|

市場調查報告書

商品編碼

1750347

軍用天線市場機會、成長動力、產業趨勢分析及 2025 - 2034 年預測Military Antenna Market Opportunity, Growth Drivers, Industry Trend Analysis, and Forecast 2025 - 2034 |

||||||

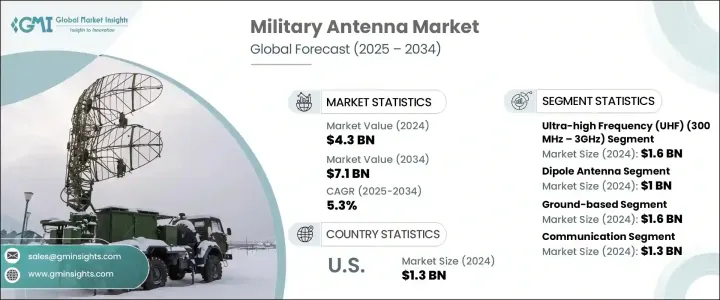

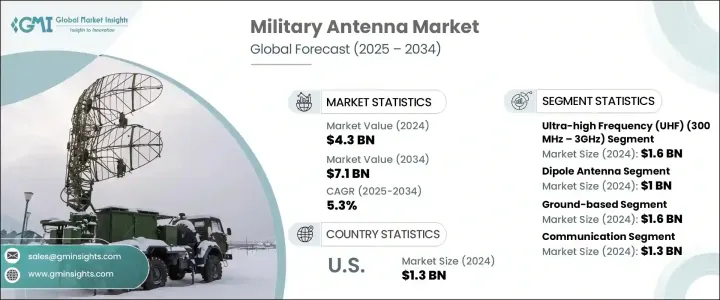

2024年,全球軍用天線市場規模達43億美元,預計2034年將以5.3%的複合年成長率成長,達到71億美元。這主要得益於全球多個地區國防開支的不斷成長以及無人系統部署的激增。現代軍事行動需要在陸地、空中和海上進行快速、安全的通訊,而天線正是這些要求對任務成功至關重要。隨著對互通性、加密和多域整合的日益重視,世界各國政府正在加快對先進天線系統的投資。這些技術支援即時戰場協調、遠程武器系統和衛星通訊。此外,不斷演變的地緣政治緊張局勢和軍事現代化計劃推動了對高度依賴高性能、關鍵任務通訊組件的先進平台的採購。

美國的政策決策也在重塑市場格局方面發揮了重要作用。川普政府對中國電子產品徵收的關稅嚴重影響了全球供應鏈。射頻模組、連接器和電路板等關鍵零件的成本不斷上漲,導致生產時間緊張。美國境內的國防承包商面臨採購延遲和成本上升的問題,這迫使他們轉向國內供應商和盟友製造合作夥伴。儘管這些措施最初的目標是增強國家安全和國內生產能力,但這些措施暫時中斷了關鍵軍用級零件的獲取,凸顯了國際依賴的脆弱性。

| 市場範圍 | |

|---|---|

| 起始年份 | 2024 |

| 預測年份 | 2025-2034 |

| 起始值 | 43億美元 |

| 預測值 | 71億美元 |

| 複合年成長率 | 5.3% |

在各個頻段中,超高頻 (UHF) 天線在 2024 年市場佔據領先地位,估值達 16 億美元。這類天線因其可靠性而被廣泛應用於高機動性軍事通訊系統,尤其是在訊號受阻的區域,例如密集地形或複雜的城市景觀。其操作靈活性以及與中短距離通訊需求的兼容性,持續推動多個平台的需求。此外,標準化的頻率協議也鼓勵對超高頻技術的進一步投資。

偶極子天線在產品類型細分市場中位居榜首,2024 年市場收入將達到 10 億美元。其設計簡潔、全向輻射和寬頻相容性使其成為整合到行動和地面軍事平台的通訊系統的首選。這些天線還經濟高效且易於整合,支援現有系統和新部署。

2024年,德國軍用天線市場規模達2.434億美元,這得益於其對軟體定義和多標準通訊架構的持續關注,從而對自適應和安全天線系統的需求強勁成長。這一發展趨勢得益於空中和地面防禦平台的現代化升級,高性能、頻率靈活的天線對於即時態勢感知和互通性至關重要。數位化戰場能力和增強電子戰韌性的推動,也促進了德國國內先進天線技術的研發。

