|

市場調查報告書

商品編碼

1750339

SGLT2 抑制劑市場機會、成長動力、產業趨勢分析及 2025 - 2034 年預測SGLT2 Inhibitors Market Opportunity, Growth Drivers, Industry Trend Analysis, and Forecast 2025 - 2034 |

||||||

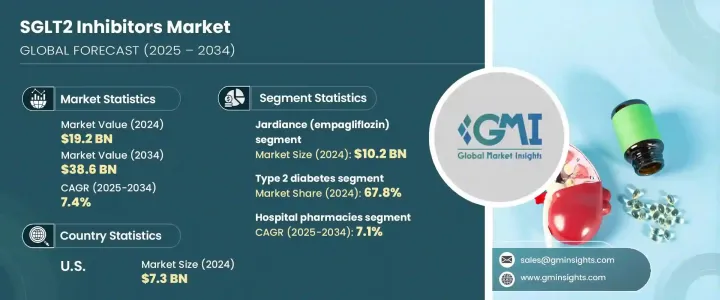

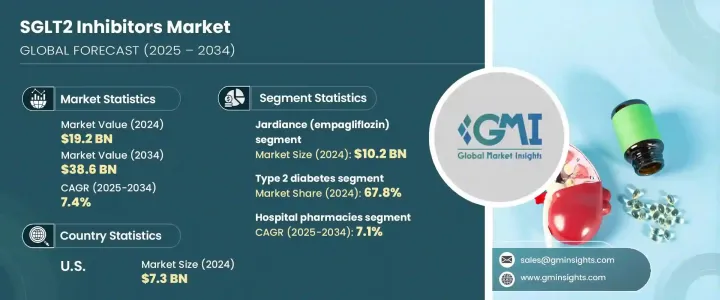

2024年,全球SGLT2抑制劑市場規模達192億美元,預計到2034年將以7.4%的複合年成長率成長,達到386億美元。這主要得益於全球第2型糖尿病盛行率的不斷上升。由於缺乏運動、人口老化和肥胖率上升等生活方式因素,第2型糖尿病影響數百萬患者。這類藥物在治療領域脫穎而出,因為它們除了降低血糖外,還有多種益處,特別適用於心血管和腎臟併發症患者。它們在慢性疾病管理中的作用日益增強,顯著擴大了患者群體。

與傳統糖尿病藥物不同,SGLT2抑制劑透過促進腎臟葡萄糖排泄來降低血糖水平,不僅有助於血糖控制,還有助於保護心血管和腎臟。這使得SGLT2抑制劑成為病患和醫護人員的首選。越來越多的臨床研究證據表明,SGLT2抑制劑可降低心臟衰竭和腎臟病患者的住院率和死亡率,因此擴大將其作為聯合療法的一部分,以提高治療效果和患者依從性。此外,藥物研究的持續進展也進一步加速了創新,並提高了產品的有效性。

| 市場範圍 | |

|---|---|

| 起始年份 | 2024 |

| 預測年份 | 2025-2034 |

| 起始值 | 192億美元 |

| 預測值 | 386億美元 |

| 複合年成長率 | 7.4% |

2024年,第2型糖尿病治療領域佔了67.8%的市場。該領域的主導地位反映出,在日益加重的糖尿病負擔下,人們迫切需要有效的解決方案。值得注意的是,許多醫生現在傾向於將這些抑制劑與其他口服抗糖尿病藥物合併使用,以增強療效。它們能夠同時應對多種疾病因素,已成為現代糖尿病管理的基石。

依配銷通路分類,全球SGLT2抑制劑市場分為醫院藥局、零售藥局和線上藥局。截至2024年,醫院藥局市場在2025年至2034年期間的複合年成長率將達到7.1%,這得益於其在住院和門診環境中提供專業治療解決方案的核心作用。醫院藥房的主導地位源於其整合了先進的藥房服務,這些服務支持協調的護理路徑並改善臨床療效。這些藥局在住院患者的藥物管理中發揮著至關重要的作用,確保及時給予處方治療,尤其是在急診環境中。

