|

市場調查報告書

商品編碼

1750436

酒吧用具市場機會、成長動力、產業趨勢分析及 2025 - 2034 年預測Barware Market Opportunity, Growth Drivers, Industry Trend Analysis, and Forecast 2025 - 2034 |

||||||

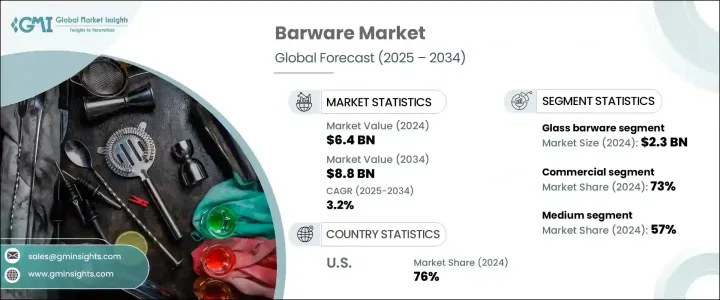

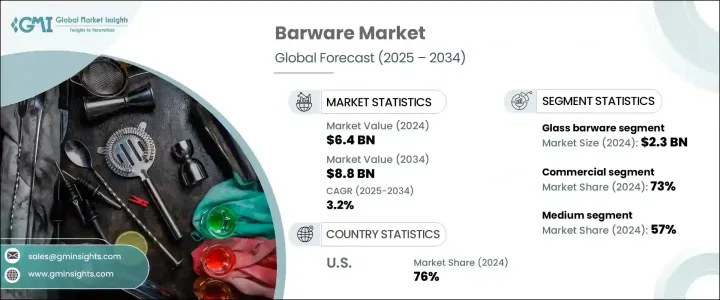

2024年,全球酒吧用具市場規模達64億美元,預計到2034年將以3.2%的複合年成長率成長,達到88億美元。這得歸功於消費者對高階且外觀精美的酒具日益成長的興趣、線上零售通路的拓展以及酒店業日益成長的需求。隨著越來越多的消費者轉向家庭娛樂,他們越來越青睞能夠體現個人風格並提升社交體驗的高級酒吧配件。材料創新和永續替代品的興起進一步增強了市場吸引力。受可支配收入成長的推動,新興經濟體的消費者現在正在加大對高品質酒吧用具的投入,無論是用於個人用途還是專業用途。

隨著家庭調酒潮流的興起,買家紛紛購買精緻的工具,希望在家中也能體驗酒吧般的體驗。飯店場所則選擇高耐用、時尚感十足的產品,以提升賓客體驗。材料科學的進步,尤其是玻璃領域的進步,帶來了更堅固、更精緻、兼具美觀和實用性的產品。如今,超薄耐用的設計備受追捧,這推動了酒吧用具的演變,使其兼具美觀性和日常實用性。人們越來越傾向於使用可生物分解吸管和可重複使用玻璃等永續材料,這也重塑了消費者的偏好。

| 市場範圍 | |

|---|---|

| 起始年份 | 2024 |

| 預測年份 | 2025-2034 |

| 起始值 | 64億美元 |

| 預測值 | 88億美元 |

| 複合年成長率 | 3.2% |

2024年,玻璃材質酒吧用具市場規模達23億美元,預計到2034年將以3.6%的複合年成長率成長。消費者越來越青睞外觀優雅、經久耐用的玻璃器皿。該領域在亞太和中東地區廣受歡迎,其驅動力在於視覺吸引力和耐用性。消費者青睞手工圖案、精細飾面以及能夠提升餐廳或酒吧氛圍的特色產品,尤其是在商業環境中。

2024年,全球酒吧用具市場的商業部分佔據了73%的佔有率,這得益於酒店業投資的不斷增加,這些企業優先考慮多功能酒吧用具,以提高服務效率並簡化庫存管理。餐廳、飯店和酒吧正轉向耐用、易於清潔且外觀精美的產品,以滿足多種飲品風格的需求,從而減少了對各種玻璃器皿的需求。客製化和品牌化也變得越來越普遍,許多機構選擇個人化設計來提升其形象並增強客戶體驗。

美國酒吧用具市場佔76%的市場佔有率,2024年市場規模達18億美元。這一成長反映了市場對高檔、美觀精緻的酒吧用具的強勁需求。精品酒吧、精釀雞尾酒文化和豪華酒店場所的擴張,為酒吧用具品牌創造了新的機會。同時,消費者對家庭娛樂的興趣日益濃厚,以及設計師酒吧用具在電商平台上的日益普及,鞏固了美國作為全球高階酒吧用具主要市場的地位。

