|

市場調查報告書

商品編碼

1750437

行動 C 臂市場機會、成長動力、產業趨勢分析及 2025 - 2034 年預測Mobile C-arm Market Opportunity, Growth Drivers, Industry Trend Analysis, and Forecast 2025 - 2034 |

||||||

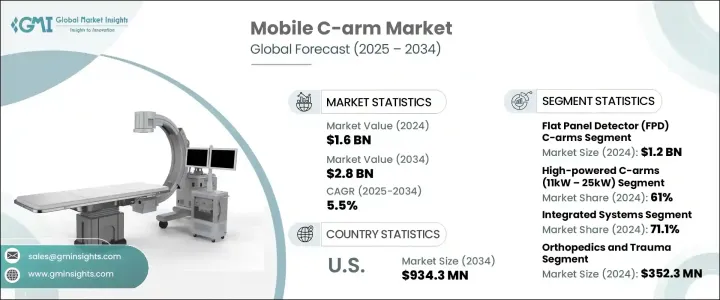

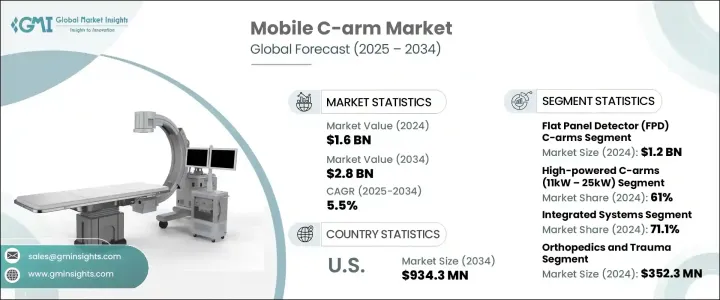

2024年,全球行動C臂市場規模達16億美元,預計2034年將以5.5%的複合年成長率成長至28億美元。移動式C臂系統是先進的攜帶式成像工具,旨在在診斷和手術過程中提供即時X光可視化。其提供即時影像回饋的能力在支持臨床決策、提高手術準確性和改善患者預後方面發揮著至關重要的作用。心血管疾病、癌症和神經系統疾病等慢性疾病在全球日益加重,這是市場擴張的關鍵驅動力,因為這些疾病通常需要精確的影像進行診斷和治療。微創手術需求的不斷成長,加上影像技術的進步,進一步推動了已開發地區和發展中地區對高性能移動C臂的需求。醫院和醫療機構正在持續投資這些系統,以確保更快的診斷速度和更高的手術效率,尤其是在緊急情況下。隨著全球(尤其是新興市場)醫療保健基礎設施不斷現代化,行動 C 臂因其便攜性、精確性和易用性而成為現代手術工作流程不可或缺的一部分。

就偵測器類型而言,市場細分為影像增強型C臂和平板偵測器 (FPD) C臂。平板偵測器C臂可提供更佳的影像品質、更高的對比度解析度和增強的解剖視覺化效果,使其成為脊椎手術、骨科創傷和心血管介入等複雜手術的理想選擇。這些偵測器還具有更高的輻射效率,能夠以更低的劑量產生更清晰的影像,從而增強患者和操作員的安全性。基於FPD的系統透過提供更寬廣、更穩定的影像視野,進一步減少了工作流程中斷,從而減少了手術期間重新定位的需要。向平板探測器技術的轉變在提高手術精度和簡化成像流程方面發揮著至關重要的作用。

| 市場範圍 | |

|---|---|

| 起始年份 | 2024 |

| 預測年份 | 2025-2034 |

| 起始值 | 16億美元 |

| 預測值 | 28億美元 |

| 複合年成長率 | 5.5% |

根據輸出功率,市場分為高功率C臂(11kW-25kW)和低功率C臂(2kW-10kW)。高功率C臂市場在2024年達到9.898億美元,佔61%的市佔率。這些高容量系統是需要深層組織成像和延長成像時間的複雜手術的首選。它們能夠在神經血管、骨科和心血管手術等高要求的介入手術中提供高解析度結果,使其成為手術室的必備設備。它們在高負荷下的出色性能也使其非常適合用於更大的解剖區域,確保在複雜的手術過程中獲得更清晰的可視化效果。

