|

市場調查報告書

商品編碼

1750337

鎳鈦合金醫療器材市場機會、成長動力、產業趨勢分析及 2025 - 2034 年預測Nitinol-based Medical Device Market Opportunity, Growth Drivers, Industry Trend Analysis, and Forecast 2025 - 2034 |

||||||

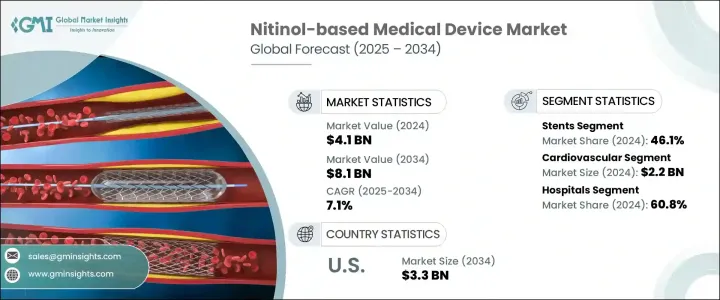

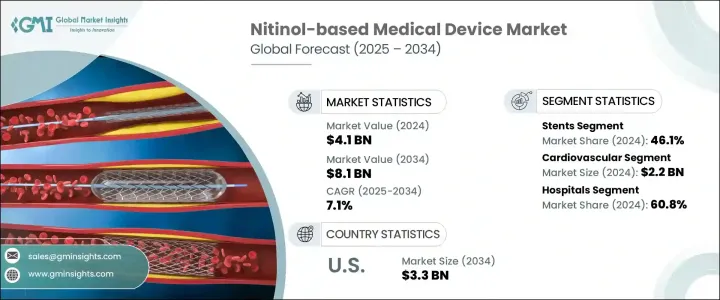

2024年,全球鎳鈦合金醫療器材市場規模達41億美元,預計2034年將以7.1%的複合年成長率成長,達到81億美元。這主要得益於心血管疾病、周邊動脈疾病和神經系統疾病等慢性疾病的日益流行,這些疾病需要先進的微創醫療介入。鎳鈦合金是一種鎳鈦合金,以其獨特的超彈性和形狀記憶特性而聞名,在醫療器材中的應用日益廣泛,以改善患者的治療效果。

鎳鈦合金在變形後能夠恢復到預定形狀,且具有抗機械應力的特性,使其成為各種醫療應用的理想選擇。這些特性尤其適用於支架、導引線和骨科植入物等對柔軟度和耐用性至關重要的器械。該材料的生物相容性和耐腐蝕性進一步增強了其長期植入的適用性。這些特性確保鎳鈦合金器械能夠在人體內長期保持其功能性和結構完整性,從而降低排斥或分解的風險。這種可靠性使鎳鈦合金成為心血管、神經血管和骨科治療中永久植入物的首選。隨著微創手術需求的成長,預計鎳鈦合金器械的採用率將有所上升,從而促進市場擴張。

| 市場範圍 | |

|---|---|

| 起始年份 | 2024 |

| 預測年份 | 2025-2034 |

| 起始值 | 41億美元 |

| 預測值 | 81億美元 |

| 複合年成長率 | 7.1% |

2024年,醫院領域佔據60.8%的市場佔有率,這得益於旨在縮短手術時間、最大程度減少患者創傷和改善康復效果的先進醫療設備的日益普及。鎳鈦合金基器械(例如支架、導引線、過濾器和骨科植入物)因其形狀記憶和超彈性等獨特特性(這些特性在微創介入中至關重要)已成為醫院不可或缺的一部分。它們在複雜解剖結構中的導航表現卓越,尤其是在心血管和神經血管手術中,這轉化為更高的手術成功率和更短的住院時間。

2024年,支架市場以46.1%的市佔率保持領先地位,這得益於血管疾病盛行率的上升以及鎳鈦合金支架帶來的臨床優勢。這些支架因其自膨脹特性以及與複雜血管通路無縫貼合的能力而備受推崇,尤其適用於周邊動脈疾病或冠狀動脈阻塞患者。隨著醫療保健提供者優先考慮微創、高效的動脈疾病治療方案,支架需求持續成長。

