|

市場調查報告書

商品編碼

1750356

儀表資料管理系統市場機會、成長動力、產業趨勢分析及 2025 - 2034 年預測Meter Data Management System Market Opportunity, Growth Drivers, Industry Trend Analysis, and Forecast 2025 - 2034 |

||||||

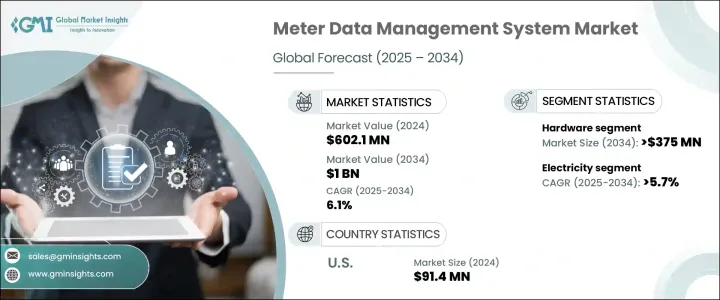

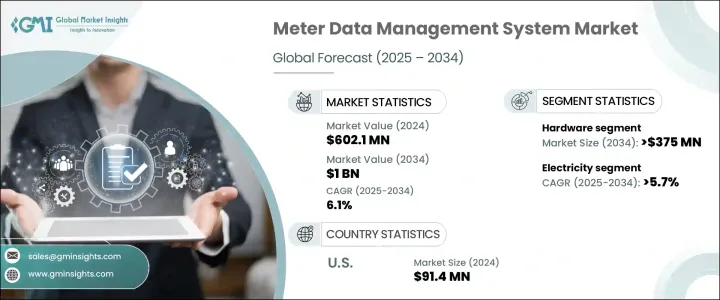

2024 年全球電錶資料管理系統市場規模為 6.021 億美元,預估年複合成長率為 6.1%,到 2034 年將達到 10 億美元。這主要得益於對更智慧能源解決方案日益成長的需求,包括先進智慧電網系統的整合和智慧電錶的日益普及,這些因素正在推動市場擴張。 MDMS 系統對於簡化智慧電錶資料的收集、處理和管理至關重要,可協助公用事業公司最佳化其基礎設施並提高營運效率。此外,提高能源效率和永續性的推動,特別是透過歐盟能源效率指令和美國智慧電網投資激勵措施等監管措施,正在推動對能夠即時監控和分析的複雜計量系統的需求。

MDMS 的實施對於公用事業公司管理大量資料(用於計費、負載分析和增強客戶參與度)也至關重要。人工智慧 (AI) 和機器學習 (ML) 被引入 MDMS,正在推動預測性維護、客戶服務和業務分析的改進。這些技術使公用事業公司能夠更有效地回應能源需求,最大限度地降低成本,並確保電網的可靠性。隨著產業的不斷發展,智慧計量基礎設施與先進通訊技術的融合預計將進一步推動該市場的成長。

| 市場範圍 | |

|---|---|

| 起始年份 | 2024 |

| 預測年份 | 2025-2034 |

| 起始值 | 6.021億美元 |

| 預測值 | 10億美元 |

| 複合年成長率 | 6.1% |

預計到2034年,電錶資料管理系統市場硬體部分規模將達到3.75億美元,這得益於對即時監控和電網可靠性日益成長的需求。隨著智慧電網的普及,公用事業公司正在大力投資支持這些系統所需的組件。智慧電錶、資料集中器和通訊模組等關鍵元件對於高效的資料傳輸、更快的響應速度以及提高能源網路的整體效率至關重要。這些硬體組件的整合對於確保平穩運行和準確的資料收集至關重要,而這對於公用事業公司滿足日益成長的能源需求至關重要。

