|

市場調查報告書

商品編碼

1750431

餅乾和薄脆餅乾市場機會、成長動力、產業趨勢分析及 2025 - 2034 年預測Biscuits and Crackers Market Opportunity, Growth Drivers, Industry Trend Analysis, and Forecast 2025 - 2034 |

||||||

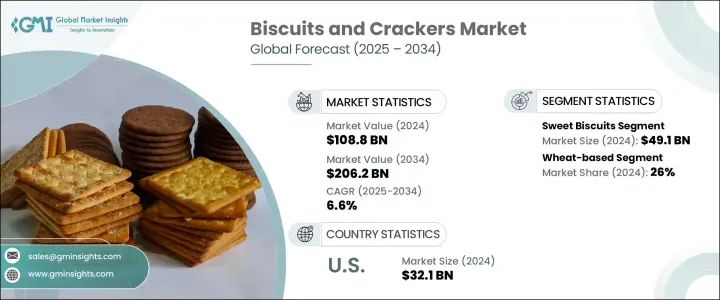

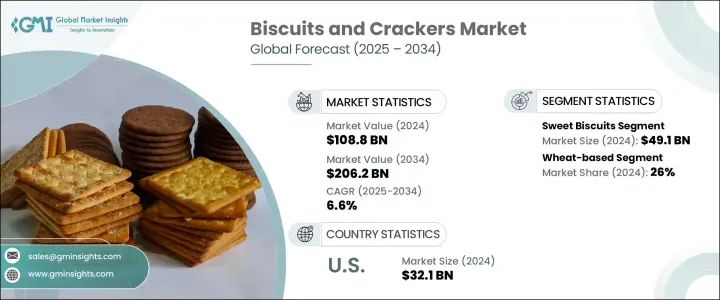

2024年,全球餅乾和薄脆餅乾市場規模達1,088億美元,預計到2034年將以6.6%的複合年成長率成長,達到2062億美元。這得歸功於消費者對便捷便攜、符合快節奏生活方式的零食日益成長的偏好。都市化進程和包裝食品取得管道的不斷拓展進一步推動了市場需求,尤其是在發展中地區。西方飲食習慣的普及和城鎮人口的不斷成長正在加速消費趨勢。人們對健康和保健的日益重視,以及人們對功能性和健康零食的偏好,也正在重塑產品開發。

消費者尋求符合特定飲食需求的選擇,例如低糖、高蛋白、無麩質和植物性配方,這促使品牌在更清潔的標籤和營養豐富的成分方面進行創新。這種注重健康的趨勢也促使人們將超級食物、益生菌和天然甜味劑融入傳統點心中,以增強其吸引力。此外,數位商務的蓬勃發展使這些產品更容易被全球更廣泛的消費者群體所接受。線上平台不僅擴大了產品覆蓋範圍,還提供個人化推薦和訂閱模式,使製造商能夠直接與消費者互動,並在不同人群中建立品牌忠誠度。

| 市場範圍 | |

|---|---|

| 起始年份 | 2024 |

| 預測年份 | 2025-2034 |

| 起始值 | 1088億美元 |

| 預測值 | 2062億美元 |

| 複合年成長率 | 6.6% |

產品多樣化繼續塑造市場格局,其中甜味餅乾市場在2024年將達到491億美元。儘管人們對糖攝取量的認知日益加深,但憑藉其廣泛的吸引力以及在口味和口感上的持續創新,該市場仍佔據主導地位。同時,隨著注重健康的消費者尋求替代品,鹹味餅乾,尤其是無麩質和富含蛋白質的餅乾,也越來越受到關注。這些品種迎合了那些注重營養又不犧牲口感的消費者的需求,為新品的推出創造了機會。

2024年,小麥餅乾和薄脆餅乾的市場價值達到285億美元,佔26%的市場。它們的主導地位源於小麥的成本效益、可靠的全球供應以及配方的靈活性,使其能夠無縫調整口味。製造商青睞小麥,是因為其口味中性且烘焙特性穩定,適合甜味和鹹味的製作。儘管對無麩質和多穀物產品的需求不斷成長,但小麥仍然是主要原料,尤其是在價格敏感、經濟適用房至關重要的地區。

