|

市場調查報告書

商品編碼

1750303

機器人戰鬥車輛市場機會、成長動力、產業趨勢分析及 2025 - 2034 年預測Robotic Combat Vehicles Market Opportunity, Growth Drivers, Industry Trend Analysis, and Forecast 2025 - 2034 |

||||||

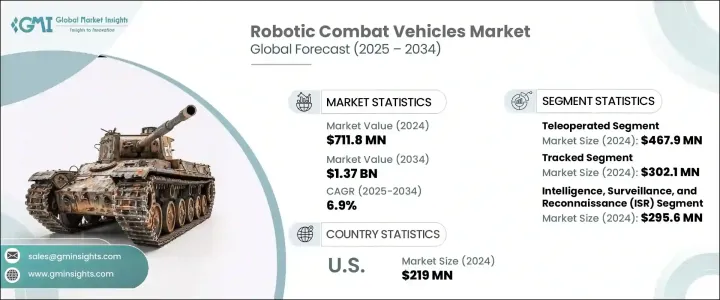

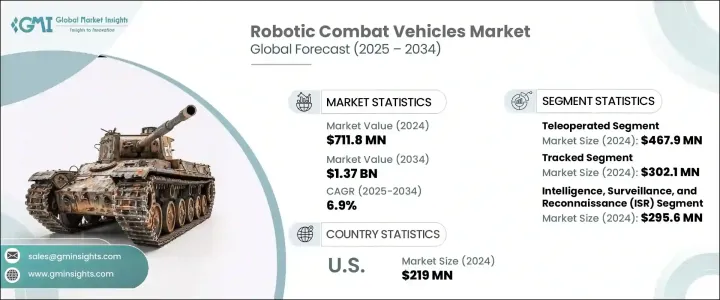

2024年,全球機器人作戰車輛市場價值為7.118億美元,預計到2034年將以6.9%的複合年成長率成長,達到13.7億美元,這得益於全球國防預算的不斷成長以及人工智慧(AI)和自主技術的進步。隨著各國不斷增加國防開支,各國更加重視軍事能力的現代化建設和部隊效能的提升。機器人作戰車輛(RCV)因其能夠顯著降低人員風險並提升作戰能力,正日益成為全球軍事戰略中不可或缺的一部分。

機器人作戰車輛能夠在高風險環境中以最少的人工干預執行任務,從而重塑戰場格局。它們的使用使軍隊能夠更有效率地進行從偵察到直接作戰等複雜行動,而無需將士兵置於不必要的危險之中。這些車輛配備了先進的感測器、人工智慧系統和武器,使其能夠執行傳統上由人類士兵執行的任務,例如監視、搜救,甚至進攻行動。現代戰爭日益複雜,推動了對這些先進無人系統的需求不斷成長。當今的軍事行動需要更靈活和動態的解決方案,尤其是在地形複雜或敵人適應性強的情況下。

| 市場範圍 | |

|---|---|

| 起始年份 | 2024 |

| 預測年份 | 2025-2034 |

| 起始值 | 7.118億美元 |

| 預測值 | 13.7億美元 |

| 複合年成長率 | 6.9% |

市場依作戰模式細分為自主系統和遙控系統。遙控遙控車輛市場在2024年創造了4.679億美元的收入,這得益於對需要在複雜環境(例如城市作戰或動態戰區)中即時控制的系統的需求。這些系統為軍事人員提供了更大的靈活性,同時仍保留了人為控制,這對於任務的可靠性和倫理考量至關重要。隨著軍隊向完全自主系統過渡,遙控遙控車輛是適應這些技術的重要過渡階段。

就機動性而言,市場分為輪式、履帶式和混合動力車輛。履帶式遙控裝甲車市場在2024年創造了3.021億美元的市場規模。這些履帶式車輛在崎嶇地形上擁有卓越的機動性,使其成為前線作戰和惡劣環境下作戰的理想選擇。它們能夠攜帶更重的有效載荷,包括先進的武器和感測器設備,這進一步增加了其在直接作戰和火力支援方面的需求。此外,履帶式車輛具有更高的穩定性和後座力吸收能力,使其非常適合快速機動和實彈射擊。