市場的主要參與者包括 Schott Zwiesel、Baccarat、Lladro、Crystal Bohemia、Anchor Hocking、Bormioli Rocco、Lucaris、Lalique、Orrefors、Saint-Louis、Dartington Crystal、Swarovski、Ravenscroft Crystal、Waterford 和 Riedel。為了鞏固市場地位,酒吧用具製造商正致力於透過材料改進和設計改進進行產品創新。許多製造商正在推出針對高階零售和酒店行業的獨家系列。各大品牌也與豪華飯店、餐廳和線上平台建立策略合作夥伴關係,以加強分銷網路。包括環保製造和可回收包裝在內的永續發展舉措,正在進一步幫助企業順應不斷變化的消費者價值觀,同時增強長期的品牌忠誠度。

目錄

第1章:方法論與範圍

第2章:執行摘要

第3章:行業洞察

- 產業生態系統分析

- 影響價值鏈的因素

- 利潤率分析

- 中斷

- 未來展望

- 製成品

- 經銷商

- 川普政府關稅的影響

- 貿易影響

- 貿易量中斷

- 報復措施

- 對產業的影響

- 供給側影響(原料)

- 主要材料價格波動

- 供應鏈重組

- 生產成本影響

- 需求面影響(客戶成本)

- 價格傳導至終端市場

- 市佔率動態

- 消費者反應模式

- 供給側影響(原料)

- 受影響的主要公司

- 策略產業反應

- 供應鏈重組

- 定價和產品策略

- 政策參與

- 展望與未來考慮

- 貿易影響

- 供應商格局

- 重要新聞和舉措

- 監管格局

- 價格趨勢分析

- 衝擊力

- 成長動力

- 高階化需求與材料創新

- 可支配收入的增加以及家庭酒吧的流行

- 產業陷阱與挑戰

- 易碎且易破損

- 供應鏈中斷和原料成本

- 成長動力

- 成長潛力分析

- 波特的分析

- PESTEL分析

第4章:競爭格局

- 介紹

- 公司市佔率分析

- 競爭定位矩陣

- 戰略展望矩陣

第5章:市場估計與預測:依產品類型,2021 - 2034 年

- 主要趨勢

- 眼鏡

- 威士忌酒杯

- 不倒翁

- 雞尾酒杯

- 其他(小酒杯等)

- 鹵水器

- 投手

- 搖酒器

- 其他(酒吧配件等)

第6章:市場估計與預測:依資料,2021 - 2034 年

- 主要趨勢

- 玻璃

- 金屬

- 塑膠

- 水晶

- 其他(木材等)

第7章:市場估計與預測:按價格,2021 - 2034 年

- 主要趨勢

- 低的

- 中等的

- 高的

第8章:市場估計與預測:依最終用途,2021 - 2034 年

- 主要趨勢

- 住宅

- 商業的

- 酒吧和休息室

- 餐廳

- 飯店

- 其他(餐飲服務商等)

第9章:市場估計與預測:按配銷通路,2021 - 2034 年

- 主要趨勢

- 線上

- 電子商務

- 公司網站

- 離線

- 超市/大賣場

- 專賣店

- 其他(百貨公司等)

第10章:市場估計與預測:按地區,2021 - 2034 年

- 主要趨勢

- 北美洲

- 美國

- 加拿大

- 歐洲

- 英國

- 德國

- 法國

- 義大利

- 西班牙

- 俄羅斯

- 亞太地區

- 中國

- 印度

- 日本

- 韓國

- 澳洲

- 拉丁美洲

- 巴西

- 墨西哥

- MEA

- 阿拉伯聯合大公國

- 沙烏地阿拉伯

- 南非

第 11 章:公司簡介

- Anchor Hocking

- Baccarat

- Bormioli Rocco

- Crystal Bohemia

- Dartington Crystal

- Lalique

- Lladro

- Lucaris

- Orrefors

- Ravenscroft Crystal

- Riedel

- Saint-Louis

- Schott Zwiesel

- Swarovski

- Waterford

The Global Barware Market was valued at USD 6.4 billion in 2024 and is estimated to grow at a CAGR of 3.2% to reach USD 8.8 billion by 2034, fueled by rising consumer interest in premium and visually appealing drinkware, expanding online retail channels, and increasing demand from the hospitality sector. With more consumers turning to home entertainment, there's a growing preference for upscale bar accessories that reflect personal style and elevate social experiences. Material innovations and the rise of sustainable alternatives are further enhancing market appeal. Consumers in emerging economies, driven by rising disposable incomes, are now investing more in high-quality barware for both personal and professional use.