2024年,北美鎳鈦合金醫療器材市場佔據40%的市場佔有率,這得益於該地區強大的醫療基礎設施、完善的報銷體係以及對先進醫療技術的早期採用。領先製造商的出現以及鎳鈦合金器材在醫院和專科診所的廣泛臨床整合,進一步鞏固了北美在這一快速發展的醫療器材領域的領先地位。

全球鎳鈦合金醫療器材產業的主要參與者包括波士頓科學公司、美敦力公司、雅培實驗室、泰爾茂公司和貝朗梅爾松根股份公司。這些公司專注於研發,以創新和提高鎳鈦合金器械的性能。由於公司旨在擴大其產品組合和市場範圍,因此策略合作、合併和收購很常見。為了鞏固其市場地位,鎳鈦合金醫療器材產業的公司正在採取幾項關鍵策略。這些策略包括投資研發以創新和提高鎳鈦合金器械的性能。由於公司旨在擴大其產品組合和市場範圍,因此策略合作、合併和收購很常見。

目錄

第1章:方法論與範圍

第2章:執行摘要

第3章:行業洞察

- 產業生態系統分析

- 產業衝擊力

- 成長動力

- 微創手術的需求不斷增加

- 心血管和骨科疾病盛行率上升

- 醫療器材製造的技術進步

- 全球老年人口不斷成長

- 產業陷阱與挑戰

- 鎳鈦合金基裝置成本高

- 嚴格的法規核准流程

- 成長動力

- 成長潛力分析

- 川普政府關稅

- 對貿易的影響

- 貿易量中斷

- 報復措施

- 對產業的影響

- 供給側影響(原料)

- 主要材料價格波動

- 供應鏈重組

- 生產成本影響

- 需求面影響(售價)

- 價格傳導至終端市場

- 市佔率動態

- 消費者反應模式

- 供給側影響(原料)

- 受影響的主要公司

- 策略產業反應

- 供應鏈重組

- 定價和產品策略

- 政策參與

- 展望與未來考慮川普政府關稅

- 對貿易的影響

- 技術格局

- 未來市場趨勢

- 監管格局

- 專利分析

- 波特的分析

- PESTEL分析

第4章:競爭格局

- 介紹

- 競爭市佔率分析

- 公司矩陣分析

- 主要市場參與者的競爭分析

- 競爭定位矩陣

- 戰略展望矩陣

第5章:市場估計與預測:按產品,2021 - 2034 年

- 主要趨勢

- 支架

- 導絲

- 導管

- 其他產品

第6章:市場估計與預測:按應用,2021 - 2034 年

- 主要趨勢

- 心血管

- 骨科

- 牙科

- 神經系統

- 泌尿科

- 其他應用

第7章:市場估計與預測:依最終用途,2021 - 2034 年

- 主要趨勢

- 醫院

- 門診手術中心

- 專科診所

- 研究和學術機構

第8章:市場估計與預測:按地區,2021 - 2034 年

- 主要趨勢

- 北美洲

- 美國

- 加拿大

- 歐洲

- 德國

- 英國

- 法國

- 義大利

- 西班牙

- 荷蘭

- 亞太地區

- 日本

- 中國

- 印度

- 澳洲

- 韓國

- 拉丁美洲

- 墨西哥

- 巴西

- 阿根廷

- 中東和非洲

- 南非

- 沙烏地阿拉伯

- 阿拉伯聯合大公國

第9章:公司簡介

- Abbott Laboratories

- Acandis

- Admedes Schuessler

- Arthrex

- B Braun

- Becton, Dickinson and Company

- Biotronik

- Boston Scientific

- Cook Medical

- Endosmart

- Jotec

- Medtronic

- MicroPort

- Stryker

- Terumo

The Global Nitinol-based Medical Device Market was valued at USD 4.1 billion in 2024 and is estimated to grow at a CAGR of 7.1% to reach USD 8.1 billion by 2034 driven by the increasing prevalence of chronic diseases such as cardiovascular conditions, peripheral artery disease, and neurological disorders, which necessitate advanced, minimally invasive medical interventions. Nitinol, a nickel-titanium alloy known for its unique properties of superelasticity and shape memory, is increasingly utilized in medical devices to improve patient outcomes.

