|

市場調查報告書

商品編碼

1750326

儀表著陸系統與目視著陸輔助系統市場機會、成長動力、產業趨勢分析及 2025 - 2034 年預測Instrument Landing System and Visual Landing Aids Market Opportunity, Growth Drivers, Industry Trend Analysis, and Forecast 2025 - 2034 |

||||||

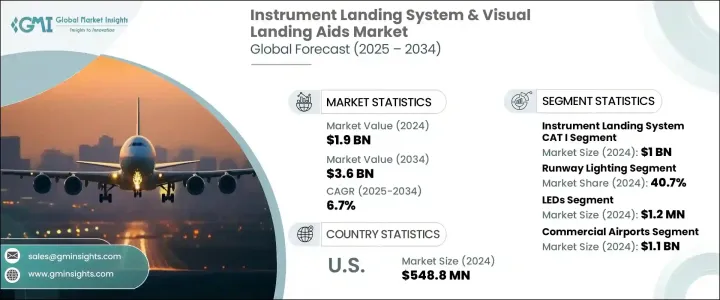

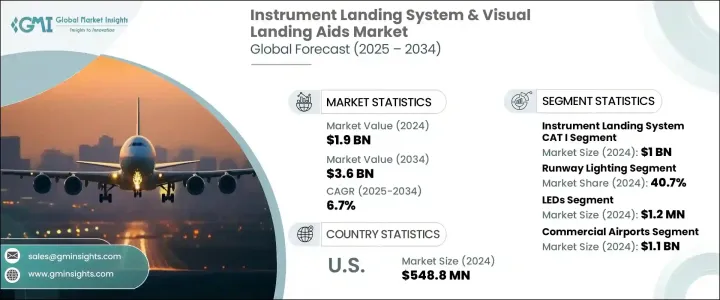

2024 年全球儀表著陸系統和目視著陸輔助設備市場價值為 19 億美元,預計到 2034 年將以 6.7% 的複合年成長率成長,達到 36 億美元,這得益於空中交通量的增加、機場基礎設施的持續現代化以及智慧機場的日益普及。隨著全球航空旅行持續激增,主要原因是商用飛機機隊不斷增加以及乘客數量增加,對精確著陸技術的需求也日益成長。機場正在對先進的著陸系統進行大量投資,以確保低能見度條件下的安全、減少延誤並提高營運效率。許多新興經濟體正在建造新機場,而已開發地區正在升級舊設施以達到國際航空標準。隨著空中交通量的增加,對 ILS 和目視導引系統的需求也在上升,因為這些技術對於提高安全性和最佳化機場容量至關重要。

現代化是推動這些系統需求的關鍵因素。各國政府和其他相關機構正在投資建造和升級航站樓、跑道和空側設施,以達到國際標準。先進的儀表著陸系統 (ILS) 和目視著陸輔助系統正變得越來越重要,因為它們有助於提高安全性、交通流量以及在各種天氣條件下的運作能力。此外,機場營運商致力於改善基礎設施以支援更高的交通量,這進一步推動了對這些精密系統的需求。

| 市場範圍 | |

|---|---|

| 起始年份 | 2024 |

| 預測年份 | 2025-2034 |

| 起始值 | 19億美元 |

| 預測值 | 36億美元 |

| 複合年成長率 | 6.7% |

就儀表著陸系統 (ILS) 類別而言,市場分為 I 類、II 類和 III 類系統。 2024 年,I 類系統市場規模達 10 億美元,因其成本效益高且能夠在大多數天氣條件下運行,受到區域機場和中型機場的青睞。 I 類系統可在 200 英尺的決斷高度安全著陸,對於希望提高運行可靠性且無需額外安裝 II 類或 III 類系統的機場而言,I 類系統是一個切實可行的選擇。

該市場還包括跑道、進場和滑行道照明,其中跑道照明市場在2024年將佔40.7%的佔有率。隨著機場數量的成長和航班數量的增加,跑道照明對於夜間安全運行和低能見度條件下的著陸至關重要。 LED照明技術的進步使維護更加便利、更具成本效益,從而加速了現代照明系統的普及。符合國際照明標準以及基礎設施現代化的推動,也促進了對這些先進系統的需求。

