|

市場調查報告書

商品編碼

1750314

矽外延晶圓市場機會、成長動力、產業趨勢分析及2025-2034年預測Silicon EPI Wafer Market Opportunity, Growth Drivers, Industry Trend Analysis, and Forecast 2025 - 2034 |

||||||

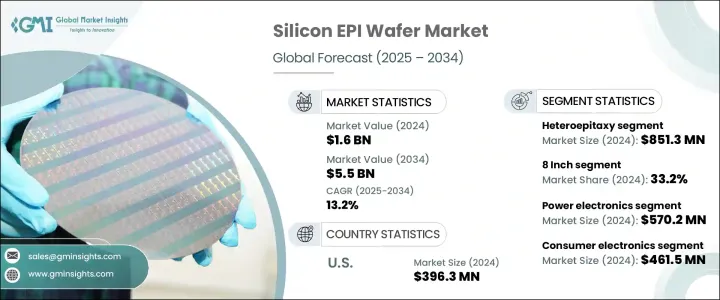

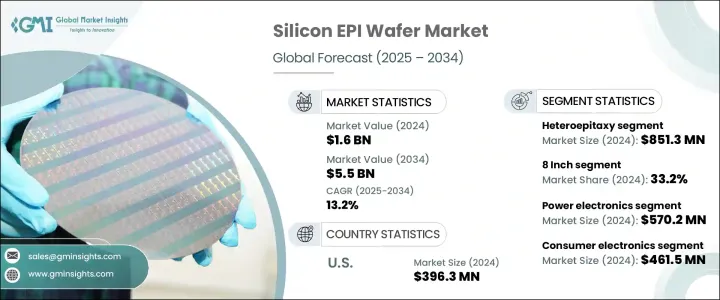

2024年,全球矽外延晶圓市場規模達16億美元,預計2034年將以13.2%的複合年成長率成長,達到55億美元。這主要得益於汽車電子需求的不斷成長、物聯網和邊緣運算設備的持續推廣,以及全球半導體製造業的大規模投資。隨著消費性電子、電動車和電信等領域晶片需求的激增,外延晶圓有助於提高設備效率並實現微型化。先進的邏輯積體電路、5G網路和基於人工智慧的技術正在加速普及,而國家政策支援和產業回流也在塑造未來成長方面發揮關鍵作用。

在美國,對來自關鍵地區的半導體進口產品徵收關稅擾亂了國內定價動態,並影響了全球競爭力。這些貿易行動增加了塑膠樹脂和特殊金屬等關鍵原料的成本,迫使企業重新評估全球供應鏈。儘管需要巨額資本投入,許多企業仍在遷移或考慮在地化生產。政府透過專門針對半導體的立法進行干預,透過提升國內晶圓製造能力並為新工廠提供財政激勵,正在幫助緩解挑戰。

| 市場範圍 | |

|---|---|

| 起始年份 | 2024 |

| 預測年份 | 2025-2034 |

| 起始值 | 16億美元 |

| 預測值 | 55億美元 |

| 複合年成長率 | 13.2% |

2024年,異質外延領域市場規模達8.513億美元,這得益於光電子元件、射頻元件和先進CMOS技術領域對高效能半導體元件日益成長的需求。異質外延能夠將不同晶格結構的材料(例如矽基矽鍺)分層,為功率、速度和尺寸敏感型應用提供了更大的設計靈活性。隨著3D整合和系統單晶片架構的日益普及,異質外延製程在實現能源效率和小型化目標方面的作用將變得更加重要。

2024年,8吋晶圓佔據了33.2%的市場。此尺寸晶圓廣泛應用於消費性電子和汽車半導體的生產,已成為主流。這些晶圓支持功率元件和感測器的經濟高效的量產,尤其是在智慧型設備和電動車中。隨著各行各業向數位化和智慧系統轉型,對基於8吋晶圓的裝置的需求持續成長。

2024年,美國矽外延晶圓市場規模達3.963億美元,這得益於聯邦政府對國內晶片製造的大力投資、電動汽車產量的不斷成長以及人工智慧和高性能計算(HPC)技術的日益融合。 5G、積體電路製造和汽車電子領域的先進應用刺激了本地需求,尤其是在企業尋求減少對海外供應商的依賴並建立具有韌性的區域生態系統的當下。

