|

市場調查報告書

商品編碼

1750323

慢性病管理市場機會、成長動力、產業趨勢分析及 2025 - 2034 年預測Chronic Disease Management Market Opportunity, Growth Drivers, Industry Trend Analysis, and Forecast 2025 - 2034 |

||||||

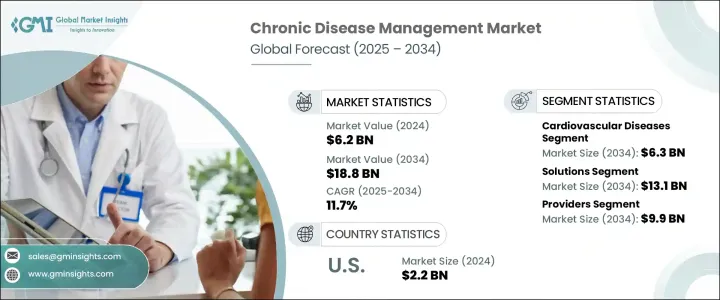

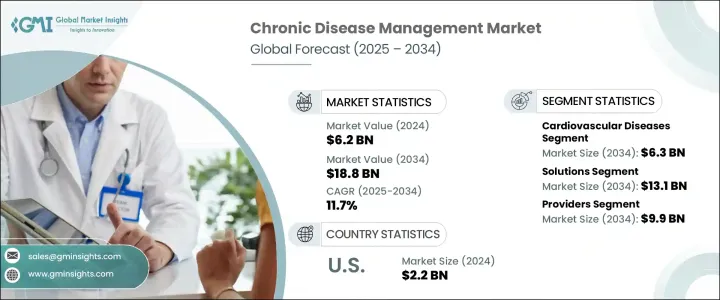

2024年,全球慢性病管理市場規模達62億美元,預計2034年將以11.7%的複合年成長率成長,達到188億美元。這主要得益於糖尿病、心血管疾病和高血壓等慢性病的日益流行,這些疾病亟需有效的管理策略。此外,遠距醫療服務、遠距監控設備和電子健康記錄等數位醫療技術的進步,也徹底改變了慢性病照護的格局。這些技術進步不僅增強了護理協調和臨床決策能力,還支持採取主動干預措施,從而預防病情進展、最大限度地減少再入院率並提高治療依從性,最終改變慢性病護理的提供方式,並提高全系統的效率。

此外,它們還能為醫療服務提供者提供即時資料洞察,簡化患者與護理團隊之間的溝通,並促進及時調整藥物,所有這些都有助於提供更敏捷、以患者為中心的護理和長期健康管理。這些工具還透過促進自我監測、教育和問責來提高患者參與度,這對於有效管理複雜且長期的疾病至關重要。

| 市場範圍 | |

|---|---|

| 起始年份 | 2024 |

| 預測年份 | 2025-2034 |

| 起始值 | 62億美元 |

| 預測值 | 188億美元 |

| 複合年成長率 | 11.7% |

2024年,心血管疾病市場規模達22億美元,預計2034年將達63億美元。冠狀動脈疾病、心臟衰竭和高血壓等疾病發生率的上升,增加了對綜合管理解決方案的需求。遠距醫療平台、穿戴式裝置和遠端監控系統有助於追蹤血壓和心率等生命徵象,促進及時干預,並提高患者對治療方案的依從性。

2024年,醫療服務提供者佔據市場主導地位,佔53.8%的佔有率,預計2025年至2034年的複合年成長率將達到11.5%。醫療保健服務提供者,包括醫院、診所和專科護理中心,是慢性病管理服務的核心。整合數位醫療技術使服務提供者能夠提供持續護理、監測患者病情進展並根據需要調整治療方案,從而改善患者的治療效果和滿意度。

美國慢性病管理市場規模在2024年達到22億美元,預計2025年至2034年期間的複合年成長率將達到11.1%。美國先進的醫療基礎設施、數位醫療技術的廣泛應用以及支持性的報銷政策促進了這一成長。美國人口中慢性病盛行率的不斷上升進一步推動了對有效管理解決方案的需求。

