|

市場調查報告書

商品編碼

1750286

電致變色與液晶聚合物市場機會、成長動力、產業趨勢分析及 2025 - 2034 年預測Electrochromic and Liquid Crystal Polymer Market Opportunity, Growth Drivers, Industry Trend Analysis, and Forecast 2025 - 2034 |

||||||

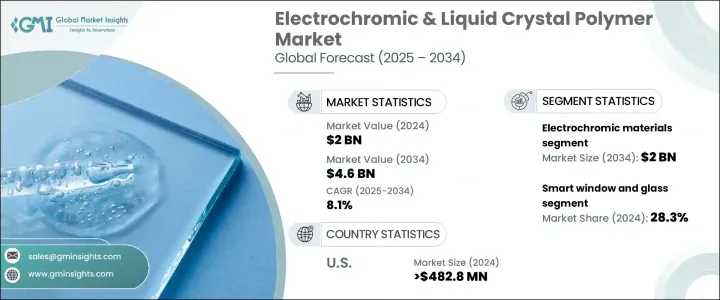

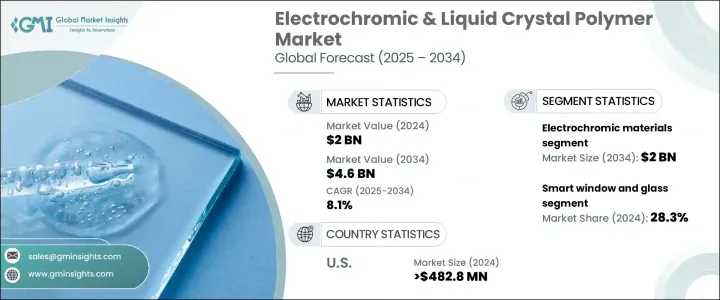

2024年,全球電致變色和液晶聚合物市場價值為20億美元,預計到2034年將以8.1%的複合年成長率成長,達到46億美元,這得益於汽車和建築等行業對節能解決方案日益成長的需求。電致變色材料能夠根據電訊號改變其光學特性,對於先進的窗戶技術至關重要。智慧窗戶對車輛和建築物至關重要,它透過管理太陽能吸收和最大限度地減少眩光來實現能源最佳化。這有助於減少對空調的需求,與全球改善能源管理和降低溫室氣體排放的努力一致。隨著各行各業尋求採用更多永續技術,電致變色材料在提高能源效率方面的作用不斷擴大。

在汽車領域,這些材料用於後視鏡和天窗,以提高駕駛員的舒適性和安全性。它們還促進了高級駕駛輔助系統 (ADAS) 和自動駕駛技術的發展。電致變色材料有助於保持車內最佳溫度,從而有助於節能。電信和電子產業對高性能材料的需求也推動了液晶聚合物產品需求的不斷成長。

| 市場範圍 | |

|---|---|

| 起始年份 | 2024 |

| 預測年份 | 2025-2034 |

| 起始值 | 20億美元 |

| 預測值 | 46億美元 |

| 複合年成長率 | 8.1% |

2024年,電致變色材料市場規模達9.015億美元,這得益於該材料在施加電壓後能夠改變顏色或透明度的多功能性,使其能夠控制熱量和光線穿過窗戶、鏡子和顯示器。這些材料節能效果顯著,是各種功能性和美觀應用的理想選擇。 PDLC(聚合物分散液晶)等更先進技術的開發,透過提供更多顏色選擇和更高的能源效率,進一步提升了市場潛力。

智慧窗戶和玻璃佔據最大的應用領域,佔28.3%。節能建築和車輛的需求日益成長,推動了這一趨勢,因為這些窗戶能夠自動調節光線和熱量的流通。這減少了對人工照明和空調的依賴。在智慧窗戶中整合電致變色或液晶元件有助於實現全球永續發展目標,同時提升高階住宅和商業房地產的舒適度和隱私。

