|

市場調查報告書

商品編碼

1750351

脂質奈米顆粒市場機會、成長動力、產業趨勢分析及 2025 - 2034 年預測Lipid Nanoparticles Market Opportunity, Growth Drivers, Industry Trend Analysis, and Forecast 2025 - 2034 |

||||||

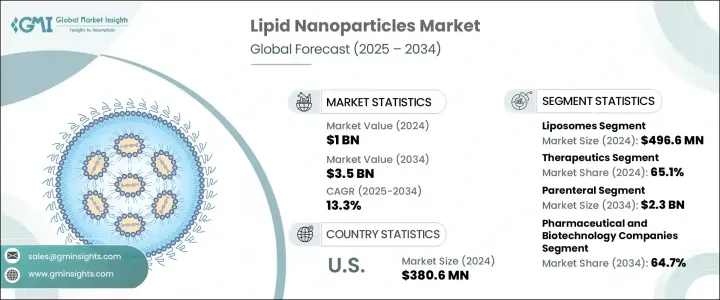

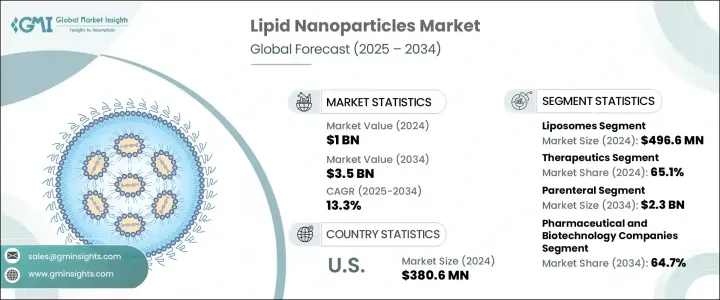

2024年,全球脂質奈米顆粒市場價值達10億美元,預計到2034年將以13.3%的複合年成長率成長,達到35億美元,這得益於對基於mRNA的療法(尤其是在疫苗和基因藥物領域)日益成長的需求。脂質奈米顆粒在mRNA遞送中的應用已引起廣泛關注,因為它們能夠保護脆弱的mRNA分子,促進其安全且有效率地運輸到細胞內。 mRNA疫苗領域的成功激發了對脂質奈米顆粒技術的更多投資和研究,使其應用範圍從傳染病擴展到癌症免疫療法、蛋白質替代療法和罕見遺傳疾病治療等領域。

隨著生物技術和製藥公司開發新一代基於mRNA的療法,對LNP等最佳化遞送系統的需求預計將激增。脂質組成、可擴展性和製造流程的進步提高了LNP在臨床應用中的可用性,進一步推動了市場擴張。 LNP是藥物遞送的關鍵組成部分,能夠包裹核酸、蛋白質和小分子等治療劑,因此對廣泛的醫療應用至關重要。

| 市場範圍 | |

|---|---|

| 起始年份 | 2024 |

| 預測年份 | 2025-2034 |

| 起始值 | 10億美元 |

| 預測值 | 35億美元 |

| 複合年成長率 | 13.3% |

2024年,脂質體領域佔據市場領先地位,價值達4.966億美元。脂質體由脂質雙層膜組成,是高效的藥物傳遞系統,在藥物穩定性和生物利用度方面具有優勢。脂質體的多功能性,尤其是在腫瘤治療領域,使其日益普及。此外,奈米技術的進步正在改進脂質體製劑,提高其載藥效率和控釋特性,從而進一步提升其市場佔有率。

2024年,治療領域佔據市場主導地位,市佔率達65.1%,並以13%的穩定速度成長。 LNP有助於遞送核酸類藥物,例如mRNA、siRNA和DNA,從而治療各種疾病。 LNP能夠增強藥物穩定性和精準遞送,尤其是在癌症、傳染病和遺傳性疾病領域,這使得它們成為下一代藥物開發的首選平台。隨著越來越多的全球核准和臨床試驗的開展,治療領域預計將保持其主導地位。

美國脂質奈米顆粒市場規模從2023年的3.342億美元成長至2024年的3.806億美元,預計2034年將以12.7%的複合年成長率成長。由於其強勁的生物技術和製藥產業、大量的研發投入以及良好的監管環境,美國在該市場保持強大的領導地位。隨著創新的持續和合作的擴大,美國很可能將繼續引領市場。