2024年,美國儀表著陸系統和目視著陸輔助系統市場規模達5.488億美元,這得益於商業航空運輸量的復甦以及對老化機場基礎設施進行現代化改造的大力推動。美國航空業正在進行全面升級,以適應日益成長的航空旅行量,尤其注重提升安全性和營運效率。諸如美國聯邦航空管理局(FAA)的NextGen計畫等關鍵舉措是這些努力的核心,旨在實現空中交通管制的現代化並最佳化航線系統。

全球儀表著陸系統和目視著陸輔助系統市場的主要參與者包括柯林斯航太(雷神技術公司)、霍尼韋爾國際公司、L3哈里斯技術公司、Indra Sistemas SA 和泰雷茲集團。各公司正在採取產品創新和合作等策略來增強其市場影響力。例如,泰雷茲集團和柯林斯航太正致力於開發先進的降落系統,以提高安全性並降低成本。霍尼韋爾國際公司正大力投資機場基礎設施的現代化,而 L3哈里斯技術公司和 Indra Sistemas SA 則專注於整合智慧技術,以提高著陸輔助系統的效率。策略合作和研發投入是在這個快速擴張的市場中獲得競爭優勢的關鍵。

目錄

第1章:方法論與範圍

第2章:執行摘要

第3章:行業洞察

- 產業生態系統分析

- 影響價值鏈的因素

- 利潤率分析

- 中斷

- 未來展望

- 製造商

- 經銷商

- 川普政府關稅

- 對貿易的影響

- 貿易量中斷

- 報復措施

- 對產業的影響

- 供應方影響(原料)

- 主要材料價格波動

- 供應鏈重組

- 生產成本影響

- 需求面影響(售價)

- 價格傳導至終端市場

- 市佔率動態

- 消費者反應模式

- 供應方影響(原料)

- 受影響的主要公司

- 策略產業反應

- 供應鏈重組

- 定價和產品策略

- 政策參與

- 展望與未來考慮

- 對貿易的影響

- 供應商格局

- 利潤率分析

- 重要新聞和舉措

- 監管格局

- 衝擊力

- 成長動力

- 空中交通量激增

- 機場基礎設施現代化

- 智慧機場的出現

- 增加軍事航空和戰術空軍基地

- 不斷進步的技術

- 產業陷阱與挑戰

- 資本和維護成本高

- 複雜性和整合挑戰

- 成長動力

- 成長潛力分析

- 波特的分析

- PESTEL分析

第4章:競爭格局

- 介紹

- 公司市佔率分析

- 競爭定位矩陣

- 戰略展望矩陣

第5章:市場估計與預測:依 ILS 類別,2021 年至 2034 年

- 主要趨勢

- 儀表著陸系統 CAT I

- 儀表著陸系統 CAT II

- 儀表著陸系統 CAT III

第6章:市場估計與預測:按類型,2021 - 2034 年

- 主要趨勢

- 跑道照明

- 進場燈光

- 滑行道照明

第7章:市場估計與預測:依技術分類,2021 - 2034 年

- 主要趨勢

- 發光二極體

- 白熾燈

第8章:市場估計與預測:按應用,2021 - 2034 年

- 主要趨勢

- 商業機場

- 軍用機場

- 直升機場

- 通用航空

- 其他

第9章:市場估計與預測:按地區,2021 - 2034 年

- 主要趨勢

- 北美洲

- 美國

- 加拿大

- 歐洲

- 英國

- 德國

- 法國

- 義大利

- 西班牙

- 俄羅斯

- 亞太地區

- 中國

- 印度

- 日本

- 韓國

- 澳洲

- 拉丁美洲

- 巴西

- 墨西哥

- MEA

- 南非

- 沙烏地阿拉伯

- 阿拉伯聯合大公國

第10章:公司簡介

- Advanced Navigation & Positioning Corporation (ANPC)

- Aeronautical & General Instruments Limited

- AGI Holdings LLC

- ATG Airports Ltd

- Carmanah Technologies Corp.

- Collins Aerospace (Raytheon Technologies)

- HENAME Co., Ltd

- Honeywell International Inc.

- Indra Sistemas SA

- Intelcan Technosystems Inc.