全球軍用天線市場的領先公司專注於創新、合作和產品擴展,以鞏固其市場地位。洛克希德馬丁公司和RTX公司大力投資未來作戰環境所需的先進通訊系統。泰雷茲公司和BAE系統公司正在擴展其產品線,以支援互通性和模組化。 Viasat公司和L3Harris Technologies公司正在加強其衛星天線產品組合。同時,科巴姆先進電子解決方案公司和羅德與施瓦茨公司正在建立策略合作夥伴關係,以提高生產效率。 MTI Wireless Edge公司和Antcom公司正在開發緊湊、堅固的天線系統,以滿足戰術需求。

目錄

第1章:方法論與範圍

第2章:執行摘要

第3章:行業洞察

- 產業生態系統分析

- 川普政府關稅

- 對貿易的影響

- 貿易量中斷

- 報復措施

- 對產業的影響

- 供給側影響

- 關鍵零件價格波動

- 供應鏈重組

- 生產成本影響

- 需求面影響(售價)

- 價格傳導至終端市場

- 市佔率動態

- 消費者反應模式

- 供給側影響

- 受影響的主要公司

- 策略產業反應

- 供應鏈重組

- 定價和產品策略

- 政策參與

- 展望與未來考慮

- 對貿易的影響

- 產業衝擊力

- 成長動力

- 全球國防預算增加

- 武裝部隊現代化

- 無人機(UAV)的成長

- 電子戰(EW)的出現

- 增加邊境監視和偵察活動

- 產業陷阱與挑戰

- 開發和整合成本高

- 複雜的監管和頻率分配問題

- 成長動力

- 成長潛力分析

- 監管格局

- 技術格局

- 未來市場趨勢

- 波特的分析

- PESTEL分析

第4章:競爭格局

- 介紹

- 公司市佔率分析

- 主要市場參與者的競爭分析

- 競爭定位矩陣

- 策略儀表板

第5章:市場估計與預測:按類型,2021 年至 2034 年

- 主要趨勢

- 偶極天線

- 單極天線

- 喇叭天線

- 環形天線

- 陣列天線

- 貼片天線

- 拋物面反射天線

- 其他

第6章:市場估計與預測:按頻段,2021 年至 2034 年

- 主要趨勢

- 高頻(HF)(3-30 MHz)

- 甚高頻(VHF)(30–300 MHz)

- 超高頻(UHF)(300 MHz 至 3 GHz)

- 超高頻(SHF)(3-30 GHz)

- 極高頻(EHF)(30–300 GHz)

第7章:市場估計與預測:按平台,2021 年至 2034 年

- 主要趨勢

- 地面

- 海軍

- 空降

- 空間

第 8 章:市場估計與預測:按應用,2021 年至 2034 年

- 主要趨勢

- 監視與偵察

- 衛星通訊

- 電子戰

- 遙測

- 溝通

- 其他

第9章:市場估計與預測:按地區,2021 年至 2034 年

- 主要趨勢

- 北美洲

- 美國

- 加拿大

- 歐洲

- 德國

- 英國

- 法國

- 西班牙

- 義大利

- 荷蘭

- 亞太地區

- 中國

- 印度

- 日本

- 澳洲

- 韓國

- 拉丁美洲

- 巴西

- 墨西哥

- 阿根廷

- 中東和非洲

- 沙烏地阿拉伯

- 南非

- 阿拉伯聯合大公國

第10章:公司簡介

- Antcom

- BAE Systems

- Cobham Advanced Electronic Solutions

- Comrod Communication

- Eylex

- General Dynamics Mission Systems

- Hascall-Denke

- Honeywell International

- L3Harris Technologies

- Lockheed Martin

- MTI Wireless Edge

- Rohde and Schwarz

- RTX

- Saab

- Thales

- Viasat

The Global Military Antenna Market was valued at USD 4.3 billion in 2024 and is estimated to grow at a CAGR of 5.3% to reach USD 7.1 billion by 2034, driven by the rising defense spending across multiple regions, as well as a surge in the deployment of unmanned systems. Modern military operations demand rapid, secure communication across land, air, and sea domains-requirements that make antennas central to mission success. With increased focus on interoperability, encryption, and multi-domain integration, governments worldwide are accelerating investments in advanced antenna systems. These technologies support real-time battlefield coordination, remote weapon systems, and satellite communications. Furthermore, evolving geopolitical tensions and military modernization programs fuel the procurement of advanced platforms that rely heavily on high-performance, mission-critical communication components.

