|

市場調查報告書

商品編碼

1750425

飛機武器運載及投放系統市場機會、成長動力、產業趨勢分析及 2025 - 2034 年預測Aircraft Weapons Carriage and Release System Market Opportunity, Growth Drivers, Industry Trend Analysis, and Forecast 2025 - 2034 |

||||||

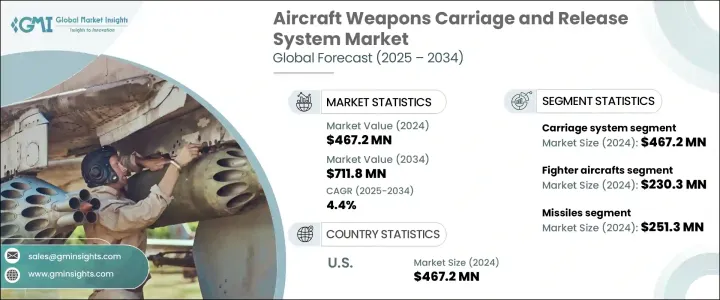

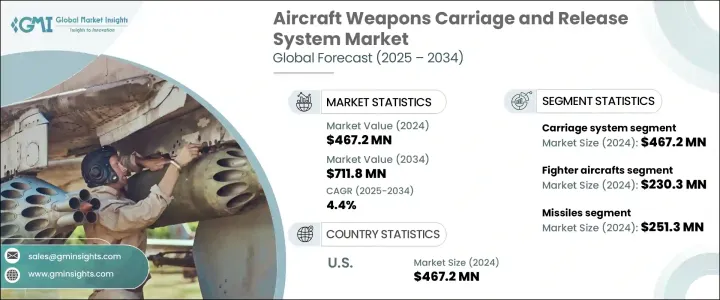

2024年,全球飛機武器運載和釋放系統市場規模達4.672億美元,預計到2034年將以4.4%的複合年成長率成長,達到7.118億美元,這主要得益於對先進軍用飛機需求的不斷成長。軍事開支的增加以及對高性能飛機研發的重視,以及對武器部署能力卓越的飛機的重視,正在推動該市場的擴張。人工智慧、智慧彈藥和精確導引武器的加入,進一步推動了對先進系統的需求,而這些武器都需要日益複雜的運載和釋放系統。

這些先進的運載和投放系統經過精心設計,不僅能確保彈藥在飛行過程中的安全運輸,還能確保在需要時精確可靠地投放。武器投放的精準度至關重要,尤其是在現代軍事行動中,任務的成功往往取決於在各種作戰條件下對各種彈藥的精準投放。無論是空對地、空對空,或是精確打擊,快速且精準地投放武器的能力對任務的成功至關重要。隨著對這些系統的需求不斷變化,尤其是現代作戰場景日益複雜,製造商正致力於整合輕質、高強度的材料,以在不損害結構完整性的情況下提高性能。

| 市場範圍 | |

|---|---|

| 起始年份 | 2024 |

| 預測年份 | 2025-2034 |

| 起始值 | 4.672億美元 |

| 預測值 | 7.118億美元 |

| 複合年成長率 | 4.4% |

市場主要分為兩大解決方案:運載系統和釋放系統。運載系統在2024年的市值為4.672億美元,在飛行過程中安全承載和運輸武器方面發揮著至關重要的作用。這些系統目前正採用鈦合金和複合材料等先進材料,以減輕重量並維持強度,進而提升飛機性能。釋放系統包括機電和氣動裝置,可確保在需要時精確部署武器。模組化設計的創新使其能夠兼容各種彈藥,從而更靈活地適應不同類型的任務。

根據平台,市場細分為戰鬥機、直升機和無人機。 2024年,戰鬥機市場規模達2.303億美元。現代第五代戰鬥機需要先進的掛載和釋放系統,能夠同時攜帶內部和外部有效載荷,同時保持隱身能力。這些系統還必須能夠適應空對空和空對地配置之間的快速切換。未來的第六代戰鬥機計畫正在推動人工智慧最佳化系統的開發,這將進一步增強武器排序和負載管理。

