|

市場調查報告書

商品編碼

1750316

寵物過敏治療市場機會、成長動力、產業趨勢分析及 2025 - 2034 年預測Pet Allergy Treatment Market Opportunity, Growth Drivers, Industry Trend Analysis, and Forecast 2025 - 2034 |

||||||

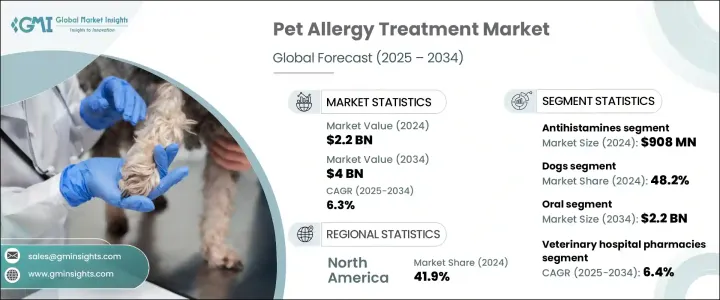

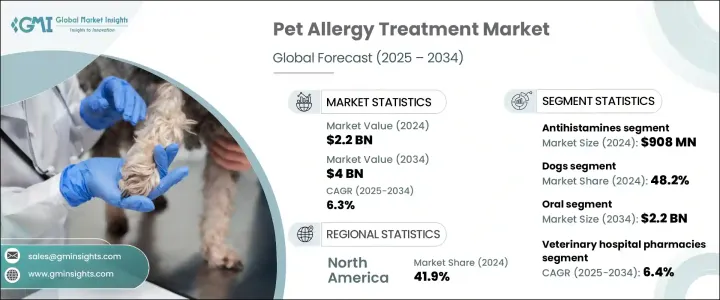

2024年,全球寵物過敏治療市場規模達22億美元,預估年複合成長率為6.3%,2034年將達40億美元。這一成長主要源於全球伴侶動物數量的成長以及寵物各種過敏症狀的診斷增加。隨著越來越多的家庭飼養寵物,跳蚤過敏、食物敏感和環境反應等過敏症狀在動物中也變得越來越常見,對有效治療的需求也日益迫切。隨著寵物主人和獸醫對現有解決方案的認知不斷提高,需求持續激增。幼寵和成年寵物過敏症狀的持續上升,正推動治療產品的創新和普及。這些治療方法不僅能改善動物的生活品質,還能透過更有效地控制症狀,降低寵物主人的長期獸醫費用。寵物過敏療法通常結合多種藥物,針對不同類型的過敏反應,包括皮膚過敏、跳蚤過敏、食物過敏和環境過敏。寵物護理支出的增加和獸醫服務的普及進一步加速了市場需求。隨著寵物主人越來越關注搔癢、發紅和打噴嚏等症狀,重視早期和持續的治療在促進全球市場產品需求方面發揮著至關重要的作用。

寵物過敏市場的治療旨在透過各種劑型(例如抗組織胺、皮質類固醇、外用產品和過敏原特異性免疫療法)來管理和控制動物的過敏症狀。 2024 年,該市場價值達 22.3 億美元。在各類藥物中,抗組織胺佔據主導地位,創造了 9.08 億美元的收入。這些藥物因其快速起效和安全性而被廣泛用作一線治療藥物。抗組織胺以快速緩解瘙癢、發炎和打噴嚏等過敏症狀而聞名。它們有多種劑型——片劑、液體和注射劑——為寵物主人和獸醫提供了便捷的選擇。此外,一些抗組織胺藥物無需處方即可獲得,提高了藥物的可及性,從而提高了藥物的採用率。它們廣泛可用,並且易於在不同大小和物種的動物身上使用,進一步鞏固了該領域的主導地位。

| 市場範圍 | |

|---|---|

| 起始年份 | 2024 |

| 預測年份 | 2025-2034 |

| 起始值 | 22億美元 |

| 預測值 | 40億美元 |

| 複合年成長率 | 6.3% |

按寵物類型分析,狗佔據了大部分市場佔有率,2024 年佔 48.2%。這個細分市場受益於越來越多的家庭養狗,以及隨之而來的寵物相關支出的成長。狗被診斷出患有過敏性疾病(尤其是慢性皮膚病)的頻率更高,這促使對針對性過敏治療的需求增加。狗過敏性疾病發生率的上升,加上人們越來越願意為高品質的醫療保健解決方案花錢,推動了這個類別的擴張。先進的犬類專用藥物的開發進一步提高了治療效果和客戶滿意度。