從設計角度來看,市場分為整合系統和獨立配置系統。整合式行動C臂佔據主導地位,2024年的市佔率為71.1%。這些系統將所有成像組件整合到一個緊湊的單元中,在擁擠或空間受限的臨床環境中尤其有用。其一體化設計簡化了操作,減少了設定時間,並提高了工作流程效率。整合系統的便利性在急診和ICU等高壓醫療環境中尤其有用,因為在這些環境中,快速取得影像至關重要。

按應用領域分類,移動式C臂市場涵蓋骨科和創傷、神經內科、心臟病學、胃腸病學、牙科、腫瘤學及其他領域。 2024年,骨科和創傷領域以3.523億美元的收入領先市場。事故相關損傷和年齡相關骨病變的增多,提升了即時術中影像的需求。移動式C臂能夠精確可視化骨骼排列和植入物位置,顯著改善手術效果並最大限度地減少併發症。即時3D成像和輻射劑量控制等技術進步,進一步支持了這些系統在骨科護理中的應用。

根據最終用途,市場細分為醫院、診斷中心和其他醫療保健機構。醫院在2024年以8.187億美元的收入引領市場。醫院提供的廣泛服務和高患者吞吐量需要可靠、高效能的影像系統。醫院的移動C臂應用於骨科、泌尿科和心血管科等多個科室。醫院數量的成長,尤其是在城市地區,直接導致了設備需求的成長。此外,醫院配備訓練有素的專業人員,提高了行動C臂系統的安全性和有效性,從而促進了更高的採用率。

從區域來看,北美市場佔據主導地位,2024 年市場規模達 5.637 億美元,預計到 2034 年將達到 9.343 億美元。美國佔了大部分佔有率,2024 年達到 4.975 億美元。需要外科手術介入的慢性病發生率不斷上升,促使該地區的醫院和診所投資先進的影像技術。主要行業參與者的強大影響力以及先進的醫療基礎設施進一步推動了該地區市場的成長。

行動C臂市場競爭激烈,前四大廠商佔全球近45%的市場。主要公司包括通用電氣醫療科技公司、西門子醫療公司、荷蘭皇家飛利浦公司和奇目成像公司。這些公司透過持續創新、強大的全球分銷和策略監管規劃來保持市場主導地位。與研究機構和公共衛生組織的合作也支持他們致力於將下一代影像解決方案推向市場。

目錄

第1章:方法論與範圍

第2章:執行摘要

第3章:行業洞察

- 產業生態系統分析

- 產業衝擊力

- 成長動力

- 外科手術數量不斷增加

- 慢性病盛行率上升

- 移動式C臂機的技術進步

- 微創手術需求不斷成長

- 產業陷阱與挑戰

- 移動式 C 臂機器成本高

- 缺乏熟練的醫療保健專業人員

- 成長動力

- 成長潛力分析

- 監管格局

- 川普政府關稅

- 對貿易的影響

- 貿易量中斷

- 各國應對措施

- 對產業的影響

- 供應方影響(製造成本)

- 主要材料價格波動

- 供應鏈重組

- 生產成本影響

- 需求面影響(消費者成本)

- 價格傳導至終端市場

- 市佔率動態

- 消費者反應模式

- 供應方影響(製造成本)

- 受影響的主要公司

- 策略產業反應

- 供應鏈重組

- 定價和產品策略

- 政策參與

- 展望與未來考慮

- 對貿易的影響

- 技術格局

- 未來市場趨勢

- 波特的分析

- PESTEL分析

第4章:競爭格局

- 介紹

- 公司市佔率分析

- 公司矩陣分析

- 主要市場參與者的競爭分析

- 競爭定位矩陣

- 策略儀表板

第5章:市場估計與預測:按探測器類型,2021 年至 2034 年

- 主要趨勢

- 平板偵測器 (FPD) C 臂

- 類型

- 非晶矽(a-Si)探測器

- 銦鎵鋅氧化物 (IGZO) 偵測器

- 互補金屬氧化物半導體 (CMOS) 偵測器

- 尺寸

- 20厘米×20厘米

- 26厘米×26厘米

- 30厘米 x 30厘米

- 其他尺寸

- 類型

- 影像增強器C臂

第6章:市場估計與預測:按發電量,2021 年至 2034 年

- 主要趨勢

- 低功率 C 臂(2kW - 10kW)

