|

市場調查報告書

商品編碼

1750268

呋喃基聚合物市場機會、成長動力、產業趨勢分析及 2025 - 2034 年預測Furan-based Polymer Market Opportunity, Growth Drivers, Industry Trend Analysis, and Forecast 2025 - 2034 |

||||||

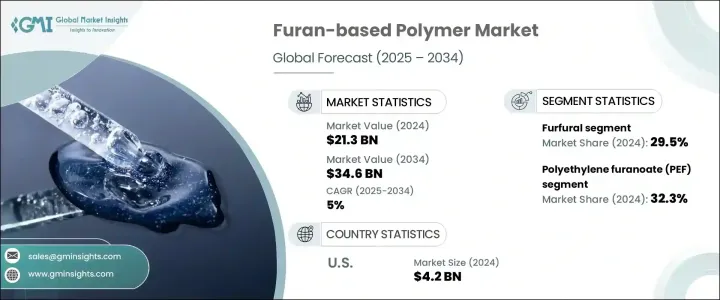

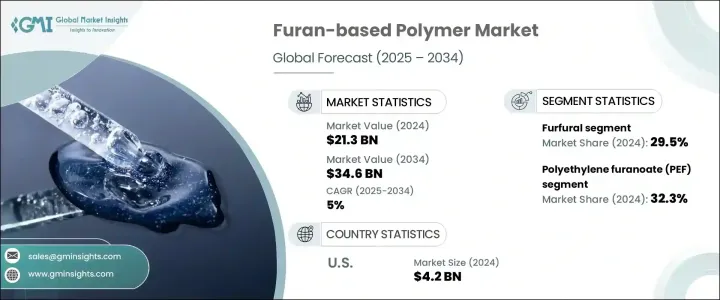

2024年,全球呋喃基聚合物市場規模達213億美元,預計到2034年將以5%的複合年成長率成長,達到346億美元。生物衍生聚合物主要由再生資源生產,例如玉米芯和甘蔗渣等農業廢棄物。由糠醛和5-羥甲基糠醛(HMF)等中間體生產的呋喃基聚合物因其永續性以及與全球環保材料趨勢的契合而日益受到關注。

呋喃基聚合物已在各行各業中廣泛應用,尤其是在食品和飲料行業,它們作為傳統包裝材料的永續替代品正日益受到歡迎。與石油基塑膠相比,這些聚合物是更環保的選擇,因為它們源自於農業廢棄物等可再生資源。它們的使用符合消費者和監管機構日益成長的對綠色產品和包裝解決方案的追求。除了永續性之外,呋喃基聚合物還具有出色的耐熱性,使其成為在極端條件下需要高耐久性應用的理想選擇。在鑄造等行業中,這些聚合物尤其重要。例如,呋喃樹脂因其耐高溫且性能穩定而被廣泛用於砂型鑄造型芯的黏合。其極低的毒性和穩定的熱性能使其成為精密鑄造金屬生產和其他高性能應用的必備材料。

| 市場範圍 | |

|---|---|

| 起始年份 | 2024 |

| 預測年份 | 2025-2034 |

| 起始值 | 213億美元 |

| 預測值 | 346億美元 |

| 複合年成長率 | 5% |

聚呋喃甲酸乙二醇酯 (PEF) 的需求尤其強勁,到 2024 年,該聚合物細分市場將佔據 32.3% 的市場佔有率。 PEF 的可回收性、阻隔性和生物基特性使其成為食品和飲料包裝中聚對苯二甲酸乙二醇酯 (PET) 的理想替代品。另一個值得關注的應用是塗料和複合材料,其中聚糠醇的耐腐蝕性確保了其在化學加工等行業的穩定需求。呋喃基聚醯胺因其耐用性、強度以及增強的熱穩定性(進而提高燃油效率)而擴大應用於汽車製造。

糠醛市場細分領域涵蓋5-羥甲基糠醛 (HMF)、糠醛、糠醇和2,5-呋喃二甲酸 (FDCA) 等衍生物,其中糠醛佔據主導地位,2024年市場佔有率達29.5%。糠醛廣泛應用於樹脂、溶劑和潤滑劑等工業領域,使其成為市場基石。利用農業殘留物生產糠醛符合更廣泛的生物經濟目標,即減少對不可再生資源的依賴。

