|

市場調查報告書

商品編碼

1750302

固定劑量複合式吸入器市場機會、成長動力、產業趨勢分析及 2025 - 2034 年預測Fixed-dose Combination Inhalers Market Opportunity, Growth Drivers, Industry Trend Analysis, and Forecast 2025 - 2034 |

||||||

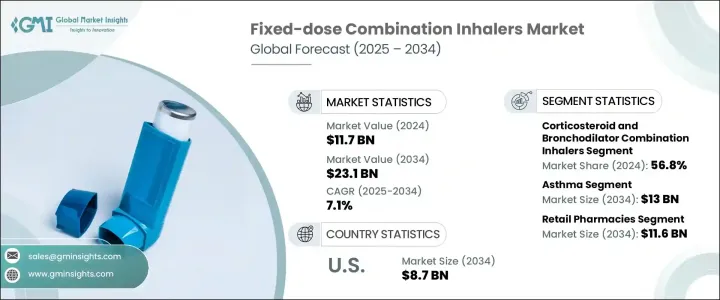

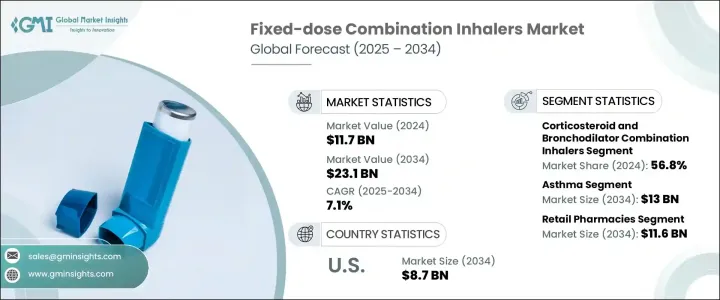

2024 年全球固定劑量複合吸入器市值為 117 億美元,預計到 2034 年將以 7.1% 的複合年成長率成長至 231 億美元。這些吸入器透過單一設備以預設比例輸送兩種或兩種以上的活性藥物成分,為管理慢性呼吸系統疾病的患者提供簡化的方法。隨著氣喘和慢性阻塞性肺病 (COPD) 等呼吸系統疾病在全球日益流行,對聯合療法的需求顯著成長。不斷發展的臨床指南、醫生越來越嚴格地遵守聯合治療方案、越來越多的監管部門批准以及吸入器技術的進步進一步推動了這一趨勢。由於呼吸系統疾病需要持續和長期的管理,特別是在中度至重度病例中,與使用多個單獨的吸入器相比,固定劑量吸入器提供了更高的便利性和依從性。

國際臨床指南的更新也推動了向聯合療法的轉變,指南現在建議即使症狀輕微的患者也使用聯合吸入器。這導致所有嚴重程度的吸入器使用量均顯著上升。這些固定劑量吸入器透過皮質類固醇消炎,同時使用支氣管擴張劑改善氣流,進而增強治療效果。單一設備給藥的便利性在提高處方治療依從性方面發揮關鍵作用。隨著慢性呼吸系統疾病負擔的加重,醫療保健提供者正在優先考慮聯合療法,以提供更好的臨床療效並最大限度地降低病情惡化的風險。市場也受益於吸入器設計的持續創新,這些創新簡化了患者和照護者的使用。

| 市場範圍 | |

|---|---|

| 起始年份 | 2024 |

| 預測年份 | 2025-2034 |

| 起始值 | 117億美元 |

| 預測值 | 231億美元 |

| 複合年成長率 | 7.1% |

就組合類型而言,市場分為皮質類固醇和支氣管擴張劑組合吸入器、長效BETA受體激動劑 (LABA) 和吸入性皮質類固醇 (ICS) 吸入器、三聯組合吸入器以及其他組合。 2024 年,皮質類固醇和支氣管擴張劑組合吸入器佔據了最大的收入佔有率,達到 56.8%,這得益於臨床廣泛傾向於將這些劑型用於治療持續性呼吸道症狀。這些吸入器在減少呼吸道發炎和改善氣流方面尤其有效,而這對於氣喘和慢性阻塞性肺病 (COPD) 的治療至關重要。雙重作用不僅可以改善症狀控制,還可以減少對急救藥物的需求,使其成為醫療保健提供者的首選。

根據適應症,市場細分為氣喘、慢性阻塞性肺病和其他疾病。氣喘領域在2024年佔據最大佔有率,為57.4%,預計到2034年將達到130億美元的市場價值。全球氣喘確診人數不斷增加,尤其是兒童氣喘患者,顯著增強了該領域的市場主導地位。氣喘是一種慢性復發性疾病,即使在症狀穩定期間也常常需要持續治療。這推動了固定劑量吸入器的重複購買,並支持了持續的收入成長。此外,按需使用複方吸入器的臨床方法的更新擴大了符合條件的患者群體,進一步推動了該領域的成長。