美國餅乾和薄脆餅乾市場在2024年創收321億美元,預計到2034年將以6.9%的複合年成長率成長。受高可支配收入、根深蒂固的零食文化以及廣泛的零售通路推動,美國仍然是全球最大、最成熟的零食市場之一。隨著消費者對健康的關注,對植物性、無過敏原和低碳水化合物餅乾的需求也日益成長。連鎖超市的自有品牌進一步提升了市場價值,提供與高階品牌互補的優質產品,同時又不犧牲其價格競爭力。

該產業的主要參與者包括賓堡集團、雀巢公司、億滋國際、不列顛尼亞工業有限公司和家樂氏公司。這些公司正透過多元化投資組合、投資更健康的產品線、區域擴張以及與數位零售商合作等重點策略來鞏固其市場地位。透過利用新興的健康趨勢並根據當地口味客製化產品,他們旨在提升品牌忠誠度,同時滿足全球消費者不斷變化的需求。

目錄

第1章:方法論與範圍

第2章:執行摘要

第3章:行業洞察

- 市場介紹

- 產業價值鏈分析

- 產品概述

- 餅乾和薄脆餅乾製造過程

- 成分功能

- 保存期限技術

- 風味開發技術

- 川普政府關稅

- 對貿易的影響

- 貿易量中斷

- 報復措施

- 對產業的影響

- 供給側影響(原料)

- 主要材料價格波動

- 供應鏈重組

- 生產成本影響

- 供給側影響(原料)

- 需求面影響(售價)

- 價格傳導至終端市場

- 市佔率動態

- 消費者反應模式

- 受影響的主要公司

- 策略產業反應

- 供應鏈重組

- 定價和產品策略

- 政策參與

- 展望與未來考慮

- 對貿易的影響

- 貿易統計(HS編碼)