2024年,美國呋喃基聚合物市場產值達42億美元。美國對生物經濟政策、現代化生物精煉系統以及不斷增加的公私投資的重視,為呋喃基聚合物的發展創造了一個良好的環境。美國市場也受到美國農業部「生物優先計畫」(BioPreferred Program)等計畫的推動,該計畫鼓勵使用生物基產品,使呋喃基聚合物成為尋求永續解決方案的行業具有競爭力且經濟可行的選擇。

Avantium、Bitrez、Swicofil、Sulzer和聖泉集團等公司處於呋喃基聚合物市場的前沿。這些公司正在採取各種策略來增強其市場地位,包括投資先進的生物精煉技術以及擴大其可再生基材料的生產能力。 Avantium和Bitrez專注於擴大生物基聚合物的生產規模並提高其成本效益,而Swicofil和聖泉集團則透過策略合作夥伴關係擴大其市場覆蓋範圍。 Sulzer正在透過整合滿足各行各業需求的永續解決方案來增強其產品組合。這些公司正在共同推動創新,並加速呋喃基聚合物在全球的應用。

目錄

第1章:方法論與範圍

第2章:執行摘要

第3章:行業洞察

- 產業生態系統分析

- 影響價值鏈的因素

- 利潤率分析

- 中斷

- 未來展望

- 製造商

- 經銷商

- 川普政府關稅

- 對貿易的影響

- 貿易量中斷

- 報復措施

- 對產業的影響

- 供給側影響(原料)

- 主要材料價格波動

- 供應鏈重組

- 生產成本影響

- 需求面影響(售價)

- 價格傳導至終端市場

- 市佔率動態

- 消費者反應模式

- 供給側影響(原料)

- 受影響的主要公司

- 策略產業反應

- 供應鏈重組

- 定價和產品策略

- 政策參與

- 展望與未來考慮

- 對貿易的影響

- 貿易統計(HS編碼)

- 主要出口國

- 主要進口國

註:以上貿易統計僅針對重點國家。

- 利潤率分析

- 重要新聞和舉措

- 技術進步與創新

- 監管格局

- 全球生物基聚合物法規

- 生物基材料的國際標準

- ASTM標準

- ISO 標準

- EN標準

- 生物分解性和可堆肥性標準

- 區域監理框架

- 環境法規

- 碳足跡法規

- 廢棄物管理法規

- 報廢處理法規

- 監管影響分析

- 對產品開發的影響

- 對市場進入障礙的影響

- 對定價策略的影響

- 衝擊力

- 成長動力

- 軟性電子和穿戴式科技的應用日益廣泛

- 擴大儲能設備的應用,特別是超級電容器和全聚合物電池

- 汽車應用需求不斷成長,尤其是電動車的成長

- 人們對智慧紡織品和生物醫學應用的興趣日益濃厚

- 產業陷阱與挑戰

- 原料供應變化

- 來自成熟聚合物的競爭

- 監管障礙

- 市場機會

- 對永續材料的需求不斷成長

- 包裝產業轉型

- 政府支持和激勵措施

- 企業永續發展承諾

- 新興應用程式開發

- 技術進步

- 成長動力

- 成長潛力分析

- 2021 - 2034 年價格分析(美元/噸)

