|

市場調查報告書

商品編碼

1750418

人工智慧訓練資料集市場機會、成長動力、產業趨勢分析及 2025 - 2034 年預測AI Training Dataset Market Opportunity, Growth Drivers, Industry Trend Analysis, and Forecast 2025 - 2034 |

||||||

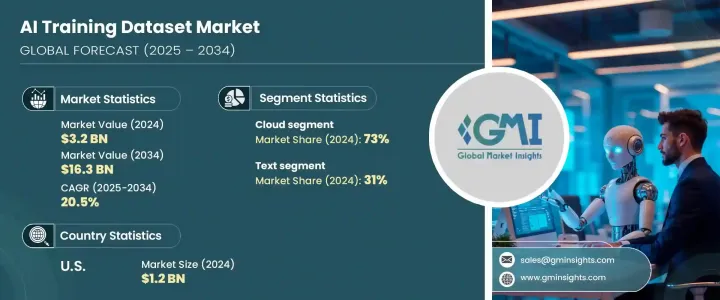

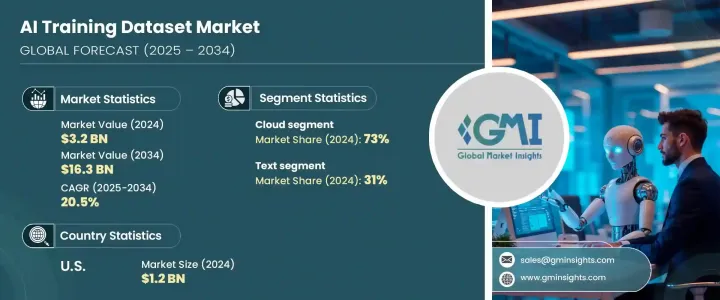

2024年,全球人工智慧訓練資料集市場規模達32億美元,預計到2034年將以20.5%的複合年成長率成長,達到163億美元,這得益於各行各業對人工智慧日益成長的依賴。隨著人工智慧應用的日益先進,對精準、高品質標註資料集的需求也日益凸顯。從機器人、醫療保健到金融和自動化,企業都在整合人工智慧,以簡化營運流程並減少對人工的依賴。這種轉變加劇了對精準訓練資料的需求,以建立能夠在現實環境中運行的模型,尤其是在生物醫學研究和工業自動化等高風險應用中。

隨著各行各業努力提升營運效率和預測能力,對客製化資料集的需求持續成長。客製化、特定領域的資料對於訓練必須在高度專業化的環境中精準運行的人工智慧系統至關重要。無論是最佳化供應鏈物流、實現更智慧的醫療診斷,或是改善自主導航,組織都需要不僅規模龐大、標籤準確且與情境相關的資料集。隨著人工智慧模型日益複雜,對高品質、結構化且無偏見資料的需求也變得愈發重要。客製化資料集有助於縮短模型訓練時間、提高準確性,並確保人工智慧解決方案能夠適應實際環境。

| 市場範圍 | |

|---|---|

| 起始年份 | 2024 |

| 預測年份 | 2025-2034 |

| 起始值 | 32億美元 |

| 預測值 | 163億美元 |

| 複合年成長率 | 20.5% |

2024年,以文字內容為基礎的資料集以31%的市佔率領先市場,預計到2034年將以21%的複合年成長率成長。這一領域的主導地位源自於自然語言處理在商業智慧、通訊工具和客戶互動平台中的廣泛應用。數位通訊的蓬勃發展創造了大量的原始文字內容,各組織現在正在將這些內容轉換為適合訓練基於語言的人工智慧模型的結構化格式。高階語言模型的成長進一步擴大了對高品質、多語言文本資料集的需求。

2024年,基於雲端的部署領域佔據了73%的佔有率,這歸功於其靈活性、可擴展性和成本效益。雲端解決方案提供了豐富的資源,用於儲存、管理和標記大量資料,同時支援遠端協作以及與高級資料處理工具的無縫整合。這些功能對於組織建立複雜的AI系統並保持敏捷運作至關重要。此外,雲端服務提供的安全性、可存取性和適應性使其成為處理訓練資料集的首選。