- 高功率 C 臂(11kW – 25kW)

第7章:市場估計與預測:依設計配置,2021 年至 2034 年

- 主要趨勢

- 整合系統

- 單獨的配置系統

第 8 章:市場估計與預測:按應用,2021 年至 2034 年

- 主要趨勢

- 骨科和創傷

- 心臟病學

- 神經病學

- 胃腸病學

- 腫瘤學

- 牙科

- 其他應用

第9章:市場估計與預測:依最終用途,2021 年至 2034 年

- 主要趨勢

- 醫院

- 診斷中心

- 其他最終用戶

第10章:市場估計與預測:按地區,2021 年至 2034 年

- 主要趨勢

- 北美洲

- 美國

- 加拿大

- 歐洲

- 德國

- 英國

- 法國

- 西班牙

- 義大利

- 荷蘭

- 亞太地區

- 中國

- 日本

- 印度

- 澳洲

- 韓國

- 拉丁美洲

- 巴西

- 墨西哥

- 阿根廷

- 中東和非洲

- 南非

- 沙烏地阿拉伯

- 阿拉伯聯合大公國

第 11 章:公司簡介

- Fujifilm Holdings Corporation

- GE HealthCare Technologies

- Genoray Co

- Hologic

- Koninklijke Philips

- Nanjing Perlove Medical Equipment Co

- Shimadzu Corporation

- Siemens Healthineers

- SternMed

- Stephanix

- Turner Imaging Systems

- Ziehm Imaging

The Global Mobile C-Arm Market was valued at USD 1.6 billion in 2024 and is estimated to grow at a CAGR of 5.5% to reach USD 2.8 billion by 2034. Mobile C-arm systems are advanced, portable imaging tools designed to deliver real-time X-ray visualization during diagnostic and surgical procedures. Their ability to provide immediate imaging feedback plays a vital role in supporting clinical decisions, improving surgical accuracy, and enhancing patient outcomes. The rising global burden of chronic illnesses such as cardiovascular conditions, cancer, and neurological disorders is a key driver of market expansion, as these conditions often require precise imaging for diagnosis and treatment. Increasing demand for minimally invasive surgeries, coupled with advancements in imaging technology, is further boosting the need for high-performance mobile C-arm units in both developed and developing regions. Hospitals and healthcare facilities are continuously investing in these systems to ensure faster diagnostics and improved surgical efficiency, particularly in emergency settings. As healthcare infrastructure continues to modernize globally, especially in emerging markets, mobile C-arms are becoming integral to modern surgical workflows due to their portability, precision, and ease of use.

In terms of detector type, the market is segmented into image intensifier C-arms and flat panel detector (FPD) C-arms. Flat panel detector C-arms offer improved image quality, higher contrast resolution, and enhanced anatomical visualization. This makes them ideal for intricate procedures such as spinal surgeries, orthopedic trauma, and cardiovascular interventions. These detectors also offer better radiation efficiency, producing clearer images at lower doses, which enhances patient and operator safety. FPD-based systems further reduce workflow interruptions by providing a broader and more stable imaging field, limiting the need for repositioning during procedures. The shift toward flat panel detector technology is playing a crucial role in improving surgical precision and streamlining imaging processes.

| Market Scope | |

|---|---|

| Start Year | 2024 |

| Forecast Year | 2025-2034 |

| Start Value | $1.6 Billion |

| Forecast Value | $2.8 Billion |

| CAGR | 5.5% |

Based on power output, the market is divided into high-powered C-arms (11kW-25kW) and low-powered C-arms (2kW-10kW). The high-powered C-arm segment accounted for USD 989.8 million in 2024, capturing 61% of the market. These high-capacity systems are preferred for complex procedures requiring deep tissue imaging and extended imaging durations. Their ability to deliver high-resolution results during demanding interventions, such as neurovascular, orthopedic, and cardiovascular surgeries, has made them essential equipment in operating rooms. Their performance under high workloads also makes them well-suited for use in larger anatomical regions, ensuring clearer visualizations during intricate procedures.

