|

市場調查報告書

商品編碼

1750330

癌症診斷人工智慧市場機會、成長動力、產業趨勢分析及 2025 - 2034 年預測Artificial Intelligence in Cancer Diagnostics Market Opportunity, Growth Drivers, Industry Trend Analysis, and Forecast 2025 - 2034 |

||||||

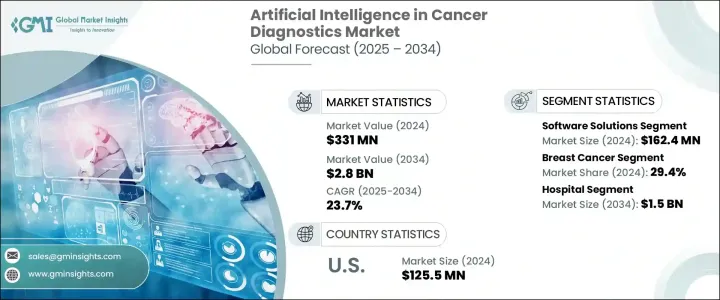

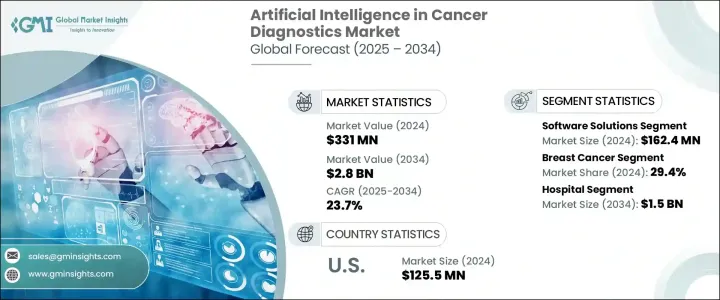

2024 年全球癌症診斷人工智慧市場價值為 3.31 億美元,預計到 2034 年將以 23.7% 的複合年成長率成長,達到 28 億美元,這得益於精準診斷需求的不斷成長和全球癌症發病率的上升。人工智慧與腫瘤學的結合正在徹底改變臨床醫生檢測和解釋癌症相關資料的方式。人工智慧工具透過將大量臨床資料集與醫學影像和病理結果整合在一起,增強了診斷工作流程,從而簡化了檢測並加速了臨床決策。非侵入性診斷領域的創新,尤其是在基因組學和分子分析中利用人工智慧的創新,可以實現更快、更準確的篩檢,同時支援個人化治療計劃和更好的患者預後。

人工智慧驅動的癌症診斷系統利用機器學習和影像辨識功能,以更高的精度識別異常。這種技術驅動的變革推動了癌症早期檢測策略和即時監測的轉變,這對於通常無症狀進展的癌症至關重要。這些智慧診斷平台透過減少解讀錯誤和提高工作流程效率來支援臨床醫生。因此,人工智慧的應用正成為下一代癌症治療的核心,在醫療保健的臨床和營運層面帶來價值。醫院、診斷實驗室和研究機構依靠人工智慧平台來提高準確性並縮短週轉時間。

| 市場範圍 | |

|---|---|

| 起始年份 | 2024 |

| 預測年份 | 2025-2034 |

| 起始值 | 3.31億美元 |

| 預測值 | 28億美元 |

| 複合年成長率 | 23.7% |

2024年,醫院領域成為癌症診斷人工智慧市場的主要終端用戶,預計到2034年其估值將達到15億美元。醫院在應用尖端人工智慧技術方面始終處於領先地位,這些技術有助於癌症的早期發現和精準診斷。這些機構越來越依賴以人工智慧為基礎的工具,例如機器學習演算法、數位病理系統和智慧成像平台,以簡化工作流程、減少診斷錯誤並改善臨床決策。人工智慧的整合還能幫助醫院管理大量患者資料,同時縮短週轉時間,最終提升病患照護效果。

