|

市場調查報告書

商品編碼

1750275

嬰兒零食市場機會、成長動力、產業趨勢分析及 2025 - 2034 年預測Baby Snacks Market Opportunity, Growth Drivers, Industry Trend Analysis, and Forecast 2025 - 2034 |

||||||

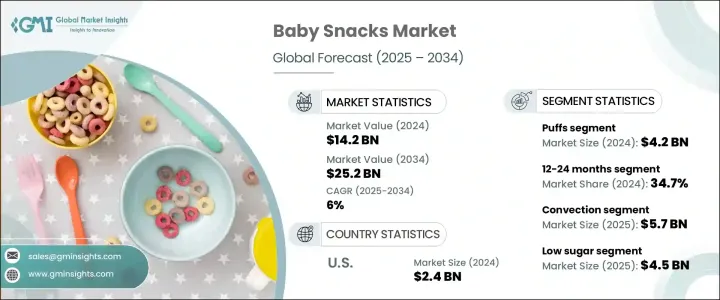

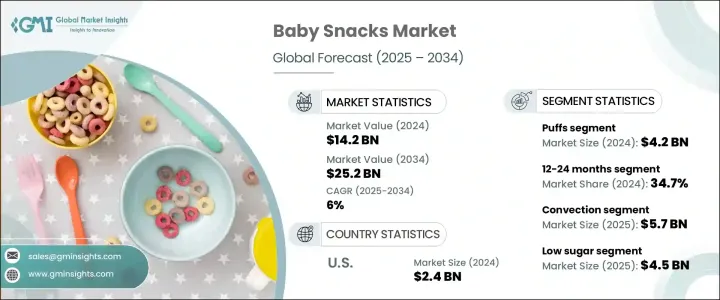

2024年,全球嬰兒零食市場規模達142億美元,預計到2034年將以6%的複合年成長率成長,達到252億美元。這得歸功於家長營養意識的不斷提升,家長們更傾向於選擇有機、非基因改造、無過敏原且富含蛋白質的產品。便利性也是一個重要因素,家長們尋求易於餵食、便於攜帶的零食,以支持孩子成長發育的各個階段。市場正在向清潔標籤產品轉變,這些產品不含人工添加劑和防腐劑。北美和歐洲憑藉其較高的消費者意識和購買力引領市場。然而,隨著中國和日本等國家家長營養意識的不斷提升,亞太地區預計將超越這些地區。

數位零售的擴張極大地重塑了嬰兒零食的格局,使這些產品比以往任何時候都更容易獲得。電子商務已成為一個重要的配銷通路,直銷模式和訂閱式服務在現代父母中越來越受歡迎。這些模式不僅提供了便利,也滿足了人們對精心策劃和個人化購物體驗日益成長的需求。千禧世代和Z世代的父母們尋求既省時又不犧牲品質的解決方案,而線上平台則提供了一種無縫的方式,讓他們能夠獲取各種符合年齡和飲食需求的健康嬰兒零食。

| 市場範圍 | |

|---|---|

| 起始年份 | 2024 |

| 預測年份 | 2025-2034 |

| 起始值 | 142億美元 |

| 預測值 | 252億美元 |

| 複合年成長率 | 6% |

2024年,膨化零食市場規模達42億美元,其柔軟入口即化的口感廣受好評,是幼兒過渡到自主進食階段的理想選擇。製造商正在改良膨化產品配方,添加營養豐富的蔬菜,降低鈉含量,並嘗試更具創新性的口味。其目標是促進早期味覺發育,同時滿足家長對清潔標籤、營養豐富的食品的渴望。

2024年,餅乾和曲奇餅乾市場價值35億美元,預計到2034年將達到63億美元,這得益於持續的創新和營養強化。各大品牌正致力於降低糖含量,同時增加全穀物的用量,以促進消化健康和整體健康。除了營養升級外,產品設計如今還融入了符合人體工學的造型,有助於提升嬰兒成長過程中的手眼協調和握力。這些發展特性不僅提升了營養價值,也使零食成為更廣泛的早期學習之旅的一部分。總而言之,這些市場轉變是由消費者對每一口產品的透明度、營養和功能性不斷變化的期望所驅動的。