- 2021-2024年主要出口國

- 2021-2024年主要進口國

註:以上貿易統計僅針對重點國家。

- 供應商格局

- 利潤率分析

- 重要新聞和舉措

- 監管格局

- 食品安全法規

- 標籤要求

- 有機和天然產品認證

- 營養聲明法規

- 過敏原標籤要求

- 衝擊力

- 成長動力

- 城市零售通路對定量控制和便攜餅乾包裝的需求不斷成長。

- 消費者對無麩質、高纖維和富含蛋白質的餅乾配方的興趣日益增加。

- 發展中經濟體有組織的零售和電子商務平台的擴張。

- 針對成年消費者的優質和奢華餅乾品種的產品創新。

- 產業陷阱與挑戰

- 原物料價格波動,尤其是小麥、糖和食用油。

- 烘焙零食產品中糖含量和反式脂肪的監管壓力。

- 成長動力

- 製造流程分析

- 麵團製備方法

- 成型和切割技術

- 烘焙技術

- 冷卻和包裝過程

- 原料分析與採購策略

- 定價分析

- 永續性和環境影響評估

- 成長潛力分析

- 波特的分析

- PESTEL分析

第4章:競爭格局

- 介紹

- 公司市佔率分析

- 競爭定位矩陣

- 戰略展望矩陣

- 市佔率分析

- 戰略框架

- 併購

- 合資與合作

- 新產品開發

- 擴張策略

- 競爭基準化分析

- 供應商格局

- 競爭定位矩陣

- 戰略儀表板

- 品牌定位與消費者認知分析

- 新參與者的市場進入策略

- 自有品牌分析與策略

第5章:市場估計與預測:依產品類型,2021-2034

- 主要趨勢

- 甜餅乾

- 餅乾

- 奶油餅乾

- 巧克力餅乾

- 酥餅

- 晶圓

- 其他甜餅乾

- 鹹味餅乾和薄脆餅乾

- 原味餅乾

- 調味餅乾

- 起司餅乾

- 鹹餅乾

- 脆麵包

- 其他鹹味餅乾和薄脆餅乾

- 消化餅乾

- 普通消化餅乾

- 巧克力消化餅乾

- 其他消化劑

- 健康餅乾

- 高纖維餅乾

- 低糖/無糖餅乾

- 低脂餅乾

- 富含蛋白質的餅乾

- 功能性餅乾

- 夾心餅乾

- 早餐餅乾

- 手工和特色餅乾

- 其他產品類型

第6章:市場估計與預測:依成分類型,2021-2034

- 主要趨勢

- 小麥基

- 精製小麥粉

- 全麥麵粉

- 不含麩質

- 米粉基

- 玉米粉基

- 杏仁粉基

- 其他無麩質麵粉

- 雜糧

- 燕麥基

- 黑麥基

- 有機成分

- 非基因改造成分

- 其他成分類型

第7章:市場估計與預測:依包裝類型,2021-2034

- 主要趨勢

- 硬包裝

- 紙箱

- 塑膠容器

- 金屬罐

- 其他硬質包裝

- 軟包裝

- 塑膠袋

- 流動包裝

- 紙袋

- 其他軟包裝

- 托盤和蛤殼

- 多包裝格式

- 單份包裝

- 永續包裝解決方案

- 可生物分解包裝

- 可回收包裝

- 可堆肥包裝

第8章:市場估計與預測:按價格細分,2021-2034 年

- 主要趨勢

- 經濟

- 中檔

- 優質的

- 超高階手工製品

第9章:市場估計與預測:按配銷通路,2021-2034

- 主要趨勢

- 超市和大賣場

- 便利商店

- 專賣店

- 網路零售

- 餐飲服務

- 咖啡館和餐廳

- 飯店和餐飲

- 機構餐飲

- 自動販賣機

- 直接面對消費者

- 其他分銷管道

第10章:市場估計與預測:按地區,2021-2034

- 主要趨勢

- 北美洲

- 美國

- 加拿大

- 歐洲

- 英國

- 德國

- 法國

- 義大利

- 西班牙

- 荷蘭

- 歐洲其他地區

- 亞太地區

- 中國

- 印度

- 日本

- 韓國

- 澳洲

- 亞太其他地區

- 拉丁美洲

- 巴西

- 墨西哥

- 阿根廷

- 拉丁美洲其他地區

- MEA

- 南非

- 沙烏地阿拉伯

- 阿拉伯聯合大公國

- 中東和非洲其他地區

第 11 章:公司簡介

- Arnott's Biscuits Limited

- Bahlsen GmbH & Co. KG

- Barilla G. e R. Fratelli SpA

- Britannia Industries Ltd.

- Burton's Biscuit Company

- Campbell Soup Company (Pepperidge Farm)

- Dare Foods Limited

- Fox's Biscuits (2 Sisters Food Group)

- General Mills, Inc.

- Grupo Bimbo

- ITC Limited

- Kellogg Company

- Keebler (Ferrero)

- Kind LLC

- Kashi Company (Kellogg)

- Lotus Bakeries

- Lotte Confectionery Co., Ltd.

- Mary's Gone Crackers

- Meiji Holdings Co., Ltd.

- Mondelez International, Inc.

- Nairn's Oatcakes Limited

- Nestle SA

- Orion Corporation

- Parle Products Pvt. Ltd.

- PepsiCo, Inc. (Frito-Lay)

- Ryvita Company Limited (ABF)

- Snyder's-Lance, Inc. (Campbell Soup Company)

- United Biscuits (pladis)

- Walkers Shortbread Ltd.

- Yildiz Holding (Ulker)

The Global Biscuits and Crackers Market was valued at USD 108.8 billion in 2024 and is estimated to grow at a CAGR of 6.6% to reach USD 206.2 billion by 2034, fueled by consumers' rising preference for convenient and portable snack options that align with fast-paced lifestyles. Urbanization and evolving access to packaged food further push market demand, especially in developing regions. Increased exposure to Western eating habits and a rising urban population are accelerating consumption trends. A growing emphasis on health and wellness, paired with a shift toward functional and better-for-you snacks, is also reshaping product development.

Consumers seek options that align with specific dietary needs, such as low-sugar, high-protein, gluten-free, and plant-based formulations, pushing brands to innovate with cleaner labels and nutrient-rich ingredients. This health-conscious trend is also encouraging the incorporation of superfoods, probiotics, and natural sweeteners into traditional snack profiles to enhance their appeal. Additionally, the surge in digital commerce is making these products more accessible to a broader consumer base globally. Online platforms are not only expanding product reach but also offering personalized recommendations and subscription models, allowing manufacturers to engage directly with consumers and build brand loyalty across diverse demographics.

| Market Scope | |

|---|---|

| Start Year | 2024 |

| Forecast Year | 2025-2034 |

| Start Value | $108.8 Billion |

| Forecast Value | $206.2 Billion |

| CAGR | 6.6% |

Product diversification continues to shape the market, with the sweet biscuits segment generating USD 49.1 billion in 2024. This segment remains dominant due to its widespread appeal and continuous innovation in flavor and texture, despite growing awareness around sugar intake. Meanwhile, savory crackers are witnessing increased attention, particularly gluten-free and protein-enriched options, as health-conscious consumers seek alternatives. These varieties cater to those prioritizing nutrition without sacrificing taste, creating opportunities for new launches.

