|

市場調查報告書

商品編碼

1750350

AI PC 市場機會、成長動力、產業趨勢分析及 2025 - 2034 年預測AI PC Market Opportunity, Growth Drivers, Industry Trend Analysis, and Forecast 2025 - 2034 |

||||||

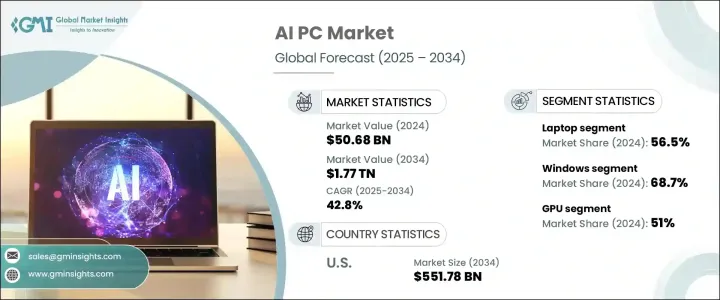

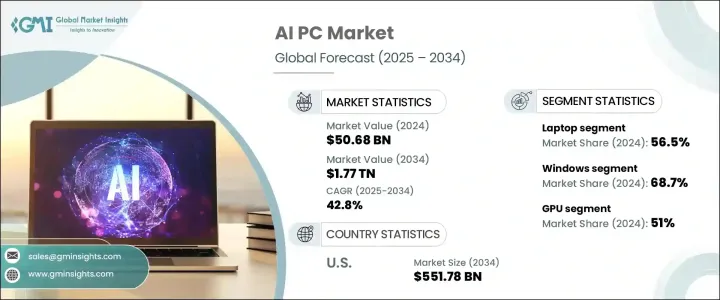

2024年,全球人工智慧PC市場規模達506.8億美元,預計到2034年將以42.8%的複合年成長率成長,達到1.77兆美元,這得益於神經處理單元(NPU)在運算設備中日益整合的趨勢。這些內建的人工智慧加速器正在將PC轉變為智慧系統,能夠直接在設備上支援先進的低延遲人工智慧功能。一個主要的成長因素源自於使用者對生產力、內容創作、通訊和設備安全等即時人工智慧驅動功能的需求不斷成長。這一轉變標誌著從傳統運算向人工智慧原生基礎設施的轉變,在這種基礎設施中,處理過程被本地化,以獲得更好的效能和資料保護。

貿易法規,包括對半導體和高效能處理器等關鍵零件徵收的關稅,已經影響了人工智慧個人電腦的成本結構。這些限制不僅導致價格波動、交貨時間延長,也擾亂了關鍵國際技術的取得。作為應對措施,製造商正在重新調整供應鏈,轉向本地生產的零件,以減少對進口的依賴,並確保符合國家科技政策。這種轉變與主要經濟體的國內晶片製造激勵措施一致,從而加強了本土人工智慧生態系統的發展。本地採購也為維持不間斷的生產週期和降低全球貿易緊張局勢所帶來的風險提供了策略優勢。

| 市場範圍 | |

|---|---|

| 起始年份 | 2024 |

| 預測年份 | 2025-2034 |

| 起始值 | 506.8億美元 |

| 預測值 | 1.77兆美元 |

| 複合年成長率 | 42.8% |

人工智慧軟體在日常運算任務中的日益普及,加速了人工智慧電腦在企業和消費市場的普及。越來越多的設備正在建立以支援設備上的人工智慧應用程式,這些應用程式無需將資料傳輸到雲端即可提升用戶體驗。這種設定確保了更高的資料隱私性和更快的效能,這在當今的混合工作文化中尤其重要。人工智慧電腦現在充當智慧終端,與邊緣和雲端運算系統無縫協作,高效管理分散式人工智慧工作負載。全球監管機構正積極推動安全、去中心化人工智慧框架的演進,強調對響應迅速且合規的人工智慧系統的需求。

就硬體設計而言,人工智慧PC市場細分為桌上型電腦、筆記型電腦和工作站。 2024年,筆記型電腦佔據最大佔有率,達到56.5%,這得益於對整合人工智慧功能的攜帶式運算能力日益成長的需求。這些設備如今配備了專為人工智慧任務設計的處理器,使其成為需要隨時隨地使用智慧功能的行動用戶的理想之選。更長的電池續航力、更靈敏的使用者介面和更強大的多媒體功能也鼓勵專業人士和普通消費者升級到支援人工智慧的筆記型電腦。