2024年,美國飛機武器運載釋放系統市場規模達4.672億美元,其先進國防項目包括下一代戰鬥機和高超音速武器的研發。由於跨軍種的多域作戰,對模組化運載和釋放系統的需求日益成長。此外,《國際武器貿易條例》(ITAR)支持美國國內武器生產的成長,限制了外國對國防領域的參與。

全球飛機武器運載和投放系統市場的主要參與者包括 L3Harris Technologies、Marotta Controls、雷神公司、薩博公司和馬文集團。這些公司專注於開發創新可靠的系統,以滿足不斷變化的軍事應用需求。為了鞏固其在飛機武器運載和投放系統市場的地位,領先的公司正在大力投資研發,以提升其產品的性能。 L3Harris Technologies、雷神公司和 Marotta Controls 等公司正在將先進材料和智慧技術融入其系統,以提高有效載荷能力、減輕重量並提高營運效率。

目錄

第1章:方法論與範圍

第2章:執行摘要

第3章:行業洞察

- 產業生態系統分析

- 川普政府關稅分析

- 對貿易的影響

- 貿易量中斷

- 報復措施

- 對產業的影響

- 供給側影響

- 價格波動

- 供應鏈重組

- 生產成本影響

- 需求面影響

- 價格傳導至終端市場

- 市佔率動態

- 消費者反應模式

- 供給側影響

- 受影響的主要公司

- 策略產業反應

- 供應鏈重組

- 定價和產品策略

- 政策參與

- 展望與未來考慮

- 對貿易的影響

- 產業衝擊力

- 成長動力

- 對先進軍用飛機的需求不斷增加

- 武器系統的技術進步

- 地緣政治緊張局勢和領土爭端加劇

- 無人機系統(UAS)日益受到關注

- 產業陷阱與挑戰

- 開發成本高

- 嚴格的法規核准

- 成長動力

- 成長潛力分析

- 監管格局

- 技術格局

- 未來市場趨勢

- 差距分析

- 波特的分析

- PESTEL分析

第4章:競爭格局

- 介紹

- 公司市佔率分析

- 主要市場參與者的競爭分析

- 競爭定位矩陣

- 策略儀表板

第5章:市場估計與預測:依解,2021-2034 年

- 主要趨勢

- 運輸系統

- 發布系統

第6章:市場估計與預測:依平台,2021-2034

- 主要趨勢

- 戰鬥機

- 直升機

- 無人機

第7章:市場估計與預測:依武器類型,2021-2034

- 主要趨勢

- 炸彈

- 飛彈

- 火箭隊

第8章:市場估計與預測:按地區,2021 年至 2034 年

- 主要趨勢

- 北美洲

- 美國

- 加拿大

- 歐洲

- 德國

- 英國

- 法國

- 西班牙

- 義大利

- 荷蘭

- 亞太地區

- 中國

- 印度

- 日本

- 澳洲

- 韓國

- 拉丁美洲

- 巴西

- 墨西哥

- 阿根廷

- 中東和非洲

- 沙烏地阿拉伯

- 南非

- 阿拉伯聯合大公國

第9章:公司簡介

- ARESIA

- L3Harris Technologies, Inc.

- The Marvin Group

- Defsys Solutions Pvt. Ltd.

- Marotta Controls, Inc.

- Groupe Chevrillon

- ORDTECH INDUSTRIES

- Eaton

- Raytheon Company

- TERMA

- Saab AB

- Moog Inc.