2024年,美國機器人作戰車輛市場價值達2.19億美元,這得益於政府在國防項目和計畫上的大量投入,例如軍方對地面和空中作戰無人系統的重視。此外,陸軍的機器人作戰車輛計畫和海軍的無人系統路線圖等項目也促進了人們對這些技術的興趣日益濃厚。降低軍事人員風險的需求日益成長,加上不斷演變的威脅,進一步刺激了美國對機器人戰鬥車輛的需求。

機器人作戰車輛市場的幾個關鍵參與者正積極增強其產品,整合人工智慧驅動功能並提升機器人系統的穩健性。通用動力陸地系統公司、BAE系統公司和Teledyne FLIR等公司在提升這些車輛的功能性和自主性方面處於領先地位。他們也致力於擴展產品組合,以滿足偵察、監視和後勤等多樣化的軍事需求。與政府機構和國防承包商的合作是這些參與者獲得長期合約並鞏固其市場地位的另一種策略。

目錄

第1章:方法論與範圍

第2章:執行摘要

第3章:行業洞察

- 產業生態系統分析

- 川普政府關稅

- 對貿易的影響

- 貿易量中斷

- 報復措施

- 對產業的影響

- 供給側影響

- 關鍵零件價格波動

- 供應鏈重組

- 生產成本影響

- 需求面影響(售價)

- 價格傳導至終端市場

- 市佔率動態

- 消費者反應模式

- 供給側影響

- 受影響的主要公司

- 策略產業反應

- 供應鏈重組

- 定價和產品策略

- 政策參與

- 展望與未來考慮

- 對貿易的影響

- 產業衝擊力

- 成長動力

- 全球國防預算不斷增加

- 人工智慧和自主導航的進步

- 模組化作戰平台的開發

- 高風險區域對無人解決方案的需求

- 增加軍事現代化計劃

- 產業陷阱與挑戰

- 開發和營運成本高

- 網路安全漏洞

- 成長動力

- 成長潛力分析

- 監管格局

- 技術格局

- 未來市場趨勢

- 差距分析

- 波特的分析

- PESTEL分析

第4章:競爭格局

- 介紹

- 公司市佔率分析

- 主要市場參與者的競爭分析

- 競爭定位矩陣

- 策略儀表板

第5章:市場估計與預測:按營運模式,2021 年至 2034 年

- 主要趨勢

- 自主

- 遙控

第6章:市場估計與預測:依移動性,2021 年至 2034 年

- 主要趨勢

- 輪式

- 履帶式

- 混合

第7章:市場估計與預測:按應用,2021 年至 2034 年

- 主要趨勢

- 情報、監視和偵察(ISR)

- 直接戰鬥與火力支援

- 戰鬥工程

- 醫療後送

- 其他

第8章:市場估計與預測:按地區,2021 年至 2034 年

- 主要趨勢

- 北美洲

- 美國

- 加拿大

- 歐洲

- 德國

- 英國

- 法國

- 西班牙

- 義大利

- 荷蘭

- 亞太地區

- 中國

- 印度

- 日本

- 澳洲

- 韓國

- 拉丁美洲

- 巴西

- 墨西哥

- 阿根廷

- 中東和非洲

- 沙烏地阿拉伯

- 南非

- 阿拉伯聯合大公國

第9章:公司簡介

- BAE Systems

- Elbit Systems

- General Dynamics Land Systems

- HDT Global

- Israel Aerospace Industries

- Kratos Defense and Security Solutions

- Milrem Robotics

- Nexter Systems

- Oshkosh Defense

- Qinetiq

- Rheinmetall

- Teledyne FLIR

- Textron Systems

The Global Robotic Combat Vehicles Market was valued at USD 711.8 million in 2024 and is estimated to grow at a CAGR of 6.9% to reach USD 1.37 billion by 2034, driven by rising global defense budgets and advancements in artificial intelligence (AI) and autonomous technologies. As countries continue to increase their defense spending, there is a heightened focus on modernizing military capabilities and enhancing force effectiveness. RCVs are becoming increasingly integral to military strategies globally due to their ability to significantly reduce the risk to human personnel while enhancing operational capabilities.

