|

市場調查報告書

商品編碼

1750310

直升機甲板監控系統市場機會、成長動力、產業趨勢分析及 2025 - 2034 年預測Helideck Monitoring System Market Opportunity, Growth Drivers, Industry Trend Analysis, and Forecast 2025 - 2034 |

||||||

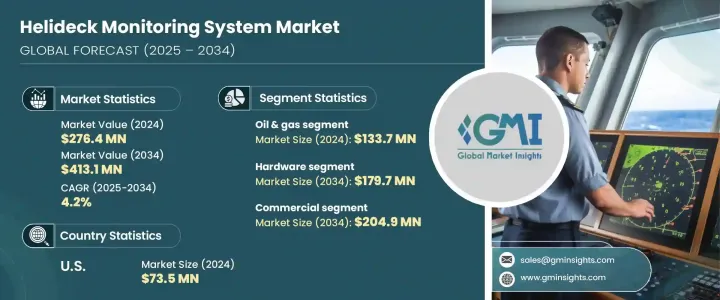

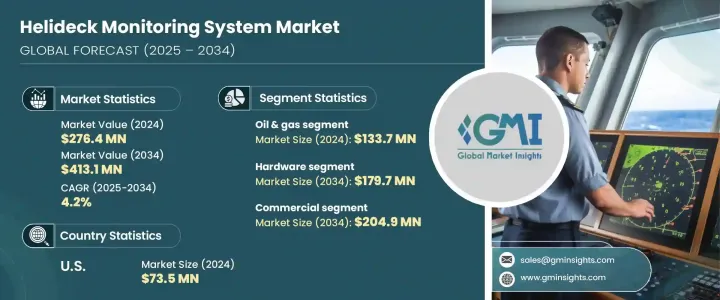

2024 年全球直升機甲板監控系統市場價值為 2.764 億美元,預計到 2034 年將以 4.2% 的複合年成長率成長至 4.131 億美元。這一成長軌跡主要受全球不斷成長的能源需求所推動,這繼續推動海上探勘和生產活動的擴張。隨著能源公司擴大將目光投向海上資源開採地點,對直升機安全且有效率地運輸人員和設備的需求大幅增加。在這樣的環境下,準確監測氣象和海洋條件變得至關重要。 HMS 平台提供即時環境資料,以確保營運安全,並協助飛行員在動態和潛在危險條件下做出明智的決策。這些系統透過追蹤風速、浪高、甲板運動和能見度等重要參數,在保障直升機運作方面發揮著至關重要的作用。

海上作業通常意味著要應對多變的天氣和惡劣的海洋環境。直升機甲板監控系統能夠提供可靠且持續的資料,使營運商能夠遵守航空安全標準並降低營運風險。隨著海上產業越來越重視安全、法規遵循和運輸物流效率,直升機甲板監控系統 (HMS) 的採用率也不斷上升。 HMS 解決方案傳統上用於石油和天然氣作業,但在再生能源等其他海上領域也越來越重要。隨著海上設施技術越來越先進,利害關係人正在投資於支持決策並確保往返偏遠地區的無縫空中運輸的綜合監控系統。海上作業範圍的不斷擴大,加上安全要求的不斷提高,促使海上營運商採用專為即時監控和預測分析而客製化的先進 HMS 解決方案。

| 市場範圍 | |

|---|---|

| 起始年份 | 2024 |

| 預測年份 | 2025-2034 |

| 起始值 | 2.764億美元 |

| 預測值 | 4.131億美元 |

| 複合年成長率 | 4.2% |

直升機甲板監控系統市場按垂直產業細分,包括石油天然氣、海洋和陸上。石油天然氣產業在2024年的市場規模為1.337億美元,成為最大的細分市場。海上平台的安裝數量不斷增加,這加劇了對可靠的直升機操作系統的需求,以確保人員和物資的安全及時運輸。除了石油天然氣外,離岸風電專案也助長了這一日益成長的需求,因為這些偏遠地區的設施需要強大的環境監控,以確保直升機的進出和人員的安全轉移。

根據系統類型,市場分為硬體和軟體。預計到 2034 年,硬體部分將達到 1.797 億美元,這反映了海上環境中對高效能組件的持續需求。風感測器、運動偵測器、能見度計和監視設備等關鍵硬體元素對於捕獲準確和即時的環境資料至關重要。這些系統經過專門設計,可承受惡劣的海上條件,包括強風、暴雨和腐蝕性海洋環境。它們在這種極端條件下可靠運行的能力可確保直升機不間斷運行,並減少因天氣相關延誤造成的停機時間。海上設施日益複雜,對先進和堅固的硬體解決方案的需求不斷增加。