2024年,美國電致變色和液晶聚合物市場規模達4.828億美元。政府的激勵措施,例如安裝智慧玻璃的稅收抵免,在推動商業和住宅建築採用電致變色窗戶方面發揮了關鍵作用。這些窗戶可降低約20%的能耗,有助於減少碳排放,並支持向永續能源解決方案的過渡。

東麗工業、住友化學、索爾維、聖戈班和旭硝子等行業公司致力於透過投資研發來擴大市場佔有率。他們致力於提升電致變色產品的性能和價格,以滿足各行各業日益成長的需求。此外,各公司也與建築承包商和汽車製造商建立策略合作夥伴關係,以確保這些先進材料在新建築和新車型中得到廣泛應用。

目錄

第1章:方法論與範圍

第2章:執行摘要

第3章:行業洞察

- 市場介紹

- 川普政府關稅

- 對貿易的影響

- 貿易量中斷

- 報復措施

- 對產業的影響

- 供給側影響(原料)

- 主要材料價格波動

- 供應鏈重組

- 生產成本影響

- 需求面影響(售價)

- 價格傳導至終端市場

- 市佔率動態

- 消費者反應模式

- 供給側影響(原料)

- 受影響的主要公司

- 策略產業反應

- 供應鏈重組

- 定價和產品策略

- 政策參與

- 展望與未來考慮

- 對貿易的影響

- 貿易統計(HS編碼)

- 2021-2024年主要出口國

- 2021-2024年主要進口國

- 產業價值鏈分析

- 技術概述

- 電致變色材料

- 液晶聚合物

- 聚合物分散液晶(PDLC)

- 技術比較分析

- 市場動態

- 市場促進因素

- 市場限制

- 市場機會

- 市場挑戰

- 產業衝擊力

- 成長潛力分析

- 產業陷阱與挑戰

- 監管框架和標準

- 電致變色設備的 ASTM 標準

- 能源效率法規

- 建築規範和認證

- 汽車業標準

- 製造流程分析

- 電致變色材料生產

- 液晶聚合物合成

- 裝置製造技術

- 原料分析與採購策略

- 定價分析

- 永續性和環境影響評估

- 杵分析

- 波特五力分析

第4章:競爭格局

- 市佔率分析

- 戰略框架

- 併購

- 合資與合作

- 新產品開發

- 擴張策略

- 競爭基準測試

- 供應商格局

- 競爭定位矩陣

- 戰略儀表板

- 技術採用與創新評估

- 新參與者的市場進入策略

第5章:市場規模及預測:依技術,2021-2034

- 主要趨勢

- 電致變色材料

- 無機電致變色材料

- 有機電致變色材料

- 混合電致變色材料

- 液晶聚合物(LCP)

- 熱致液晶多醣

- 溶致性LCPS

- 聚合物分散液晶(PDLC)

- 普通模式PDLC

- 反向模式PDLC

- 懸浮顆粒物檢測裝置(SPD)