這些吸入器的分銷主要透過零售藥局、醫院藥局和線上藥局進行。其中,零售藥局佔據市場主導地位,預計到2034年其價值將達到116億美元。慢性呼吸系統疾病需要定期補充藥物,而零售藥局提供的便利性和可近性正是滿足這些持續需求的關鍵。它們遍布城鄉地區,確保患者能夠輕鬆獲得處方並獲得藥劑師諮詢,從而提高患者依從性並支持市場穩定成長。

從區域來看,北美繼續保持領先市場地位,其中美國佔據主導地位。 2024年,美國固定劑量複方吸入器市場規模達45億美元,預計2034年將成長至87億美元。氣喘和慢性阻塞性肺病(COPD)的高發生率,以及患者對臨床治療方案的嚴格遵從性,正在推動市場需求。美國醫師遵循實證治療策略,優先考慮複方吸入器,因此處方率較高。此外,遍布全國的藥房網路提高了產品的可及性和續藥便利性,從而促進了複方吸入器使用率的提高。

全球市場呈現寡占格局,少數幾家關鍵企業主導競爭格局。四大製藥公司佔據了約75%的市場佔有率,它們擁有強大的呼吸產品組合和設備專業知識。這些公司持續大力投資研發,以維持競爭優勢。同時,學名藥和區域性製造商正透過提供經濟高效的替代品,滿足價格敏感人群的需求,在新興經濟體中逐漸獲得青睞。此外,由於吸入器設備的創新,這些產品提高了可用性並改善了患者療效,市場也越來越傾向於每日一次的給藥方案和三重療法。

目錄

第1章:方法論與範圍

第2章:執行摘要

第3章:行業洞察

- 產業生態系統分析

- 產業衝擊力

- 成長動力

- 氣喘和慢性呼吸系統疾病發生率不斷上升

- 支持使用聯合療法的有利指南

- 吸入器技術的進步

- 聯合吸入療法的認可度不斷提高

- 產業陷阱與挑戰

- 固定劑量組合吸入器成本高

- 與不當使用和副作用相關的擔憂

- 成長動力

- 成長潛力分析

- 川普政府關稅

- 對貿易的影響

- 貿易量中斷

- 報復措施

- 對產業的影響

- 供給側影響(原料)

- 主要材料價格波動

- 供應鏈重組

- 生產成本影響

- 需求面影響(售價)

- 價格傳導至終端市場

- 市佔率動態

- 消費者反應模式

- 供給側影響(原料)

- 受影響的主要公司

- 策略產業反應

- 供應鏈重組

- 定價和產品策略

- 政策參與

- 展望與未來考慮

- 對貿易的影響

- 技術格局

- 未來市場趨勢

- 差距分析

- 專利分析

- 監管格局

- 波特的分析

- PESTEL分析

第4章:競爭格局

- 介紹

- 公司市佔率分析

- 公司矩陣分析

- 主要市場參與者的競爭分析

- 競爭定位矩陣

- 策略儀表板

第5章:市場估計與預測:按組合,2021 - 2034 年

- 主要趨勢

- 皮質類固醇和支氣管擴張劑複合式吸入器

- 長效BETA受體激動劑和吸入性皮質類固醇複合式吸入器

- 三重組合

- 其他組合

第6章:市場估計與預測:按適應症,2021 - 2034 年

- 主要趨勢

- 氣喘

- 慢性阻塞性肺病

- 其他適應症

第7章:市場估計與預測:按配銷通路,2021 - 2034 年

- 主要趨勢

- 零售藥局

- 醫院藥房

- 網路藥局

第8章:市場估計與預測:按地區,2021 - 2034 年

- 主要趨勢

- 北美洲

- 美國

- 加拿大

- 歐洲

- 德國

- 英國

- 法國

- 義大利

- 西班牙

- 荷蘭

- 亞太地區

- 日本

- 中國

- 印度

- 澳洲

- 韓國

- 拉丁美洲

- 墨西哥

- 巴西

- 阿根廷

- 中東和非洲

- 南非

- 沙烏地阿拉伯

- 阿拉伯聯合大公國

第9章:公司簡介

- AstraZeneca

- Boehringer Ingelheim

- Chiesi Farmaceutici

- Cipla

- GlaxoSmithKline

- Glenmark Pharmaceuticals

- Hikma Pharmaceuticals

- Lupin

- Mylan (Viatris)

- Novartis

- Orion

- Sun Pharmaceutical Industries

- Teva Pharmaceuticals

- Vectura Group

- Zydus Group

The Global Fixed-Dose Combination Inhalers Market was valued at USD 11.7 billion in 2024 and is estimated to grow at a CAGR of 7.1% to reach USD 23.1 billion by 2034. These inhalers deliver two or more active pharmaceutical ingredients in a pre-set ratio through a single device, offering a streamlined approach for patients managing chronic respiratory conditions. With respiratory illnesses like asthma and chronic obstructive pulmonary disease (COPD) becoming more prevalent globally, the demand for combination therapies has grown significantly. This trend is further propelled by evolving clinical guidelines, growing physician adherence to combination treatment protocols, increasing regulatory approvals, and advancements in inhaler technologies. As respiratory conditions require consistent and long-term management, particularly in moderate to severe cases, fixed-dose inhalers offer enhanced convenience and compliance compared to using multiple separate inhalers.