- L3Harris Technologies

- NEC Corporation

- Normarc Flight Systems AS (a brand under Indra)

- Systems Interface Ltd

- Thales Group

The Global Instrument Landing System and Visual Landing Aids Market was valued at USD 1.9 billion in 2024 and is estimated to grow at a CAGR of 6.7% to reach USD 3.6 billion by 2034, driven by the rise in air traffic, the ongoing modernization of airport infrastructures, and the increasing prevalence of smart airports. As global air travel continues to surge, largely due to the growing fleet of commercial jets and more passengers, there is a growing need for precision landing technologies. Airports are making significant investments in advanced landing systems to ensure safety during low-visibility conditions, reduce delays, and improve operational efficiency. Many emerging economies are constructing new airports, while developed regions are upgrading older facilities to meet international aviation standards. With the increase in air traffic, the demand for ILS and visual guidance systems is rising, as these technologies are critical to enhancing safety and optimizing airport capacity.

Modernization is a key factor fueling the demand for these systems. Governments and other relevant bodies are investing in the construction and upgrading of terminals, runways, and airside facilities to meet international standards. Advanced ILS and visual landing aids are becoming more essential as they help improve safety, traffic flow, and the ability to operate in all weather conditions. Additionally, airport operators are focused on improving infrastructure to support higher traffic volumes, further driving the need for these precision systems.

| Market Scope | |

|---|---|

| Start Year | 2024 |

| Forecast Year | 2025-2034 |

| Start Value | $1.9 Billion |

| Forecast Value | $3.6 Billion |

| CAGR | 6.7% |

In terms of ILS categories, the market is divided into CAT I, CAT II, and CAT III systems. In 2024, the CAT I segment accounted for USD 1 billion, as it is favored by regional and mid-sized airports for its cost-effectiveness and ability to operate in most weather conditions. CAT I systems provide safe landings at decision heights of 200 feet, making them a practical choice for airports looking to enhance operational reliability without the added costs of CAT II or CAT III installations.

The market also includes runway, approach, and taxiway lighting, with the runway lighting segment holding a 40.7% share in 2024. As airports grow and the number of flights increases, runway lighting becomes critical for safe nocturnal operations and landings in poor visibility. Advances in LED lighting technology have made maintenance easier and more cost-effective, accelerating the adoption of modern lighting systems. Compliance with international lighting standards and the push for infrastructure modernization are contributing to the demand for these advanced systems.

U.S. Instrument Landing System & Visual Landing Aids Market was valued at USD 548.8 million in 2024, driven by the resurgence in commercial airline traffic and significant efforts to modernize aging airport infrastructure. The country's aviation industry is undergoing a comprehensive upgrade to accommodate the increasing volume of air travel, with a particular emphasis on enhancing safety and operational efficiency. Key initiatives, such as the FAA's NextGen program, are central to these efforts, designed to modernize air traffic control and optimize flight routing systems.

Key players in the Global Instrument Landing System & Visual Landing Aids Market include Collins Aerospace (Raytheon Technologies), Honeywell International Inc., L3Harris Technologies, Indra Sistemas S.A., and Thales Group. Companies are adopting strategies such as product innovation and partnerships to strengthen their market presence. For instance, Thales Group and Collins Aerospace are focusing on developing advanced landing systems to enhance safety and reduce costs. Honeywell International Inc. is investing heavily in the modernization of airport infrastructure, while L3Harris Technologies and Indra Sistemas S.A. are concentrating on integrating smart technologies to improve the efficiency of landing aids. Strategic collaborations and investments in research and development are key to gaining a competitive edge in this rapidly expanding market.

Table of Contents

Chapter 1 Methodology & Scope

- 1.1 Market scope & definitions

- 1.2 Base estimates & calculations

- 1.3 Forecast calculations

- 1.4 Data sources

- 1.4.1 Primary

- 1.4.2 Secondary

- 1.4.2.1 Paid sources

- 1.4.2.2 Public sources

Chapter 2 Executive Summary

- 2.1 Industry synopsis, 2021 - 2034

Chapter 3 Industry Insights

- 3.1 Industry ecosystem analysis

- 3.1.1 Factor affecting the value chain

- 3.1.2 Profit margin analysis

- 3.1.3 Disruptions

- 3.1.4 Future outlook

- 3.1.5 Manufacturers

- 3.1.6 Distributors

- 3.2 Trump administration tariffs

- 3.2.1 Impact on trade

- 3.2.1.1 Trade volume disruptions

- 3.2.1.2 Retaliatory measures

- 3.2.2 Impact on the industry

- 3.2.2.1 Supply-side impact (raw materials)