- 其他

第6章:市場規模及預測:依應用,2021-2034

- 主要趨勢

- 智慧窗戶和玻璃

- 建築窗戶

- 汽車車窗和天窗

- 飛機窗戶

- 船用窗戶

- 電子元件

- 連接器

- 電路板

- 天線

- 微電子封裝

- 顯示器和視覺設備

- 智慧顯示器

- 穿戴式顯示器

- 標誌和資訊顯示

- 汽車零件

- 鏡子

- 照明系統

- 感測器和控制器

- 結構部件

- 醫療器材及設備

- 航太和國防應用

- 其他

第7章:市場規模及預測:依最終用途產業,2021-2034

- 主要趨勢

- 建築與建築

- 住宅建築

- 商業建築

- 機構建築

- 工業設施

- 汽車與運輸

- 搭乘用車

- 商用車

- 電動車

- 鐵路和公共交通

- 電子與電信

- 消費性電子產品

- 電信設備

- 運算和 IT 硬體

- 5G基礎設施

- 航太與國防

- 醫療保健

- 能源與發電

- 其他

第8章:市場規模及預測:按地區,2021-2034

- 主要趨勢

- 北美洲

- 美國

- 加拿大

- 歐洲

- 英國

- 德國

- 法國

- 義大利

- 西班牙

- 歐洲其他地區

- 亞太地區

- 中國

- 印度

- 日本

- 韓國

- 澳洲

- 亞太其他地區

- 拉丁美洲

- 巴西

- 墨西哥

- 阿根廷

- 拉丁美洲其他地區

- MEA

- 南非

- 沙烏地阿拉伯

- 阿拉伯聯合大公國

- 中東和非洲其他地區

第9章:公司簡介

- Saint-Gobain

- AGC

- Gentex Corporation

- Gauzy

- Halio

- ChromoGenics

- Polytronix

- Research Frontiers

- Celanese Corporation

- Solvay

- Toray Industries

- Sumitomo Chemical Company

- Kuraray

- Murata Manufacturing

- Chiyoda Integre

- RTP Company

- SABIC

- Ynvisible Interactive

- Crown Electrokinetics

- Smart Glass Group

- Smart Films International

- Corning Incorporated

- Continental

- Panasonic Holdings Corporation

The Global Electrochromic and Liquid Crystal Polymer Market was valued at USD 2 billion in 2024 and is estimated to grow at a CAGR of 8.1% to reach USD 4.6 billion by 2034, driven by the increasing demand for energy-efficient solutions in industries like automotive and construction. Electrochromic materials, which change their optical properties in response to electrical signals, are essential for advanced window technologies. Smart windows are crucial in vehicles and buildings, enabling energy optimization by managing solar energy absorption and minimizing glare. This helps reduce the need for air conditioning, aligning with global efforts to improve energy management and lower greenhouse gas emissions. As industries seek to incorporate more sustainable technologies, the role of electrochromic materials continues to expand in improving energy efficiency.

In the automotive sector, these materials are used in rearview mirrors and sunroofs to enhance driver comfort and safety. They also contribute to the evolution of advanced driver-assistance systems (ADAS) and autonomous driving technologies. Electrochromic materials help maintain an optimal temperature inside vehicles, contributing to energy savings. The increasing demand for liquid crystal polymer products is also fueled by the telecommunications and electronics industries, where high-performance materials are required.

| Market Scope | |

|---|---|

| Start Year | 2024 |

| Forecast Year | 2025-2034 |

| Start Value | $2 Billion |

| Forecast Value | $4.6 Billion |

| CAGR | 8.1% |

The electrochromic materials segment generated USD 901.5 million in 2024, attributed to the materials' versatility in changing colors or transparency when voltage is applied, allowing them to control heat and light passage through windows, mirrors, and displays. These materials are highly energy-efficient, making them ideal for various applications in both functional and aesthetic settings. The development of more sophisticated technology, such as PDLC (polymer-dispersed liquid crystal), further enhances the market's potential by offering more color options and increased energy efficiency.

Smart windows and glass hold the largest application segment, representing 28.3% share. The increasing demand for energy-efficient buildings and vehicles has driven this trend, as these windows are capable of automatically regulating light and heat passage. This results in reduced reliance on artificial lighting and air conditioning. The integration of electrochromic or liquid crystal devices in smart windows helps meet global sustainability goals while also improving comfort and privacy in high-end residential and commercial real estate.

United States Electrochromic and Liquid Crystal Polymer Market generated USD 482.8 million in 2024. Government incentives like tax credits for installing smart glass have played a key role in promoting the adoption of electrochromic windows in commercial and residential buildings. These windows can reduce energy consumption by approximately 20%, contributing to reducing carbon emissions and supporting the transition toward sustainable energy solutions.

Companies in this industry, such as Toray Industries, Sumitomo Chemical Company, Solvay, Saint-Gobain, and AGC, focus on expanding their market share by investing in research and development. They are working on enhancing the performance and affordability of electrochromic products to meet the growing demand across various industries. Companies are also forging strategic partnerships with building contractors and vehicle manufacturers to ensure widespread adoption of these advanced materials in new constructions and vehicle models.