As the trend of home bartending grows, buyers purchase sophisticated tools to replicate bar-like experiences at home. The hospitality venues opt for high-durability, stylish pieces that add to the guest experience. Advancements in material science, particularly in glass, have resulted in stronger, more refined products that offer beauty and functionality. Ultra-thin and durable designs are now in demand, supporting the evolution of barware suited for aesthetic appeal and everyday use. The shift toward sustainable materials like biodegradable straws and reusable glass has also reshaped consumer preferences.

| Market Scope | |

|---|---|

| Start Year | 2024 |

| Forecast Year | 2025-2034 |

| Start Value | $6.4 Billion |

| Forecast Value | $8.8 Billion |

| CAGR | 3.2% |

In 2024, the glass-based barware segment generated USD 2.3 billion and is projected to grow at a CAGR of 3.6% through 2034. Consumers are gravitating toward elegant glassware that offers durability and a premium appearance. Popular in the Asia Pacific and Middle East regions, this segment is driven by visual appeal and functional longevity. Consumers favor artisanal patterns, detailed finishes, and statement pieces that elevate the dining or bar setting, especially in commercial environments.

The commercial segment in the global barware market held a 73% share in 2024, reinforced by rising investments from hospitality businesses, which prioritize multifunctional barware that enhances service efficiency and simplifies inventory management. Restaurants, hotels, and bars are shifting toward durable, easy-to-clean, and visually appealing products serving multiple drink styles, reducing the need for extensive glassware assortments. Customization and branding are also becoming more common, with establishments opting for personalized designs to elevate their presentation and enhance the customer experience.

United States Barware Market held a 76% share and generated USD 1.8 billion in 2024. This growth reflects a sharp demand for upscale, aesthetically refined barware. The expansion of boutique bars, craft cocktail culture, and luxury hospitality venues is creating new opportunities for barware brands. Simultaneously, rising consumer interest in home entertaining and growing ecommerce availability of designer bar tools reinforce the country's position as a key global market for premium barware.

Key players in this market include Schott Zwiesel, Baccarat, Lladro, Crystal Bohemia, Anchor Hocking, Bormioli Rocco, Lucaris, Lalique, Orrefors, Saint-Louis, Dartington Crystal, Swarovski, Ravenscroft Crystal, Waterford, and Riedel. To secure a stronger market position, barware manufacturers are focusing on product innovation through material advancements and design enhancements. Many are launching exclusive collections targeting both the premium retail and hospitality sectors. Brands are also forming strategic partnerships with luxury hotels, restaurants, and online platforms to strengthen distribution networks. Sustainability initiatives, including eco-conscious manufacturing and recyclable packaging, are further helping companies align with evolving consumer values while reinforcing long-term brand loyalty.

Table of Contents

Chapter 1 Methodology & Scope

- 1.1 Research design

- 1.1.1 Research approach

- 1.1.2 Data collection methods

- 1.2 Base estimates and calculations

- 1.2.1 Base year calculation

- 1.2.2 Key trends for market estimates

- 1.3 Forecast model

- 1.4 Primary research & validation

- 1.4.1 Primary sources

- 1.4.2 Data mining sources

- 1.5 Market definitions

Chapter 2 Executive Summary

- 2.1 Industry 3600 synopsis, 2021 - 2034

Chapter 3 Industry Insights

- 3.1 Industry ecosystem analysis

- 3.1.1 Factor affecting the value chain

- 3.1.2 Profit margin analysis

- 3.1.3 Disruptions

- 3.1.4 Future outlook

- 3.1.5 Manufactures

- 3.1.6 Distributors

- 3.2 Impact of Trump administration tariffs

- 3.2.1 Trade impact

- 3.2.1.1 Trade volume disruptions

- 3.2.1.2 Retaliatory measures

- 3.2.2 Impact on industry

- 3.2.2.1 Supply-side impact (raw materials)

- 3.2.2.1.1 Price volatility in key materials

- 3.2.2.1.2 Supply chain restructuring

- 3.2.2.1.3 Production cost implications

- 3.2.2.2 Demand-side impact (cost to customers)