Wheat-based biscuits and crackers secured USD 28.5 billion market value in 2024, holding a 26% share. Their dominance stems from wheat's cost-effectiveness, reliable global supply, and flexibility in formulation, which allows for seamless flavor adaptation. Manufacturers favor wheat for its neutral taste and consistent baking properties, which support sweet and savory applications. While demand for gluten-free and multi-grain offerings rises, wheat remains the staple base, especially in price-sensitive regions where affordability is critical.

U.S. Biscuits and Crackers Market generated USD 32.1 billion in 2024 and is set to grow at a 6.9% CAGR through 2034. The country remains one of the largest and most mature snack markets in the world, driven by high disposable income, an ingrained snacking culture, and widespread retail availability. Demand for plant-based, allergen-free, and low-carb biscuit options is also gaining traction, aligning with consumer focus on wellness. Private labels in grocery chains have further contributed to market value, providing quality offerings that complement premium brands without sacrificing affordability.

Key players in the industry include Grupo Bimbo, Nestle S.A., Mondelez International Inc., Britannia Industries Limited, and Kellogg Company. These companies are strengthening their market position through focused strategies such as portfolio diversification, investment in healthier product lines, regional expansion, and partnerships with digital retailers. By tapping into emerging wellness trends and customizing offerings for local tastes, they aim to boost brand loyalty while meeting the dynamic needs of global consumers.

Table of Contents

Chapter 1 Methodology & Scope

- 1.1 Market scope & definitions

- 1.2 Research methodology

- 1.3 Research scope & assumptions

- 1.4 List of data sources

- 1.5 Market estimation technique

- 1.6 Market segmentation & breakdown

- 1.7 Research limitations

Chapter 2 Executive Summary

- 2.1 Segment highlights

- 2.2 Competitive landscape snapshot

- 2.3 Regional market outlook

- 2.4 Key market trends

- 2.5 Future market outlook

Chapter 3 Industry Insights

- 3.1 Market introduction

- 3.2 Industry value chain analysis

- 3.3 Product overview

- 3.3.1 Biscuit & cracker manufacturing process

- 3.3.2 Ingredient functionality

- 3.3.3 Shelf-life technologies

- 3.3.4 Flavor development techniques

- 3.4 Trump administration tariffs

- 3.4.1 Impact on trade

- 3.4.1.1 Trade volume disruptions

- 3.4.1.2 Retaliatory measures

- 3.4.2 Impact on the industry

- 3.4.2.1 Supply-side impact (raw materials)

- 3.4.2.1.1 Price volatility in key materials

- 3.4.2.1.2 Supply chain restructuring

- 3.4.2.1.3 Production cost implications

- 3.4.2.1 Supply-side impact (raw materials)

- 3.4.3 Demand-side impact (selling price)

- 3.4.3.1 Price transmission to end markets

- 3.4.3.2 Market share dynamics

- 3.4.3.3 Consumer response patterns

- 3.4.4 Key companies impacted

- 3.4.5 Strategic industry responses

- 3.4.5.1 Supply chain reconfiguration

- 3.4.5.2 Pricing and product strategies

- 3.4.5.3 Policy engagement

- 3.4.6 Outlook and future considerations

- 3.4.1 Impact on trade

- 3.5 Trade statistics (HS code)

- 3.5.1 Major exporting countries, 2021-2024 (kilo tons)

- 3.5.2 Major importing countries, 2021-2024 (kilo tons)

Note: the above trade statistics will be provided for key countries only.

