|

市場調查報告書

商品編碼

1750320

鋁箔市場機會、成長動力、產業趨勢分析及2025-2034年預測Aluminum Foil Market Opportunity, Growth Drivers, Industry Trend Analysis, and Forecast 2025 - 2034 |

||||||

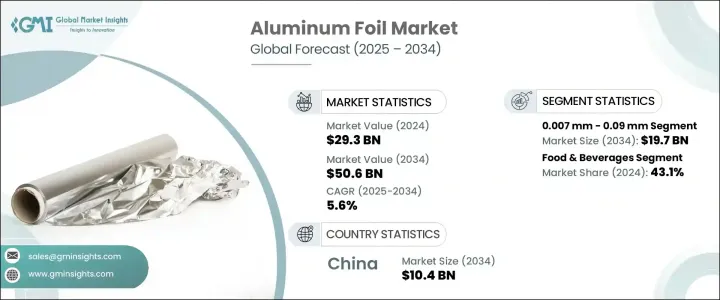

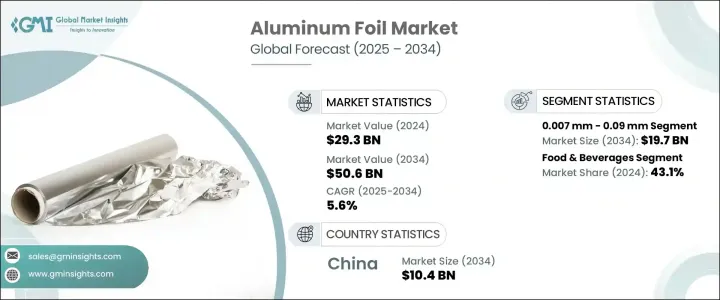

2024年,全球鋁箔市場規模達293億美元,預計到2034年將以5.6%的複合年成長率成長,達到506億美元。這一成長主要得益於食品和醫藥包裝行業日益成長的需求,以及工業絕緣和汽車隔熱領域日益成長的應用。鋁箔以其輕質、高阻隔性和可回收性而聞名,已成為現代包裝解決方案的關鍵材料,尤其是在全球對永續材料的關注日益增強的背景下。在發展中國家,包裝食品消費量的激增進一步促進了市場擴張,促使製造商和供應商不斷滿足不斷變化的包裝標準。

多種因素加速了這一成長,包括遵守環境和包裝法規、消費者對便捷易用產品的偏好,以及對包裝材料可回收性的日益關注。尤其是在醫藥領域,由於對產品保存期限和污染預防的嚴格要求,鋁箔發揮著至關重要的作用。在此背景下,鋁箔複合膜的需求預計將持續成長。此外,技術進步也帶來了新的市場機遇,例如活性和可生物分解的鋁箔解決方案、奈米複合膜產品以及鋁箔複合材料,所有這些產品都具有更優異的性能和永續性優勢。同時,建築和汽車等行業正在轉向更輕、更節能的材料,進一步拓寬了鋁箔在包裝以外的應用領域。

| 市場範圍 | |

|---|---|

| 起始年份 | 2024 |

| 預測年份 | 2025-2034 |

| 起始值 | 293億美元 |

| 預測值 | 506億美元 |

| 複合年成長率 | 5.6% |

專注於清潔生產流程的投資,例如綠色能源冶煉和回收能力,也有助於減少對環境的影響。這些努力可能會重塑價值鏈,增強鋁箔製造業的整體永續性。隨著各國對生產設施進行現代化改造並轉向環保營運,長期效益將繼續支持該產業的成長。

按厚度細分,鋁箔市場包括 0.007 毫米 - 0.09 毫米、0.09 毫米 - 0.2 毫米、0.2 毫米 - 0.4 毫米等類別。其中,0.007 毫米 - 0.09 毫米部分佔據最大收益佔有率,2024 年創造 113 億美元的收益。預計到 2034 年,該部分收益將達到 197 億美元,複合年成長率為 5.8%。其主導地位歸因於其在各種應用領域的適應性,包括食品包裝、藥品、家用包裝和工業絕緣。成本效益、阻隔強度和靈活性的平衡使其成為滿足消費者和商業需求的首選。它尤其因其能夠保護內容物免受濕氣、氧氣和光線的影響而受到重視,這使其成為一次性物品和可回收形式的理想選擇。

