|

市場調查報告書

商品編碼

1750353

聚酮(PK)市場機會、成長動力、產業趨勢分析及2025-2034年預測Polyketone (PK) Market Opportunity, Growth Drivers, Industry Trend Analysis, and Forecast 2025 - 2034 |

||||||

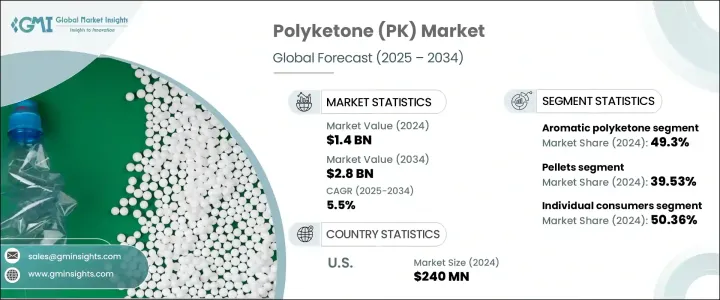

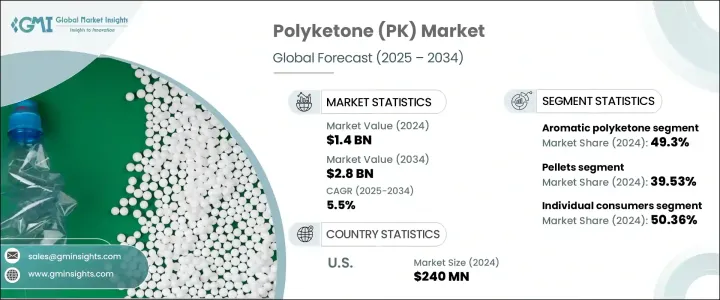

2024年,全球聚酮市場規模達14億美元,預計到2034年將以5.5%的複合年成長率成長,達到28億美元,這得益於各行各業對高性能聚合物的需求不斷成長。這一成長主要源自於人們對先進材料替代品的探索,這些材料具有優異的耐化學性、低吸濕性和更佳的耐磨性。這些特性使聚酮成為聚醯胺和聚甲醛等傳統材料的有力替代品。其應用領域不斷擴展,尤其是在需要滿足嚴格性能和監管標準的材料領域。日益增強的環保意識以及對輕量化、節能解決方案的追求推動了其應用。

聚酮的市場表現強勁,尤其是對耐用性和耐化學性要求較高的領域。像聚酮這樣的輕質聚合物擴大應用於高壓力環境,例如燃油系統和汽車結構部件。它們幫助製造商滿足嚴格的排放標準,同時提升產品性能並減輕車輛總重。聚酮在極端條件下仍能保持機械強度,使其成為傳統工程塑膠的寶貴替代品,尤其是在經常接觸燃料、潤滑劑和高溫的環境中。該材料具有多種形態,例如顆粒、纖維、片材和薄膜,這進一步擴大了其在電子、消費品和運輸等行業的吸引力。

| 市場範圍 | |

|---|---|

| 起始年份 | 2024 |

| 預測年份 | 2025-2034 |

| 起始值 | 14億美元 |

| 預測值 | 28億美元 |

| 複合年成長率 | 5.5% |

2024年,顆粒材料市場佔據了39.53%的市場佔有率,這得益於其易於加工且與擠出和注塑等標準製造流程相容。顆粒材料均勻、吸濕性低且尺寸穩定性優異,能夠精確製造複雜零件。此外,其對腐蝕性化學物質和碳氫化合物的強烈耐受性使其成為暴露於惡劣環境的部件的首選。這些優勢使顆粒材料成為汽車等高要求行業的首選材料,因為這些行業對性能、安全性和合規性的要求至關重要。

同時,消費者對環保替代品的認知推動了個人消費領域的需求,到2024年,這一比例將達到50.36%。人們傾向於在日常用品中使用永續材料,這一趨勢與聚酮的可回收和環保特性相得益彰。消費者觀念的轉變不僅推動了綠色產品的銷售,也鼓勵企業使用高性能永續聚合物來改進現有產品。這種轉變為聚酮在體育用品、穿戴式技術、廚具和個人配件等產品的生產中開闢了新的機會——在這些領域,用戶如今期待環保設計,同時又不犧牲耐用性或功能性。