2024年,美國嬰兒零食市場產值達24億美元。美國市場的特點是積極創新和消費者細分,越來越多的父母尋求既方便又營養的零食。美國食品藥物管理局(FDA)的監管確保產品開發流程遵守嚴格的指導方針,尤其是在成分和過敏聲明方面。最近的指導方針鼓勵限制產品中的過敏原含量。多通路分銷盛行,在注重便利性和精心挑選的千禧世代父母中,電商訂閱量顯著成長。

全球嬰兒零食市場的主要參與者包括雀巢公司、達能公司、雅培實驗室、海恩天體集團和卡夫亨氏。嬰兒零食市場的公司正專注於多項關鍵策略,以鞏固其市場地位。產品創新是主要關注點,各品牌不斷開發新的口味、質地和包裝形式,以滿足父母和孩子不斷變化的喜好。為了滿足日益成長的清潔標籤產品需求,各品牌非常重視有機和天然成分的加入。此外,為了吸引具有環保意識的消費者,永續包裝解決方案也正在被採用。隨著可支配收入的增加和城市化帶來新的成長機會,進軍新興市場是一項策略性舉措。

目錄

第1章:方法論與範圍

第2章:執行摘要

第3章:行業洞察

- 產業生態系統分析

- 影響價值鏈的因素

- 利潤率分析

- 中斷

- 未來展望

- 製造商

- 經銷商

- 川普政府關稅

- 對貿易的影響

- 貿易量中斷

- 報復措施

- 對產業的影響

- 供給側影響(原料)

- 主要材料價格波動

- 供應鏈重組

- 生產成本影響

- 需求面影響(售價)

- 價格傳導至終端市場

- 市佔率動態

- 消費者反應模式

- 供給側影響(原料)

- 受影響的主要公司

- 策略產業反應

- 供應鏈重組

- 定價和產品策略

- 政策參與

- 展望與未來考慮

- 對貿易的影響

- 貿易統計(HS編碼)

- 2021-2024年主要出口國

- 2021-2024年主要進口國

註:以上貿易統計僅針對重點國家

- 供應商格局

- 重要新聞和舉措

- 衝擊力

- 成長動力

- 隨著父母健康意識的增強,對有機和無過敏原嬰兒食品的需求不斷增加。

- 人們對兒童早期營養和嬰兒零食對發育益處的認知不斷提高。

- 以便利性為中心的產品創新,例如為忙碌的父母提供易於食用、方便攜帶的包裝解決方案。

- 產業陷阱與挑戰

- 嬰兒食品產品有嚴格的法規和安全標準,需要持續遵守。

- 產品定價過高,尤其是有機產品和高階產品,限制了部分消費者的負擔能力。

- 來自自有品牌和經濟實惠品牌的激烈競爭,挑戰品牌忠誠度和市場佔有率。

- 成長動力

- 成長潛力分析

- 波特的分析

- PESTEL分析

- 製造和生產分析

- 製造流程概述

- 原料採購與準備

- 加工和配方

- 擠壓和成型

- 烘焙/乾燥/冷凍乾燥

- 品質控制和測試

- 包裝和儲存

- 生產成本分析

- 原料成本

- 勞動成本

- 能源成本

- 包裝成本

- 製造費用

- 成本最佳化策略

- 製造設施分析

- 主要製造地點

- 生產能力評估

- 設施擴建計劃

- 供應鏈挑戰與解決方案

- 原物料採購

- 整個供應鏈的品質控制

- 運輸和物流

- 庫存管理

- 品質控制和保證

- 品質標準和認證

- 測試方法和程序

- 品質管理體系

- 製造流程概述

- 監管環境和標準

- 全球監理框架

- 區域監理框架

- 北美洲

- FDA法規

- 美國農業部標準

- 嬰兒食品安全法

- 歐洲

- 歐洲食品安全局(efsa)