就終端應用產業而言,市場可分為食品飲料、藥品、個人護理和化妝品、家居、工業及其他。 2024年,食品飲料領域佔最大佔有率,佔全球市場收入的43.1%。鋁箔在該領域的廣泛應用得益於其對水分、光照和空氣等外部因素的有效防護。它有助於延長保存期限、保持產品新鮮度並確保安全——這些都是包裝食品行業的關鍵要求。鋁箔廣泛應用於軟包裝袋、蓋子、容器和複合包裝,適用於各種消費品。

從區域來看,中國市場在2024年的營收為59億美元,預計到2034年將達到104億美元,複合年成長率為5.8%。中國將繼續主導全球鋁箔生產,到2025年將佔全球鋁箔產量的約60%。國內鋁箔產量也出現了顯著成長,反映出消費成長的普遍趨勢。為了因應產能過剩和環境問題等挑戰,中國正在放棄擴大初級冶煉業務,轉而採用更環保的替代方法。這些措施包括利用再生能源和提高回收能力,目標是到2027年每年回收超過1500萬噸鋁。

全球鋁箔產業仍維持適度整合,截至2024年,五家領先公司合計佔據超過40%的市場。許多企業正專注於新興市場,以滿足醫療保健、絕緣材料和電子等行業對先進鋁箔日益成長的需求。這項策略轉變不僅強調產量擴張,也強調產品創新,包括具有壓花、多層和高硬度等特性的優質鋁箔。隨著市場的發展,競爭態勢可能會受到永續性、技術創新和全球貿易協調的影響。

目錄

第1章:方法論與範圍

第2章:執行摘要

第3章:行業洞察

- 產業生態系統分析

- 影響價值鏈的因素

- 利潤率分析

- 中斷

- 未來展望

- 製造商

- 經銷商

- 川普政府關稅的影響—結構化概述

- 對貿易的影響

- 貿易量中斷

- 報復措施

- 對產業的影響

- 供給側影響(原料)

- 主要材料價格波動

- 供應鏈重組

- 生產成本影響

- 需求面影響(售價)

- 價格傳導至終端市場

- 市佔率動態

- 消費者反應模式

- 供給側影響(原料)

