|

市場調查報告書

商品編碼

1750277

維生素 K2 市場機會、成長動力、產業趨勢分析及 2025 - 2034 年預測Vitamin K2 Market Opportunity, Growth Drivers, Industry Trend Analysis, and Forecast 2025 - 2034 |

||||||

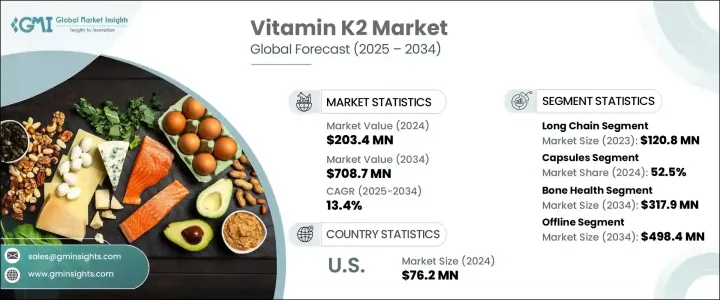

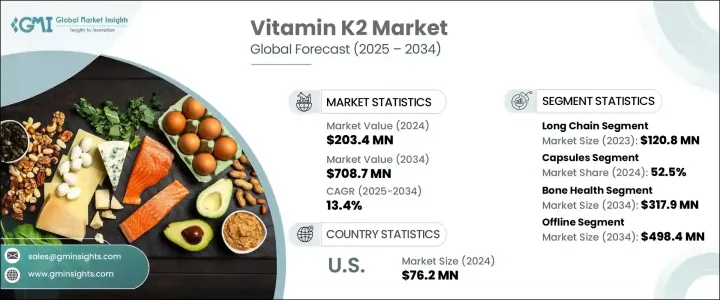

2024年,全球維生素K2市場規模達2.034億美元,預計到2034年將以13.4%的複合年成長率成長,達到7.087億美元,這主要得益於骨質疏鬆症、心臟病和某些癌症等慢性疾病發病率的上升。人們日益認知到維生素K2的益處,尤其是在維持心血管和骨骼健康方面,這在各年齡層補充劑消費的成長中發揮了重要作用。隨著越來越多的消費者關注營養和預防保健,對有針對性的補充劑的需求持續成長。人們對骨密度健康和骨質疏鬆症等疾病管理的日益重視也加速了維生素K2產品的普及。

此外,醫學界對新生兒維生素K缺乏症(尤其是遲發性出血的風險)的擔憂日益加劇,促使醫療機構加強了對新生兒補充維生素K的建議。這導致維生素K2在兒科護理中的使用量上升,開啟了一個以嬰兒健康為重點的快速新興領域。隨著父母和照護者對早期營養重要性的認知不斷提高,對安全、有效且耐受性良好的嬰兒專用維生素K2配方的需求也不斷成長。如今,兒科補充劑以滴劑或口服液等較溫和的劑型提供,這些劑型易於服用,專為新生兒需求而設計。

| 市場範圍 | |

|---|---|

| 起始年份 | 2024 |

| 預測年份 | 2025-2034 |

| 起始值 | 2.034億美元 |

| 預測值 | 7.087億美元 |

| 複合年成長率 | 13.4% |

長鏈形式的MK-7憑藉其卓越的吸收率和更長的體內半衰期,在2024年佔據了產品類別的主導地位。 MK-7贏得了醫療保健專業人士的信賴,他們現在更傾向於用它來管理骨質脆弱性和降低心血管風險。越來越多的臨床研究支持MK-7在預防骨折和提高骨密度方面的作用,這進一步提升了它的受歡迎程度,尤其是在尋求天然解決方案的老年人群中。隨著人們對有機植物補充劑的認知不斷提高,對源自天然成分的MK-7的需求也持續成長。

膠囊劑型在劑型方面佔據市場領先地位,2024 年的市佔率為 52.5%。膠囊配方的靈活性及其高吸收率促成了這一成長。軟膠囊因其能夠提高維生素 K2 等脂溶性營養素的生物利用度而備受讚譽,從而提高依從性並加快起效。衛生部門對軟膠囊劑型的監管支持也支持其在非處方補充劑中的廣泛應用。

