|

市場調查報告書

商品編碼

1750265

二輪車懸吊系統市場機會、成長動力、產業趨勢分析及 2025 - 2034 年預測Two-Wheeler Suspension System Market Opportunity, Growth Drivers, Industry Trend Analysis, and Forecast 2025 - 2034 |

||||||

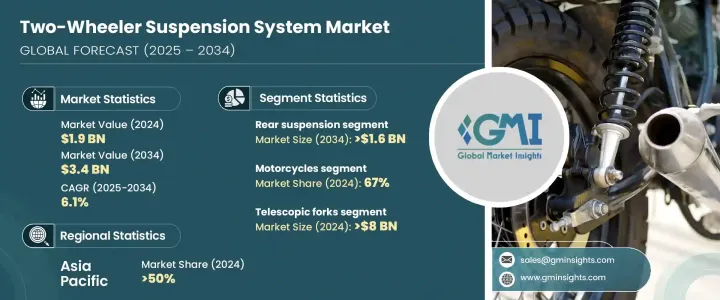

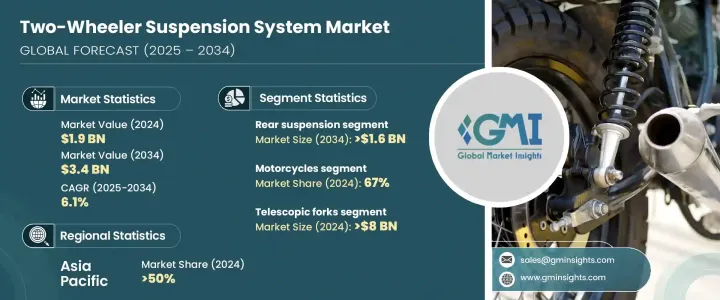

2024年,全球二輪車懸吊系統市場規模達19億美元,預計2034年將以6.1%的複合年成長率成長,達到34億美元。這主要得益於發展中國家二輪車使用量的持續成長。這些國家的城市密度不斷上升、公共交通選擇有限,以及中等收入人口的不斷成長,使得人們強烈偏好經濟實惠且省油的出行解決方案。隨著個人交通在城市和半城市地區蓬勃發展,對耐用高性能懸吊系統的需求也日益成長。駕駛者希望獲得更平穩的操控性、更舒適的駕駛體驗和更佳的安全性,因此製造商優先考慮能夠滿足監管標準和不斷變化的用戶期望的懸吊創新。

前後懸吊技術的演變——尤其是向先進的單減震器裝置、輕量化材料和電子控制系統的轉變——正在塑造市場。消費者的選擇性越來越強,要求系統能夠提供更好的駕駛動態,尤其是在維護不良的道路上。隨著對配備精良懸吊部件的中檔和通勤二輪車的需求不斷成長,各公司正將重點轉向提供更具適應性的解決方案。能夠根據地形或速度自動調整的智慧懸吊正在成為一種性能提升功能,吸引著注重安全的用戶。

| 市場範圍 | |

|---|---|

| 起始年份 | 2024 |

| 預測年份 | 2025-2034 |

| 起始值 | 19億美元 |

| 預測值 | 34億美元 |

| 複合年成長率 | 6.1% |

前後懸吊系統在提升整體駕駛體驗方面繼續發揮著至關重要的作用,其中後懸吊單元在市場上佔據著顯著的領先地位。 2024年,後懸吊市場規模達10億美元,預計2034年將達到16億美元。這一成長歸功於這些單位在吸收道路衝擊、確保駕駛舒適度和提高車輛穩定性方面的重要作用,尤其是在基礎設施低度開發的地區。在低度開發的城市和半城市地區,道路經常磨損,後懸吊系統對於減少不平路面對整體駕駛品質的影響至關重要。

2024年,摩托車在二輪車懸吊系統市場的佔有率為67%。由於製造商擴大將單減震後懸吊整合到中階車型中,預計該領域將保持領先地位。這些系統曾經僅限於高性能摩托車,如今已應用於日常使用的摩托車,以提升操控性、轉彎性能和道路舒適度。對性能、燃油效率和價格實惠的重視促使原始設備製造商重新校準減震器系統,以滿足日常通勤者在崎嶇地形中行駛的需求。