全球慢性病管理市場的主要參與者包括 ResMed、Veradigm、IBM Corporation、Amwell、Oracle Corporation、Teladoc Health、Cerner Corporation、HealthSnap、Medtronic 和 Koninklijke Philips NV。這些公司專注於開發創新解決方案,以增強慢性病管理。他們正在採取諸如擴展遠距醫療服務、整合人工智慧進行預測分析以及與醫療保健提供者建立合作夥伴關係等策略,以增強其市場影響力。此外,研發投入旨在提高病患參與度和治療效果,從而使這些公司在不斷發展的醫療保健領域中保持持續成長。

目錄

第1章:方法論與範圍

第2章:執行摘要

第3章:行業洞察

- 產業生態系統分析

- 產業衝擊力

- 成長動力

- 慢性病盛行率上升

- 遠距醫療和遠端監控的不斷進步

- 不斷擴大的數位醫療領域

- 政府為創新解決方案提供的措施和資金

- 產業陷阱與挑戰

- 實施成本高

- 資料隱私和安全問題

- 成長動力

- 成長潛力分析

- 監管格局

- 川普政府關稅

- 對貿易的影響

- 貿易量中斷

- 報復措施

- 對產業的影響

- 供給側影響(原料)

- 主要材料價格波動

- 供應鏈重組

- 生產成本影響

- 需求面影響(售價)

- 價格傳導至終端市場

- 市佔率動態

- 消費者反應模式

- 供給側影響(原料)

- 受影響的主要公司

- 策略產業反應

- 供應鏈重組

- 定價和產品策略

- 政策參與

- 展望與未來考慮

- 對貿易的影響

- 波特的分析

- PESTEL分析

第4章:競爭格局

- 介紹

- 公司矩陣分析

- 主要市場參與者的競爭分析

- 競爭定位矩陣

- 策略儀表板

第5章:市場估計與預測:依疾病類型,2021 年至 2034 年

- 主要趨勢

- 心血管疾病(CVD)

- 糖尿病

- 慢性呼吸道肺部疾病(COPD)

- 癌症

- 神經系統疾病

- 其他疾病類型

第6章:市場估計與預測:按類型,2021 年至 2034 年

- 主要趨勢

- 解決方案

- 基於 Web 的解決方案

- 基於雲端的解決方案

- 本地解決方案

- 服務

- 疾病管理計劃和服務

- 監控服務

- 諮詢和支援服務

- 其他服務類型

第7章:市場估計與預測:依最終用途,2021 年至 2034 年

- 主要趨勢

- 提供者

- 付款人

- 其他最終用途

第8章:市場估計與預測:按地區,2021 年至 2034 年

- 主要趨勢

- 北美洲

- 美國

- 加拿大

- 歐洲

- 德國

- 英國

- 法國

- 西班牙

- 義大利

- 荷蘭

- 亞太地區

- 中國

- 印度

- 日本

- 澳洲

- 韓國

- 拉丁美洲

- 巴西

- 墨西哥

- 阿根廷

- 中東和非洲

- 南非

- 沙烏地阿拉伯

- 阿拉伯聯合大公國

第9章:公司簡介

- Active Health Technologies

- Amwell

- Apollo TeleHealth

- Epic Systems

- HealthSnap

- IBM

- Koninklijke Philips NV

- Medicross

- Medtronic

- Oracle

- ResMed

- ScienceSoft USA

- Teladoc

- TimeDoc Health

- Topcon Healthcare

- Veradigm

- ZEISS

The Global Chronic Disease Management Market was valued at USD 6.2 billion in 2024 and is estimated to grow at a CAGR of 11.7% to reach USD 18.8 billion by 2034, driven by the increasing prevalence of chronic conditions such as diabetes, cardiovascular diseases, and hypertension, which necessitate effective management strategies. Additionally, advancements in digital health technologies, including telehealth services, remote monitoring devices, and electronic health records, have transformed the landscape of chronic care. These technological advancements not only enhance care coordination and clinical decision-making but also support proactive interventions that prevent disease progression, minimize hospital readmissions, and increase treatment adherence, ultimately transforming chronic care delivery and boosting system-wide efficiency.