Table of Contents

Chapter 1 Methodology & Scope

- 1.1 Report scope and objectives

- 1.2 Research design and approach

- 1.3 Data collection methods

- 1.3.1 Primary research

- 1.3.2 Secondary research

- 1.4 Market estimation and forecasting methodology

- 1.5 Assumptions and limitations

- 1.6 Data validation and triangulation techniques

Chapter 2 Executive Summary

- 2.1 Industry synopsis, 2021-2034

Chapter 3 Industry Insights

- 3.1 Market Introduction

- 3.2 Trump administration tariffs

- 3.2.1 Impact on trade

- 3.2.1.1 Trade volume disruptions

- 3.2.1.2 Retaliatory measures

- 3.2.2 Impact on the industry

- 3.2.2.1 Supply-side impact (raw materials)

- 3.2.2.1.1 Price volatility in key materials

- 3.2.2.1.2 Supply chain restructuring

- 3.2.2.1.3 Production cost implications

- 3.2.2.2 Demand-side impact (selling price)

- 3.2.2.2.1 Price transmission to end markets

- 3.2.2.2.2 Market share dynamics

- 3.2.2.2.3 Consumer response patterns

- 3.2.2.1 Supply-side impact (raw materials)

- 3.2.3 Key companies impacted

- 3.2.4 Strategic industry responses

- 3.2.4.1 Supply chain reconfiguration

- 3.2.4.2 Pricing and product strategies

- 3.2.4.3 Policy engagement

- 3.2.5 Outlook and future considerations

- 3.2.1 Impact on trade

- 3.3 Trade statistics (HS Code)

- 3.3.1 Major exporting countries, 2021-2024 (USD Mn)

- 3.3.2 Major importing countries, 2021-2024 (USD Mn)

- 3.4 Industry value chain analysis

- 3.5 Technology overview

- 3.5.1 Electrochromic materials

- 3.5.2 Liquid crystal polymers

- 3.5.3 Polymer dispersed liquid crystals (PDLC)

- 3.5.4 Comparative analysis of technologies

- 3.6 Market dynamics

- 3.6.1 Market drivers

- 3.6.2 Market restraints

- 3.6.3 Market opportunities

- 3.6.4 Market challenges

- 3.7 Industry impact forces

- 3.7.1 Growth potential analysis

- 3.7.2 Industry pitfalls & challenges

- 3.8 Regulatory framework & standards

- 3.8.1 ASTM standards for electrochromic devices

- 3.8.2 Energy efficiency regulations

- 3.8.3 Building codes & certifications

- 3.8.4 Automotive industry standards

- 3.9 Manufacturing process analysis

- 3.9.1 Electrochromic materials production

- 3.9.2 Liquid crystal polymer synthesis

- 3.9.3 Device fabrication techniques

- 3.10 Raw material analysis & procurement strategies

- 3.11 Pricing analysis

- 3.12 Sustainability & environmental impact assessment

- 3.13 Pestle analysis

- 3.14 Porter's five forces analysis

Chapter 4 Competitive Landscape, 2024

- 4.1 Market share analysis

- 4.2 Strategic framework

- 4.2.1 Mergers & acquisitions

- 4.2.2 Joint ventures & collaborations

- 4.2.3 New product developments

- 4.2.4 Expansion strategies

- 4.3 Competitive benchmarking

- 4.4 Vendor landscape

- 4.5 Competitive positioning matrix

- 4.6 Strategic dashboard

- 4.7 Technology adoption & innovation assessment

- 4.8 Market entry strategies for new players

Chapter 5 Market Size and Forecast, By Technology, 2021-2034 (USD Million) (Tons)

- 5.1 Key trends

- 5.2 Electrochromic materials

- 5.2.1 Inorganic electrochromic materials

- 5.2.2 Organic electrochromic materials

- 5.2.3 Hybrid electrochromic materials

- 5.3 Liquid crystal polymers (LCP)