按作業系統分類,Windows 將在 2024 年以 68.7% 的市佔率領先 AI PC 市場。這種優勢可以歸因於廣泛的硬體合作夥伴、完善的軟體生態系統以及圍繞 Windows 平台構建的企業級採用。隨著舊作業系統的逐步淘汰,硬體更新周期不斷推進,企業正在投資新的 AI 最佳化 Windows PC,這些 PC 可提供增強的合規性、安全性和生產力功能。

依計算類型,市場分為 GPU、NPU 和其他。 GPU 在 2024 年佔據了最高的市場佔有率,達到 51%,這得益於其在處理複雜的 AI 演算法和提供高階圖形性能方面發揮的重要作用。這些處理器對於處理深度學習、影像處理和即時資料分析等 AI 工作負載尤其重要。先進 GPU 架構的整合正在提升視覺質量,並在各種應用中實現 AI 加速功能。

從區域來看,預計到2034年,美國人工智慧PC市場規模將達到5,517.8億美元。政府對國內人工智慧和半導體基礎設施的大力投資,加上企業對邊緣人工智慧解決方案的興趣,正在推動市場成長。隨著越來越多的企業採用基於人工智慧的工具和服務,對高效能運算設備的需求持續成長。企業對技術獨立性和數位彈性的追求,正鼓勵他們採用符合嚴格資料保護和效能標準的人工智慧PC。

人工智慧 PC 領域的競爭日益激烈,監管要求和生產力需求成為採購決策的核心。醫療、教育和金融等行業的企業紛紛轉向人工智慧 PC,以滿足合規標準並維持營運效率。設備上的人工智慧處理功能可以減少對雲端儲存的依賴,從而符合日益嚴格的全球資料保護和網路安全法規。隨著對生成式人工智慧工具和智慧自動化的需求不斷成長,企業正在使用支援人工智慧的系統更新 IT 基礎設施,以最佳化工作流程、減少重複性任務並支援明智的決策。 PC 製造商和軟體開發人員之間的合作正在進一步增強人工智慧整合,從而改變用戶與個人計算設備的交互方式。

目錄

第1章:方法論與範圍

第2章:執行摘要

第3章:行業洞察

- 產業生態系統分析

- 川普政府關稅

- 對貿易的影響

- 貿易量中斷

- 報復措施

- 對產業的影響

- 供給面影響(服務提供者)

- 關鍵服務價格波動

- 供應鏈重組

- 生產成本影響

- 需求面影響(定價)

- 價格傳導至終端市場

- 市佔率動態

- 消費者反應模式

- 受影響的主要公司

- 策略產業反應

- 伺服器提供者重新配置

- 定價和服務策略

- 政策參與

- 展望與未來考慮

- 供給面影響(服務提供者)

- 對貿易的影響

- 產業衝擊力

- 成長動力

- 神經處理單元 (NPU) 在 PC 中的整合

- 人工智慧應用激增

- 人工智慧演算法的進步

- 政府對人工智慧的措施和投資

- 雲端運算和邊緣運算的擴展

- 產業陷阱與挑戰

- AI整合硬體組件成本高昂

- 設備端人工智慧處理中的資料隱私和安全問題

- 成長動力

- 成長潛力分析

- 監管格局

- 技術格局

- 未來市場趨勢

- 差距分析

- 波特的分析

- PESTEL分析

第4章:競爭格局

- 介紹

- 公司市佔率分析

- 主要市場參與者的競爭分析

- 競爭定位矩陣

- 策略儀表板

第5章:市場估計與預測:依外形尺寸,2021-2034

- 主要趨勢

- 桌面

- 軟體

- 工作站

第6章:市場估計與預測:按作業系統,2021-2034 年

- 主要趨勢

- 視窗

- MacOS

- 其他

第7章:市場估計與預測:依計算類型,2021-2034

- 主要趨勢

- 圖形處理器

- 神經網路處理器

- 其他

第8章:市場估計與預測:依最終用途,2021-2034

- 消費者

- 企業

第9章:市場估計與預測:按地區,2021 年至 2034 年

- 主要趨勢

- 北美洲

- 美國

- 加拿大

- 歐洲

- 德國

- 英國

- 法國

- 西班牙

- 義大利

- 亞太地區

- 中國

- 印度

- 日本

- 澳新銀行

- 韓國

- 拉丁美洲

- 巴西

- 墨西哥

- 中東和非洲

- 阿拉伯聯合大公國

- 沙烏地阿拉伯

- 南非

第10章:公司簡介

- Acer

- Apple Inc.

- ASUSTeK Computer Inc.

- BOXX

- CORSAIR

- Dell Inc.

- GIGA-BYTE Technology Co., Ltd.

- HP Development Company, LP

- Huawei

- Lenovo

- Microsoft

- Micro-Star INT'L CO., LTD.