Additionally, they empower healthcare providers with real-time data insights, streamline communication between patients and care teams, and facilitate timely medication adjustments, all of which contribute to more responsive, patient-centered care and long-term health management. These tools also foster greater patient engagement by promoting self-monitoring, education, and accountability, which are essential for managing complex, long-duration conditions effectively.

| Market Scope | |

|---|---|

| Start Year | 2024 |

| Forecast Year | 2025-2034 |

| Start Value | $6.2 Billion |

| Forecast Value | $18.8 Billion |

| CAGR | 11.7% |

The cardiovascular diseases segment was valued at USD 2.2 billion in 2024 and is anticipated to reach USD 6.3 billion by 2034. The rising incidence of conditions like coronary artery disease, heart failure, and hypertension has increased the demand for comprehensive management solutions. Telehealth platforms, wearable devices, and remote monitoring systems help in tracking vital signs such as blood pressure and heart rate, facilitating timely interventions, and enhancing patient compliance with treatment regimens.

In 2024, the providers segment dominated the market, accounting for 53.8% of the share, and is expected to grow at a CAGR of 11.5% from 2025 to 2034. Healthcare providers, including hospitals, clinics, and specialized care centers, are central to chronic disease management services. Integrating digital health technologies allows providers to offer continuous care, monitor patient progress, and adjust treatment plans as needed, leading to improved patient outcomes and satisfaction.

U.S. Chronic Disease Management Market accounted for USD 2.2 billion in 2024 and is projected to grow at a CAGR of 11.1% between 2025 and 2034. The country's advanced healthcare infrastructure, widespread adoption of digital health technologies, and supportive reimbursement policies contribute to this growth. The increasing prevalence of chronic conditions among the U.S. population further drives the demand for effective management solutions.

Key players in the Global Chronic Disease Management Market include ResMed, Veradigm, IBM Corporation, Amwell, Oracle Corporation, Teladoc Health, Cerner Corporation, HealthSnap, Medtronic, and Koninklijke Philips N.V. These companies are focusing on developing innovative solutions to enhance chronic disease management. Strategies such as expanding telehealth services, integrating artificial intelligence for predictive analytics, and forming partnerships with healthcare providers are being employed to strengthen their market presence. Additionally, investments in research and development aim to improve patient engagement and treatment outcomes, positioning these companies for sustained growth in the evolving healthcare landscape.

Table of Contents

Chapter 1 Methodology and Scope

- 1.1 Market scope and definition

- 1.2 Research design

- 1.2.1 Research approach

- 1.2.2 Data collection methods

- 1.3 Base estimates and calculations

- 1.3.1 Base year calculation

- 1.3.2 Key trends for market estimation

- 1.4 Forecast model

- 1.5 Primary research and validation

- 1.5.1 Primary sources

- 1.5.2 Data mining sources

Chapter 2 Executive Summary

- 2.1 Industry 3600 synopsis

Chapter 3 Industry Insights

- 3.1 Industry ecosystem analysis

- 3.2 Industry impact forces

- 3.2.1 Growth drivers

- 3.2.1.1 Rising prevalence of chronic disease

- 3.2.1.2 Growing advancements in telehealth and remote monitoring

- 3.2.1.3 Expanding digital health sector

- 3.2.1.4 Government initiatives and funding for innovative solution

- 3.2.2 Industry pitfalls and challenges

- 3.2.2.1 High implementation costs

- 3.2.2.2 Data privacy and security concerns

- 3.2.1 Growth drivers

- 3.3 Growth potential analysis

- 3.4 Regulatory landscape

- 3.5 Trump administration tariffs

- 3.5.1 Impact on trade

- 3.5.1.1 Trade volume disruptions

- 3.5.1.2 Retaliatory measures

- 3.5.2 Impact on the Industry

- 3.5.2.1 Supply-side impact (raw materials)