美國SGLT2抑制劑市場在2024年佔41.1%的市場佔有率,並將以7.2%的複合年成長率成長至2034年。 2034年,美國SGLT2抑制劑市場規模達73億美元。美國的成長軌跡得益於其強大的醫療基礎設施、廣泛的患者可及性以及鼓勵處方藥使用的強力報銷政策。同時,由於診斷率的提高、醫療投資的增加以及創新療法的可及性不斷擴大,歐洲和亞太市場正展現出顯著的吸引力。

全球SGLT2抑制劑產業的知名企業包括默克公司、魯賓有限公司、格蘭馬克製藥、安斯泰來、勃林格殷格翰國際、Lexicon製藥、阿斯特捷利康、強生(楊森製藥)、賽諾菲、禮來公司、TheracosBio和百時美施貴寶公司。為了鞏固其在全球SGLT2抑制劑市場的地位,各公司正積極投資策略合作夥伴關係、聯合行銷協議並拓展臨床適應症。北美和歐洲的主要企業正在利用研發管線開發先進的製劑,不僅針對糖尿病,也針對心臟衰竭和腎臟疾病。亞太地區的企業正在擴大生產能力並組成分銷聯盟,以滿足不斷成長的需求。

目錄

第1章:方法論與範圍

第2章:執行摘要

第3章:行業洞察

- 產業生態系統分析

- 產業衝擊力

- 成長動力

- 2型糖尿病盛行率上升

- 擴大治療適應症

- 患者對口服療法的偏好增加

- 產業陷阱與挑戰

- 與藥物相關的副作用

- 來自替代療法的競爭

- 成長動力

- 成長潛力分析

- 監管格局

- 川普政府關稅

- 對貿易的影響

- 貿易量中斷

- 報復措施

- 對產業的影響

- 供給側影響(原料)

- 主要材料價格波動

- 供應鏈重組

- 生產成本影響

- 需求面影響(售價)

- 價格傳導至終端市場

- 市佔率動態

- 消費者反應模式

- 供給側影響(原料)

- 受影響的主要公司

- 策略產業反應

- 供應鏈重組

- 定價和產品策略

- 政策參與

- 展望與未來考慮

- 對貿易的影響

- 未來市場趨勢

- 管道分析

- 波特的分析

- PESTEL分析

第4章:競爭格局

- 介紹

- 公司矩陣分析

- 主要市場參與者的競爭分析

- 競爭定位矩陣

- 策略儀表板

第5章:市場估計與預測:按藥物類別,2021 - 2034 年

- 主要趨勢

- Jardiance(恩格列淨)

- Farxiga(達格列淨)

- Invokana(卡格列淨)

- Inpefa(索格列淨)

- Qtern(達格列淨/沙格列汀)

- 其他SGLT2抑制劑

第6章:市場估計與預測:按適應症,2021 - 2034 年

- 主要趨勢

- 2型糖尿病

- 心血管疾病

- 慢性腎臟病(CKD)

- 其他適應症

第7章:市場估計與預測:按配銷通路,2021 - 2034 年

- 主要趨勢

- 醫院藥房

- 零售藥局

- 網路藥局

第8章:市場估計與預測:按地區,2021 - 2034 年

- 主要趨勢

- 北美洲

- 美國

- 加拿大

- 歐洲

- 德國

- 英國

- 法國

- 義大利

- 西班牙

- 荷蘭

- 亞太地區

- 中國

- 日本

- 印度

- 澳洲

- 韓國

- 拉丁美洲

- 巴西

- 墨西哥

- 阿根廷

- 中東和非洲

- 南非

- 沙烏地阿拉伯

- 阿拉伯聯合大公國

第9章:公司簡介

- Astellas

- AstraZeneca

- Boehringer Ingelheim International

- Bristol-Myers Squibb Company

- Eli Lilly and Company

- Glenmark Pharmaceuticals

- Johnson & Johnson (Janssen Pharmaceuticals)

- Lexicon Pharmaceuticals

- Lupin Limited

- Merck

- Sanofi

- TheracosBio

The Global SGLT2 Inhibitors Market was valued at USD 19.2 billion in 2024 and is estimated to grow at a CAGR of 7.4% to reach USD 38.6 billion by 2034, driven by the increasing global prevalence of type 2 diabetes, a condition affecting millions due to lifestyle factors such as physical inactivity, aging populations, and rising obesity rates. These medications stand out in the therapeutic landscape because they offer multiple benefits beyond lowering blood sugar, particularly for patients with cardiovascular and renal complications. Their expanding role in managing chronic health conditions has significantly broadened their patient base.