U.S. policy decisions have also played a major role in reshaping the market landscape. Tariffs imposed on Chinese electronics under the Trump administration significantly impacted global supply chains. Costs of essential components like RF modules, connectors, and circuit boards escalated, straining production timelines. Defense contractors within the United States faced procurement delays and rising expenses, which forced a pivot toward domestic suppliers and allied manufacturing partnerships. While the original goal was to boost national security and domestic capability, these actions temporarily disrupted access to critical military-grade parts, highlighting the vulnerability of international dependency.

| Market Scope | |

|---|---|

| Start Year | 2024 |

| Forecast Year | 2025-2034 |

| Start Value | $4.3 Billion |

| Forecast Value | $7.1 Billion |

| CAGR | 5.3% |

Among the frequency segments, ultra-high frequency (UHF) antennas led the market in 2024 with a valuation of USD 1.6 billion. These antennas are widely adopted for their reliability in high-mobility military communication systems, particularly in areas with signal obstruction like dense terrain or complex urban landscapes. Their operational flexibility and compatibility with short-to-mid-range communication needs continue to drive demand across multiple platforms. Additionally, standardized frequency protocols are encouraging further investment in UHF technologies.

Dipole antennas topped the product type segment, generating revenues of USD 1 billion in 2024. Their simple design, omnidirectional radiation, and broad frequency compatibility make them a preferred option in communication systems integrated into mobile and ground-based military platforms. These antennas are also cost-efficient and easy to integrate, supporting long-standing systems and new deployments.

Germany Military Antenna Market generated USD 243.4 million in 2024, driven by advancing its focus on software-defined and multi-standard communication architectures, creating robust demand for adaptive and secure antenna systems. This evolution is fueled by modernization efforts across both aerial and terrestrial defense platforms, where high-performance, frequency-agile antennas are essential for real-time situational awareness and interoperability. The push toward digital battlefield capabilities and enhanced electronic warfare resilience encourages domestic R&D in advanced antenna technologies.

Leading companies in the Global Military Antenna Market focus on innovation, partnerships, and product expansion to secure their market position. Lockheed Martin and RTX invest heavily in advanced communication systems for future combat environments. Thales and BAE Systems are expanding their product lines to support interoperability and modularity. Viasat and L3Harris Technologies are strengthening their satellite-based antenna portfolios. Meanwhile, Cobham Advanced Electronic Solutions and Rohde & Schwarz are forming strategic partnerships to increase production efficiency. MTI Wireless Edge and Antcom are developing compact, rugged antenna systems to meet tactical demands.

Table of Contents

Chapter 1 Methodology and Scope

- 1.1 Market scope and definitions

- 1.2 Research design

- 1.2.1 Research approach

- 1.2.2 Data collection methods

- 1.3 Base estimates and calculations

- 1.3.1 Base year calculation

- 1.3.2 Key trends for market estimation

- 1.4 Forecast model

- 1.5 Primary research and validation

- 1.5.1 Primary sources

- 1.5.2 Data mining sources

Chapter 2 Executive Summary

- 2.1 Industry 360° synopsis

Chapter 3 Industry Insights

- 3.1 Industry ecosystem analysis

- 3.2 Trump administration tariffs

- 3.2.1 Impact on trade

- 3.2.1.1 Trade volume disruptions

- 3.2.1.2 Retaliatory measures

- 3.2.2 Impact on the industry

- 3.2.2.1 Supply-side impact

- 3.2.2.1.1 Price volatility in key components

- 3.2.2.1.2 Supply chain restructuring

- 3.2.2.1.3 Production cost implications

- 3.2.2.2 Demand-side impact (selling price)

