|

市場調查報告書

商品編碼

1750349

商用飛機 LED 照明市場機會、成長動力、產業趨勢分析及 2025 - 2034 年預測Commercial Aircraft LED Lighting Market Opportunity, Growth Drivers, Industry Trend Analysis, and Forecast 2025 - 2034 |

||||||

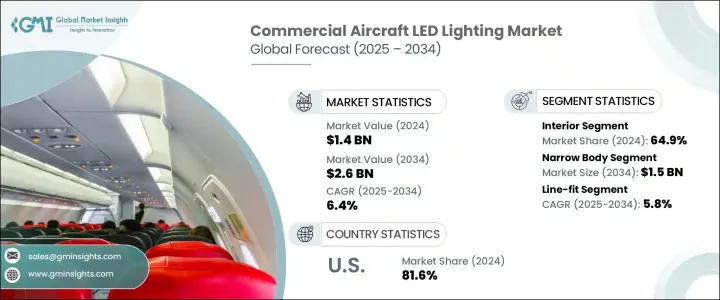

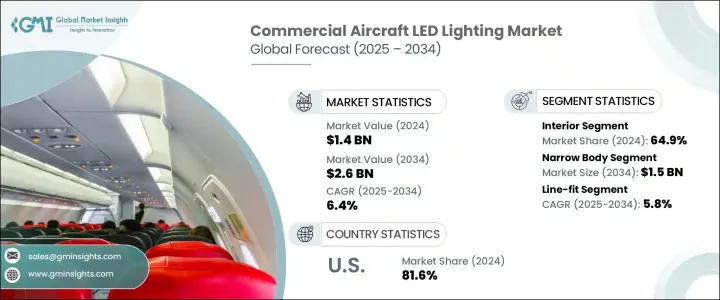

2024年,全球商用飛機LED照明市場規模達14億美元,預計2034年將以6.4%的複合年成長率成長,達到26億美元。隨著全球商用飛機數量的不斷成長以及旅遊業的蓬勃發展,該市場的需求正在穩步成長。航空公司優先考慮節能且技術先進的照明系統,以提高營運績效和乘客滿意度。隨著機隊的擴張和頻繁升級,LED照明已成為提供現代化客艙體驗和提高燃油效率的重要組成部分。

儘管航空業面臨經濟和地緣政治方面的不利因素,包括貿易相關的成本壓力,但該行業已透過重塑採購策略和多元化供應鏈穩步適應。這些轉變在穩定市場方面發揮了關鍵作用,有助於維持對飛機照明系統的穩定需求。 LED照明已成為關鍵解決方案,尤其是在航空公司持續投資現代化內裝並尋求降低營運成本的當下。市場參與者如今更加重視在新飛機和正在升級的老舊機隊中整合先進、耐用且以人為本的照明技術。這種轉變不僅有助於滿足不斷變化的監管標準,也符合整個航空業設定的環境永續目標。此外,LED系統設計的進步使其能夠更好地與機上娛樂系統和航空電子設備整合,從而提升飛機的整體性能和乘客舒適度。

| 市場範圍 | |

|---|---|

| 起始年份 | 2024 |

| 預測年份 | 2025-2034 |

| 起始值 | 14億美元 |

| 預測值 | 26億美元 |

| 複合年成長率 | 6.4% |

就照明類型而言,市場細分為內部照明和外部照明。內部LED照明佔市場主導地位,2024年市佔率達64.9%。隨著航空公司投資晝夜節律和環境照明系統,以滿足經濟艙和頭等艙乘客的需求,對先進客艙照明的需求持續成長。這些系統有助於提高乘客舒適度,提升航空公司品牌形象,並透過智慧照明設計降低功耗。航空公司擴大採用動態照明方案,在創造個人化旅行體驗的同時,也有助於節能。

根據飛機類型,市場進一步細分為窄體飛機、寬體飛機和支線飛機。其中,預計到2034年,窄體飛機的市場規模將達到15億美元。人們對中短程航線的日益青睞,推動了窄體飛機的生產和部署。營運這些航線的航空公司正在整合LED照明,將其作為經濟高效的選擇,以升級內裝並提升旅遊體驗,尤其針對預算有限的旅客。由於航空公司正在尋求在不影響成本效益的情況下提升氛圍的方法,新交付的飛機和現有飛機都將受益於這些升級。

