|

市場調查報告書

商品編碼

1750430

牙科顯微外科市場機會、成長動力、產業趨勢分析及 2025 - 2034 年預測Dental Microsurgery Market Opportunity, Growth Drivers, Industry Trend Analysis, and Forecast 2025 - 2034 |

||||||

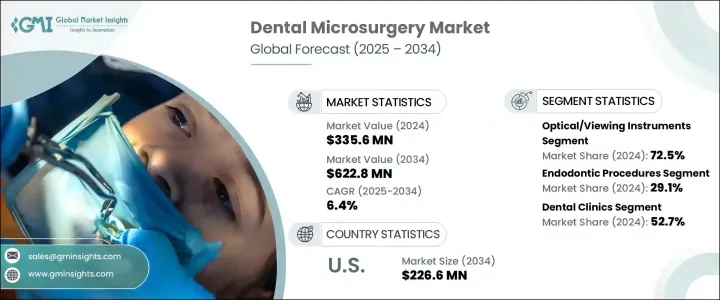

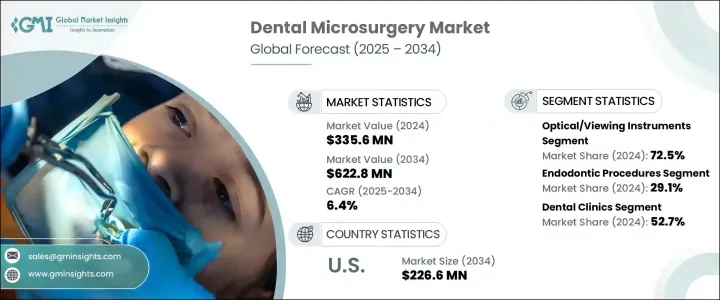

2024年,全球牙科顯微外科市場規模達3.356億美元,預估年複合成長率為6.4%,到2034年將達到6.228億美元。該市場將採用先進的外科技術進行精準手術,同時最大程度地減少組織損傷並縮短癒合時間。此領域高度依賴手術顯微鏡、微型器械和精細縫線等專用工具,以實現精細的放大手術。全球老齡化人口的不斷成長對該市場的擴張發揮著重要作用,因為牙齦萎縮、牙齒脫落和慢性牙周炎等與年齡相關的牙科疾病需要高度精準的外科手術干預。此外,齲齒和牙周炎等口腔健康問題的增加也加劇了對牙科顯微外科的需求。

口腔衛生不良、不健康的飲食習慣以及糖尿病和高血壓等慢性疾病的盛行率上升等因素,都顯著加劇了口腔健康問題的惡化。這些因素不僅加速了蛀牙、牙周炎和牙齦疾病等疾病的發展,也使這些問題變得更加棘手。隨著這些口腔健康問題在全球範圍內持續上升,對精準、高效、恢復時間更快的先進外科手術解決方案的需求也日益成長。牙科顯微外科手術已成為許多專業人士的首選,因為它能夠進行高度可控的微創手術,並具有更好的視覺清晰度,這在複雜病例中尤其重要。

| 市場範圍 | |

|---|---|

| 起始年份 | 2024 |

| 預測年份 | 2025-2034 |

| 起始值 | 3.356億美元 |

| 預測值 | 6.228億美元 |

| 複合年成長率 | 6.4% |

2024年,光學和觀察儀器市場佔72.5%的佔有率。牙科手術顯微鏡、放大鏡和內視鏡對於提高手術精確度和臨床療效至關重要。這些設備可以增強放大倍率和照明效果,使醫生能夠觀察複雜的細節,從而改善診斷並減少錯誤。高清影像和人體工學設計等創新技術正在加速這些工具的普及,尤其是在根管治療領域。

市場的另一個關鍵驅動力是牙髓治療領域,該領域在2024年佔據了最大的市場佔有率,達到29.1%。牙髓壞死和根尖周圍疾病的增加使得根管治療等精準干預措施成為必要,從而推動了該領域對顯微外科手術的需求。先進的顯微外科可視化輔助設備的使用提高了這些治療的成功率,從而引發了市場日益成長的興趣。

