|

市場調查報告書

商品編碼

1750422

光纖雷射器市場機會、成長動力、產業趨勢分析及2025-2034年預測Fiber Laser Market Opportunity, Growth Drivers, Industry Trend Analysis, and Forecast 2025 - 2034 |

||||||

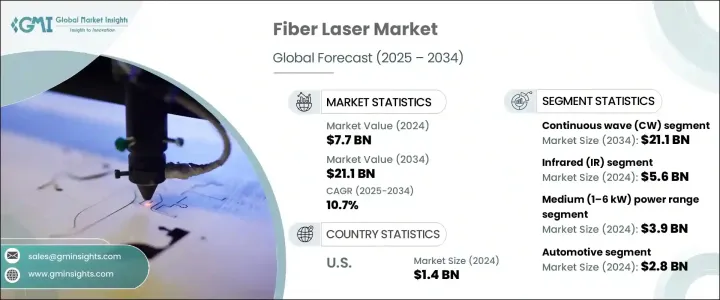

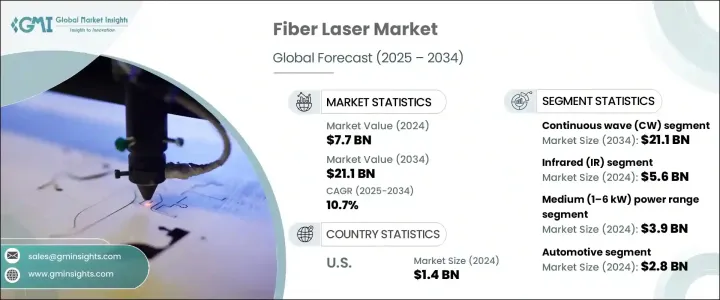

2024年,全球光纖雷射器市場規模達77億美元,預計到2034年將以10.7%的複合年成長率成長,達到211億美元。這得歸功於汽車、航太、電子和醫療等各行各業對光纖雷射的日益普及。市場對高精度、節能、低維護雷射系統的需求推動市場的發展。此外,電動車(EV)的興起和製造技術的進步也促進了光纖雷射市場的擴張。

與傳統雷射系統相比,光纖雷射具有許多優勢,例如更高的光束品質、更高的效率以及處理各種材料的能力。這些特性使其成為切割、焊接和打標等對精度和速度要求高的應用的理想選擇。光纖雷射的多功能性使其能夠應用於各種波長,包括紅外線 (IR)、紫外線 (UV) 和可見光,從而滿足特定的工業需求。連續波 (CW) 光纖雷射器市場預計將佔據主導地位,因為它們適用於高功率應用,並且能夠以更快的速度處理厚材料。

| 市場範圍 | |

|---|---|

| 起始年份 | 2024 |

| 預測年份 | 2025-2034 |

| 起始值 | 77億美元 |

| 預測值 | 211億美元 |

| 複合年成長率 | 10.7% |

2024年,紅外線 (IR) 光纖雷射器市場規模達到56億美元,憑藉其在眾多工業應用中的適應性和卓越性能,繼續保持主導地位。紅外線光纖雷射在焊接、熔覆和高速切割等重型金屬加工製程中尤其有效。其輸出功率高達30千瓦,加上卓越的光束質量,能夠深度穿透金屬,確保獲得乾淨、精確的加工效果。這些特性使其成為航太和電動車製造等高需求領域的必備技術,因為這些領域的精度、耐用性和性能至關重要。

2024年,中功率(1-6千瓦)光纖雷射器市場規模達39億美元,反映出製造商對高性能和低能耗的強烈需求。這類雷射在精度和價格之間實現了切實的平衡,尤其適用於汽車鈑金加工、中型航太加工和高級3D列印。它們在電動車電池托盤和結構部件製造中的應用,有助於快速生產並最大程度地減少材料浪費。隨著輕質金屬和高性能合金在製造業中的日益普及,中功率光纖雷射為可擴展、清潔的加工提供了理想的解決方案。

2024年,美國光纖雷射器市場規模達14億美元。美國高度重視研發,加上其先進的製造能力,支撐著光纖雷射市場的成長。政府在國防、醫療技術和電子等領域的舉措和投資進一步推動了對光纖雷射系統的需求。專注於高功率工業雷射和用於半導體應用的超快雷射的公司在市場擴張中發揮重要作用。

全球光纖雷射市場的主要參與者包括通快 (TRUMPF)、相干公司 (Coherent Corporation)、恩萊特 (nLIGHT, Inc.)、Lumentum Operations LLC 和 IPG Photonics Corporation。這些公司走在創新的前沿,不斷開發新技術以滿足各行各業不斷變化的需求。他們的策略包括擴大產品組合、增強技術能力以及探索新應用,以保持市場競爭優勢。為了鞏固市場地位,光纖雷射產業的公司正在採取幾項關鍵策略。首先,他們大力投資研發,以創新和提高產品性能。這包括開發具有更高功率輸出、更好光束品質和更高能效的雷射。其次,各公司正在建立策略夥伴關係,以擴大市場範圍並進入新的客戶群。