- 影響定價的因素

- 原料成本

- 能源成本

- 生產規模

- 技術成熟度

- 市場競爭

- 石油基替代品定價

- 影響定價的因素

- 產業趨勢和最終用途偏好

- 轉向永續材料

- 包裝產業趨勢

- 汽車產業趨勢

- 建築業趨勢

- 消費品趨勢

- 波特的分析

- PESTEL分析

- 價值鏈分析

- COVID-19對市場的影響

第4章:競爭格局

- 介紹

- 公司市佔率分析

- 公司熱圖分析

- 主要市場參與者的競爭分析

- 競爭定位矩陣

- 策略儀表板

- Expansion

- Mergers & acquisition

- Collaborations

- New product launches

- Research & development

- 競爭格局

- 市場集中度分析

- 競爭定位和策略

- 合併、收購和策略夥伴關係

- 新產品發布和創新

- 行銷和促銷策略

- 主要參與者的最新發展和影響分析

- 公司分類

- 參與者概述

- 財務表現

- 來源基準測試

第5章:市場估計與預測:按類型,2021 - 2034 年

- 主要趨勢

- 聚呋喃甲酸乙二醇酯(PEF)

- 聚糠醇(PFA)

- 呋喃樹脂

- 聚(2,5-呋喃二甲醚琥珀酸酯)(PFS)

- 呋喃基聚酯

- 呋喃基聚醯胺

- 其他

第6章:市場估計與預測:按衍生性商品,2021 - 2034

- 主要趨勢

- 5-羥甲基糠醛(HMF)

- 2,5-呋喃二甲酸(FDCA)

- 糠醛

- 糠醇

- 其他

第7章:市場估計與預測:依生質能原料來源,2021 - 2034 年

- 主要趨勢

- 農業殘留物

- 林業殘留物

- 食物浪費

- 甘蔗渣

- 玉米棒

- 其他

第8章:市場估計與預測:按應用,2021 - 2034 年

- 主要趨勢

- 包裝

- 瓶子和容器

- 薄膜和層壓板

- 食品包裝

- 飲料包裝

- 其他

- 複合材料

- 汽車複合材料

- 建築複合材料

- 航太複合材料

- 海洋複合材料

- 其他

- 塗料和黏合劑

- 工業塗料

- 木器塗料

- 木製品用黏合劑

- 其他

- 鑄造廠

- 砂黏合劑

- 模具和型芯製造

- 其他

- 紡織品和纖維

- 技術紡織品

- 服飾

- 其他

- 汽車

- 內裝部件

- 引擎蓋下

- 外部元件

- 其他

- 電子產品

- 電路板

- 電子元件

- 其他

- 醫療保健

- 醫療器材

- 醫藥包裝

- 其他

- 其他

- 農業

- 消費品

- 新興應用

- 其他

第9章:市場估計與預測:按地區,2021 - 2034 年

- 主要趨勢

- 北美洲

- 美國

- 加拿大

- 歐洲

- 德國

- 英國

- 法國

- 西班牙

- 義大利

- 荷蘭

- 亞太地區

- 中國

- 印度

- 日本

- 澳洲

- 韓國

- 拉丁美洲

- 巴西

- 墨西哥

- 阿根廷

- 中東和非洲

- 沙烏地阿拉伯

- 南非

- 阿拉伯聯合大公國

第10章:公司簡介

- AVA Biochem

- Avantium

- Bitrez

- Globe Carbon Industries

- KANTO CHEMICAL

- Origin Materials

- Penn A Kem

- Shengquan Group

- Sulzer

- Swicofil

- TransFurans Chemicals

The Global Furan-based Polymer Market was valued at USD 21.3 billion in 2024 and is estimated to grow at a CAGR of 5% to reach USD 34.6 billion by 2034, as bio-derived polymers are primarily produced from renewable sources such as agricultural residues, including corn cobs and sugarcane bagasse. Furan-based polymers, produced from intermediates like furfural and 5-hydroxymethylfurfural (HMF), are gaining traction due to their sustainability and alignment with the global trend towards eco-friendly materials.