- 歐盟關於嬰兒配方奶粉和後續配方奶粉的指令

- 特定國家的法規

- 亞太

- 國家食品藥物監督管理總局

- 日本食品衛生法

- 其他地區法規

- 世界其他地區

- 北美洲

- 食品安全標準和認證

- Haccp認證

- ISO 22000

- BRC全球食品安全標準

- 國際食品標準

- 標籤和包裝法規

- 成分揭露要求

- 營養標籤

- 過敏原訊息

- 健康和營養聲明

- 污染物和重金屬法規

- 鉛含量限制

- 砷限量

- 鎘和汞法規

- 農藥殘留限量

- 合規挑戰與策略

- 未來監管趨勢及其影響

- 環境、社會與治理 (esg) 分析

- 環境影響評估

- 碳足跡分析

- 用水和管理

- 廢棄物產生和管理

- 永續採購實踐

- 社會責任實踐

- 勞動實務和工作條件

- 社區參與與支持

- 消費者健康和營養

- 道德行銷實踐

- 治理和道德考慮

- 公司治理結構

- 道德供應鏈管理

- 透明度和報告

- 反腐敗與合規措施

- 關鍵參與者的 ESG 績效基準

- ESG風險評估及緩解策略

- 嬰兒零食產業的未來 ESG 趨勢

- 環境影響評估

- 消費者行為與市場趨勢分析

- 消費者偏好與購買模式

- 父母決策因素

- 品牌忠誠度與轉換行為

- 價格敏感度分析

- 兒科醫師建議的影響

- 消費者人口統計分析

- 年齡層分析

- 收入水平分析

- 地理分佈

- 生活風格和心理細分

- 消費者對嬰兒零食的看法

- 營養價值認知

- 安全和品質認知

- 便利因素

- 物有所值的看法

- 新興消費趨勢

- 清潔標籤需求

- 有機和天然偏好

- 無過敏原和特殊飲食需求

- 永續與道德消費

- 數位轉型對消費者參與度的影響

- 消費者回饋分析及啟示

- 消費者偏好與購買模式

- 定價分析與經濟因素

- 價格趨勢分析

- 歷史價格趨勢

- 目前定價情景

- 價格預測

- 影響定價的因素

- 原料成本

- 生產加工成本

- 包裝和標籤成本

- 配送和物流成本

- 行銷和推廣成本

- 跨產品細分市場的定價策略

- 高階產品與經濟型產品

- 有機產品與傳統產品

- 自有品牌與品牌產品

- 區域價格差異和因素

- 價格價值關係分析

- 影響市場的經濟指標

- GDP成長與消費者支出

- 通貨膨脹和貨幣波動

- 就業率和可支配收入

- 出生率與人口結構變化

- 價格趨勢分析

- 技術格局與創新分析

- 嬰兒零食的當前科技趨勢

- 新興技術及其潛在影響

- 先進的加工技術

- 新穎的保存方法

- 智慧包裝解決方案

- 數位供應鏈管理

- 產品創新趨勢

- 清潔標籤配方

- 植物性和純素食選擇

- 功能性成分與超級食品

- 質地和感官創新

- 風味和成分創新

- 全球和民族風味

- 優質有機成分

- 減少糖和鹽的配方

- 天然防腐劑和添加劑

- 包裝創新

- 永續包裝材料

- 延長保存期限的包裝

- 方便且份量控制的包裝

- 智慧主動包裝

- 研發活動與創新中心

- 各地區技術採用趨勢

- 未來技術路線圖(2025-2033)