全球矽外延晶圓市場的主要參與者包括信越半導體(SEH)、世創電子(Siltronic)股份公司、勝高株式會社、SK Siltron 株式會社和環球晶圓株式會社。為了鞏固市場地位,領導企業正在採取以產能擴張、技術創新和垂直整合為重點的策略。這些企業正在大力投資升級製造能力,並探索新的晶圓技術,以滿足下一代設備不斷變化的性能標準。與半導體製造商的策略合作確保了穩定的供應協議,而地理多元化則降低了與政治或貿易中斷相關的風險。

目錄

第1章:方法論與範圍

第2章:執行摘要

第3章:行業洞察

- 產業生態系統分析

- 影響價值鏈的因素

- 利潤率分析

- 中斷

- 未來展望

- 製造商

- 經銷商

- 川普政府關稅

- 對貿易的影響

- 貿易量中斷

- 報復措施

- 對產業的影響

- 供給側影響(原料)

- 主要材料價格波動

- 供應鏈重組

- 生產成本影響

- 需求面影響(售價)

- 價格傳導至終端市場

- 市佔率動態

- 消費者反應模式

- 供給側影響(原料)

- 受影響的主要公司

- 策略產業反應

- 供應鏈重組

- 定價和產品策略

- 政策參與

- 展望與未來考慮

- 對貿易的影響

- 供應商格局

- 利潤率分析

- 重要新聞和舉措

- 監管格局

- 衝擊力

- 成長動力

- 先進半導體裝置需求激增

- 汽車電子的擴展

- 物聯網和邊緣設備的採用率不斷提高

- 半導體製造投資不斷成長

- 電力電子應用的成長

- 產業陷阱與挑戰

- 外延生長的資本和營運成本高

- 嚴格的品質和缺陷控制要求

- 成長動力

- 成長潛力分析

- 波特的分析

- PESTEL分析

第4章:競爭格局

- 介紹

- 公司市佔率分析

- 競爭定位矩陣

- 戰略展望矩陣

第5章:市場估計與預測:依外延類型,2021-2034

- 主要趨勢

- 異質外延

- 同質外延

第6章:市場預估與預測:依晶圓尺寸,2021-2034

- 主要趨勢

- 6吋

- 8吋

- 12英吋

- 其他

第7章:市場估計與預測:按應用,2021-2034

- 主要趨勢

- 電力電子

- 微機電系統

- 射頻電子元件

- 光子學

- 其他

第8章:市場估計與預測:依最終用途,2021-2034

- 主要趨勢

- 消費性電子產品

- 汽車

- 衛生保健

- 航太和國防

- 其他

第9章:市場估計與預測:按地區,2021-2034

- 主要趨勢

- 北美洲

- 美國

- 加拿大

- 歐洲

- 英國

- 德國

- 法國

- 義大利

- 西班牙

- 俄羅斯

- 亞太地區

- 中國

- 印度

- 日本

- 韓國

- 澳洲

- 拉丁美洲

- 巴西

- 墨西哥

- MEA

- 南非

- 沙烏地阿拉伯

- 阿拉伯聯合大公國

第10章:公司簡介

- Beijing Eswell Technology Group Co., Ltd.

- Coherent, Inc.

- Episil-Precision Inc.

- GlobalWafers Co., Ltd.

- IQE PLC

- Jenoptik AG

- MOSPEC Semiconductor Corporation

- NTT Advanced Technology Corporation

- Okmetic Oy

- Shanghai Simgui Technology Co., Ltd.

- Shin-Etsu Handotai

- Siltronic AG

- SK Siltron Co., Ltd.

- SOITEC SA

- SRI International

- SUMCO Corporation

- SweGaN AB

- Wafer Works Corporation

- Xiamen Powerway Advanced Material Co., Ltd

The Global Silicon EPI Wafer Market was valued at USD 1.6 billion in 2024 and is estimated to grow at a CAGR of 13.2% to reach USD 5.5 billion by 2034, driven by rising demand for automotive electronics, the continued rollout of IoT and edge computing devices, and massive investments in global semiconductor manufacturing. As chip demand surges across sectors like consumer electronics, electric vehicles, and telecommunications, epitaxial wafers help improve device efficiency and miniaturization. Advanced logic ICs, 5G networks, and AI-based technologies are accelerating adoption, while national policy support and industrial re-shoring efforts also play a crucial role in shaping future growth.