- 3.6 Supplier landscape

- 3.7 Profit margin analysis

- 3.8 Key news & initiatives

- 3.9 Regulatory landscape

- 3.9.1 Food safety regulations

- 3.9.2 Labeling requirements

- 3.9.3 Organic & natural product certifications

- 3.9.4 Nutritional claim regulations

- 3.9.5 Allergen labeling requirements

- 3.10 Impact forces

- 3.10.1 Growth drivers

- 3.10.1.1 Rising demand for portion-controlled and on-the-go biscuit packs in urban retail channels.

- 3.10.1.2 Increased consumer interest in gluten-free, high-fiber, and protein-enriched biscuit formulations.

- 3.10.1.3 Expansion of organized retail and e-commerce platforms in developing economies.

- 3.10.1.4 Product innovation in premium and indulgent biscuit varieties targeting adult consumers.

- 3.10.2 Industry pitfalls & challenges

- 3.10.2.1 Volatility in raw material prices, especially wheat, sugar, and edible oils.

- 3.10.2.2 Regulatory pressures around sugar content and trans fats in baked snack products.

- 3.10.1 Growth drivers

- 3.11 Manufacturing process analysis

- 3.11.1 Dough preparation methods

- 3.11.2 Forming & cutting techniques

- 3.11.3 Baking technologies

- 3.11.4 Cooling & packaging processes

- 3.12 Raw material analysis & procurement strategies

- 3.13 Pricing analysis

- 3.14 Sustainability & environmental impact assessment

- 3.15 Growth potential analysis

- 3.16 Porter's analysis

- 3.17 PESTEL analysis

Chapter 4 Competitive Landscape, 2024

- 4.1 Introduction

- 4.2 Company market share analysis

- 4.3 Competitive positioning matrix

- 4.4 Strategic outlook matrix

- 4.5 Market Share Analysis

- 4.6 Strategic Framework

- 4.6.1 Mergers & Acquisitions

- 4.6.2 Joint Ventures & Collaborations

- 4.6.3 New Product Developments

- 4.6.4 Expansion Strategies

- 4.7 Competitive Benchmarking

- 4.8 Vendor Landscape

- 4.9 Competitive Positioning Matrix

- 4.10 Strategic Dashboard

- 4.11 Brand Positioning & Consumer Perception Analysis

- 4.12 Market Entry Strategies for New Players

- 4.13 Private Label Analysis & Strategies

Chapter 5 Market Estimates & Forecast, By Product Type, 2021-2034 (USD Billion) (Kilo Tons)

- 5.1 Key trends

- 5.2 Sweet biscuits

- 5.2.1 Cookies

- 5.2.2 Cream-filled biscuits

- 5.2.3 Chocolate-coated biscuits

- 5.2.4 Shortbread

- 5.2.5 Wafers

- 5.2.6 Other sweet biscuits

- 5.3 Savory biscuits & crackers

- 5.3.1 Plain crackers

- 5.3.2 Flavored crackers

- 5.3.3 Cheese crackers

- 5.3.4 Saltines

- 5.3.5 Crispbreads

- 5.3.6 Other savory biscuits & crackers

- 5.4 Digestive biscuits

- 5.4.1 Plain digestives

- 5.4.2 Chocolate-coated digestives

- 5.4.3 Other digestives

- 5.5 Health & wellness biscuits

- 5.5.1 High-fiber biscuits

- 5.5.2 Low-sugar/sugar-free biscuits

- 5.5.3 Low-fat biscuits

- 5.5.4 Protein-enriched biscuits

- 5.5.5 Functional biscuits

- 5.6 Sandwich biscuits

- 5.7 Breakfast biscuits

- 5.8 Artisanal & specialty biscuits

- 5.9 Other product types

Chapter 6 Market Estimates & Forecast, By Ingredient Type, 2021-2034 (USD Billion) (Kilo Tons)

- 6.1 Key trends

- 6.2 Wheat-based

- 6.2.1 Refined wheat flour

- 6.2.2 Whole wheat flour

- 6.3 Gluten-free

- 6.3.1 Rice flour-based

- 6.3.2 Corn flour-based

- 6.3.3 Almond flour-based

- 6.3.4 Other gluten-free flours

- 6.4 Multi-grain

- 6.5 Oat-based

- 6.6 Rye-based

- 6.7 Organic ingredients

- 6.8 Non-GMO ingredients

- 6.9 Other ingredient types

Chapter 7 Market Estimates & Forecast, By Packaging Type, 2021-2034 (USD Billion) (Kilo Tons)