- 行銷策略和品牌分析

- 當前的行銷格局

- 品牌定位策略

- 目標受眾細分

- 訊息傳遞與價值主張

- 特定通路策略

- 數位行銷策略

- 社群媒體行銷

- 內容行銷

- 影響力人物合作關係

- 電子郵件行銷

- 行動行銷

- 傳統行銷方法

- 店內促銷

- 印刷廣告

- 電視和廣播

- 直接行銷

- 主要參與者的品牌分析

- 品牌資產評估

- 品牌認知與知名度

- 品牌忠誠度和客戶保留率

- 包裝作為行銷工具

- 設計元素和視覺吸引力

- 資訊溝通

- 品牌形象強化

- 成功的行銷案例研究

- 未來行銷趨勢和策略

- 當前的行銷格局

第4章:競爭格局

- 介紹

- 公司市佔率分析

- 競爭定位矩陣

- 戰略展望矩陣

第5章:市場估計與預測:依產品類型,2021 - 2034 年

- 主要趨勢

- 泡芙

- 餅乾和曲奇

- 水果類零食

- 優格滴和凍乾零食

- 蔬菜類零食

- 出牙餅乾和烤麵包

- 其他零食類型

第6章:市場估計與預測:依年齡層 2021 - 2034

- 主要趨勢

- 6-9個月

- 9-12個月

- 12-24個月

- 24個月以上

第7章:市場估計與預測:按成分類型,2021 - 2034 年

- 主要趨勢

- 有機的

- 傳統的

- 非基因改造

- 不含麩質

- 無過敏原

第8章:市場估計與預測:按營養成分,2021 - 2034 年

- 主要趨勢

- 高蛋白

- 低糖

- 全穀物

- 富含超級食物

第9章:市場估計與預測:按配銷通路,2021 - 2034 年

- 主要趨勢

- 超市和大賣場

- 便利商店和藥局

- 嬰兒用品專賣店

- 網路零售

- 直接面對消費者

- 其他

第 10 章:市場估計與預測:按銷售管道,2021 年至 2034 年

- 主要趨勢

- B2B

- B2C

第 11 章:市場估計與預測:按地區,2021 年至 2034 年

- 主要趨勢

- 北美洲

- 美國

- 加拿大

- 歐洲

- 德國

- 英國

- 法國

- 西班牙

- 義大利

- 亞太地區

- 中國

- 印度

- 日本

- 澳洲

- 韓國

- 拉丁美洲

- 巴西

- 墨西哥

- 阿根廷

- 中東和非洲

- 沙烏地阿拉伯

- 南非

- 阿拉伯聯合大公國

第12章:公司簡介

- Abbott Laboratories

- Amara Organic Foods

- Danone SA (Happy Baby Organics)

- Ella's Kitchen

- Hain Celestial Group (Earth's Best)

- Hero Group (Beech-Nut)

- Kewpie Corporation

- Little Bellies

- Little Freddie

- Nestle SA (Gerber)

- Plum Organics (Campbell Soup Company)

- Serenity Kids

- Sprout Foods, Inc.

- The Kraft Heinz Company

The Global Baby Snacks Market was valued at USD 14.2 billion in 2024 and is estimated to grow at a CAGR of 6% to reach USD 25.2 billion by 2034, driven by increasing parental awareness of nutrition, with a preference for organic, non-GMO, allergen-free, and protein-rich products. Convenience is also a significant factor, with parents seeking easy-to-feed, portable snacks that support their children's developmental milestones. The market is experiencing a shift toward clean-label products, which are free from artificial additives and preservatives. North America and Europe lead the market due to high consumer awareness and purchasing power. However, the Asia Pacific region is expected to outpace these regions, driven by rising parental nutrition consciousness in countries like China and Japan.

The expansion of digital retail has significantly reshaped the baby snacks landscape, making these products more accessible than ever before. E-commerce has emerged as a key distribution channel, with direct-to-consumer models and subscription-based services gaining traction among modern parents. These formats not only offer convenience but also cater to the growing demand for curated and personalized shopping experiences. As millennial and Gen Z parents seek time-saving solutions without compromising on quality, online platforms provide a seamless way to access a variety of health-conscious baby snacks tailored to age and dietary needs.

| Market Scope | |

|---|---|

| Start Year | 2024 |

| Forecast Year | 2025-2034 |

| Start Value | $14.2 Billion |

| Forecast Value | $25.2 Billion |

| CAGR | 6% |

In 2024, the puffed snacks segment accounted for USD 4.2 billion, widely appreciated for their soft, melt-in-the-mouth texture, making them ideal for toddlers transitioning to self-feeding. Manufacturers are reformulating puff products to include nutrient-dense vegetables, reduce sodium content, and experiment with more adventurous flavor profiles. The goal is to encourage early palate development while aligning with parents' desire for clean-label, nutrient-rich foods.

The biscuits and cookies segment was valued at USD 3.5 billion in 2024 and is projected to reach USD 6.3 billion by 2034, driven by sustained innovation and nutritional enhancements. Brands are focusing on lowering sugar content while increasing the use of whole grains to support digestive health and overall wellness. In addition to nutritional upgrades, product design now includes ergonomic shapes that promote better hand-eye coordination and grip strength in growing infants. These developmental features add value beyond nutrition, making the snacks part of a broader early-learning journey. Altogether, these market shifts are driven by evolving consumer expectations for transparency, nutrition, and function in every bite.

