|

市場調查報告書

商品編碼

1750415

非公路電動車零件市場機會、成長動力、產業趨勢分析及 2025 - 2034 年預測Off-highway EV Component Market Opportunity, Growth Drivers, Industry Trend Analysis, and Forecast 2025 - 2034 |

||||||

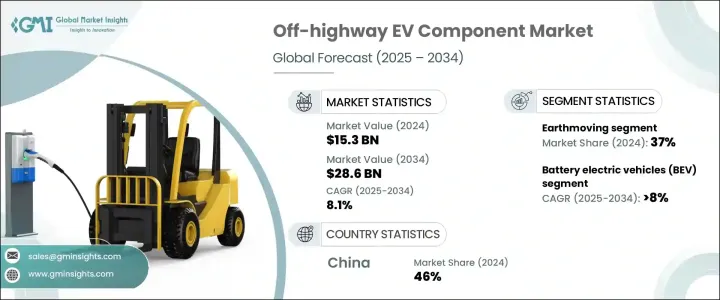

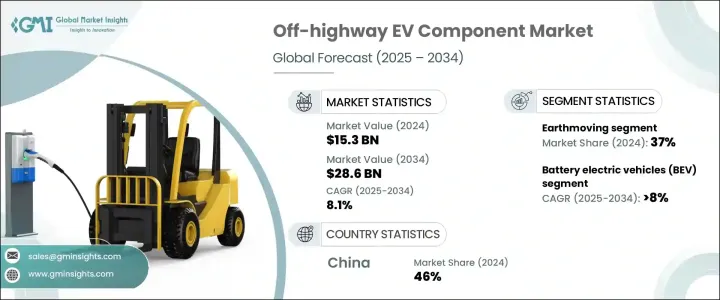

2024年,全球非公路用電動車零件市場規模達153億美元,預計到2034年將以8.1%的複合年成長率成長,達到286億美元,這得益於建築、採礦和農業機械向電氣化轉型的加速。隨著各行各業優先考慮採用更清潔的替代傳統內燃機,電動設備因其減少排放、降低油耗和降低維護成本的優勢而日益受到青睞。監管規定、排放控制法規以及日益增強的環保意識正迫使原始設備製造商投資電動解決方案。此外,政府和私營部門正在大力投資智慧基礎設施和綠色發展,這進一步增加了對非公路用電動車零件的需求。

採用裝載機、推土機和起重機等電動設備對於減少大型城市發展和基礎設施項目的環境足跡至關重要。除了電氣化之外,預測性診斷、車隊互聯和智慧遠端資訊處理等數位技術的整合正在重新定義非公路用車領域的營運效率。這些進步推動了對專為惡劣高負載環境量身定做的高度專業化電子元件的需求。具備遠端監控和即時資料功能的設備能夠支援更佳的正常運作時間和生命週期成本控制,進而幫助車隊營運商最佳化現場作業績效。

| 市場範圍 | |

|---|---|

| 起始年份 | 2024 |

| 預測年份 | 2025-2034 |

| 起始值 | 153億美元 |

| 預測值 | 286億美元 |

| 複合年成長率 | 8.1% |

在應用類別中,土方機械在2024年佔據最大佔有率,達到37%,這得益於電動挖土機、裝載機及類似設備在不同專案現場的廣泛使用。土方機械因其穩定的使用模式以及在排放管制區域內作業的需求日益成長,非常適合電氣化。原始設備製造商和系統供應商正在推出下一代電池組、電動傳動系統和冷卻系統,以滿足公共和私人專案日益成長的需求。

2024年,純電動車 (BEV) 佔據了非公路用電動車零件市場的最大佔有率,達到66%,這得益於其零廢氣排放的特性,這在當今倡導綠色建築和採礦作業的背景下是一項重要優勢。由於油耗更低、機械複雜性降低以及維修需求極低,BEV 還具有營運效率和長期成本效益。它們與隧道、人口密集的城市施工現場和室內農業設施等封閉或受限環境的兼容性進一步提升了其實用性。 BEV 的安靜運行也使其在噪音管制環境中越來越受歡迎,從而支持其在多個非公路用車領域中得到更廣泛的應用。

2024年,中國非公路用電動車零件市場佔46%的市場佔有率,產值達32.5億美元,這得益於國家持續推行的旨在減少工業排放和提高設備效率的政策。中國擁有先進的製造能力,尤其是在電池生產和電動動力總成技術方面,能夠大規模供應高性能電動車零件。中國完善的電動車基礎設施,加上其在農業、採礦業和建築業的廣泛部署,將繼續鞏固其領先地位,並加速該地區整體市場的擴張。