Nitinol's ability to return to a predetermined shape after deformation and its resistance to mechanical stress make it ideal for various medical applications. These properties are particularly beneficial in devices like stents, guidewires, and orthopedic implants, where flexibility and durability are crucial. The material's biocompatibility and corrosion resistance further enhance its suitability for long-term implantation. These properties ensure that nitinol devices maintain their functionality and structural integrity within the human body over extended periods, reducing the risk of rejection or degradation. This reliability makes nitinol a preferred choice for permanent implants used in cardiovascular, neurovascular, and orthopedic treatments. As the demand for minimally invasive procedures grows, the adoption of nitinol-based devices is expected to rise, contributing to the market's expansion.

| Market Scope | |

|---|---|

| Start Year | 2024 |

| Forecast Year | 2025-2034 |

| Start Value | $4.1 Billion |

| Forecast Value | $8.1 Billion |

| CAGR | 7.1% |

The hospital segment held a 60.8% share in 2024, driven by the increasing incorporation of advanced medical devices aimed at reducing operative time, minimizing patient trauma, and improving recovery outcomes. Nitinol-based devices-such as stents, guidewires, filters, and orthopedic implants-have become integral to hospitals due to their unique properties like shape memory and super-elasticity, which are critical in minimally invasive interventions. Their superior performance in navigating complex anatomies, particularly during cardiovascular and neurovascular procedures, translates into higher procedural success rates and reduced length of hospital stays.

In 2024, the stents segment maintained its leading position with a 46.1% share, fueled by the rising prevalence of vascular disorders and the clinical advantages provided by nitinol stents. These stents are valued for their self-expanding properties and ability to conform seamlessly to complex vascular pathways, especially in patients with peripheral artery disease or coronary blockages. The demand continues to rise as healthcare providers prioritize less invasive, highly effective treatment options for managing arterial conditions.

North America Nitinol-based Medical Device Market held 40% share in 2024, attributed to the region's robust healthcare infrastructure, well-established reimbursement systems, and early adoption of advanced medical technologies. The presence of leading manufacturers and widespread clinical integration of nitinol-based tools in hospitals and specialty clinics has further reinforced North America's stronghold in this rapidly evolving medical device space.

Key players in the Global Nitinol-Based Medical Device Industry include Boston Scientific Corporation, Medtronic plc, Abbott Laboratories, Terumo Corporation, and B. Braun Melsungen AG. These companies are focusing on research and development to innovate and enhance the performance of nitinol-based devices. Strategic collaborations, mergers, and acquisitions are common as companies aim to expand their product portfolios and market reach. To strengthen their market position, companies in the nitinol-based medical device industry are adopting several key strategies. These include investing in research and development to innovate and improve the performance of nitinol-based devices. Strategic collaborations, mergers, and acquisitions are common as companies aim to expand their product portfolios and market reach.

Table of Contents

Chapter 1 Methodology and Scope

- 1.1 Market scope and definitions

- 1.2 Research design

- 1.2.1 Research approach

- 1.2.2 Data collection methods

- 1.3 Base estimates and calculations

- 1.3.1 Base year calculation

- 1.3.2 Key trends for market estimation

- 1.4 Forecast model

- 1.5 Primary research and validation

- 1.5.1 Primary sources

- 1.5.2 Data mining sources

Chapter 2 Executive Summary

- 2.1 Industry 3600 synopsis

Chapter 3 Industry Insights

- 3.1 Industry ecosystem analysis

- 3.2 Industry impact forces

- 3.2.1 Growth drivers

- 3.2.1.1 Increasing demand for minimally invasive surgeries

- 3.2.1.2 Rising prevalence of cardiovascular and orthopedic disorders

- 3.2.1.3 Technological advancements in medical device manufacturing

- 3.2.1.4 Growing geriatric population globally

- 3.2.2 Industry pitfalls and challenges

- 3.2.2.1 High cost of nitinol-based devices

- 3.2.2.2 Stringent regulatory approval processes

- 3.2.1 Growth drivers

- 3.3 Growth potential analysis

- 3.4 Trump administration tariffs

- 3.4.1 Impact on trade

- 3.4.1.1 Trade volume disruptions

- 3.4.1.2 Retaliatory measures

- 3.4.2 Impact on the Industry

- 3.4.2.1 Supply-side impact (raw materials)