U.S. Baby Snacks Market generated USD 2.4 billion in 2024. The U.S. market is characterized by aggressive innovation and consumer segmentation, with parents increasingly seeking both convenient and nutritious snacks. The FDA's oversight ensures product development processes adhere to strict guidelines, particularly concerning ingredients and allergy assertions. Recent guidelines have encouraged the restriction of allergen exposure in products. Multi-channel distribution is prevalent, with notable growth in e-commerce subscriptions among millennial parents who value convenience and curated choices.

Key players in the Global Baby Snacks Market include Nestle S.A., Danone S.A., Abbott Laboratories, The Hain Celestial Group, and The Kraft Heinz Company. Companies in the baby snacks market are focusing on several key strategies to strengthen their market position. Product innovation is a primary focus, with brands developing new flavors, textures, and packaging formats to meet the evolving preferences of parents and children. There is a significant emphasis on incorporating organic and natural ingredients, catering to the growing demand for clean-label products. Sustainable packaging solutions are also being adopted to appeal to environmentally conscious consumers. Expansion into emerging markets is a strategic move, as rising disposable incomes and urbanization present new growth opportunities.

Table of Contents

Chapter 1 Methodology and Scope

- 1.1 Market scope and definition

- 1.2 Base estimates and calculations

- 1.3 Forecast calculation

- 1.4 Data sources

- 1.4.1 Primary

- 1.4.2 Secondary

- 1.4.2.1 Paid sources

- 1.4.2.2 Public sources

- 1.5 Primary research and validation

- 1.5.1 Primary sources

- 1.5.2 Data mining sources

Chapter 2 Executive Summary

- 2.1 Industry synopsis, 2021-2034

Chapter 3 Industry Insights

- 3.1 Industry ecosystem analysis

- 3.1.1 Factor affecting the value chain

- 3.1.2 Profit margin analysis

- 3.1.3 Disruptions

- 3.1.4 Future outlook

- 3.1.5 Manufacturers

- 3.1.6 Distributors

- 3.2 Trump administration tariffs

- 3.2.1 Impact on trade

- 3.2.1.1 Trade volume disruptions

- 3.2.1.2 Retaliatory measures

- 3.2.2 Impact on the industry

- 3.2.2.1 Supply-side impact (raw materials)

- 3.2.2.1.1 Price volatility in key materials

- 3.2.2.1.2 Supply chain restructuring

- 3.2.2.1.3 Production cost implications

- 3.2.2.2 Demand-side impact (selling price)

- 3.2.2.2.1 Price transmission to end markets

- 3.2.2.2.2 Market share dynamics

- 3.2.2.2.3 Consumer response patterns

- 3.2.2.1 Supply-side impact (raw materials)

- 3.2.3 Key companies impacted

- 3.2.4 Strategic industry responses

- 3.2.4.1 Supply chain reconfiguration

- 3.2.4.2 Pricing and product strategies

- 3.2.4.3 Policy engagement

- 3.2.5 Outlook and future considerations

- 3.2.1 Impact on trade

- 3.3 Trade statistics (HS Code)

- 3.3.1 Major exporting countries, 2021-2024 (Kilo Tons)

- 3.3.2 Major importing countries, 2021-2024 (Kilo Tons)

Note: the above trade statistics will be provided for key countries only

- 3.4 Supplier landscape

- 3.5 Key news and initiatives

- 3.6 Impact forces

- 3.6.1 Growth drivers

- 3.6.1.1 Increasing demand for organic and allergen-free baby food options due to growing health-consciousness among parents.

- 3.6.1.2 Rising awareness about early childhood nutrition and developmental benefits of baby snacks.

- 3.6.1.3 Convenience-focused product innovations, such as easy-to-consume, on-the-go packaging solutions for busy parents.

- 3.6.2 Industry pitfalls and challenges

- 3.6.2.1 Stringent regulations and safety standards for baby food products, requiring continuous compliance.

- 3.6.2.2 High product pricing, especially for organic and premium options, limiting affordability for some consumers.

- 3.6.2.3 Intense competition from private label and budget-friendly brands, challenging brand loyalty and market share.