Furan-based polymers have seen significant adoption in various industries, especially in the food and beverage sector, where they are becoming increasingly popular as sustainable alternatives to conventional packaging materials. These polymers offer a more environmentally friendly option compared to petroleum-based plastics, as they are derived from renewable resources like agricultural residues. Their use aligns with the growing consumer and regulatory push for greener products and packaging solutions. In addition to their sustainability, furan-based polymers also boast impressive thermal resistance, making them ideal for applications that require high durability in extreme conditions. In industries like the foundry sector, these polymers are particularly valuable. Furan resins, for example, are widely used in sand casting core binding due to their ability to withstand high temperatures without compromising performance. Their minimal toxicity and stable thermal properties make them essential in the production of precision casting metals and other high-performance applications.

| Market Scope | |

|---|---|

| Start Year | 2024 |

| Forecast Year | 2025-2034 |

| Start Value | $21.3 Billion |

| Forecast Value | $34.6 Billion |

| CAGR | 5% |

The demand for polyethylene furanoate (PEF) is particularly strong, with this polymer segment accounting for a 32.3% share in 2024. PEF's recyclability, barrier properties, and bio-based nature make it a favorable alternative to polyethylene terephthalate (PET) in food and beverage packaging. Another notable application is in coatings and composites, where polyfurfuryl alcohol's resistance to corrosion ensures its stable demand in industries like chemical processing. Furan-based polyamides are increasingly being used in automotive manufacturing due to their durability, strength, and ability to enhance thermal stability, which in turn boosts fuel efficiency.

The market is segmented by derivatives such as 5-hydroxymethylfurfural (HMF), furfural, furfuryl alcohol, and 2,5-furandicarboxylic acid (FDCA), with furfural leading the segment, holding 29.5% share in 2024. Furfural's extensive use in industrial applications like resins, solvents, and lubricants has positioned it as a cornerstone in the market. Its production from agricultural residues aligns with the broader bioeconomy goals of reducing dependency on non-renewable resources.

United States Furan-based Polymer Market generated USD 4.2 billion in 2024. The country's focus on bioeconomy policies, modern biorefinery systems, and increasing public-private funding has fostered a supportive environment for the growth of furan-based polymers. The U.S. market is also driven by programs like the USDA's BioPreferred Program, which encourages the use of biobased products, making furan-based polymers a competitive and economically viable option for industries seeking sustainable solutions.

Companies like Avantium, Bitrez, Swicofil, Sulzer, and Shengquan Group are at the forefront of the furan-based polymer market. These companies are adopting various strategies to strengthen their market presence, including investments in advanced biorefinery technologies and expanding their production capabilities for renewable-based materials. Avantium and Bitrez are focused on scaling up the production of bio-based polymers and improving their cost-effectiveness, while Swicofil and Shengquan Group are expanding their market reach through strategic partnerships. Sulzer is enhancing its product portfolio by incorporating sustainable solutions that cater to a variety of industrial sectors. Together, these companies are driving innovation and accelerating the adoption of furan-based polymers globally.

Table of Contents

Chapter 1 Methodology & Scope

- 1.1 Market scope & definition

- 1.2 Base estimates & calculations

- 1.3 Forecast calculation

- 1.4 Data sources

- 1.4.1 Primary

- 1.4.2 Secondary

- 1.4.2.1 Paid sources

- 1.4.2.2 Public sources

- 1.5 Primary research and validation

- 1.5.1 Primary sources

- 1.5.2 Data mining sources

Chapter 2 Executive Summary

- 2.1 Industry synopsis, 2021 - 2034

Chapter 3 Industry Insights

- 3.1 Industry ecosystem analysis

- 3.1.1 Factor affecting the value chain

- 3.1.2 Profit margin analysis

- 3.1.3 Disruptions

- 3.1.4 Future outlook

- 3.1.5 Manufacturers

- 3.1.6 Distributors

- 3.2 Trump administration tariffs

- 3.2.1 Impact on trade

- 3.2.1.1 Trade volume disruptions

- 3.2.1.2 Retaliatory measures

- 3.2.2 Impact on the industry

- 3.2.2.1 Supply-side impact (raw materials)

- 3.2.2.1.1 Price volatility in key materials

- 3.2.2.1.2 Supply chain restructuring

- 3.2.2.1.3 Production cost implications

- 3.2.2.2 Demand-side impact (selling price)

- 3.2.2.2.1 Price transmission to end markets

- 3.2.2.2.2 Market share dynamics

- 3.2.2.2.3 Consumer response patterns

- 3.2.2.1 Supply-side impact (raw materials)