2024年,美國聚酮 (PK) 市場規模達2.4億美元,並將繼續快速成長,這得益於其強大的產業框架、以創新為核心的發展模式以及對先進材料的旺盛需求。由於電子、航太和汽車行業的蓬勃發展,北美仍然是PK應用的主要中心。當地對永續技術和先進聚合物科學的重視,對鞏固聚酮在該地區的地位發揮重要作用。

聚酮 (PK) 產業的參與者包括 Nexeo Plastics、Ensinger、曉星、三井塑膠和 Avient。為了鞏固市場地位,各公司正大力投資研發,專注於產品創新和拓展應用領域。與汽車和電子行業製造商建立策略合作夥伴關係有助於提升商業應用。企業也在提升供應鏈效率,並引入永續的生產流程。透過開發客製化等級和多元化產品組合,他們正在滿足不斷變化的終端用戶需求,並增強長期競爭力。

目錄

第1章:方法論與範圍

第2章:執行摘要

第3章:行業洞察

- 產業生態系統分析

- 影響價值鏈的因素

- 利潤率分析

- 中斷

- 未來展望

- 製造商

- 經銷商

- 川普政府關稅

- 對貿易的影響

- 貿易量中斷

- 報復措施

- 對產業的影響

- 供應方影響(原料)

- 主要材料價格波動

- 供應鏈重組

- 生產成本影響

- 需求面影響(售價)

- 價格傳導至終端市場

- 市佔率動態

- 消費者反應模式

- 受影響的主要公司

- 策略產業反應

- 供應鏈重組

- 定價和產品策略

- 政策參與

- 展望與未來考慮

- 對貿易的影響

- 貿易統計(HS編碼)

- 主要出口國

- 主要進口國

註:以上貿易統計僅針對重點國家。

- 監管格局

- 衝擊力

- 成長動力

- 汽車產業需求不斷成長

- 電動車(EV)與永續旅行的興起

- 對高性能材料的需求不斷增加

- 產業陷阱與挑戰

- 生產成本高

- 監管和環境問題

- 成長動力

- 政策參與

- 成長潛力分析

- 波特的分析

- PESTEL分析

第4章:競爭格局

- 介紹

- 公司市佔率分析

- 競爭定位矩陣

- 戰略展望矩陣

第5章:市場估計與預測:按類型,2021-2034

- 主要趨勢

- 芳香聚酮

- 脂肪族聚酮

- 共聚物聚酮

第6章:市場估計與預測:依形式,2021-2034

- 主要趨勢

- 顆粒

- 纖維

- 電影

- 工作表

第7章:市場估計與預測:按應用,2021-2034

- 主要趨勢

- 汽車零件

- 電氣和電子產品

- 產業機械

- 消費品

- 塗料和黏合劑

- 醫療器材

- 包裝

- 其他

第8章:市場估計與預測:按地區,2021-2034

- 主要趨勢

- 北美洲

- 美國

- 加拿大

- 歐洲

- 德國

- 英國

- 法國

- 西班牙

- 義大利

- 歐洲其他地區

- 亞太地區

- 中國

- 印度

- 日本

- 澳洲

- 韓國

- 亞太其他地區

- 拉丁美洲

- 巴西

- 墨西哥

- 阿根廷

- 拉丁美洲其他地區

- 中東和非洲

- 沙烏地阿拉伯

- 南非

- 阿拉伯聯合大公國

- 中東和非洲其他地區

第9章:公司簡介

- AKRO-PLASTIC

- Avient

- Distrupol

- Ensinger

- HYOSUNG

- KD Feddersen

- LEHVOSS

- MITSUI PLASTICS

- Nexeo Plastics

- POLYOLS & POLYMERS

- Rochling

- Specialist Engineering Plastics

- Technoform

The Global Polyketone Market was valued at USD 1.4 billion in 2024 and is estimated to grow at a CAGR of 5.5% to reach USD 2.8 billion by 2034 due to increasing demand for high-performance polymers across several industries. This growth is largely fueled by the search for advanced material alternatives that offer superior chemical resistance, low moisture absorption, and improved wear properties. These characteristics position polyketones as a competitive substitute for traditional materials like polyamides and polyoxymethylene. Their applications continue to expand, especially in sectors requiring materials that meet stringent performance and regulatory standards. Rising environmental consciousness and the push for lightweight, fuel-efficient solutions drive adoption.