2024年,乳癌領域佔了相當大的佔有率,達到29.4%,這歸因於乳癌在全球範圍內的廣泛發病率,以及對能夠在早期發現、更易治療的惡性腫瘤的技術的迫切需求。人工智慧驅動的診斷解決方案在識別乳房X光、超音波和核磁共振掃描中的細微模式和異常方面尤其有效,而這些模式和異常在常規評估中往往被忽略。將人工智慧融入乳癌篩檢不僅可以提高靈敏度和特異性,還可以支援風險分層和個人化治療計劃。由於早期診斷對於減少

2024年,北美癌症診斷人工智慧市場佔據41.3%的市場佔有率,這得益於先進的醫療基礎設施、大量的癌症病例以及對人工智慧整合診斷工具日益成長的需求。美國高度重視醫療創新,並積極推動學術機構、醫療新創公司和監管機構之間的合作夥伴關係,加速了人工智慧的普及步伐。深度學習和影像解讀技術的快速發展使臨床醫生能夠更早發現腫瘤,並更有效地制定治療方案,從而降低成本並改善患者預後。

癌症診斷人工智慧產業的主要參與者包括 Tempus、西門子醫療、EarlySign、Vuno、Paige AI、Flatiron、微軟、Cancer Center.ai、SkinVision、GE Healthcare、Kheiron Medical Technologies、Nanox Imaging、Path AI 和 Therapixel。為了鞏固其在全球癌症診斷人工智慧市場的市場地位,公司正專注於策略合作、軟體創新和監管許可。在美國和北美市場,許多參與者投資與醫院和生物技術公司的合作,以使用真實世界的臨床資料來完善人工智慧模型。主要公司也透過本地化解決方案和參與特定地區的臨床試驗來擴大其在歐洲和亞太地區的業務。此外,成像演算法和基於雲端的診斷平台的持續升級正在幫助供應商在全球範圍內擴展其產品/服務,同時滿足不斷變化的臨床需求。

目錄

第1章:方法論與範圍

第2章:執行摘要

第3章:行業洞察

- 產業生態系統分析

- 產業衝擊力

- 成長動力

- 全球癌症發生率上升

- 人工智慧技術和成像系統的進步

- 人工智慧與醫療IT系統的整合

- 產業陷阱與挑戰

- 實施和營運成本高

- 對資料隱私和安全的擔憂

- 成長動力

- 成長潛力分析

- 監管格局

- 川普政府關稅

- 對產業的影響

- 需求面影響(售價)

- 市佔率動態

- 消費者反應模式

- 需求面影響(售價)