- 3.2.3 Key companies impacted

- 3.2.4 Strategic industry responses

- 3.2.4.1 Supply chain reconfiguration

- 3.2.4.2 Pricing and product strategies

- 3.2.4.3 Policy engagement

- 3.2.5 Outlook and future considerations

- 3.2.1 Impact on trade

- 3.3 Trade statistics (HS Code)

- 3.3.1 Major exporting countries

- 3.3.2 Major importing countries

- 3.4 Profit margin analysis

- 3.5 Key news & initiatives

- 3.6 Technological advancements and innovations

- 3.7 Regulatory landscape

- 3.7.1 Global bio-based polymers regulations

- 3.7.2 International standards for bio-based materials

- 3.7.2.1 ASTM standards

- 3.7.2.2 ISO standards

- 3.7.2.3 EN standards

- 3.7.2.4 Biodegradability and compostability standards

- 3.7.3 Regional regulatory frameworks

- 3.7.4 Environmental regulations

- 3.7.4.1 Carbon footprint regulations

- 3.7.4.2 Waste management regulations

- 3.7.4.3 End-of-life disposal regulations

- 3.7.5 Regulatory impact analysis

- 3.7.5.1 Impact on product development

- 3.7.5.2 Impact on market entry barriers

- 3.7.5.3 Impact on pricing strategies

- 3.8 Impact forces

- 3.8.1 Growth drivers

- 3.8.1.1 Rising adoption in flexible electronics and wearable technology

- 3.8.1.2 Expanding applications in energy storage devices, particularly supercapacitors and all-polymer batteries

- 3.8.1.3 Increasing demand in automotive applications, especially with the growth of electric vehicles

- 3.8.1.4 Growing interest in smart textiles and biomedical applications

- 3.8.2 Industry pitfalls & challenges

- 3.8.2.1 Feedstock supply variability

- 3.8.2.2 Competition from established polymers

- 3.8.2.3 Regulatory hurdles

- 3.8.3 Market opportunities

- 3.8.3.1 Growing demand for sustainable materials

- 3.8.3.2 Packaging industry transformation

- 3.8.3.3 Government support and incentives

- 3.8.3.4 Corporate sustainability commitments

- 3.8.3.5 Emerging applications development

- 3.8.3.6 Technological advancements

- 3.8.1 Growth drivers

- 3.9 Growth potential analysis

- 3.10 Pricing analysis (USD/Tons) 2021 - 2034

- 3.10.1 Factors affecting pricing

- 3.10.1.1 Raw material costs

- 3.10.1.2 Energy costs

- 3.10.1.3 Production scale

- 3.10.1.4 Technology maturity

- 3.10.1.5 Market competition

- 3.10.1.6 Petroleum-based alternatives pricing

- 3.10.1 Factors affecting pricing

- 3.11 Industry trends and end use preferences

- 3.11.1 Shift towards sustainable materials

- 3.11.2 Packaging industry trends

- 3.11.3 Automotive industry trends

- 3.11.4 Construction industry trends

- 3.11.5 Consumer goods trends

- 3.12 Porter's analysis

- 3.13 PESTEL analysis

- 3.14 Value chain analysis

- 3.15 Impact of COVID-19 on the market

Chapter 4 Competitive Landscape, 2024

- 4.1 Introduction

- 4.2 Company market share analysis, 2024

- 4.3 Company heat map analysis

- 4.4 Competitive analysis of major market players

- 4.5 Competitive positioning matrix

- 4.6 Strategy dashboard

- 4.7 Competitive landscape

- 4.7.1 Market concentration analysis

- 4.7.2 Competitive positioning and strategies

- 4.7.3 Mergers, acquisitions, and strategic partnerships

- 4.7.4 New product launches and innovations

- 4.7.5 Marketing and promotional strategies

- 4.8 Recent developments & impact analysis by key players

- 4.8.1 Company categorization

- 4.8.2 Participant’s overview

- 4.8.3 Financial performance

- 4.9 Source benchmarking

Chapter 5 Market Estimates and Forecast, By Type, 2021 - 2034 (USD Billion) (Kilo Tons)