Unlike traditional diabetes medications, SGLT2 inhibitors reduce glucose levels by promoting glucose excretion through the kidneys, which not only supports glycemic control but also contributes to cardiovascular and kidney protection. This makes them a preferred option among both patients and healthcare providers. With mounting evidence from clinical studies showing reduced hospitalization rates and mortality in heart failure and kidney disease patients, these drugs are increasingly used as part of combination therapies to improve treatment efficacy and patient compliance. Additionally, ongoing advancements in pharmaceutical research are further accelerating innovation and enhancing product effectiveness.

| Market Scope | |

|---|---|

| Start Year | 2024 |

| Forecast Year | 2025-2034 |

| Start Value | $19.2 Billion |

| Forecast Value | $38.6 Billion |

| CAGR | 7.4% |

In 2024, the segment for managing type 2 diabetes held a 67.8% share. The dominance of this segment reflects the urgent need for effective solutions amid the growing diabetes burden. Notably, many physicians now favor prescribing these inhibitors alongside other oral antidiabetic agents to amplify therapeutic outcomes. Their ability to address multiple disease factors simultaneously has made them a cornerstone of modern diabetes management.

By distribution channel, the global SGLT2 inhibitors market is segmented into hospital pharmacies, retail pharmacies, and online pharmacies. As of 2024, the hospital pharmacies segment will grow at a CAGR of 7.1% from 2025-2034, driven by its central role in delivering specialized treatment solutions across inpatient and outpatient settings. The dominant position of hospital pharmacies stems from their integration of advanced pharmacy services that support coordinated care pathways and improve clinical outcomes. These pharmacies play a crucial role in medication management for hospitalized patients, ensuring the timely administration of prescribed therapies, especially in acute care settings.

United States SGLT2 Inhibitors Market held 41.1% share in 2024 and will grow at a 7.2% CAGR through 2034. United States generated USD 7.3 billion in 2034. The country's growth trajectory is supported by a robust healthcare infrastructure, widespread patient access to treatments, and strong reimbursement policies encouraging prescription adoption. Meanwhile, Europe and the Asia-Pacific markets are showing significant traction due to improved diagnosis rates, rising healthcare investments, and broader access to innovative therapies.

Prominent players in the Global SGLT2 Inhibitors Industry include Merck, Lupin Limited, Glenmark Pharmaceuticals, Astellas, Boehringer Ingelheim International, Lexicon Pharmaceuticals, AstraZeneca, Johnson & Johnson (Janssen Pharmaceuticals), Sanofi, Eli Lilly and Company, TheracosBio, and Bristol-Myers Squibb Company. To strengthen their position in the Global SGLT2 Inhibitors Market, companies are actively investing in strategic partnerships, co-marketing agreements, and expanding clinical indications. Major players in North America and Europe are leveraging R&D pipelines to develop advanced formulations targeting not just diabetes, but also heart failure and kidney disease. Firms in Asia-Pacific are expanding manufacturing capacities and forming distribution alliances to meet rising demand.

Table of Contents

Chapter 1 Methodology and Scope

- 1.1 Market scope and definition

- 1.2 Research design

- 1.2.1 Research approach

- 1.2.2 Data collection methods

- 1.3 Base estimates and calculations

- 1.3.1 Base year calculation

- 1.3.2 Key trends for market estimation

- 1.4 Forecast model

- 1.5 Primary research and validation

- 1.5.1 Primary sources

- 1.5.2 Data mining sources

Chapter 2 Executive Summary

- 2.1 Industry 3600 synopsis

Chapter 3 Industry Insights

- 3.1 Industry ecosystem analysis

- 3.2 Industry impact forces

- 3.2.1 Growth drivers

- 3.2.1.1 Rising prevalence of type 2 diabetes

- 3.2.1.2 Expanding therapeutic indications

- 3.2.1.3 Increased patient preference for oral therapies

- 3.2.2 Industry pitfalls and challenges

- 3.2.2.1 Side effects associated with drugs

- 3.2.2.2 Competition from alternative therapies

- 3.2.1 Growth drivers

- 3.3 Growth potential analysis

- 3.4 Regulatory landscape

- 3.5 Trump administration tariffs

- 3.5.1 Impact on trade

- 3.5.1.1 Trade volume disruptions

- 3.5.1.2 Retaliatory measures

- 3.5.2 Impact on the industry

- 3.5.2.1 Supply-side impact (raw materials)