- 受影響的主要公司

- 策略產業反應

- 定價和產品策略

- 政策參與

- 展望與未來考慮

- 對產業的影響

- 未來市場趨勢

- 波特的分析

- PESTEL分析

第4章:競爭格局

- 介紹

- 公司矩陣分析

- 主要市場參與者的競爭分析

- 競爭定位矩陣

- 策略儀表板

第5章:市場估計與預測:按組成部分,2021-2034

- 主要趨勢

- 軟體解決方案

- 硬體

- 服務

第6章:市場估計與預測:按癌症類型,2021-2034 年

- 主要趨勢

- 乳癌

- 肺癌

- 大腸直腸癌

- 攝護腺癌

- 其他癌症類型

第7章:市場估計與預測:依最終用途,2021-2034

- 主要趨勢

- 醫院

- 診斷實驗室

- 其他最終用途

第8章:市場估計與預測:按地區,2021-2034

- 主要趨勢

- 北美洲

- 美國

- 加拿大

- 歐洲

- 德國

- 英國

- 法國

- 西班牙

- 義大利

- 荷蘭

- 亞太地區

- 中國

- 日本

- 印度

- 澳洲

- 韓國

- 拉丁美洲

- 巴西

- 墨西哥

- 阿根廷

- 中東和非洲

- 南非

- 沙烏地阿拉伯

- 阿拉伯聯合大公國

第9章:公司簡介

- Cancer Center.ai

- EarlySign

- Flatiron

- GE Healthcare

- Kheiron Medical Technologies

- Microsoft

- Nanox Imaging

- Paige AI

- Path AI

- Siemens Healthineers

- SkinVision

- Tempus

- Therapixel

- Vuno

The Global Artificial Intelligence in Cancer Diagnostics Market was valued at USD 331 million in 2024 and is estimated to grow at a CAGR of 23.7% to reach USD 2.8 billion by 2034, driven by increasing demand for precision diagnostics and the rising incidence of cancer worldwide. The integration of artificial intelligence into oncology is revolutionizing the way clinicians detect and interpret cancer-related data. AI tools enhance diagnostic workflows by consolidating vast clinical datasets with medical imaging and pathology results, which streamlines detection and accelerates clinical decision-making. Innovations in non-invasive diagnostics, especially those leveraging AI in genomics and molecular profiling, enable faster, more accurate screening while supporting personalized treatment planning and better patient outcomes.

AI-powered cancer diagnostic systems utilize machine learning and image recognition capabilities to identify abnormalities with higher precision. This tech-driven transformation fosters a shift toward early detection strategies and real-time monitoring essential for cancers that typically progress without symptoms. These smart diagnostic platforms support clinicians by reducing interpretation errors and boosting workflow efficiency. As a result, the implementation of AI is becoming central to next-generation cancer care, bringing value across both clinical and operational dimensions in healthcare. Hospitals, diagnostics labs, and research institutions rely on AI platforms to improve accuracy and reduce turnaround time.

| Market Scope | |

|---|---|

| Start Year | 2024 |

| Forecast Year | 2025-2034 |

| Start Value | $331 Million |

| Forecast Value | $2.8 Billion |

| CAGR | 23.7% |

In 2024, the hospital segment emerged as the leading end user in the artificial intelligence in cancer diagnostics market and is projected to reach a valuation of USD 1.5 billion by 2034. Hospitals remain at the forefront of adopting cutting-edge AI technologies that assist in the early detection and precise cancer diagnosis. These facilities increasingly rely on AI-based tools such as machine learning algorithms, digital pathology systems, and intelligent imaging platforms to streamline workflows, reduce diagnostic errors, and improve clinical decision-making. Integration of AI also helps hospitals manage large volumes of patient data while enabling faster turnaround times, ultimately enhancing patient care outcomes.

The breast cancer segment held a substantial portion of 29.4% share in 2024, attributed to the widespread incidence of breast cancer globally and the pressing demand for technologies that can detect malignancies at an early, more treatable stage. AI-powered diagnostic solutions are especially impactful in identifying subtle patterns and anomalies in mammograms, ultrasound, and MRI scans, which often go unnoticed during conventional assessments. Integrating AI in breast cancer screening not only enhances sensitivity and specificity but also supports risk stratification and personalized treatment planning. As early diagnosis remains critical in reducing

North America Artificial Intelligence in Cancer Diagnostics Market held 41.3% share in 2024, shaped by advanced healthcare infrastructure, a high volume of cancer cases, and growing demand for AI-integrated diagnostic tools. The country's strong emphasis on medical innovation and collaborative partnerships among academic institutions, healthcare startups, and regulatory agencies has accelerated the pace of AI adoption. Rapid advances in deep learning and imaging interpretation enable clinicians to detect tumors earlier and tailor treatments more effectively, reducing costs and improving patient prognosis.

Major players operating in the artificial intelligence in cancer diagnostics industry include Tempus, Siemens Healthineers, EarlySign, Vuno, Paige AI, Flatiron, Microsoft, Cancer Center.ai, SkinVision, GE Healthcare, Kheiron Medical Technologies, Nanox Imaging, Path AI, and Therapixel.To strengthen their market position in the Global Artificial Intelligence in Cancer Diagnostics Market, companies are focusing on strategic collaborations, software innovation, and regulatory clearances. In the US and North America markets, many players invest in partnerships with hospitals and biotech firms to refine AI models using real-world clinical data. Key companies are also expanding their presence in Europe and Asia Pacific by localizing solutions and engaging in region-specific clinical trials. Furthermore, continuous upgrades in imaging algorithms and cloud-based diagnostic platforms are helping providers scale their offerings globally while addressing evolving clinical demands.