從應用角度來看,直升機甲板監控系統市場分為商業和國防領域。預計到2034年,商業領域的市場規模將達到2.049億美元。在商業運作中,直升機甲板監控系統(HMS)對於確保人員和設備透過直升機安全地運輸到海上平台和船舶至關重要。貨運和海上客運等產業越來越依賴這些系統來增強態勢感知、安全性和合規性。隨著海上物流挑戰日益嚴峻,商業領域正在採用HMS來確保在不可預測的環境條件下關鍵任務運作的可靠性。

從地區來看,美國在全球直升機甲板監控系統市場佔有相當大的佔有率,2024年的估值為7,350萬美元。美國龐大的海上基礎設施以及對替代能源項目(尤其是海上項目)不斷成長的投資,持續推動直升機甲板監控系統的需求。監管機構也對海上直升機作業制定了嚴格的安全要求,這進一步加速了直升機甲板監控解決方案的採用。此外,海軍作戰行動依賴直升機進行戰略和後勤支援,也推動了該地區對直升機甲板監控技術的需求不斷成長。

HMS 市場競爭格局分散,許多區域和國際參與者參與其中。海上設施營運商、海洋安全組織和技術開發商之間的合作正在推動創新,並促進先進 HMS 解決方案的部署。這些公司利用在環境監測、通訊系統和整合技術方面的專業知識,提供全面的 HMS 解決方案。該領域的競爭很大程度上取決於公司能否提供可靠、符合法規的系統,並輔以專有技術和強大的售後服務。市場領導者專注於建立策略合作夥伴關係,根據特定客戶需求客製化產品,並投資研發,以提供能夠應對新興海上安全挑戰的下一代系統。

目錄

第1章:方法論與範圍

第2章:執行摘要

第3章:行業洞察

- 產業生態系統分析

- 產業衝擊力

- 成長動力

- 海上油氣探勘活動增多

- 海上直升機停機坪的嚴格安全規定

- 離岸風電裝置容量成長

- 增加即時天氣監測的部署

- 感測器整合和分析的技術進步

- 陷阱與挑戰

- 安裝和維護成本高

- 由於預算限制,發展中離岸市場的採用率有限

- 成長動力

- 成長潛力分析

- 監管格局

- 技術格局

- 未來市場趨勢

- 差距分析

- 波特的分析

- PESTEL分析

第4章:競爭格局

- 介紹

- 公司市佔率分析

- 主要市場參與者的競爭分析

- 競爭定位矩陣

- 策略儀表板

第5章:市場估計與預測:按垂直產業,2021 年至 2034 年

- 主要趨勢

- 石油和天然氣

- 固定式海上鑽井平台

- 移動式海上鑽井平台

- 海洋

- 船上

- 海軍艦艇

- 商船

- 岸上

- 港口

- 海軍基地

第6章:市場估計與預測:按系統,2021 年至 2034 年

- 主要趨勢

- 硬體

- 運動感應器

- 風感測器

- 氣象感測器

- 全球定位系統

- 陀螺儀

- 軟體

第7章:市場估計與預測:按應用,2021 年至 2034 年

- 主要趨勢

- 商業的

- 防禦

第8章:市場估計與預測:按地區,2021 年至 2034 年

- 主要趨勢

- 北美洲

- 美國

- 加拿大

- 歐洲

- 德國

- 英國

- 法國

- 西班牙

- 義大利

- 荷蘭

- 亞太地區

- 中國

- 印度

- 日本

- 澳洲

- 韓國

- 拉丁美洲

- 巴西

- 墨西哥

- 阿根廷

- 中東和非洲

- 沙烏地阿拉伯

- 南非

- 阿拉伯聯合大公國

第9章:公司簡介

- Kongsberg Gruppen ASA

- Fugro NV

- Vaisala Oyj

- ABB Ltd.

- AWA Marine Ltd.

- ASB Systems Private Ltd.

- Monitor Systems Scotland Ltd.

- Dynamax Inc.

