|

市場調查報告書

商品編碼

1750345

充血性心臟衰竭藥物市場機會、成長動力、產業趨勢分析及 2025 - 2034 年預測Congestive Heart Failure Drugs Market Opportunity, Growth Drivers, Industry Trend Analysis, and Forecast 2025 - 2034 |

||||||

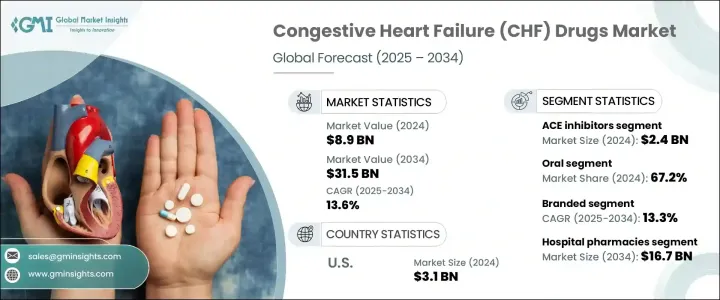

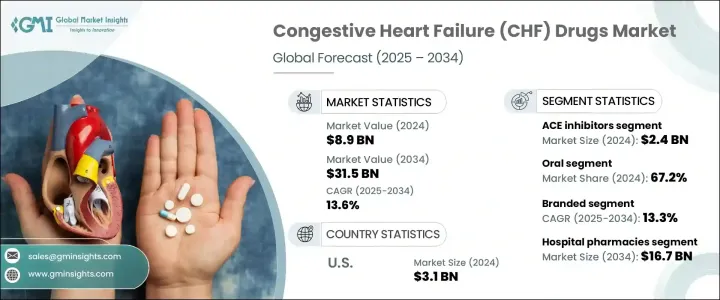

2024年,全球充血性心臟衰竭藥物市場規模達89億美元,預計2034年將以13.6%的複合年成長率成長,達到315億美元。受人口老化以及高血壓、肥胖症和糖尿病等疾病發病率上升的影響,全球心臟衰竭負擔日益加重,顯著促進了市場成長。隨著人口老化和慢性疾病的日益普遍,對心臟衰竭長期治療方案的需求持續成長。這一趨勢在醫療基礎設施日益完善、心血管健康意識日益增強的地區尤為突出。由於診斷能力的提高和對預防保健的日益重視,充血性心臟衰竭的早期診斷和治療如今變得更加可行。

針對急性和慢性充血性心臟衰竭(CHF)的研發活動不斷增加,也推動了市場的發展。隨著製藥公司加大對新藥研發的投資,充血性心臟衰竭(CHF)治療的整體格局正在迅速演變。此外,支持性醫療政策、藥品可及性的提高以及更廣泛的治療手段的結合,正在鞏固市場的穩定成長。市場參與者也正在利用合作夥伴關係、策略聯盟和法規核准來增強其產品組合併提升全球影響力,進一步推動市場的長期成長。

| 市場範圍 | |

|---|---|

| 起始年份 | 2024 |

| 預測年份 | 2025-2034 |

| 起始值 | 89億美元 |

| 預測值 | 315億美元 |

| 複合年成長率 | 13.6% |

藥理學進展在重新定義充血性心臟衰竭(CHF)治療方案方面發揮重要作用。雖然BETA受體阻斷劑、血管張力素轉換酶(ACE)抑制劑和利尿劑等傳統療法仍是治療疾病的基礎,但新型藥物因其臨床益處而日益受到重視。血管張力素受體-腦啡肽酶抑制劑 (ARNI) 和鈉-葡萄糖協同轉運蛋白-2 (SGLT2) 抑制劑在改善患者預後方面取得了顯著進展。這些新型療法得到了大量臨床研究的支持,並已顯示出降低住院率和死亡率的潛力,使其成為醫護人員和患者都青睞的選擇。隨著臨床試驗和創新的不斷推進,這些新型療法正在重塑整個醫療體系中充血性心臟衰竭的管理方式。

根據藥物類別,市場包括BETA受體阻斷劑、血管緊張素轉換酶 (ACE) 抑制劑、利尿劑、鹽皮質激素受體拮抗劑 (MRAs)、血管緊張素Ⅱ受體阻斷劑、伊伐布雷定、SGLT2抑制劑、正性肌力藥等。 2024年,ACE抑制劑市場規模達24億美元,領先市場。 ACE抑制劑在降低射血分數心臟衰竭治療中長期發揮重要作用,加上其降低住院率和提高存活率的功效,使其保持高度的市場競爭力。由於價格實惠、品牌藥和學名藥種類繁多、且在全球治療指南中得到一致認可,這些藥物被廣泛使用。