- 7.1 Key trends

- 7.2 Rigid packaging

- 7.2.1 Paperboard boxes

- 7.2.2 Plastic containers

- 7.2.3 Metal tins

- 7.2.4 Other rigid packaging

- 7.3 Flexible packaging

- 7.3.1 Plastic pouches

- 7.3.2 Flow wraps

- 7.3.3 Paper bags

- 7.3.4 Other flexible packaging

- 7.4 Trays & clamshells

- 7.5 Multi-pack formats

- 7.6 Single-serve packaging

- 7.7 Sustainable packaging solutions

- 7.7.1 Biodegradable packaging

- 7.7.2 Recyclable packaging

- 7.7.3 Compostable packaging

Chapter 8 Market Estimates & Forecast, By Price Segment, 2021-2034 (USD Billion) (Kilo Tons)

- 8.1 Key trends

- 8.2 Economy

- 8.3 Mid-range

- 8.4 Premium

- 8.5 Super-premium & artisanal

Chapter 9 Market Estimates & Forecast, By Distribution Channel, 2021-2034 (USD Billion) (Kilo Tons)

- 9.1 Key trends

- 9.2 Supermarkets & hypermarkets

- 9.3 Convenience stores

- 9.4 Specialty stores

- 9.5 Online retail

- 9.6 Foodservice

- 9.6.1 Cafes & restaurants

- 9.6.2 Hotels & catering

- 9.6.3 Institutional catering

- 9.7 Vending machines

- 9.8 Direct-to-consumer

- 9.9 Other distribution channels

Chapter 10 Market Estimates & Forecast, By Region, 2021-2034 (USD Billion) (Kilo Tons)

- 10.1 Key trends

- 10.2 North America

- 10.2.1 U.S.

- 10.2.2 Canada

- 10.3 Europe

- 10.3.1 UK

- 10.3.2 Germany

- 10.3.3 France

- 10.3.4 Italy

- 10.3.5 Spain

- 10.3.6 Netherlands

- 10.3.7 Rest of Europe

- 10.4 Asia Pacific

- 10.4.1 China

- 10.4.2 India

- 10.4.3 Japan

- 10.4.4 South Korea

- 10.4.5 Australia

- 10.4.6 Rest of Asia Pacific

- 10.5 Latin America

- 10.5.1 Brazil

- 10.5.2 Mexico

- 10.5.3 Argentina

- 10.5.4 Rest of Latin America

- 10.6 MEA

- 10.6.1 South Africa

- 10.6.2 Saudi Arabia

- 10.6.3 UAE

- 10.6.4 Rest of Middle East and Africa

Chapter 11 Company Profiles

- 11.1 Arnott's Biscuits Limited

- 11.2 Bahlsen GmbH & Co. KG

- 11.3 Barilla G. e R. Fratelli S.p.A.

- 11.4 Britannia Industries Ltd.

- 11.5 Burton's Biscuit Company

- 11.6 Campbell Soup Company (Pepperidge Farm)

- 11.7 Dare Foods Limited

- 11.8 Fox's Biscuits (2 Sisters Food Group)

- 11.9 General Mills, Inc.

- 11.10 Grupo Bimbo

- 11.11 ITC Limited

- 11.12 Kellogg Company

- 11.13 Keebler (Ferrero)

- 11.14 Kind LLC

- 11.15 Kashi Company (Kellogg)

- 11.16 Lotus Bakeries

- 11.17 Lotte Confectionery Co., Ltd.

- 11.18 Mary's Gone Crackers

- 11.19 Meiji Holdings Co., Ltd.

- 11.20 Mondelez International, Inc.

- 11.21 Nairn's Oatcakes Limited

- 11.22 Nestle S.A.

- 11.23 Orion Corporation

- 11.24 Parle Products Pvt. Ltd.

- 11.25 PepsiCo, Inc. (Frito-Lay)

- 11.26 Ryvita Company Limited (ABF)

- 11.27 Snyder's-Lance, Inc. (Campbell Soup Company)

- 11.28 United Biscuits (pladis)

- 11.29 Walkers Shortbread Ltd.

- 11.30 Yildiz Holding (Ulker)