美國牙科顯微外科市場在2024年創收1.236億美元,預計2034年將達到2.266億美元。根尖手術和牙周再生等先進手術的需求不斷成長是推動其成長的主要動力。這些服務在美國,尤其是在老齡化人口中的高普及率,進一步加速了市場的成長。隨著越來越多的牙科專業人士採用顯微外科技術,預計美國市場將繼續在全球市場中佔據主導地位。

該行業的主要參與者包括 B. Braun Melsungen、Dentsply Sirona、MediThinQ、Microsurgery Instruments、Kerr、Global Surgical、Henry Schein、Peter LAZIC、Zeiss International、Microsurgical Technology、Zut Biomet、Institut Straumann、Hu-Friedy 和 Danaher。牙科顯微外科市場的公司為鞏固其地位而採用的關鍵策略包括不斷創新先進的手術器械、更加注重方便用戶使用型設計以及擴展其產品種類以滿足各種牙科手術的需求。此外,與牙科診所和教育機構的合作有助於提高牙科員工的意識和培訓,從而提高市場滲透率。對研發技術和設備的投資進一步增強了他們的競爭優勢,並確保他們在快速發展的市場中始終處於領先地位。

目錄

第1章:方法論與範圍

第2章:執行摘要

第3章:行業洞察

- 產業生態系統分析

- 產業衝擊力

- 成長動力

- 全球牙科疾病盛行率不斷上升

- 全球老齡人口不斷增加

- 微創牙科手術的需求不斷成長

- 牙科手術顯微鏡和視覺化技術的進步

- 產業陷阱與挑戰

- 有限的報銷政策

- 顯微外科設備及手術費用高昂

- 成長動力

- 成長潛力分析

- 監管格局

- 川普政府關稅

- 對貿易的影響

- 貿易量中斷

- 各國應對措施

- 對產業的影響

- 供應方影響(製造成本)

- 主要材料價格波動

- 供應鏈重組

- 生產成本影響

- 需求面影響(消費者成本)

- 價格傳導至終端市場

- 市佔率動態

- 消費者反應模式

- 供應方影響(製造成本)

- 受影響的主要公司

- 策略產業反應

- 供應鏈重組

- 定價和產品策略

- 政策參與

- 展望與未來考慮

- 對貿易的影響

- 技術格局

- 未來市場趨勢

- 差距分析

- 波特的分析

- PESTEL分析

第4章:競爭格局

- 介紹

- 公司市佔率分析

- 公司矩陣分析

- 主要市場參與者的競爭分析

- 競爭定位矩陣

- 策略儀表板

第5章:市場估計與預測:按產品,2021 - 2034 年

- 主要趨勢

- 光學/觀測儀器

- 顯微外科器械

- 其他產品

第6章:市場估計與預測:按程序,2021 - 2034 年

- 主要趨勢

- 牙種植體

- 診斷程序

- 根尖切除術

- 牙周手術

- 根管治療

- 其他程式

第7章:市場估計與預測:依最終用途,2021 - 2034 年

- 主要趨勢

- 牙醫診所

- 醫院

- 其他最終用途

第8章:市場估計與預測:按地區,2021 - 2034 年

- 主要趨勢

- 北美洲

- 美國

- 加拿大

- 歐洲

- 德國

- 英國

- 法國

- 西班牙

- 義大利

- 荷蘭

- 亞太地區

- 中國

- 印度

- 日本

- 澳洲

- 韓國

- 拉丁美洲

- 巴西

- 墨西哥

- 阿根廷

- 中東和非洲

- 沙烏地阿拉伯

- 南非

- 阿拉伯聯合大公國

第9章:公司簡介

- B. Braun Melsungen

- Danaher

- Dentsply Sirona

- Global Surgical

- Henry Schein

- Hu-Friedy

- Institut Straumann

- Kerr

- MediThinQ

- Microsurgery Instruments

- Microsurgical Technology

- Peter LAZIC

- Zeiss International

- Zimmer Biomet

The Global Dental Microsurgery Market was valued at USD 335.6 million in 2024 and is estimated to grow at a 6.4% CAGR, to reach USD 622.8 million by 2034, driven using advanced surgical techniques to perform precise procedures while minimizing tissue damage and enhancing healing times. This field relies heavily on specialized tools such as surgical microscopes, micro-instruments, and fine sutures, allowing detailed, magnified operations. The increasing global aging population plays a significant role in this market's expansion, as age-related dental conditions like gum recession, tooth loss, and chronic periodontitis require highly accurate surgical interventions. Additionally, the rise in oral health issues, including tooth decay and periodontitis, contributes to the demand for dental microsurgery.