2024年,亞太地區二輪車懸吊系統市場佔50%的市場佔有率,其中中國占主導地位。中國龐大的二輪車用戶群體,加上嚴重的城市交通堵塞,推動了對高性能懸吊系統的需求。隨著城市交通量的增加,二輪車因其經濟實惠和操控性而成為個人出行的必備工具。日益壯大的中產階級正在尋求經濟高效的出行解決方案,這進一步推動了對可靠懸吊系統的需求成長。在此背景下,懸吊系統不僅對安全性至關重要,而且對於提供舒適穩定的駕駛體驗也至關重要,使其成為二輪車設計和製造的關鍵特性。

KYB、Endurance Technologies、Showa、Gabriel India、WP Suspension、Mando、Tenneco、Fox Factory、BITUBO 和重慶川動避震器等領先的市場參與者正在透過專注的研發投入、策略合作和新產品的推出來提升其市場地位。這些公司不斷完善其產品線,為不同等級的摩托車提供更強大的懸吊性能。許多公司優先考慮輕量化、耐用的材料和電子自適應解決方案。與原始設備製造商 (OEM) 和售後市場供應商的合作使企業能夠強化其分銷管道,而全球擴張策略和技術差異化則有助於他們在不斷變化的出行格局中保持競爭力。

目錄

第1章:方法論與範圍

第2章:執行摘要

第3章:行業洞察

- 產業生態系統分析

- 供應商格局

- 原物料供應商

- 零件製造商

- OEM (原始設備製造商)

- 技術提供者

- 售後市場供應商和經銷商

- 川普政府關稅的影響

- 對貿易的影響

- 貿易量中斷

- 報復措施

- 對產業的影響

- 主要材料價格波動

- 供應鏈重組

- 價格傳導至終端市場

- 策略產業反應

- 供應鏈重組

- 定價和產品策略

- 對貿易的影響

- 利潤率分析

- 技術與創新格局

- 重要新聞和舉措

- 成本細分分析

- 定價分析

- 產品

- 地區

- 專利分析

- 監管格局

- 衝擊力

- 成長動力

- 新興經濟體對二輪車的需求不斷成長

- 懸吊系統的技術進步

- 更加重視騎士的安全和舒適度

- 相較於短途航班,人們越來越傾向選擇公路旅行

- 產業陷阱與挑戰

- 新興市場的價格敏感度

- 跨模型的標準化有限

- 成長動力

- 成長潛力分析

- 波特的分析

- PESTEL分析

第4章:競爭格局

- 介紹

- 公司市佔率分析

- 競爭定位矩陣

- 戰略展望矩陣

第5章:市場估計與預測:依暫停分類,2021 - 2034 年

- 主要趨勢

- 前懸吊

- 後懸吊

第6章:市場估計與預測:按產品,2021 - 2034 年

- 主要趨勢

- 伸縮叉

- 單震

- 雙減震器

- 彈簧和避震器單元

第7章:市場估計與預測:依車型,2021 - 2034 年

- 主要趨勢

- 摩托車

- 踏板車

- 電動二輪車

第8章:市場估計與預測:依銷售管道,2021 - 2034 年

- 主要趨勢

- OEM (原始設備製造商)

- 售後市場

第9章:市場估計與預測:按地區,2021 - 2034 年

- 主要趨勢

- 北美洲

- 美國

- 加拿大

- 歐洲

- 英國

- 德國

- 法國

- 義大利

- 西班牙

- 俄羅斯

- 北歐人

- 亞太地區

- 中國

- 印度

- 日本

- 韓國

- 澳洲

- 東南亞

- 拉丁美洲

- 巴西

- 墨西哥

- 阿根廷

- MEA

- 阿拉伯聯合大公國

- 沙烏地阿拉伯

- 南非

第10章:公司簡介

- BITUBO

- Chongqing Chuandong Shock Absorber

- Duro Shox

- Endurance Technologies

- Fox Factory

- Fras-le

- Gabriel

- Hagon Shocks

- JRi Shocks

- K-Tech Suspension

- KYB

- Mando

- Matris Dampers

- Norton Motorcycle

- Penske Racing Shocks

- Showa

- Tenneco

- Touratech

- WP Suspension

- ZF Friedrichshafen

The Global Two-Wheeler Suspension System Market was valued at USD 1.9 billion in 2024 and is estimated to grow at a CAGR of 6.1% to reach USD 3.4 billion by 2034, driven by rising two-wheeler usage across developing nations, where increasing urban density, limited public transit options, and a growing middle-income population have created a strong preference for affordable and fuel-efficient mobility solutions. As personal transportation gains momentum in urban and semi-urban areas, the demand for durable and high-performance suspension systems is climbing. Riders want smoother handling, enhanced comfort, and improved safety, leading manufacturers to prioritize suspension innovations that meet regulatory standards and evolving user expectations.