Design-wise, the market is categorized into integrated systems and separate configuration systems. Integrated mobile C-arms dominated with a 71.1% share in 2024. These systems combine all imaging components into a single compact unit, making them especially valuable in crowded or space-constrained clinical environments. Their all-in-one design simplifies operation, reduces setup time, and improves workflow efficiency. The convenience of integrated systems is especially useful in high-pressure medical environments such as emergency departments and ICUs, where rapid imaging access is essential.

By application, the mobile C-arm market covers orthopedics and trauma, neurology, cardiology, gastroenterology, dental, oncology, and other uses. The orthopedics and trauma segment led the market in 2024 with USD 352.3 million in revenue. The increasing volume of accident-related injuries and age-related bone disorders has elevated the demand for real-time intraoperative imaging. Mobile C-arms offer accurate visualization of bone alignment and implant placement, significantly enhancing surgical outcomes and minimizing complications. Technological advancements, such as real-time 3D imaging and radiation dose control, are further supporting the use of these systems in orthopedic care.

Based on end use, the market is segmented into hospitals, diagnostic centers, and other healthcare settings. Hospitals led the market with USD 818.7 million in revenue in 2024. Their wide service offerings and high patient throughput necessitate reliable, high-performance imaging systems. Mobile C-arms in hospitals are used across various specialties including orthopedics, urology, and cardiovascular care. The growing number of hospitals, especially in urban areas, directly contributes to increasing equipment demand. Additionally, the availability of trained professionals in hospitals enhances the safe and effective use of mobile C-arm systems, encouraging higher adoption rates.

Regionally, North America dominated the market with USD 563.7 million in 2024 and is projected to reach USD 934.3 million by 2034. The United States contributed the majority share, recording USD 497.5 million in 2024. The growing incidence of chronic conditions requiring surgical interventions is pushing hospitals and clinics in the region to invest in state-of-the-art imaging technology. The strong presence of key industry players and the availability of advanced healthcare infrastructure further drive market growth in the region.

The mobile C-arm market is highly competitive, with the top four players accounting for nearly 45% of the global share. Key companies include GE HealthCare Technologies, Siemens Healthineers, Koninklijke Philips, and Ziehm Imaging. These firms maintain market dominance through continuous innovation, strong global distribution, and strategic regulatory planning. Collaborations with research institutions and public health organizations also support their efforts in bringing next-generation imaging solutions to the market.

Table of Contents

Chapter 1 Methodology and Scope

- 1.1 Market scope and definitions

- 1.2 Research design

- 1.2.1 Research approach

- 1.2.2 Data collection methods

- 1.3 Base estimates and calculations

- 1.3.1 Base year calculation

- 1.3.2 Key trends for market estimation

- 1.4 Forecast model

- 1.5 Primary research and validation

- 1.5.1 Primary sources

- 1.5.2 Data mining sources

Chapter 2 Executive Summary

- 2.1 Industry 360° synopsis

Chapter 3 Industry Insights

- 3.1 Industry ecosystem analysis

- 3.2 Industry impact forces

- 3.2.1 Growth drivers

- 3.2.1.1 Growing number of surgical procedures

- 3.2.1.2 Rising prevalence of chronic diseases

- 3.2.1.3 Technological advancements of mobile C-arm machines

- 3.2.1.4 Rising demand for minimally invasive procedures

- 3.2.2 Industry pitfalls and challenges

- 3.2.2.1 High cost associated with mobile C-arm machines

- 3.2.2.2 Dearth of skilled healthcare professionals

- 3.2.1 Growth drivers

- 3.3 Growth potential analysis

- 3.4 Regulatory landscape

- 3.5 Trump administration tariffs

- 3.5.1 Impact on trade

- 3.5.1.1 Trade volume disruptions

- 3.5.1.2 Country-wise response

- 3.5.2 Impact on the industry

- 3.5.2.1 Supply-side impact (Cost of Manufacturing)

- 3.5.2.1.1 Price volatility in key materials

- 3.5.2.1.2 Supply chain restructuring

- 3.5.2.1.3 Production cost implications

- 3.5.2.2 Demand-side impact (Cost to Consumers)