- NVIDIA Corporation

- Puget Systems

- Razer Inc.

The Global AI PC Market was valued at USD 50.68 billion in 2024 and is estimated to grow at a CAGR of 42.8% to reach USD 1.77 trillion by 2034, fueled by the increasing integration of neural processing units (NPUs) in computing devices. These built-in AI accelerators are transforming PCs into intelligent systems capable of supporting advanced, low-latency AI functions directly on the device. A major growth factor stems from evolving user demands for real-time, AI-driven capabilities across productivity, content creation, communication, and device security. This transition marks a shift from traditional computing to AI-native infrastructure, where processing is localized for better performance and data protection.

Trade regulations, including tariffs on key components like semiconductors and high-performance processors, have impacted the cost structure of AI PCs. These restrictions have not only led to price volatility and increased delivery timelines but have also disrupted access to essential international technologies. As a response, manufacturers are realigning supply chains and turning toward regionally produced components to reduce dependency on imports and ensure compliance with national tech policies. This shift is in line with domestic chip-making incentives across major economies, reinforcing the development of homegrown AI ecosystems. Local sourcing also provides strategic advantages in maintaining uninterrupted production cycles and mitigating risks linked to global trade tensions.

| Market Scope | |

|---|---|

| Start Year | 2024 |

| Forecast Year | 2025-2034 |

| Start Value | $50.68 Billion |

| Forecast Value | $1.77 Trillion |

| CAGR | 42.8% |

The increasing use of AI-enabled software in everyday computing tasks is accelerating the adoption of AI PCs across both business and consumer markets. More devices are being built to support on-device AI applications, which enhance user experience without needing to offload data to the cloud. This setup ensures greater data privacy and quicker performance, which are especially critical in today's hybrid work culture. AI PCs are now acting as intelligent endpoints, working seamlessly with edge and cloud computing systems to manage distributed AI workloads efficiently. The evolution of secure, decentralized AI frameworks is being actively promoted by global regulatory bodies, emphasizing the need for responsive and compliant AI systems.

In terms of hardware design, the AI PC market is segmented into desktops, laptops, and workstations. In 2024, laptops accounted for the largest share at 56.5%, driven by growing demand for portable computing power integrated with AI capabilities. These devices now come equipped with processors specifically designed for AI tasks, making them ideal for mobile users who need intelligent features on the go. Improved battery life, responsive user interfaces, and enhanced multimedia functions are also encouraging professionals and general consumers to upgrade to AI-powered laptops.

When categorized by operating systems, Windows leads the AI PC market with a share of 68.7% in 2024. This dominance can be attributed to the widespread presence of hardware partners, software ecosystems, and enterprise adoption built around the Windows platform. Ongoing hardware refresh cycles, driven by the phasing out of older operating systems, are pushing organizations to invest in new AI-optimized Windows PCs that offer enhanced compliance, security, and productivity features.

By compute type, the market is divided into GPUs, NPUs, and others. GPUs held the highest market share at 51% in 2024, owing to their vital role in processing complex AI algorithms and delivering high-end graphics performance. These processors are particularly important for handling AI workloads such as deep learning, image processing, and real-time data analysis. The integration of advanced GPU architectures is enhancing visual quality and enabling AI-accelerated features across a wide range of applications.

In regional terms, the U.S. AI PC market is expected to reach USD 551.78 billion by 2034. Strong government investments in domestic AI and semiconductor infrastructure, combined with corporate interest in edge AI solutions, are driving market growth. As more companies embrace AI-based tools and services, the need for high-performance computing devices continues to grow. The shift toward technology independence and digital resilience is encouraging businesses to adopt AI PCs that meet stringent data protection and performance standards.

Competition in the AI PC space is intensifying, with regulatory requirements and productivity demands becoming central to purchasing decisions. Organizations across industries such as healthcare, education, and finance are turning to AI PCs to meet compliance standards while maintaining operational efficiency. On-device AI processing enables reduced reliance on cloud storage, aligning with increasing global data protection and cybersecurity regulations. As demand for generative AI tools and intelligent automation grows, companies are refreshing IT infrastructure with AI-ready systems to optimize workflows, cut down on repetitive tasks, and support informed decision-making. Collaborative efforts between PC manufacturers and software developers are further enhancing AI integration, transforming the way users interact with personal computing devices.