By enabling missions in high-risk environments with minimal human intervention, robotic combat vehicles are reshaping the battlefield. Their use allows military forces to conduct complex operations more efficiently, from reconnaissance to direct combat, without exposing soldiers to unnecessary danger. These vehicles are equipped with advanced sensors, AI systems, and weaponry that enable them to perform tasks traditionally carried out by human soldiers, such as surveillance, search-and-rescue, and even offensive operations. The growing demand for these advanced unmanned systems is driven by the increasing complexity of modern warfare. Military operations today require more versatile and dynamic solutions, especially in situations where the terrain is challenging or the enemy is highly adaptive.

| Market Scope | |

|---|---|

| Start Year | 2024 |

| Forecast Year | 2025-2034 |

| Start Value | $711.8 Million |

| Forecast Value | $1.37 Billion |

| CAGR | 6.9% |

The market is segmented by the mode of operation into autonomous and teleoperated systems. The teleoperated RCVs segment generated USD 467.9 million in 2024, due to the demand for systems that require real-time control in complex environments, such as urban combat or dynamic combat zones. These systems offer military personnel greater flexibility while still retaining human control, which is vital for mission reliability and ethical considerations. As militaries transition toward fully autonomous systems, teleoperated RCVs serve as an important intermediary step in adapting to these technologies.

In terms of mobility, the market is divided into wheeled, tracked, and hybrid vehicles. The tracked RCV segment generated USD 302.1 million in 2024. These tracked vehicles offer superior mobility on rugged terrain, making them ideal for frontline operations and combat situations in difficult environments. Their ability to carry heavier payloads, including advanced weaponry and sensor equipment, further increases their demand in direct combat and fire support roles. Additionally, tracked vehicles provide greater stability and recoil absorption, making them well-suited for rapid maneuvers and live-fire scenarios.

U.S. Robotic Combat Vehicles Market was valued at USD 219 million in 2024 due to substantial government spending on defense programs and initiatives, such as the military's focus on unmanned systems for ground and aerial operations. Furthermore, programs like the Army's Robotic Combat Vehicle initiative and the Navy's unmanned systems roadmap contribute to the growing interest in these technologies. The increasing need to reduce risks to military personnel, coupled with evolving threats, further fuels demand for RCVs in the U.S.

Several key players in the Robotic Combat Vehicles Market are actively enhancing their offerings by integrating AI-driven capabilities and improving the robustness of their robotic systems. Companies like General Dynamics Land Systems, BAE Systems, and Teledyne FLIR are leading the way in advancing the functionality and autonomy of these vehicles. They are also focusing on expanding their product portfolios to cater to diverse military needs, such as reconnaissance, surveillance, and logistics. Collaborations with government agencies and defense contractors are another strategy used by these players to secure long-term contracts and reinforce their market presence.

Table of Contents

Chapter 1 Methodology and Scope

- 1.1 Market scope and definitions

- 1.2 Research design

- 1.2.1 Research approach

- 1.2.2 Data collection methods

- 1.3 Base estimates and calculations

- 1.3.1 Base year calculation

- 1.3.2 Key trends for market estimation

- 1.4 Forecast model

- 1.5 Primary research and validation

- 1.5.1 Primary sources

- 1.5.2 Data mining sources

Chapter 2 Executive Summary

- 2.1 Industry 360° synopsis

Chapter 3 Industry Insights

- 3.1 Industry ecosystem analysis

- 3.2 Trump administration tariffs

- 3.2.1 Impact on trade

- 3.2.1.1 Trade volume disruptions

- 3.2.1.2 Retaliatory measures

- 3.2.2 Impact on the industry

- 3.2.2.1 Supply-side impact

- 3.2.2.1.1 Price volatility in key components

- 3.2.2.1.2 Supply chain restructuring

- 3.2.2.1.3 Production cost implications

- 3.2.2.2 Demand-side impact (selling price)