預計電力產業將成為電錶資料管理系統 (MDMS) 市場中成長最快的產業,到 2034 年的複合年成長率將達到 5.7%。隨著全球公用事業公司持續重視能源效率和電網效能,對智慧電錶的需求也日益成長。這些電錶能夠更精確地監控能源使用情況,提高計費準確性,並支援動態定價模型。因此,公用事業公司正在增加對 MDMS 平台的投資,以管理這些智慧電錶產生的大量資料,從而進一步促進市場的成長。持續提升電網可靠性和降低營運成本的努力也推動了對智慧電網技術的投資,加速了 MDMS 解決方案的普及。

2024年,美國電錶資料管理系統市場規模達9,140萬美元,反映出美國能源產業正向先進計量基礎設施(AMI)轉型。隨著即時資料處理需求的不斷成長,AMI系統使公用事業公司能夠快速且準確地收集和分析大量資料。資料量的激增進一步凸顯了MDMS平台的重要性,該平台對於確保公用事業公司能夠應對日益複雜的能源消耗資料管理至關重要。隨著美國在智慧計量技術部署方面持續保持領先地位,MDMS解決方案對於維持能源產業高效營運和改善客戶服務正變得不可或缺。

全球計量資料管理系統 (MDMS) 市場的主要參與者包括 Itron、ABB、施耐德電氣、霍尼韋爾、西門子、Landis+Gyr、Kamstrup 和 Sensus。這些公司不斷創新並擴展其產品組合,以在不斷成長的市場中佔據更大的佔有率。為了鞏固其市場地位,MDMS 領域的公司專注於技術進步和策略合作夥伴關係。 Itron、Kamstrup 和 ABB 等公司正在將人工智慧 (AI) 和機器學習 (ML) 功能整合到其系統中,以提高資料準確性和預測能力。此外,這些公司還透過提供可自訂的解決方案來簡化能源管理並促進即時監控,從而增強客戶關係。

目錄

第1章:方法論與範圍

第2章:執行摘要

第3章:行業洞察

- 產業生態系統分析

- 川普政府關稅分析

- 對貿易的影響

- 貿易量中斷

- 報復措施

- 對產業的影響

- 供給側影響(原料)

- 主要材料價格波動

- 供應鏈重組

- 生產成本影響

- 需求面影響(售價)

- 價格傳導至終端市場

- 市佔率動態

- 消費者反應模式

- 供給側影響(原料)