Table of Contents

Chapter 1 Methodology and Scope

- 1.1 Market scope and definitions

- 1.2 Research design

- 1.2.1 Research approach

- 1.2.2 Data collection methods

- 1.3 Base estimates and calculations

- 1.3.1 Base year calculation

- 1.3.2 Key trends for market estimation

- 1.4 Forecast model

- 1.5 Primary research and validation

- 1.5.1 Primary sources

- 1.5.2 Data mining sources

Chapter 2 Executive Summary

- 2.1 Industry 3600 synopsis

Chapter 3 Industry Insights

- 3.1 Industry ecosystem analysis

- 3.2 Industry impact forces

- 3.2.1 Growth drivers

- 3.2.1.1 Rising cancer incidence globally

- 3.2.1.2 Advancements in AI technologies and imaging systems

- 3.2.1.3 Integration of AI with healthcare IT systems

- 3.2.2 Industry pitfalls and challenges

- 3.2.2.1 High implementation and operational costs

- 3.2.2.2 Concerns over data privacy and security

- 3.2.1 Growth drivers

- 3.3 Growth potential analysis

- 3.4 Regulatory landscape

- 3.5 Trump administration tariffs

- 3.5.1 Impact on the Industry

- 3.5.1.1 Demand-side impact (selling price)

- 3.5.1.1.1 Market share dynamics

- 3.5.1.1.2 Consumer response patterns

- 3.5.1.1 Demand-side impact (selling price)

- 3.5.2 Key companies impacted

- 3.5.3 Strategic industry responses

- 3.5.3.1 Pricing and product strategies

- 3.5.3.2 Policy engagement

- 3.5.4 Outlook and future considerations

- 3.5.1 Impact on the Industry

- 3.6 Future market trends

- 3.7 Porter's analysis

- 3.8 PESTEL analysis

Chapter 4 Competitive Landscape, 2024

- 4.1 Introduction

- 4.2 Company matrix analysis

- 4.3 Competitive analysis of major market players

- 4.4 Competitive positioning matrix

- 4.5 Strategy dashboard

Chapter 5 Market Estimates and Forecast, By Component, 2021-2034 ($ Mn)

- 5.1 Key trends

- 5.2 Software solutions

- 5.3 Hardware

- 5.4 Services

Chapter 6 Market Estimates and Forecast, By Cancer Type, 2021-2034 ($ Mn)

- 6.1 Key trends

- 6.2 Breast cancer

- 6.3 Lung cancer

- 6.4 Colorectal cancer

- 6.5 Prostate cancer

- 6.6 Other cancer types

Chapter 7 Market Estimates and Forecast, By End Use, 2021-2034 ($ Mn)

- 7.1 Key trends

- 7.2 Hospitals

- 7.3 Diagnostic laboratories

- 7.4 Other end use

Chapter 8 Market Estimates and Forecast, By Region, 2021-2034 ($ Mn)

- 8.1 Key trends

- 8.2 North America

- 8.2.1 U.S.

- 8.2.2 Canada

- 8.3 Europe

- 8.3.1 Germany

- 8.3.2 UK

- 8.3.3 France

- 8.3.4 Spain

- 8.3.5 Italy

- 8.3.6 Netherlands

- 8.4 Asia Pacific

- 8.4.1 China

- 8.4.2 Japan

- 8.4.3 India

- 8.4.4 Australia

- 8.4.5 South Korea

- 8.5 Latin America

- 8.5.1 Brazil

- 8.5.2 Mexico

- 8.5.3 Argentina

- 8.6 Middle East and Africa

- 8.6.1 South Africa

- 8.6.2 Saudi Arabia

- 8.6.3 UAE

Chapter 9 Company Profiles

- 9.1 Cancer Center.ai

- 9.2 EarlySign

- 9.3 Flatiron

- 9.4 GE Healthcare

- 9.5 Kheiron Medical Technologies

- 9.6 Microsoft

- 9.7 Nanox Imaging

- 9.8 Paige AI

- 9.9 Path AI

- 9.10 Siemens Healthineers

- 9.11 SkinVision

- 9.12 Tempus

- 9.13 Therapixel

- 9.14 Vuno