- 3.6.1 Growth drivers

- 3.7 Growth potential analysis

- 3.8 Porter's analysis

- 3.9 PESTEL analysis

- 3.10 Manufacturing and Production Analysis

- 3.10.1 Manufacturing process overview

- 3.10.1.1 Raw material procurement and preparation

- 3.10.1.2 Processing and formulation

- 3.10.1.3 Extrusion and shaping

- 3.10.1.4 Baking/drying/freeze-drying

- 3.10.1.5 Quality control and testing

- 3.10.1.6 Packaging and storage

- 3.10.2 Production cost analysis

- 3.10.2.1 Raw material costs

- 3.10.2.2 Labor costs

- 3.10.2.3 Energy costs

- 3.10.2.4 Packaging costs

- 3.10.2.5 Manufacturing overheads

- 3.10.2.6 Cost optimization strategies

- 3.10.3 Manufacturing facilities analysis

- 3.10.3.1 Key manufacturing locations

- 3.10.3.2 Production capacity assessment

- 3.10.3.3 Facility expansion plans

- 3.10.4 Supply chain challenges and solutions

- 3.10.4.1 Raw material sourcing

- 3.10.4.2 Quality control throughout supply chain

- 3.10.4.3 Transportation and logistics

- 3.10.4.4 Inventory management

- 3.10.5 Quality control and assurance

- 3.10.5.1 Quality standards and certifications

- 3.10.5.2 Testing methods and procedures

- 3.10.5.3 Quality management systems

- 3.10.1 Manufacturing process overview

- 3.11 Regulatory landscape and standards

- 3.11.1 Global regulatory framework

- 3.11.2 Regional regulatory frameworks

- 3.11.2.1 North america

- 3.11.2.1.1 Fda regulations

- 3.11.2.1.2 Usda standards

- 3.11.2.1.3 Baby food safety act

- 3.11.2.2 Europe

- 3.11.2.2.1 European food safety authority (efsa)