- 受影響的主要公司

- 策略產業反應

- 供應鏈重組

- 定價和產品策略

- 政策參與

- 展望與未來考慮

- 對貿易的影響

- 監管格局

- 產業衝擊力

- 成長動力

- 產業陷阱與挑戰

- 成長潛力分析

- 波特的分析

- PESTEL分析

第4章:競爭格局

- 戰略儀表板

- 創新與永續發展格局

第5章:市場規模及預測:依組件,2021 - 2034

- 主要趨勢

- 硬體

- 軟體

第6章:市場規模及預測:依公用事業,2021 - 2034 年

- 主要趨勢

- 電

- 氣體

- 水

第7章:市場規模及預測:依應用,2021 - 2034

- 主要趨勢

- 智慧電網

- 微型電網

- 儲能

- 電動車充電

第8章:市場規模及預測:依最終用途,2021 - 2034

- 主要趨勢

- 住宅

- 商業的

- 工業的

第9章:市場規模及預測:按地區,2021 - 2034

- 主要趨勢

- 北美洲

- 美國

- 加拿大

- 歐洲

- 德國

- 英國

- 法國

- 義大利

- 瑞典

- 亞太地區

- 中國

- 日本

- 印度

- 韓國

- 澳洲

- 中東和非洲

- 阿拉伯聯合大公國

- 沙烏地阿拉伯

- 南非

- 埃及

- 拉丁美洲

- 墨西哥

- 巴西

- 阿根廷

第10章:公司簡介

- ABB

- Alcara

- DIEHL

- Eaton

- Genus

- German Metering GmbH

- Honeywell

- ITCPL

- Itron

- Kamstrup

- Landis+Gyr

- Powel

- Procetradi

- Schneider Electric

- Sensus

- Siemens

The Global Meter Data Management System Market was valued at USD 602.1 million in 2024 and is estimated to grow at a CAGR of 6.1% to reach USD 1 billion by 2034, driven by the growing demand for smarter energy solutions, including the integration of advanced smart grid systems and the rising adoption of smart meters, is driving this market's expansion. MDMS systems are critical for streamlining the collection, processing, and management of smart meter data, helping utilities optimize their infrastructure and improve operational efficiency. Furthermore, the push for improved energy efficiency and sustainability, particularly through regulatory measures like the European Union's Energy Efficiency Directive and U.S. smart grid investment incentives, is boosting the demand for sophisticated metering systems that enable real-time monitoring and analytics.

The implementation of MDMS is also pivotal for utilities in managing large amounts of data for billing, load profiling, and enhancing customer engagement. The introduction of artificial intelligence (AI) and machine learning (ML) into MDMS is driving improvements in predictive maintenance, customer service, and business analytics. These technologies enable utilities to respond to energy demands more effectively, minimize costs, and ensure the reliability of energy grids. As the industry continues to evolve, the integration of smart metering infrastructure and advanced communication technologies is expected to further fuel the growth of this market.

| Market Scope | |

|---|---|

| Start Year | 2024 |

| Forecast Year | 2025-2034 |

| Start Value | $602.1 Million |

| Forecast Value | $1 Billion |

| CAGR | 6.1% |

The hardware segment in the meter data management system market is projected to reach USD 375 million by 2034, driven by the increasing demand for real-time monitoring and enhanced grid reliability. As the adoption of smart grids continues to rise, utilities are investing heavily in the necessary components to support these systems. Key elements like smart meters, data concentrators, and communication modules are crucial for efficient data transmission, enabling faster response times and improving the overall efficiency of energy networks. The integration of these hardware components plays a critical role in ensuring smooth operation and accurate data collection, which is vital for utilities to meet growing energy demands.

The electricity sector is expected to see the highest growth within the meter data management system market, with a CAGR of 5.7% through 2034. As utilities worldwide continue to prioritize energy efficiency and grid performance, the demand for smart meters is increasing. These meters enable more precise monitoring of energy usage, enhance billing accuracy, and allow for dynamic pricing models. As a result, utilities are increasingly investing in MDMS platforms to manage the large volumes of data generated by these smart meters, further promoting the growth of the market. The ongoing efforts to improve grid reliability and reduce operational costs are also driving investments in smart grid technologies, accelerating the adoption of MDMS solutions.

U.S. Meter Data Management System Market generated USD 91.4 million in 2024, reflecting the ongoing shift toward advanced metering infrastructure (AMI) in the country's energy sector. With a growing need for real-time data processing, AMI systems are providing utilities with the ability to collect and analyze vast amounts of data quickly and accurately. This surge in data volume further emphasizes the importance of MDMS platforms, which are essential for ensuring that utilities can handle the increased complexity of managing energy consumption data. As the U.S. continues to lead in the deployment of smart metering technologies, MDMS solutions are becoming indispensable for maintaining efficient operations and improving customer service in the energy sector.

Key players in the Global Meter Data Management System Market include Itron, ABB, Schneider Electric, Honeywell, Siemens, Landis+Gyr, Kamstrup, and Sensus. These companies are continually innovating and expanding their product portfolios to capture a larger share of the growing market. To solidify their market presence, companies in the MDMS sector focus on technological advancements and strategic partnerships. Players like Itron, Kamstrup, and ABB are integrating AI and ML capabilities into their systems to improve data accuracy and predictive capabilities. Additionally, these companies are enhancing customer relationships by offering customizable solutions that streamline energy management and facilitate real-time monitoring.