Table of Contents

Chapter 1 Methodology and Scope

- 1.1 Market scope and definitions

- 1.2 Research design

- 1.2.1 Research approach

- 1.2.2 Data collection methods

- 1.3 Base estimates and calculations

- 1.3.1 Base year calculation

- 1.3.2 Key trends for market estimation

- 1.4 Forecast model

- 1.5 Primary research and validation

- 1.5.1 Primary sources

- 1.5.2 Data mining sources

Chapter 2 Executive Summary

- 2.1 Industry 360° synopsis

Chapter 3 Industry Insights

- 3.1 Industry ecosystem analysis

- 3.2 Trump administration tariffs

- 3.2.1 Impact on trade

- 3.2.1.1 Trade volume disruptions

- 3.2.1.2 Retaliatory measures

- 3.2.1.3 Impact on the industry

- 3.2.1.3.1 Supply-side impact (service providers)

- 3.2.1.3.1.1 Price volatility in key services

- 3.2.1.3.1.2 Supply chain restructuring

- 3.2.1.3.1.3 Production cost implications

- 3.2.1.3.2 Demand-side impact (pricing)

- 3.2.1.3.2.1 Price transmission to end markets

- 3.2.1.3.2.2 Market share dynamics

- 3.2.1.3.2.3 Consumer response patterns

- 3.2.1.3.3 Key companies impacted

- 3.2.1.3.4 Strategic industry responses

- 3.2.1.3.4.1 Server provider reconfiguration

- 3.2.1.3.4.2 Pricing and service strategies

- 3.2.1.3.4.3 Policy engagement

- 3.2.1.3.5 Outlook and future considerations

- 3.2.1.3.1 Supply-side impact (service providers)

- 3.2.1 Impact on trade

- 3.3 Industry impact forces

- 3.3.1 Growth drivers

- 3.3.1.1 Integration of Neural Processing Units (NPUs) in PCs

- 3.3.1.2 Surge in AI-powered applications

- 3.3.1.3 Advancements in AI algorithms

- 3.3.1.4 Government initiatives and investments in AI

- 3.3.1.5 Expansion of cloud and edge computing

- 3.3.2 Industry pitfalls and challenges

- 3.3.2.1 High cost of AI-integrated hardware components

- 3.3.2.2 Data privacy and security concerns in on-device AI processing

- 3.3.1 Growth drivers

- 3.4 Growth potential analysis

- 3.5 Regulatory landscape

- 3.6 Technology landscape

- 3.7 Future market trends

- 3.8 Gap analysis

- 3.9 Porter's analysis

- 3.10 PESTEL analysis

Chapter 4 Competitive Landscape, 2024

- 4.1 Introduction

- 4.2 Company market share analysis

- 4.3 Competitive analysis of major market players

- 4.4 Competitive positioning matrix

- 4.5 Strategy dashboard

Chapter 5 Market Estimates & Forecast, By Form Factor, 2021-2034 (USD Billion & units)

- 5.1 Key trends

- 5.2 Desktop

- 5.3 Software

- 5.4 Workstation

Chapter 6 Market Estimates & Forecast, By Operating System, 2021-2034 (USD Billion & units)

- 6.1 Key trends

- 6.2 Windows

- 6.3 MacOS

- 6.4 Others

Chapter 7 Market Estimates & Forecast, By Compute Type, 2021-2034 (USD Billion & units)

- 7.1 Key trends

- 7.2 GPU

- 7.3 NPU

- 7.4 Others

Chapter 8 Market Estimates & Forecast, By End Use, 2021-2034 (USD Billion & units)

- 8.1 Consumers

- 8.2 Enterprises

Chapter 9 Market Estimates and Forecast, By Region, 2021 – 2034 (USD Billion & units)

- 9.1 Key trends

- 9.2 North America

- 9.2.1 U.S.

- 9.2.2 Canada

- 9.3 Europe

- 9.3.1 Germany

- 9.3.2 UK

- 9.3.3 France

- 9.3.4 Spain

- 9.3.5 Italy

- 9.4 Asia Pacific

- 9.4.1 China

- 9.4.2 India

- 9.4.3 Japan

- 9.4.4 ANZ

- 9.4.5 South Korea

- 9.5 Latin America

- 9.5.1 Brazil

- 9.5.2 Mexico

- 9.6 Middle East and Africa

- 9.6.1 UAE

- 9.6.2 Saudi Arabia

- 9.6.3 South Africa

Chapter 10 Company Profiles

- 10.1 Acer

- 10.2 Apple Inc.

- 10.3 ASUSTeK Computer Inc.

- 10.4 BOXX

- 10.5 CORSAIR

- 10.6 Dell Inc.

- 10.7 GIGA-BYTE Technology Co., Ltd.

- 10.8 HP Development Company, L.P

- 10.9 Huawei

- 10.10 Lenovo

- 10.11 Microsoft

- 10.12 Micro-Star INT'L CO., LTD.

- 10.13 NVIDIA Corporation

- 10.14 Puget Systems

- 10.15 Razer Inc.