依給藥途徑,充血性心臟衰竭(CHF)藥物市場分為口服和腸外給藥。 2024年,口服藥物佔了67.2%的市場。其便利性、易用性和價格實惠使其成為充血性心臟衰竭(CHF)長期管理的首選方案。大多數常用的充血性心臟衰竭(CHF)藥物都有口服劑型,這有利於提高患者依從性,並實現經濟高效的疾病管理,無論高收入國家或低收入國家。

就藥品類型而言,市場分為品牌藥和學名藥。預計到2034年,品牌藥市場的複合年成長率將達到13.3%。這一成長得益於療效和安全性更高的創新療法的引入。醫療保健提供者通常更青睞品牌藥,因為它們經過了廣泛的臨床驗證,而全球醫療保健支出的不斷成長也支持了品牌藥在已開發市場的普及。

充血性心臟衰竭(CHF)藥物市場的分銷管道包括醫院藥房、零售藥房和線上藥房。預計到2034年,醫院藥局的銷售額將達到167億美元。這一成長源於醫院在靜脈注射藥物和門診通常無法獲得的專科治療方面發揮的關鍵作用。隨著治療方法日益複雜,醫院在提供先進充血性心臟衰竭(CHF)療法方面發揮越來越重要的作用。

從地理分佈來看,北美在2024年佔據CHF藥物市場的38.5%佔有率,佔據主導地位。尤其是美國,2024年的營收達到31億美元,反映出對心臟衰竭治療藥物的強勁需求。美國完善的醫療基礎設施、廣泛的保險藥品可及性以及較高的認知度,使其成為市場領導者。

市場競爭依然激烈,阿斯特捷利康、諾華、拜耳、禮來、勃林格殷格翰和默克等主要公司合計佔全球約45%的市場。這些公司持續推動創新,追求監管里程碑,並進行區域擴張,以在不斷變化的治療領域中保持優勢。

目錄

第1章:方法論與範圍

第2章:執行摘要

第3章:行業洞察

- 產業生態系統分析

- 產業衝擊力

- 成長動力

- 心臟衰竭盛行率上升

- 藥物研發的進展

- 提高認知和篩檢

- 產業陷阱與挑戰

- 嚴格的法規核准

- 先進藥物成本高昂

- 成長動力

- 成長潛力分析

- 監管格局

- 川普政府關稅

- 對貿易的影響

- 貿易量中斷

- 報復措施

- 對產業的影響

- 供給側影響(原料)

- 主要材料價格波動

- 供應鏈重組

- 生產成本影響

- 需求面影響(售價)

- 價格傳導至終端市場

- 市佔率動態

- 消費者反應模式

- 供給側影響(原料)

- 受影響的主要公司

- 策略產業反應

- 供應鏈重組

- 定價和產品策略

- 政策參與

- 展望與未來考慮

- 對貿易的影響

- 管道分析

- 波特的分析

- PESTEL分析

第4章:競爭格局

- 介紹

- 公司矩陣分析

- 主要市場參與者的競爭分析

- 競爭定位矩陣

- 策略儀表板

第5章:市場估計與預測:按藥物類別,2021 - 2034 年

- 主要趨勢

- 血管緊張素轉換酶抑制劑

- BETA受體阻斷劑

- 利尿劑

- 血管張力素2受體阻斷劑

- 鹽皮質激素受體拮抗劑(MRAs)

- 伊伐布雷定

- 強心劑

- SGLT2抑制劑

- 其他藥物類別

第6章:市場估計與預測:按管理路線,2021 - 2034 年

- 主要趨勢

- 口服

- 腸外

第7章:市場估計與預測:按類型,2021 - 2034 年

- 主要趨勢

- 品牌

- 通用的

第8章:市場估計與預測:按配銷通路,2021 - 2034 年

- 主要趨勢

- 醫院藥房

- 零售藥局

- 網路藥局

第9章:市場估計與預測:按地區,2021 - 2034 年

- 主要趨勢

- 北美洲

- 美國

- 加拿大

- 歐洲

- 德國

- 英國

- 法國

- 義大利

- 西班牙

- 荷蘭

- 亞太地區

- 中國

- 日本

- 印度

- 澳洲

- 韓國

- 拉丁美洲

- 巴西

- 墨西哥

- 阿根廷

- 中東和非洲

- 南非

- 沙烏地阿拉伯

- 阿拉伯聯合大公國

第10章:公司簡介

- Alnylam Pharmaceuticals

- Amgen

- AstraZeneca

- Bayer

- Boehringer Ingelheim International

- Bristol-Myers Squibb Company

- Eli Lilly and Company

- GlaxoSmithKline

- Johnson & Johnson

- Merck

- Novartis

- Otsuka Pharmaceutical

- Pfizer

- Sanofi

- Teva Pharmaceutical Industries

The Global Congestive Heart Failure Drugs Market was valued at USD 8.9 billion in 2024 and is estimated to grow at a CAGR of 13.6% to reach USD 31.5 billion by 2034. The increasing global burden of heart failure, driven by aging demographics and the rising incidence of conditions like hypertension, obesity, and diabetes, is significantly contributing to market growth. As the population ages and chronic health conditions become more prevalent, the need for long-term treatment solutions for heart failure continues to grow. This trend is especially prominent in regions with growing access to healthcare infrastructure and increasing awareness of cardiovascular health. Early diagnosis and treatment of CHF are now more feasible thanks to improved diagnostic capabilities and a growing emphasis on preventive care.