全球脂質奈米顆粒產業的知名企業包括開曼化學公司 (Cayman Chemicals)、Arcturus Therapeutics、Alnylam Pharmaceuticals、Moderna、BioNTech SE、Sigma-Tau Pharmaceuticals、贏創 (Evonik)、默克 (Merck)、Ascendia Pharmaceuticals、ABP Biouret、Merck)、Ascendia Pharmaceuticals (ThermoFischer Scientific) 和 Acuitas Therapeutics。全球脂質奈米顆粒市場的企業為鞏固其市場地位,採取的關鍵策略包括增加研發投入以增強脂質奈米顆粒 (LNP) 輸送系統、探索基因療法和癌症免疫療法的新應用,以及建立策略合作夥伴關係以擴展其產品供應。此外,各企業也致力於改進製造程序,以確保可擴展性和成本效益,從而滿足市場對基於脂質奈米顆粒 (LNP) 的療法日益成長的需求。

目錄

第1章:方法論與範圍

第2章:執行摘要

第3章:行業洞察

- 產業生態系統分析

- 產業衝擊力

- 成長動力

- 慢性病盛行率上升

- 對改善穩定性和生物利用度藥物製劑的需求不斷成長

- 擴大研究經費和活動

- mRNA 療法的不斷擴展

- 產業陷阱與挑戰

- 嚴格的監管要求

- 原料成本高

- 成長動力

- 成長潛力分析

- 管道分析

- 監管格局

- 川普政府關稅

- 對貿易的影響

- 貿易量中斷

- 報復措施

- 對產業的影響

- 供給側影響(原料)

- 主要材料價格波動

- 供應鏈重組

- 生產成本影響

- 需求面影響(售價)

- 價格傳導至終端市場

- 市佔率動態

- 消費者反應模式

- 供給側影響(原料)

- 受影響的主要公司

- 策略產業反應

- 供應鏈重組

- 定價和產品策略

- 政策參與

- 展望與未來考慮

- 對貿易的影響

- 波特的分析

- PESTEL分析

第4章:競爭格局

- 介紹

- 公司矩陣分析

- 主要市場參與者的競爭分析

- 競爭定位矩陣

- 策略儀表板

第5章:市場估計與預測:依產品類型,2021 年至 2034 年

- 主要趨勢

- 脂質體

- 固體脂質奈米顆粒

- 奈米結構脂質載體

- 其他產品類型

第6章:市場估計與預測:按應用,2021 年至 2034 年

- 主要趨勢

- 療法

- 癌症

- 真菌病

- 止痛藥

- 疫苗

- 其他應用

- 研究

第7章:市場估計與預測:依管理路線,2021 年至 2034 年

- 主要趨勢

- 口服

- 腸外

- 外用

- 其他給藥途徑

第8章:市場估計與預測:依最終用途,2021 年至 2034 年

- 主要趨勢

- 製藥和生物技術公司

- 研究機構

- 其他最終用途

第9章:市場估計與預測:按地區,2021 年至 2034 年

- 主要趨勢

- 北美洲

- 美國

- 加拿大

- 歐洲

- 德國

- 英國

- 法國

- 西班牙

- 義大利

- 荷蘭

- 亞太地區

- 中國

- 印度

- 日本

- 澳洲

- 韓國

- 拉丁美洲

- 巴西

- 墨西哥

- 阿根廷

- 中東和非洲

- 南非

- 沙烏地阿拉伯

- 阿拉伯聯合大公國

第10章:公司簡介

- ABP Biosciences

- Acuitas Therapeutics

- Alnylam Pharmaceuticals

- Arcturus Therapeutics

- Ascendia Pharmaceuticals

- Bayer

- BioNTech SE

- Cayman Chemicals

- Creative Biostructure

- Diant Pharma

- Evonik

- Merck

- Moderna

- Sigma-Tau Pharmaceuticals

- ThermoFischer Scientific

The Global Lipid Nanoparticles Market was valued at USD 1 billion in 2024, and it is estimated to grow at a CAGR of 13.3% to reach USD 3.5 billion by 2034, driven by the increasing demand for mRNA-based therapeutics, particularly in vaccines and genetic medicines. The use of lipid nanoparticles in the delivery of mRNA has gained significant attention due to their ability to protect fragile mRNA molecules, facilitating their safe and efficient transport into cells. This success in the mRNA vaccine space has sparked greater investment and research in LNP technologies, pushing their applications beyond infectious diseases into areas like cancer immunotherapy, protein replacement therapies, and treatments for rare genetic disorders.