The shift toward combination therapies is also influenced by updates in international clinical guidelines, which now recommend combination inhalers even for patients with mild symptoms. This has led to a noticeable uptick in inhaler usage across all severity levels. These fixed-dose inhalers enhance treatment efficacy by reducing inflammation through corticosteroids while simultaneously improving airflow using bronchodilators. The convenience of single-device administration plays a critical role in increasing adherence to prescribed treatments. With the growing burden of chronic respiratory diseases, healthcare providers are prioritizing combination therapies to deliver better clinical outcomes and minimize the risk of exacerbations. The market is also benefiting from ongoing innovations in inhaler designs that simplify usage for both patients and caregivers.

| Market Scope | |

|---|---|

| Start Year | 2024 |

| Forecast Year | 2025-2034 |

| Start Value | $11.7 Billion |

| Forecast Value | $23.1 Billion |

| CAGR | 7.1% |

In terms of combination types, the market is categorized into corticosteroid and bronchodilator combination inhalers, long-acting beta-agonist (LABA) and inhaled corticosteroid (ICS) inhalers, triple combination inhalers, and other combinations. In 2024, corticosteroid and bronchodilator combination inhalers held the largest revenue share at 56.8%, driven by widespread clinical preference for these formulations in managing persistent respiratory symptoms. These inhalers are particularly effective in reducing airway inflammation and improving airflow, which are central to managing both asthma and COPD. The dual action not only improves symptom control but also reduces the need for rescue medications, making them a preferred choice among healthcare providers.

Based on indication, the market is segmented into asthma, chronic obstructive pulmonary disorder, and other conditions. The asthma segment accounted for the largest share at 57.4% in 2024 and is projected to reach a value of USD 13 billion by 2034. The increasing number of individuals diagnosed with asthma globally, especially among children, is significantly contributing to this segment's dominance. Asthma is a chronic and relapsing illness that often requires continuous therapy even during periods of symptom stability. This drives repeat purchases of fixed-dose inhalers and supports consistent revenue generation. Additionally, the updated clinical approach of prescribing combination inhalers for as-needed use has expanded the eligible patient base, further propelling growth in this segment.

The distribution of these inhalers is primarily through retail pharmacies, hospital pharmacies, and online pharmacies. Among these, retail pharmacies dominated the market and are anticipated to reach a value of USD 11.6 billion by 2034. Chronic respiratory diseases necessitate regular medication refills, and retail pharmacies offer the convenience and accessibility required to meet these ongoing needs. Their widespread presence in urban and suburban regions ensures patients have easy access to their prescriptions and pharmacist consultations, which improves adherence and supports steady market growth.

Regionally, North America continues to be a leading market, with the U.S. playing a major role. The fixed-dose combination inhalers market in the U.S. was valued at USD 4.5 billion in 2024 and is projected to grow to USD 8.7 billion by 2034. The high prevalence of asthma and COPD, along with strong compliance with clinical treatment protocols, is fueling demand. Physicians in the U.S. follow evidence-based treatment strategies that prioritize combination inhalers, leading to higher prescription rates. Furthermore, extensive pharmacy networks across the country enhance product availability and refill convenience, contributing to increased usage.

Globally, the market maintains an oligopolistic structure, with a few key players dominating the competitive landscape. Around 75% of the total market share is held by four major pharmaceutical companies with strong respiratory portfolios and device expertise. These firms continue to invest heavily in research and development to maintain their competitive edge. Meanwhile, generic and regional manufacturers are gaining traction in emerging economies by offering cost-effective alternatives, catering to the needs of price-sensitive populations. The market is also witnessing a growing inclination toward once-daily dosing options and triple therapy combinations, supported by innovations in inhaler devices that enhance usability and patient outcomes.