In the United States, the imposition of tariffs on semiconductor imports from key regions has disrupted domestic pricing dynamics and affected global competitiveness. These trade actions have increased costs for critical inputs like plastic resins and specialty metals, forcing companies to reassess global supply chains. Many firms are relocating or considering localizing production despite the heavy capital outlay required. Government intervention through semiconductor-specific legislation is helping mitigate challenges by boosting domestic wafer manufacturing capabilities and offering financial incentives for new plants.

| Market Scope | |

|---|---|

| Start Year | 2024 |

| Forecast Year | 2025-2034 |

| Start Value | $1.6 Billion |

| Forecast Value | $5.5 Billion |

| CAGR | 13.2% |

The heteroepitaxy segment generated USD 851.3 million in 2024, driven by the increasing need for high-performance semiconductor devices in optoelectronics, RF components, and advanced CMOS technology. The ability of heteroepitaxy to layer materials with differing lattice structures, such as silicon-germanium on silicon, offers greater design flexibility in power, speed, and size-sensitive applications. As 3D integration and system-on-chip architectures grow more prevalent, the role of heteroepitaxial processes will become even more essential to meet energy efficiency and miniaturization goals.

The 8-inch wafer category held a 33.2% market share in 2024. Its widespread use in the production of consumer electronics and automotive semiconductors has made this wafer size a mainstay. These wafers support cost-effective mass manufacturing of power devices and sensors, particularly those deployed in smart devices and electric vehicles. As industries shift toward digitalization and smarter systems, the demand for 8-inch wafer-based devices continues to rise.

U.S. Silicon EPI Wafer Market generated USD 396.3 million in 2024, bolstered by strong federal investment in domestic chip fabrication, rising EV production, and the growing integration of AI and HPC technologies. Advanced applications in 5G, IC manufacturing, and automotive electronics boost local demand, especially as companies seek to reduce reliance on overseas suppliers and build resilient regional ecosystems.

Key players in the Global Silicon EPI Wafer Market include Shin-Etsu Handotai (SEH), Siltronic AG, SUMCO Corporation, SK Siltron Co., Ltd., and GlobalWafers Co., Ltd. Strengthening their market presence, leading companies are adopting strategies that focus on capacity expansion, technological innovation, and vertical integration. Firms are heavily investing in upgrading manufacturing capabilities and exploring new wafer technologies that meet the evolving performance standards required for next-generation devices. Strategic collaborations with semiconductor manufacturers ensure steady supply agreements, while geographic diversification reduces risks related to political or trade disruptions.

Table of Contents

Chapter 1 Methodology & Scope

- 1.1 Market scope & definitions

- 1.2 Base estimates & calculations

- 1.3 Forecast calculations

- 1.4 Data sources

- 1.4.1 Primary

- 1.4.2 Secondary

- 1.4.2.1 Paid sources

- 1.4.2.2 Public sources

Chapter 2 Executive Summary

- 2.1 Industry synopsis, 2021-2034

Chapter 3 Industry Insights

- 3.1 Industry ecosystem analysis

- 3.1.1 Factor affecting the value chain

- 3.1.2 Profit margin analysis

- 3.1.3 Disruptions

- 3.1.4 Future outlook

- 3.1.5 Manufacturers

- 3.1.6 Distributors

- 3.2 Trump administration tariffs

- 3.2.1 Impact on trade

- 3.2.1.1 Trade volume disruptions

- 3.2.1.2 Retaliatory measures

- 3.2.1.3 Impact on the industry

- 3.2.1.3.1 Supply-side impact (raw materials)

- 3.2.1.3.1.1 Price volatility in key materials

- 3.2.1.3.1.2 Supply chain restructuring

- 3.2.1.3.1.3 Production cost implications

- 3.2.1.3.2 Demand-side impact (selling price)

- 3.2.1.3.2.1 Price transmission to end markets

- 3.2.1.3.2.2 Market share dynamics

- 3.2.1.3.2.3 Consumer response patterns

- 3.2.1.3.1 Supply-side impact (raw materials)