- 3.2.2.1.1 Price volatility in key materials

- 3.2.2.1.2 Supply chain restructuring

- 3.2.2.1.3 Production cost implications

- 3.2.2.2 Demand-side impact (selling price)

- 3.2.2.2.1 Price transmission to end markets

- 3.2.2.2.2 Market share dynamics

- 3.2.2.2.3 Consumer response patterns

- 3.2.2.1 Supply-side impact (raw materials)

- 3.2.3 Key companies impacted

- 3.2.4 Strategic industry responses

- 3.2.4.1 Supply chain reconfiguration

- 3.2.4.2 Pricing and product strategies

- 3.2.4.3 Policy engagement

- 3.2.5 Outlook and future considerations

- 3.2.1 Impact on trade

- 3.3 Supplier landscape

- 3.4 Profit margin analysis

- 3.5 Key news & initiatives

- 3.6 Regulatory landscape

- 3.7 Impact forces

- 3.7.1 Growth drivers

- 3.7.1.1 Surge in air traffic growth

- 3.7.1.2 Modernization of airport infrastructure

- 3.7.1.3 Emergence of smart airports

- 3.7.1.4 Increasing military aviation & tactical airbases

- 3.7.1.5 Rising technological advancements

- 3.7.2 Industry pitfalls & challenges

- 3.7.2.1 High capital and maintenance costs

- 3.7.2.2 Complexity and integration challenges

- 3.7.1 Growth drivers

- 3.8 Growth potential analysis

- 3.9 Porter's analysis

- 3.10 PESTEL analysis

Chapter 4 Competitive Landscape, 2024

- 4.1 Introduction

- 4.2 Company market share analysis

- 4.3 Competitive positioning matrix

- 4.4 Strategic outlook matrix

Chapter 5 Market Estimates & Forecast, By ILS Category, 2021 - 2034 (USD Million)

- 5.1 Key trends

- 5.2 Instrument Landing System CAT I

- 5.3 Instrument Landing System CAT II

- 5.4 Instrument Landing System CAT III

Chapter 6 Market Estimates & Forecast, By Type, 2021 - 2034 (USD Million)

- 6.1 Key trends

- 6.2 Runway lighting

- 6.3 Approach lighting

- 6.4 Taxiway lighting

Chapter 7 Market Estimates & Forecast, By Technology, 2021 - 2034 (USD Million)

- 7.1 Key trends

- 7.2 LEDs

- 7.3 Incandescent lamps

Chapter 8 Market Estimates & Forecast, By Application, 2021 - 2034 (USD Million)

- 8.1 Key trends

- 8.2 Commercial airports

- 8.3 Military airports

- 8.4 Heliports

- 8.5 General aviation

- 8.6 Others

Chapter 9 Market Estimates & Forecast, By Region, 2021 - 2034 (USD Million)

- 9.1 Key trends

- 9.2 North America

- 9.2.1 U.S.

- 9.2.2 Canada

- 9.3 Europe

- 9.3.1 UK

- 9.3.2 Germany

- 9.3.3 France

- 9.3.4 Italy

- 9.3.5 Spain

- 9.3.6 Russia

- 9.4 Asia Pacific

- 9.4.1 China

- 9.4.2 India

- 9.4.3 Japan

- 9.4.4 South Korea

- 9.4.5 Australia

- 9.5 Latin America

- 9.5.1 Brazil

- 9.5.2 Mexico

- 9.6 MEA

- 9.6.1 South Africa

- 9.6.2 Saudi Arabia

- 9.6.3 UAE

Chapter 10 Company Profiles

- 10.1 Advanced Navigation & Positioning Corporation (ANPC)

- 10.2 Aeronautical & General Instruments Limited

- 10.3 AGI Holdings LLC

- 10.4 ATG Airports Ltd

- 10.5 Carmanah Technologies Corp.

- 10.6 Collins Aerospace (Raytheon Technologies)

- 10.7 HENAME Co., Ltd

- 10.8 Honeywell International Inc.

- 10.9 Indra Sistemas S.A.

- 10.10 Intelcan Technosystems Inc.

- 10.11 L3Harris Technologies

- 10.12 NEC Corporation

- 10.13 Normarc Flight Systems AS (a brand under Indra)

- 10.14 Systems Interface Ltd

- 10.15 Thales Group