The market is also being bolstered by an uptick in research and development activities focused on both acute and chronic forms of the disease. With pharmaceutical companies ramping up investments in new drug development, the overall landscape for CHF treatment is rapidly evolving. Additionally, the combination of supportive healthcare policies, improved drug accessibility, and a wider therapeutic arsenal is reinforcing the market's steady rise. Market players are also leveraging partnerships, strategic alliances, and regulatory approvals to strengthen their product portfolios and enhance global reach, further fueling long-term market growth.

| Market Scope | |

|---|---|

| Start Year | 2024 |

| Forecast Year | 2025-2034 |

| Start Value | $8.9 Billion |

| Forecast Value | $31.5 Billion |

| CAGR | 13.6% |

Pharmacological advancements are playing a major role in redefining CHF treatment protocols. While conventional therapies like beta blockers, ACE inhibitors, and diuretics remain fundamental in managing the disease, newer classes of drugs are gaining ground for their clinical benefits. Angiotensin receptor-neprilysin inhibitors (ARNIs) and sodium-glucose cotransporter-2 (SGLT2) inhibitors are making significant strides in improving patient outcomes. These novel therapies are supported by extensive clinical research and have shown promise in reducing hospitalization and mortality rates, making them an attractive option for both healthcare providers and patients. With ongoing clinical trials and innovation, these newer treatments are reshaping how CHF is managed across healthcare systems.

Based on drug class, the market includes beta blockers, ACE inhibitors, diuretics, mineralocorticoid receptor antagonists (MRAs), angiotensin 2 receptor blockers, ivabradine, SGLT2 inhibitors, inotropes, and others. In 2024, the ACE inhibitors segment led the market with a valuation of USD 2.4 billion. Their long-established role in managing heart failure with reduced ejection fraction, combined with their proven ability to reduce hospital admissions and enhance survival, keeps them highly relevant. These drugs are widely prescribed due to their affordability, broad availability in branded and generic formats, and consistent endorsement in treatment guidelines worldwide.

By route of administration, the CHF drugs market is segmented into oral and parenteral formulations. Oral drugs accounted for 67.2% of the market in 2024. Their convenience, ease of use, and affordability make them the preferred option for long-term management of CHF. Most commonly used CHF medications are available in oral formulations, promoting patient adherence and cost-effective disease management across both high- and low-income countries.

In terms of drug type, the market is divided into branded and generic drugs. The branded drugs segment is forecasted to grow at a CAGR of 13.3% through 2034. This growth is attributed to the introduction of innovative therapies that offer enhanced efficacy and safety profiles. Healthcare providers often prefer branded medications due to their extensive clinical validation, while increasing global healthcare spending supports their uptake in developed markets.

The distribution channels in the CHF drugs market include hospital pharmacies, retail pharmacies, and online pharmacies. Hospital pharmacies are projected to reach USD 16.7 billion by 2034. This growth is driven by the critical role hospitals play in administering intravenous medications and specialized treatments that are typically not available in outpatient settings. As treatment approaches become more complex, hospitals are increasingly central to the delivery of advanced CHF therapies.

Geographically, North America led the CHF drugs market in 2024 with a 38.5% share. The United States, in particular, recorded revenue of USD 3.1 billion in 2024, reflecting strong demand for heart failure treatments. The country's well-established healthcare infrastructure, wide access to medications through insurance, and high awareness levels contribute to its leading market position.

The market remains highly competitive, with major players like AstraZeneca, Novartis, Bayer, Eli Lilly, Boehringer Ingelheim, and Merck collectively holding around 45% of the global market. These companies continue to drive innovation, pursue regulatory milestones, and expand regionally to maintain their edge in the evolving treatment landscape.