- 5.1 Key trends

- 5.2 Polyethylene furanoate (PEF)

- 5.3 Polyfurfuryl alcohol (PFA)

- 5.4 Furan resins

- 5.5 Poly(2,5-furandimethylene succinate) (PFS)

- 5.6 Furan-based polyesters

- 5.7 Furan-based polyamides

- 5.8 Others

Chapter 6 Market Estimates and Forecast, By Derivatives , 2021 - 2034 (USD Billion) (Kilo Tons)

- 6.1 Key trends

- 6.2 5-Hydroxymethylfurfural (HMF)

- 6.3 2,5-Furandicarboxylic acid (FDCA)

- 6.4 Furfural

- 6.5 Furfuryl alcohol

- 6.6 Others

Chapter 7 Market Estimates and Forecast, By Biomass Feedstock Source, 2021 - 2034 (USD Billion) (Kilo Tons)

- 7.1 Key trends

- 7.2 Agricultural residues

- 7.3 Forestry residues

- 7.4 Food waste

- 7.5 Sugarcane bagasse

- 7.6 Corn cobs

- 7.7 Others

Chapter 8 Market Estimates and Forecast, By Application, 2021 - 2034 (USD Billion) (Kilo Tons)

- 8.1 Key trends

- 8.2 Packaging

- 8.2.1 Bottles and containers

- 8.2.2 Films and laminates

- 8.2.3 Food packaging

- 8.2.4 Beverage packaging

- 8.2.5 Others

- 8.3 Composites

- 8.3.1 Automotive composites

- 8.3.2 Construction composites

- 8.3.3 Aerospace composites

- 8.3.4 Marine composites

- 8.3.5 Others

- 8.4 Coatings and adhesives

- 8.4.1 Industrial coatings

- 8.4.2 Wood coatings

- 8.4.3 Adhesives for wood products

- 8.4.4 Others

- 8.5 Foundry

- 8.5.1 Sand binders

- 8.5.2 Mold and core making

- 8.5.3 Others

- 8.6 Textiles and Fibers

- 8.6.1 Technical Textiles

- 8.6.2 Apparel

- 8.6.3 Others

- 8.7 Automotive

- 8.7.1 Interior components

- 8.7.2 Under-the-hood

- 8.7.3 Exterior components

- 8.7.4 Others

- 8.8 Electronics

- 8.8.1 Circuit boards

- 8.8.2 Electronic components

- 8.8.3 Others

- 8.9 Medical and healthcare

- 8.9.1 Medical devices

- 8.9.2 Pharmaceutical packaging

- 8.9.3 Others

- 8.10 Others

- 8.10.1 Agriculture

- 8.10.2 Consumer goods

- 8.10.3 Emerging applications

- 8.10.4 Others

Chapter 9 Market Estimates and Forecast, By Region, 2021 - 2034 (USD Billion) (Kilo Tons)

- 9.1 Key trends

- 9.2 North America

- 9.2.1 U.S.

- 9.2.2 Canada

- 9.3 Europe

- 9.3.1 Germany

- 9.3.2 UK

- 9.3.3 France

- 9.3.4 Spain

- 9.3.5 Italy

- 9.3.6 Netherlands

- 9.4 Asia Pacific

- 9.4.1 China

- 9.4.2 India

- 9.4.3 Japan

- 9.4.4 Australia

- 9.4.5 South Korea

- 9.5 Latin America

- 9.5.1 Brazil

- 9.5.2 Mexico

- 9.5.3 Argentina

- 9.6 Middle East and Africa

- 9.6.1 Saudi Arabia

- 9.6.2 South Africa

- 9.6.3 UAE

Chapter 10 Company Profiles

- 10.1 AVA Biochem

- 10.2 Avantium

- 10.3 Bitrez

- 10.4 Globe Carbon Industries

- 10.5 KANTO CHEMICAL

- 10.6 Origin Materials

- 10.7 Penn A Kem

- 10.8 Shengquan Group

- 10.9 Sulzer

- 10.10 Swicofil

- 10.11 TransFurans Chemicals