Factors such as inadequate oral hygiene, unhealthy dietary habits, and the rising prevalence of chronic conditions like diabetes and hypertension are significantly contributing to the worsening of oral health issues. These factors not only accelerate the development of conditions like tooth decay, periodontitis, and gum disease but also make these issues more challenging. As these oral health problems continue to rise globally, the demand for advanced surgical solutions that offer precision, efficiency, and quicker recovery times is growing. Dental microsurgery has become a preferred choice for many professionals because it allows for highly controlled, minimally invasive procedures with better visual clarity, which is especially important in complex cases.

| Market Scope | |

|---|---|

| Start Year | 2024 |

| Forecast Year | 2025-2034 |

| Start Value | $335.6 Million |

| Forecast Value | $622.8 Million |

| CAGR | 6.4% |

The optical and viewing instruments segment held a 72.5% share in 2024. Dental operating microscopes, loupes, and endoscopes are critical for improving surgical precision and clinical outcomes. These devices enhance magnification and lighting, enabling practitioners to view intricate details, improving diagnosis and reducing errors. Innovations like high-definition imaging and ergonomic designs are accelerating the adoption of these tools, especially for root canal procedures.

Another key driver in the market is the endodontic procedures segment, which accounted for the largest share of USD 29.1% in 2024. The rise in pulp necrosis and periapical diseases necessitates precise interventions like root canal therapy, driving the demand for microsurgery in this area. The use of advanced microsurgical visualization aids has enhanced the success rates of these treatments, leading to growing market interest.

United States Dental Microsurgery Market generated USD 123.6 million in 2024 and is expected to reach USD 226.6 million by 2034. The growing demand for advanced procedures such as root-end surgeries and periodontal regeneration is a major driver of this expansion. The high adoption rates of these services in the U.S., particularly among the aging population, are further accelerating market growth. As more dental professionals embrace microsurgical techniques, the U.S. market is expected to remain a dominant player in the global landscape.

Major players in the industry include B. Braun Melsungen, Dentsply Sirona, MediThinQ, Microsurgery Instruments, Kerr, Global Surgical, Henry Schein, Peter LAZIC, Zeiss International, Microsurgical Technology, Zimmer Biomet, Institut Straumann, Hu-Friedy, and Danaher. Key strategies employed by companies in the Dental Microsurgery Market to strengthen their position include continuous innovation in advanced surgical instruments, increasing their focus on user-friendly designs, and expanding their product offerings to cater to diverse dental procedures. Additionally, partnerships with dental practices and educational institutions help enhance awareness and training of the dental workforce, boosting market penetration. Investment in R&D to develop technologies and devices further strengthens their competitive edge and ensures they remain at the forefront of the rapidly evolving market.

Table of Contents

Chapter 1 Methodology and Scope

- 1.1 Market scope and definitions

- 1.2 Research design

- 1.2.1 Research approach

- 1.2.2 Data collection methods

- 1.3 Base estimates and calculations

- 1.3.1 Base year calculation

- 1.3.2 Key trends for market estimation

- 1.4 Forecast model

- 1.5 Primary research and validation

- 1.5.1 Primary sources

- 1.5.2 Data mining sources

Chapter 2 Executive Summary

- 2.1 Industry 3600 synopsis

Chapter 3 Industry Insights

- 3.1 Industry ecosystem analysis

- 3.2 Industry impact forces

- 3.2.1 Growth drivers

- 3.2.1.1 Growing prevalence of dental disorders globally

- 3.2.1.2 Increasing elderly population worldwide

- 3.2.1.3 Rising demand for minimally invasive dental procedures

- 3.2.1.4 Advancements in dental operating microscopes and visualization technologies