The evolution of rear and front suspension technologies-especially the shift toward advanced mono-shock setups, lightweight materials, and electronically controlled systems-helps shape the market. Consumers are becoming more selective, demanding systems that offer better ride dynamics, particularly on poorly maintained roads. As demand grows for mid-range and commuter two-wheelers with refined suspension components, companies are shifting their focus to provide more adaptable solutions. Intelligent suspensions that adjust automatically to terrain or speed are emerging as performance-enhancing features that appeal to safety-conscious users.

| Market Scope | |

|---|---|

| Start Year | 2024 |

| Forecast Year | 2025-2034 |

| Start Value | $1.9 Billion |

| Forecast Value | $3.4 Billion |

| CAGR | 6.1% |

Front and rear suspension systems continue to play a crucial role in enhancing the overall riding experience, with rear suspension units taking a significant lead in the market. In 2024, the rear suspension segment generated USD 1 billion, with projections indicating that this value will reach USD 1.6 billion by 2034. This growth is attributed to the vital function these units serve in absorbing road shocks, ensuring rider comfort, and improving vehicle stability, especially in regions with underdeveloped infrastructure. In less-developed urban and semi-urban areas, where roads often face wear and tear, rear suspension systems are essential for reducing the impact of rough surfaces on the overall ride quality.

The Motorcycles segment in the two-wheeler suspension system market held 67% share in 2024. This segment is expected to maintain its leadership, thanks to manufacturers increasingly integrating mono-shock rear suspension into mid-segment models. These systems, once reserved for high-performance bikes, are now featured in daily-use motorcycles to improve handling, cornering, and road comfort. The emphasis on performance, fuel efficiency, and affordability has pushed OEMs to recalibrate shock absorber systems for everyday commuters navigating rugged terrains.

Asia Pacific Two-Wheeler Suspension System Market held 50% share in 2024, with China leading the way. The large population of two-wheeler users in China, paired with heavy urban congestion, has driven the demand for high-performance suspension systems. As urban traffic increases, two-wheelers have become an essential mode of personal transportation due to their affordability and maneuverability. The growing middle class, which is seeking cost-effective mobility solutions, has further contributed to the increased demand for reliable suspension systems. In this context, suspension systems are critical not just for safety but also for offering a comfortable and stable ride, making them a key feature in two-wheeler design and manufacturing.

Leading market players like KYB, Endurance Technologies, Showa, Gabriel India, WP Suspension, Mando, Tenneco, Fox Factory, BITUBO, and Chongqing Chuandong Shock Absorber are advancing their market positions through focused R&D investments, strategic collaborations, and new product rollouts. These companies refine their product lines to offer enhanced suspension performance for various motorcycle classes. Many are prioritizing lightweight, durable materials and electronically adaptive solutions. Partnerships with OEMs and aftermarket suppliers allow firms to strengthen their distribution channels, while global expansion strategies and technological differentiation help them remain competitive in an evolving mobility landscape.

Table of Contents

Chapter 1 Methodology & Scope

- 1.1 Research design

- 1.1.1 Research approach

- 1.1.2 Data collection methods

- 1.2 Base estimates and calculations

- 1.2.1 Base year calculation

- 1.2.2 Key trends for market estimates

- 1.3 Forecast model

- 1.4 Primary research & validation

- 1.4.1 Primary sources

- 1.4.2 Data mining sources

- 1.5 Market definitions

Chapter 2 Executive Summary

- 2.1 Industry 3600 synopsis, 2021 - 2034

Chapter 3 Industry Insights

- 3.1 Industry ecosystem analysis

- 3.2 Supplier landscape

- 3.2.1 Raw material suppliers

- 3.2.2 Component manufacturers

- 3.2.3 OEM (Original Equipment Manufacturers)