Polyketone's market performance has been strong, particularly in segments that demand durability and chemical resistance. Lightweight polymers like PK are increasingly used in high-stress environments, such as fuel systems and structural automotive components. They help manufacturers meet strict emissions standards while improving product performance and reducing overall vehicle weight. Polyketone's ability to maintain mechanical strength under extreme conditions makes it a valuable alternative to conventional engineering plastics, especially where exposure to fuels, lubricants, and high temperatures is common. The material's adaptability in various forms-like pellets, fibers, sheets, and films-has further widened its appeal across industries, including electronics, consumer goods, and transportation.

| Market Scope | |

|---|---|

| Start Year | 2024 |

| Forecast Year | 2025-2034 |

| Start Value | $1.4 Billion |

| Forecast Value | $2.8 Billion |

| CAGR | 5.5% |

The pellets segment accounted for 39.53% share in 2024 due to their ease of processing and compatibility with standard manufacturing techniques such as extrusion and injection molding. Their uniformity, low moisture absorption, and excellent dimensional stability allow precision in manufacturing complex parts. Additionally, their strong resistance to harsh chemicals and hydrocarbons makes them a preferred choice for components exposed to aggressive environments. These advantages make pellets the go-to form in demanding sectors like automotive, where performance, safety, and compliance with regulations are non-negotiable.

Meanwhile, consumer awareness of eco-friendly alternatives has pushed demand within the individual consumer segment, representing a 50.36% share in 2024. People lean toward sustainable materials in everyday products, a trend that aligns well with polyketone's recyclable and environmentally conscious profile. The shift in consumer mindset is not only driving sales of green products but also encouraging companies to reformulate existing goods using high-performance sustainable polymers. This shift has opened new opportunities for polyketone in the production of items such as sporting goods, wearable tech, kitchenware, and personal accessories-areas where users are now expecting eco-conscious design without compromising on durability or function.

United States Polyketone (PK) Market was valued at USD 240 million in 2024 and continues to grow rapidly, backed by a robust industrial framework, innovation-focused development, and a high demand for advanced materials. North America remains a major hub for PK applications due to strong activity in the electronics, aerospace, and automotive sectors. Local emphasis on sustainable technologies and advanced polymer science plays a significant role in reinforcing polyketone's presence in the region.

The Polyketone (PK) industry players include Nexeo Plastics, Ensinger, HYOSUNG, MITSUI PLASTICS, and Avient. To secure a stronger position in the market, companies are heavily investing in research and development, focusing on product innovations and expanding application areas. Strategic partnerships with manufacturers across the automotive and electronics sectors help boost commercial adoption. Businesses are also improving supply chain efficiency and introducing sustainable manufacturing processes. By developing custom grades and diversifying product portfolios, they're addressing evolving end-user needs and reinforcing long-term competitiveness.

Table of Contents

Chapter 1 Methodology & Scope

- 1.1 Market scope & definition

- 1.2 Base estimates & calculations

- 1.3 Forecast calculation

- 1.4 Data sources

- 1.4.1 Primary

- 1.4.2 Secondary

- 1.4.2.1 Paid sources

- 1.4.2.2 Public sources

- 1.5 Primary research and validation

- 1.5.1 Primary sources

- 1.5.2 Data mining sources

Chapter 2 Executive Summary

- 2.1 Industry synopsis, 2021-2034

Chapter 3 Industry Insights

- 3.1 Industry ecosystem analysis

- 3.1.1 Factor affecting the value chain

- 3.1.2 Profit margin analysis

- 3.1.3 Disruptions

- 3.1.4 Future outlook

- 3.1.5 Manufacturers

- 3.1.6 Distributors

- 3.2 Trump administration tariffs

- 3.2.1 Impact on trade

- 3.2.1.1 Trade volume disruptions

- 3.2.1.2 Retaliatory measures

- 3.2.2 Impact on the industry

- 3.2.3 Supply-side impact (raw materials)