目錄

第1章:方法論與範圍

第2章:執行摘要

第3章:行業洞察

- 產業生態系統分析

- 產業衝擊力

- 成長動力

- 電動車和輕質材料需求不斷成長

- 航太和國防應用的成長

- 5G與消費性電子產品的擴展

- 工業自動化與智慧製造

- 產業陷阱與挑戰

- 初始成本高

- 技術複雜性

- 成長動力

- 成長潛力分析

- 監管格局

- 技術格局

- 未來市場趨勢

- 差距分析

- 波特的分析

- PESTEL分析

第4章:競爭格局

- 介紹

- 公司市佔率分析

- 主要市場參與者的競爭分析

- 競爭定位矩陣

- 策略儀表板

第5章:市場估計與預測:按系統,2021 - 2034 年

- 主要趨勢

- 連續波(CW)光纖雷射器

- 脈衝光纖雷射

- 其他

第6章:市場估計與預測:依波長,2021 - 2034

- 主要趨勢

- 紅外線(IR)

- 紫外線(UV)

- 可見波長

- 中紅外線

第7章:市場估計與預測:依功率範圍,2021 - 2034 年

- 主要趨勢

- 低(≤1 kW)

- 中(1-6千瓦)

- 高(>6千瓦)

第8章:市場估計與預測:按應用,2021 - 2034 年

- 主要趨勢

- 汽車

- 航太

- 電子產品

- 醫療的

- 能源

- 其他

第9章:市場估計與預測:按地區,2021 - 2034 年

- 主要趨勢

- 北美洲

- 美國

- 加拿大

- 歐洲

- 德國

- 英國

- 法國

- 西班牙

- 義大利

- 荷蘭

- 亞太地區

- 中國

- 印度

- 日本

- 澳洲

- 韓國

- 拉丁美洲

- 巴西

- 墨西哥

- 阿根廷

- 中東和非洲

- 沙烏地阿拉伯

- 南非

- 阿拉伯聯合大公國

第10章:公司簡介

- IPG Photonics Corporation

- TRUMPF

- Coherent Corp.

- nLIGHT, Inc.

- Lumentum Operations LLC

- Thorlabs, Inc.

- Wuhan Raycus Fiber Laser Technologies Co., Ltd.

- FANUC CORPORATION

- EO Technics Co., Ltd.

- Laserax

- Fujikura Ltd.

- AdValue Photonics

- Keopsys Group

- Calmar Laser

- Laser Photonics

- NKT Photonics A/S

- LUMIBIRD

The Global Fiber Laser Market was valued at USD 7.7 billion in 2024 and is estimated to grow at a CAGR of 10.7% to reach USD 21.1 billion by 2034, driven by the increasing adoption of fiber lasers across various industries, including automotive, aerospace, electronics, and medical sectors. The demand for high-precision, energy-efficient, and low-maintenance laser systems propels the market forward. Additionally, the rise of electric vehicles (EVs) and advancements in manufacturing technologies are contributing to the expansion of the fiber laser market.

Fiber lasers offer several advantages over traditional laser systems, such as higher beam quality, greater efficiency, and the ability to process a wide range of materials. These characteristics make them ideal for applications requiring precision and speed, such as cutting, welding, and marking. The versatility of fiber lasers allows them to be used in various wavelengths, including infrared (IR), ultraviolet (UV), and visible light, catering to specific industrial needs. The continuous wave (CW) fiber lasers segment is expected to dominate the market due to their suitability for high-power applications and their ability to process thick materials at faster speeds.

| Market Scope | |

|---|---|

| Start Year | 2024 |

| Forecast Year | 2025-2034 |

| Start Value | $7.7 Billion |

| Forecast Value | $21.1 Billion |

| CAGR | 10.7% |

The infrared (IR) fiber laser market reached USD 5.6 billion in 2024, maintaining its dominant position due to its adaptability and strong performance in vast industrial applications. IR fiber lasers are especially effective in heavy-duty metalworking processes such as welding, cladding, and high-speed cutting. Their ability to deliver high output power, reaching up to 30 kW, combined with excellent beam quality, allows for deep penetration into metals, ensuring clean, precise results. These features make them an essential technology in high-demand sectors like aerospace and electric vehicle manufacturing, where accuracy, durability, and performance are paramount.

The medium-power (1-6 kW) segment of the fiber laser market stood at USD 3.9 billion in 2024, reflecting strong demand from manufacturers seeking optimal performance without excessive power consumption. These lasers strike a practical balance between precision and affordability, making them particularly attractive for automotive sheet metal processing, mid-scale aerospace work, and advanced 3D printing. Their application in fabricating EV battery trays and structural components supports rapid production with minimal material waste. As lightweight metals and high-performance alloys become more common in manufacturing, medium-power fiber lasers offer the ideal solution for scalable, clean processing.

United States Fiber Laser Market was valued at USD 1.4 billion in 2024. The country's strong focus on research and development, coupled with its advanced manufacturing capabilities, supports the growth of the fiber laser market. Government initiatives and investments in sectors such as defense, medical technology, and electronics further drive the demand for fiber laser systems. Companies specializing in high-power industrial and ultrafast lasers for semiconductor applications play a significant role in the market's expansion.