根據給藥途徑,市場分為口服、腸外和外用製劑。口服藥物市場佔據主導地位,預計2034年將達到22億美元。口服藥物因其易於使用而備受青睞,是長期過敏管理的理想選擇。這些藥物通常以咀嚼片和液體等可口劑型提供,更容易融入寵物的日常生活,不會造成壓力或不適。寵物主人喜歡口服藥物,因為它們是非侵入性的,可以謹慎地添加到飲食中,從而提高治療依從性和療效。此外,製藥公司也不斷開發更多口味、更親民的產品,使其更容易被動物接受,從而增強了它們在寵物照護者中的受歡迎程度。

寵物過敏治療藥物的通路包括獸醫院藥局、零售店和線上平台。獸醫院藥局在2024年佔最大佔有率,預計到2034年將以超過6.4%的複合年成長率成長。這些藥房受益於直接獲得專業護理的優勢,因為治療通常經過獸醫專業人員的全面評估後才進行。提供個人化用藥計畫和專家指導的能力顯著提升了客戶的信任度和忠誠度。寵物主人也傾向於依賴這些管道獲得更高品質且經獸醫認可的藥物,從而鞏固了其市場主導地位。

從地區來看,2024年北美佔據全球寵物過敏治療市場41.9%的佔有率,光是美國市場就達到8.512億美元。寵物飼養普及、可支配收入高以及獲得先進獸醫護理等因素促成了該地區的領先地位。寵物人性化趨勢的日益增強也導致寵物健康和保健產品支出增加,從而支持了市場擴張。競爭態勢激烈,全球領導企業和地區參與者都在推出創新解決方案並擴展產品組合。

包括禮來動保、碩騰、默克動保、Vetoquinol、維克和勃林格殷格翰在內的頂級公司佔據了整個市場的約55-60%。這些公司採取收購、合作和新產品發布等策略性舉措,以在這個不斷發展的行業中站穩腳跟,並推動進一步成長。

目錄

第1章:方法論與範圍

第2章:執行摘要

第3章:行業洞察

- 產業生態系統分析

- 產業衝擊力

- 成長動力

- 寵物過敏盛行率上升

- 非處方藥(OTC)的供應情況

- 寵物擁有量增加,獸醫費用增加

- 產業陷阱與挑戰

- 藥物的副作用

- 越來越多人採用自然療法或家庭療法

- 成長動力

- 成長潛力分析

- 監管格局

- 管道分析

- 未來市場趨勢

- 川普政府關稅

- 對貿易的影響

- 貿易量中斷

- 報復措施

- 對產業的影響

- 供給側影響

- 主要材料價格波動

- 供應鏈重組

- 生產成本影響

- 需求面影響(售價)