為了鞏固市場地位,塔塔Elxsi、沃爾沃集團、小松、利勃海爾和迪爾公司等公司正專注於垂直整合和長期合作。對下一代電池系統、電力電子和數位平台的策略性投資使這些公司能夠引領電氣化趨勢。與技術提供者的合作以及共同開發客製化解決方案,使這些公司能夠滿足特定行業的需求,同時保持成本競爭力。

目錄

第1章:方法論與範圍

第2章:執行摘要

第3章:行業洞察

- 產業生態系統分析

- 供應商格局

- 原物料供應商

- 一級汽車供應商

- 專業非公路系統整合商

- 非公路車輛OEM

- 技術提供者

- 利潤率分析

- 川普政府關稅

- 對貿易的影響

- 貿易量中斷

- 其他國家的報復措施

- 對產業的影響

- 主要材料價格波動

- 供應鏈重組

- 生產成本影響

- 受影響的主要公司

- 策略產業反應

- 供應鏈重組

- 定價和產品策略

- 展望與未來考慮

- 對貿易的影響

- 技術與創新格局

- 價格趨勢

- 地區

- 成分

- 成本細分分析

- 專利分析

- 重要新聞和舉措

- 監管格局

- 衝擊力

- 成長動力

- 世界各國政府正在實施越來越嚴格的法規來遏制溫室氣體排放

- 建築、採礦和農業設備的電氣化

- 電池和馬達技術的進步

- 增加對智慧城市、採礦自動化和機械化農業的投資

- OEM和一級供應商合作

- 產業陷阱與挑戰

- 初始購買成本高

- 電池技術限制

- 成長動力

- 成長潛力分析

- 波特的分析

- PESTEL分析

第4章:競爭格局

- 介紹

- 公司市佔率分析

- 競爭定位矩陣

- 戰略展望矩陣

第5章:市場估計與預測:按組件,2021 - 2034 年

- 主要趨勢

- 電池組

- 電動機

- 控制器

- 逆變器

- 電力電子

- 熱管理系統

- 車用充電器

- 電動輔助轉向系統

- 其他

第6章:市場估計與預測:以推進方式,2021 - 2034 年

- 主要趨勢

- 純電動車(BEV)

- 插電式混合動力車(PHEV)

- 混合動力電動車(HEV)

- 燃料電池電動車(FCEV)

第7章:市場估計與預測:按應用,2021 - 2034 年

- 主要趨勢

- 物料處理

- 土方工程

- 收穫

- 運輸和拖運

- 鑽孔和爆破

第8章:市場估計與預測:依車型,2021 - 2034 年

- 主要趨勢

- 電動工程車輛

- 挖土機

- 推土機

- 裝載機

- 電動農用車

- 聯結機

- 收割機

- 噴霧器

- 電動採礦車

- 運輸卡車

- 鑽頭

- 其他

第9章:市場估計與預測:依銷售管道,2021 - 2034 年

- 主要趨勢

- 原始設備製造商(OEM)

- 售後市場

第10章:市場估計與預測:按地區,2021 - 2034 年

- 主要趨勢

- 北美洲

- 美國

- 加拿大

- 歐洲

- 英國

- 德國

- 法國

- 義大利

- 西班牙

- 俄羅斯

- 北歐人

- 亞太地區

- 中國

- 印度

- 日本

- 韓國

- 澳新銀行

- 東南亞

- 拉丁美洲

- 巴西

- 墨西哥

- 阿根廷

- MEA

- 阿拉伯聯合大公國

- 沙烏地阿拉伯

- 南非

第 11 章:公司簡介

- Bell Equipment

- Caterpillar

- CNH Industrial

- Dana

- Deere & Company

- Doosan

- Epiroc

- Hitachi Construction Machinery

- JCB

- Komatsu

- Kubota

- Liebherr

- Manitou Group

- Sandvik

- Sona Comstar

- Sumitomo Heavy Industries

- Tata AutoComp

- Tata Elxsi

- Terex

- Volvo AB

The Global Off-highway EV Component Market was valued at USD 15.3 billion in 2024 and is estimated to grow at a CAGR of 8.1% to reach USD 28.6 billion by 2034, fueled by the accelerating transition toward electrified construction, mining, and agricultural machinery. As industries prioritize cleaner alternatives to traditional combustion engines, electric-powered equipment is gaining traction for reduced emissions, lower fuel consumption, and minimized maintenance costs. Regulatory mandates, emission control laws, and rising environmental awareness are pressuring original equipment manufacturers to invest in electric solutions. Additionally, governments and private sectors are investing heavily in smart infrastructure and green development, further increasing the demand for off-highway EV components.