Table of Contents

Chapter 1 Methodology & Scope

- 1.1 Market definitions

- 1.2 Base estimates & calculations

- 1.3 Forecast calculation

- 1.4 Data sources

- 1.4.1 Primary

- 1.4.2 Secondary

- 1.4.2.1 Paid

- 1.4.2.2 Public

Chapter 2 Executive Summary

- 2.1 Industry synopsis, 2021 – 2034

Chapter 3 Industry Insights

- 3.1 Industry ecosystem analysis

- 3.2 Trump administration tariff analysis

- 3.2.1 Impact on trade

- 3.2.1.1 Trade volume disruptions

- 3.2.1.2 Retaliatory measures

- 3.2.2 Impact on the industry

- 3.2.2.1 Supply-side impact (raw materials)

- 3.2.2.1.1 Price volatility in key materials

- 3.2.2.1.2 Supply chain restructuring

- 3.2.2.1.3 Production cost implications

- 3.2.2.2 Demand-side impact (selling price)

- 3.2.2.2.1 Price transmission to end markets

- 3.2.2.2.2 Market share dynamics

- 3.2.2.2.3 Consumer response patterns

- 3.2.2.1 Supply-side impact (raw materials)

- 3.2.3 Key companies impacted

- 3.2.4 Strategic industry responses

- 3.2.4.1 Supply chain reconfiguration

- 3.2.4.2 Pricing and product strategies

- 3.2.4.3 Policy engagement

- 3.2.5 Outlook and future considerations

- 3.2.1 Impact on trade

- 3.3 Regulatory landscape

- 3.4 Industry impact forces

- 3.4.1 Growth drivers

- 3.4.2 Industry pitfalls & challenges

- 3.5 Growth potential analysis

- 3.6 Porter's analysis

- 3.6.1 Bargaining power of suppliers

- 3.6.2 Bargaining power of buyers

- 3.6.3 Threat of new entrants

- 3.6.4 Threat of substitutes

- 3.7 PESTEL analysis

Chapter 4 Competitive Landscape, 2024

- 4.1 Strategic dashboard

- 4.2 Innovation & sustainability landscape

Chapter 5 Market Size and Forecast, By Component, 2021 - 2034 (USD Million)

- 5.1 Key trends

- 5.2 Hardware

- 5.3 Software

Chapter 6 Market Size and Forecast, By Utility, 2021 - 2034 (USD Million)

- 6.1 Key trends

- 6.2 Electricity

- 6.3 Gas

- 6.4 Water

Chapter 7 Market Size and Forecast, By Application, 2021 - 2034 (USD Million)

- 7.1 Key trends

- 7.2 Smart grid

- 7.3 Micro grid

- 7.4 Energy storage

- 7.5 EV charging

Chapter 8 Market Size and Forecast, By End Use, 2021 - 2034 (USD Million)

- 8.1 Key trends

- 8.2 Residential

- 8.3 Commercial

- 8.4 Industrial

Chapter 9 Market Size and Forecast, By Region, 2021 - 2034 (USD Million)

- 9.1 Key trends

- 9.2 North America

- 9.2.1 U.S.

- 9.2.2 Canada

- 9.3 Europe

- 9.3.1 Germany

- 9.3.2 UK

- 9.3.3 France

- 9.3.4 Italy

- 9.3.5 Sweden

- 9.4 Asia Pacific

- 9.4.1 China

- 9.4.2 Japan

- 9.4.3 India

- 9.4.4 South Korea

- 9.4.5 Australia

- 9.5 Middle East & Africa

- 9.5.1 UAE

- 9.5.2 Saudi Arabia

- 9.5.3 South Africa

- 9.5.4 Egypt

- 9.6 Latin America

- 9.6.1 Mexico

- 9.6.2 Brazil

- 9.6.3 Argentina

Chapter 10 Company Profiles

- 10.1 ABB

- 10.2 Alcara

- 10.3 DIEHL

- 10.4 Eaton

- 10.5 Genus

- 10.6 German Metering GmbH

- 10.7 Honeywell

- 10.8 ITCPL

- 10.9 Itron

- 10.10 Kamstrup

- 10.11 Landis+Gyr

- 10.12 Powel

- 10.13 Procetradi

- 10.14 Schneider Electric

- 10.15 Sensus

- 10.16 Siemens