- 受影響的主要公司

- 策略產業反應

- 供應鏈重組

- 定價和產品策略

- 政策參與

- 展望與未來考慮

- 對貿易的影響

- 供應商格局

- 利潤率分析

- 重要新聞和舉措

- 監管格局

- 衝擊力

- 成長動力

- 原物料價格波動

- 來自替代包裝材料的競爭

- 環境問題

- 與鋁浸出有關的健康問題

- 產業陷阱與挑戰

- 原物料價格波動

- 來自替代包裝材料的競爭

- 環境問題

- 與鋁浸出有關的健康問題

- 成長動力

- 成長潛力分析

- 波特的分析

- PESTEL分析

- 價值鏈分析

- 原物料供應商

- 鋁箔製造商

- 轉換器和處理器

- 經銷商

- 最終用途

- 定價分析

- 成本結構分析

- 價格趨勢分析

- 價格預測

- 技術格局

- 製造流程概述

- 鑄件

- 熱軋

- 冷軋

- 退火

- 整理和分切

- 技術進步

- 鋁箔生產自動化

- 品質控制技術

- 製造流程概述

- 監理框架

- 食品接觸材料法規

- 美國FDA法規

- 歐盟法規

- 其他地區法規

- 環境法規

- 貿易政策和關稅

- 法規對市場成長的影響

第4章:競爭格局

- 介紹

- 公司市佔率分析

- 競爭定位矩陣

- 戰略展望矩陣

第5章:市場估計與預測:按厚度,2021 - 2034 年

- 主要趨勢

- 0.007 毫米 - 0.09 毫米

- 0.09 毫米 - 0.2 毫米

- 0.2 毫米 - 0.4 毫米

- 其他

第6章:市場估計與預測:按箔類型,2021 - 2034 年

- 主要趨勢

- 印刷鋁箔

- 未印刷的鋁箔

- 層壓鋁箔

- 背襯鋁箔

- 其他

第7章:市場估計與預測:按應用,2021 - 2034 年

- 主要趨勢

- 包包和小袋

- 捲餅和麵包卷

- 水泡

- 蓋子

- 層壓管

- 托盤

- 其他

第8章:市場估計與預測:按最終用途產業,2021 - 2034 年

- 主要趨勢

- 食品和飲料

- 烘焙和糖果

- 即食食品

- 乳製品

- 飲料

- 其他

- 製藥

- 吸塑包裝

- 條狀包裝

- 其他

- 個人護理和化妝品

- 家庭

- 工業的

- 絕熱

- 電氣應用

- 其他

- 其他

第9章:市場估計與預測:按地區,2021 - 2034 年

- 主要趨勢

- 北美洲

- 美國

- 加拿大

- 歐洲

- 德國

- 英國

- 法國

- 西班牙

- 義大利

- 歐洲其他地區

- 亞太地區

- 中國

- 印度

- 日本

- 澳洲

- 韓國

- 亞太其他地區

- 拉丁美洲

- 巴西

- 墨西哥

- 阿根廷

- 拉丁美洲其他地區

- 中東和非洲

- 沙烏地阿拉伯

- 南非

- 阿拉伯聯合大公國

- MEA 其餘地區

第10章:公司簡介

- Alcoa Corporation

- Aleris Corporation

- Alufoil Products

- Amco India

- Amcor

- Assan Aluminyum

- China Hongqiao Group

- Constellium

- Ess Dee Aluminium

- Eurofoil

- Hindalco Industries

- Huawei Aluminum

- Norsk Hydro

- Novelis

- Reynolds Consumer Products

- Symetal Aluminium Foil Industry

- UACJ Corporation

- United Company RUSAL

- Xiamen Xiashun Aluminium Foil

- Zhejiang Junma Aluminium Industry

The Global Aluminum Foil Market was valued at USD 29.3 billion in 2024 and is estimated to grow at a CAGR of 5.6% to reach USD 50.6 billion by 2034. This growth is primarily fueled by rising demand across the food and pharmaceutical packaging sectors, as well as increasing applications in industrial insulation and automotive thermal shielding. As aluminum foil is known for its lightweight nature, strong barrier properties, and recyclability, it has become a key material in modern packaging solutions, especially as the focus on sustainable materials gains momentum worldwide. In developing nations, the surge in consumption of packaged foods is further contributing to market expansion, pushing manufacturers and suppliers to meet evolving packaging standards.

A combination of factors is accelerating this growth, including compliance with environmental and packaging regulations, consumer preference for convenient and easy-to-use products, and growing attention to the recyclability of packaging materials. Particularly in the pharmaceutical space, aluminum foil plays a vital role due to strict requirements surrounding product shelf life and contamination prevention. The demand for foil laminates is expected to climb in this context. Additionally, technological advancements are unlocking new market opportunities, such as active and biodegradable foil solutions, nano-laminated products, and foil-based composites, all of which offer greater performance and sustainability benefits. Meanwhile, industries such as construction and automotive are turning to lighter, more energy-efficient materials, further widening the use of aluminum foil beyond packaging.

| Market Scope | |

|---|---|

| Start Year | 2024 |

| Forecast Year | 2025-2034 |

| Start Value | $29.3 Billion |

| Forecast Value | $50.6 Billion |

| CAGR | 5.6% |

Investments focused on cleaner production processes, such as green energy-powered smelting and recycling capabilities, are also contributing to reduced environmental impact. These efforts are likely to reshape the value chain, enhancing the overall sustainability of aluminum foil manufacturing. As countries modernize production facilities and shift toward eco-conscious operations, the long-term benefits will continue to support growth in the sector.

When segmented by thickness, the aluminum foil market includes categories such as 0.007 mm - 0.09 mm, 0.09 mm - 0.2 mm, 0.2 mm - 0.4 mm, and others. Among these, the 0.007 mm - 0.09 mm segment accounted for the largest revenue share, generating USD 11.3 billion in 2024. This segment is forecast to reach USD 19.7 billion by 2034, growing at a CAGR of 5.8%. Its dominance is attributed to its adaptability across various applications, including food packaging, pharmaceutical products, household wraps, and industrial insulation. The balance of cost-effectiveness, barrier strength, and flexibility makes it a preferred choice for both consumer and commercial needs. It is especially valued for its ability to shield contents from moisture, oxygen, and light, making it ideal for single-use items and recyclable formats.

In terms of end-use industries, the market is categorized into food and beverages, pharmaceuticals, personal care and cosmetics, household, industrial, and others. The food and beverages segment held the largest share in 2024, accounting for 43.1% of global market revenue. The widespread use of foil in this sector is driven by its effective protection against external elements such as moisture, light, and air. It helps extend shelf life, maintain product freshness, and ensure safety-key requirements in the packaged food industry. Foil finds extensive use in flexible pouches, lids, containers, and laminated wraps, serving a variety of consumable products.