- Miros Group AS

- Observator Group BV

- RH Marine BV

- RIGSTAT LLC

- ShoreConnection International AS

The Global Helideck Monitoring System Market was valued at USD 276.4 million in 2024 and is estimated to grow at a CAGR of 4.2% to reach USD 413.1 million by 2034. This growth trajectory is primarily fueled by the mounting global demand for energy, which continues to drive expansion in offshore exploration and production activities. As energy companies increasingly look toward offshore locations for resource extraction, the need for secure and efficient transportation of personnel and equipment by helicopter has grown substantially. In such environments, accurate monitoring of meteorological and oceanographic conditions becomes critical. HMS platforms deliver real-time environmental data to ensure operational safety and help pilots make informed decisions under dynamic and potentially hazardous conditions. These systems play a crucial role in safeguarding helicopter operations by tracking vital parameters like wind speed, wave height, deck movement, and visibility.

Operating offshore often means contending with volatile weather and harsh marine environments. The ability of helideck monitoring systems to provide reliable and continuous data allows operators to comply with aviation safety standards and mitigate operational risks. HMS adoption is rising as offshore industries increasingly prioritize safety, regulatory compliance, and the efficiency of transport logistics. While traditionally used in oil and gas operations, HMS solutions are also gaining relevance in other offshore sectors, such as renewable energy. As offshore facilities become more technologically advanced, stakeholders are investing in integrated monitoring systems that support decision-making and ensure seamless air transport to and from remote locations. The expanding scope of offshore operations, coupled with heightened safety requirements, is prompting offshore operators to adopt advanced HMS solutions tailored for real-time monitoring and predictive analysis.

| Market Scope | |

|---|---|

| Start Year | 2024 |

| Forecast Year | 2025-2034 |

| Start Value | $276.4 Million |

| Forecast Value | $413.1 Million |

| CAGR | 4.2% |

The helideck monitoring system market is segmented by vertical into oil & gas, marine, and onshore. The oil & gas sector accounted for USD 133.7 million in 2024, making it the largest segment. Increasing offshore platform installations are amplifying the need for dependable helicopter operation systems that ensure the safe and timely movement of crew and materials. In addition to oil and gas, offshore wind projects are contributing to this growing demand, as these remote installations require robust environmental monitoring for helicopter access and safe personnel transfers.

Based on the system type, the market is categorized into hardware and software. The hardware segment is projected to reach USD 179.7 million by 2034, reflecting consistent demand for high-performance components in offshore settings. Key hardware elements such as wind sensors, motion detectors, visibility meters, and surveillance equipment are critical for capturing accurate and real-time environmental data. These systems are specifically engineered to endure harsh offshore conditions, including strong winds, heavy rainfall, and corrosive marine environments. Their ability to perform reliably under such extreme conditions ensures uninterrupted helicopter operations and reduces downtime due to weather-related delays. The increasing complexity of offshore installations continues to elevate the need for advanced and rugged hardware solutions.

In terms of application, the helideck monitoring system market is bifurcated into commercial and defense segments. The commercial segment is anticipated to reach USD 204.9 million by 2034. In commercial operations, HMS is integral to ensuring safe transport logistics for personnel and equipment via helicopter to offshore platforms and vessels. Sectors such as cargo shipping and offshore passenger transport increasingly rely on these systems for enhanced situational awareness, safety, and regulatory compliance. As offshore logistics become more challenging, the commercial sector is adopting HMS to ensure reliability in mission-critical operations under unpredictable environmental conditions.

Regionally, the United States held a significant share of the global helideck monitoring system market, with a valuation of USD 73.5 million in 2024. The country's substantial offshore infrastructure and increasing investments in alternative energy projects, particularly those located offshore, continue to fuel demand for helideck monitoring systems. Regulatory bodies have also set stringent safety requirements for offshore helicopter operations, which is further accelerating the adoption of HMS solutions. Additionally, the presence of naval operations relying on helicopters for strategic and logistical purposes contributes to the growing demand for helideck monitoring technologies in the region.

The HMS market is characterized by a fragmented competitive landscape, with numerous regional and international players participating in the ecosystem. Collaboration between offshore facility operators, marine safety organizations, and technology developers is driving innovation and facilitating the deployment of advanced HMS solutions. These companies leverage specialized expertise in environmental monitoring, communication systems, and integrated technologies to offer comprehensive HMS solutions. Competition in this space is largely driven by a company's ability to offer reliable, regulation-compliant systems enhanced with proprietary technology and strong after-sales service. Market leaders are focused on forming strategic partnerships, tailoring products to specific customer needs, and investing in research and development to deliver next-generation systems that address emerging offshore safety challenges.