根據安裝方式,市場可分為原廠安裝和改裝。預計到2034年,原廠安裝的複合年成長率將達到5.8%。新飛機在製造階段擴大配備LED照明系統,製造商與照明解決方案提供商密切合作,以確保順利整合。這種方法不僅減少了未來改裝的需求,還確保照明系統符合最新的技術標準和客艙管理系統。

從地區來看,美國在2024年佔據了全球商用飛機LED照明市場超過81.6%的佔有率。美國強大的飛機製造生態系統和對技術創新的高度重視,推動了智慧照明系統的廣泛應用。美國國內航空公司機隊持續的改造計劃以及對客艙內飾現代化的推動,進一步推動了該地區市場的成長。不斷變化的客戶期望以及航空公司營運成本管理改善的需求,推動了對持久高效照明解決方案的需求。

商用飛機LED照明市場競爭激烈,前五大廠商合計佔超過60%的市佔率。市場領導者正在投資符合以乘客為中心的設計原則的下一代照明技術。各公司正透過與飛機製造商建立長期合作夥伴關係,實現生產過程中的無縫組裝整合,從而鞏固其市場地位。隨著航空公司希望延長機隊壽命並提昇機上體驗,老舊飛機的改裝也日益興起。為了滿足日益成長的全球需求,製造商正在加大研發投入,擴大其國際影響力,並高度重視滿足合規標準和實現永續發展目標。

目錄

第1章:方法論與範圍

第2章:執行摘要

第3章:行業洞察

- 產業生態系統分析

- 川普政府關稅分析

- 對貿易的影響

- 貿易量中斷

- 報復措施

- 對產業的影響

- 供給側影響(原料)

- 主要材料價格波動

- 供應鏈重組

- 生產成本影響

- 需求面影響(售價)

- 價格傳導至終端市場

- 市佔率動態

- 消費者反應模式

- 供給側影響(原料)

- 受影響的主要公司

- 策略產業反應

- 供應鏈重組

- 定價和產品策略

- 政策參與

- 展望與未來考慮

- 對貿易的影響

- 產業衝擊力

- 成長動力

- 商用飛機擴張

- 對乘客舒適度和客艙美觀度的需求不斷成長

- 改造和升級專案的成長

- 智慧座艙系統的應用日益廣泛

- 旅遊業的成長

- 產業陷阱與挑戰

- 初期投資改造成本高

- 嚴格的監管標準和認證延遲

- 成長動力

- 成長潛力分析

- 監管格局

- 技術格局

- 未來市場趨勢

- 差距分析

- 波特的分析

- Pestel 分析

第4章:競爭格局

- 介紹

- 公司市佔率分析

- 主要市場參與者的競爭分析

- 競爭定位矩陣

- 策略儀表板

第5章:市場估計與預測:依明類型,2021 - 2034 年

- 主要趨勢

- 內部的

- 標誌和閱讀

- 天花板和壁燈

- 外部的

- 緊急狀況

- 防撞

- 探照燈

第6章:市場估計與預測:依飛機類型,2021 - 2034 年

- 主要趨勢

- 窄體

- 寬體

- 支線噴射機

第7章:市場估計與預測:按擬合,2021 - 2034 年

- 主要趨勢

- 線擬合

- 改造

第8章:市場估計與預測:按地區,2021 - 2034 年

- 主要趨勢

- 北美洲

- 美國

- 加拿大

- 歐洲

- 德國

- 英國

- 法國

- 西班牙

- 義大利

- 荷蘭

- 亞太地區

- 中國

- 印度

- 日本

- 澳洲

- 韓國

- 拉丁美洲

- 巴西

- 墨西哥

- 阿根廷

- 中東和非洲

- 沙烏地阿拉伯

- 南非

- 阿拉伯聯合大公國

第9章:公司簡介

- Aero Dynamix

- AeroLEDs

- Aerospace

- Aircraft Lighting International

- American Bright

- Astronics

- Bruce Aerospace

- Cobalt Aerospace Group

- Collins Aerospace

- Diehl Stiftung

- Honeywell International

- Luminator Aerospace

- Lumitex

- Oxley Group

- Prizm Lighting

- PWI

- Safran

- SELA

- Whelen Aerospace Technologies

The Global Commercial Aircraft LED Lighting Market was valued at USD 1.4 billion in 2024 and is estimated to grow at a CAGR of 6.4% to reach USD 2.6 billion by 2034. The market is witnessing a steady surge in demand due to the growing number of commercial aircraft in operation and a thriving tourism industry worldwide. Airlines are prioritizing energy-efficient and technologically advanced lighting systems to enhance both operational performance and passenger satisfaction. As fleets expand and undergo frequent upgrades, LED lighting has become an essential component in delivering modern cabin experiences and improving fuel efficiency.