- 3.2.3.1 Price volatility in key materials

- 3.2.3.2 Supply chain restructuring

- 3.2.3.3 Production cost implications

- 3.2.4 Demand-side impact (selling price)

- 3.2.4.1 Price transmission to end markets

- 3.2.4.2 Market share dynamics

- 3.2.4.3 Consumer response patterns

- 3.2.5 Key companies impacted

- 3.2.6 Strategic industry responses

- 3.2.6.1 Supply chain reconfiguration

- 3.2.6.2 Pricing and product strategies

- 3.2.6.3 Policy engagement

- 3.2.7 Outlook and future considerations

- 3.2.1 Impact on trade

- 3.3 Trade statistics (HS Code)

- 3.3.1 Major exporting countries

- 3.3.2 Major importing countries

Note: the above trade statistics will be provided for key countries only.

- 3.4 Regulatory landscape

- 3.5 Impact forces

- 3.5.1 Growth drivers

- 3.5.1.1 Growing demand in the automotive industry

- 3.5.1.2 Rise of electric vehicles (EVs) and sustainable mobility

- 3.5.1.3 Increasing demand for high-performance materials

- 3.5.2 Industry pitfalls & challenges

- 3.5.2.1 High production costs

- 3.5.2.2 Regulatory & environmental concerns

- 3.5.1 Growth drivers

- 3.6 Policy engagement

- 3.7 Growth potential analysis

- 3.8 Porter's analysis

- 3.9 PESTEL analysis

Chapter 4 Competitive Landscape, 2024

- 4.1 Introduction

- 4.2 Company market share analysis

- 4.3 Competitive positioning matrix

- 4.4 Strategic outlook matrix

Chapter 5 Market Estimates and Forecast, By Type, 2021-2034 (USD Billion) (Kilo Tons)

- 5.1 Key trends

- 5.2 Aromatic polyketone

- 5.3 Aliphatic polyketone

- 5.4 Copolymer polyketone

Chapter 6 Market Estimates and Forecast, By Form, 2021-2034 (USD Billion) (Kilo Tons)

- 6.1 Key trends

- 6.2 Pellets

- 6.3 Fibers

- 6.4 Films

- 6.5 Sheets

Chapter 7 Market Estimates and Forecast, By Application, 2021-2034 (USD Billion) (Kilo Tons)

- 7.1 Key trends

- 7.2 Automotive components

- 7.3 Electrical & electronics

- 7.4 Industrial machinery

- 7.5 Consumer goods

- 7.6 Coatings & adhesives

- 7.7 Medical devices

- 7.8 Packaging

- 7.9 Others

Chapter 8 Market Estimates and Forecast, By Region, 2021-2034 (USD Billion) (Kilo Tons)

- 8.1 Key trends

- 8.2 North America

- 8.2.1 U.S.

- 8.2.2 Canada

- 8.3 Europe

- 8.3.1 Germany

- 8.3.2 UK

- 8.3.3 France

- 8.3.4 Spain

- 8.3.5 Italy

- 8.3.6 Rest of Europe

- 8.4 Asia Pacific

- 8.4.1 China

- 8.4.2 India

- 8.4.3 Japan

- 8.4.4 Australia

- 8.4.5 South Korea

- 8.4.6 Rest of Asia Pacific

- 8.5 Latin America

- 8.5.1 Brazil

- 8.5.2 Mexico

- 8.5.3 Argentina

- 8.5.4 Rest of Latin America

- 8.6 Middle East and Africa

- 8.6.1 Saudi Arabia

- 8.6.2 South Africa

- 8.6.3 UAE

- 8.6.4 Rest of Middle East and Africa

Chapter 9 Company Profiles

- 9.1 AKRO-PLASTIC

- 9.2 Avient

- 9.3 Distrupol

- 9.4 Ensinger

- 9.5 HYOSUNG

- 9.6 K.D. Feddersen

- 9.7 LEHVOSS

- 9.8 MITSUI PLASTICS

- 9.9 Nexeo Plastics

- 9.10 POLYOLS & POLYMERS

- 9.11 Rochling

- 9.12 Specialist Engineering Plastics

- 9.13 Technoform