- 3.2.4 Technology providers

- 3.2.5 Aftermarket suppliers and distributors

- 3.3 Impact of Trump administration tariffs

- 3.3.1 Impact on trade

- 3.3.1.1 Trade volume disruptions

- 3.3.1.2 Retaliatory measures

- 3.3.2 Impact on the Industry

- 3.3.2.1 Price volatility in key materials

- 3.3.2.2 Supply chain restructuring

- 3.3.2.3 Price transmission to end markets

- 3.3.3 Strategic industry responses

- 3.3.3.1 Supply chain reconfiguration

- 3.3.3.2 Pricing and product strategies

- 3.3.1 Impact on trade

- 3.4 Profit margin analysis

- 3.5 Technology & innovation landscape

- 3.6 Key news & initiatives

- 3.7 Cost breakdown analysis

- 3.8 Pricing analysis

- 3.8.1 Product

- 3.8.2 Region

- 3.9 Patent analysis

- 3.10 Regulatory landscape

- 3.11 Impact forces

- 3.11.1 Growth drivers

- 3.11.1.1 Growing demand for two-wheelers in emerging economies

- 3.11.1.2 Technological advancements in suspension systems

- 3.11.1.3 Increasing focus on rider safety and comfort

- 3.11.1.4 Increasing preference for road-based travel over short-haul flights

- 3.11.2 Industry pitfalls & challenges

- 3.11.2.1 Price sensitivity in emerging markets

- 3.11.2.2 Limited standardization across models

- 3.11.1 Growth drivers

- 3.12 Growth potential analysis

- 3.13 Porter's analysis

- 3.14 PESTEL analysis

Chapter 4 Competitive Landscape, 2024

- 4.1 Introduction

- 4.2 Company market share analysis

- 4.3 Competitive positioning matrix

- 4.4 Strategic outlook matrix

Chapter 5 Market Estimates & Forecast, By Suspension, 2021 - 2034 ($Mn, Units)

- 5.1 Key trends

- 5.2 Front suspension

- 5.3 Rear suspension

Chapter 6 Market Estimates & Forecast, By Product, 2021 - 2034 ($Mn, Units)

- 6.1 Key trends

- 6.2 Telescopic forks

- 6.3 Mono shock

- 6.4 Twin shock absorbers

- 6.5 Spring and damper units

Chapter 7 Market Estimates & Forecast, By Vehicles, 2021 - 2034 ($Mn, Units)

- 7.1 Key trends

- 7.2 Motorcycles

- 7.3 Scooters

- 7.4 Electric two-wheelers

Chapter 8 Market Estimates & Forecast, By Sales Channels, 2021 - 2034 ($Mn, Units)

- 8.1 Key trends

- 8.2 OEM (Original Equipment Manufacturers)

- 8.3 Aftermarket

Chapter 9 Market Estimates & Forecast, By Region, 2021 - 2034 ($Mn, Units)

- 9.1 Key trends

- 9.2 North America

- 9.2.1 U.S.

- 9.2.2 Canada

- 9.3 Europe

- 9.3.1 UK

- 9.3.2 Germany

- 9.3.3 France

- 9.3.4 Italy

- 9.3.5 Spain

- 9.3.6 Russia

- 9.3.7 Nordics

- 9.4 Asia Pacific

- 9.4.1 China

- 9.4.2 India

- 9.4.3 Japan

- 9.4.4 South Korea

- 9.4.5 Australia

- 9.4.6 Southeast Asia

- 9.5 Latin America

- 9.5.1 Brazil

- 9.5.2 Mexico

- 9.5.3 Argentina

- 9.6 MEA

- 9.6.1 UAE

- 9.6.2 Saudi Arabia

- 9.6.3 South Africa

Chapter 10 Company Profiles

- 10.1 BITUBO

- 10.2 Chongqing Chuandong Shock Absorber

- 10.3 Duro Shox

- 10.4 Endurance Technologies

- 10.5 Fox Factory

- 10.6 Fras-le

- 10.7 Gabriel

- 10.8 Hagon Shocks

- 10.9 JRi Shocks

- 10.10 K-Tech Suspension

- 10.11 KYB

- 10.12 Mando

- 10.13 Matris Dampers

- 10.14 Norton Motorcycle

- 10.15 Penske Racing Shocks

- 10.16 Showa

- 10.17 Tenneco

- 10.18 Touratech

- 10.19 WP Suspension

- 10.20 ZF Friedrichshafen