While the industry has faced economic and geopolitical headwinds, including trade-related cost pressures, it has steadily adapted by reshaping sourcing strategies and diversifying supply chains. These shifts have played a key role in stabilizing the market, helping to maintain a consistent demand for aircraft lighting systems. LED lighting has emerged as a critical solution, especially as airlines continue to invest in modern interiors and seek to reduce operational costs. Market participants are now more focused on integrating advanced, durable, and human-centric lighting technologies in both new aircraft and older fleets undergoing upgrades. This shift is not only helping meet evolving regulatory standards but also aligning with environmental sustainability goals set across the aviation sector. Furthermore, advancements in LED system design are enabling better integration with in-flight entertainment systems and avionics, enhancing overall aircraft performance and passenger comfort.

| Market Scope | |

|---|---|

| Start Year | 2024 |

| Forecast Year | 2025-2034 |

| Start Value | $1.4 Billion |

| Forecast Value | $2.6 Billion |

| CAGR | 6.4% |

In terms of light type, the market is segmented into interior and exterior lighting. Interior LED lighting dominated the market with a share of 64.9% in 2024. The demand for advanced cabin lighting continues to rise as airlines invest in circadian rhythm and ambient lighting systems that cater to both economy and premium class passengers. These systems are helping improve passenger comfort, boost airline brand image, and lower power consumption through intelligent lighting designs. Airlines are increasingly adopting dynamic lighting schemes that create personalized travel experiences while also contributing to energy savings.

The market is further divided by aircraft type into narrow body, wide body, and regional jets. Among these, narrow body aircraft are projected to reach USD 1.5 billion by 2034. The growing preference for short to medium-haul routes is prompting increased production and deployment of narrow body jets. Airlines operating on these routes are integrating LED lighting as a cost-effective option to upgrade interiors and elevate the travel experience, especially for budget travelers. Both newly delivered and existing aircraft are benefiting from these upgrades as airlines seek ways to enhance ambiance without compromising on cost efficiency.

Based on fitting, the market is classified into line fit and retrofit. Line-fit installations are estimated to grow at a CAGR of 5.8% through 2034. New aircraft are increasingly being equipped with LED lighting systems during the manufacturing phase, with manufacturers working closely with lighting solution providers to ensure smooth integration. This approach not only reduces the need for future retrofitting but also ensures that the lighting systems are aligned with the latest technological standards and cabin management systems.

Regionally, the United States captured over 81.6% of the global commercial aircraft LED lighting market in 2024. The country's robust aircraft manufacturing ecosystem and a strong focus on technological innovation have led to the wide-scale adoption of smart lighting systems. Continuous retrofitting initiatives across domestic airline fleets and the push toward modernizing cabin interiors have further propelled market growth in the region. The demand for long-lasting and high-efficiency lighting solutions is being driven by evolving customer expectations and the need to improve cost management across airline operations.

The commercial aircraft LED lighting market is highly competitive, with the top five players holding a collective share of over 60%. Market leaders are investing in next-generation lighting technologies that align with passenger-centric design principles. Companies are strengthening their market positions by forging long-term partnerships with aircraft manufacturers, enabling seamless line-fit integration during production. The push toward retrofitting older aircraft is also gaining momentum, as airlines look to extend fleet life while enhancing onboard experience. To meet growing global demand, manufacturers are ramping up research and development investments and expanding their international footprint, with a sharp focus on meeting compliance standards and addressing sustainability targets.

Table of Contents

Chapter 1 Methodology and scope

- 1.1 Market scope and definitions

- 1.2 Research design

- 1.2.1 Research approach

- 1.2.2 Data collection methods

- 1.3 Base estimates and calculations

- 1.3.1 Base year calculation

- 1.3.2 Key trends for market estimation

- 1.4 Forecast model

- 1.5 Primary research and validation

- 1.5.1 Primary sources

- 1.5.2 Data mining sources

Chapter 2 Executive summary

- 2.1 Industry 3600 synopsis

Chapter 3 Industry insights

- 3.1 Industry ecosystem analysis

- 3.2 Trump administration tariffs analysis

- 3.2.1 Impact on trade

- 3.2.1.1 Trade volume disruptions

- 3.2.1.2 Retaliatory measures

- 3.2.2 Impact on the industry

- 3.2.2.1 Supply-side impact (raw materials)