- 3.11.2.2.2 Eu directive on infant formula and follow-on formula

- 3.11.2.2.3 Country-specific regulations

- 3.11.2.3 Asia-pacific

- 3.11.2.3.1 China food and drug administration

- 3.11.2.3.2 Japan food sanitation law

- 3.11.2.3.3 Other regional regulations

- 3.11.2.4 Rest of the world

- 3.11.2.1 North america

- 3.11.3 Food safety standards and certifications

- 3.11.3.1 Haccp certification

- 3.11.3.2 Iso 22000

- 3.11.3.3 Brc global standard for food safety

- 3.11.3.4 Ifs food standard

- 3.11.4 Labeling and packaging regulations

- 3.11.4.1 Ingredient disclosure requirements

- 3.11.4.2 Nutritional labeling

- 3.11.4.3 Allergen information

- 3.11.4.4 Health and nutrition claims

- 3.11.5 Contaminant and heavy metal regulations

- 3.11.5.1 Lead limits

- 3.11.5.2 Arsenic limits

- 3.11.5.3 Cadmium and mercury regulations

- 3.11.5.4 Pesticide residue limits

- 3.11.6 Compliance challenges and strategies

- 3.11.7 Future regulatory trends and their implications

- 3.12 Environmental, social, and governance (esg) analysis

- 3.12.1 Environmental impact assessment

- 3.12.1.1 Carbon footprint analysis

- 3.12.1.2 Water usage and management

- 3.12.1.3 Waste generation and management

- 3.12.1.4 Sustainable sourcing practices

- 3.12.2 Social responsibility practices

- 3.12.2.1 Labor practices and working conditions

- 3.12.2.2 Community engagement and support

- 3.12.2.3 Consumer health and nutrition

- 3.12.2.4 Ethical marketing practices

- 3.12.3 Governance and ethical considerations

- 3.12.3.1 Corporate governance structures

- 3.12.3.2 Ethical supply chain management

- 3.12.3.3 Transparency and reporting

- 3.12.3.4 Anti-corruption and compliance measures

- 3.12.4 Esg performance benchmarking of key players

- 3.12.5 Esg risk assessment and mitigation strategies

- 3.12.6 Future esg trends in the baby snacks industry

- 3.12.1 Environmental impact assessment

- 3.13 Consumer behavior and market trends analysis

- 3.13.1 Consumer preferences and purchasing patterns

- 3.13.1.1 Parental decision-making factors

- 3.13.1.2 Brand loyalty and switching behavior

- 3.13.1.3 Price sensitivity analysis

- 3.13.1.4 Influence of pediatrician recommendations

- 3.13.2 Demographic analysis of consumers

- 3.13.2.1 Age group analysis

- 3.13.2.2 Income level analysis

- 3.13.2.3 Geographic distribution

- 3.13.2.4 Lifestyle and psychographic segmentation

- 3.13.3 Consumer perception of baby snacks

- 3.13.3.1 Nutritional value perception

- 3.13.3.2 Safety and quality perception

- 3.13.3.3 Convenience factor

- 3.13.3.4 Value for money perception

- 3.13.4 Emerging consumer trends

- 3.13.4.1 Clean label demand

- 3.13.4.2 Organic and natural preferences

- 3.13.4.3 Allergen-free and special diet requirements

- 3.13.4.4 Sustainable and ethical consumption

- 3.13.5 Impact of digital transformation on consumer engagement

- 3.13.6 Consumer feedback analysis and implications

- 3.13.1 Consumer preferences and purchasing patterns

- 3.14 Pricing analysis and economic factors

- 3.14.1 Pricing trends analysis

- 3.14.1.1 Historical price trends

- 3.14.1.2 Current pricing scenario

- 3.14.1.3 Price forecast

- 3.14.2 Factors affecting pricing

- 3.14.2.1 Raw material costs

- 3.14.2.2 Production and processing costs

- 3.14.2.3 Packaging and labeling costs

- 3.14.2.4 Distribution and logistics costs

- 3.14.2.5 Marketing and promotion costs

- 3.14.3 Pricing strategies across product segments

- 3.14.3.1 Premium vs. Economy products

- 3.14.3.2 Organic vs. Conventional products

- 3.14.3.3 Private label vs. Branded products

- 3.14.4 Regional price variations and factors

- 3.14.5 Price-value relationship analysis

- 3.14.6 Economic indicators impacting the market

- 3.14.6.1 Gdp growth and consumer spending

- 3.14.6.2 Inflation and currency fluctuations

- 3.14.6.3 Employment rates and disposable income

- 3.14.6.4 Birth rates and demographic shifts

- 3.14.1 Pricing trends analysis

- 3.15 Technological landscape and innovation analysis

- 3.15.1 Current technological trends in baby snacks

- 3.15.2 Emerging technologies and their potential impact

- 3.15.2.1 Advanced processing technologies

- 3.15.2.2 Novel preservation methods

- 3.15.2.3 Smart packaging solutions

- 3.15.2.4 Digital supply chain management

- 3.15.3 Product innovation trends

- 3.15.3.1 Clean label formulations

- 3.15.3.2 Plant-based and vegan options

- 3.15.3.3 Functional ingredients and superfoods

- 3.15.3.4 Texture and sensory innovations

- 3.15.4 Flavor and ingredient innovations

- 3.15.4.1 Global and ethnic flavor profiles

- 3.15.4.2 Premium and organic ingredients

- 3.15.4.3 Reduced sugar and salt formulations

- 3.15.4.4 Natural preservatives and additives

- 3.15.5 Packaging innovations

- 3.15.5.1 Sustainable packaging materials

- 3.15.5.2 Extended shelf-life packaging

- 3.15.5.3 Convenient and portion-controlled packaging

- 3.15.5.4 Smart and active packaging

- 3.15.6 R&d activities and innovation hubs

- 3.15.7 Technology adoption trends across regions

- 3.15.8 Future technology roadmap (2025-2033)