The demand for optimized delivery systems like LNPs is expected to surge as biotech and pharmaceutical companies develop new generations of mRNA-based treatments. Advances in lipid composition, scalability, and manufacturing processes have enhanced the availability of LNPs for clinical applications, further fueling market expansion. LNPs are a key component in drug delivery, encapsulating therapeutic agents such as nucleic acids, proteins, and small molecules, making them critical for a wide range of medical applications.

| Market Scope | |

|---|---|

| Start Year | 2024 |

| Forecast Year | 2025-2034 |

| Start Value | $1 Billion |

| Forecast Value | $3.5 Billion |

| CAGR | 13.3% |

The liposomes segment led the market in 2024, with a value of USD 496.6 million. Liposomes, composed of lipid bilayers, are highly efficient in drug delivery systems, offering advantages in drug stability and bioavailability. Their versatility, especially in oncology treatments, has grown their popularity. In addition, advancements in nanotechnology are improving liposomal formulations, increasing their drug loading efficiency and controlled release profiles, further boosting their market share.

The therapeutics segment dominated the market with a 65.1% share in 2024, growing at a steady rate of 13%. LNPs help deliver nucleic acid-based drugs such as mRNA, siRNA, and DNA to treat various diseases. Their ability to enhance drug stability and precision delivery, particularly in cancer, infectious diseases, and genetic disorders, has made them a preferred platform in next-generation drug development. With more global approvals and clinical trials underway, the therapeutics segment is expected to maintain its dominance.

United States Lipid Nanoparticles Market reached USD 380.6 million in 2024, growing from USD 334.2 million in 2023, and is expected to grow at a CAGR of 12.7% through 2034. The U.S. maintains a strong leadership position in the market, supported by its robust biotechnology and pharmaceutical industries, substantial R&D investments, and favorable regulatory environment. As innovations continue and collaborations expand, the U.S. will likely continue to lead the market.

Prominent players in the Global Lipid Nanoparticles Industry include Cayman Chemicals, Arcturus Therapeutics, Alnylam Pharmaceuticals, Moderna, BioNTech SE, Sigma-Tau Pharmaceuticals, Evonik, Merck, Ascendia Pharmaceuticals, ABP Biosciences, Creative Biostructure, Diant Pharma, Bayer, ThermoFischer Scientific, and Acuitas Therapeutics. Key strategies adopted by companies in the Global Lipid Nanoparticles Market to strengthen their position include increasing R&D investments to enhance LNP delivery systems, exploring new applications in gene therapies and cancer immunotherapies, and forming strategic partnerships to expand their product offerings. Additionally, companies are focused on improving manufacturing processes to ensure scalability and cost-effectiveness, enabling them to meet the growing demand for LNP-based therapeutics.

Table of Contents

Chapter 1 Methodology and Scope

- 1.1 Market scope and definition

- 1.2 Research design

- 1.2.1 Research approach

- 1.2.2 Data collection methods

- 1.3 Base estimates and calculations

- 1.3.1 Base year calculation

- 1.3.2 Key trends for market estimation

- 1.4 Forecast model

- 1.5 Primary research and validation

- 1.5.1 Primary sources

- 1.5.2 Data mining sources

Chapter 2 Executive Summary

- 2.1 Industry 360° synopsis

Chapter 3 Industry Insights

- 3.1 Industry ecosystem analysis

- 3.2 Industry impact forces

- 3.2.1 Growth drivers

- 3.2.1.1 Rising prevalence of chronic disease

- 3.2.1.2 Growing demand for improved stability and bioavailability drug formulations