2024年,美國人工智慧訓練資料集市場佔據88%的市場佔有率,產值達12.3億美元。美國強大的技術基礎設施、早期的人工智慧應用以及大量的公共和私營部門投資,為資料訓練領域的創新創造了良好的環境。聯邦政府的資助以及產學合作也有助於促進市場成長。

市場的主要參與者包括TELUS International、IBM、亞馬遜網路服務、Lionbridge AI、CloudFactory、Google、微軟、NVIDIA、Appen和iMerit。為了增強競爭優勢,人工智慧訓練資料集市場中的公司專注於幾項核心策略。許多公司正在大力投資用於資料標記和合成資料生成的自動化工具,以降低成本並提高效率。與學術機構和研究實驗室的策略合作有助於擴大對多樣化和專業化資料集的存取。企業也正在採用垂直特定的資料解決方案,以滿足醫療保健、汽車和零售等領域日益成長的需求。

目錄

第1章:方法論與範圍

第2章:執行摘要

第3章:行業洞察

- 產業生態系統分析

- 供應商格局

- 資料發起者/收集者

- 數據聚合器和市場

- 資料註釋和標籤服務提供者

- 技術和基礎設施提供商

- 最終用戶

- 利潤率分析

- 川普政府關稅

- 對貿易的影響

- 貿易量中斷

- 其他國家的報復措施

- 對產業的影響

- 主要材料價格波動

- 供應鏈重組

- 資料模態成本影響

- 受影響的主要公司

- 策略產業反應

- 供應鏈重組

- 定價和資料模式策略

- 展望與未來考慮

- 對貿易的影響

- 技術與創新格局

- 專利分析

- 重要新聞和舉措

- 監管格局

- 衝擊力

- 成長動力

- 各行各業對人工智慧和機器學習的採用日益增多

- 電腦視覺和自然語言處理 (NLP) 應用的成長

- 資料註釋外包激增

- 自動駕駛汽車和機器人技術的進步

- 增加對人工智慧新創公司和基礎設施的投資

- 產業陷阱與挑戰

- 資料標記的成本高且耗時

- 資料隱私和安全問題

- 成長動力

- 成長潛力分析

- 波特的分析

- PESTEL分析

第4章:競爭格局

- 介紹

- 公司市佔率分析

- 競爭定位矩陣

- 戰略展望矩陣

第5章:市場估計與預測:依資料形態,2021 - 2034 年

- 主要趨勢

- 文字

- 影像

- 音訊和語音

- 影片

- 多式聯運

第6章:市場估計與預測:依部署模式,2021 - 2034 年

- 主要趨勢

- 本地

- 雲

第7章:市場估計與預測:依資料類型,2021 - 2034 年

- 主要趨勢

- 結構化資料

- 非結構化資料

- 半結構化資料

第8章:市場估計與預測:依資料蒐集方法,2021 - 2034 年

- 主要趨勢

- 公共資料集

- 私有資料集

- 合成資料

第9章:市場估計與預測:依最終用途,2021 - 2034 年

- 主要趨勢

- 衛生保健

- 汽車

- 金融服務業

- 零售與電子商務

- IT和電信

- 政府和國防

- 製造業

- 其他

第10章:市場估計與預測:按地區,2021 - 2034 年

- 主要趨勢

- 北美洲

- 美國

- 加拿大

- 歐洲

- 英國

- 德國

- 法國

- 義大利

- 西班牙

- 俄羅斯

- 北歐人

- 亞太地區

- 中國

- 印度

- 日本

- 韓國

- 澳新銀行

- 東南亞

- 拉丁美洲

- 巴西

- 墨西哥

- 阿根廷

- MEA

- 阿拉伯聯合大公國

- 沙烏地阿拉伯

- 南非

第 11 章:公司簡介

- Amazon Web Services

- Appen

- Clickworker

- CloudFactory

- Cogito Tech

- DataLoop

- Dataturks

- IBM

- iMerit

- Innodata

- Lionbridge AI

- LXT

- Microsoft

- NVIDIA

- Sama

- Scale AI

- TELUS International

- TransPerfect

- Trillium Data

The Global AI Training Dataset Market was valued at USD 3.2 billion in 2024 and is estimated to grow at a CAGR of 20.5% to reach USD 16.3 billion by 2034, fueled by the increasing reliance on artificial intelligence across multiple sectors. As AI applications become more advanced, the need for precise and high-quality labeled datasets becomes increasingly critical. From robotics and healthcare to finance and automation, businesses are integrating AI to streamline operations and reduce human dependency. This shift intensifies the need for accurate training data to build models capable of navigating real-world environments, especially in high-stakes applications like biomedical research and industrial automation.