Table of Contents

Chapter 1 Methodology and Scope

- 1.1 Market scope and definitions

- 1.2 Research design

- 1.2.1 Research approach

- 1.2.2 Data collection methods

- 1.3 Base estimates and calculations

- 1.3.1 Base year calculation

- 1.3.2 Key trends for market estimation

- 1.4 Forecast model

- 1.5 Primary research and validation

- 1.5.1 Primary sources

- 1.5.2 Data mining sources

Chapter 2 Executive Summary

- 2.1 Industry 3600 synopsis

Chapter 3 Industry Insights

- 3.1 Industry ecosystem analysis

- 3.2 Industry impact forces

- 3.2.1 Growth drivers

- 3.2.1.1 Increasing incidence of asthma and chronic respiratory diseases

- 3.2.1.2 Favorable guidelines supporting the use of combination therapy

- 3.2.1.3 Advancements in inhaler technologies

- 3.2.1.4 Growing approval of combination inhaler therapies

- 3.2.2 Industry pitfalls and challenges

- 3.2.2.1 High cost of fixed dose combination inhalers

- 3.2.2.2 Concerns related to improper use and side effects

- 3.2.1 Growth drivers

- 3.3 Growth potential analysis

- 3.4 Trump administration tariffs

- 3.4.1 Impact on trade

- 3.4.1.1 Trade volume disruptions

- 3.4.1.2 Retaliatory measures

- 3.4.2 Impact on the Industry

- 3.4.2.1 Supply-side impact (raw materials)

- 3.4.2.1.1 Price volatility in key materials

- 3.4.2.1.2 Supply chain restructuring

- 3.4.2.1.3 Production cost implications

- 3.4.2.2 Demand-side impact (selling price)

- 3.4.2.2.1 Price transmission to end markets

- 3.4.2.2.2 Market share dynamics

- 3.4.2.2.3 Consumer response patterns

- 3.4.2.1 Supply-side impact (raw materials)

- 3.4.3 Key companies impacted

- 3.4.4 Strategic industry responses

- 3.4.4.1 Supply chain reconfiguration

- 3.4.4.2 Pricing and product strategies

- 3.4.4.3 Policy engagement

- 3.4.5 Outlook and future considerations

- 3.4.1 Impact on trade

- 3.5 Technology landscape

- 3.6 Future market trends

- 3.7 Gap analysis

- 3.8 Patent analysis

- 3.9 Regulatory landscape

- 3.10 Porter's analysis

- 3.11 PESTEL analysis

Chapter 4 Competitive Landscape, 2024

- 4.1 Introduction

- 4.2 Company market share analysis

- 4.3 Company matrix analysis

- 4.4 Competitive analysis of major market players

- 4.5 Competitive positioning matrix

- 4.6 Strategy dashboard

Chapter 5 Market Estimates and Forecast, By Combination, 2021 - 2034 ($ Mn)

- 5.1 Key trends

- 5.2 Corticosteroid and bronchodilator combination inhalers

- 5.3 Long-acting beta agonist and inhaled corticosteroid combination inhalers

- 5.4 Triple combination

- 5.5 Other combinations

Chapter 6 Market Estimates and Forecast, By Indication, 2021 - 2034 ($ Mn)

- 6.1 Key trends

- 6.2 Asthma

- 6.3 Chronic obstructive pulmonary disorder

- 6.4 Other indications

Chapter 7 Market Estimates and Forecast, By Distribution Channel, 2021 - 2034 ($ Mn)

- 7.1 Key trends

- 7.2 Retail pharmacies

- 7.3 Hospital pharmacies

- 7.4 Online pharmacies

Chapter 8 Market Estimates and Forecast, By Region, 2021 - 2034 ($ Mn)

- 8.1 Key trends

- 8.2 North America

- 8.2.1 U.S.

- 8.2.2 Canada

- 8.3 Europe

- 8.3.1 Germany

- 8.3.2 UK

- 8.3.3 France

- 8.3.4 Italy

- 8.3.5 Spain

- 8.3.6 Netherlands

- 8.4 Asia Pacific

- 8.4.1 Japan

- 8.4.2 China

- 8.4.3 India

- 8.4.4 Australia

- 8.4.5 South Korea

- 8.5 Latin America

- 8.5.1 Mexico

- 8.5.2 Brazil

- 8.5.3 Argentina

- 8.6 Middle East and Africa

- 8.6.1 South Africa

- 8.6.2 Saudi Arabia

- 8.6.3 UAE

Chapter 9 Company Profiles

- 9.1 AstraZeneca

- 9.2 Boehringer Ingelheim

- 9.3 Chiesi Farmaceutici

- 9.4 Cipla

- 9.5 GlaxoSmithKline

- 9.6 Glenmark Pharmaceuticals

- 9.7 Hikma Pharmaceuticals

- 9.8 Lupin

- 9.9 Mylan (Viatris)

- 9.10 Novartis

- 9.11 Orion

- 9.12 Sun Pharmaceutical Industries

- 9.13 Teva Pharmaceuticals

- 9.14 Vectura Group

- 9.15 Zydus Group