- RUAG Group

- Ferra

The Global Aircraft Weapons Carriage and Release System Market was valued at USD 467.2 million in 2024 and is estimated to grow at a CAGR of 4.4% to reach USD 711.8 million by 2034, driven by the increasing demand for advanced military aircraft. The rise in military spending and the focus on developing high-performance aircraft with superior weapon deployment capabilities are contributing to the expansion of this market. The demand for advanced systems is being further propelled by the incorporation of AI, smart munitions, and precision-guided weapons, all of which require increasingly sophisticated carriage and release systems.

These advanced carriage and release systems are meticulously engineered to not only ensure the safe transport of munitions during flight but also to guarantee their precise and reliable release when required. Precision in weapon release is critical, especially for modern military operations, where the success of missions often hinges on the accurate deployment of a wide range of munitions under varied combat conditions. Whether for air-to-ground, air-to-air, or even precision strikes, the ability to quickly and accurately release weapons plays a vital role in mission success. As the demands on these systems continue to evolve, particularly with the increasing complexity of modern combat scenarios, manufacturers are focusing on integrating lightweight, high-strength materials to enhance performance without compromising structural integrity.

| Market Scope | |

|---|---|

| Start Year | 2024 |

| Forecast Year | 2025-2034 |

| Start Value | $467.2 Million |

| Forecast Value | $711.8 Million |

| CAGR | 4.4% |

The market is divided into two key solutions: carriage systems and release systems. The carriage system, which was valued at USD 467.2 million in 2024, plays a vital role in securely holding and transporting weapons during flight. These systems are now using advanced materials like titanium and composites to reduce weight while maintaining strength, which in turn boosts aircraft performance. Release systems, which include electromechanical and pneumatic mechanisms, ensure the precise deployment of weapons when needed. Innovations in modular designs allow compatibility with various munitions, making these systems more versatile for different types of missions.

Based on platforms, the market is segmented into fighter aircraft, helicopters, and UAVs. The fighter aircraft segment generated USD 230.3 million in 2024. Modern 5th-generation fighters require advanced carriage and release systems capable of carrying both internal and external payloads while maintaining stealth capabilities. These systems must also be adaptable to handle the rapid switch between air-to-air and air-to-ground configurations. Future 6th-generation fighter programs are pushing the development of AI-optimized systems, which could further enhance weapon sequencing and load management.

U.S. Aircraft Weapons Carriage and Release System Market generated USD 467.2 million in 2024, with its advanced defense programs, such as the development of next-generation fighter jets and hypersonic weapons. The demand for modular carriage and release systems is increasing due to multi-domain operations across various military branches. Additionally, the International Traffic in Arms Regulations (ITAR) support the growth of domestic production in the U.S., limiting foreign involvement in the defense sector.

Key players in the Global Aircraft Weapons Carriage and Release System Market include L3Harris Technologies, Marotta Controls, Raytheon Company, Saab AB, and The Marvin Group. These companies are focusing on developing innovative and reliable systems that meet the evolving needs of military applications. To strengthen their position in the aircraft weapons carriage and release system market, leading companies are investing heavily in research and development to enhance the performance of their products. Companies like L3Harris Technologies, Raytheon, and Marotta Controls are incorporating advanced materials and smart technologies into their systems to improve payload capacity, reduce weight, and increase operational efficiency.