- 3.16 Marketing strategies and brand analysis

- 3.16.1 Current marketing landscape

- 3.16.1.1 Brand positioning strategies

- 3.16.1.2 Target audience segmentation

- 3.16.1.3 Messaging and value propositions

- 3.16.1.4 Channel-specific strategies

- 3.16.2 Digital marketing strategies

- 3.16.2.1 Social media marketing

- 3.16.2.2 Content marketing

- 3.16.2.3 Influencer partnerships

- 3.16.2.4 Email marketing

- 3.16.2.5 Mobile marketing

- 3.16.3 Traditional marketing approaches

- 3.16.3.1 In-store promotions

- 3.16.3.2 Print advertising

- 3.16.3.3 Television and radio

- 3.16.3.4 Direct marketing

- 3.16.4 Brand analysis of key players

- 3.16.4.1 Brand equity assessment

- 3.16.4.2 Brand perception and awareness

- 3.16.4.3 Brand loyalty and customer retention

- 3.16.5 Packaging as a marketing tool

- 3.16.5.1 Design elements and visual appeal

- 3.16.5.2 Information communication

- 3.16.5.3 Brand identity reinforcement

- 3.16.6 Successful marketing case studies

- 3.16.7 Future marketing trends and strategies

- 3.16.1 Current marketing landscape

Chapter 4 Competitive Landscape, 2024

- 4.1 Introduction

- 4.2 Company market share analysis

- 4.3 Competitive positioning matrix

- 4.4 Strategic outlook matrix

Chapter 5 Market Estimates and Forecast, By Product Type, 2021 - 2034 (USD Billion) (Kilo Tons)

- 5.1 Key trends

- 5.2 Puffs

- 5.3 Biscuits and cookies

- 5.4 Fruit-based snacks

- 5.5 Yogurt drops and freeze-dried snacks

- 5.6 Vegetable-based snacks

- 5.7 Teething biscuits and rusks

- 5.8 Other snack types

Chapter 6 Market Estimates and Forecast, By Age Group 2021 - 2034 (USD Billion) (Kilo Tons)

- 6.1 Key trends

- 6.2 6-9 Months

- 6.3 9-12 Months

- 6.4 12-24 Months

- 6.5 Above 24 Months

Chapter 7 Market Estimates and Forecast, By Ingredient Type, 2021 - 2034 (USD Billion) (Kilo Tons)

- 7.1 Key trends

- 7.2 Organic

- 7.3 Conventional

- 7.4 Non-GMO

- 7.5 Gluten-free

- 7.6 Allergen-free

Chapter 8 Market Estimates and Forecast, By Nutritional Content, 2021 - 2034 (USD Billion) (Kilo Tons)

- 8.1 Key trends

- 8.2 High protein

- 8.3 Low sugar

- 8.4 Whole grain

- 8.5 Superfood-enriched

Chapter 9 Market Estimates and Forecast, By Distribution Channel, 2021 - 2034 (USD Billion) (Kilo Tons)

- 9.1 Key trends

- 9.2 Supermarkets and hypermarkets

- 9.3 Convenience stores and drugstores

- 9.4 Specialty baby stores

- 9.5 Online retail

- 9.6 Direct-to-consumer

- 9.7 Others

Chapter 10 Market Estimates and Forecast, By Sales Channel, 2021 - 2034 (USD Billion) (Kilo Tons)

- 10.1 Key trends

- 10.2 B2B

- 10.3 B2C

Chapter 11 Market Estimates and Forecast, By Region, 2021 - 2034 (USD Billion) (Kilo Tons)

- 11.1 Key trends

- 11.2 North America

- 11.2.1 U.S.

- 11.2.2 Canada

- 11.3 Europe

- 11.3.1 Germany

- 11.3.2 UK

- 11.3.3 France

- 11.3.4 Spain

- 11.3.5 Italy

- 11.4 Asia Pacific

- 11.4.1 China

- 11.4.2 India

- 11.4.3 Japan

- 11.4.4 Australia

- 11.4.5 South Korea

- 11.5 Latin America

- 11.5.1 Brazil

- 11.5.2 Mexico

- 11.5.3 Argentina

- 11.6 Middle East and Africa

- 11.6.1 Saudi Arabia

- 11.6.2 South Africa

- 11.6.3 UAE

Chapter 12 Company Profiles

- 12.1 Abbott Laboratories

- 12.2 Amara Organic Foods

- 12.3 Danone S.A. (Happy Baby Organics)

- 12.4 Ella's Kitchen

- 12.5 Hain Celestial Group (Earth's Best)

- 12.6 Hero Group (Beech-Nut)

- 12.7 Kewpie Corporation

- 12.8 Little Bellies

- 12.9 Little Freddie

- 12.10 Nestle S.A. (Gerber)

- 12.11 Plum Organics (Campbell Soup Company)

- 12.12 Serenity Kids

- 12.13 Sprout Foods, Inc.

- 12.14 The Kraft Heinz Company