The demand for tailored datasets continues to rise, as industries strive to enhance operational efficiency and predictive capabilities. Customized, domain-specific data is becoming essential for training AI systems that must operate with precision in highly specialized environments. Whether it's optimizing supply chain logistics, enabling smarter healthcare diagnostics, or improving autonomous navigation, organizations require datasets that are not only large but also accurately labeled and contextually relevant. As AI models become more complex, the need for high-quality, structured, and unbiased data grows even more critical. Tailored datasets help reduce model training time, increase accuracy, and ensure AI solutions are adaptable to real-world conditions.

| Market Scope | |

|---|---|

| Start Year | 2024 |

| Forecast Year | 2025-2034 |

| Start Value | $3.2 Billion |

| Forecast Value | $16.3 Billion |

| CAGR | 20.5% |

In 2024, datasets based on textual content led the market with a 31% share and are expected to grow at a CAGR of 21% through 2034. The dominance of this segment stems from the wide adoption of natural language processing in business intelligence, communication tools, and customer interaction platforms. The boom in digital communications has created an abundance of raw textual content, which organizations are now converting into structured formats suitable for training language-based AI models. The growth of advanced language models has only amplified the requirement for high-quality, multilingual text datasets.

The cloud-based deployment segment held a 73% share in 2024, attributed to its flexibility, scalability, and cost-efficiency. Cloud solutions offer extensive resources for storing, managing, and labeling enormous data volumes while enabling remote collaboration and seamless integration with advanced tools for data processing. These features are essential for organizations to build sophisticated AI systems while maintaining agile operations. Moreover, the security, accessibility, and adaptability provided by cloud services continue to make them the preferred choice for handling training datasets.

United States AI Training Dataset Market held 88% share in 2024, generating USD 1.23 billion. The country's strong technological infrastructure, early AI adoption, and substantial private and public sector investment have created an environment conducive to innovation in data training. Federal funding and collaborative efforts between academia and industry help foster market growth.

Key players in the market include TELUS International, IBM, Amazon Web Services, Lionbridge AI, CloudFactory, Google, Microsoft, NVIDIA, Appen, and iMerit. To enhance their competitive edge, companies in the AI training dataset market focus on several core strategies. Many are investing heavily in automation tools for data labeling and synthetic data generation to cut costs and improve efficiency. Strategic collaborations with academic institutions and research labs are helping expand access to diverse and specialized datasets. Firms are also adopting vertical-specific data solutions to meet the rising demand in sectors such as healthcare, automotive, and retail.