- 5.3.1 Thermotropic LCPS

- 5.3.2 Lyotropic LCPS

- 5.4 Polymer dispersed liquid crystals (PDLC)

- 5.4.1 Normal mode PDLC

- 5.4.2 Reverse mode PDLC

- 5.5 Suspended particle devices (SPD)

- 5.6 Other

Chapter 6 Market Size and Forecast, By Application, 2021-2034 (USD Million) (Tons)

- 6.1 Key trends

- 6.2 Smart windows & glass

- 6.2.1 Architectural windows

- 6.2.2 Automotive windows & sunroofs

- 6.2.3 Aircraft windows

- 6.2.4 Marine windows

- 6.3 Electronic components

- 6.3.1 Connectors

- 6.3.2 Circuit boards

- 6.3.3 Antennas

- 6.3.4 Microelectronic packaging

- 6.4 Displays & visual devices

- 6.4.1 Smart displays

- 6.4.2 Wearable displays

- 6.4.3 Signage & information displays

- 6.5 Automotive components

- 6.5.1 Mirrors

- 6.5.2 Lighting systems

- 6.5.3 Sensors & controls

- 6.5.4 Structural components

- 6.6 Medical devices & equipment

- 6.7 Aerospace & defense applications

- 6.8 Other

Chapter 7 Market Size and Forecast, By End Use Industry, 2021-2034 (USD Million) (Tons)

- 7.1 Key trends

- 7.2 Construction & architecture

- 7.2.1 Residential buildings

- 7.2.2 Commercial buildings

- 7.2.3 Institutional buildings

- 7.2.4 Industrial facilities

- 7.3 Automotive & transportation

- 7.3.1 Passenger vehicles

- 7.3.2 Commercial vehicles

- 7.3.3 Electric vehicles

- 7.3.4 Railways & mass transit

- 7.4 Electronics & telecommunications

- 7.4.1 Consumer electronics

- 7.4.2 Telecommunications equipment

- 7.4.3 Computing & IT hardware

- 7.4.4 5g infrastructure

- 7.5 Aerospace & defense

- 7.6 Healthcare & medical

- 7.7 Energy & power generation

- 7.8 Others

Chapter 8 Market Size and Forecast, By Region, 2021-2034 (USD Million) (Tons)

- 8.1 Key trends

- 8.2 North America

- 8.2.1 U.S.

- 8.2.2 Canada

- 8.3 Europe

- 8.3.1 UK

- 8.3.2 Germany

- 8.3.3 France

- 8.3.4 Italy

- 8.3.5 Spain

- 8.3.6 Rest of Europe

- 8.4 Asia Pacific

- 8.4.1 China

- 8.4.2 India

- 8.4.3 Japan

- 8.4.4 South Korea

- 8.4.5 Australia

- 8.4.6 Rest of Asia Pacific

- 8.5 Latin America

- 8.5.1 Brazil

- 8.5.2 Mexico

- 8.5.3 Argentina

- 8.5.4 Rest of Latin America

- 8.6 MEA

- 8.6.1 South Africa

- 8.6.2 Saudi Arabia

- 8.6.3 UAE

- 8.6.4 Rest of Middle East & Africa

Chapter 9 Company Profiles

- 9.1 Saint-Gobain

- 9.2 AGC

- 9.3 Gentex Corporation

- 9.4 Gauzy

- 9.5 Halio

- 9.6 ChromoGenics

- 9.7 Polytronix

- 9.8 Research Frontiers

- 9.9 Celanese Corporation

- 9.10 Solvay

- 9.11 Toray Industries

- 9.12 Sumitomo Chemical Company

- 9.13 Kuraray

- 9.14 Murata Manufacturing

- 9.15 Chiyoda Integre

- 9.16 RTP Company

- 9.17 SABIC

- 9.18 Ynvisible Interactive

- 9.19 Crown Electrokinetics

- 9.20 Smart Glass Group

- 9.21 Smart Films International

- 9.22 Corning Incorporated

- 9.23 Continental

- 9.24 Panasonic Holdings Corporation