Table of Contents

Chapter 1 Methodology and Scope

- 1.1 Market scope and definition

- 1.2 Research design

- 1.2.1 Research approach

- 1.2.2 Data collection methods

- 1.3 Base estimates and calculations

- 1.3.1 Base year calculation

- 1.3.2 Key trends for market estimation

- 1.4 Forecast model

- 1.5 Primary research and validation

- 1.5.1 Primary sources

- 1.5.2 Data mining sources

Chapter 2 Executive Summary

- 2.1 Industry 3600 synopsis

Chapter 3 Industry Insights

- 3.1 Industry ecosystem analysis

- 3.2 Industry impact forces

- 3.2.1 Growth drivers

- 3.2.1.1 Rising prevalence of heart failure

- 3.2.1.2 Advancements in drug development

- 3.2.1.3 Increasing awareness and screening

- 3.2.2 Industry pitfalls and challenges

- 3.2.2.1 Stringent regulatory approval

- 3.2.2.2 High cost of advanced medications

- 3.2.1 Growth drivers

- 3.3 Growth potential analysis

- 3.4 Regulatory landscape

- 3.5 Trump administration tariffs

- 3.5.1 Impact on trade

- 3.5.1.1 Trade volume disruptions

- 3.5.1.2 Retaliatory measures

- 3.5.2 Impact on the industry

- 3.5.2.1 Supply-side impact (raw materials)

- 3.5.2.1.1 Price volatility in key materials

- 3.5.2.1.2 Supply chain restructuring

- 3.5.2.1.3 Production cost implications

- 3.5.2.2 Demand-side impact (selling price)

- 3.5.2.2.1 Price transmission to end markets

- 3.5.2.2.2 Market share dynamics

- 3.5.2.2.3 Consumer response patterns

- 3.5.2.1 Supply-side impact (raw materials)

- 3.5.3 Key companies impacted

- 3.5.4 Strategic industry responses

- 3.5.4.1 Supply chain reconfiguration

- 3.5.4.2 Pricing and product strategies

- 3.5.4.3 Policy engagement

- 3.5.5 Outlook and future considerations

- 3.5.1 Impact on trade

- 3.6 Pipeline analysis

- 3.7 Porter's analysis

- 3.8 PESTEL analysis

Chapter 4 Competitive Landscape, 2024

- 4.1 Introduction

- 4.2 Company matrix analysis

- 4.3 Competitive analysis of major market players

- 4.4 Competitive positioning matrix

- 4.5 Strategy dashboard

Chapter 5 Market Estimates and Forecast, By Drug Class, 2021 - 2034 ($ Mn)

- 5.1 Key trends

- 5.2 ACE inhibitors

- 5.3 Beta blockers

- 5.4 Diuretics

- 5.5 Angiotensin 2 receptor blockers

- 5.6 Mineralocorticoid receptor antagonists (MRAs)

- 5.7 Ivabradine

- 5.8 Inotropes

- 5.9 SGLT2 inhibitors

- 5.10 Other drug classes

Chapter 6 Market Estimates and Forecast, By Route of Administration, 2021 - 2034 ($ Mn)

- 6.1 Key trends

- 6.2 Oral

- 6.3 Parenteral

Chapter 7 Market Estimates and Forecast, By Type, 2021 - 2034 ($ Mn)

- 7.1 Key trends

- 7.2 Branded

- 7.3 Generic

Chapter 8 Market Estimates and Forecast, By Distribution Channel, 2021 - 2034 ($ Mn)

- 8.1 Key trends

- 8.2 Hospital pharmacies

- 8.3 Retail pharmacies

- 8.4 Online pharmacies

Chapter 9 Market Estimates and Forecast, By Region, 2021 - 2034 ($ Mn)

- 9.1 Key trends

- 9.2 North America

- 9.2.1 U.S.

- 9.2.2 Canada

- 9.3 Europe

- 9.3.1 Germany

- 9.3.2 UK

- 9.3.3 France

- 9.3.4 Italy

- 9.3.5 Spain

- 9.3.6 Netherlands

- 9.4 Asia Pacific

- 9.4.1 China

- 9.4.2 Japan

- 9.4.3 India

- 9.4.4 Australia

- 9.4.5 South Korea

- 9.5 Latin America

- 9.5.1 Brazil

- 9.5.2 Mexico

- 9.5.3 Argentina

- 9.6 Middle East and Africa

- 9.6.1 South Africa

- 9.6.2 Saudi Arabia

- 9.6.3 UAE

Chapter 10 Company Profiles

- 10.1 Alnylam Pharmaceuticals

- 10.2 Amgen

- 10.3 AstraZeneca

- 10.4 Bayer

- 10.5 Boehringer Ingelheim International

- 10.6 Bristol-Myers Squibb Company

- 10.7 Eli Lilly and Company

- 10.8 GlaxoSmithKline

- 10.9 Johnson & Johnson

- 10.10 Merck

- 10.11 Novartis

- 10.12 Otsuka Pharmaceutical

- 10.13 Pfizer

- 10.14 Sanofi

- 10.15 Teva Pharmaceutical Industries