- 3.2.1.3 Expanding research fundings and activities

- 3.2.1.4 Growing expansion in mRNA therapeutics

- 3.2.2 Industry pitfalls and challenges

- 3.2.2.1 Stringent regulatory requirements

- 3.2.2.2 High cost of raw materials

- 3.2.1 Growth drivers

- 3.3 Growth potential analysis

- 3.4 Pipeline analysis

- 3.5 Regulatory landscape

- 3.6 Trump administration tariffs

- 3.6.1 Impact on trade

- 3.6.1.1 Trade volume disruptions

- 3.6.1.2 Retaliatory measures

- 3.6.2 Impact on the Industry

- 3.6.2.1 Supply-side impact (raw materials)

- 3.6.2.1.1 Price volatility in key materials

- 3.6.2.1.2 Supply chain restructuring

- 3.6.2.1.3 Production cost implications

- 3.6.2.2 Demand-side impact (selling price)

- 3.6.2.2.1 Price transmission to end markets

- 3.6.2.2.2 Market share dynamics

- 3.6.2.2.3 Consumer response patterns

- 3.6.2.1 Supply-side impact (raw materials)

- 3.6.3 Key companies impacted

- 3.6.4 Strategic industry responses

- 3.6.4.1 Supply chain reconfiguration

- 3.6.4.2 Pricing and product strategies

- 3.6.4.3 Policy engagement

- 3.6.5 Outlook and future considerations

- 3.6.1 Impact on trade

- 3.7 Porter's analysis

- 3.8 PESTEL analysis

Chapter 4 Competitive Landscape, 2024

- 4.1 Introduction

- 4.2 Company matrix analysis

- 4.3 Competitive analysis of major market players

- 4.4 Competitive positioning matrix

- 4.5 Strategy dashboard

Chapter 5 Market Estimates and Forecast, By Product Type, 2021 – 2034 ($ Mn)

- 5.1 Key trends

- 5.2 Liposomes

- 5.3 Solid lipid nanoparticles

- 5.4 Nanostructured lipid carriers

- 5.5 Other product types

Chapter 6 Market Estimates and Forecast, By Application, 2021 – 2034 ($ Mn)

- 6.1 Key trends

- 6.2 Therapeutics

- 6.2.1 Cancer

- 6.2.2 Fungal disease

- 6.2.3 Analgesics

- 6.2.4 Vaccines

- 6.2.5 Other applications

- 6.3 Research

Chapter 7 Market Estimates and Forecast, By Route of Administration, 2021 – 2034 ($ Mn)

- 7.1 Key trends

- 7.2 Oral

- 7.3 Parenteral

- 7.4 Topical

- 7.5 Other routes of administration

Chapter 8 Market Estimates and Forecast, By End Use, 2021 – 2034 ($ Mn)

- 8.1 Key trends

- 8.2 Pharmaceutical and biotechnology companies

- 8.3 Research Institutes

- 8.4 Other end use

Chapter 9 Market Estimates and Forecast, By Region, 2021 – 2034 ($ Mn)

- 9.1 Key trends

- 9.2 North America

- 9.2.1 U.S.

- 9.2.2 Canada

- 9.3 Europe

- 9.3.1 Germany

- 9.3.2 UK

- 9.3.3 France

- 9.3.4 Spain

- 9.3.5 Italy

- 9.3.6 Netherlands

- 9.4 Asia Pacific

- 9.4.1 China

- 9.4.2 India

- 9.4.3 Japan

- 9.4.4 Australia

- 9.4.5 South Korea

- 9.5 Latin America

- 9.5.1 Brazil

- 9.5.2 Mexico

- 9.5.3 Argentina

- 9.6 Middle East and Africa

- 9.6.1 South Africa

- 9.6.2 Saudi Arabia

- 9.6.3 UAE

Chapter 10 Company Profiles

- 10.1 ABP Biosciences

- 10.2 Acuitas Therapeutics

- 10.3 Alnylam Pharmaceuticals

- 10.4 Arcturus Therapeutics

- 10.5 Ascendia Pharmaceuticals

- 10.6 Bayer

- 10.7 BioNTech SE

- 10.8 Cayman Chemicals

- 10.9 Creative Biostructure

- 10.10 Diant Pharma

- 10.11 Evonik

- 10.12 Merck

- 10.13 Moderna

- 10.14 Sigma-Tau Pharmaceuticals

- 10.15 ThermoFischer Scientific