- 價格傳導至終端市場

- 市佔率動態

- 消費者反應模式

- 供給側影響

- 受影響的主要公司

- 策略產業反應

- 供應鏈重組

- 定價和產品策略

- 政策參與

- 展望與未來考慮

- 對貿易的影響

- 波特的分析

- PESTEL分析

第4章:競爭格局

- 介紹

- 公司矩陣分析

- 主要市場參與者的競爭分析

- 競爭定位矩陣

- 策略儀表板

第5章:市場估計與預測:按藥物類別,2021 - 2034 年

- 主要趨勢

- 抗組織胺藥

- 皮質類固醇

- 免疫療法

- 其他藥物類別

第6章:市場估計與預測:按寵物類型,2021 - 2034 年

- 主要趨勢

- 狗

- 貓

- 兔子

- 其他寵物類型

第7章:市場估計與預測:按管理路線,2021 - 2034 年

- 主要趨勢

- 口服

- 腸外

- 外用

第8章:市場估計與預測:按配銷通路,2021 - 2034 年

- 主要趨勢

- 獸醫院藥房

- 零售藥局

- 網路藥局

第9章:市場估計與預測:按地區,2021 - 2034 年

- 主要趨勢

- 北美洲

- 美國

- 加拿大

- 歐洲

- 德國

- 英國

- 法國

- 義大利

- 西班牙

- 荷蘭

- 亞太地區

- 中國

- 日本

- 印度

- 澳洲

- 韓國

- 拉丁美洲

- 巴西

- 墨西哥

- 阿根廷

- 中東和非洲

- 南非

- 沙烏地阿拉伯

- 阿拉伯聯合大公國

第10章:公司簡介

- Boehringer Ingelheim International

- Ceva Sante Animale

- Dechra

- Elanco

- Idexx

- Merck Animal Health

- Neogen Corporation

- PetIQ

- Provetica

- Vetoquinol

- Virbac

- Zoetis

The Global Pet Allergy Treatment Market was valued at USD 2.2 billion in 2024 and is estimated to grow at a CAGR of 6.3% to reach USD 4 billion by 2034. This growth is primarily driven by the rising number of companion animals globally and the increasing diagnosis of various allergic conditions in pets. With more households owning pets, conditions such as flea allergies, food sensitivities, and environmental reactions are becoming more common in animals, creating a strong need for effective treatments. As awareness increases among pet owners and veterinarians about available solutions, demand continues to surge. The consistent rise in allergic conditions among both young and adult pets is encouraging innovation and greater adoption of therapeutic products. These treatments not only improve the quality of life for animals but also reduce long-term veterinary costs for pet owners by managing symptoms more effectively. Pet allergy therapies typically involve a combination of drugs aimed at different types of reactions, including skin, flea, food, and environmental allergies. Increasing pet care expenditures and improved access to veterinary services are further accelerating market demand. As pet parents become more attentive to symptoms such as itching, redness, and sneezing, the emphasis on early and consistent treatment is playing a crucial role in boosting product uptake across global markets.

Treatments in the pet allergy market aim to manage and control allergic symptoms in animals through various formulations such as antihistamines, corticosteroids, topical products, and allergen-specific immunotherapy. In 2024, the market was valued at USD 2.23 billion. Among drug classes, antihistamines emerged as the leading segment, generating revenue worth USD 908 million. These drugs are widely used as a first-line therapy due to their quick onset of action and safety profile. Antihistamines are known for delivering fast relief from allergic signs such as itching, inflammation, and sneezing. Their availability in multiple formats-tablets, liquids, and injectables-makes them a convenient option for both pet owners and veterinarians. Additionally, the option to obtain some antihistamines without a prescription increases accessibility, promoting higher adoption rates. Their widespread availability and ease of administration across different animal sizes and species further support this segment's dominance.

| Market Scope | |

|---|---|

| Start Year | 2024 |

| Forecast Year | 2025-2034 |

| Start Value | $2.2 Billion |

| Forecast Value | $4 Billion |

| CAGR | 6.3% |

When analyzed by pet type, dogs held the majority share, accounting for 48.2% of the market in 2024. This segment benefits from the rising number of households adopting dogs and the subsequent increase in pet-related spending. Dogs are more frequently diagnosed with allergic conditions, particularly chronic skin issues, prompting higher demand for targeted allergy treatments. This growing incidence of allergic disorders in dogs, combined with an increasing willingness to spend on high-quality healthcare solutions, fuels the expansion of this category. The development of advanced dog-specific medications further enhances treatment effectiveness and customer satisfaction.

Based on the route of administration, the market is divided into oral, parenteral, and topical formulations. The oral segment led the market and is expected to reach USD 2.2 billion by 2034. Oral treatments are highly favored due to their ease of use, making them ideal for long-term allergy management. These medications are often available in palatable forms like chews and liquids, making them easier to incorporate into a pet's routine without causing stress or discomfort. Pet owners prefer oral options because they are non-invasive and can be discreetly added to meals, improving treatment compliance and outcomes. Additionally, pharmaceutical companies are consistently developing more flavor-friendly products, making them more acceptable to animals, which strengthens their popularity among pet caregivers.

Distribution channels for pet allergy treatments include veterinary hospital pharmacies, retail outlets, and online platforms. Veterinary hospital pharmacies held the largest share in 2024 and are forecasted to grow at over 6.4% CAGR through 2034. These pharmacies benefit from direct access to specialized care, as treatments are usually dispensed following thorough assessments by veterinary professionals. The ability to offer personalized medication plans and expert guidance significantly boosts customer trust and loyalty. Pet owners also tend to rely on these channels for higher-quality and veterinarian-approved medications, reinforcing their dominant market position.

Regionally, North America accounted for 41.9% of the global pet allergy treatment market share in 2024, with the U.S. market alone reaching USD 851.2 million. Factors such as widespread pet ownership, high disposable income, and access to advanced veterinary care contribute to the region's leading position. The increasing trend of pet humanization also results in more spending on health and wellness products for pets, supporting market expansion. Competitive dynamics are intense, with both global leaders and regional players introducing innovative solutions and expanding product portfolios.

Top companies including Elanco Animal Health, Zoetis, Merck Animal Health, Vetoquinol, Virbac, and Boehringer Ingelheim collectively account for around 55-60% of the total market. These players engage in strategic moves such as acquisitions, partnerships, and new product launches to maintain their foothold and drive further growth in this evolving industry.