The adoption of electric equipment such as loaders, dozers, and cranes is essential in reducing the environmental footprint of major urban development and infrastructure projects. Beyond electrification, the integration of digital technologies-such as predictive diagnostics, fleet connectivity, and smart telematics-is redefining operational efficiency in off-highway segments. These advancements fuel demand for highly specialized electronic components tailored for rugged, high-duty environments. Equipment with remote monitoring and real-time data capabilities supports better uptime and lifecycle cost control, helping fleet operators optimize performance in field operations.

| Market Scope | |

|---|---|

| Start Year | 2024 |

| Forecast Year | 2025-2034 |

| Start Value | $15.3 Billion |

| Forecast Value | $28.6 Billion |

| CAGR | 8.1% |

Among application categories, the earthmoving segment captured the largest share in 2024, accounting for 37% share, driven by the high usage of electric excavators, loaders, and similar equipment across diverse project sites. Earthmoving machinery is well-suited for electrification, given its consistent usage patterns and the increasing need to operate in emission-regulated zones. OEMs and system suppliers are responding with next-gen battery packs, electric drivetrains, and cooling systems to meet growing demand in both public and private projects.

In 2024, battery electric vehicles (BEVs) captured the largest portion in the off-highway EV component market, making up 66% share, driven by their ability to operate without tailpipe emissions, a major advantage in today's push for greener construction and mining operations. BEVs also offer operational efficiency and long-term cost benefits, thanks to lower fuel consumption, reduced mechanical complexity, and minimal maintenance requirements. Their compatibility with closed or restricted environments, such as tunnels, dense urban job sites, and indoor agriculture facilities, further enhances their utility. The quiet operation of BEVs also makes them increasingly favored in noise-regulated environments, supporting broader adoption across multiple off-highway sectors.

China Off-highway EV Component Market held 46% share and generated USD 3.25 billion in 2024, underpinned by consistent support from national policies aimed at reducing industrial emissions and improving equipment efficiency. With advanced manufacturing capabilities, especially in battery production and electric powertrain technologies, China supplies high-performance EV components at scale. The nation's comprehensive EV infrastructure, combined with widespread deployment across agriculture, mining, and construction sectors, continues to reinforce its leadership and accelerate the region's overall market expansion.

To reinforce their market positions, companies such as Tata Elxsi, Volvo AB, Komatsu, Liebherr, and Deere & Company are focusing on vertical integration and long-term collaborations. Strategic investments in next-gen battery systems, power electronics, and digital platforms enable these firms to lead electrification trends. Partnerships with tech providers and co-development of customized solutions allow these players to cater to sector-specific needs while maintaining cost competitiveness.

Table of Contents

Chapter 1 Methodology & Scope

- 1.1 Research design

- 1.1.1 Research approach

- 1.1.2 Data collection methods

- 1.2 Base estimates and calculations

- 1.2.1 Base year calculation

- 1.2.2 Key trends for market estimates

- 1.3 Forecast model

- 1.4 Primary research & validation

- 1.4.1 Primary sources

- 1.4.2 Data mining sources

- 1.5 Market definitions

Chapter 2 Executive Summary

- 2.1 Industry 3600 synopsis, 2021 - 2034

Chapter 3 Industry Insights

- 3.1 Industry ecosystem analysis

- 3.2 Supplier landscape

- 3.2.1 Raw material suppliers

- 3.2.2 Tier 1 automotive suppliers

- 3.2.3 Specialized off-highway system integrators

- 3.2.4 Off-highway vehicle OEM

- 3.2.5 Technology providers

- 3.3 Profit margin analysis

- 3.4 Trump administration tariffs

- 3.4.1 Impact on trade

- 3.4.1.1 Trade volume disruptions

- 3.4.1.2 Retaliatory measures by other countries

- 3.4.2 Impact on the industry

- 3.4.2.1 Price Volatility in key materials

- 3.4.2.2 Supply chain restructuring

- 3.4.2.3 Production cost implications

- 3.4.3 Key companies impacted

- 3.4.4 Strategic industry responses

- 3.4.4.1 Supply chain reconfiguration

- 3.4.4.2 Pricing and product strategies

- 3.4.5 Outlook and future considerations

- 3.4.1 Impact on trade

- 3.5 Technology & innovation landscape

- 3.6 Price trends

- 3.6.1 Region

- 3.6.2 Component

- 3.7 Cost breakdown analysis

- 3.8 Patent analysis

- 3.9 Key news & initiatives

- 3.10 Regulatory landscape

- 3.11 Impact forces

- 3.11.1 Growth drivers

- 3.11.1.1 Governments worldwide are implementing increasingly strict regulations to curb greenhouse gas emissions

