Profiles

- 9.1 Fahrzeugbau KEMPF

- 9.2 Fliegl Agrartechnik

- 9.3 Fors MW

- 9.4 Fortuna Fahrzeugbau GmbH

- 9.5 Hiab Corporation

- 9.6 Hyva Group

- 9.7 Joskin

- 9.8 Krampe Fahrzeugbau

- 9.9 Marrel SAS

- 9.10 Meiller Group

- 9.11 Metaltech

- 9.12 MS DORSE

- 9.13 Palfinger AG

- 9.14 Palmse Metall

- 9.15 Peeters Group

- 9.16 Peter Kroger GmbH

- 9.17 Stellar Industries

- 9.18 Stronga

- 9.19 SwapLoader USA

- 9.20 VDL Containersystemen BV