- 3.2.2.1.1 Price volatility in key materials

- 3.2.2.1.2 Supply chain restructuring

- 3.2.2.1.3 Production cost implications

- 3.2.2.2 Demand-side impact (selling price)

- 3.2.2.2.1 Price transmission to end markets

- 3.2.2.2.2 Market share dynamics

- 3.2.2.2.3 Consumer response patterns

- 3.2.2.1 Supply-side impact (raw materials)

- 3.2.3 Key companies impacted

- 3.2.4 Strategic industry responses

- 3.2.4.1.1 Supply chain reconfiguration

- 3.2.4.1.2 Pricing and product strategies

- 3.2.4.1.3 Policy engagement

- 3.2.5 Outlook and future considerations

- 3.2.1 Impact on trade

- 3.3 Industry impact forces

- 3.3.1 Growth drivers

- 3.3.1.1 Commercial aircraft expansion

- 3.3.1.2 Rising demand for passenger comfort and cabin aesthetics

- 3.3.1.3 Growth in retrofit and upgrade programs

- 3.3.1.4 Increasing adoption of smart cabin systems

- 3.3.1.5 Growth in tourism industry

- 3.3.2 Industry pitfalls and challenges

- 3.3.2.1 High initial investment and retrofit costs

- 3.3.2.2 Stringent regulatory standards and certification delays

- 3.3.1 Growth drivers

- 3.4 Growth potential analysis

- 3.5 Regulatory landscape

- 3.6 Technology landscape

- 3.7 Future market trends

- 3.8 Gap analysis

- 3.9 Porter's analysis

- 3.10 Pestel analysis

Chapter 4 Competitive landscape, 2024

- 4.1 Introduction

- 4.2 Company market share analysis

- 4.3 Competitive analysis of major market players

- 4.4 Competitive positioning matrix

- 4.5 Strategy dashboard

Chapter 5 Market Estimates & Forecast, By Light Type, 2021 - 2034 (USD Million & units)

- 5.1 Key trends

- 5.2 Interior

- 5.2.1 Signage & reading

- 5.2.2 Ceiling & wall lights

- 5.3 Exterior

- 5.3.1 Emergency

- 5.3.2 Anti-collision

- 5.3.3 Search lights

Chapter 6 Market Estimates & Forecast, By Aircraft Type, 2021 - 2034 (USD Million & units)

- 6.1 Key trends

- 6.2 Narrow body

- 6.3 Wide body

- 6.4 Regional jets

Chapter 7 Market Estimates & Forecast, By Fitting, 2021 - 2034 (USD Million & units)

- 7.1 Key trends

- 7.2 Line-fit

- 7.3 Retrofit

Chapter 8 Market Estimates and Forecast, By Region, 2021 - 2034 (USD Million & units)

- 8.1 Key trends

- 8.2 North America

- 8.2.1 U.S.

- 8.2.2 Canada

- 8.3 Europe

- 8.3.1 Germany

- 8.3.2 UK

- 8.3.3 France

- 8.3.4 Spain

- 8.3.5 Italy

- 8.3.6 Netherlands

- 8.4 Asia Pacific

- 8.4.1 China

- 8.4.2 India

- 8.4.3 Japan

- 8.4.4 Australia

- 8.4.5 South Korea

- 8.5 Latin America

- 8.5.1 Brazil

- 8.5.2 Mexico

- 8.5.3 Argentina

- 8.6 Middle East and Africa

- 8.6.1 Saudi Arabia

- 8.6.2 South Africa

- 8.6.3 UAE

Chapter 9 Company Profiles

- 9.1 Aero Dynamix

- 9.2 AeroLEDs

- 9.3 Aerospace

- 9.4 Aircraft Lighting International

- 9.5 American Bright

- 9.6 Astronics

- 9.7 Bruce Aerospace

- 9.8 Cobalt Aerospace Group

- 9.9 Collins Aerospace

- 9.10 Diehl Stiftung

- 9.11 Honeywell International

- 9.12 Luminator Aerospace

- 9.13 Lumitex

- 9.14 Oxley Group

- 9.15 Prizm Lighting

- 9.16 PWI

- 9.17 Safran

- 9.18 SELA

- 9.19 Whelen Aerospace Technologies