Key players in the Global Fiber Laser Market include TRUMPF, Coherent Corporation, nLIGHT, Inc., Lumentum Operations LLC, and IPG Photonics Corporation. These companies are at the forefront of innovation, continuously developing new technologies to meet the evolving needs of various industries. Their strategies involve expanding product portfolios, enhancing technological capabilities, and exploring new applications to maintain a competitive edge in the market. To strengthen their market position, companies in the fiber laser industry are adopting several key strategies. First, they are investing heavily in research and development to innovate and improve the performance of their products. This includes developing lasers with higher power outputs, better beam quality, and greater energy efficiency. Second, companies are forming strategic partnerships and collaborations to expand their market reach and access new customer segments.

Table of Contents

Chapter 1 Methodology and Scope

- 1.1 Market scope and definitions

- 1.2 Research design

- 1.2.1 Research approach

- 1.2.2 Data collection methods

- 1.3 Base estimates and calculations

- 1.3.1 Base year calculation

- 1.3.2 Key trends for market estimation

- 1.4 Forecast model

- 1.5 Primary research and validation

- 1.5.1 Primary sources

- 1.5.2 Data mining sources

Chapter 2 Executive Summary

- 2.1 Industry 3600 synopsis

Chapter 3 Industry Insights

- 3.1 Industry ecosystem analysis

- 3.2 Industry impact forces

- 3.2.1 Growth drivers

- 3.2.1.1 Rising demand for electric vehicles (evs) and lightweight materials

- 3.2.1.2 Growth in aerospace and defense applications

- 3.2.1.3 Expansion of 5g and consumer electronics

- 3.2.1.4 Industrial automation and smart manufacturing

- 3.2.2 Industry pitfalls and challenges

- 3.2.2.1 High initial costs

- 3.2.2.2 Technical complexity

- 3.2.1 Growth drivers

- 3.3 Growth potential analysis

- 3.4 Regulatory landscape

- 3.5 Technology landscape

- 3.6 Future market trends

- 3.7 Gap analysis

- 3.8 Porter's analysis

- 3.9 PESTEL analysis

Chapter 4 Competitive Landscape, 2024

- 4.1 Introduction

- 4.2 Company market share analysis

- 4.3 Competitive analysis of major market players

- 4.4 Competitive positioning matrix

- 4.5 Strategy dashboard

Chapter 5 Market Estimates & Forecast, By System, 2021 - 2034 (USD Million & Thousand Units)

- 5.1 Key trends

- 5.2 Continuous wave (CW) fiber lasers

- 5.3 Pulsed fiber lasers

- 5.4 Others

Chapter 6 Market Estimates & Forecast, By Wavelength, 2021 - 2034 (USD Million & Thousand Units)

- 6.1 Key trends

- 6.2 Infrared (IR)

- 6.3 Ultraviolet (UV)

- 6.4 Visible wavelength

- 6.5 Mid-infrared

Chapter 7 Market Estimates & Forecast, By Power Range, 2021 - 2034 (USD Million & Thousand Units)

- 7.1 Key trends

- 7.2 Low (≤1 kW)

- 7.3 Medium (1–6 kW)

- 7.4 High (>6 kW)

Chapter 8 Market Estimates & Forecast, By Application, 2021 - 2034 (USD Million & Thousand Units)

- 8.1 Key trends

- 8.2 Automotive

- 8.3 Aerospace

- 8.4 Electronics

- 8.5 Medical

- 8.6 Energy

- 8.7 Others

Chapter 9 Market Estimates and Forecast, By Region, 2021 - 2034 (USD Million & Thousand Units)

- 9.1 Key trends

- 9.2 North America

- 9.2.1 U.S.

- 9.2.2 Canada

- 9.3 Europe

- 9.3.1 Germany

- 9.3.2 UK

- 9.3.3 France

- 9.3.4 Spain

- 9.3.5 Italy

- 9.3.6 Netherlands

- 9.4 Asia Pacific

- 9.4.1 China

- 9.4.2 India

- 9.4.3 Japan

- 9.4.4 Australia

- 9.4.5 South Korea

- 9.5 Latin America

- 9.5.1 Brazil

- 9.5.2 Mexico

- 9.5.3 Argentina

- 9.6 Middle East and Africa

- 9.6.1 Saudi Arabia

- 9.6.2 South Africa

- 9.6.3 UAE

Chapter 10 Company Profiles

- 10.1 IPG Photonics Corporation

- 10.2 TRUMPF

- 10.3 Coherent Corp.

- 10.4 nLIGHT, Inc.

- 10.5 Lumentum Operations LLC

- 10.6 Thorlabs, Inc.

- 10.7 Wuhan Raycus Fiber Laser Technologies Co., Ltd.

- 10.8 FANUC CORPORATION

- 10.9 EO Technics Co., Ltd.

- 10.10 Laserax

- 10.11 Fujikura Ltd.

- 10.12 AdValue Photonics

- 10.13 Keopsys Group

- 10.14 Calmar Laser

- 10.15 Laser Photonics

- 10.16 NKT Photonics A/S

- 10.17 LUMIBIRD