Regionally, the market in China recorded a revenue of USD 5.9 billion in 2024 and is projected to reach USD 10.4 billion by 2034, registering a CAGR of 5.8%. China continues to dominate global production, accounting for roughly 60% of the world's aluminum foil output by 2025. Domestic production levels have also witnessed significant growth, reflecting a broader trend toward increased consumption. In response to challenges like overcapacity and environmental concerns, the country is steering away from expanding primary smelting operations and moving toward greener alternatives. These include utilizing renewable energy sources and enhancing recycling capabilities, with a targeted goal to recycle over 15 million tons of aluminum annually by 2027.

The global aluminum foil industry remains moderately consolidated, with five leading companies collectively holding over 40% market share as of 2024. Many businesses are focusing on emerging markets to meet the growing demand for advanced foil types across industries like healthcare, insulation, and electronics. This strategic shift emphasizes not just expansion in output but also innovation in product offerings, including premium foils with features like embossing, multi-layering, and increased hardness. As the market evolves, competitive dynamics are likely to be shaped by sustainability, technological innovation, and global trade alignment.

Table of Contents

Chapter 1 Methodology & Scope

- 1.1 Market scope & definition

- 1.2 Base estimates & calculations

- 1.3 Forecast calculation

- 1.4 Data sources

- 1.4.1 Primary

- 1.4.2 Secondary

- 1.4.2.1 Paid sources

- 1.4.2.2 Public sources

Chapter 2 Executive Summary

- 2.1 Industry synopsis, 2021 - 2034

Chapter 3 Industry Insights

- 3.1 Industry ecosystem analysis

- 3.1.1 Factor affecting the value chain

- 3.1.2 Profit margin analysis

- 3.1.3 Disruptions

- 3.1.4 Future outlook

- 3.1.5 Manufacturers

- 3.1.6 Distributors

- 3.2 Impact of trump administration tariffs - structured overview

- 3.2.1 Impact on trade

- 3.2.1.1 Trade volume disruptions

- 3.2.1.2 Retaliatory measures

- 3.2.2 Impact on the industry

- 3.2.2.1 Supply-side impact (raw materials)

- 3.2.2.1.1 Price volatility in key materials

- 3.2.2.1.2 Supply chain restructuring

- 3.2.2.1.3 Production cost implications

- 3.2.2.2 Demand-side impact (selling price)

- 3.2.2.2.1 Price transmission to end markets

- 3.2.2.2.2 Market share dynamics

- 3.2.2.2.3 Consumer response patterns

- 3.2.2.1 Supply-side impact (raw materials)

- 3.2.3 Key companies impacted

- 3.2.4 Strategic industry responses

- 3.2.4.1 Supply chain reconfiguration

- 3.2.4.2 Pricing and product strategies

- 3.2.4.3 Policy engagement

- 3.2.5 Outlook and future considerations

- 3.2.1 Impact on trade

- 3.3 Supplier landscape

- 3.4 Profit margin analysis

- 3.5 Key news & initiatives

- 3.6 Regulatory landscape

- 3.7 Impact forces

- 3.7.1 Growth drivers

- 3.7.1.1 Fluctuating raw material prices

- 3.7.1.2 Competition from alternative packaging materials

- 3.7.1.3 Environmental concerns

- 3.7.1.4 Health concerns related to aluminum leaching

- 3.7.2 Industry pitfalls & challenges

- 3.7.2.1 Fluctuating raw material prices

- 3.7.2.2 Competition from alternative packaging materials

- 3.7.2.3 Environmental concerns

- 3.7.2.4 Health concerns related to aluminum leaching

- 3.7.1 Growth drivers

- 3.8 Growth potential analysis

- 3.9 Porter's analysis

- 3.10 PESTEL analysis

- 3.11 Value chain analysis

- 3.11.1 Raw material suppliers

- 3.11.2 Aluminum foil manufacturers

- 3.11.3 Converters & processors

- 3.11.4 Distributors

- 3.11.5 End use

- 3.12 Pricing analysis

- 3.12.1 Cost structure analysis

- 3.12.2 Price trends analysis

- 3.12.3 Price forecast

- 3.13 Technology landscape

- 3.13.1 Manufacturing process overview

- 3.13.1.1 Casting

- 3.13.1.2 Hot rolling

- 3.13.1.3 Cold rolling

- 3.13.1.4 Annealing

- 3.13.1.5 Finishing & slitting

- 3.13.2 Technological advancements

- 3.13.3 Automation in aluminum foil production

- 3.13.4 Quality control technologies

- 3.13.1 Manufacturing process overview

- 3.14 Regulatory framework

- 3.14.1 Food contact materials regulations

- 3.14.2 Fda regulations (us)