- 3.5.2.2.1 Price transmission to end markets

- 3.5.2.2.2 Market share dynamics

- 3.5.2.2.3 Consumer response patterns

- 3.5.2.1 Supply-side impact (Cost of Manufacturing)

- 3.5.3 Key companies impacted

- 3.5.4 Strategic industry responses

- 3.5.4.1 Supply chain reconfiguration

- 3.5.4.2 Pricing and product strategies

- 3.5.4.3 Policy engagement

- 3.5.5 Outlook and future considerations

- 3.5.1 Impact on trade

- 3.6 Technology landscape

- 3.7 Future market trends

- 3.8 Porter's analysis

- 3.9 PESTEL analysis

Chapter 4 Competitive Landscape, 2024

- 4.1 Introduction

- 4.2 Company market share analysis

- 4.3 Company matrix analysis

- 4.4 Competitive analysis of major market players

- 4.5 Competitive positioning matrix

- 4.6 Strategy dashboard

Chapter 5 Market Estimates and Forecast, By Detector Type, 2021 – 2034 ($ Mn)

- 5.1 Key trends

- 5.2 Flat panel detector (FPD) C-arms

- 5.2.1 Type

- 5.2.1.1 Amorphous silicon (a-Si) detectors

- 5.2.1.2 Indium gallium zinc oxide (IGZO) detectors

- 5.2.1.3 Complementary metal-oxide semiconductor (CMOS) detectors

- 5.2.2 Size

- 5.2.2.1 20 cm × 20 cm

- 5.2.2.2 26 cm × 26 cm

- 5.2.2.3 30 cm x 30 cm

- 5.2.2.4 Other sizes

- 5.2.1 Type

- 5.3 Image intensifier C-arms

Chapter 6 Market Estimates and Forecast, By Power Output, 2021 – 2034 ($ Mn)

- 6.1 Key trends

- 6.2 Low-powered C-arms (2kW - 10kW)

- 6.3 High-powered C-arms (11kW – 25kW)

Chapter 7 Market Estimates and Forecast, By Design Configuration, 2021 – 2034 ($ Mn)

- 7.1 Key trends

- 7.2 Integrated systems

- 7.3 Separate configuration systems

Chapter 8 Market Estimates and Forecast, By Application, 2021 – 2034 ($ Mn)

- 8.1 Key trends

- 8.2 Orthopedics and trauma

- 8.3 Cardiology

- 8.4 Neurology

- 8.5 Gastroenterology

- 8.6 Oncology

- 8.7 Dental

- 8.8 Other applications

Chapter 9 Market Estimates and Forecast, By End Use, 2021 – 2034 ($ Mn)

- 9.1 Key trends

- 9.2 Hospitals

- 9.3 Diagnostic centers

- 9.4 Other end users

Chapter 10 Market Estimates and Forecast, By Region, 2021 – 2034 ($ Mn)

- 10.1 Key trends

- 10.2 North America

- 10.2.1 U.S.

- 10.2.2 Canada

- 10.3 Europe

- 10.3.1 Germany

- 10.3.2 UK

- 10.3.3 France

- 10.3.4 Spain

- 10.3.5 Italy

- 10.3.6 Netherlands

- 10.4 Asia Pacific

- 10.4.1 China

- 10.4.2 Japan

- 10.4.3 India

- 10.4.4 Australia

- 10.4.5 South Korea

- 10.5 Latin America

- 10.5.1 Brazil

- 10.5.2 Mexico

- 10.5.3 Argentina

- 10.6 Middle East and Africa

- 10.6.1 South Africa

- 10.6.2 Saudi Arabia

- 10.6.3 UAE

Chapter 11 Company Profiles

- 11.1 Fujifilm Holdings Corporation

- 11.2 GE HealthCare Technologies

- 11.3 Genoray Co

- 11.4 Hologic

- 11.5 Koninklijke Philips

- 11.6 Nanjing Perlove Medical Equipment Co

- 11.7 Shimadzu Corporation

- 11.8 Siemens Healthineers

- 11.9 SternMed

- 11.10 Stephanix

- 11.11 Turner Imaging Systems

- 11.12 Ziehm Imaging