Table of Contents

Chapter 1 Methodology and Scope

- 1.1 Market scope and definition

- 1.2 Research design

- 1.2.1 Research approach

- 1.2.2 Data collection methods

- 1.3 Base estimates and calculations

- 1.3.1 Base year calculation

- 1.3.2 Key trends for market estimation

- 1.4 Forecast model

- 1.5 Primary research and validation

- 1.5.1 Primary sources

- 1.5.2 Data mining sources

Chapter 2 Executive Summary

- 2.1 Industry 3600 synopsis

Chapter 3 Industry Insights

- 3.1 Industry ecosystem analysis

- 3.2 Industry impact forces

- 3.2.1 Growth drivers

- 3.2.1.1 Rising prevalence of pet allergies

- 3.2.1.2 Availability of over the counter (OTC) medications

- 3.2.1.3 Increasing pet ownership and rising veterinary expenditure

- 3.2.2 Industry pitfalls and challenges

- 3.2.2.1 Side effects of medications

- 3.2.2.2 Increasing adoption of natural or home-based remedies

- 3.2.1 Growth drivers

- 3.3 Growth potential analysis

- 3.4 Regulatory landscape

- 3.5 Pipeline analysis

- 3.6 Future market trends

- 3.7 Trump administration tariffs

- 3.7.1 Impact on trade

- 3.7.1.1 Trade volume disruptions

- 3.7.1.2 Retaliatory measures

- 3.7.2 Impact on the Industry

- 3.7.2.1 Supply-side impact

- 3.7.2.1.1 Price volatility in key materials

- 3.7.2.1.2 Supply chain restructuring

- 3.7.2.1.3 Production cost implications

- 3.7.2.2 Demand-side impact (selling price)

- 3.7.2.2.1 Price transmission to end markets

- 3.7.2.2.2 Market share dynamics

- 3.7.2.2.3 Consumer response patterns

- 3.7.2.1 Supply-side impact

- 3.7.3 Key companies impacted

- 3.7.4 Strategic industry responses

- 3.7.4.1 Supply chain reconfiguration

- 3.7.4.2 Pricing and product strategies

- 3.7.4.3 Policy engagement

- 3.7.5 Outlook and future considerations

- 3.7.1 Impact on trade

- 3.8 Porter's analysis

- 3.9 PESTEL analysis

Chapter 4 Competitive Landscape, 2024

- 4.1 Introduction

- 4.2 Company matrix analysis

- 4.3 Competitive analysis of major market players

- 4.4 Competitive positioning matrix

- 4.5 Strategy dashboard

Chapter 5 Market Estimates and Forecast, By Drug Class, 2021 - 2034 ($ Mn)

- 5.1 Key trends

- 5.2 Antihistamines

- 5.3 Corticosteroids

- 5.4 Immunotherapy

- 5.5 Other drug classes

Chapter 6 Market Estimates and Forecast, By Pet Type, 2021 - 2034 ($ Mn)

- 6.1 Key trends

- 6.2 Dogs

- 6.3 Cats

- 6.4 Rabbits

- 6.5 Other pet types

Chapter 7 Market Estimates and Forecast, By Route of Administration, 2021 - 2034 ($ Mn)

- 7.1 Key trends

- 7.2 Oral

- 7.3 Parenteral

- 7.4 Topical

Chapter 8 Market Estimates and Forecast, By Distribution Channel, 2021 - 2034 ($ Mn)

- 8.1 Key trends

- 8.2 Veterinary hospital pharmacies

- 8.3 Retail pharmacies

- 8.4 Online pharmacies

Chapter 9 Market Estimates and Forecast, By Region, 2021 - 2034 ($ Mn)

- 9.1 Key trends

- 9.2 North America

- 9.2.1 U.S.

- 9.2.2 Canada

- 9.3 Europe

- 9.3.1 Germany

- 9.3.2 UK

- 9.3.3 France

- 9.3.4 Italy

- 9.3.5 Spain

- 9.3.6 Netherlands

- 9.4 Asia Pacific

- 9.4.1 China

- 9.4.2 Japan

- 9.4.3 India

- 9.4.4 Australia

- 9.4.5 South Korea

- 9.5 Latin America

- 9.5.1 Brazil

- 9.5.2 Mexico

- 9.5.3 Argentina

- 9.6 Middle East and Africa

- 9.6.1 South Africa

- 9.6.2 Saudi Arabia

- 9.6.3 UAE

Chapter 10 Company Profiles

- 10.1 Boehringer Ingelheim International

- 10.2 Ceva Sante Animale

- 10.3 Dechra

- 10.4 Elanco

- 10.5 Idexx

- 10.6 Merck Animal Health

- 10.7 Neogen Corporation

- 10.8 PetIQ

- 10.9 Provetica

- 10.10 Vetoquinol

- 10.11 Virbac

- 10.12 Zoetis