2024年,美國維生素K2市場規模達7,620萬美元,這得益於人們對骨骼健康的關注日益成長,尤其是在老年人群中,以及更廣泛的宣傳活動。線上銷售管道的成長使得維生素K2產品更加便捷,為消費者提供了更廣泛的選擇和便利的配送方式。此外,大眾對維生素K2在預防骨骼和心臟問題方面所扮演的角色的宣傳教育也持續推動著美國市場的擴張。

全球維生素 K2 市場的主要參與者,例如 Zenith Nutrition、Carlyle Nutritionals、Doctor's Best、Health Veda Organics、Vlado's Himalayan Organics、Amway Nutrilite、NattoPharma、Pharma Cure Laboratories、Kappa Biosciences (Balchem Corporation、NattoPharma、Pharma Cure Laboratories、Kappa Biosciences (Balchem Corporation)、WOW Lifes、Smarter Organics,正在採取策略方法來提升其市場地位。這些策略包括開發清潔標籤和有機產品、投資科學研究以驗證其健康聲明、擴大其數位影響力以及建立分銷合作夥伴關係以提升全球影響力。許多公司也專注於透過提高生物利用度和獨特的給藥方式來實現產品差異化。

目錄

第1章:方法論與範圍

第2章:執行摘要

第3章:行業洞察

- 產業生態系統分析

- 產業衝擊力

- 成長動力

- 人口老化加劇和生活方式相關疾病

- 骨骼和心血管健康意識不斷提高

- 日益轉向預防性醫療保健

- 產業陷阱與挑戰

- 監管挑戰和品質問題

- 替代產品的可用性

- 成長動力

- 成長潛力分析

- 監管格局

- 川普政府關稅

- 對貿易的影響

- 貿易量中斷

- 報復措施

- 對產業的影響

- 供給側影響(原料)

- 主要材料價格波動

- 供應鏈重組

- 生產成本影響

- 需求面影響(售價)

- 價格傳導至終端市場

- 市佔率動態

- 消費者反應模式

- 供給側影響(原料)

- 受影響的主要公司

- 策略產業反應

- 供應鏈重組

- 定價和產品策略

- 政策參與

- 展望與未來考慮

- 對貿易的影響

- 波特的分析

- PESTEL分析

第4章:競爭格局

- 介紹

- 公司矩陣分析

- 主要市場參與者的競爭分析

- 競爭定位矩陣

- 策略儀表板

第5章:市場估計與預測:依產品類型,2021 - 2034 年

- 主要趨勢

- 短鏈(MK--4)

- 長鏈(MK-7)

第6章:市場估計與預測:按劑型,2021 - 2034 年

- 主要趨勢

- 膠囊

- 平板電腦

- 掉落

- 其他劑型

第7章:市場估計與預測:按適應症,2021 - 2034 年

- 主要趨勢

- 骨骼健康

- 心臟健康

- 血液凝固

- 其他適應症

第8章:市場估計與預測:按配銷通路,2021 - 2034 年

- 主要趨勢

- 離線

- 藥局和藥局

- 超市/大賣場

- 其他線下門市

- 線上

第9章:市場估計與預測:按地區,2021 - 2034 年

- 主要趨勢

- 北美洲

- 美國

- 加拿大

- 歐洲

- 德國

- 英國

- 法國

- 西班牙

- 義大利

- 荷蘭

- 亞太地區

- 中國

- 日本

- 印度

- 澳洲

- 韓國

- 拉丁美洲

- 巴西

- 墨西哥

- 阿根廷

- 中東和非洲

- 南非

- 沙烏地阿拉伯

- 阿拉伯聯合大公國

第10章:公司簡介

- Amway Nutrilite

- Carlyle Nutritionals

- Doctor's Best

- Health Veda Organics

- Innovix labs

- Kappa Biosciences (Balchem Corporation)

- Mary Ruth Organics

- NattoPharma

- Pharma Cure Laboratories

- Phi Naturals

- Smarter Vitamins

- Vlado's Himalayan Organics

- WOW Lifesciences

- Zenith Nutrition

The Global Vitamin K2 Market was valued at USD 203.4 million in 2024 and is estimated to grow at a CAGR of 13.4% to reach USD 708.7 million by 2034, driven by the rising occurrence of chronic illnesses such as osteoporosis, heart disease, and certain cancers. The growing awareness of vitamin K2's benefits, especially in maintaining cardiovascular and bone health, has played a major role in increasing supplement consumption across all age groups. As more consumers focus on nutrition and preventive care, demand for targeted supplements continues to rise. The increased emphasis on bone density health and the management of conditions like osteoporosis is also accelerating the uptake of vitamin K2 products.