- 3.2.2.2.1 Price transmission to end markets

- 3.2.2.2.2 Market share dynamics

- 3.2.2.2.3 Consumer response patterns

- 3.2.2.1 Supply-side impact

- 3.2.3 Key companies impacted

- 3.2.4 Strategic industry responses

- 3.2.4.1 Supply chain reconfiguration

- 3.2.4.2 Pricing and product strategies

- 3.2.4.3 Policy engagement

- 3.2.5 Outlook and future considerations

- 3.2.1 Impact on trade

- 3.3 Industry impact forces

- 3.3.1 Growth drivers

- 3.3.1.1 Increased defense budgets worldwide

- 3.3.1.2 Modernization of armed forces

- 3.3.1.3 Growth in unmanned aerial vehicles (UAVs)

- 3.3.1.4 Emergence of electronic warfare (EW)

- 3.3.1.5 Increase in border surveillance and reconnaissance activities

- 3.3.2 Industry pitfalls and challenges

- 3.3.2.1 High development and integration costs

- 3.3.2.2 Complex regulatory and frequency allocation issues

- 3.3.1 Growth drivers

- 3.4 Growth potential analysis

- 3.5 Regulatory landscape

- 3.6 Technology landscape

- 3.7 Future market trends

- 3.8 Porter's analysis

- 3.9 PESTEL analysis

Chapter 4 Competitive Landscape, 2024

- 4.1 Introduction

- 4.2 Company market share analysis

- 4.3 Competitive analysis of major market players

- 4.4 Competitive positioning matrix

- 4.5 Strategy dashboard

Chapter 5 Market Estimates and Forecast, By Type, 2021 – 2034 (USD Million & Million Units)

- 5.1 Key trends

- 5.2 Dipole antenna

- 5.3 Monopole antennas

- 5.4 Horn antennas

- 5.5 Loop antenna

- 5.6 Array antenna

- 5.7 Patch antennas

- 5.8 Parabolic reflector antennas

- 5.9 Others

Chapter 6 Market Estimates and Forecast, By Frequency Band, 2021 – 2034 (USD Million & Million Units)

- 6.1 Key trends

- 6.2 High frequency (HF) (3–30 MHz)

- 6.3 Very high frequency (VHF) (30–300 MHz)

- 6.4 Ultra high frequency (UHF) (300 MHz–3 GHz)

- 6.5 Super high frequency (SHF) (3–30 GHz)

- 6.6 Extremely high frequency (EHF) (30–300 GHz)

Chapter 7 Market Estimates and Forecast, By Platform, 2021 – 2034 (USD Million & Million Units)

- 7.1 Key trends

- 7.2 Ground-based

- 7.3 Naval

- 7.4 Airborne

- 7.5 Space

Chapter 8 Market Estimates and Forecast, By Application, 2021 – 2034 (USD Million & Million Units)

- 8.1 Key trends

- 8.2 Surveillance & reconnaissance

- 8.3 Satcom

- 8.4 Electronic warfare

- 8.5 Telemetry

- 8.6 Communication

- 8.7 Others

Chapter 9 Market Estimates and Forecast, By Region, 2021 – 2034 (USD Million & Million Units)

- 9.1 Key trends

- 9.2 North America

- 9.2.1 U.S.

- 9.2.2 Canada

- 9.3 Europe

- 9.3.1 Germany

- 9.3.2 UK

- 9.3.3 France

- 9.3.4 Spain

- 9.3.5 Italy

- 9.3.6 Netherlands

- 9.4 Asia Pacific

- 9.4.1 China

- 9.4.2 India

- 9.4.3 Japan

- 9.4.4 Australia

- 9.4.5 South Korea

- 9.5 Latin America

- 9.5.1 Brazil

- 9.5.2 Mexico

- 9.5.3 Argentina

- 9.6 Middle East and Africa

- 9.6.1 Saudi Arabia

- 9.6.2 South Africa

- 9.6.3 UAE

Chapter 10 Company Profiles

- 10.1 Antcom

- 10.2 BAE Systems

- 10.3 Cobham Advanced Electronic Solutions

- 10.4 Comrod Communication

- 10.5 Eylex

- 10.6 General Dynamics Mission Systems

- 10.7 Hascall-Denke

- 10.8 Honeywell International

- 10.9 L3Harris Technologies

- 10.10 Lockheed Martin

- 10.11 MTI Wireless Edge

- 10.12 Rohde and Schwarz

- 10.13 RTX

- 10.14 Saab

- 10.15 Thales

- 10.16 Viasat