Table of Contents

Chapter 1 Methodology and Scope

- 1.1 Market scope and definitions

- 1.2 Research design

- 1.2.1 Research approach

- 1.2.2 Data collection methods

- 1.3 Base estimates and calculations

- 1.3.1 Base year calculation

- 1.3.2 Key trends for market estimation

- 1.4 Forecast model

- 1.5 Primary research and validation

- 1.5.1 Primary sources

- 1.5.2 Data mining sources

Chapter 2 Executive Summary

- 2.1 Industry 360° synopsis

Chapter 3 Industry Insights

- 3.1 Industry ecosystem analysis

- 3.2 Industry impact forces

- 3.2.1 Growth drivers

- 3.2.1.1 Rising offshore oil & gas exploration activities

- 3.2.1.2 Stringent safety regulations for offshore helidecks

- 3.2.1.3 Growth in offshore wind energy installations

- 3.2.1.4 Increased deployment of real-time weather monitoring

- 3.2.1.5 Technological advancements in sensor integration and analytics

- 3.2.2 pitfalls and challenges

- 3.2.2.1 High installation and maintenance costs

- 3.2.2.2 Limited adoption in developing offshore markets due to budget constraints

- 3.2.1 Growth drivers

- 3.3 Growth potential analysis

- 3.4 Regulatory landscape

- 3.5 Technology landscape

- 3.6 Future market trends

- 3.7 Gap analysis

- 3.8 Porter's analysis

- 3.9 PESTEL analysis

Chapter 4 Competitive Landscape, 2024

- 4.1 Introduction

- 4.2 Company market share analysis

- 4.3 Competitive analysis of major market players

- 4.4 Competitive positioning matrix

- 4.5 Strategy dashboard

Chapter 5 Market Estimates and Forecast, By Vertical, 2021 – 2034 ($ Mn)

- 5.1 Key trends

- 5.2 Oil & gas

- 5.2.1 Fixed offshore rigs

- 5.2.2 Mobile offshore rigs

- 5.3 Marine

- 5.3.1 On-board

- 5.3.2 Naval ship

- 5.3.3 Commercial ship

- 5.4 On-shore

- 5.4.1 port

- 5.4.2 Naval base

Chapter 6 Market Estimates and Forecast, By System, 2021 – 2034 ($ Mn)

- 6.1 Key trends

- 6.2 Hardware

- 6.2.1 Motion sensor

- 6.2.2 Wind sensor

- 6.2.3 Meteorology sensor

- 6.2.4 GPS

- 6.2.5 Gyro

- 6.3 Software

Chapter 7 Market Estimates and Forecast, By Application, 2021 – 2034 ($ Mn)

- 7.1 Key trends

- 7.2 Commercial

- 7.3 Defense

Chapter 8 Market Estimates and Forecast, By Region, 2021 – 2034 ($ Mn)

- 8.1 Key trends

- 8.2 North America

- 8.2.1 U.S.

- 8.2.2 Canada

- 8.3 Europe

- 8.3.1 Germany

- 8.3.2 UK

- 8.3.3 France

- 8.3.4 Spain

- 8.3.5 Italy

- 8.3.6 Netherlands

- 8.4 Asia Pacific

- 8.4.1 China

- 8.4.2 India

- 8.4.3 Japan

- 8.4.4 Australia

- 8.4.5 South Korea

- 8.5 Latin America

- 8.5.1 Brazil

- 8.5.2 Mexico

- 8.5.3 Argentina

- 8.6 Middle East and Africa

- 8.6.1 Saudi Arabia

- 8.6.2 South Africa

- 8.6.3 UAE

Chapter 9 Company Profiles

- 9.1 Kongsberg Gruppen ASA

- 9.2 Fugro N.V.

- 9.3 Vaisala Oyj

- 9.4 ABB Ltd.

- 9.5 AWA Marine Ltd.

- 9.6 ASB Systems Private Ltd.

- 9.7 Monitor Systems Scotland Ltd.

- 9.8 Dynamax Inc.

- 9.9 Miros Group AS

- 9.10 Observator Group B.V.

- 9.11 RH Marine B.V.

- 9.12 RIGSTAT LLC

- 9.13 ShoreConnection International AS