- 3.2.2.2.1 Price transmission to end markets

- 3.2.2.2.2 Market share dynamics

- 3.2.2.2.3 Consumer response patterns

- 3.2.2.1 Supply-side impact

- 3.2.3 Key companies impacted

- 3.2.4 Strategic industry responses

- 3.2.4.1 Supply chain reconfiguration

- 3.2.4.2 Pricing and product strategies

- 3.2.4.3 Policy engagement

- 3.2.5 Outlook and future considerations

- 3.2.1 Impact on trade

- 3.3 Industry impact forces

- 3.3.1 Growth drivers

- 3.3.1.1 Rising global defense budgets

- 3.3.1.2 Advancements in ai and autonomous navigation

- 3.3.1.3 Development of modular combat platforms

- 3.3.1.4 Demand for unmanned solutions in high-risk zones

- 3.3.1.5 Increasing military modernization programs

- 3.3.2 Industry pitfalls and challenges

- 3.3.2.1 High development and operational costs

- 3.3.2.2 Cybersecurity vulnerabilities

- 3.3.1 Growth drivers

- 3.4 Growth potential analysis

- 3.5 Regulatory landscape

- 3.6 Technology landscape

- 3.7 Future market trends

- 3.8 Gap analysis

- 3.9 Porter's analysis

- 3.10 PESTEL analysis

Chapter 4 Competitive Landscape, 2024

- 4.1 Introduction

- 4.2 Company market share analysis

- 4.3 Competitive analysis of major market players

- 4.4 Competitive positioning matrix

- 4.5 Strategy dashboard

Chapter 5 Market Estimates and Forecast, By Mode of Operation, 2021 – 2034 (USD Million & Thousand Units)

- 5.1 Key trends

- 5.2 Autonomous

- 5.3 Teleoperated

Chapter 6 Market Estimates and Forecast, By Mobility, 2021 – 2034 (USD Million & Thousand Units)

- 6.1 Key trends

- 6.2 Wheeled

- 6.3 Tracked

- 6.4 Hybrid

Chapter 7 Market Estimates and Forecast, By Application, 2021 – 2034 (USD Million & Thousand Units)

- 7.1 Key trends

- 7.2 Intelligence, surveillance, and reconnaissance (ISR)

- 7.3 Direct Combat & Fire Support

- 7.4 Combat Engineering

- 7.5 Medical Evacuation

- 7.6 Others

Chapter 8 Market Estimates and Forecast, By Region, 2021 – 2034 (USD Million & Thousand Units)

- 8.1 Key trends

- 8.2 North America

- 8.2.1 U.S.

- 8.2.2 Canada

- 8.3 Europe

- 8.3.1 Germany

- 8.3.2 UK

- 8.3.3 France

- 8.3.4 Spain

- 8.3.5 Italy

- 8.3.6 Netherlands

- 8.4 Asia Pacific

- 8.4.1 China

- 8.4.2 India

- 8.4.3 Japan

- 8.4.4 Australia

- 8.4.5 South Korea

- 8.5 Latin America

- 8.5.1 Brazil

- 8.5.2 Mexico

- 8.5.3 Argentina

- 8.6 Middle East and Africa

- 8.6.1 Saudi Arabia

- 8.6.2 South Africa

- 8.6.3 UAE

Chapter 9 Company Profiles

- 9.1 BAE Systems

- 9.2 Elbit Systems

- 9.3 General Dynamics Land Systems

- 9.4 HDT Global

- 9.5 Israel Aerospace Industries

- 9.6 Kratos Defense and Security Solutions

- 9.7 Milrem Robotics

- 9.8 Nexter Systems

- 9.9 Oshkosh Defense

- 9.10 Qinetiq

- 9.11 Rheinmetall

- 9.12 Teledyne FLIR

- 9.13 Textron Systems