- 3.11.1.2 Electrification of construction, mining & agriculture equipment

- 3.11.1.3 Advancements in battery & motor technologies

- 3.11.1.4 Increased investments in smart cities, mining automation, and mechanized agriculture

- 3.11.1.5 OEM & tier-1 supplier collaborations

- 3.11.2 Industry pitfalls & challenges

- 3.11.2.1 High initial purchase cost

- 3.11.2.2 Battery technology limitations

- 3.11.1 Growth drivers

- 3.12 Growth potential analysis

- 3.13 Porter's analysis

- 3.14 PESTEL analysis

Chapter 4 Competitive Landscape, 2024

- 4.1 Introduction

- 4.2 Company market share analysis

- 4.3 Competitive positioning matrix

- 4.4 Strategic outlook matrix

Chapter 5 Market Estimates & Forecast, By Component, 2021 - 2034 ($Bn, Units)

- 5.1 Key trends

- 5.2 Battery packs

- 5.3 Electric motors

- 5.4 Controllers

- 5.5 Inverters

- 5.6 Power electronics

- 5.7 Thermal management systems

- 5.8 Onboard chargers

- 5.9 Electric power steering systems

- 5.10 Others

Chapter 6 Market Estimates & Forecast, By Propulsion, 2021 - 2034 ($Bn, Units)

- 6.1 Key trends

- 6.2 Battery electric vehicles (BEV)

- 6.3 Plug-in hybrid electric vehicles (PHEV)

- 6.4 Hybrid electric vehicles (HEV)

- 6.5 Fuel cell electric vehicles (FCEV)

Chapter 7 Market Estimates & Forecast, By Application, 2021 - 2034 ($Bn, Units)

- 7.1 Key trends

- 7.2 Material handling

- 7.3 Earthmoving

- 7.4 Harvesting

- 7.5 Transport & hauling

- 7.6 Drilling & blasting

Chapter 8 Market Estimates & Forecast, By Vehicle, 2021 - 2034 ($Bn, Units)

- 8.1 Key trends

- 8.2 Electric construction vehicles

- 8.2.1 Excavators

- 8.2.2 Bulldozers

- 8.2.3 Loaders

- 8.3 Electric agricultural vehicles

- 8.3.1 Tractors

- 8.3.2 Harvesters

- 8.3.3 Sprayers

- 8.4 Electric mining vehicles

- 8.4.1 Haul trucks

- 8.4.2 Drills

- 8.5 Others

Chapter 9 Market Estimates & Forecast, By Sales Channel, 2021 - 2034 ($Bn, Units)

- 9.1 Key trends

- 9.2 Original Equipment Manufacturers (OEM)

- 9.3 Aftermarket

Chapter 10 Market Estimates & Forecast, By Region, 2021 - 2034 ($Bn, Units)

- 10.1 Key trends

- 10.2 North America

- 10.2.1 U.S.

- 10.2.2 Canada

- 10.3 Europe

- 10.3.1 UK

- 10.3.2 Germany

- 10.3.3 France

- 10.3.4 Italy

- 10.3.5 Spain

- 10.3.6 Russia

- 10.3.7 Nordics

- 10.4 Asia Pacific

- 10.4.1 China

- 10.4.2 India

- 10.4.3 Japan

- 10.4.4 South Korea

- 10.4.5 ANZ

- 10.4.6 Southeast Asia

- 10.5 Latin America

- 10.5.1 Brazil

- 10.5.2 Mexico

- 10.5.3 Argentina

- 10.6 MEA

- 10.6.1 UAE

- 10.6.2 Saudi Arabia

- 10.6.3 South Africa

Chapter 11 Company Profiles

- 11.1 Bell Equipment

- 11.2 Caterpillar

- 11.3 CNH Industrial

- 11.4 Dana

- 11.5 Deere & Company

- 11.6 Doosan

- 11.7 Epiroc

- 11.8 Hitachi Construction Machinery

- 11.9 JCB

- 11.10 Komatsu

- 11.11 Kubota

- 11.12 Liebherr

- 11.13 Manitou Group

- 11.14 Sandvik

- 11.15 Sona Comstar

- 11.16 Sumitomo Heavy Industries

- 11.17 Tata AutoComp

- 11.18 Tata Elxsi

- 11.19 Terex

- 11.20 Volvo AB