- 3.2.2 Industry pitfalls and challenges

- 3.2.2.1 Limited reimbursement policies

- 3.2.2.2 High cost of microsurgical equipment and procedures

- 3.2.1 Growth drivers

- 3.3 Growth potential analysis

- 3.4 Regulatory landscape

- 3.5 Trump administration tariffs

- 3.5.1 Impact on trade

- 3.5.1.1 Trade volume disruptions

- 3.5.1.2 Country-wise response

- 3.5.2 Impact on the Industry

- 3.5.2.1 Supply-side impact (cost of manufacturing)

- 3.5.2.1.1 Price volatility in key materials

- 3.5.2.1.2 Supply chain restructuring

- 3.5.2.1.3 Production cost implications

- 3.5.2.2 Demand-side impact (cost to consumers)

- 3.5.2.2.1 Price transmission to end markets

- 3.5.2.2.2 Market share dynamics

- 3.5.2.2.3 Consumer response patterns

- 3.5.2.1 Supply-side impact (cost of manufacturing)

- 3.5.3 Key companies impacted

- 3.5.4 Strategic industry responses

- 3.5.4.1 Supply chain reconfiguration

- 3.5.4.2 Pricing and product strategies

- 3.5.4.3 Policy engagement

- 3.5.5 Outlook and future considerations

- 3.5.1 Impact on trade

- 3.6 Technological landscape

- 3.7 Future market trends

- 3.8 Gap analysis

- 3.9 Porter's analysis

- 3.10 PESTEL analysis

Chapter 4 Competitive Landscape, 2024

- 4.1 Introduction

- 4.2 Company market share analysis

- 4.3 Company matrix analysis

- 4.4 Competitive analysis of major market players

- 4.5 Competitive positioning matrix

- 4.6 Strategy dashboard

Chapter 5 Market Estimates and Forecast, By Product, 2021 - 2034 ($ Mn)

- 5.1 Key trends

- 5.2 Optical/viewing instruments

- 5.3 Microsurgical instrumentation

- 5.4 Other products

Chapter 6 Market Estimates and Forecast, By Procedure, 2021 - 2034 ($ Mn)

- 6.1 Key trends

- 6.2 Dental implants

- 6.3 Diagnostic procedures

- 6.4 Apicoectomy

- 6.5 Periodontal surgery

- 6.6 Endodontic procedures

- 6.7 Other procedures

Chapter 7 Market Estimates and Forecast, By End Use, 2021 - 2034 ($ Mn)

- 7.1 Key trends

- 7.2 Dental clinics

- 7.3 Hospitals

- 7.4 Other end use

Chapter 8 Market Estimates and Forecast, By Region, 2021 - 2034 ($ Mn)

- 8.1 Key trends

- 8.2 North America

- 8.2.1 U.S.

- 8.2.2 Canada

- 8.3 Europe

- 8.3.1 Germany

- 8.3.2 UK

- 8.3.3 France

- 8.3.4 Spain

- 8.3.5 Italy

- 8.3.6 Netherlands

- 8.4 Asia Pacific

- 8.4.1 China

- 8.4.2 India

- 8.4.3 Japan

- 8.4.4 Australia

- 8.4.5 South Korea

- 8.5 Latin America

- 8.5.1 Brazil

- 8.5.2 Mexico

- 8.5.3 Argentina

- 8.6 Middle East and Africa

- 8.6.1 Saudi Arabia

- 8.6.2 South Africa

- 8.6.3 UAE

Chapter 9 Company Profiles

- 9.1 B. Braun Melsungen

- 9.2 Danaher

- 9.3 Dentsply Sirona

- 9.4 Global Surgical

- 9.5 Henry Schein

- 9.6 Hu-Friedy

- 9.7 Institut Straumann

- 9.8 Kerr

- 9.9 MediThinQ

- 9.10 Microsurgery Instruments

- 9.11 Microsurgical Technology

- 9.12 Peter LAZIC

- 9.13 Zeiss International

- 9.14 Zimmer Biomet