Furthermore, growing medical concern surrounding vitamin K deficiency in newborns, particularly the risk of late-onset bleeding, have prompted healthcare authorities to strengthen recommendations for supplementation at birth. This has led to an uptick in the use of vitamin K2 in pediatric care, opening a rapidly emerging segment focused on infant health. As awareness increases among parents and caregivers about the importance of early-life nutrition, the demand for safe, effective, and well-tolerated vitamin K2 formulations tailored for infants is expanding. Pediatric supplements are now being offered in gentler forms such as drops or oral solutions, which are easy to administer and designed specifically for neonatal needs.

| Market Scope | |

|---|---|

| Start Year | 2024 |

| Forecast Year | 2025-2034 |

| Start Value | $203.4 million |

| Forecast Value | $708.7 million |

| CAGR | 13.4% |

The long-chain form, MK-7, dominated the product category in 2024 due to its superior absorption and extended half-life in the body. MK-7 has gained trust among healthcare professionals who now prefer it for managing bone fragility and reducing cardiovascular risk. Increased clinical research supporting the role of MK-7 in preventing fractures and improving bone mineral density has further propelled its popularity, particularly among aging adults seeking natural solutions. As awareness of organic, plant-based supplements grows, demand for MK-7 sourced from natural ingredients continues to rise.

The capsules segment led the market in terms of dosage form, holding 52.5% share in 2024. The flexibility in formulating capsules, combined with their high absorption rate, has contributed to this growth. Soft gel variants are praised for their ability to improve the bioavailability of fat-soluble nutrients like vitamin K2, resulting in better compliance and faster action. Regulatory backing for soft gel formats from health authorities also supports their expanding use in over-the-counter supplements.

United States Vitamin K2 Market was valued at USD 76.2 million in 2024, driven by the rising interest in bone health, especially among older adults, alongside broader awareness campaigns. The growth of online sales channels has made vitamin K2 products more accessible, offering consumers a wider selection and convenient delivery options. Additionally, efforts to educate the public on the role in preventing bone and heart issues continue to drive market expansion in the country.

Key players in the Global Vitamin K2 Market such as Zenith Nutrition, Carlyle Nutritionals, Doctor's Best, Health Veda Organics, Vlado's Himalayan Organics, Amway Nutrilite, NattoPharma, Pharma Cure Laboratories, Kappa Biosciences (Balchem Corporation), WOW Lifesciences, Smarter Vitamins, Innovix Labs, Phi Naturals, and Mary Ruth Organics are employing strategic approaches to enhance their market position. These include the development of clean-label and organic products, investment in scientific research to validate health claims, expanding their digital presence, and forming distribution partnerships to boost global reach. Many also focus on product differentiation through enhanced bioavailability and unique delivery forms.

Table of Contents

Chapter 1 Methodology and Scope

- 1.1 Market scope and definitions

- 1.2 Research design

- 1.2.1 Research approach

- 1.2.2 Data collection methods

- 1.3 Base estimates and calculations

- 1.3.1 Base year calculation

- 1.3.2 Key trends for market estimation

- 1.4 Forecast model

- 1.5 Primary research and validation

- 1.5.1 Primary sources

- 1.5.2 Data mining sources

Chapter 2 Executive Summary

- 2.1 Industry 3600 synopsis

Chapter 3 Industry Insights

- 3.1 Industry ecosystem analysis

- 3.2 Industry impact forces

- 3.2.1 Growth drivers

- 3.2.1.1 Growing aging population and lifestyle related disorders

- 3.2.1.2 Rising awareness of bone and cardiovascular health

- 3.2.1.3 Increasing shift toward preventive healthcare

- 3.2.2 Industry pitfalls and challenges

- 3.2.2.1 Regulatory challenges and quality concerns

- 3.2.2.2 Availability of alternative products

- 3.2.1 Growth drivers

- 3.3 Growth potential analysis

- 3.4 Regulatory landscape

- 3.5 Trump administration tariffs

- 3.5.1 Impact on trade

- 3.5.1.1 Trade volume disruptions

- 3.5.1.2 Retaliatory measures

- 3.5.2 Impact on the Industry

- 3.5.2.1 Supply-side impact (raw materials)