- 3.5.2.1.1 Price volatility in key materials

- 3.5.2.1.2 Supply chain restructuring

- 3.5.2.1.3 Production cost implications

- 3.5.2.2 Demand-side impact (selling price)

- 3.5.2.2.1 Price transmission to end markets

- 3.5.2.2.2 Market share dynamics

- 3.5.2.2.3 Consumer response patterns

- 3.5.2.1 Supply-side impact (raw materials)

- 3.5.3 Key companies impacted

- 3.5.4 Strategic industry responses

- 3.5.4.1 Supply chain reconfiguration

- 3.5.4.2 Pricing and product strategies

- 3.5.4.3 Policy engagement

- 3.5.5 Outlook and future considerations

- 3.5.1 Impact on trade

- 3.6 Future market trends

- 3.7 Pipeline analysis

- 3.8 Porter's analysis

- 3.9 PESTEL analysis

Chapter 4 Competitive Landscape, 2024

- 4.1 Introduction

- 4.2 Company matrix analysis

- 4.3 Competitive analysis of major market players

- 4.4 Competitive positioning matrix

- 4.5 Strategy dashboard

Chapter 5 Market Estimates and Forecast, By Drug Class, 2021 - 2034 ($ Mn)

- 5.1 Key trends

- 5.2 Jardiance (Empagliflozin)

- 5.3 Farxiga (Dapagliflozin)

- 5.4 Invokana (Canagliflozin)

- 5.5 Inpefa (Sotagliflozin)

- 5.6 Qtern (Dapagliflozin/Saxagliptin)

- 5.7 Other SGLT2 inhibitors

Chapter 6 Market Estimates and Forecast, By Indication, 2021 - 2034 ($ Mn)

- 6.1 Key trends

- 6.2 Type 2 diabetes

- 6.3 Cardiovascular diseases

- 6.4 Chronic kidney disease (CKD)

- 6.5 Other indications

Chapter 7 Market Estimates and Forecast, By Distribution Channel, 2021 - 2034 ($ Mn)

- 7.1 Key trends

- 7.2 Hospital pharmacies

- 7.3 Retail pharmacies

- 7.4 Online pharmacies

Chapter 8 Market Estimates and Forecast, By Region, 2021 - 2034 ($ Mn)

- 8.1 Key trends

- 8.2 North America

- 8.2.1 U.S.

- 8.2.2 Canada

- 8.3 Europe

- 8.3.1 Germany

- 8.3.2 UK

- 8.3.3 France

- 8.3.4 Italy

- 8.3.5 Spain

- 8.3.6 Netherlands

- 8.4 Asia Pacific

- 8.4.1 China

- 8.4.2 Japan

- 8.4.3 India

- 8.4.4 Australia

- 8.4.5 South Korea

- 8.5 Latin America

- 8.5.1 Brazil

- 8.5.2 Mexico

- 8.5.3 Argentina

- 8.6 Middle East and Africa

- 8.6.1 South Africa

- 8.6.2 Saudi Arabia

- 8.6.3 UAE

Chapter 9 Company Profiles

- 9.1 Astellas

- 9.2 AstraZeneca

- 9.3 Boehringer Ingelheim International

- 9.4 Bristol-Myers Squibb Company

- 9.5 Eli Lilly and Company

- 9.6 Glenmark Pharmaceuticals

- 9.7 Johnson & Johnson (Janssen Pharmaceuticals)

- 9.8 Lexicon Pharmaceuticals

- 9.9 Lupin Limited

- 9.10 Merck

- 9.11 Sanofi

- 9.12 TheracosBio