Table of Contents

Chapter 1 Methodology & Scope

- 1.1 Research design

- 1.1.1 Research approach

- 1.1.2 Data collection methods

- 1.2 Base estimates and calculations

- 1.2.1 Base year calculation

- 1.2.2 Key trends for market estimates

- 1.3 Forecast model

- 1.4 Primary research & validation

- 1.4.1 Primary sources

- 1.4.2 Data mining sources

- 1.5 Market definitions

Chapter 2 Executive Summary

- 2.1 Industry 3600 synopsis, 2021 - 2034

Chapter 3 Industry Insights

- 3.1 Industry ecosystem analysis

- 3.2 Supplier landscape

- 3.2.1 Data originators/collectors

- 3.2.2 Data aggregators & marketplaces

- 3.2.3 Data annotation & labeling service providers

- 3.2.4 Technology & infrastructure providers

- 3.2.5 End-users

- 3.3 Profit margin analysis

- 3.4 Trump administration tariffs

- 3.4.1 Impact on trade

- 3.4.1.1 Trade volume disruptions

- 3.4.1.2 Retaliatory measures by other countries

- 3.4.2 Impact on the industry

- 3.4.2.1 Price Volatility in key materials

- 3.4.2.2 Supply chain restructuring

- 3.4.2.3 Data Modality cost implications

- 3.4.3 Key companies impacted

- 3.4.4 Strategic industry responses

- 3.4.4.1 Supply chain reconfiguration

- 3.4.4.2 Pricing and Data Modality strategies

- 3.4.5 Outlook and future considerations

- 3.4.1 Impact on trade

- 3.5 Technology & innovation landscape

- 3.6 Patent analysis

- 3.7 Key news & initiatives

- 3.8 Regulatory landscape

- 3.9 Impact forces

- 3.9.1 Growth drivers

- 3.9.1.1 Rising adoption of AI and machine learning across industries

- 3.9.1.2 Growth of computer vision and natural language processing (NLP) applications

- 3.9.1.3 Surge in data annotation outsourcing

- 3.9.1.4 Advancements in autonomous vehicles and robotics

- 3.9.1.5 Increasing investment in AI startups and infrastructure

- 3.9.2 Industry pitfalls & challenges

- 3.9.2.1 High cost and time-intensive nature of data labeling

- 3.9.2.2 Data privacy and security concerns

- 3.9.1 Growth drivers

- 3.10 Growth potential analysis

- 3.11 Porter's analysis

- 3.12 PESTEL analysis

Chapter 4 Competitive Landscape, 2024

- 4.1 Introduction

- 4.2 Company market share analysis

- 4.3 Competitive positioning matrix

- 4.4 Strategic outlook matrix

Chapter 5 Market Estimates & Forecast, By Data Modality, 2021 - 2034 ($Bn)

- 5.1 Key trends

- 5.2 Text

- 5.3 Image

- 5.4 Audio & speech

- 5.5 Video

- 5.6 Multimodal

Chapter 6 Market Estimates & Forecast, By Deployment Mode, 2021 - 2034 ($Bn)

- 6.1 Key trends

- 6.2 On-premises

- 6.3 Cloud

Chapter 7 Market Estimates & Forecast, By Data Type, 2021 - 2034 ($Bn)

- 7.1 Key trends

- 7.2 Structured data

- 7.3 Unstructured data

- 7.4 Semi-structured data

Chapter 8 Market Estimates & Forecast, By Data Collection Method, 2021 - 2034 ($Bn)

- 8.1 Key trends

- 8.2 Public datasets

- 8.3 Private datasets

- 8.4 Synthetic data

Chapter 9 Market Estimates & Forecast, By End Use, 2021 - 2034 ($Bn)

- 9.1 Key trends

- 9.2 Healthcare

- 9.3 Automotive

- 9.4 BFSI

- 9.5 Retail & e-commerce

- 9.6 IT and telecom

- 9.7 Government and defense

- 9.8 Manufacturing

- 9.9 Others

Chapter 10 Market Estimates & Forecast, By Region, 2021 - 2034 ($Bn)

- 10.1 Key trends

- 10.2 North America

- 10.2.1 U.S.

- 10.2.2 Canada

- 10.3 Europe

- 10.3.1 UK

- 10.3.2 Germany

- 10.3.3 France

- 10.3.4 Italy

- 10.3.5 Spain

- 10.3.6 Russia

- 10.3.7 Nordics

- 10.4 Asia Pacific

- 10.4.1 China

- 10.4.2 India

- 10.4.3 Japan

- 10.4.4 South Korea

- 10.4.5 ANZ

- 10.4.6 Southeast Asia

- 10.5 Latin America

- 10.5.1 Brazil

- 10.5.2 Mexico

- 10.5.3 Argentina

- 10.6 MEA

- 10.6.1 UAE

- 10.6.2 Saudi Arabia

- 10.6.3 South Africa

Chapter 11 Company Profiles

- 11.1 Amazon Web Services

- 11.2 Appen

- 11.3 Clickworker

- 11.4 CloudFactory

- 11.5 Cogito Tech

- 11.6 DataLoop

- 11.7 Dataturks

- 11.8 Google

- 11.9 IBM

- 11.10 iMerit

- 11.11 Innodata

- 11.12 Lionbridge AI

- 11.13 LXT

- 11.14 Microsoft

- 11.15 NVIDIA

- 11.16 Sama

- 11.17 Scale AI

- 11.18 TELUS International

- 11.19 TransPerfect

- 11.20 Trillium Data