- 3.2.1.4 Key companies impacted

- 3.2.1.5 Strategic industry responses

- 3.2.1.5.1 Supply chain reconfiguration

- 3.2.1.5.2 Pricing and product strategies

- 3.2.1.5.3 Policy engagement

- 3.2.1.6 Outlook and future considerations

- 3.2.1 Impact on trade

- 3.3 Supplier landscape

- 3.4 Profit margin analysis

- 3.5 Key news & initiatives

- 3.6 Regulatory landscape

- 3.7 Impact forces

- 3.7.1 Growth drivers

- 3.7.1.1 Surge in demand for advanced semiconductor devices

- 3.7.1.2 Expansion of automotive electronics

- 3.7.1.3 Increasing adoption of IoT and edge devices

- 3.7.1.4 Growing investments in semiconductor manufacturing

- 3.7.1.5 Rising growth in power electronics applications

- 3.7.2 Industry pitfalls & challenges

- 3.7.2.1 High capital and operational costs of epitaxial growth

- 3.7.2.2 Stringent quality and defect control requirements

- 3.7.1 Growth drivers

- 3.8 Growth potential analysis

- 3.9 Porter's analysis

- 3.10 PESTEL analysis

Chapter 4 Competitive Landscape, 2024

- 4.1 Introduction

- 4.2 Company market share analysis

- 4.3 Competitive positioning matrix

- 4.4 Strategic outlook matrix

Chapter 5 Market Estimates & Forecast, By Epitaxy Type, 2021-2034 (USD Million & Units)

- 5.1 Key trends

- 5.2 Heteroepitaxy

- 5.3 Homoepitaxy

Chapter 6 Market Estimates & Forecast, By Wafer Size, 2021-2034 (USD Million & Units)

- 6.1 Key trends

- 6.2 6 inch

- 6.3 8 inch

- 6.4 12 inch

- 6.5 Others

Chapter 7 Market Estimates & Forecast, By Application, 2021-2034 (USD Million & Units)

- 7.1 Key trends

- 7.2 Power electronics

- 7.3 MEMS

- 7.4 RF electronics

- 7.5 Photonics

- 7.6 Others

Chapter 8 Market Estimates & Forecast, By End Use, 2021-2034 (USD Million & Units)

- 8.1 Key trends

- 8.2 Consumer electronics

- 8.3 Automotive

- 8.4 Healthcare

- 8.5 Aerospace and defense

- 8.6 Others

Chapter 9 Market Estimates & Forecast, By Region, 2021-2034 (USD Million & Units)

- 9.1 Key trends

- 9.2 North America

- 9.2.1 U.S.

- 9.2.2 Canada

- 9.3 Europe

- 9.3.1 UK

- 9.3.2 Germany

- 9.3.3 France

- 9.3.4 Italy

- 9.3.5 Spain

- 9.3.6 Russia

- 9.4 Asia Pacific

- 9.4.1 China

- 9.4.2 India

- 9.4.3 Japan

- 9.4.4 South Korea

- 9.4.5 Australia

- 9.5 Latin America

- 9.5.1 Brazil

- 9.5.2 Mexico

- 9.6 MEA

- 9.6.1 South Africa

- 9.6.2 Saudi Arabia

- 9.6.3 UAE

Chapter 10 Company Profiles

- 10.1 Beijing Eswell Technology Group Co., Ltd.

- 10.2 Coherent, Inc.

- 10.3 Episil-Precision Inc.

- 10.4 GlobalWafers Co., Ltd.

- 10.5 IQE PLC

- 10.6 Jenoptik AG

- 10.7 MOSPEC Semiconductor Corporation

- 10.8 NTT Advanced Technology Corporation

- 10.9 Okmetic Oy

- 10.10 Shanghai Simgui Technology Co., Ltd.

- 10.11 Shin-Etsu Handotai

- 10.12 Siltronic AG

- 10.13 SK Siltron Co., Ltd.

- 10.14 SOITEC SA

- 10.15 SRI International

- 10.16 SUMCO Corporation

- 10.17 SweGaN AB

- 10.18 Wafer Works Corporation

- 10.19 Xiamen Powerway Advanced Material Co., Ltd