- 3.5.2.1.1 Price volatility in key materials

- 3.5.2.1.2 Supply chain restructuring

- 3.5.2.1.3 Production cost implications

- 3.5.2.2 Demand-side impact (selling price)

- 3.5.2.2.1 Price transmission to end markets

- 3.5.2.2.2 Market share dynamics

- 3.5.2.2.3 Consumer response patterns

- 3.5.2.1 Supply-side impact (raw materials)

- 3.5.3 Key companies impacted

- 3.5.4 Strategic industry responses

- 3.5.4.1 Supply chain reconfiguration

- 3.5.4.2 Pricing and product strategies

- 3.5.4.3 Policy engagement

- 3.5.5 Outlook and future considerations

- 3.5.1 Impact on trade

- 3.6 Porter's analysis

- 3.7 PESTEL analysis

Chapter 4 Competitive Landscape, 2024

- 4.1 Introduction

- 4.2 Company matrix analysis

- 4.3 Competitive analysis of major market players

- 4.4 Competitive positioning matrix

- 4.5 Strategy dashboard

Chapter 5 Market Estimates and Forecast, By Disease Type, 2021 – 2034 ($ Mn)

- 5.1 Key trends

- 5.2 Cardiovascular diseases (CVD)

- 5.3 Diabetes

- 5.4 Chronic respiratory pulmonary diseases (COPD)

- 5.5 Cancer

- 5.6 Neurological disorders

- 5.7 Other disease types

Chapter 6 Market Estimates and Forecast, By Type, 2021 – 2034 ($ Mn)

- 6.1 Key trends

- 6.2 Solutions

- 6.2.1 Web-based solutions

- 6.2.2 Cloud-based solutions

- 6.2.3 On-premises solutions

- 6.3 Services

- 6.3.1 Disease management program and services

- 6.3.2 Monitoring services

- 6.3.3 Counseling and support services

- 6.3.4 Other service types

Chapter 7 Market Estimates and Forecast, By End Use, 2021 – 2034 ($ Mn)

- 7.1 Key trends

- 7.2 Providers

- 7.3 Payers

- 7.4 Other end use

Chapter 8 Market Estimates and Forecast, By Region, 2021 – 2034 ($ Mn)

- 8.1 Key trends

- 8.2 North America

- 8.2.1 U.S.

- 8.2.2 Canada

- 8.3 Europe

- 8.3.1 Germany

- 8.3.2 UK

- 8.3.3 France

- 8.3.4 Spain

- 8.3.5 Italy

- 8.3.6 Netherlands

- 8.4 Asia Pacific

- 8.4.1 China

- 8.4.2 India

- 8.4.3 Japan

- 8.4.4 Australia

- 8.4.5 South Korea

- 8.5 Latin America

- 8.5.1 Brazil

- 8.5.2 Mexico

- 8.5.3 Argentina

- 8.6 Middle East and Africa

- 8.6.1 South Africa

- 8.6.2 Saudi Arabia

- 8.6.3 UAE

Chapter 9 Company Profiles

- 9.1 Active Health Technologies

- 9.2 Amwell

- 9.3 Apollo TeleHealth

- 9.4 Epic Systems

- 9.5 HealthSnap

- 9.6 IBM

- 9.7 Koninklijke Philips N.V.

- 9.8 Medicross

- 9.9 Medtronic

- 9.10 Oracle

- 9.11 ResMed

- 9.12 ScienceSoft USA

- 9.13 Teladoc

- 9.14 TimeDoc Health

- 9.15 Topcon Healthcare

- 9.16 Veradigm

- 9.17 ZEISS