- 3.14.3 Eu regulations

- 3.14.4 Other regional regulations

- 3.15 Environmental regulations

- 3.15.1 Trade policies & tariffs

- 3.15.2 Impact of regulations on market growth

Chapter 4 Competitive Landscape, 2024

- 4.1 Introduction

- 4.2 Company market share analysis

- 4.3 Competitive positioning matrix

- 4.4 Strategic outlook matrix

Chapter 5 Market Estimates and Forecast, By Thickness, 2021 - 2034 (USD Billion) (Tons)

- 5.1 Key trends

- 5.2 0.007 mm - 0.09 mm

- 5.3 0.09 mm - 0.2 mm

- 5.4 0.2 mm - 0.4 mm

- 5.5 Others

Chapter 6 Market Estimates and Forecast, By Foil Type, 2021 - 2034 (USD Billion) (Tons)

- 6.1 Key trends

- 6.2 Printed aluminum foil

- 6.3 Unprinted aluminum foil

- 6.4 Laminated aluminum foil

- 6.5 Backed aluminum foil

- 6.6 Others

Chapter 7 Market Estimates and Forecast, By Application, 2021 - 2034 (USD Billion) (Tons)

- 7.1 Key trends

- 7.2 Bags & pouches

- 7.3 Wraps & rolls

- 7.4 Blisters

- 7.5 Lids

- 7.6 Laminated tubes

- 7.7 Trays

- 7.8 Others

Chapter 8 Market Estimates and Forecast, By End Use Industry, 2021 - 2034 (USD Billion) (Tons)

- 8.1 Key trends

- 8.1.1 Food & beverages

- 8.1.2 Bakery & confectionery

- 8.1.3 Ready-to-eat meals

- 8.1.4 Dairy products

- 8.1.5 Beverages

- 8.1.6 Others

- 8.2 Pharmaceuticals

- 8.2.1 Blister packaging

- 8.2.2 Strip packaging

- 8.2.3 Others

- 8.3 Personal care & cosmetics

- 8.4 Household

- 8.5 Industrial

- 8.5.1 Heat insulation

- 8.5.2 Electrical applications

- 8.5.3 Others

- 8.6 Others

Chapter 9 Market Estimates and Forecast, By Region, 2021 - 2034 (USD Billion) (Tons)

- 9.1 Key trends

- 9.2 North America

- 9.2.1 U.S.

- 9.2.2 Canada

- 9.3 Europe

- 9.3.1 Germany

- 9.3.2 UK

- 9.3.3 France

- 9.3.4 Spain

- 9.3.5 Italy

- 9.3.6 Rest of Europe

- 9.4 Asia Pacific

- 9.4.1 China

- 9.4.2 India

- 9.4.3 Japan

- 9.4.4 Australia

- 9.4.5 South Korea

- 9.4.6 Rest of Asia Pacific

- 9.5 Latin America

- 9.5.1 Brazil

- 9.5.2 Mexico

- 9.5.3 Argentina

- 9.5.4 Rest of Latin America

- 9.6 Middle East and Africa

- 9.6.1 Saudi Arabia

- 9.6.2 South Africa

- 9.6.3 UAE

- 9.6.4 Rest of MEA

Chapter 10 Company Profiles

- 10.1 Alcoa Corporation

- 10.2 Aleris Corporation

- 10.3 Alufoil Products

- 10.4 Amco India

- 10.5 Amcor

- 10.6 Assan Aluminyum

- 10.7 China Hongqiao Group

- 10.8 Constellium

- 10.9 Ess Dee Aluminium

- 10.10 Eurofoil

- 10.11 Hindalco Industries

- 10.12 Huawei Aluminum

- 10.13 Norsk Hydro

- 10.14 Novelis

- 10.15 Reynolds Consumer Products

- 10.16 Symetal Aluminium Foil Industry

- 10.17 UACJ Corporation

- 10.18 United Company RUSAL

- 10.19 Xiamen Xiashun Aluminium Foil

- 10.20 Zhejiang Junma Aluminium Industry