- 3.2.2.2.1 Price transmission to end markets

- 3.2.2.2.2 Market share dynamics

- 3.2.2.2.3 Consumer response patterns

- 3.2.2.1 Supply-side impact (raw materials)

- 3.2.3 Key companies impacted

- 3.2.4 Strategic industry responses

- 3.2.4.1 Supply chain reconfiguration

- 3.2.4.2 Pricing and product strategies

- 3.2.4.3 Policy engagement

- 3.2.5 Outlook & future considerations

- 3.2.1 Trade impact

- 3.3 Supplier landscape

- 3.4 Key news & initiatives

- 3.5 Regulatory landscape

- 3.6 Pricing trend analysis

- 3.7 Impact forces

- 3.7.1 Growth drivers

- 3.7.1.1 Demand for premiumization along with material innovation

- 3.7.1.2 Rising disposable income along with the surging popularity of home bars

- 3.7.2 Industry pitfalls & challenges

- 3.7.2.1 Fragile and subjected to breakage

- 3.7.2.2 Supply chain disruptions and raw material costs

- 3.7.1 Growth drivers

- 3.8 Growth potential analysis

- 3.9 Porter's analysis

- 3.10 PESTEL analysis

Chapter 4 Competitive Landscape, 2024

- 4.1 Introduction

- 4.2 Company market share analysis

- 4.3 Competitive positioning matrix

- 4.4 Strategic outlook matrix

Chapter 5 Market Estimates & Forecast, By Product Type, 2021 - 2034 ($Billion, Million Units)

- 5.1 Key trends

- 5.2 Glasses

- 5.2.1 Whiskey glasses

- 5.2.2 Tumblers

- 5.2.3 Cocktail glasses

- 5.2.4 Others (shot glasses etc.)

- 5.3 Decanters

- 5.4 Pitchers

- 5.5 Shaker

- 5.6 Others (bar accessories etc.)

Chapter 6 Market Estimates & Forecast, By Material, 2021 - 2034 ($Billion, Million Units)

- 6.1 Key trends

- 6.2 Glass

- 6.3 Metal

- 6.4 Plastic

- 6.5 Crystal

- 6.6 Others (wood etc.)

Chapter 7 Market Estimates & Forecast, By Price, 2021 - 2034 ($Billion, Million Units)

- 7.1 Key trends

- 7.2 Low

- 7.3 Medium

- 7.4 High

Chapter 8 Market Estimates & Forecast, By End Use, 2021 - 2034 ($Billion, Million Units)

- 8.1 Key trends

- 8.2 Residential

- 8.3 Commercial

- 8.3.1 Bars and lounges

- 8.3.2 Restaurants

- 8.3.3 Hotels

- 8.3.4 Others (caterers etc.)

Chapter 9 Market Estimates & Forecast, By Distribution Channel, 2021 - 2034 ($Billion, Million Units)

- 9.1 Key trends

- 9.2 Online

- 9.2.1 E-commerce

- 9.2.2 Company websites

- 9.3 Offline

- 9.3.1 Supermarket/hypermarket

- 9.3.2 Specialty store

- 9.3.3 Others (department stores etc.)

Chapter 10 Market Estimates & Forecast, By Region, 2021 - 2034 ($Billion, Million Units)

- 10.1 Key trends

- 10.2 North America

- 10.2.1 U.S.

- 10.2.2 Canada

- 10.3 Europe

- 10.3.1 UK

- 10.3.2 Germany

- 10.3.3 France

- 10.3.4 Italy

- 10.3.5 Spain

- 10.3.6 Russia

- 10.4 Asia Pacific

- 10.4.1 China

- 10.4.2 India

- 10.4.3 Japan

- 10.4.4 South Korea

- 10.4.5 Australia

- 10.5 Latin America

- 10.5.1 Brazil

- 10.5.2 Mexico

- 10.6 MEA

- 10.6.1 UAE

- 10.6.2 Saudi Arabia

- 10.6.3 South Africa

Chapter 11 Company Profiles

- 11.1 Anchor Hocking

- 11.2 Baccarat

- 11.3 Bormioli Rocco

- 11.4 Crystal Bohemia

- 11.5 Dartington Crystal

- 11.6 Lalique

- 11.7 Lladro

- 11.8 Lucaris

- 11.9 Orrefors

- 11.10 Ravenscroft Crystal

- 11.11 Riedel

- 11.12 Saint-Louis

- 11.13 Schott Zwiesel

- 11.14 Swarovski

- 11.15 Waterford