Table of Contents

Chapter 1 Methodology and Scope

- 1.1 Market scope and definitions

- 1.2 Research design

- 1.2.1 Research approach

- 1.2.2 Data collection methods

- 1.3 Base estimates and calculations

- 1.3.1 Base year calculation

- 1.3.2 Key trends for market estimation

- 1.4 Forecast model

- 1.5 Primary research and validation

- 1.5.1 Primary sources

- 1.5.2 Data mining sources

Chapter 2 Executive Summary

- 2.1 Industry 3600 synopsis

Chapter 3 Industry Insights

- 3.1 Industry ecosystem analysis

- 3.2 Trump administration tariffs analysis

- 3.2.1 Impact on trade

- 3.2.1.1 Trade volume disruptions

- 3.2.1.2 Retaliatory measures

- 3.2.2 Impact on the industry

- 3.2.2.1 Supply-side impact

- 3.2.2.1.1 Price volatility

- 3.2.2.1.2 Supply chain restructuring

- 3.2.2.1.3 Production cost implications

- 3.2.2.2 Demand-side impact

- 3.2.2.2.1 Price transmission to end markets

- 3.2.2.2.2 Market share dynamics

- 3.2.2.2.3 Consumer response patterns

- 3.2.2.1 Supply-side impact

- 3.2.3 Key companies impacted

- 3.2.4 Strategic industry responses

- 3.2.4.1 Supply chain reconfiguration

- 3.2.4.2 Pricing and product strategies

- 3.2.4.3 Policy engagement

- 3.2.5 Outlook and future considerations

- 3.2.1 Impact on trade

- 3.3 Industry impact forces

- 3.3.1 Growth drivers

- 3.3.1.1 Increasing demand for advanced military aircraft

- 3.3.1.2 Technological advancements in weapons systems

- 3.3.1.3 Rising geopolitical tensions and territorial disputes

- 3.3.1.4 Growing focus on unmanned aerial systems (UAS)

- 3.3.2 Industry pitfalls and challenges

- 3.3.2.1 High development costs

- 3.3.2.2 Stringent regulatory approvals

- 3.3.1 Growth drivers

- 3.4 Growth potential analysis

- 3.5 Regulatory landscape

- 3.6 Technology landscape

- 3.7 Future market trends

- 3.8 Gap analysis

- 3.9 Porter's analysis

- 3.10 PESTEL analysis

Chapter 4 Competitive Landscape, 2024

- 4.1 Introduction

- 4.2 Company market share analysis

- 4.3 Competitive analysis of major market players

- 4.4 Competitive positioning matrix

- 4.5 Strategy dashboard

Chapter 5 Market Estimates & Forecast, By Solution, 2021-2034 (USD Million & Units)

- 5.1 Key trends

- 5.2 Carriage system

- 5.3 Release system

Chapter 6 Market Estimates & Forecast, By Platform, 2021-2034 (USD Million & Units)

- 6.1 Key trends

- 6.2 Fighter aircrafts

- 6.3 Helicopter

- 6.4 UAV

Chapter 7 Market Estimates & Forecast, By Weapon Type, 2021-2034 (USD Million & Units)

- 7.1 Key trends

- 7.2 Bomb

- 7.3 Missile

- 7.4 Rockets

Chapter 8 Market Estimates and Forecast, By Region, 2021 – 2034 (USD Million & Units)

- 8.1 Key trends

- 8.2 North America

- 8.2.1 U.S.

- 8.2.2 Canada

- 8.3 Europe

- 8.3.1 Germany

- 8.3.2 UK

- 8.3.3 France

- 8.3.4 Spain

- 8.3.5 Italy

- 8.3.6 Netherlands

- 8.4 Asia Pacific

- 8.4.1 China

- 8.4.2 India

- 8.4.3 Japan

- 8.4.4 Australia

- 8.4.5 South Korea

- 8.5 Latin America

- 8.5.1 Brazil

- 8.5.2 Mexico

- 8.5.3 Argentina

- 8.6 Middle East and Africa

- 8.6.1 Saudi Arabia

- 8.6.2 South Africa

- 8.6.3 UAE

Chapter 9 Company Profiles

- 9.1 ARESIA

- 9.2 L3Harris Technologies, Inc.

- 9.3 The Marvin Group

- 9.4 Defsys Solutions Pvt. Ltd.

- 9.5 Marotta Controls, Inc.

- 9.6 Groupe Chevrillon

- 9.7 ORDTECH INDUSTRIES

- 9.8 Eaton

- 9.9 Raytheon Company

- 9.10 TERMA

- 9.11 Saab AB

- 9.12 Moog Inc.

- 9.13 RUAG Group

- 9.14 Ferra