- 3.4.2.1.1 Price volatility in key materials

- 3.4.2.1.2 Supply chain restructuring

- 3.4.2.1.3 Production cost implications

- 3.4.2.2 Demand-side impact (selling price)

- 3.4.2.2.1 Price transmission to end markets

- 3.4.2.2.2 Market share dynamics

- 3.4.2.2.3 Consumer response patterns

- 3.4.2.1 Supply-side impact (raw materials)

- 3.4.3 Key companies impacted

- 3.4.4 Strategic industry responses

- 3.4.4.1 Supply chain reconfiguration

- 3.4.4.2 Pricing and product strategies

- 3.4.4.3 Policy engagement

- 3.4.5 Outlook and future considerationsTrump administration tariffs

- 3.4.1 Impact on trade

- 3.5 Technology landscape

- 3.6 Future market trends

- 3.7 Regulatory landscape

- 3.8 Patent analysis

- 3.9 Porter's analysis

- 3.10 PESTEL analysis

Chapter 4 Competitive Landscape, 2024

- 4.1 Introduction

- 4.2 Competitive market share analysis

- 4.3 Company matrix analysis

- 4.4 Competitive analysis of major market players

- 4.5 Competitive positioning matrix

- 4.6 Strategic outlook matrix

Chapter 5 Market Estimates and Forecast, By Product, 2021 - 2034 ($ Mn)

- 5.1 Key trends

- 5.2 Stents

- 5.3 Guidewires

- 5.4 Catheters

- 5.5 Other products

Chapter 6 Market Estimates and Forecast, By Application, 2021 - 2034 ($ Mn)

- 6.1 Key trends

- 6.2 Cardiovascular

- 6.3 Orthopedic

- 6.4 Dental

- 6.5 Neurological

- 6.6 Urology

- 6.7 Other applications

Chapter 7 Market Estimates and Forecast, By End Use, 2021 - 2034 ($ Mn)

- 7.1 Key trends

- 7.2 Hospitals

- 7.3 Ambulatory surgical centers

- 7.4 Specialty clinics

- 7.5 Research and academic institutes

Chapter 8 Market Estimates and Forecast, By Region, 2021 - 2034 ($ Mn)

- 8.1 Key trends

- 8.2 North America

- 8.2.1 U.S.

- 8.2.2 Canada

- 8.3 Europe

- 8.3.1 Germany

- 8.3.2 UK

- 8.3.3 France

- 8.3.4 Italy

- 8.3.5 Spain

- 8.3.6 Netherlands

- 8.4 Asia Pacific

- 8.4.1 Japan

- 8.4.2 China

- 8.4.3 India

- 8.4.4 Australia

- 8.4.5 South Korea

- 8.5 Latin America

- 8.5.1 Mexico

- 8.5.2 Brazil

- 8.5.3 Argentina

- 8.6 Middle East and Africa

- 8.6.1 South Africa

- 8.6.2 Saudi Arabia

- 8.6.3 UAE

Chapter 9 Company Profiles

- 9.1 Abbott Laboratories

- 9.2 Acandis

- 9.3 Admedes Schuessler

- 9.4 Arthrex

- 9.5 B Braun

- 9.6 Becton, Dickinson and Company

- 9.7 Biotronik

- 9.8 Boston Scientific

- 9.9 Cook Medical

- 9.10 Endosmart

- 9.11 Jotec

- 9.12 Medtronic

- 9.13 MicroPort

- 9.14 Stryker

- 9.15 Terumo