- 3.5.2.1.1 Price volatility in key materials

- 3.5.2.1.2 Supply chain restructuring

- 3.5.2.1.3 Production cost implications

- 3.5.2.2 Demand-side impact (selling price)

- 3.5.2.2.1 Price transmission to end markets

- 3.5.2.2.2 Market share dynamics

- 3.5.2.2.3 Consumer response patterns

- 3.5.2.1 Supply-side impact (raw materials)

- 3.5.3 Key companies impacted

- 3.5.4 Strategic industry responses

- 3.5.4.1 Supply chain reconfiguration

- 3.5.4.2 Pricing and product strategies

- 3.5.4.3 Policy engagement

- 3.5.5 Outlook and future considerations

- 3.5.1 Impact on trade

- 3.6 Porter's analysis

- 3.7 PESTEL analysis

Chapter 4 Competitive Landscape, 2024

- 4.1 Introduction

- 4.2 Company matrix analysis

- 4.3 Competitive analysis of major market players

- 4.4 Competitive positioning matrix

- 4.5 Strategy dashboard

Chapter 5 Market Estimates and Forecast, By Product Type, 2021 - 2034 ($ Mn)

- 5.1 Key trends

- 5.2 Short chain (MK--4)

- 5.3 Long chain (MK-7)

Chapter 6 Market Estimates and Forecast, By Dosage Form, 2021 - 2034 ($ Mn)

- 6.1 Key trends

- 6.2 Capsules

- 6.3 Tablets

- 6.4 Drops

- 6.5 Other dosage form

Chapter 7 Market Estimates and Forecast, By Indication, 2021 - 2034 ($ Mn)

- 7.1 Key trends

- 7.2 Bone health

- 7.3 Heart health

- 7.4 Blood clotting

- 7.5 Other indications

Chapter 8 Market Estimates and Forecast, By Distribution Channel, 2021 - 2034 ($ Mn)

- 8.1 Key trends

- 8.2 Offline

- 8.2.1 Pharmacies and drug stores

- 8.2.2 Supermarkets/ hypermarkets

- 8.2.3 Other offline stores

- 8.3 Online

Chapter 9 Market Estimates and Forecast, By Region, 2021 - 2034 ($ Mn)

- 9.1 Key trends

- 9.2 North America

- 9.2.1 U.S.

- 9.2.2 Canada

- 9.3 Europe

- 9.3.1 Germany

- 9.3.2 UK

- 9.3.3 France

- 9.3.4 Spain

- 9.3.5 Italy

- 9.3.6 Netherlands

- 9.4 Asia Pacific

- 9.4.1 China

- 9.4.2 Japan

- 9.4.3 India

- 9.4.4 Australia

- 9.4.5 South Korea

- 9.5 Latin America

- 9.5.1 Brazil

- 9.5.2 Mexico

- 9.5.3 Argentina

- 9.6 Middle East and Africa

- 9.6.1 South Africa

- 9.6.2 Saudi Arabia

- 9.6.3 UAE

Chapter 10 Company Profiles

- 10.1 Amway Nutrilite

- 10.2 Carlyle Nutritionals

- 10.3 Doctor's Best

- 10.4 Health Veda Organics

- 10.5 Innovix labs

- 10.6 Kappa Biosciences (Balchem Corporation)

- 10.7 Mary Ruth Organics

- 10.8 NattoPharma

- 10.9 Pharma Cure Laboratories

- 10.10 Phi Naturals

- 10.11 Smarter Vitamins

- 10.12 Vlado's Himalayan Organics

- 10.13 WOW Lifesciences

- 10.14 Zenith Nutrition